November 25 — November 29: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (YoY) (October): 3.3%, (pre: 3.3%)

- Consumer Price Index (CPI) (YoY) (October): 2.6%, (pre: 2.4%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (October): 2.6%, pre: 2.7%;

- 5-year expected inflation (October): 3.2% pre: 3.1%.

Federal Reserve Inflation Benchmark:

- Core Personal Consumption Expenditures (PCE) Index (MoM) (October): 0.3% (previous: 0.3%).

- Core Personal Consumption Expenditures (PCE) Index (YoY) (October): 2.8% (previous: 2.7%).

Personal Consumption Expenditures (PCE) Index (YoY) (October): 2.3% (previous: 2.1%).

GDP (Bureau of Economic Analysis, BEA) (QoQ) (Q3, second estimate): 2.8% (previous: 3.0%).

- GDP (Bank of Atlanta) Short-Term Forecast: Up to 2.7% (previous: 2.6%).

- GDP Deflator (QoQ) (Q3): 1.9% (previous: 2.5%).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (November): 57.0 (October: 55.0);

- Manufacturing sector (November): 46.3 (October: 49 revised).

- S&P Global Composite (November): 55.3 (October: 54.1).

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.50%–4.75% (range).

- Federal Reserve Balance Sheet: $6.905 trillion (vs. last week: $6.923 trillion).

MARKET FORECAST FOR RATE

Commentary:

According to the "second" estimate released by the Bureau of Economic Analysis, real Gross Domestic Product (GDP) increased at an annual rate of 2.8% in the third quarter of 2024. No significant economic contraction is observed. Overall, this figure represents the average for the range since Q3 2022.

The GDP deflator rose by 1.9%, with a continued downward trend in this index.

Personal Income:

- Current-dollar personal income increased by $175.9 billion in the third quarter, $45.3 billion lower than the previous estimate.

- Disposable personal income rose by $122.9 billion, or 2.3%, in the third quarter, $43.1 billion less than the previous estimate. Real disposable personal income increased by 0.8%.

- Personal savings amounted to $934.4 billion in the third quarter, $34.0 billion lower than the previous estimate. The personal saving rate—personal savings as a percentage of disposable personal income—was 4.3%.

The Federal Reserve’s primary inflation metric increased by 0.2% and 0.3% month-over-month for the PCE and Core PCE indexes, respectively. Year-over-year, growth was 2.1% and 2.8% for the PCE and Core PCE indexes, respectively.

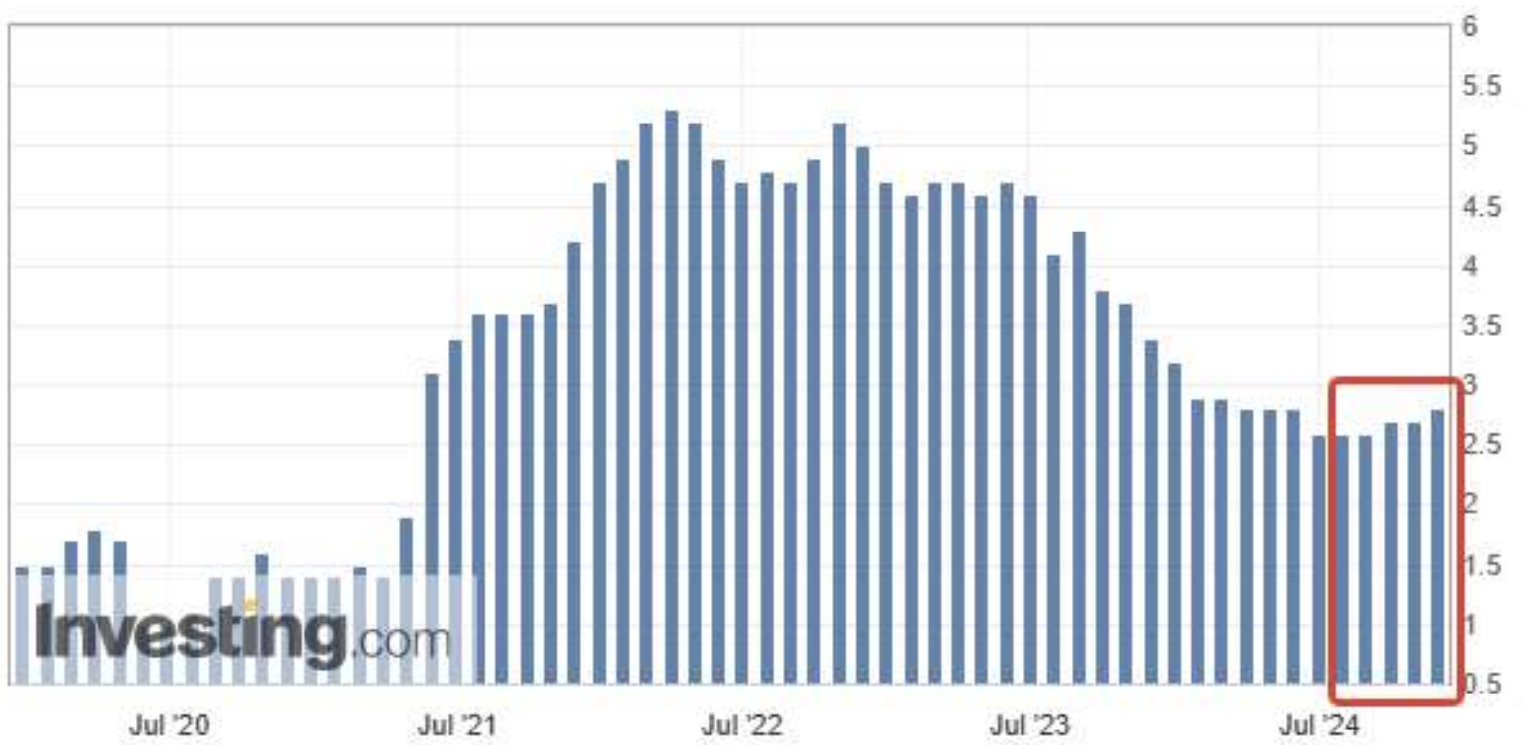

Periods where the Federal Reserve paused rate hikes are highlighted in red squares. A rise in Core PCE is observed both on a monthly and annual basis. The volatile PCE index also increased slightly in the current release.

Risks of further inflation growth persist. Concerns have intensified due to Donald Trump’s announced plans to impose 25% tariffs on all goods imported from Mexico and Canada.

The PCE data release and the announced tariff plans support a narrative of slowing the pace of rate cuts. This perspective was also reflected in the Federal Reserve minutes, which emphasized the central bank’s cautious approach to rate reductions, citing economic uncertainty and persistent inflation concerns.

Nevertheless, over the past week, expectations for one rate cut according to FedWatch slightly increased from 56% to 63%. Long-term expectations remain unchanged: an additional two cuts of 0.25% each, bringing the rate to the range of 3.75–4.00%.

MARKET

MARKET CAP PERFORMANCE

The stock market:

Last week, the market grew by +1.1%. The leaders were healthcare, consumer goods, and real estate sectors. Optimism emerged in the markets, driven by Donald Trump's nomination of hedge fund manager Scott Bessent for the position of Treasury Secretary. Investors anticipate his actions to reduce market risks and soften protectionist measures.

SP500

+0.65%, another all-time high of 6,044 was reached on Friday.

NASDAQ100

Nasdaq100: +0.04%

Comparative dynamics of the S&P index by years. The growth in 2024 turned out to be one of the strongest since 1928.

TREASURY MARKET

**Treasury Bonds UST2:**0.31%, today opened with a gap of 0.19%.

Treasury Bonds UST10: +1.23%

A decline in Treasury bond yields is observed despite the regulator's cautious rhetoric—this is likely more related to the increase in market uncertainty.

Yields and Spreads

The spread between the 10-Year Treasury (4.25%) and the Corporate Index BBB US (5.29%) is 1.04%.

10-Year Treasury minus 2-Year Treasury: 0,05%; 10-Year Treasury Constant Maturity Minus 3-Month Treasury: -0,40%:

GOLD FUTURES

Gold futures (GC) declined by 2.31% over the past week.

DOLLAR FUTURES (DX)

Dollar Futures (DX): -1.14%.

BTC

Bitcoin Futures: -3.48%.

ETH

Ethereum Futures: +8.32%

You may also like:

November 18 — November 22: Weekly economic update

Join 20,000+ investors and access top-tier financial instruments