On the Right Note

Structured Notes Monthly Performance Digest

We are launching a refreshed format of our regular series, On the Right Note — now an expanded analytical digest for the Raison blog. Our goal is not just to present the figures, but to explain the underlying logic: why specific strategies succeeded and what was happening behind the scenes of the market. This material is designed to help noteholders better understand their assets, while potential investors can see how protective mechanisms perform in real market conditions

December: Stable Markets and Growing Risk Appetite

The end of 2025 marked a period of market stabilization, accompanied by increased interest across investor segments in higher-risk, higher-yield assets. Favorable conditions emerged for structured products portfolios:

- 13 notes were observed between December 12 and 31

- 8 notes remained active

- 5 notes were autocalled (redeemed early as predefined price levels were reached)

- 2 notes triggered the Memory Effect (coupon payments deferred and preserved until barrier recovery)

The key driver was a low-volatility regime. The VIX index settled at multi-year lows, which, for noteholders, translates into fewer sharp price drawdowns and a higher probability of staying above coupon barriers. Five-year CDS spreads have been trending lower over the past year, indicating improved stability and reduced market stress in U.S. financial markets.

As interest rate cutting cycles continue, traditional bonds are losing their appeal. Investors seeking yield are shifting toward equity markets, boosting liquidity and pushing valuations toward autocall triggers. In this environment, structured notes occupy a middle ground between bonds and equities. They offer higher yields than fixed-income instruments while providing protective mechanisms (Geared Put, One Star) unavailable through direct equity purchases.

Key Trends of the Month

- AI Infrastructure

The sector has moved from expectations to a phase of capital deployment. Sustained demand for server capacity and data storage systems supported the performance of Broadcom, AMD, and Pure Storage. For our structured notes, this translated into a rapid approach to autocall levels (early redemption).

- Resource Sovereignty

Gold reached new all-time highs, reaffirming its role as a safe-haven asset. Rising protectionism supported producers of strategic raw materials such as MP Materials and Albemarle. Structured solutions enabled investors to benefit from the upside in these assets while mitigating their inherent volatility.

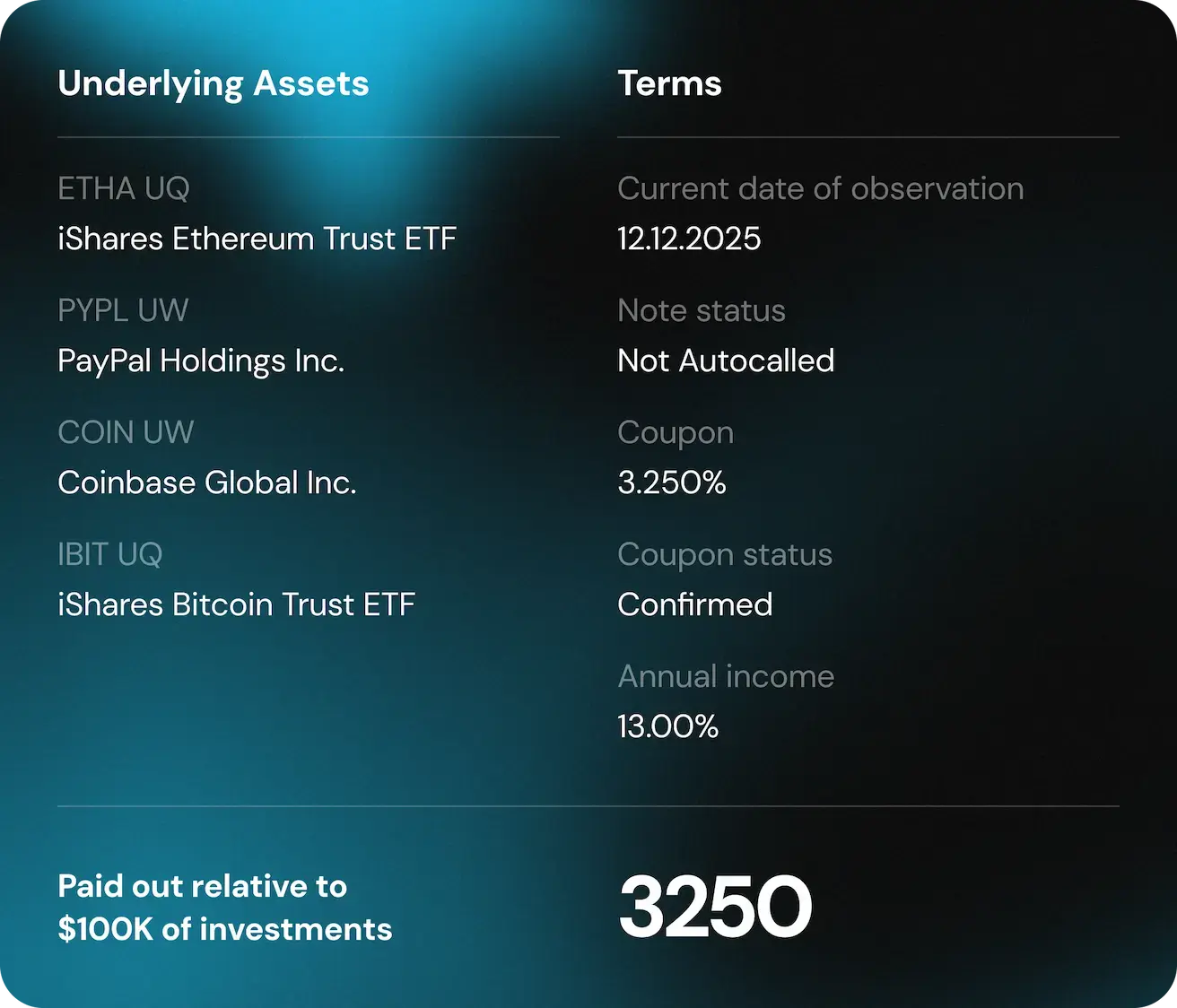

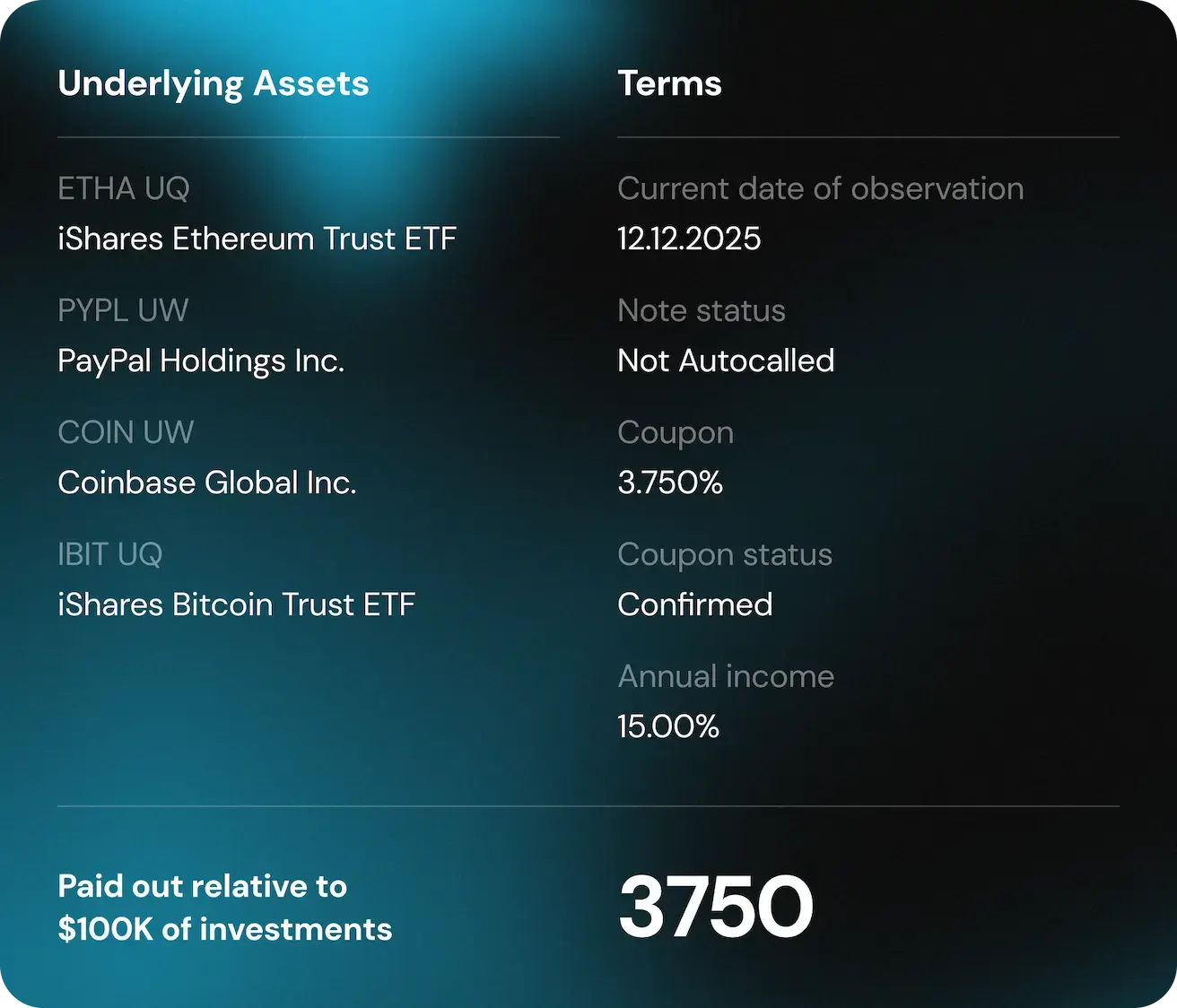

- Institutional Crypto Adoption

The deeper integration of DeFi into the traditional financial system and improved regulatory clarity became key growth drivers for the sector. Notes linked to crypto assets provided exposure to this upside with significantly lower risk compared to direct token ownership.

Notes in Detail

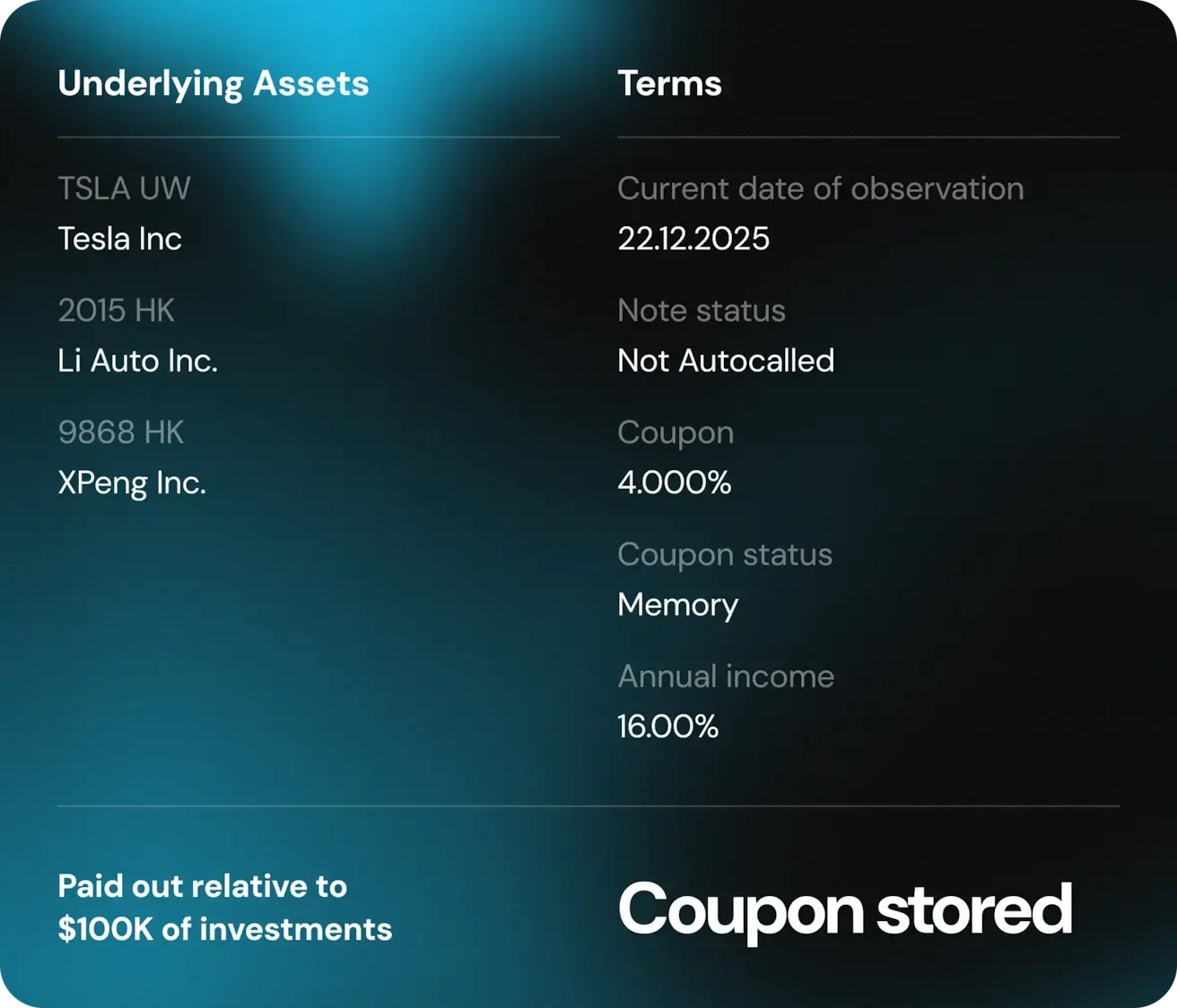

In this section, we move from market trends to concrete performance figures. Below are the note cards for which an observation date occurred in December. We have grouped them into three categories: Active, Autocalled, and those where the Memory Effect was triggered.

Each note card includes:

- Basket composition: the underlying assets whose performance is being monitored.

- Coupon status: whether the coupon was confirmed for the period.

- Realized return: the investor’s actual profit per $100,000 invested.

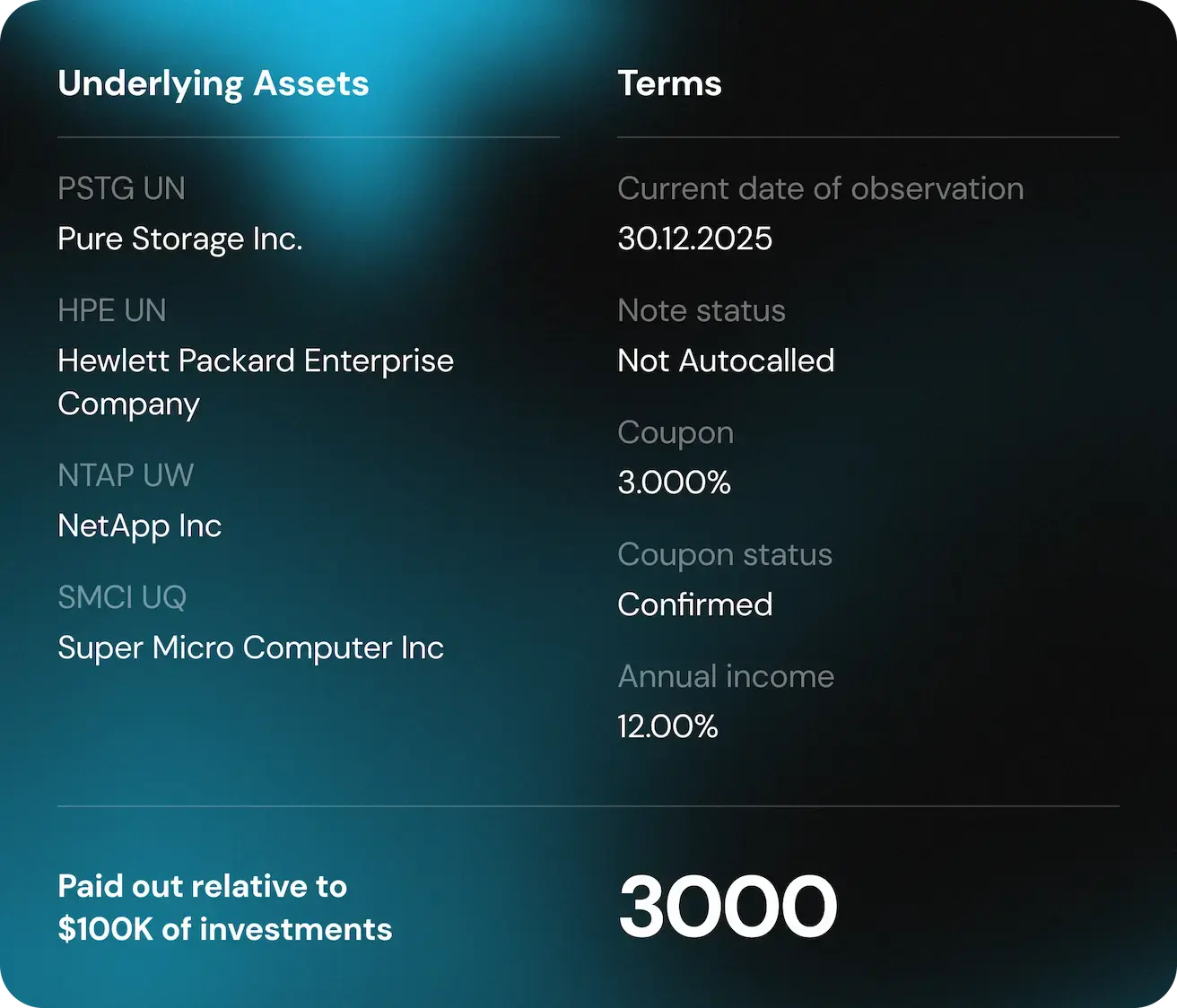

Active Notes

Digital Horizon | ISIN: XS2748059511

Crypto | ISIN: XS2748084386

Oil & Gas | ISIN: XS2794297619

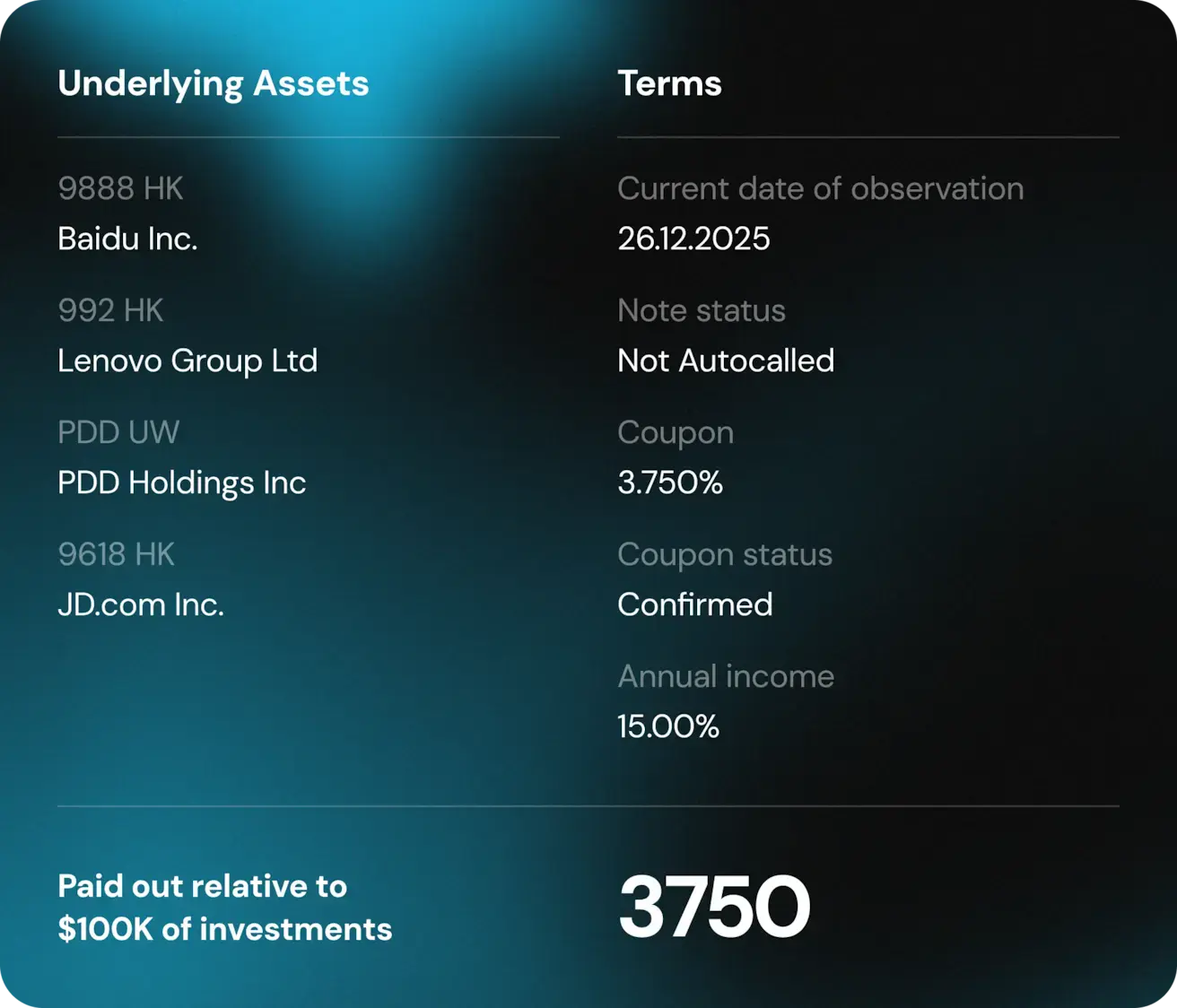

China | ISIN: XS2912064685

Crypto | ISIN: XS2984876248

Digital Infrastructure | ISIN: XS2984875943

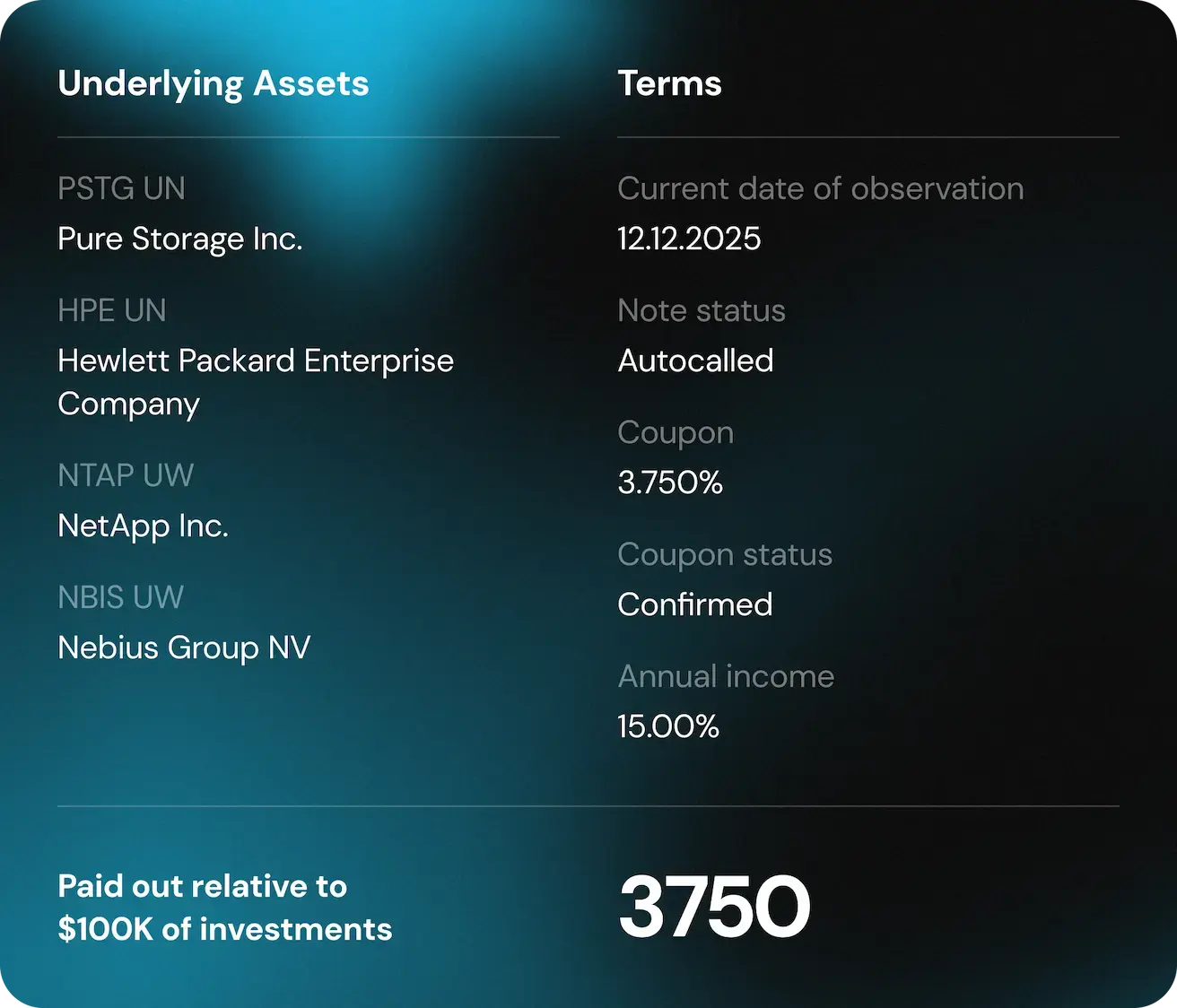

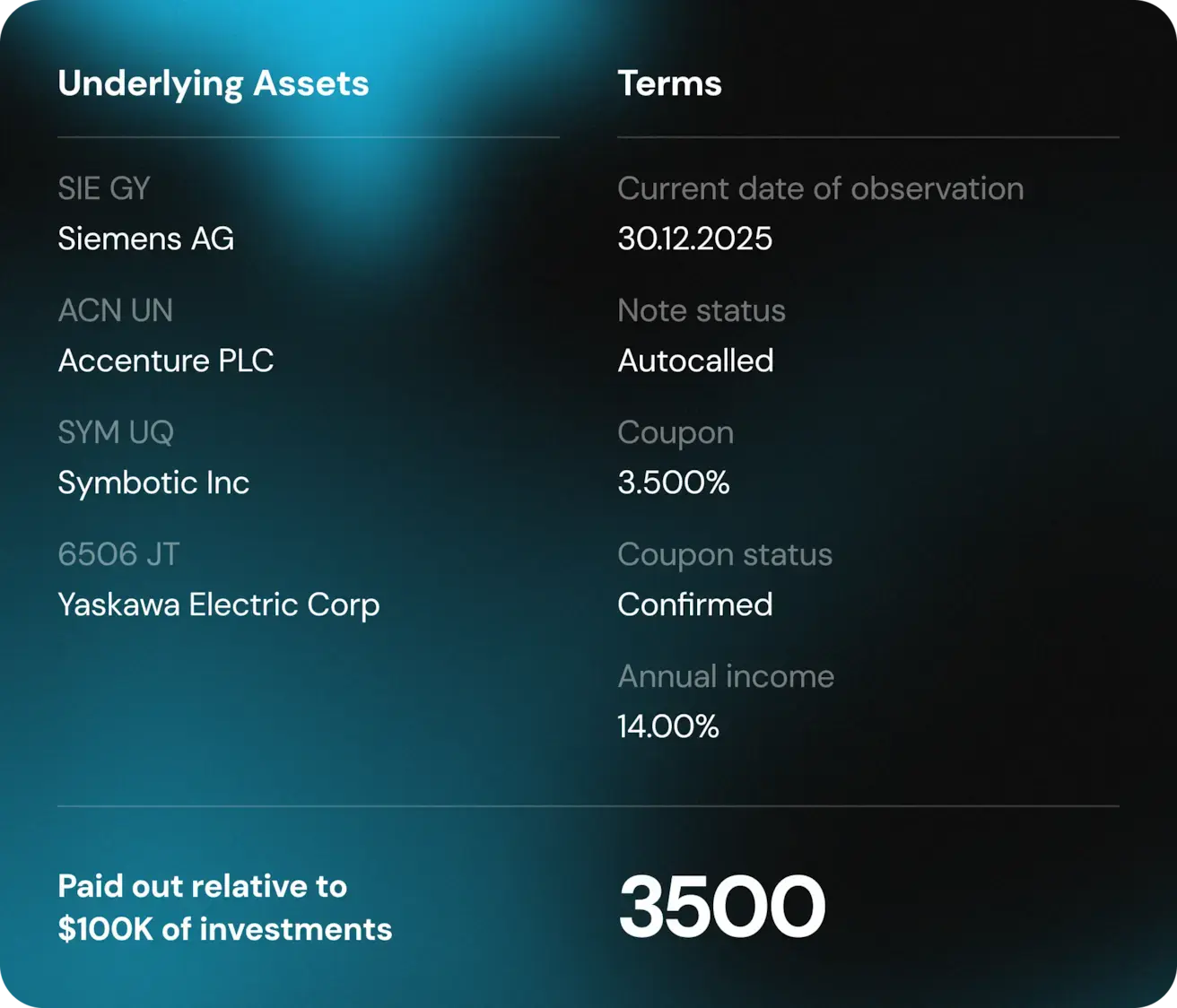

Autocalled

Digital Infrastructure | ISIN: XS2748059602

Commodities | ISIN: XS2697187578

Commodities | ISIN: XS2794297536

Next-Gen Driven Automation & AI Robotics | ISIN: XS3082768212

Commodities | ISIN: XS2794301403

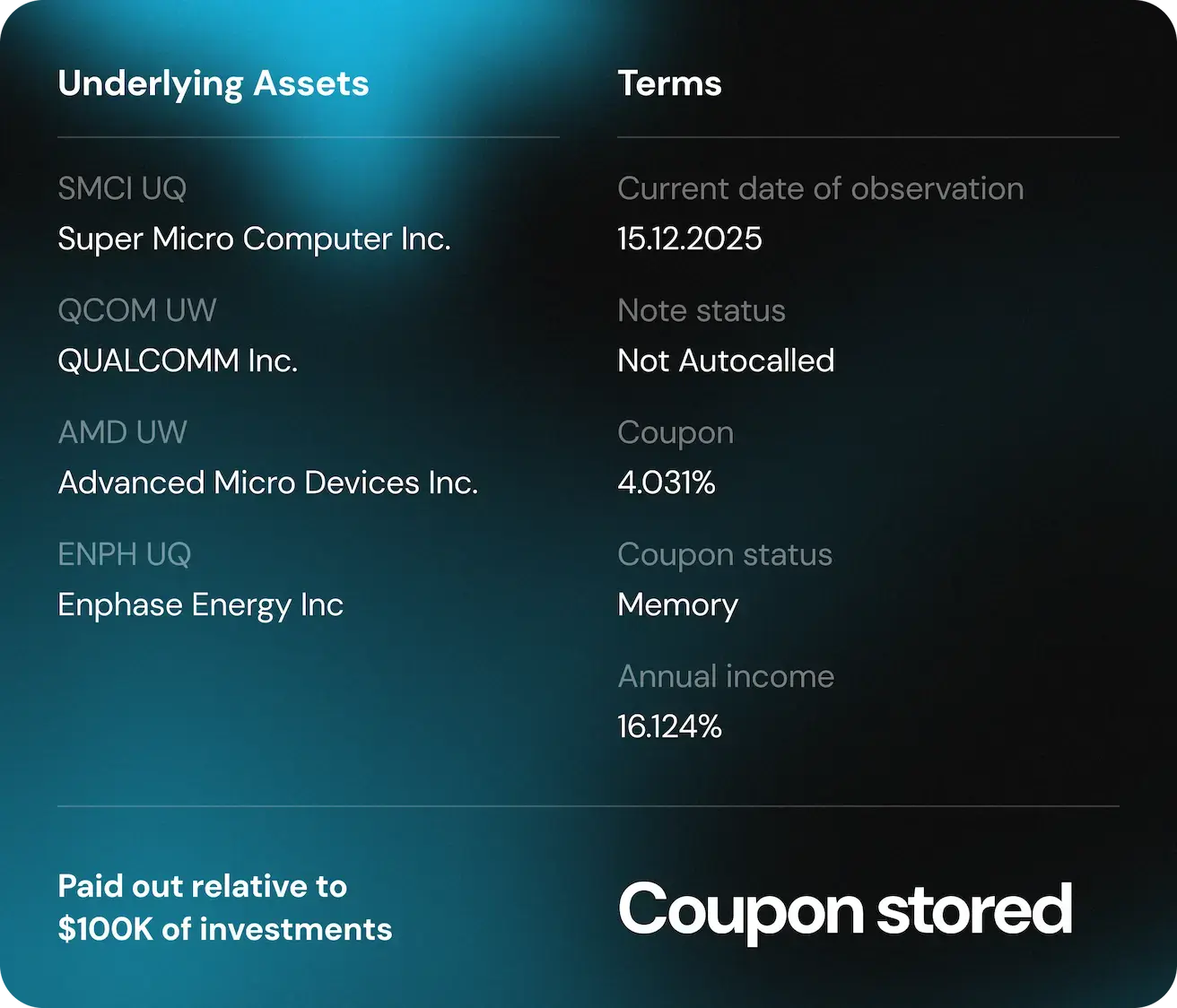

Memory Effect

Semiconductors | ISIN: XS2697187651

Why the Memory Effect Was Triggered

The payout for this note has temporarily entered standby mode due to a price drawdown in Enphase Energy (ENPH) and Super Micro Computer (SMCI). Under the note's mechanism, the coupon is not lost; instead, it is paid in full as soon as the asset's price recovers to the barrier level.

-

Enphase Energy (ENPH): The share price decline was driven by market concerns following the introduction of new U.S. tariffs. At the same time, the company’s fundamentals remain solid, with revenue up 19% year over year. Strong demand for solar energy is expected to continue supporting growth, and as a leading inverter manufacturer, Enphase is well-positioned to benefit from this structural trend.

-

Super Micro Computer (SMCI): The stock was pressured by a loss of investor confidence related to management issues and a change of auditor. Nevertheless, the company remains a key partner of Nvidia. The share price decline appears unjustified given SMCI’s role in the rapidly growing AI server segment.

Conclusion: With two years remaining until maturity, there is sufficient time for the news flow to normalize. We view the current situation as a temporary market inefficiency and expect all accumulated coupons to be paid once prices recover.

Electric Vehicles | ISIN: XS2697198690

Why the Memory Effect Was Triggered

The coupon payment was deferred due to a correction in Li Auto shares amid trade tensions between China and the European Union. The introduction of EU protective tariffs triggered a sell-off across the entire sector. However, risks for the company itself appear overstated: Li Auto remains a profitable market leader in China and continues to expand across Asia and the Middle East.

Conclusion: The current drawdown reflects a temporary geopolitical reaction. The underlying strength of Li Auto’s business supports expectations of a recovery to barrier levels and the payment of all accumulated coupons.

Monthly Summary

December once again confirmed the effectiveness of Raison’s defensive strategies. Capital protection and coupon memory mechanisms allowed the portfolio to deliver stable performance despite localized volatility. Over the month, 11 coupons were paid, including 5 autocalls.

Even during temporary corrections in individual securities, the memory effect protects investor returns by preserving coupons until market conditions normalize. We continue to structure products around key macro trends, maintaining a balance between attractive yields and robust downside protection.

English

English