22.–28. jaanuar 2025: Nädalane majandusülevaade

Peamised turuülevaated

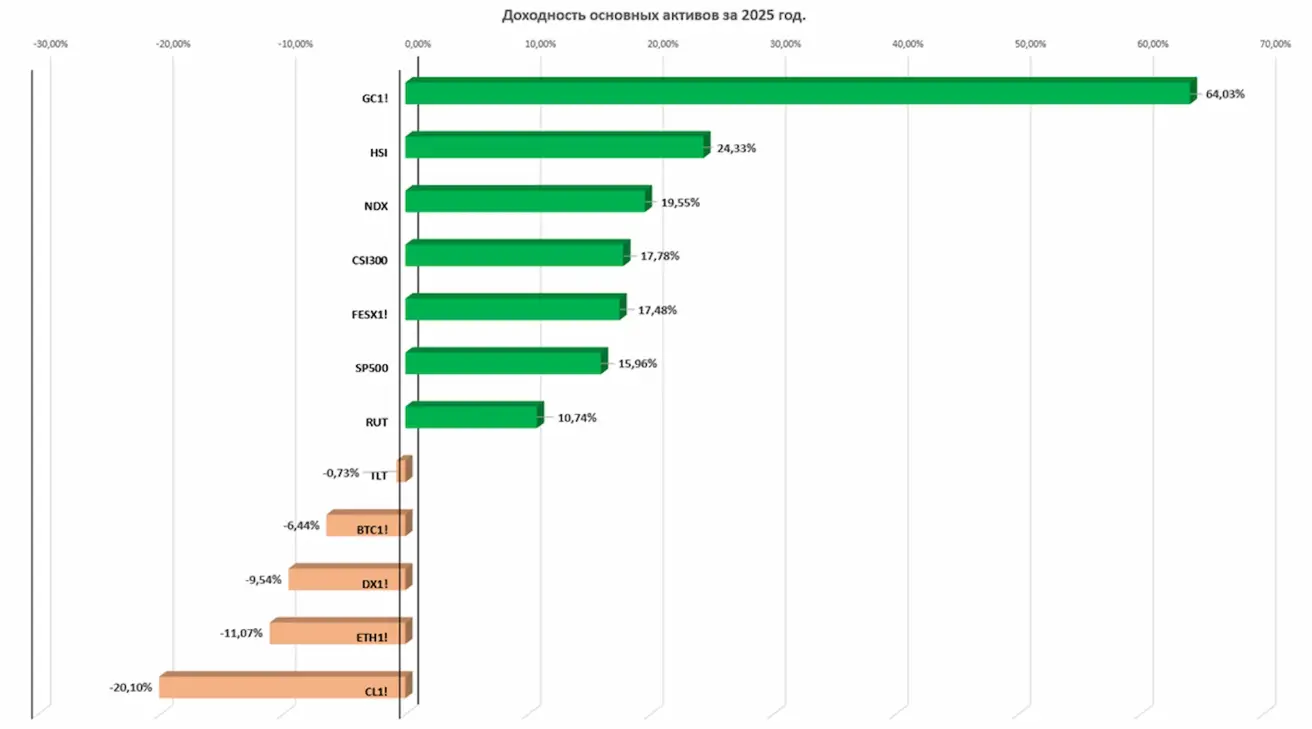

Key Assets'i tootlus 2025. aastal:

Möödunud nädalal püsis turu sentiment laias laastus positiivne hoolimata jätkuvatest geopoliitilistest riskidest ja Föderaalreservi rahapoliitiliste eesmärkidega võrreldes nõrgematest makromajandusnäitajatest. Kõrge riskiga varad näitasid tugevaimat tootlust.

USA inflatsiooniootused on naasnud tõusvale trajektoorile. Tööpuuduse määr langes 0,2 protsendipunkti võrra; siiski viitavad enamik teisi tööturu näitajaid jätkuvale hõive dünaamika aeglustumisele. Samal ajal hindab Atlanta Föderaalreservi pank oma mudeli GDPNow põhjal USA SKP jooksvaks kasvuks 5,4%.

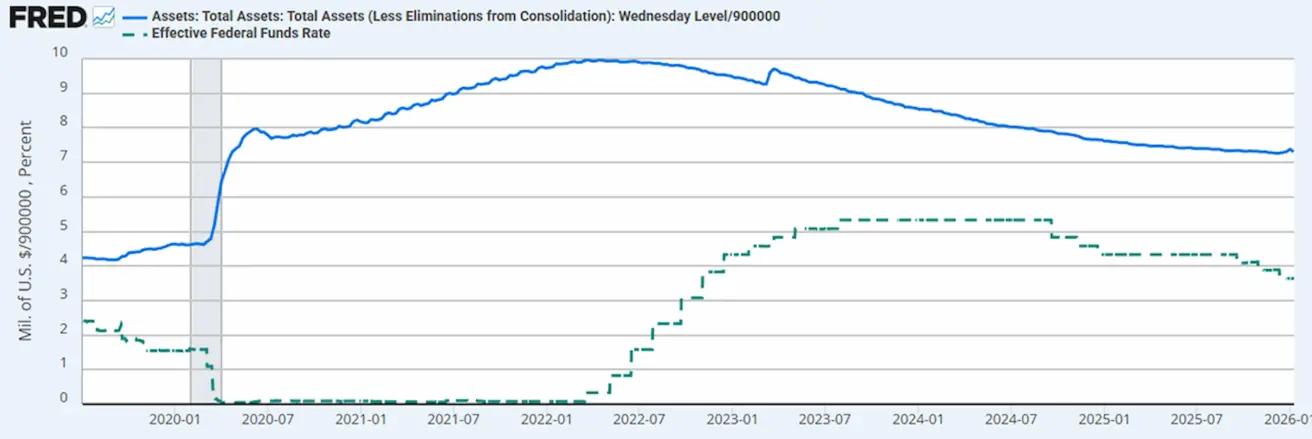

Pärast kvantitatiivse karmistamise (QT) peatamist on Föderaalreservi bilanss kasvanud 0,59% võrra, ulatudes 6,57 triljoni USA dollarini.

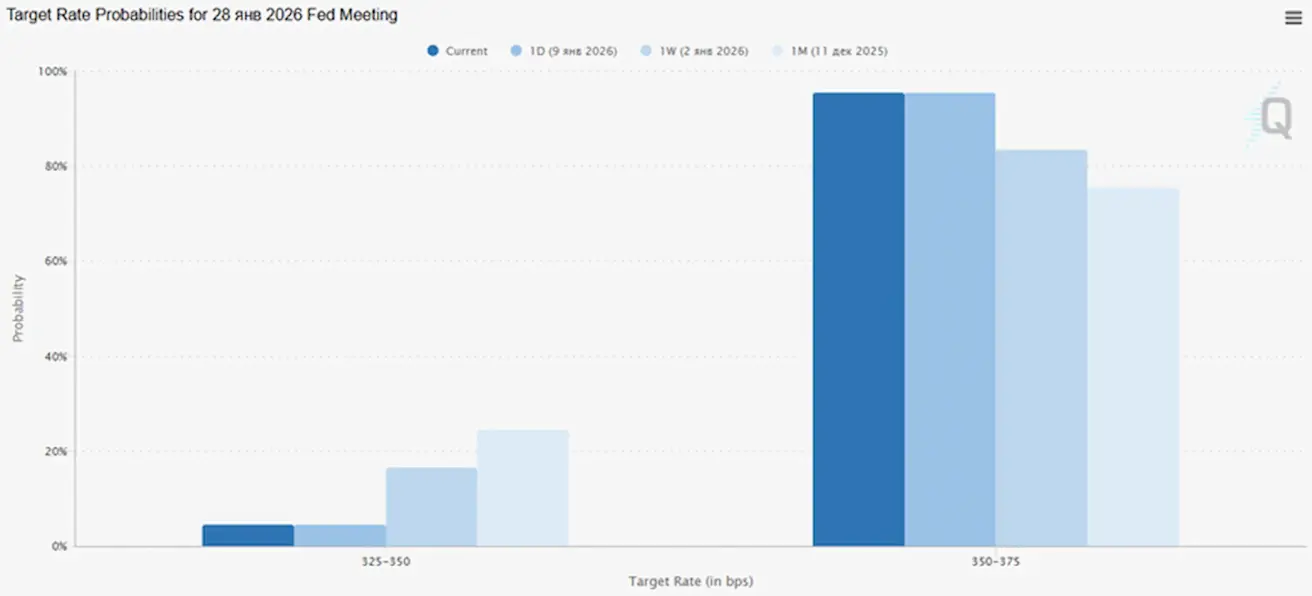

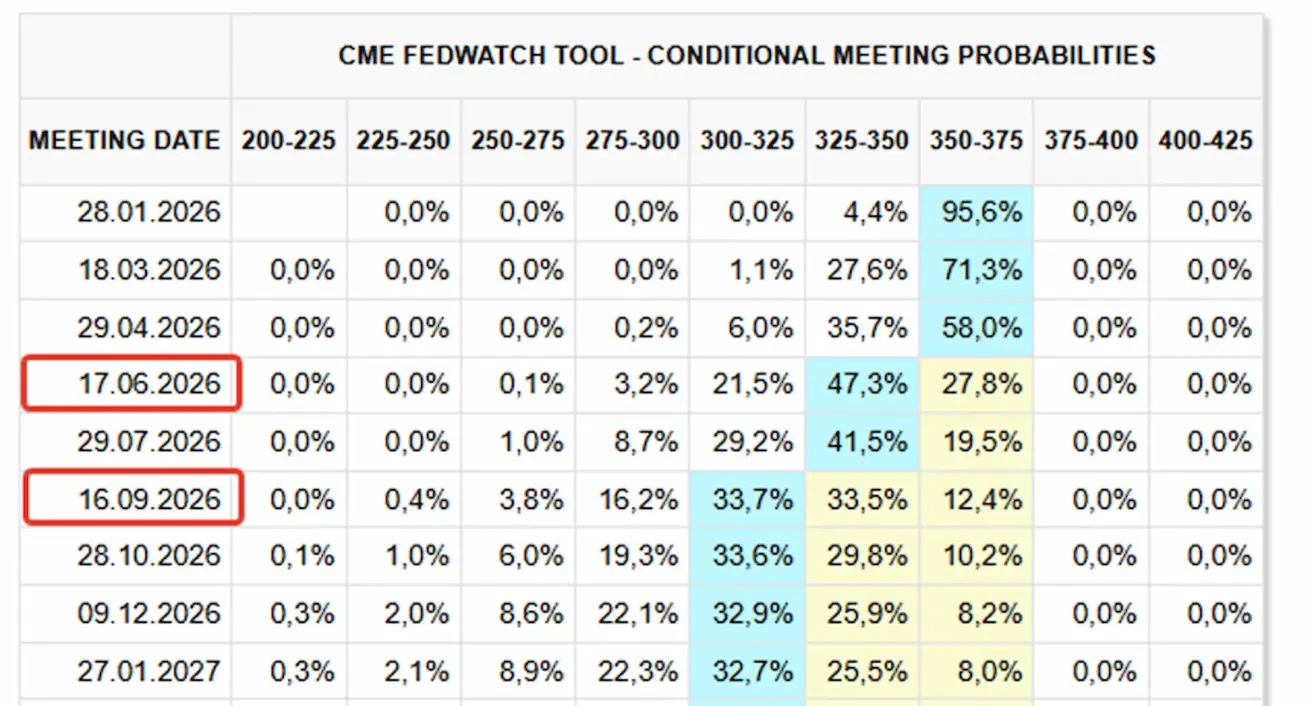

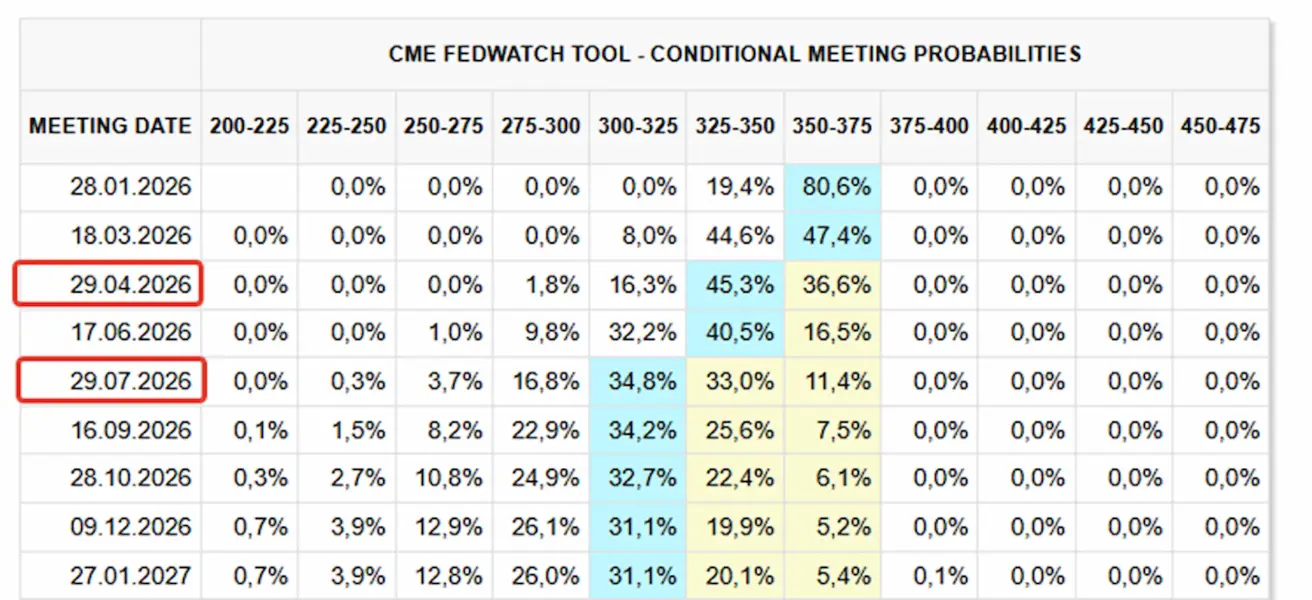

Intressimäära-swap’ide turg (FedWatch) hinnastab praegu 2026. aastaks sisse kahte baasintressimäära langetust, kusjuures esimene kärbe on nihkunud juuli istungile. Implitseeritud tõenäosus 25 baaspunkti suuruseks intressimäära langetuseks jaanuari FOMC istungil (28. jaanuar) on vaid 4,43%.

USA Justiitsministeerium andis reedel Föderaalreservile üle vandekohuse kohtukutse, viidates võimalikule kriminaalvastutusele seoses mitmeaastase renoveerimisprojektiga, mis puudutab Föderaalreservi ajaloolisi büroohooneid.

Esimees Powell kommenteeris: „Neid enneolematu iseloomuga samme tuleks vaadelda laiemas kontekstis koos administratsiooni poolsete ähvarduste ja jätkuva survega.”

Ameerika Ühendriigid

- Baasintressimäär muutmata; kommunikatsioon püsib ettevaatlik.

- Rahapoliitika hoiak on mõõdukalt piirav, liikudes järk-järgult neutraalse suunas.

- Föderaalreserv hoiab hoolikalt tasakaalu: toetatakse finantsturge, vältides samas signaale kiirendatud intressimäära langetuste tsüklist.

- USA makromajanduslikud näitajad toetavad jätkuvalt pehme maandumise stsenaariumi: majanduskasv püsib üle potentsiaali, inflatsioon aeglustub ning tööturg jahtub ilma majanduslanguse märkideta.

Makromajandusstatistika

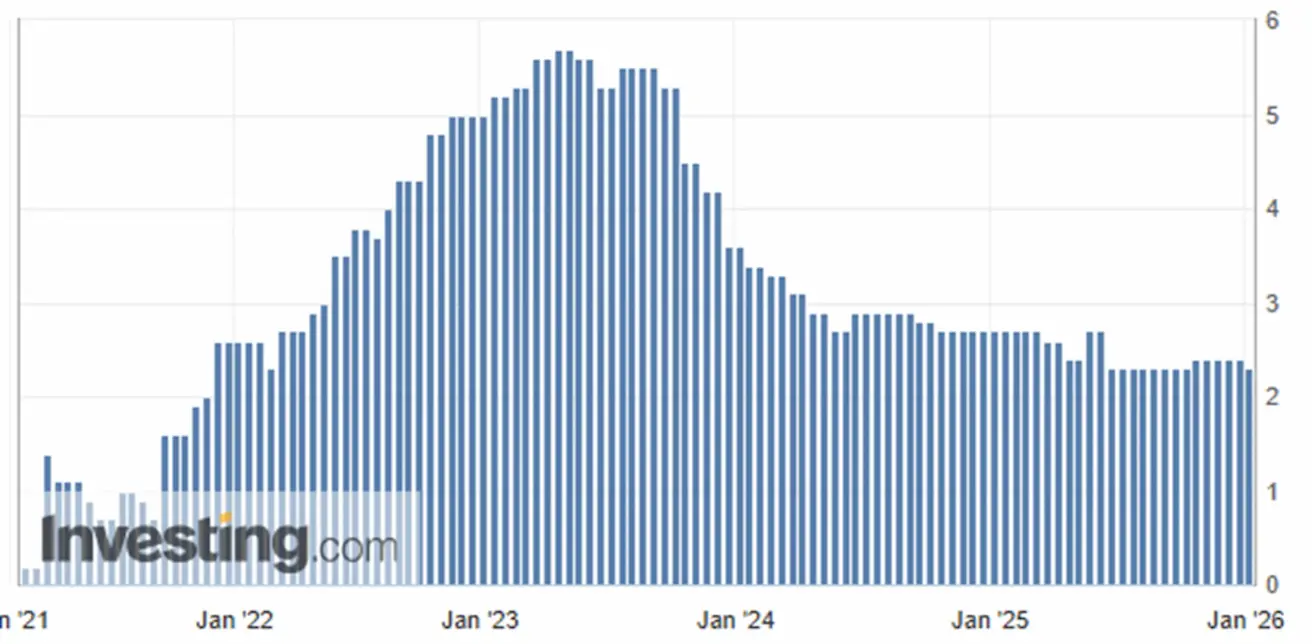

INFLATSIOON: TARBIJAHINDADE INDEKS (SEPTEMBER):

- Põhiinflatsioon (Core CPI): (k/k) 0,2% (varem: 0,3%); (a/a) 2,6% (varem: 3,0%).

- Üldine CPI: (k/k) 0,3% (varem: 0,4%); (a/a) 2,7% (varem: 3,0%).

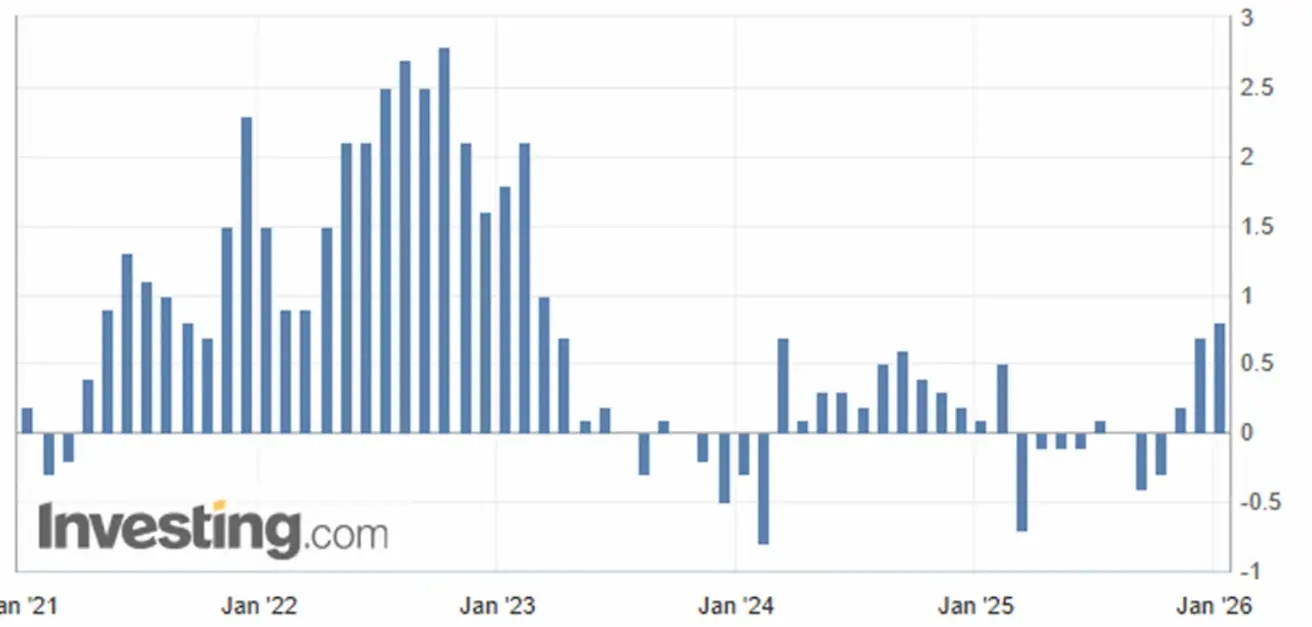

TOOTJAHINDADE INDEKS (SEPTEMBER):

- PPI (k/k): 0,3%, varem: −0,1%.

- Põhi-PPI (k/k): 0,1%, varem: −0,1%.

INFLATSIOONIOOTUSED (MICHIGAN) (DETSEMBER):

- 12 kuu inflatsiooniootus: 4,2%, varem: 4,1%;

- 5 aasta inflatsiooniootus: 3,4%, varem: 3,2%.

PÕHILINE ISIKLIKU TARBIKULUTUSE HINNAINDEKS (CORE PCE, SEPTEMBER)

(Föderaalreservi eelistatuim inflatsioonimõõdik):

- (k/k): 0,2%, varem: 0,2%; (a/a): 2,8%, varem: 2,9%.

SKP (U.S. Bureau of Economic Analysis, BEA) (III kv 2025, annualiseeritud, esialgne hinnang): +4,3% (II kv 2025: +3,8%). Atlanta Föderaalreservi panga GDPNow näitaja (IV kv): 5,4% (varem: 5,5%):

(GDPNow prognoosimudel annab ametlikule näitajale enne avaldamist „jooksvat” hinnangut, kasutades SKP kasvu hindamisel metoodikat, mis on sarnane USA majandusanalüüsi büroo (BEA) omaga.)

(GDPNow prognoosimudel annab ametlikule näitajale enne avaldamist „jooksvat” hinnangut, kasutades SKP kasvu hindamisel metoodikat, mis on sarnane USA majandusanalüüsi büroo (BEA) omaga.)

ÄRITEGEVUSE INDEKS (PMI) (DETSEMBER):

(Üle 50 viitab laienemisele; alla 50 viitab kokkutõmbele)

- Teenindussektor: 52,5 (varem: 54,9);

- Töötlev tööstus: 51,8 (varem: 51,8);

- S&P Global Composite: 52,7 (varem: 53,0).

TÖÖTURG (BLS) (detsember)

- Tööpuuduse määr: 4,4% (varem: 4,6%);

- Töötushüvitist saavate isikute koguarv USA-s: 1 914 tuhat (varem: 1 923 tuhat, revideeritud);

- Esmased töötutoetuse taotlused: 208 tuhat (varem: 200 tuhat);

- Palkade kasv väljaspool põllumajandust (nonfarm payrolls): +37 tuhat (varem: +64 tuhat);

- Erasektori nonfarm hõive muutus: +37 tuhat (varem: +69 tuhat);

- Keskmine tunnipalk (a/a): 3,8% (varem: 3,5%);

- Vabade töökohtade arv (JOLTS): 7,146 miljonit (varem: 7,227 miljonit).

RAHAPOLIITIKA

- Efektiivne föderaalfondide määr (EFFR): 3,50%–3,75%;

- Föderaalreservi bilanss: 6,573 triljonit USD, +0,59% alates kvantitatiivse karmistamise peatamisest (6,535 triljonit USD).

TURU OOTUSED INTRESSIMÄÄRA SUHTES (FEDWATCH)

Järgmine FOMC istung (28. jaanuar): implitseeritud tõenäosus 25 baaspunkti suuruseks intressimäära langetuseks on 4,43%.

12 kuu väljavaade: turg hinnastab sisse kahte 25 baaspunkti suurust kärbet, mis viivad baasintressimäära vahemikku 3,00–3,25%. Esimene langetus on oodatud juulis, pärast kolme FOMC istungit.

Täna:

Nädal varem:

Turg

SP500

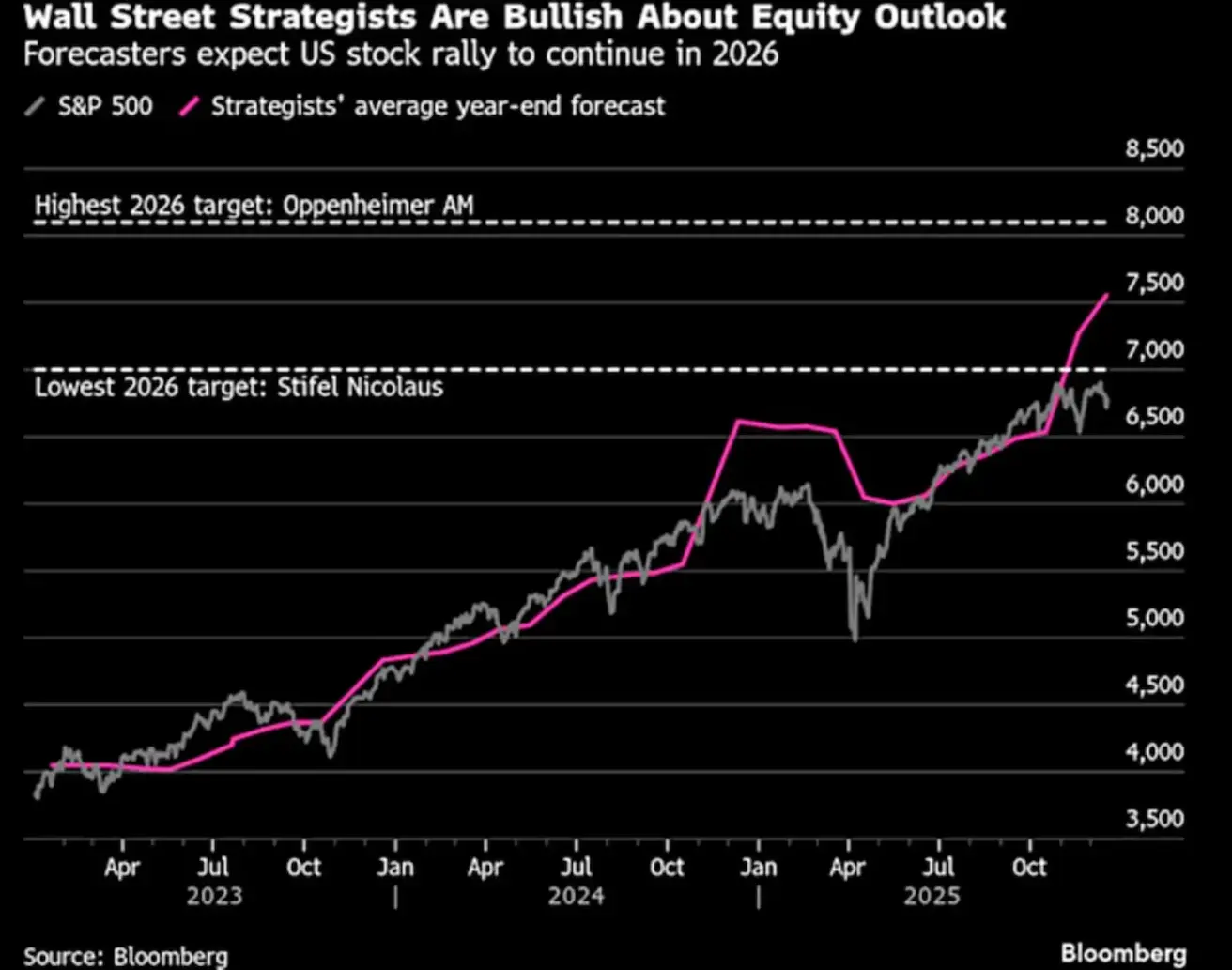

Aasta algusest (Year-to-Date): +1,76% (nädala lõpu sulgemistase: 6 966,29).

NASDAQ100

Aasta algusest: +2,05% (nädala lõpu sulgemistase: 25 766,26).

RUSSEL 2000 (RUT)

Aasta algusest: +5,73% (nädala lõpu sulgemistase: 2 624,22).

VIX

VIX volatiilsusindeks kaupleb taas oma madalate tasemete lähedal, nädal sulgus alla 15 punkti piiri.

USA aktsiaturu väljavaate osas järgmiseks aastaks püsib Wall Street’i konsensus mõõdukalt tõusule orienteeritud. Prognoosivahemiku ülemine piir ulatub üle 8 000 punkti, alumine piir on koondunud 7 000 punkti ümbrusse. Sentimenti toetavad ootused ligikaudu 14% suuruseks ettevõtete kasumite kasvuks 2026. aastal koos tehisintellekti jätkuva arengu ja levikuga.

Euroala

- Baasintressimäärad muutmata; inflatsioon on kontrolli all.

- Rahapoliitika hoiak on neutraalne, riskide tasakaal on nihkumas inflatsioonilt majanduse nõrkuse suunas.

- Kaubanduspingete leevenedes on EKP tõstnud oma keskpika perioodi SKP ja inflatsiooni prognoose.

- Euroopa majandus stabiliseerub, kuid kasvudünaamika jääb endiselt USA omale alla.

Intressimäärad:

- Hoiustamise püsivõimaluse intressimäär (deposit facility rate): 2,0% (varem: 2,0%).

- Laenamise püsivõimaluse intressimäär (marginal lending facility rate): 2,4% (varem: 2,4%) – määr, millega pangad saavad keskpangast üleöölikviidsust.

- Lühiajaline (poliitika) intressimäär: 2,15% (varem: 2,15%).

Inflatsioon (novembri CPI):

- Põhiinflatsioon (Core CPI, a/a): 2,3% (varem: 2,4%).

SKP (III kv, lõplik hinnang):

- Kvartaalselt: 0,3% (varem: 0,1%).

- Aastas: 1,4% (varem: 1,5%).

Tööpuuduse määr (detsember): 6,23% (varem: 6,4%).

Ostujuhtide indeksid (PMI, detsember):

- Teenused: 52,4 (varem: 52,6).

- Töötlev tööstus: 48,8 (varem: 49,2).

- S&P Global Composite: 51,5 (varem: 51,9).

EURO STOXX 600

Aasta algusest: +2,96% (nädala lõpu sulgemistase: 611,6).

Hiina

- Majandus stabiliseerub ekspordi toel, samal ajal kui sisenõudlus ja investeeringud püsivad nõrgad; poliitikameetmed on sihitud ja ettevaatlikud.

- Intressimäärad muutmata.

- Rahapoliitika hoiak on ekspansiivne.

- Hiina kinnitas oma 2026. aasta raamistikus pühendumust hoida majanduskasvu toetavat fiskaalpoliitikat, keskendudes sisenõudluse ergutamisele, maksusoodustuste ja toetuste optimeerimisele ning tööstuse moderniseerimisele.

Intressimäärad:

- 1-aastane laenu baasintressimäär (1Y Loan Prime Rate, keskpika tähtajaga laenud): 3,50%.

- 5-aastane laenu baasintressimäär (5Y Loan Prime Rate, viie aasta baas, oluline eluasemelaenude hinnastamisel): 3,50%.

Inflatsiooninäitajad (detsember):

- Tarbijahinnaindeks (CPI), kuises võrdluses: 0,2% (varem: −0,1%); aastases võrdluses: 0,8% (varem: 0,7%).

Tootjahinnad ja aktiivsusnäitajad:

- Tootjahinnaindeks (PPI), a/a: −1,9% (varem: −2,2%).

- Tööpuuduse määr (november): 5,1% (varem: 5,1%).

- Tööstustoodang (november), a/a: 4,8% (varem: 4,9%).

- Põhivara investeeringud (november), a/a: −2,6% (varem: −1,7%).

- Jaemüük (november), a/a: 1,3% (varem: 2,9%).

Väline kaubandus (detsember):

- Import, a/a: 1,9% (varem: 1,0%).

- Eksport, a/a: 5,9% (varem: −1,1%).

- Kaubandusbilanss (USD, detsember): 111,68 miljardit USD (varem: 90,7 miljardit USD).

Ostujuhtide indeksid (PMI, november):

- Töötlev tööstus: 49,2 (varem: 49,0).

- Mittemanufaktuur (teenused ja ehitus): 49,0 (varem: 49,0).

- Komposiit-PMI: 49,5 (varem: 50,1).

CSI 300 INDEKS

Aasta algusest: +2,79% (nädala lõpu sulgemistase: 4 758,692).

HANG SENG TECH INDEKS (HSTECH.HK)

Aasta algusest: +3,10% (nädala lõpu sulgemistase: 5 687,14).

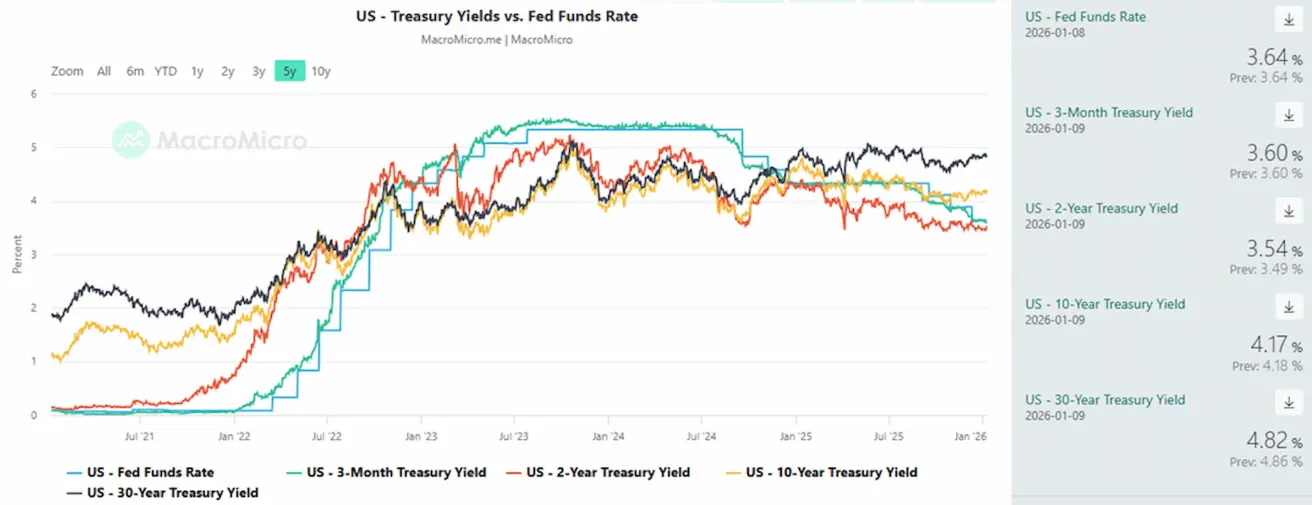

VÕLAKIRJATURG

Tootlused ja krediidimarginaalid ei viita sügava majanduslanguse või kõrgenenud süsteemse riski stsenaariumile. USA riigivõlakirjad 20+ aastat (ETF: TLT): aasta algusest tootlus +0,88%, nädal sulgus tasemel 87,93.

TOOTLUSED JA SPREADID

- USA 10-aastaste riigivõlakirjade tulumäär (10-Year Constant Maturity): 4,17% (varem: 4,14%); 2-aastane riigivõlakirja tootlus: 3,54% (varem: 3,49%).

- ICE BofA BBB USA ettevõtete võlakirjaindeks – efektiivne tootlus: 5,04% (varem: 5,01%).

- 10a–2a USA riigivõlakirjade tulususe vahe: 63 baaspunkti (varem: 68 bp).

- 10a–3k USA riigivõlakirjade tulususe vahe: 57 baaspunkti (varem: 54 bp).

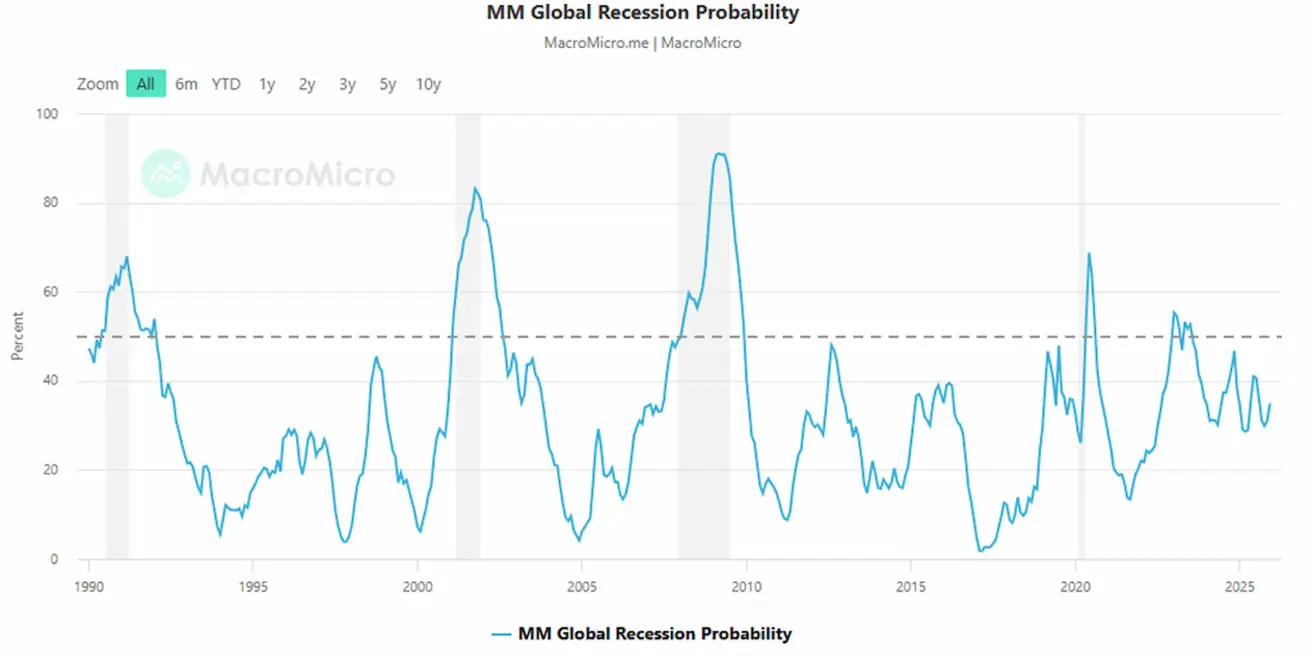

USA 5-aastane krediidiriski vahetustehing (CDS): 26,54 bp, võrreldes 26,99 bp-ga eelmisel nädalal, viidates stabiilsele riigi krediidiriskile. MacroMicro Global Recession Indicator: püsib alla 50 punkti piiri, viidates väikesele tõenäosusele globaalse majanduslanguse stsenaariumi realiseerumiseks:

KULDA FUTUURID (GC)

Aasta algusest: +4,30%, nädal sulgus hinnatasemel 4 518,4 USA dollarit troi untsi kohta. Kulla hinnatõusu veab kombinatsioon püsivast keskpankade nõudlusest ja globaalse riigi- ja avaliku sektori võlakoormuse jätkuvalt kiirest kasvust.

Juhtivate pankade ja varahaldurite kulla hinnaprognoosid 2026. aasta lõpuks: hinnangute vahemik on jätkuvalt lai, konsensuslik keskmine on ligikaudu kooskõlas praeguse spot-hinnatasemega:

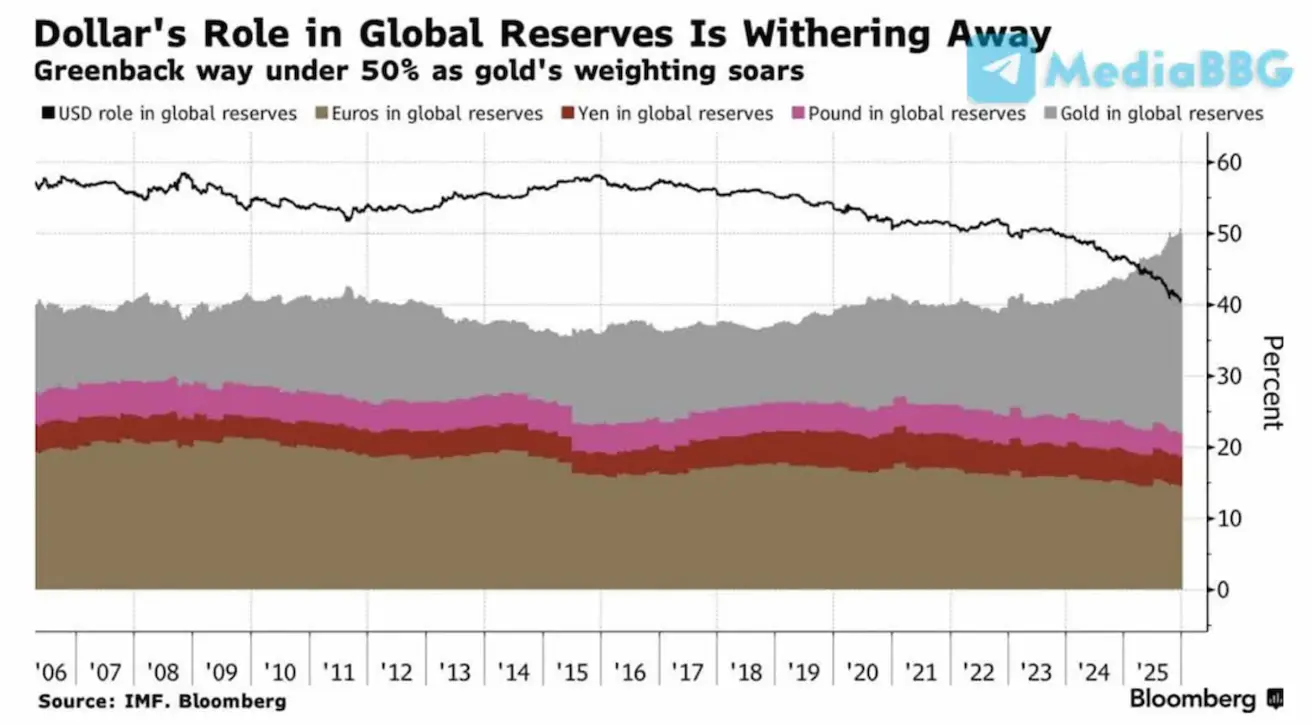

- aastal edestas kuld USA dollarit ning sai maailma suurimaks reservvaraks.

DOLLARIINDEKSI FUTUURID (DX)

Aasta algusest: +0,92%, nädal sulgus tasemel 98,92. USA dollar on jätkuvalt väga tundlik intressimääraerinevuste suhtes, kuid tõenäoliselt leiab lühikeses plaanis tuge intressimäära langetuste pausi tingimustes.

Naftaturg on viimastele arengutele rahulikult reageerinud. Venezuela roll globaalses naftapakkumises on praegu marginaalne, moodustades vähem kui 1% kogutoodangust. Toodang on viimastel aastatel sanktsioonide tõttu järsult vähenenud. Samas tuleks keskpikas plaanis oodata raske toornafta – Venezuela peamise kvaliteedi – pakkumise kasvu, potentsiaaliga suurenemiseks järgmise kolme kuni viie aasta jooksul.

NAFTAFUTUURID

Aasta algusest: +2,39%, nädal sulgus tasemel 58,78 USA dollarit barreli kohta.

- Ootused naftaturu pakkumise kasvuks püsivad.

- Selle taustal on oodata, et OPEC+ peatab edasised tootmise suurendamised, samal ajal kui Venezuela ja Lähis-Ida geopoliitilised arengud lisavad täiendava määramatuse kihi.

56 USA dollari tase barreli kohta toimib jätkuvalt tugeva tehnilise toetusena.

Krüptoturg areneb jätkuvalt institutsionaalses suunas: arenev turuinfrastruktuur, pankade kasvav osalus ja tõusev on-chain likviidsus kujundavad küpsemat turukeskkonda, ilma selgete spekulatiivse ülekuumenemise märkideta.

BTC FUTUURID

Aasta algusest: +3,72%, nädal sulgus tasemel 90 984 USA dollarit.

Üks maailma suurimaid varahaldureid VanEck prognoosib, et Bitcoin on 2026. aastal parima tootlusega vara.

ETH FUTUURID

Aasta algusest: +5,0%, nädal sulgus tasemel 3 122,60 USA dollarit.

KOGU KRÜPTOVALUUTATURU TURUKAPITALISATSIOON

3,10 triljonit USD (võrreldes 3,02 triljoni USD-ga nädal varem, CoinMarketCap)

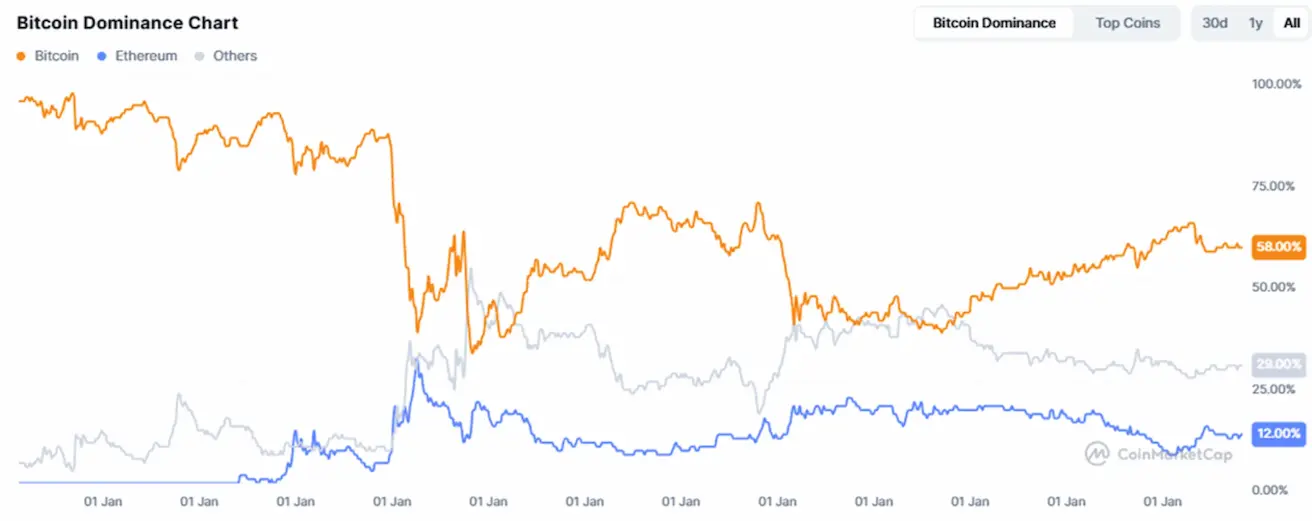

Turujagatis varaklasside lõikes:

- Bitcoin: 58,4% (varem: 59,1%).

- Ethereum: 12,1% (muutumatult).

- Muud krüptovaluutad: 29,5% (varem: 28,8%).

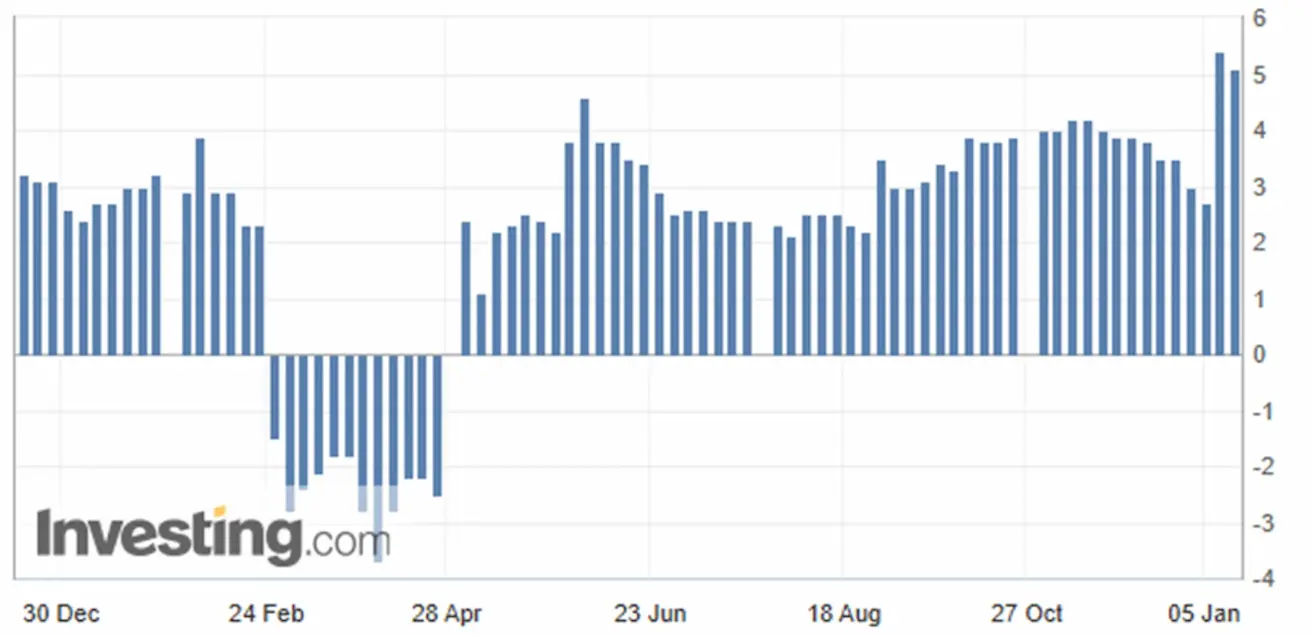

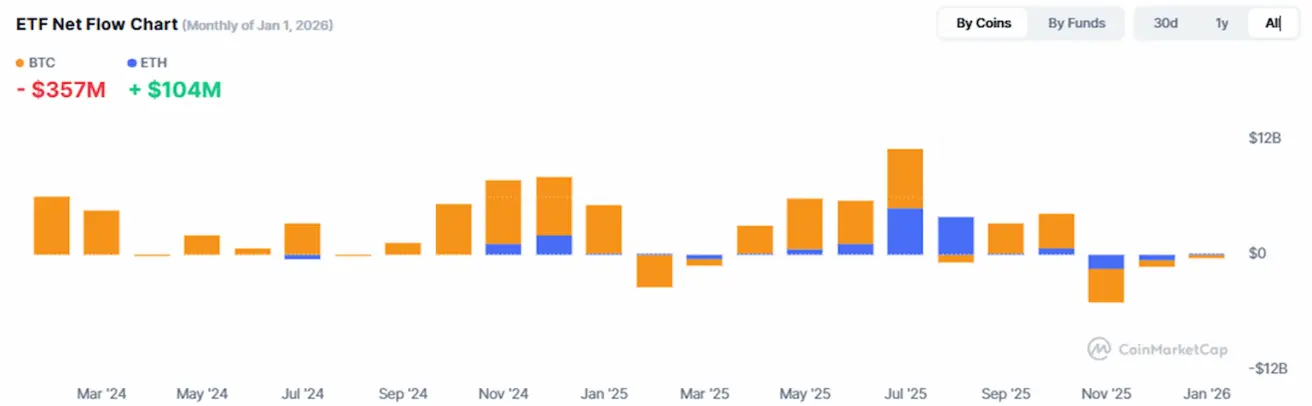

ETF-ide netovoolude graafik:

English

English Қазақша

Қазақша