Destinus Acquires Daedalean for $223M

Raison Invested in Destinus Back in 2022

The future of aviation is no longer defined by engine power or speed. The focus is shifting toward intelligence. This is why the deal in which Mikhail Kokorich’s Destinus acquires Swiss AI startup Daedalean for $223 million is a milestone. It is not just another merger and acquisition (M&A), but a bet on autonomous defense systems, where artificial intelligence becomes the core operating system of military drones.

From Hypersonics to AI Drones

Mikhail Kokorich’s path reflects how entrepreneurial strategies adapt to changing realities. From Dauria in Russia to Momentus in the United States, and finally to Switzerland with the founding of Destinus.

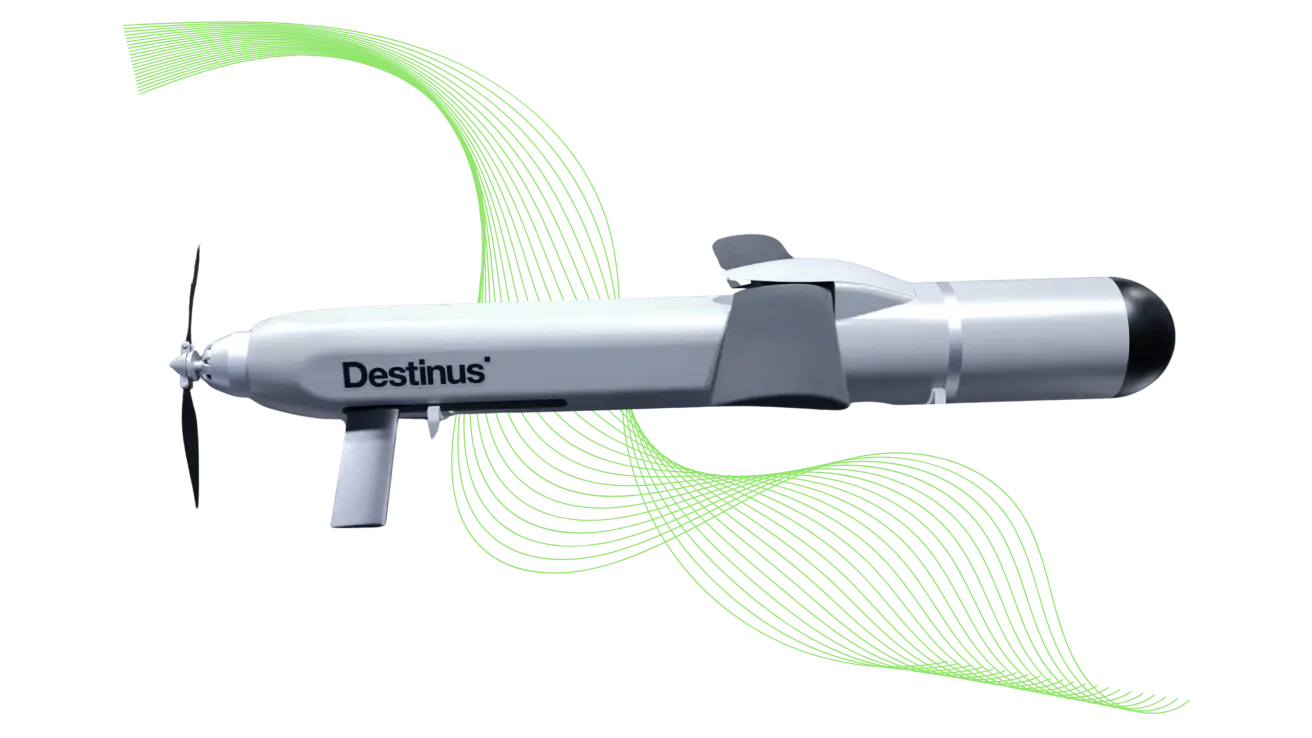

The initial ambition was to build a hydrogen-powered hypersonic aircraft. Today, the strategic focus has shifted to AI-powered drones, where competitive advantage no longer lies in thrust but in intelligent algorithms capable of GPS-free navigation.

Daedalean: AI Intelligence Beyond Satellites

Founded in Zurich in 2016, Daedalean has grown into a leading developer of AI for aviation. The company builds certifiable software that:

- enables navigation without GPS and GNSS,

- recognizes environments and objects in real time,

- supports pilots and drones in communication-denied environments.

With more than 150 specialists, including 13 PhDs, Daedalean is not just a startup but a hub of deep AI and aviation expertise that is nearly impossible to replicate from scratch.

Why This Acquisition Matters

The transaction, valued at 180 million Swiss francs (~$223 million), is structured as a mix of cash and equity, with closing expected by late 2025.

For Destinus, this acquisition represents a step into a new league: not only acquiring technology but also gaining a team capable of certifying complex AI systems. This allows faster go-to-market timelines, narrows the gap with established defense players, and enables offerings competitors cannot yet match — GPS-independent navigation for military drones.

It is also important to note that Raison was among the earliest direct investors in Destinus, backing the company in February 2022. The current deal validates that early bet: Destinus is now firmly positioned in a sector that is becoming strategic for global defense and security.

As Kokorich stresses, the future of drones depends on autonomy — and this autonomy must be war-resilient, operating even when satellite signals are jammed or denied.

Market Implications

- AI becomes the backbone of defense. Artificial intelligence is no longer peripheral; it is now at the center of defense innovation, with governments already procuring such systems.

- From startup to contractor. With Daedalean’s integration, Destinus transitions from an ambitious aerospace concept to a credible defense technology contractor.

- Shift in investment priorities. Hypersonic passenger aircraft remain futuristic, while capital is now flowing into AI military drones, where return on investment (ROI) is stronger and demand is secure.

The Investor Lens

Key signals for investors include:

- Defense drives civilian innovation. Historically, military tech creates the foundation for civilian adoption. GPS-free AI navigation may soon be used in commercial aviation and logistics.

- AI navigation without GPS is a growth market. Geopolitical pressures accelerate demand for satellite-independent solutions.

- R&D meets capital. Teams like Daedalean cannot scale alone; they require partners such as Destinus, which combines research and development (R&D) capabilities with financial strength.

Conclusion

This acquisition marks a turning point.

Unmanned systems are becoming the new infrastructure of defense, and artificial intelligence their decisive instrument.

For investors, the message is clear: growth opportunities are shifting to the intersection of defense, autonomy, and AI. Risks are above average, but this is precisely the sector that will shape company valuations over the next 5–10 years.

For Raison, this also confirms the accuracy of its early investment strategy: supporting Destinus in February 2022 was a forward-looking bet on technologies that today are entering the global spotlight.

Қазақша

Қазақша