Why is it profitable to invest in cryptocurrencies in 2024

Key insights of 2024

Cryptocurrency exchanges continue to attract the attention of investors around the world. In 2024, investments in crypto exchanges are becoming especially relevant. Today we’ll review why investing in cryptocurrency exchanges can be a profitable and promising move this year.

One of the main reasons for crypto exchanges' appeal is the continued growth of cryptocurrency popularity. Every year, more and more individuals and organizations recognize cryptocurrencies as legitimate and valuable assets. In 2024, there will be a steady increase in the number of cryptocurrency users and the volume of trading on crypto exchanges, making them an attractive investment opportunity.

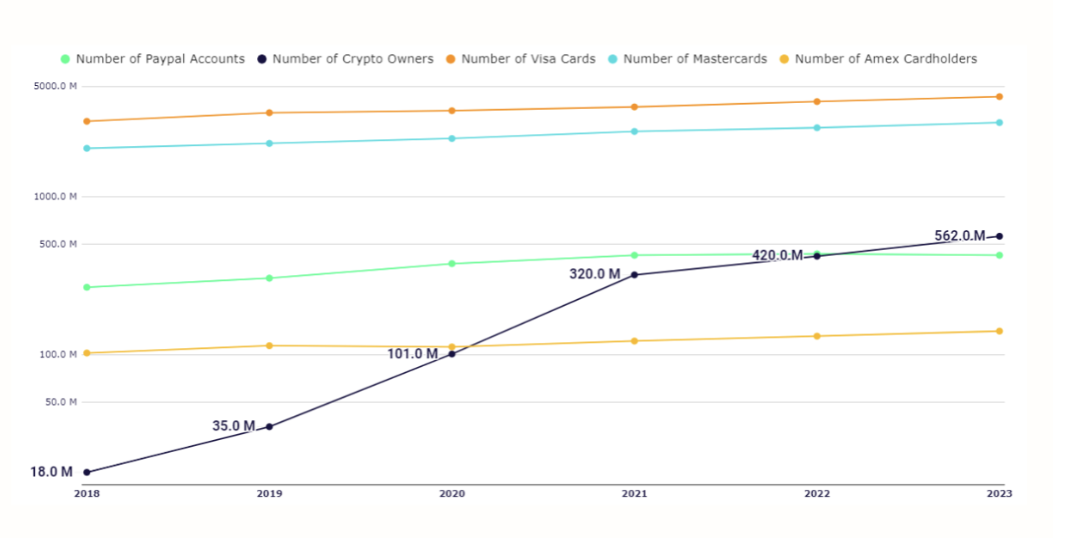

According to triple-a, in 2024, the global share of cryptocurrency ownership is estimated to average 6.8%, with more than 560 million users worldwide.

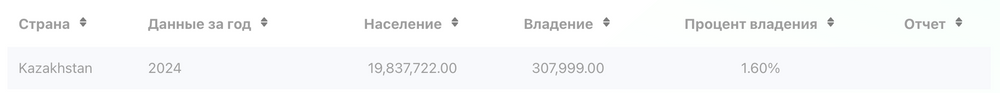

You can see the statistics for Kazakhstan below:

The increase in cryptocurrency ownership is significantly outpacing the growth of traditional payment methods, which averaged 8% between 2018 and 2023. In fact, over the same period, the growth rate of cryptocurrency ownership has surpassed that of several large payment companies, such as American Express.

It is important to note that the growth of crypto exchanges is also driven by institutional investors such as hedge funds, pension funds, and large financial companies that are actively entering the cryptocurrency market. This leads to increased liquidity and market stabilization. Crypto exchanges that provide reliable and secure trading platforms benefit from the influx of institutional funds.

Cryptocurrency exchanges are actively implementing new technologies to improve their infrastructure and provide better services to users. In 2024, technologies such as blockchain, artificial intelligence, and machine learning are expected to be actively used to enhance security, transaction speed, and platform usability. These innovations make crypto exchanges more attractive to investors.

In recent years, regulators worldwide have become more actively involved in regulating the cryptocurrency market, and it seems they have reached a certain consensus. In 2024, the regulatory environment will further improve, which will help to strengthen investor confidence. Clear rules and standards help to reduce risks and ensure investor protection, making crypto exchanges a more reliable investment opportunity.

Investing in Crypto Exchanges: The Example of Kraken

Investing in crypto exchanges provides a unique opportunity to diversify your investment portfolio. Cryptocurrencies and related assets have a low correlation with traditional financial markets, which reduces risks and increases potential profitability. Including cryptocurrency exchanges in the investment portfolio can be a strategic step to achieve stable capital growth.

One of the oldest American crypto exchanges, Kraken, in which Kazakhstani investors have already invested $250,000, plans to raise $100 million ahead of its IPO. The exchange made this decision amid increased investor interest. This will be the last round of funding before the initial public offering (IPO).

Raising funds is linked to the digital asset rally. The industry's growth has created a stir around investments in cryptocurrency companies.

According to available information, the fundraising will be completed by the end of 2024. The IPO is expected to be held in 2025.

The cryptocurrency market is known for its high volatility, which creates opportunities for significant profits. Successful crypto exchanges with a good reputation and substantial trading volume can provide investors with high returns on their investments. In 2024, given the continued growth of the market and the interest from large investors, the profitability potential of crypto exchanges remains high.

Conclusion

Investing in crypto exchanges in 2024 can be profitable for several reasons: the growing popularity of cryptocurrencies, increased institutional investments, technological innovations, an improved regulatory environment, opportunities for diversification, and high profitability potential. However, as with any investment, it is important to carefully assess risks and choose reliable and proven investment platforms.

Source: Bluescreen.kz

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша