2025 m. liepos 14–18 d.: Savaitinis ekonomikos apžvalga

Pagrindiniai rinkos atnaujinimai

MAKROEKONOMINĖ STATISTIKA

INFLIACIJA

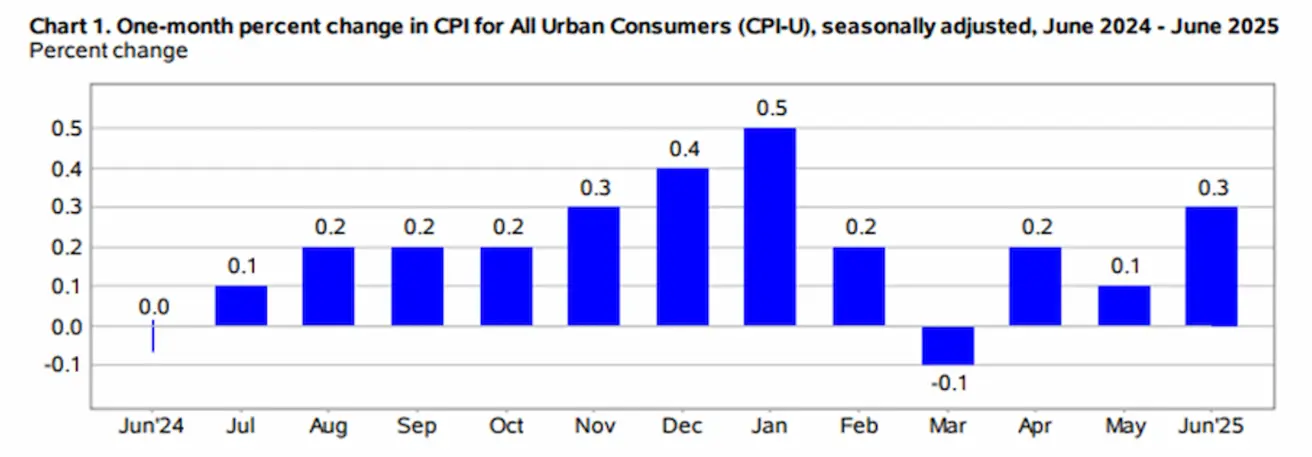

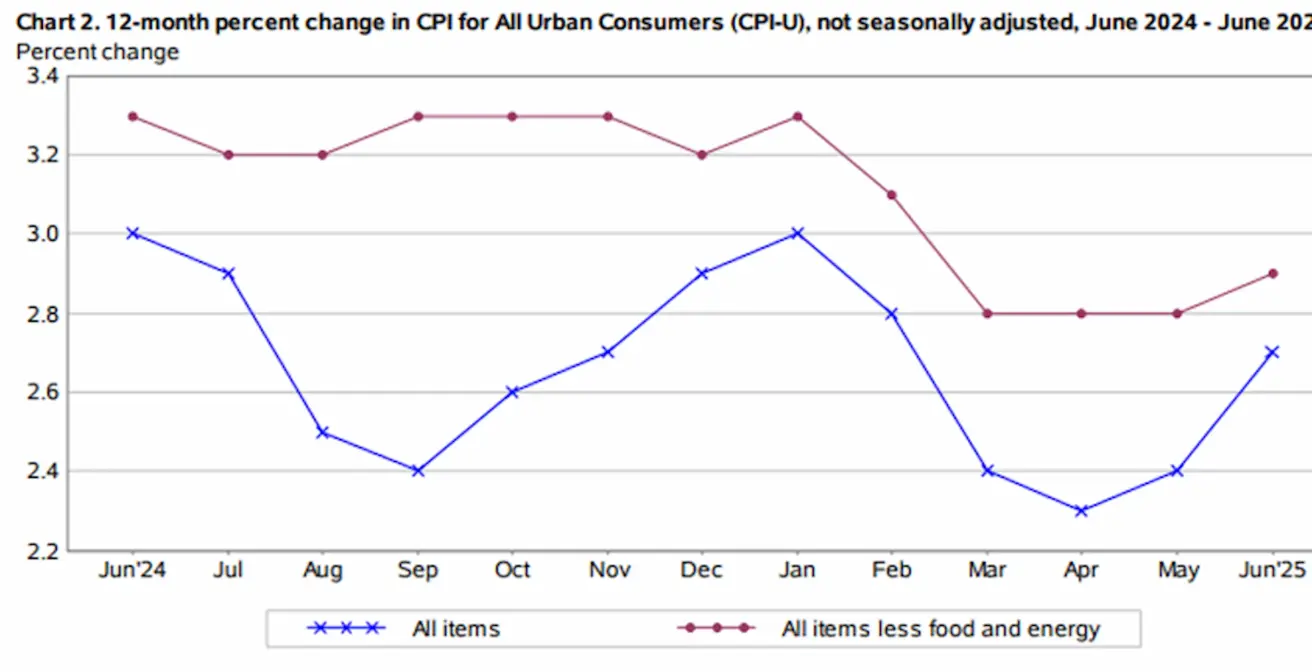

- Core vartotojų kainų indeksas (CPI) (mėn./mėn.) (birželis): 0,2 % (ankstesnis: 0,1 %)

- Vartotojų kainų indeksas (CPI) (mėn./mėn.) (birželis): 0,3 % (ankstesnis: 0,1 %)

- Core vartotojų kainų indeksas (CPI) (m./m.) (birželis): 2,9 % (ankstesnis: 2,8 %)

- Vartotojų kainų indeksas (CPI) (m./m.) (birželis): 2,7 % (ankstesnis: 2,4 %)

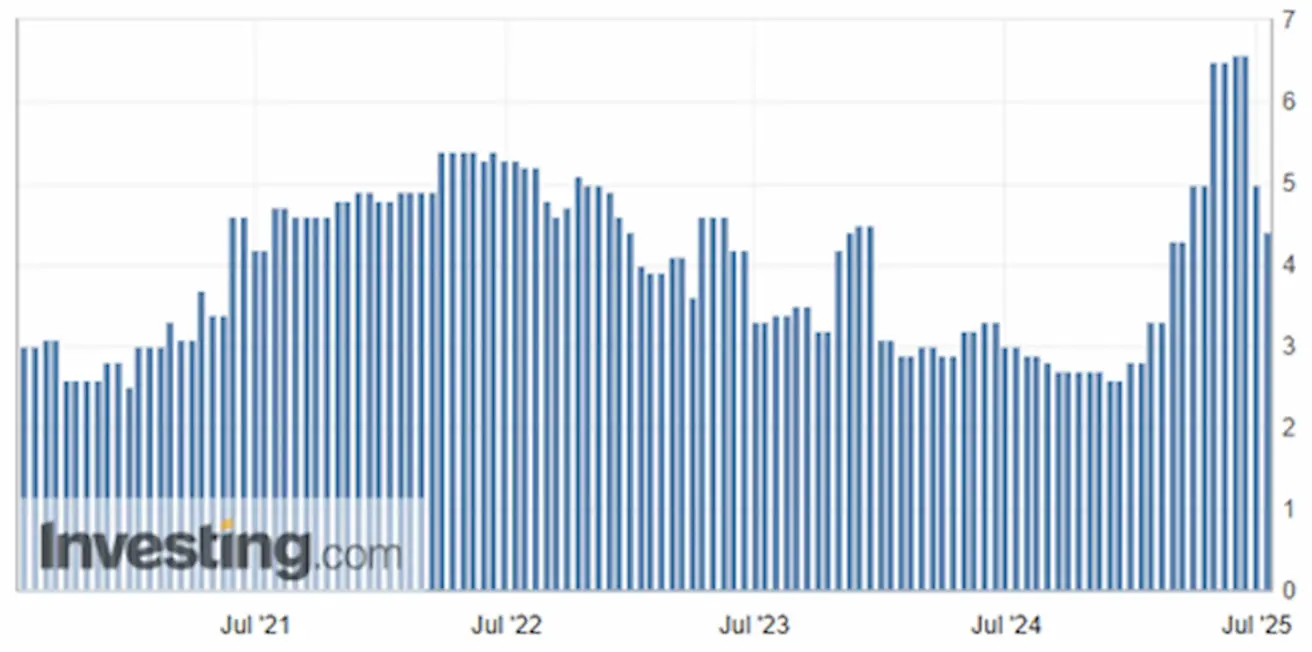

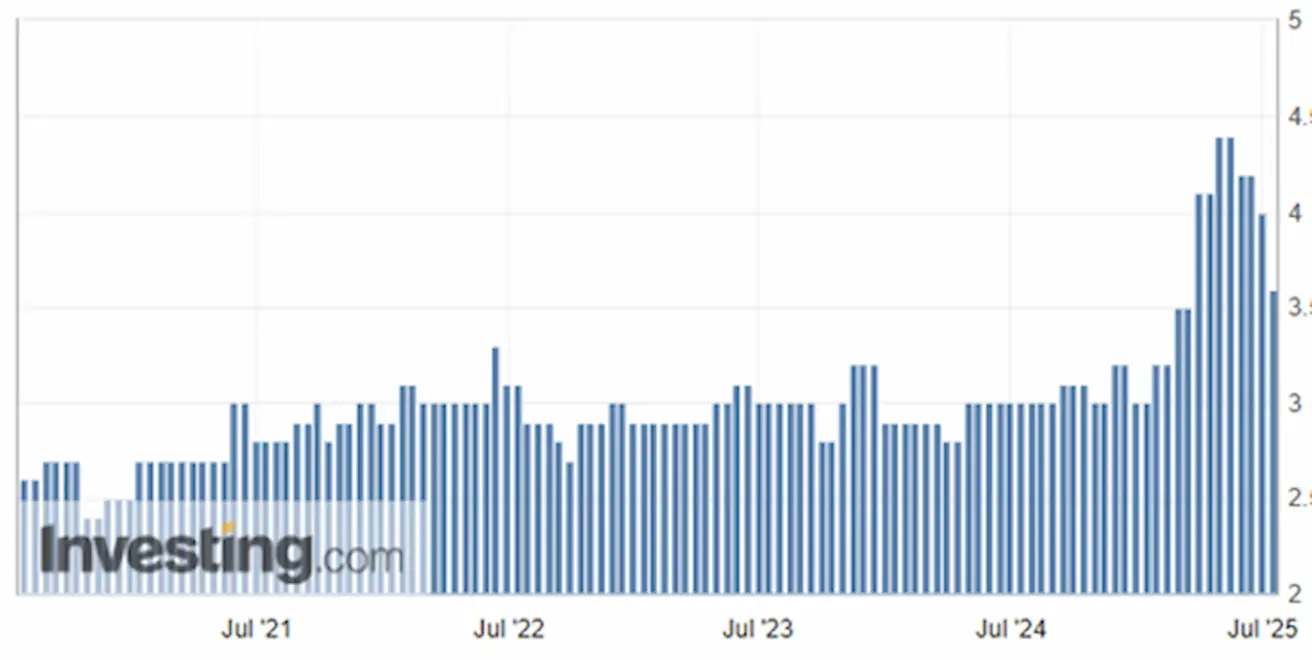

INFLIACIJOS LŪKESČIAI (MICHIGANAS)

- 12 mėn. laukiamas infliacijos lygis (gegužė): 4,4 % (ankst.: 5,0 %)

- 5 metų laukiamas infliacijos lygis (balandis): 3,6 % (ankst.: 4,0 %)

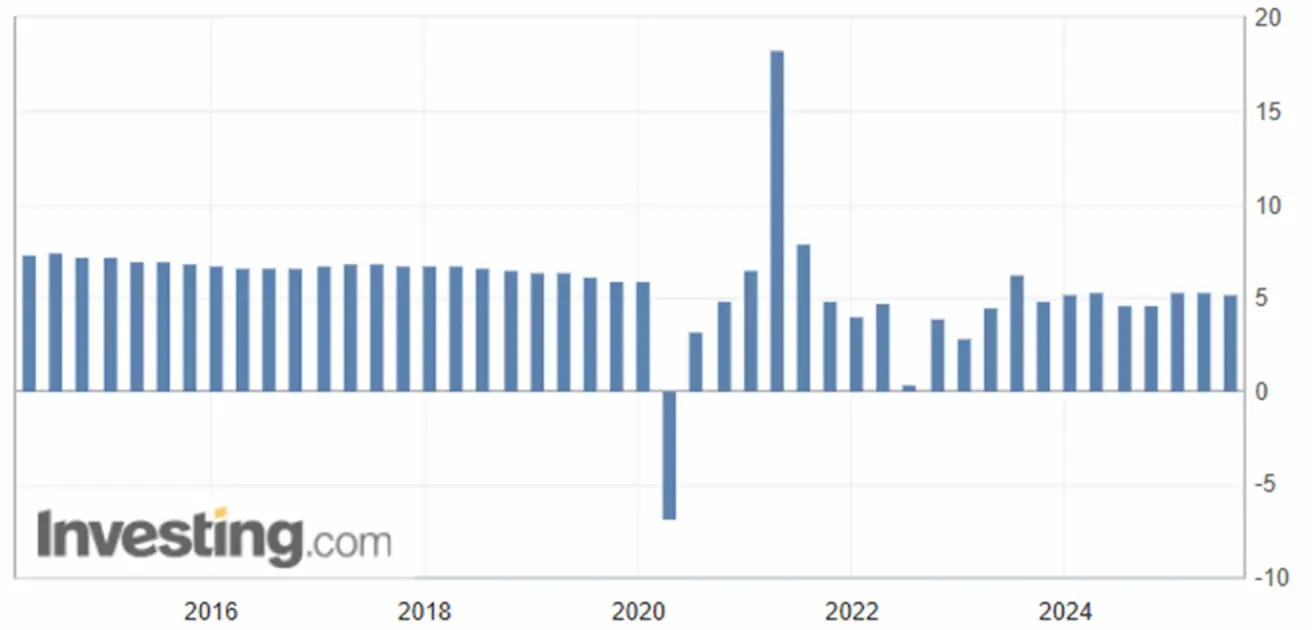

BVP (JAV ekonomikos analizės biuras, BEA) – I ketv. 2025

- Metinis (trečias įvertis): -0,5 % (antras įvertis: -0,2 %; IV ketv. 2024: 2,4 %)

- Atlantos FED "GDPNow" prognozė II ketv.: 2,4 % (prieš: 2,6 %)

VERSLO AKTYVUMO INDEKSAS (PMI):

(Virš 50 – augimas, žemiau 50 – mažėjimas)

- Paslaugų sektorius (birželis): 52,9 (ankstesnis: 53,1)

- Gamybos sektorius (birželis): 52,9 (ankstesnis: 52,0 – pataisyta)

- S&P Global Composite (birželis): 52,9 (ankstesnis: 52,8)

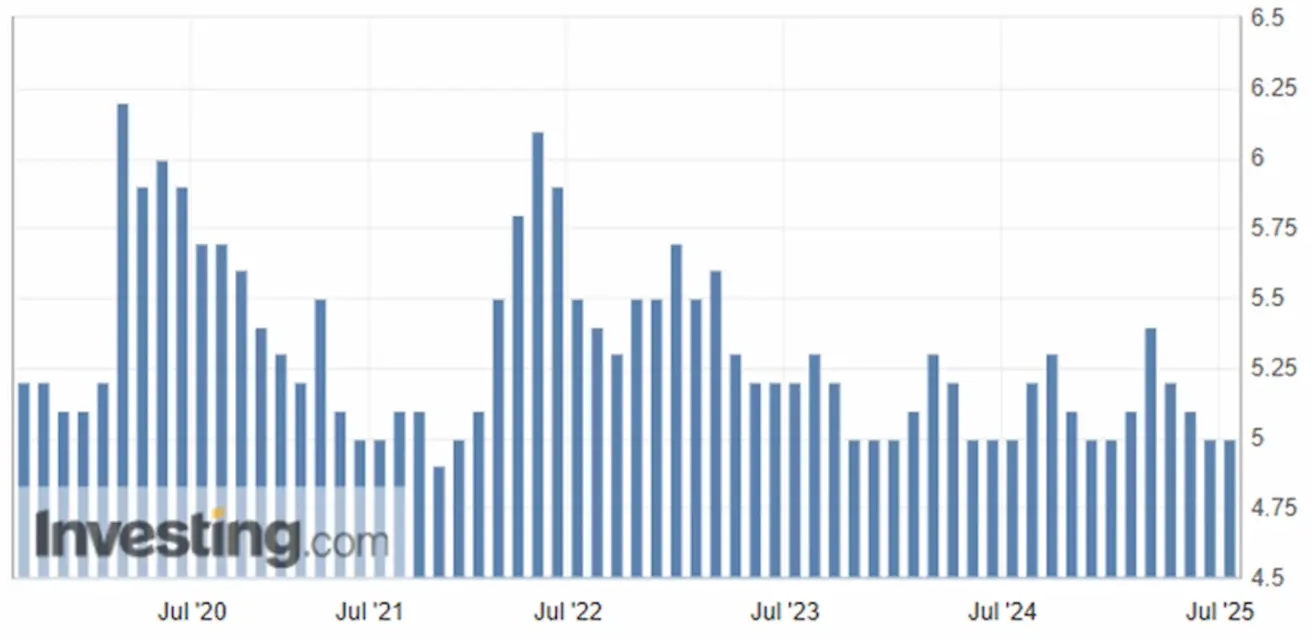

DARBO RINKA:

- Nedarbo lygis (birželis): 4,1 % (ankst.: 4,2 %)

- Ne žemės ūkio darbo vietų pokytis (birželis): 147 tūkst. (ankst.: 144 tūkst. – pataisyta)

- JAV privačių ne žemės ūkio darbo vietų pokytis (birželis): 74 tūkst. (ankst.: 137 tūkst.)

- Vidutinis valandinis atlygis (birželis, m./m.): 3,7 % (ankst.: 3,8 %)

- JOLTS laisvų darbo vietų skaičius (gegužė): 7,769 mln. (ankst.: 7,395 mln.)

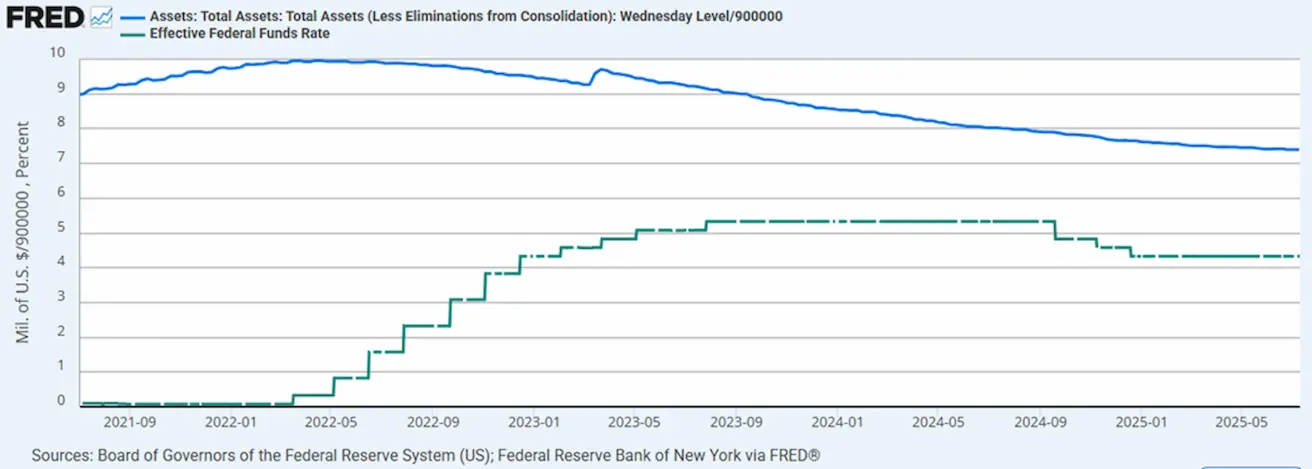

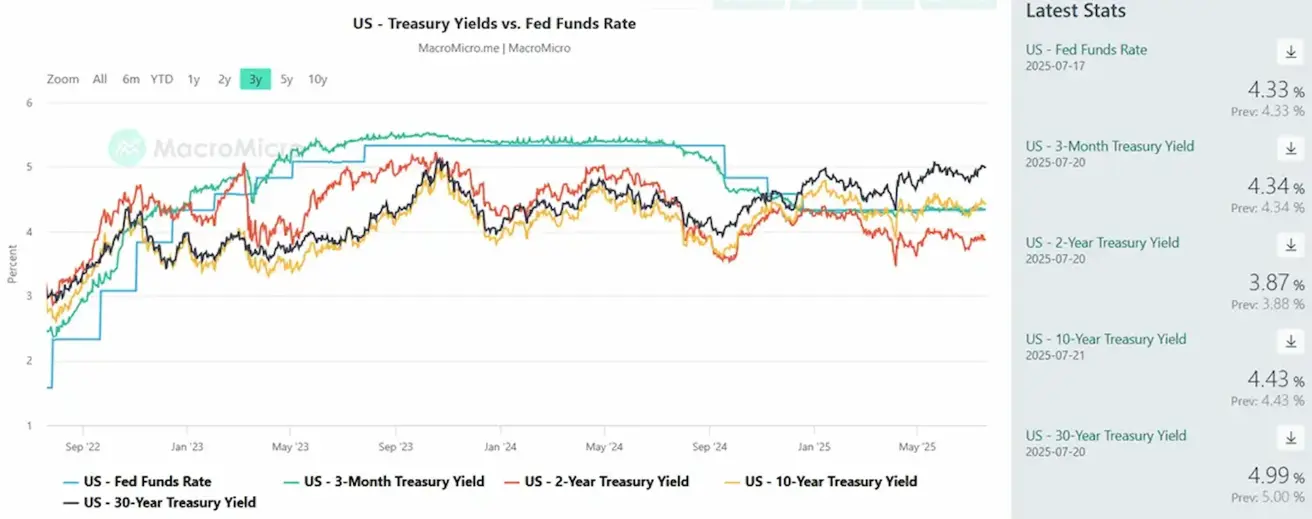

MONETARINĖ POLITIKA

- Federalinių fondų efektyvioji palūkanų norma (EFFR): 4,25 % – 4,50 % (nepasikeitė)

- FED balansas padidėjo: 6,659 trln. USD (ankstesnė savaitė: 6,662 trln. USD)

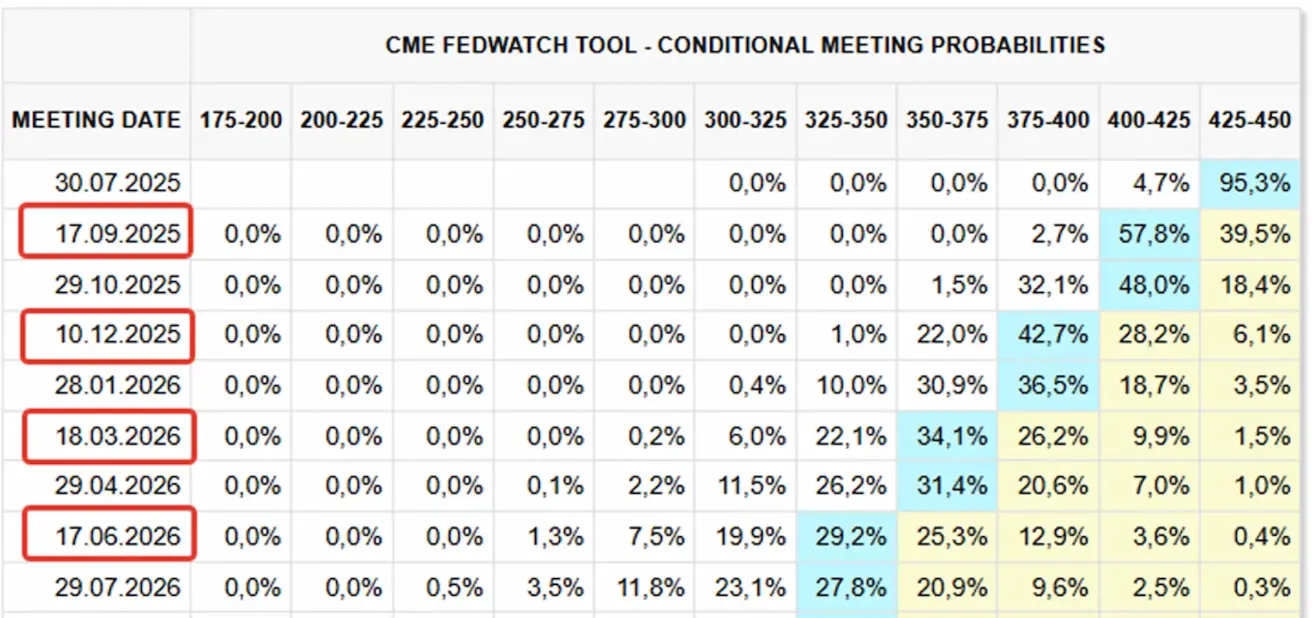

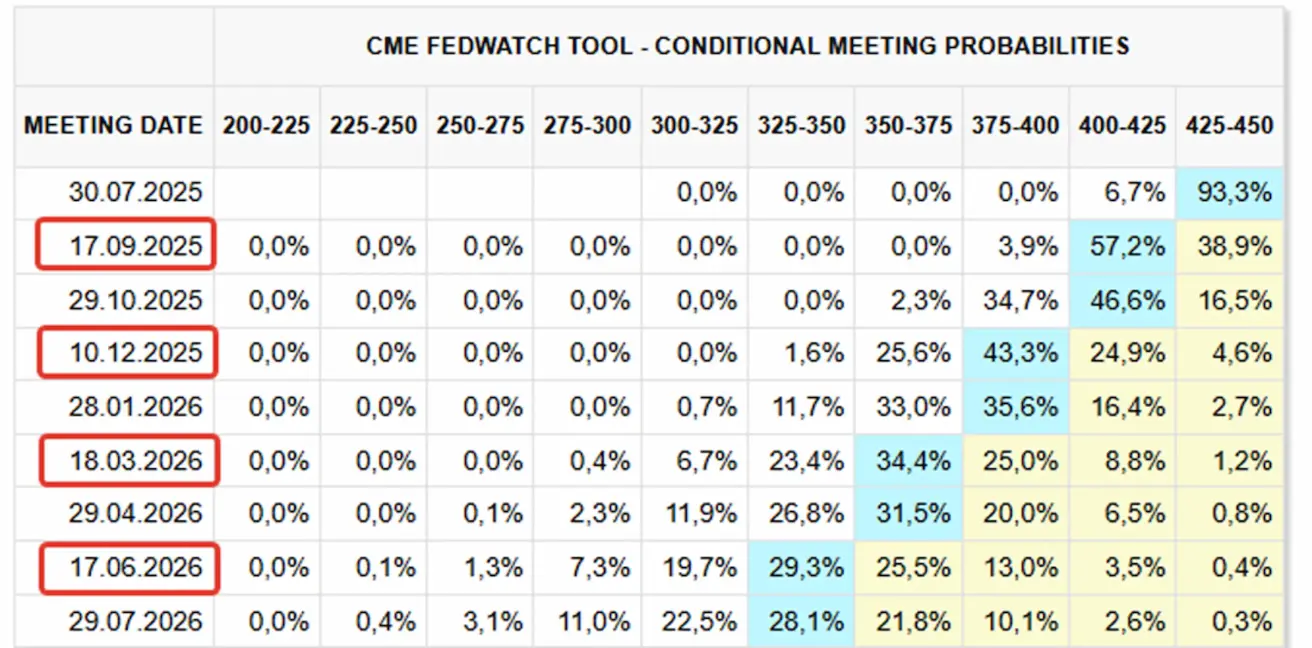

RINKOS PALŪKANŲ LŪKESČIAI

Šiandien:

Prieš savaitę:

Komentaras

Kinija

- Birželį augo tiek importas, tiek eksportas (m./m.). Kinijos prekybos balansas (USD) toliau augo – perteklinis balansas pasiekė 114,77 mlrd. USD.

- Kinijos BVP (m./m.) sumažėjo 0,2 proc. punkto iki 5,2 % (buvo 5,4 %), bet viršijo rinkos lūkesčius. Visgi nominalus augimas buvo mažesnis, kas rodo išliekantį defliacinį spaudimą ekonomikai.

Kinijos pramonės produkcija (m./m.) išaugo 6,8 %, gerokai viršydama prognozes. Bendras pramonės augimas fiksuojamas nuo 2022 m. rugsėjo.

Kinijos nedarbo lygis išlieka žemas ir siekia 5,0 %:

Kinijos ekonomikos atsigavimas lieka laipsniškas, didžiausią riziką kelia besitęsianti prekybos įtampa su JAV ir silpna vidaus paklausa. Statistikos biuras ataskaitoje pabrėžė, kad esamos politikos priemonės tęsis norint palaikyti vartojimą antrąjį metų pusmetį, tačiau įspėjo dėl didesnio neapibrėžtumo ateityje.

Jungtinės Valstijos

JAV vartotojų infliacija vėl ima didėti. CPI per birželį padidėjo 0,3 % (gegužę buvo +0,1 %) mėnesiniu tempu. Metinis apimantis bei pagrindinis infliacijos lygiai taip pat padidėjo ir siekia atitinkamai 2,7 % ir 2,9 %.

Būsto kainų indeksas išaugo 0,2 % birželį ir tapo pagrindiniu kainų augimo veiksniu. Energetikos kainų indeksas kilo 0,9 %, o benzino – 1,0 % per mėnesį. Maisto produkto indeksas didėjo 0,3 %, iš jų „namuose vartojamas maistas“ – 0,3 %, „ne namie“ – 0,4 % birželį. Gamintojų kainų indeksas (PPI) išliko nepakitęs ir mėnesiniu, ir metiniu mastu. Infliacijos lūkesčiai, anot Mičigano universiteto apklausos, pagerėjo: 12 mėnesių lūkestis gegužę sumažėjo iki 4,47 % (prieš tai – 5,0 %), o 5 metų balandį – iki 3,6 % (prieš tai – 4,0 %).

CPI kilimas nesukėlė neigiamų rinkos nuotaikų – tikėtina, investuotojai sutinka su monetarinės valdžios pozicija. Jerome Powell pažymėjo, kad FED mato rizikų dėl trumpalaikio infliacijos spaudimo.

Christopher Waller, Čikagos Federalinio Rezervo banko prezidentas, teigė: „Muitai reiškia vienkartinį kainų kilimą, o ne nuolatinę infliaciją – tik laikiną šuolį.“ Jis taip pat pridūrė: „platus duomenų spektras rodo, kad monetarinė politika turėtų būti artima neutraliai, o ne griežta.“ Waller yra vienas iš pagrindinių kandidatų į Federalinio rezervo pirmininko poziciją.

Rinkos lūkesčiai pagal FedWatch:

- Artėjančiame posėdyje (liepos 30 d.): jokių pokyčių nesitikima, 95 % tikimybė, kad norma nebus mažinama.

- Per artimiausius 12 mėn.: rinka tikisi keturių 25 bazinių punktų mažinimų, palūkanų norma sumažės iki 3,25–3,50 %. Pirmas mažinimas numatomas rugsėjį, nors tikimybė reikšmingai sumažėjo.

- Likusiai šių metų daliai: įkainota tik du mažinimai.

- Rugsėjo sumažinimo tikimybė sumažėjo iki 57 %, kai prieš kelis mėnesius buvo 94 %.

Prekybos karai

- ES pritaikė sankcijas dviem Kinijos bankams ir penkioms Kinijos įmonėms. Kinija sureagavo teigdama, kad sankcijos „padarė didelės žalos prekybos, ekonominiams ir finansiniams ryšiams“ ir pažadėjo imtis priemonių „apsaugoti teisėtus Kinijos įmonių ir finansų institucijų interesus“.

- JAV prekybos departamentas taikys preliminarius antidempingo muitus – 93,5 % – Kinijos grafitui. Kartu su esamais tarifais bendra norma išaugs iki 160 %.

Rinka

Akcijų rinka

Per pastarąją savaitę JAV sektorių rodikliai kito nevienodai. Vidutinis nuosmukis siekė -0,31 %. Daugiausiai pakilo technologijų, komunalinių paslaugų ir ryšių paslaugų sektoriai.

Nuo metų pradžios (YTD) augimas – +0,2 %. Didžiausią prieaugį nuo metų pradžios rodo komunalinės paslaugos, žaliavų bei finansų sektoriai.

SP500

Savaitė: +0,59 % (savaitinis uždarymas: 6296,78), 2025 m. nuo metų pradžios: +6,67 %

NASDAQ100

Savaitė: +1,25 % (savaitinis uždarymas: 23065,47), YTD: +9,21 %. Šio ryto išankstinė prekyba vėl pasiekė naują visų laikų rekordą – 23 135.

Euro Stoxx 600

Indeksas beveik nepakito, prekyba vyko arčiau trumpalaikio diapazono vidurio. Savaitės rezultatas – -0,33 %, uždarymo lygis – 546,2. Nuo metų pradžios užfiksuotas augimas – 8,03 %.

Kinijos indeksai smarkiai augo po to, kai Nacionalinė statistikos tarnyba patvirtino tolesnes skatinamąsias pinigų politikos priemones.

###CSI indeksas +0,85 % (savaitinis uždarymas: 4048), nuo metų pradžios: +2,98 %

Hang Seng

Savaitė: +5,53 % (savaitinis uždarymas: 5539,83), nuo metų pradžios: +24,84 %

OBLIGACIJŲ RINKA

Obligacijų rinka išlieka spaudžiama – pajamingumai dar šiek tiek kilo. Ilgalaikės JAV iždo obligacijos (20+ metų, ETF: TLT) nuvertėjo 0,64 %, savaitę uždarius ties 85,24. Nuo metų pradžios rezultatas – -2,92 %. Tačiau šiandienos išankstinėje prekyboje fondas kilo 0,80 %.

PAJAMOS IR SKIRTUMAI 2025/06/30 vs 2024/07/07

- 10 metų JAV iždo obligacijų rinkos pajamingumas: 4,43 % (prieš: 4,41 %)

- ICE BofA BBB JAV bendrovių obligacijų indeksas: 5,33 % (prieš: 5,28 %)

- Skirtumas: 10 m. vs 2 m. obligacijos: 56,0 vs 52,0 bps

- Skirtumas: 10 m. vs 3 mėn. obligacijos: 0,9 vs 0,5 bps

AUKSO ATEITIES SANDORIAI (GC)

Aukso ateities sandoriai išlieka techniškai bulių stadijoje. Per savaitę sandoris smuktelėjo -0,43 % ir užsidarė prie 3355,5 USD už Trojos unciją. Tačiau nuo metų pradžios auksas pakilo net 27,05 %.

DOLERIO INDEKSO ATEITIES SANDORIAI (DX)

Dolerių indeksas rodo atsigavimo požymių, savaitinį augimą +0,67 %, uždarymas ties 98,21. Nepaisant kilimo, nuo metų pradžios indeksas vis dar -9,34 %.

NAFTOS ATEITIES SANDORIAI

Naftos kainos krinta ties vietiniu palaikymo lygiu, savaitės pokytis -3,96 % ir uždarymas ties 66,03 USD už barelį. Nuo metų pradžios kaina krito 8,10 %.

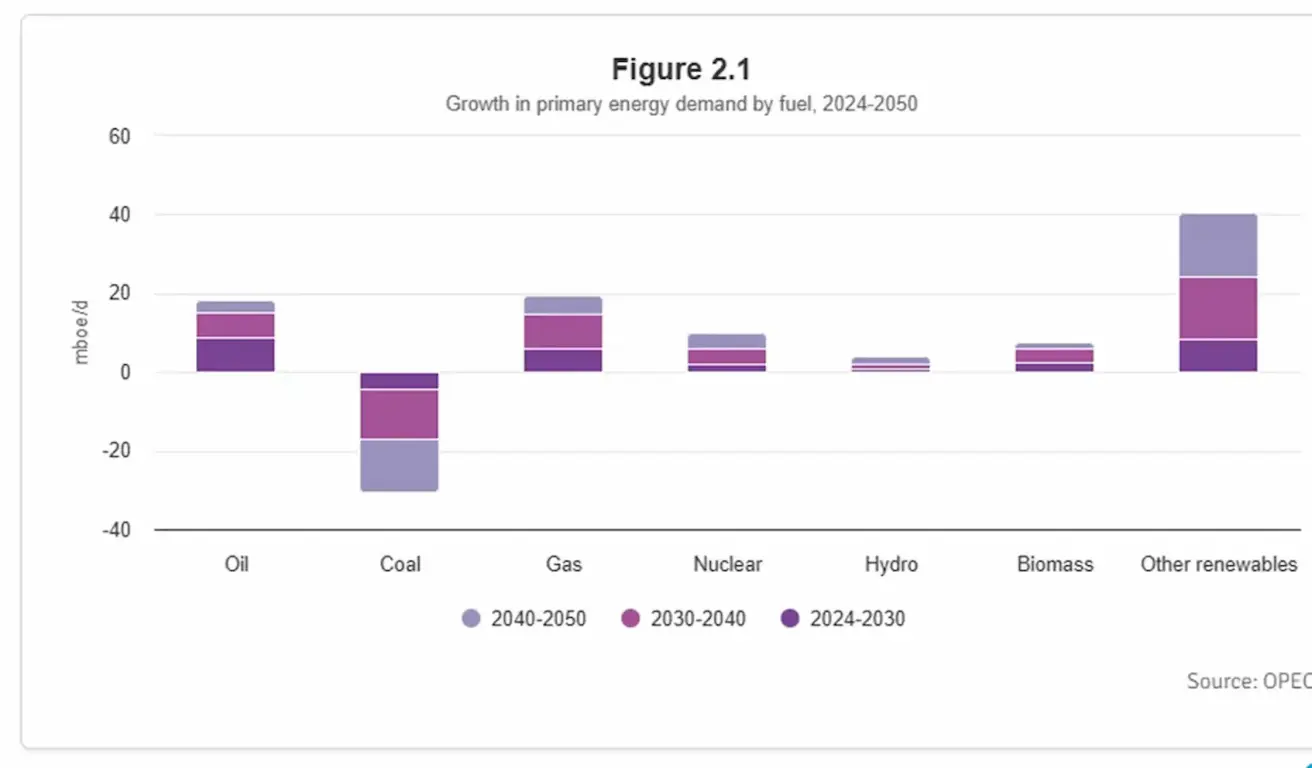

9-OJO OPEC TARPTAUTINIO SEMINARO PAGRINDINĖS IŠVADOS

- Ilgalaikė energijos paklausa: pasaulinė energijos paklausa iki 2050 m. išaugs 23 % ir pasieks beveik 123 mln. naftos ekvivalentu per dieną. Ši prognozė įvertina naujausius energijos ir ekonominės politikos pokyčius, susijusius su augančiu dėmesiu saugumui, kainų prieinamumui ir emisijų mažėjimui.

- Iškastinis kuras išlieka dominuojantis: 2024 m. nafta, dujos ir anglis sudarė apie 80 % pasaulinio energijos balanso – vos šiek tiek mažiau nei 1960 m., kai įkurta OPEC – nors bendras suvartojimas nuo to laiko padidėjo daugiau nei penkis kartus.

- Naftos vaidmuo išliks esminis: nafta išlieka pagrindine pasaulio ekonomikos ir kasdienio gyvenimo dalimi. Jos paklausa, kaip prognozuojama, ir toliau augs iki 2050 m. – aiškaus piko ženklų nematyti.

BTC ATEITIES SANDORIAI

Bitkoino ateities sandoriai per savaitę sumažėjo -0,40 %, savaitės uždarymas – 117 670. Nuo metų pradžios rodiklis stipriai auga – +23,51 % (2025 m.).

ETH ATEITIES SANDORIAI

Ethereum ateities sandoriai pašoko net 14,23 % per savaitę, uždarymas – 3 417. Tačiau nuo metų pradžios – tik +0,98 %.

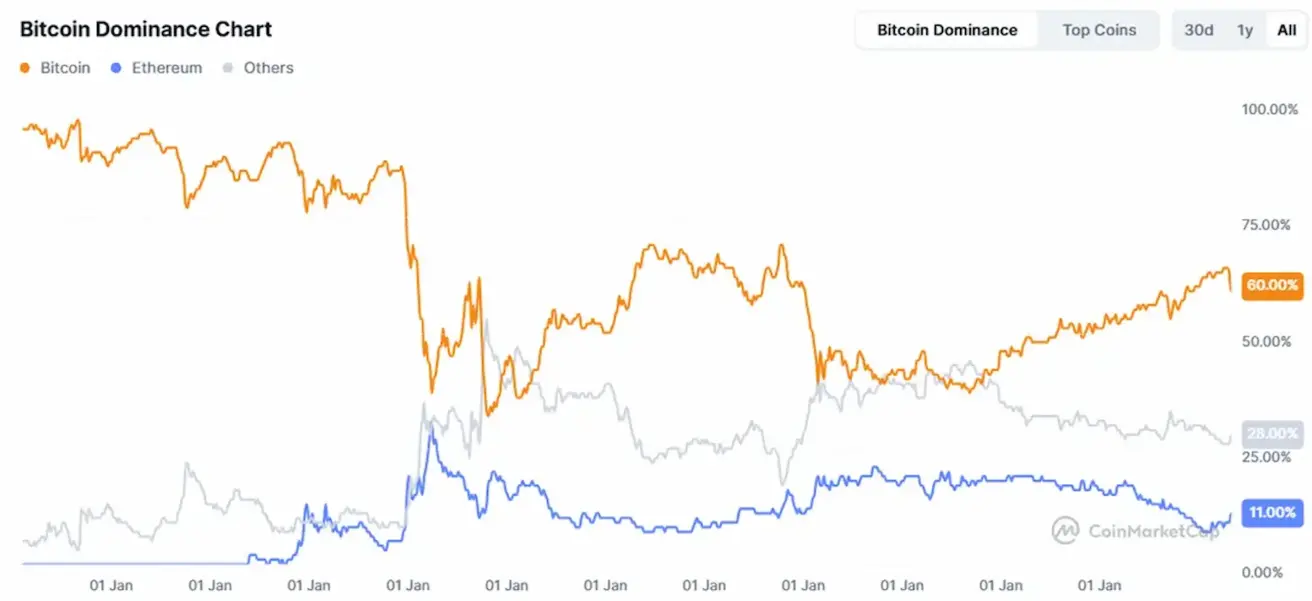

Kripto rinkos kapitalizacija:

Visos kriptoturto rinkos kapitalizacija padidėjo iki 3,95 trln. USD (prieš savaitę buvo 3,82 trln., šaltinis: CoinMarketCap).

- Bitkoino dalis rinkoje sumažėjo iki 60,0 % (nuo 63,8 %)

- Ethereum dalis išaugo iki 11,6 % (buvo 9,6 %)

- Altcoinų dalis išliko stabili – 28,5 % (buvo 26,5 %)

English

English Қазақша

Қазақша