2025 m. liepos 21–25 d.: Savaitinė ekonomikos apžvalga

Svarbiausios rinkos naujienos

MAKROEKONOMINĖ STATISTIKA

INFLIACIJA

- Pagrindinis vartotojų kainų indeksas (CPI) (mėn./mėn.) (birželis): 0,2% (ankstesnis: 0,1%)

- Vartotojų kainų indeksas (CPI) (mėn./mėn.) (birželis): 0,3% (ankstesnis: 0,1%)

- Pagrindinis vartotojų kainų indeksas (CPI) (m./m.) (birželis): 2,9% (ankstesnis: 2,8%)

- Vartotojų kainų indeksas (CPI) (m./m.) (birželis): 2,7% (ankstesnis: 2,4%)

INFLIACIJOS LŪKESČIAI (MICHIGANAS)

- 12 mėnesių tikėtina infliacija (gegužė): 4,4% (ankst.: 5,0%)

- 5 metų tikėtina infliacija (balandis): 3,6% (ankst.: 4,0%)

BVP (JAV ekonominės analizės biuras, BEA) – I ketv. 2025

- Metinis augimas (trečiasis įvertis): -0,5% (antrasis įvertis: -0,2%; IV ketv. 2024: 2,4%)

- Atlantos federalinio rezervo banko GDPNow II ketv.: 2,4% (prieš tai 2,6%)

Verslo aktyvumo indeksas (PMI):

(Virš 50 žymi plėtrą; žemiau 50 žymi nuosmukį)

- Paslaugų sektorius (liepa): 55,2 (ankst.: 52,9)

- Gamybos sektorius (liepa): 52,0 (ankst.: 52,9, patikslinta)

- S&P Global Composite (liepa): 54,6 (ankst.: 52,9)

DARBO RINKA:

- Nedarbo lygis (birželis): 4,1% (ankst.: 4,2%)

- Nežemės ūko darbo vietų pokytis (birželis): 147 tūkst. (ankst.: 144 tūkst., patikslinta)

- JAV privačiojo sektoriaus nežemės ūkio darbo vietų pokytis (birželis): 74 tūkst. (ankst.: 137 tūkst.)

- Vidutinis valandinis atlygis (birželis, m./m.): 3,7% (ankst.: 3,8%)

- JOLTS laisvos darbo vietos (gegužė): 7,769 mln. (prieš tai 7,395 mln.)

PINIGŲ POLITIKA

- Federalinių fondų palūkanų norma (EFFR): 4,25% - 4,50% (nepakitusi)

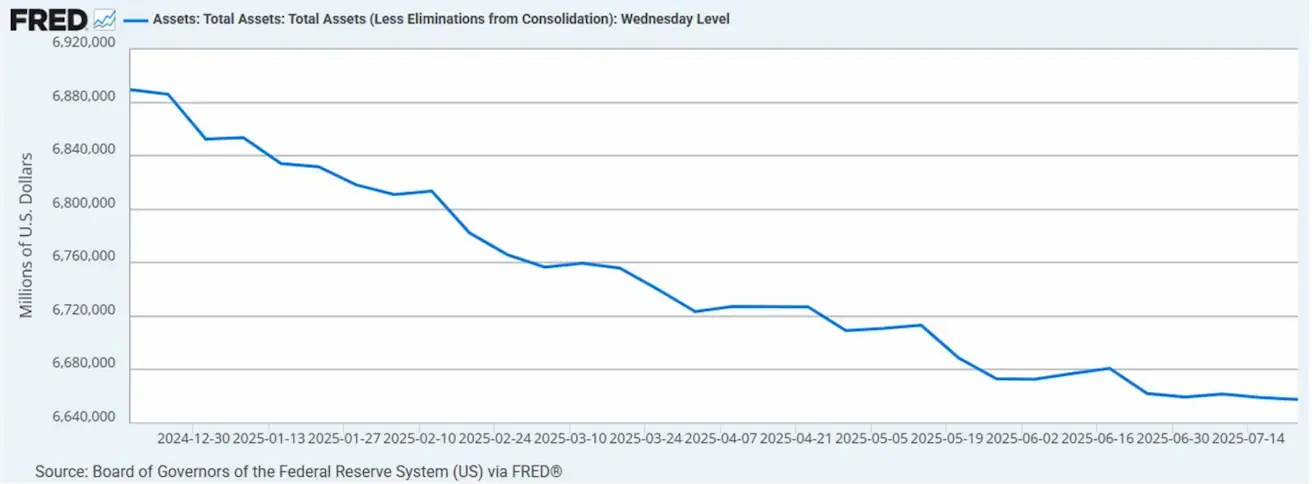

- FED balansas išaugo: 6,667 trln. USD (ankstesnė savaitė: 6,59 trln. USD)

PALŪKANŲ NORMOS RINKOS PROGNOZĖ

Šiandien:

Prieš savaitę:

Komentaras

Kinijos liaudies bankas išlaikė bazines paskolų palūkanų normas 3,00–3,50% intervale.

Europos Centrinis bankas taip pat nekeitė savo palūkanų normų, signalizuodamas apie galimą pauzę ateityje. Sprendimą lėmė infliacijos rizika, kylanti dėl prekybos karo ir didėjančių vyriausybės išlaidų (susitikimas vyko dar nepasirašius prekybos susitarimo su JAV).

- ECB indėlių palūkanų norma (liepa): 2,00%

- ECB ribotos paskolos palūkanų norma: 2,40%

- Pagrindinė refinansavimo norma (liepa): 2,15%

Pasirašytas susitarimas dėl 15% muitų daugumai Europos eksporto prekių, įskaitant automobilius ir farmacijos produktus. Nors susitarimas padeda išvengti tolesnio eskalavimo, jis sudaro akivaizdžią disproporciją: ES susiduria su didesniais tarifais nei JAV.

Pagal susitarimą ES įsipareigoja:

- Investuoti 600 mlrd. USD į JAV ekonomiką

- Įsigyti 750 mlrd. USD vertės amerikietiškų energetikos produktų

- Suteikti prieigą JAV gaminiams be muitų

- Didinti JAV karinės įrangos pirkimą

ES plieno ir aliuminio eksportui vis dar taikomi 50% muitai. Briuselis tikisi sušvelninti šiuos reikalavimus derybose, siekdamas gauti dalines kvotas. Šiuo metu ES verslo aktyvumo rodikliai rodo paslaugų sektoriaus plėtrą, tačiau gamybos sektorius lėtėja.

Jungtinės Valstijos

Atlanto FED GDPNow II ketvirčio prognozė išlieka 2,4% (prieš tai 2,4%).

PMI rodikliai:

- Paslaugų sektorius: stipresnė nei tikėtasi plėtra – 55,2 (ankst.: 52,9)

- Gamybos sektorius (birželis): tęstinis lėtėjimas – 52,0 (ankst.: patikslinta 52,9)

- S&P Global Composite PMI (birželis): 54,6 (ankst.: 52,9)

Pinigų politika

FED balansas iš esmės nepakitęs jau ketvirtą savaitę iš eilės.

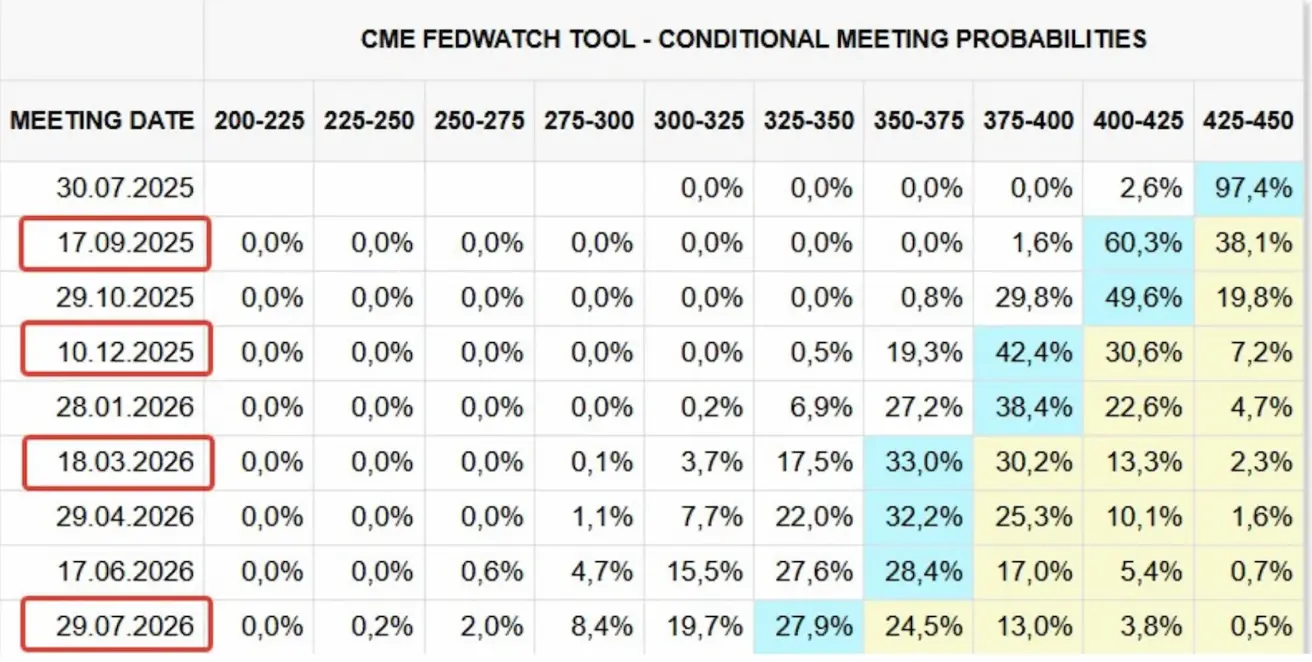

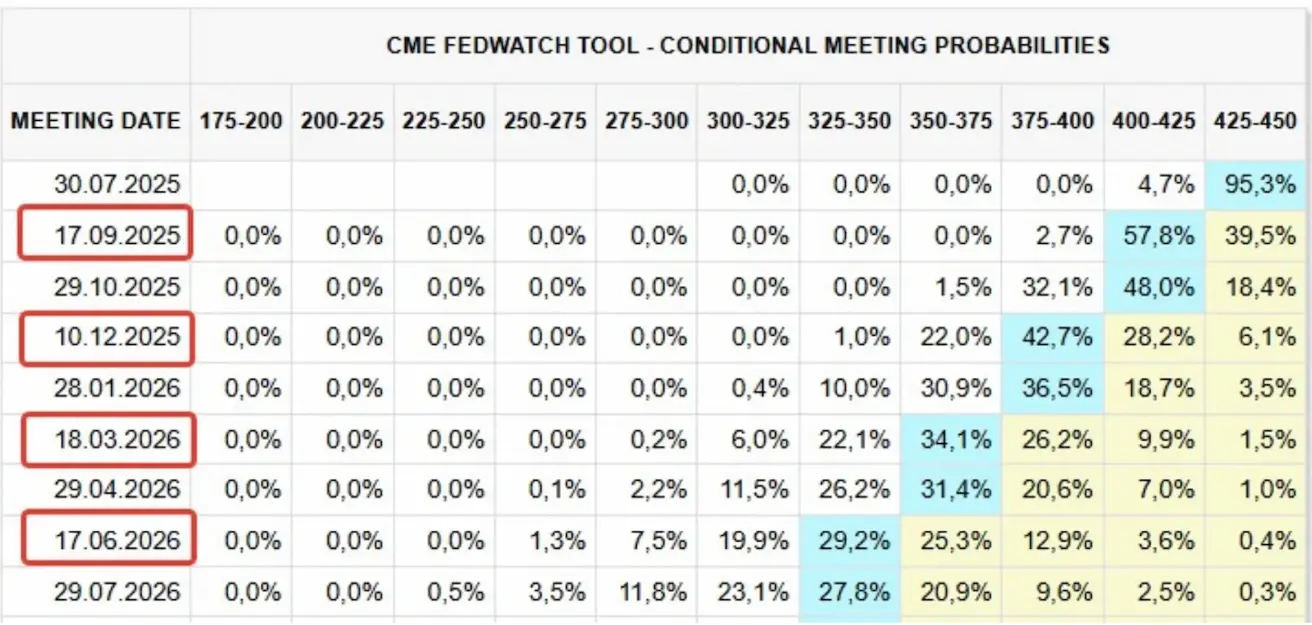

Rinkos lūkesčiai (CME FedWatch Tool):

- Artimiausias FOMC posėdis (liepos 30 d.): pokyčiai nenumatomi – 97% tikimybė, kad palūkanų mažinimo nebus

- Per artimiausius 12 mėnesių: rinka įskaičiuoja 4 kartus po 25 bazinius punktus sumažėjimą, tikslinė riba – iki 3,25–3,50%

- Pirmasis mažinimas prognozuojamas rugsėjį, tiksli tikimybė nenurodyta

- Iki metų pabaigos: lieka įskaičiuoti tik du palūkanų mažinimai.

Rinka

Akcijų rinka

Pastarąją savaitę JAV akcijų sektoriai fiksavo plačią teigiamą dinamiką. Vidutinis sektoriaus prieaugis – 1,04%. Lyderiai:

- Sveikatos apsauga

- Vartojimo prekių sektorius

- Bazinės žaliavos

Nuo metų pradžios

Nuo metų pradžios JAV akcijų rinka bendrai pakilo +0,74%. Geriausiai pasirodę sektoriai:

- Komunalinės paslaugos

- Bazinės žaliavos

- Finansai

SP500

Savaitinis pokytis: +1,46% (uždarymo kaina: 6388,5) nuo metų pradžios (2025): +8,22%

NASDAQ100

Savaitinis pokytis: +0,90% (uždarymo kaina: 23272,25), nuo metų pradžios: +10,19%.

Euro Stoxx 600

Savaitinis pokytis: +1,14%, uždarymo lygis 552,4. Nuo metų pradžios: +9,26%

CSI indeksas

Savaitinis pokytis: +1,95% (uždarymo lygis: 4127), nuo metų pradžios: +4,99%

OBLIGACIJŲ RINKA

Pelningumas praėjusią savaitę mažėjo ir tai lėmė kainų augimą obligacijų rinkoje. JAV ilgalaikės iždo obligacijos (20+ metų, ETF: TLT):

- Savaitinis pokytis: +1,40%

- Savaitės uždarymo kaina: 86,43 USD

- Nuo metų pradžios (2025): –1,56%

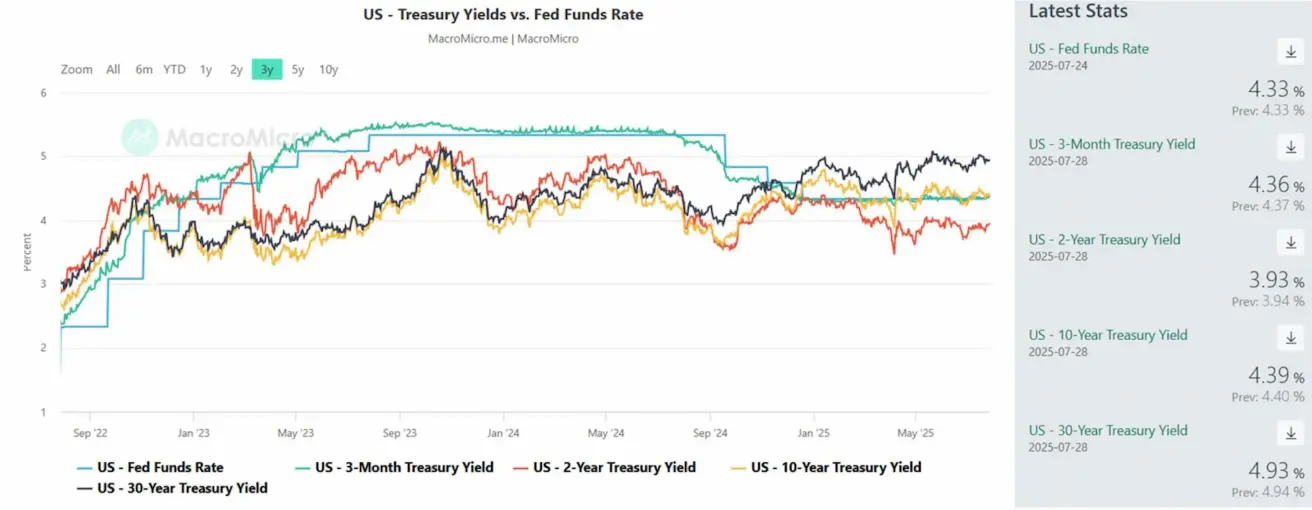

PALŪKANOS IR SPREDAI 2025/06/30 vs 2024/07/07

- 10 metų JAV iždo obligacijų pelningumas: 4,39% (prieš tai: 4,43%)

- ICE BofA BBB JAV korporacijų obligacijų efektyvi palūkanų norma: 5,28% (prieš tai: 5,33%)

- Spreedas: 10 metų vs. 2 metų obligacijos – 46,0 vs. 56,0 bazinių punktų

- Spreedas: 10 metų vs. 3 mėnesių obligacijos – 300 vs. 9,0 bazinių punktų

AUKSO ATEITIES SANDORIAI (GC)

Savaitinis pokytis: –0,51%. Savaitės uždarymo kaina: 3 338,50 USD už Trojos unciją. Metinis pokytis: +26,41%.

DOLERIO INDEKSO ATEITIES SANDORIAI (DX)

Savaitinis pokytis: –0,79%. Savaitės uždarymo lygis: 97,435. Nuo metų pradžios (2025): –10,06%

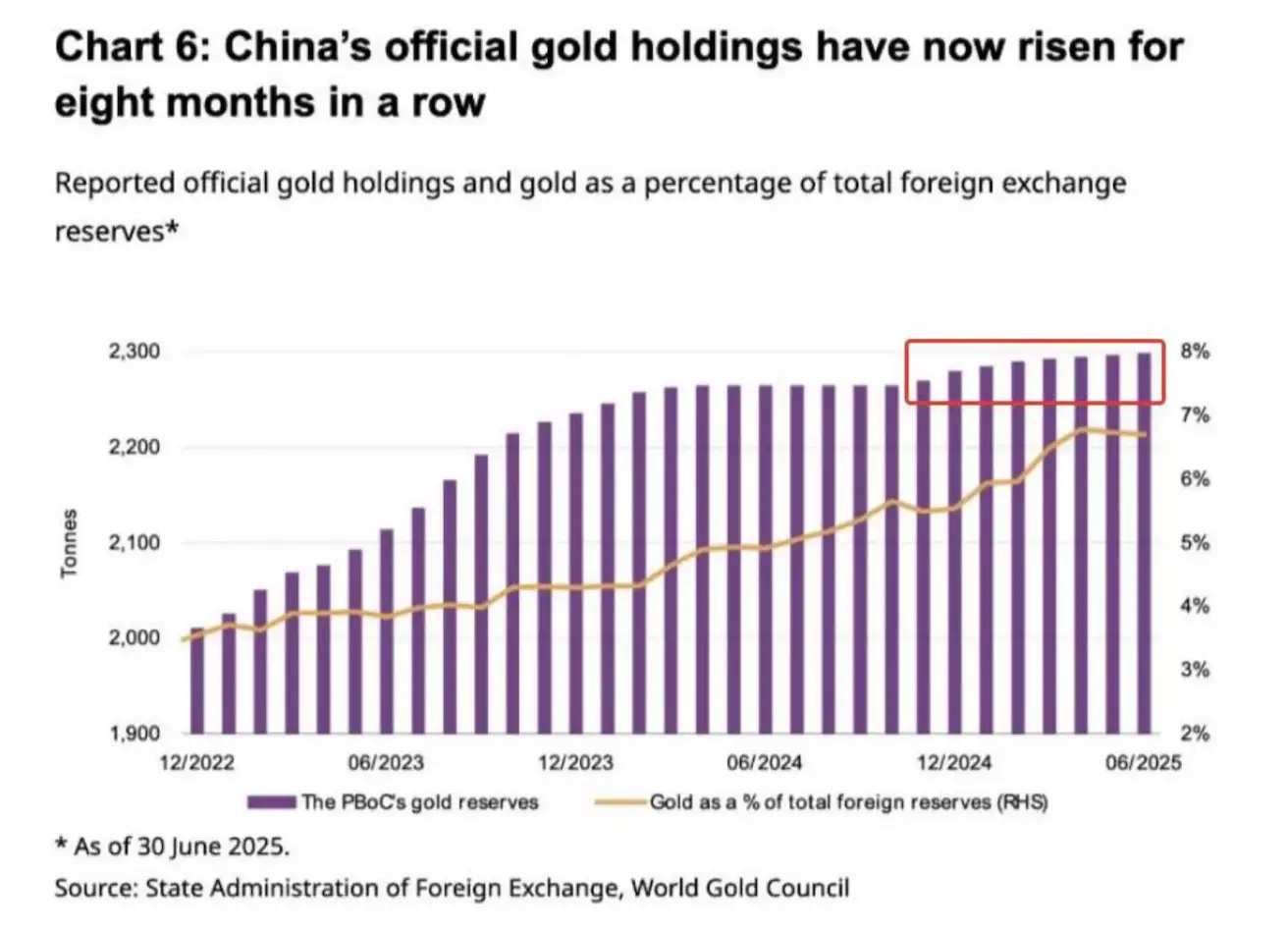

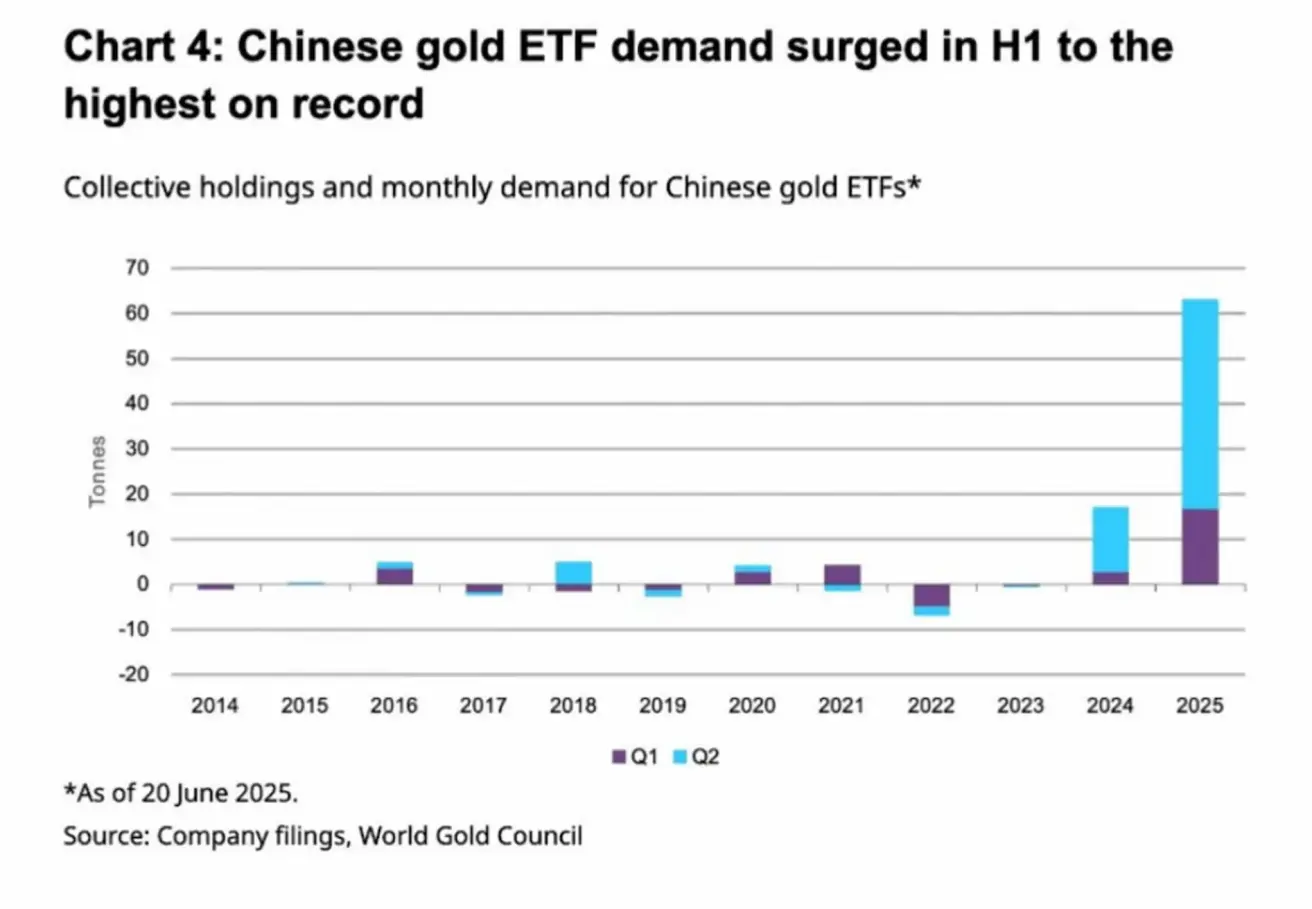

Kinija spartina aukso pirkimą – auga tiek fizinio aukso, tiek ETF įsigijimai.

NAFTOS ATEITIES SANDORIAI

Savaitinis pokytis: –1,45%. Savaitės uždarymo kaina: 65,07 USD už barelį. Metinis pokytis: –9,44%.

BTC ATEITIES SANDORIAI

Savaitinis pokytis: +0,53%. Savaitės uždarymo kaina: 118 295 USD. Metinis pokytis (2025): +24,17%.

ETH ATEITIES SANDORIAI

Savaitinis pokytis: +9,03%. Savaitės uždarymo kaina: 3 725,50 USD. Metinis pokytis (2025): +10,09%.

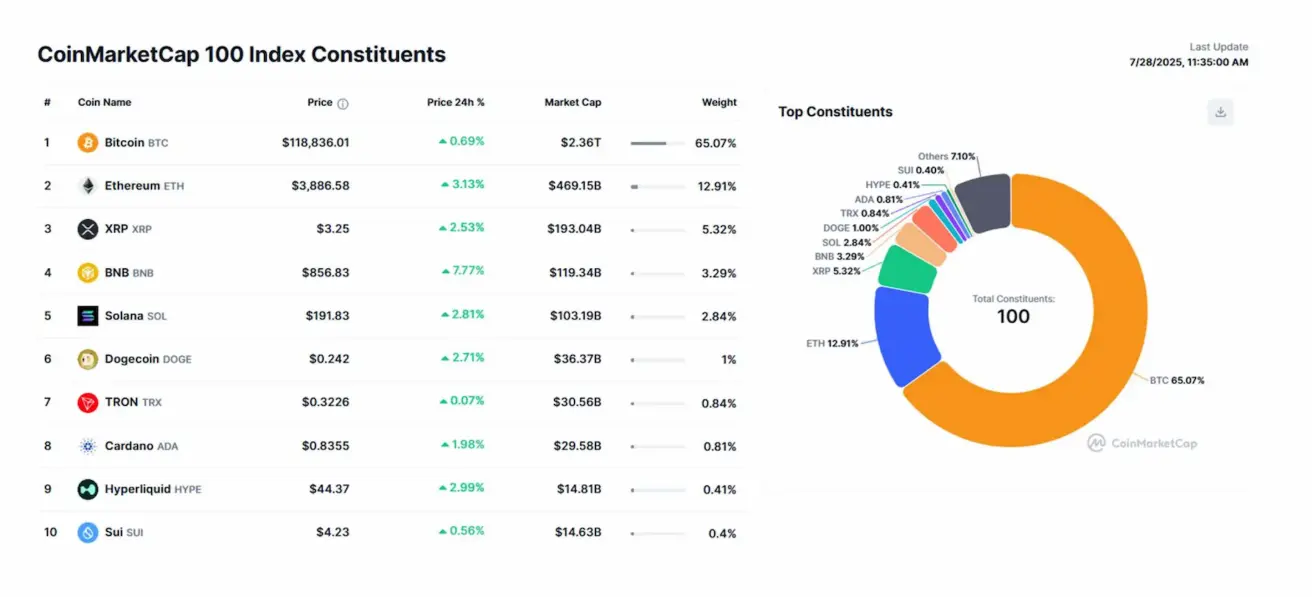

Kriptovaliutų rinkos apžvalga

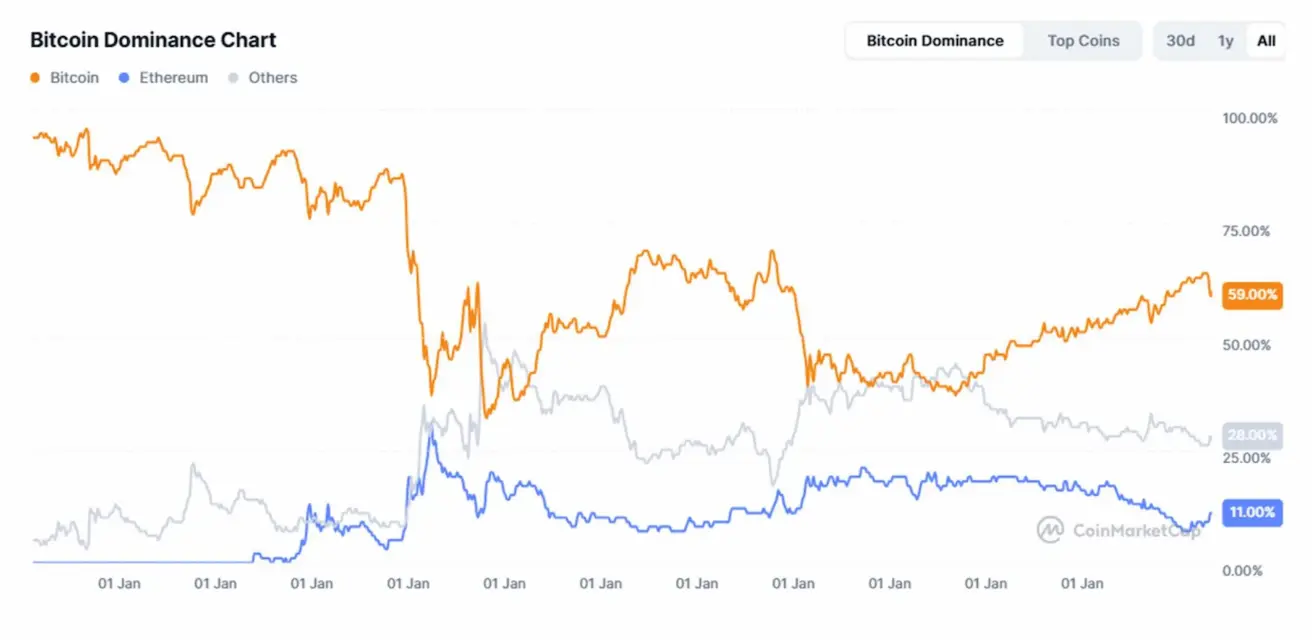

- Bendra rinkos kapitalizacija: 3,95 trln. USD, pokyčių nėra lyginant su praėjusia savaite (šaltinis: coinmarketcap.com)

- Bitcoin dominavimas: 59,9% (prieš savaitę – 60,0%)

- Ethereum dominavimas: 11,9% (prieš savaitę – 11,6%)

- Altkoinai (kitos kriptovaliutos): 28,2% (buvo 28,5%), pokytis minimalus

Kripto naujienos

Prezidentas Trumpas pasirašė istorinio pobūdžio dokumentą „JAV stabilkoinų nacionalinių inovacijų gairės“ (GENIUS), nustatantį stabilių kriptovaliutų reguliavimo pagrindą JAV. Pagrindiniai reikalavimai:

- KYC/AML reikalavimai didelėms operacijoms

- JAV Iždo teisės įšaldyti įtartinus srautus

- Diferencijuota federalinė ir valstijų priežiūra pagal apimtį

- Visiška užtikrinimo prievolė – grynaisiais arba JAV iždo vertybiniais popieriais

- Privalomas mėnesinis rezervų atskleidimas

English

English Қазақша

Қазақша