2025 m. rugpjūčio 11–15 d.: Savaitinė ekonomikos apžvalga

Pagrindinės rinkos naujienos

Makroekonominė statistika

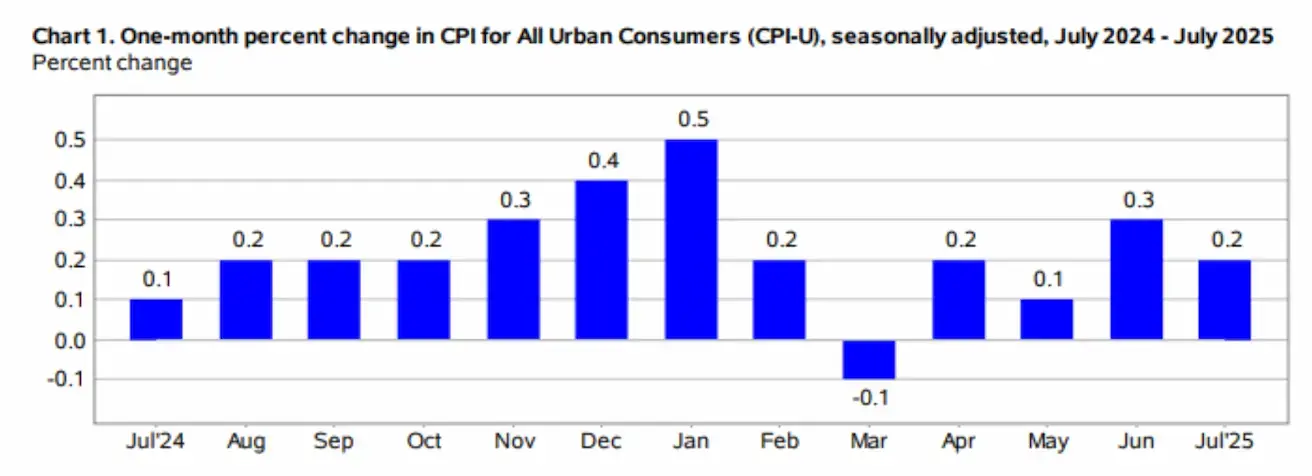

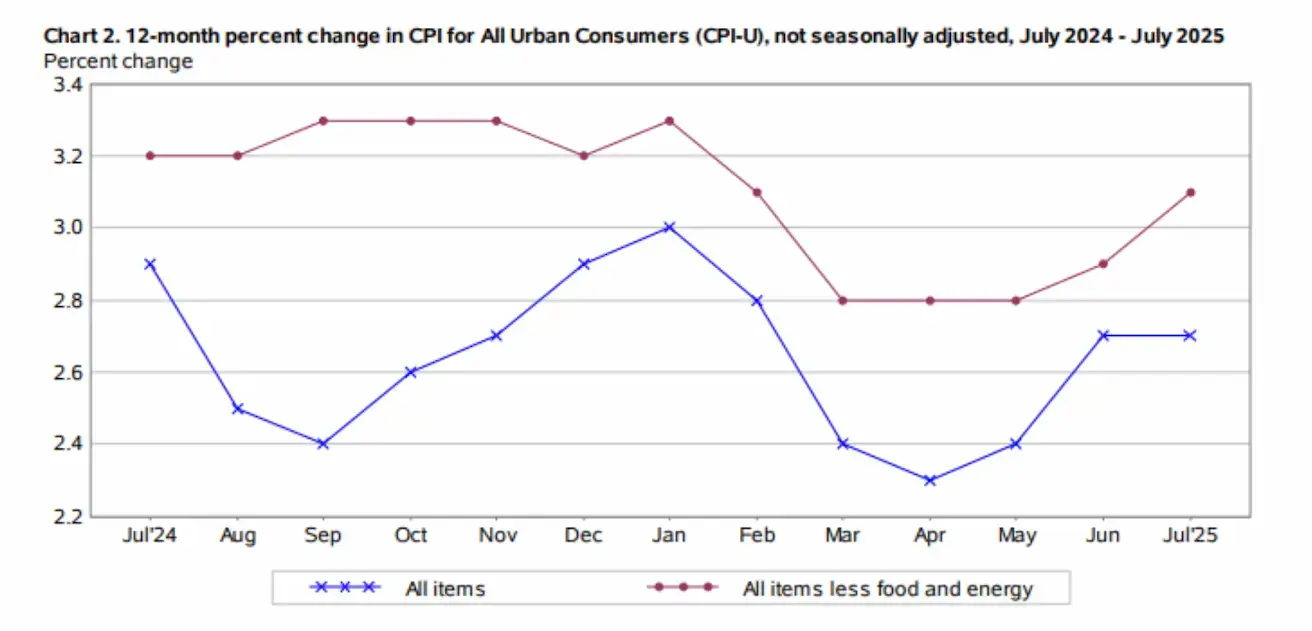

Infliacija (VKI):

- Pagrindinis vartotojų kainų indeksas (VKI) (mėn./mėn.) (birželis): 0,3 % (ankst.: 0,2 %)

- Vartotojų kainų indeksas (VKI) (mėn./mėn.) (birželis): 0,2 % (ankst.: 0,3 %)

- Pagrindinis VKI (m./m.) (birželis): 3,1 % (ankst.: 2,9 %)

- VKI (m./m.) (birželis): 2,7 % (ankst.: 2,7 %)

Infliacijos lūkesčiai (Mičiganas):

- 12 mėn. prognozuojama infliacija (rugpjūtis): 4,9 % (ankst.: 4,5 %)

- 5 metų prognozuojama infliacija (rugpjūtis): 3,9 % (ankst.: 3,4 %)

Gamintojų kainų indeksas (GKI):

- GKI (mėn./mėn.) (rugpjūtis): 0,9 % (ankst.: 0,0 %)

- Pagrindinis GKI (mėn./mėn.) (rugpjūtis): 0,9 % (ankst.: 0,0 %)

BVP (JAV Ekonominės analizės biuras, BEA):

- 2025 m. 2 ketv. metinis, preliminarus įvertis: 3,0 % (2024 m. 1 ketv.: –0,5 %)

- Atlanta Fed GDPNow (2 ketv.): 2,5 % (prieš 2,5 %) (GDPNow modelis pateikia „real‑time“ oficialaus įverčio versiją prieš jo paskelbimą, naudodamas metodiką, panašią į JAV BEA.)

Verslo aktyvumo indeksas (PMI) (virš 50 = augimas, žemiau 50 = lėtėjimas):

- Paslaugų sektorius (liepa): 55,7 (ankst.: 52,9)

- Gamybos sektorius (liepa): 49,8 (ankst.: pakoreguota 52,0)

- „S&P Global Composite“ (liepa): 55,1 (ankst.: 52,9)

Darbo rinka:

- Nedarbo lygis (birželis): 4,2 % (ankst.: 4,1 %)

- Ne žemės ūkio darbo vietos (birželis): +73 tūkst. (ankst.: pakoreguota 144 tūkst.)

- Privačiojo ne žemės ūkio sektoriaus darbo vietos (birželis): +83 tūkst. (ankst.: 137 tūkst.)

- Vidutinis valandinis uždarbis (m./m., birželis): 3,9 % (ankst.: 3,8 %)

- JOLTS laisvos darbo vietos (gegužė): 7,769 mln. (prieš 7,395 mln.)

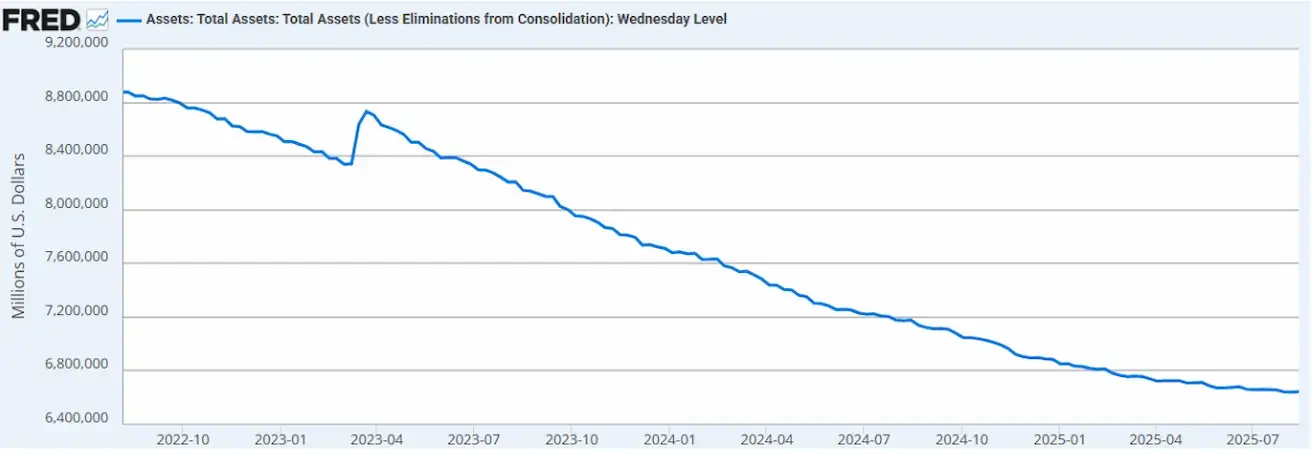

Pinigų politika

- Federalinių fondų norma (EFFR): 4,25–4,50 % (tikslinis intervalas)

- FED balansas: 6,643 trln. USD (prieš savaitę: 6,42 trln. USD)

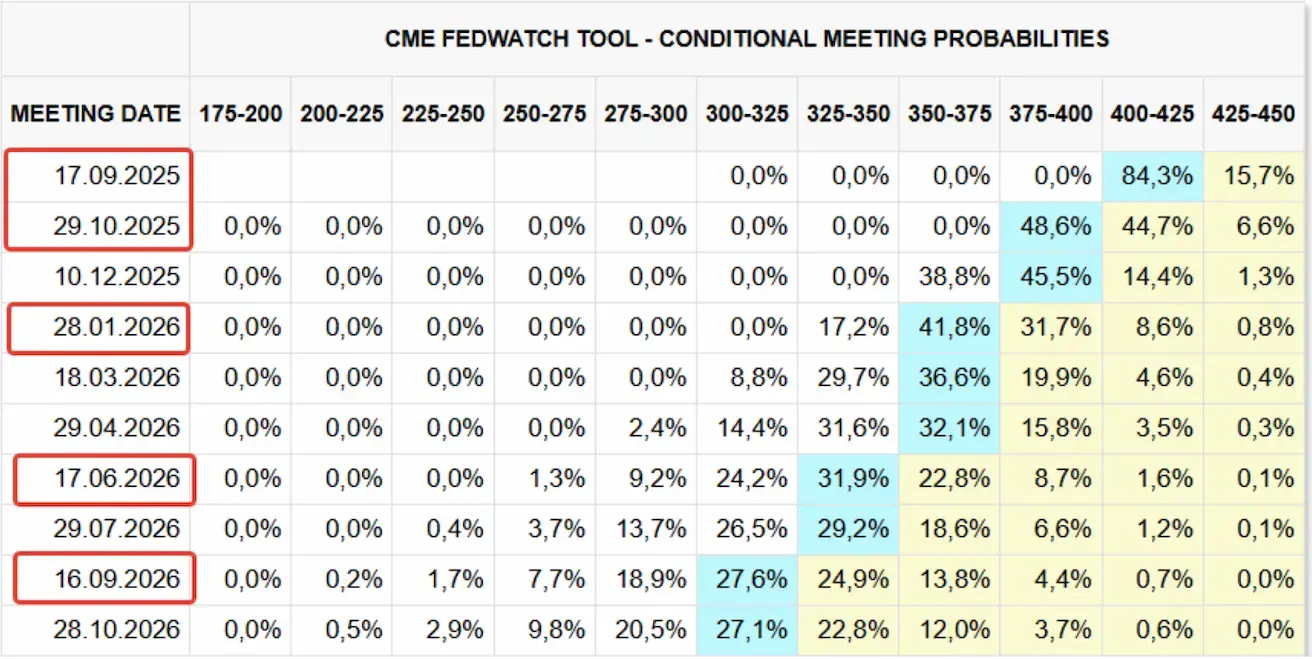

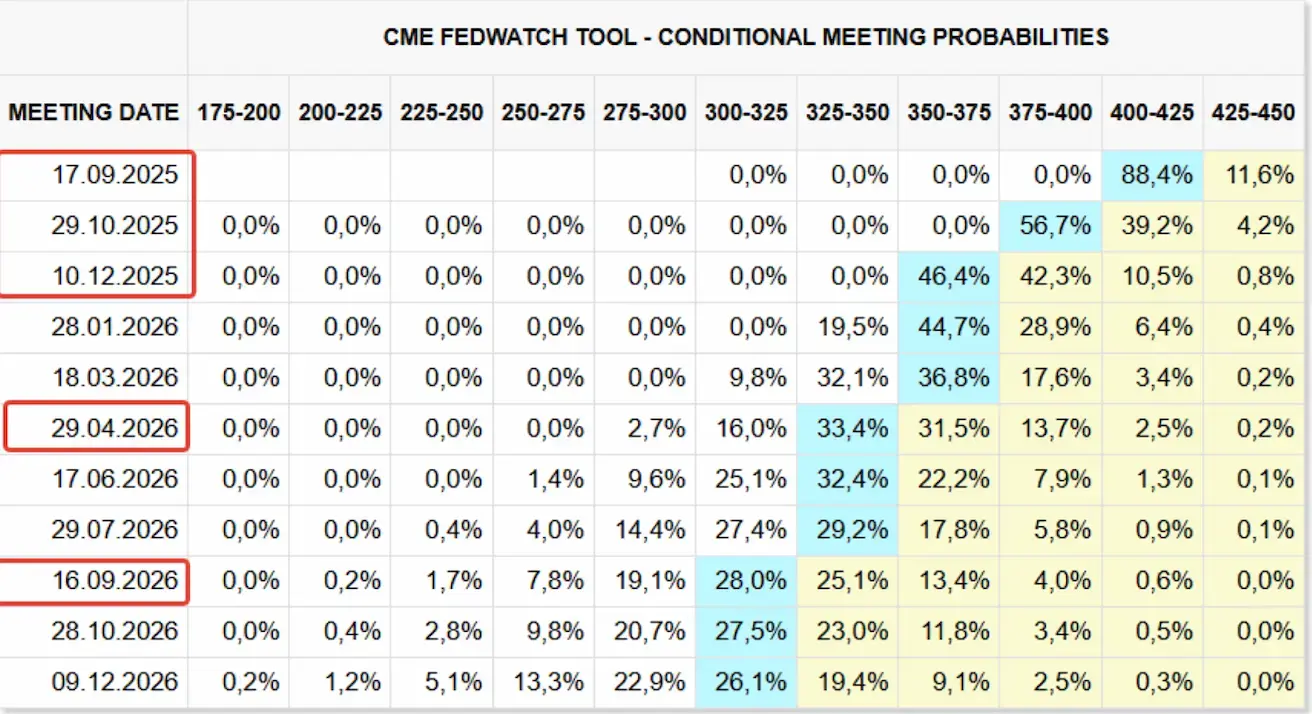

Rinkos palūkanų prognozė (FedWatch):

Šiandien:

Prieš savaitę:

Komentaras

Praėjusią savaitę akcijų rinkos išliko Risk-on režime. Vartotojų infliacijos duomenys buvo mišrūs ir rinkos priimti vidutiniškai pozityviai. Viena vertus, mėnesinis VKI liepą parodė mažesnį augimą – +0,2 %, palyginti su 0,3 % birželį. Metiniu pagrindu VKI išliko nepakitęs – 2,7 %, tačiau, kita vertus, pagrindinis VKI pakilo iki 3,1 % (prieš 2,9 % birželį) – tai aiškus apsisukimas į viršų.

Ketvirtadienį taip pat buvo paskelbti duomenys apie gamybos infliaciją (GKI). Indeksas parodė 0,9 % augimą (mėn./mėn.) liepą, pakoregavus dėl sezoniškumo, ir tai buvo didžiausias augimas nuo 2022 m. birželio.

Nepritaikius sezoniškumo, indeksas per 12 mėn. iki liepos paaugo 3,3 % – tai didžiausias 12 mėn. padidėjimas nuo 3,4 % šuolio 2025 m. vasarį.

Šis augimas rodo, kad bendrovės neabsorbuoja didesnių importo sąnaudų, susijusių su tarifais.

VKI atspindi einamąją infliaciją, o GKI – būsimą infliaciją. Atitinkamai naujausias GKI paskelbimas didina tikimybę, kad artimiausiomis savaitėmis vartotojų infliacijos rodikliai bus aukštesni. Tokiu scenarijumi FED retorika gali išlikti vidutiniškai griežta.

Be to, padidėjo infliacijos lūkesčiai: 12 mėn. – 4,9 %, 5 metai – 3,9 %.

Tačiau rinkos lūkesčiai pagal FedWatch išlieka pozityvūs:

- Kitam posėdžiui (rugsėjo 17 d.): palūkanų normos mažinimo tikimybė vertinama 84,3 %;

- Per artimiausius 12 mėn.: 5 žingsniai po 0,25 % mažinimą iki 3,00–3,25 % intervalo.

- Iki metų pabaigos lieka 2 sumažinimai.

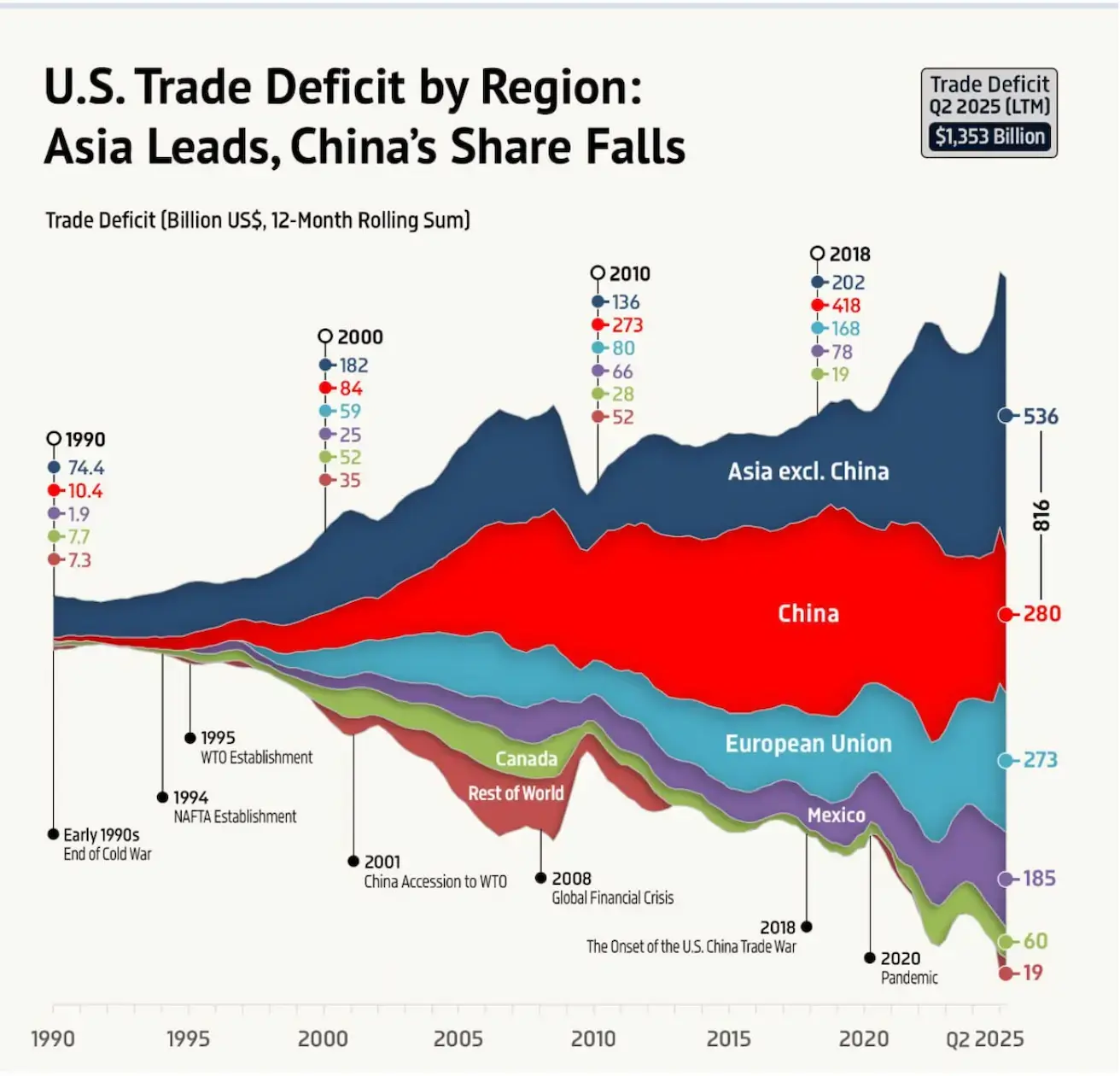

Prekybos karai per JAV užsienio prekybos balanso prizmę

- JAV prekių prekybos deficitas (12 mėn. iki 2025 m. 2 ketv.): 1,353 trln. USD.

- Azija: 816 mlrd. USD (60 %) — Kinija 280 mlrd. USD (21 %), likusi Azija 536 mlrd. USD (40 %).

- ES: 273 mlrd. USD (20 %).

- Meksika: 185 mlrd. USD (14 %).

- Kanada: 60 mlrd. USD (5 %).

Akcijų rinka

- Savaitinis medianinis augimas: +1,41 %. Lyderiai: bazinės žaliavos, ciklinis vartojimas, sveikatos apsauga.

- Nuo metų pradžios: +0,42 %. Lyderiai: komunalinės paslaugos, bazinės žaliavos, ryšių paslaugos. Atšiliekantieji: technologijos (–7,96 %), sveikatos apsauga (–10,93 %).

Indeksai:

- S&P 500: +0,94 % (savaitės uždarymas 6449,79). Nuo metų pradžios +9,26 %.

- Nasdaq 100: +0,43 % (savaitės uždarymas 23712,07). Nuo metų pradžios +12,27 %.

- Euro Stoxx 600: +1,09 % (savaitės uždarymas 555,1). Nuo metų pradžios +9,79 %.

- CSI indeksas (Kinija): +2,37 % (savaitės uždarymas 4202,35). Nuo metų pradžios +6,90 %.

Kinija / prekyba:

- Trumpas leido dalį JAV lustų pardavimų Kinijai; paliaubos su Pekinu pratęstos 3 mėnesiams (iki lapkričio 10 d.).

- Kinijos indeksai atitinkamai pakilo.

- Hang Seng TECH indeksas: +1,52 % (savaitės uždarymas 5543,17). Nuo metų pradžios +24,94 %.

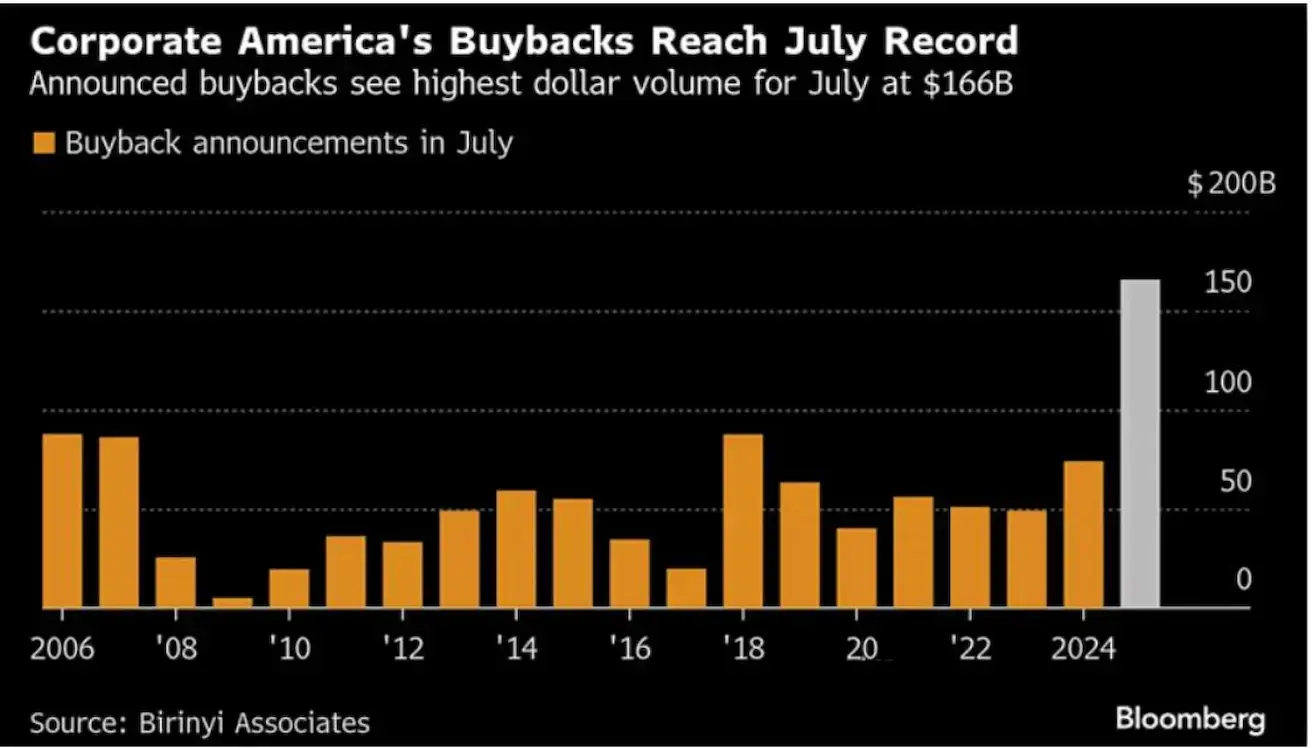

Supirkimas (buybacks):

- Liepa: JAV bendrovės paskelbė apie 166 mlrd. USD vertės akcijų supirkimą — didžiausia liepa per 20 metų.

- Vertinama kaip pasitikėjimas rinkos atsparumu.

- Tačiau vadovų (insider) pardavimai dideli: pavyzdžiui, „Amazon“ įkūrėjas Jeffas Bezosas liepą pardavė akcijų už 1,51 mlrd. USD.

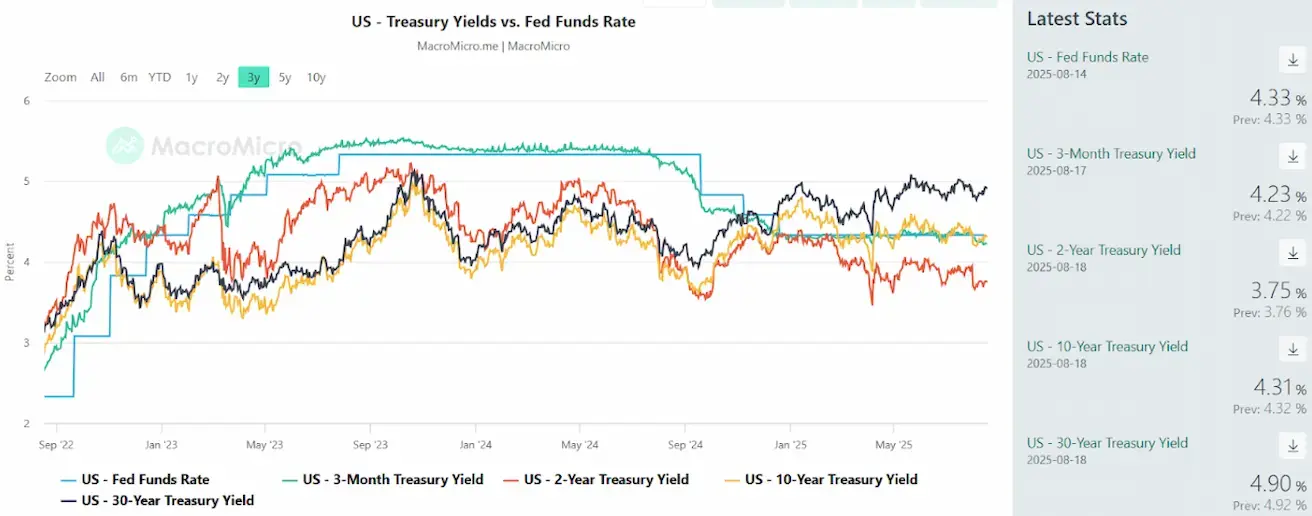

Obligacijų rinka

- JAV iždo pajamingumai kilo (neigiama reakcija į infliacijos duomenis).

- 20+ metų JAV iždo ETF (TLT): –1,02 % (uždarymas 86,40). Nuo metų pradžios –1,59 %.

Pajamingumai ir „spreadai“ (2025-06-30 vs 2024-07-07):

- JAV 10 m. iždo pajamingumas: 4,31 % (prieš 4,27 %).

- ICE BofA BBB JAV įmonių obligacijų indekso pajamingumas: 5,12 % (prieš 5,14 %).

- 10 m.–2 m. iždo „spreadas“: 56 baziniai punktai (prieš 51).

- 10 m.–3 mėn. iždo „spreadas“: 8 baziniai punktai (prieš 2).

Žaliavos

Auksas (ateities sandoriai, GC):

- –2,21 % (savaitės uždarymas 3381,7 USD/oz).

- Nuo metų pradžios +28,05 %.

- Nuo balandžio prekybos diapazonas: 3250–3450 USD/oz.

JAV dolerio indeksas (DX ateities sandoriai):

- –0,39 % (savaitės uždarymas 97,705).

- Nuo metų pradžios –9,81 %.

Nafta (CL ateities sandoriai):

- –0,33 % (savaitės uždarymas 63,14 USD/bbl).

- Nuo metų pradžios –12,12 %.

- Esama pasiūlos/paklausos pusiausvyra nepalanki aukštesnėms naftos kainoms.

OPEC+:

- 2025 m. paklausos prognozė nekeičiama: 105,14 mln. bpd (+1,29 mln.).

- 2026 m. paklausa pakoreguota aukštyn: 106,52 mln. bpd (+1,38 mln. vs 1,28 mln.).

- Gamybos koregavimas: 2025 m. rugsėjį 8 nariai sumažins gavybą 547 tūkst. bpd, palyginti su rugpjūčio lygiu (atitinka 4 mėnesių padidinimų atšaukimą).

- Lankstumas leidžia sustabdyti atšaukimą, jei pasikeistų rinkos sąlygos.

EIA (JAV Energetikos informacijos administracija):

- „Brent“ prognozė: kritimas nuo 71 USD/bbl (liepa) iki 58 USD 2025 m. 4 ketv., ir iki ~50 USD 2026 m. pradžioje.

- Priežastis: atsargų didėjimas po OPEC+ sprendimų.

- Tikimasi, kad pasaulinės atsargos 2025 m. 4 ketv. ir 2026 m. 1 ketv. augs daugiau kaip 2 mln. bpd.

Šaltinis: EIA STEO

TJT (Tarptautinė energetikos agentūra, IEA):

- Prognozuoja rekordinius naftos perteklius 2026 m.: +2,96 mln. bpd (didesnis nei per 2020 m. pandemiją).

- Pasaulinės paklausos augimas 2025 m.: 680 tūkst. bpd (prieš 700 tūkst.).

- 2026 m.: 700 tūkst. bpd (prieš 740 tūkst.), iki 104,4 mln. bpd bendros paklausos.

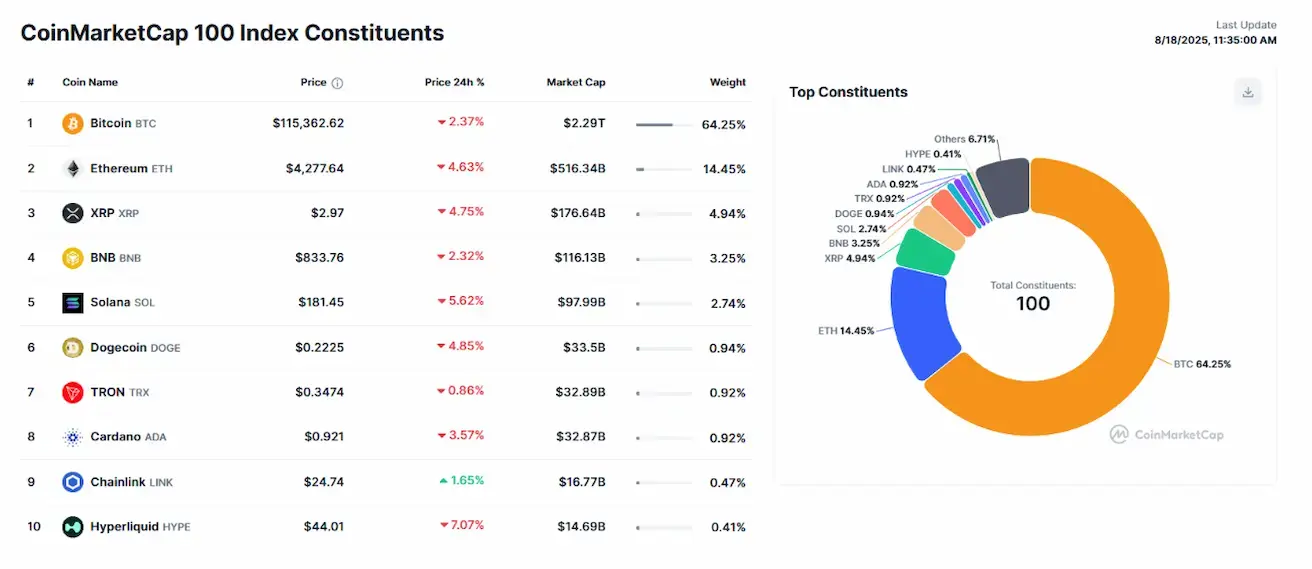

Kriptovaliutos

Bitcoin ateities sandoriai:

- +0,16 % (savaitės uždarymas 117 610 USD).

- Nuo metų pradžios +23,45 %.

Ethereum ateities sandoriai:

- +9,02 % (savaitės uždarymas 4448,5 USD).

- Nuo metų pradžios +31,46 %.

- Tiek BTC (ATH 125 tūkst. USD), tiek ETH (vietinis maksimumas 4800 USD) smuko po GKI paskelbimo.

- Šiandien prieš atidarymą: BTC –2 %, ETH –5 %.

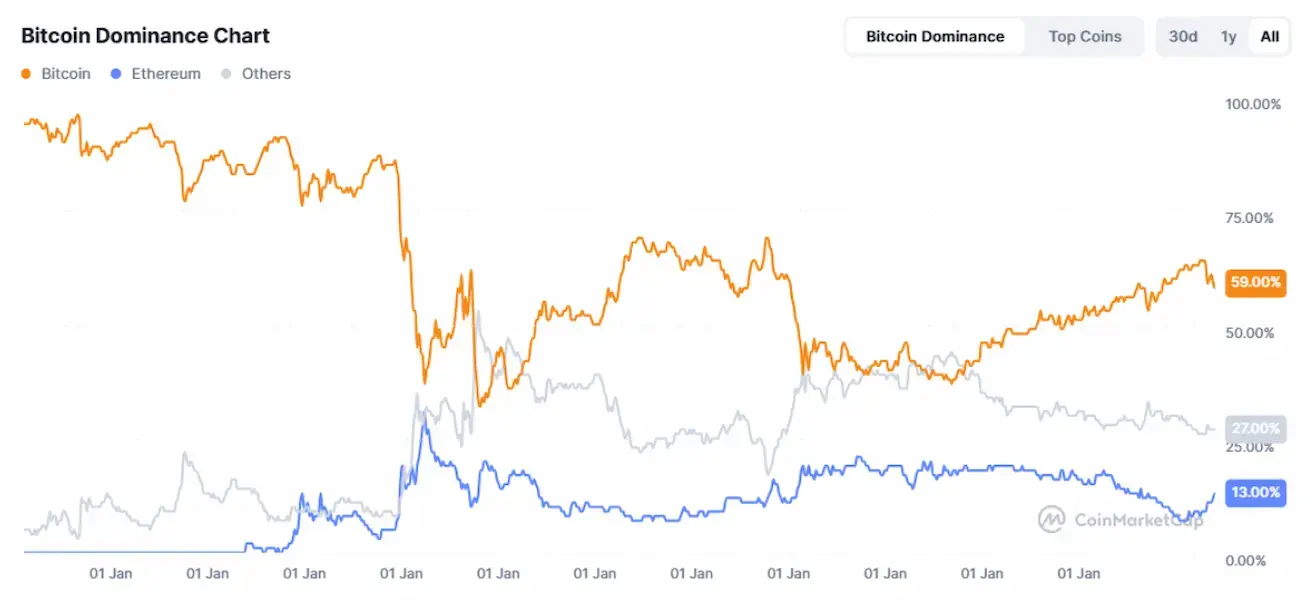

Rinkos kapitalizacija:

- 3,89 trln. USD (prieš 4,06 trln. USD praėjusią savaitę).

- BTC dominavimas: 59,0 % (ankst. 59,9 %).

- ETH dominavimas: 13,3 % (ankst. 12,8 %).

- Kitos kriptovaliutos: 27,7 % (ankst. 27,3 %).

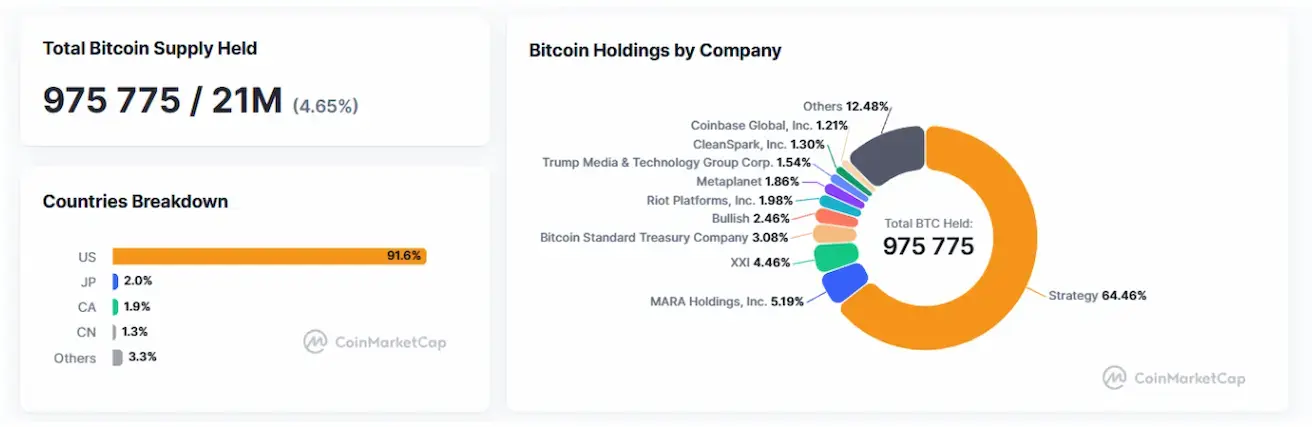

Bitcoin atsargos įmonių balansuose:

- Bendrovės laiko 4,65 % visos BTC pasiūlos; 91 % – JAV bendrovės.

Naujienos:

- JAV iždo sekretorius Scottas Bessentas atmetė tolesnius Bitcoin rezervų pirkimus (nepaisant ankstesnio palaikymo).

- Dabartiniai JAV BTC rezervai: 15–20 mlrd. USD.

Šaltinis: CryptoBriefing

English

English Қазақша

Қазақша