On the Right Note: January 2026

Structured Notes Monthly Performance Digest

On the Right Note is Raison’s regular analytical digest focused on its structured notes portfolio. In each issue, we go beyond reporting results to explain the underlying logic: how market conditions shape performance, how protective mechanisms work, and how strategies behave on actual observation dates. The material helps noteholders better understand their assets and allows prospective investors to see how downside protection works in practice.

January: Continued Market Stability and Support for Yield Strategies

Market conditions in January 2026 largely mirrored those seen at the end of 2025. Stable macroeconomic fundamentals and moderate market growth continued to support investor interest in yield-generating strategies, including structured products. Against this backdrop, structured notes portfolios continued to demonstrate consistent performance of their protective mechanisms.

Between January 1 and January 31, 2026, observation dates occurred for 8 notes:

- 4 notes remained active.

- 4 notes were redeemed early via Autocall (the notes closed ahead of maturity, with investors receiving both coupon payments and principal).

- For 1 active note, the Memory Effect was triggered (the coupon for the period was preserved and will be paid once the coupon barrier is met again).

Market Environment and Key Events

Key market indicators in January continued to support structured strategies. Volatility remained low, with the VIX index holding near local lows. This reduced the risk of sharp drawdowns in underlying assets and increased the likelihood of coupon barrier compliance.

At its January meeting, the U.S. Federal Reserve kept the policy rate unchanged in the 3.50–3.75% range. The U.S. economy remains resilient, with no signs of recession.

Since the beginning of the year, major equity indices have posted moderate gains:

- S&P 500: +1.37%

- Nasdaq 100: +1.20%

- Russell 2000: +5.31%

The corporate earnings season has been broadly positive. Large U.S. companies reported year-over-year revenue growth, while AI-related capital expenditure forecasts were revised upward, reinforcing constructive market sentiment.

Activity in the precious metals market also remained elevated. Despite a short-term correction in gold prices toward the end of the month, the broader upward trend persisted, supported by steady demand from central banks and investors. Mining companies continued to show solid performance.

Impact on Structured Notes

Moderate market growth combined with low volatility continues to create a favorable environment for structured notes. This configuration reduces the probability of underlying assets falling below coupon barriers and increases the likelihood of Autocall events.

Structured notes continue to offer investors a yield premium relative to traditional bonds while maintaining protective features that allow participation in market upside with a more controlled risk profile than direct equity exposure.

Notes in Detail

We now move from market trends to specific figures. Below are the notes that reached an observation date in January. They are grouped into three categories: Active, Autocalled, and Memory Effect. Each note card includes:

- Basket composition: the underlying assets being tracked.

- Coupon status: whether the coupon was confirmed for the period.

- Actual return: investor income per $100,000 invested.

Active Notes

Electric Vehicles | ISIN: XS2984895032

Data Centers | ISIN: XS2984894902

Software | ISIN: XS2912086068

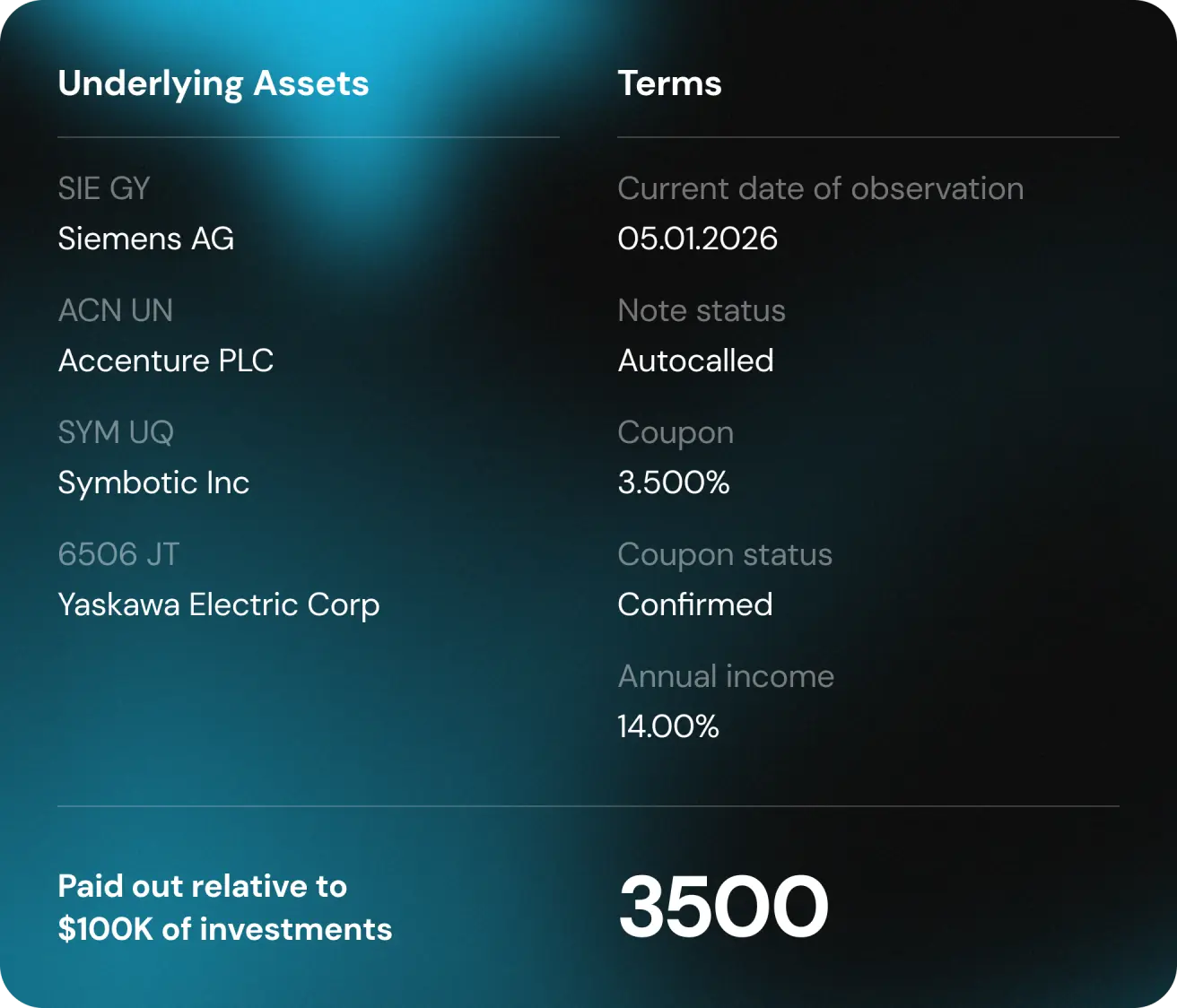

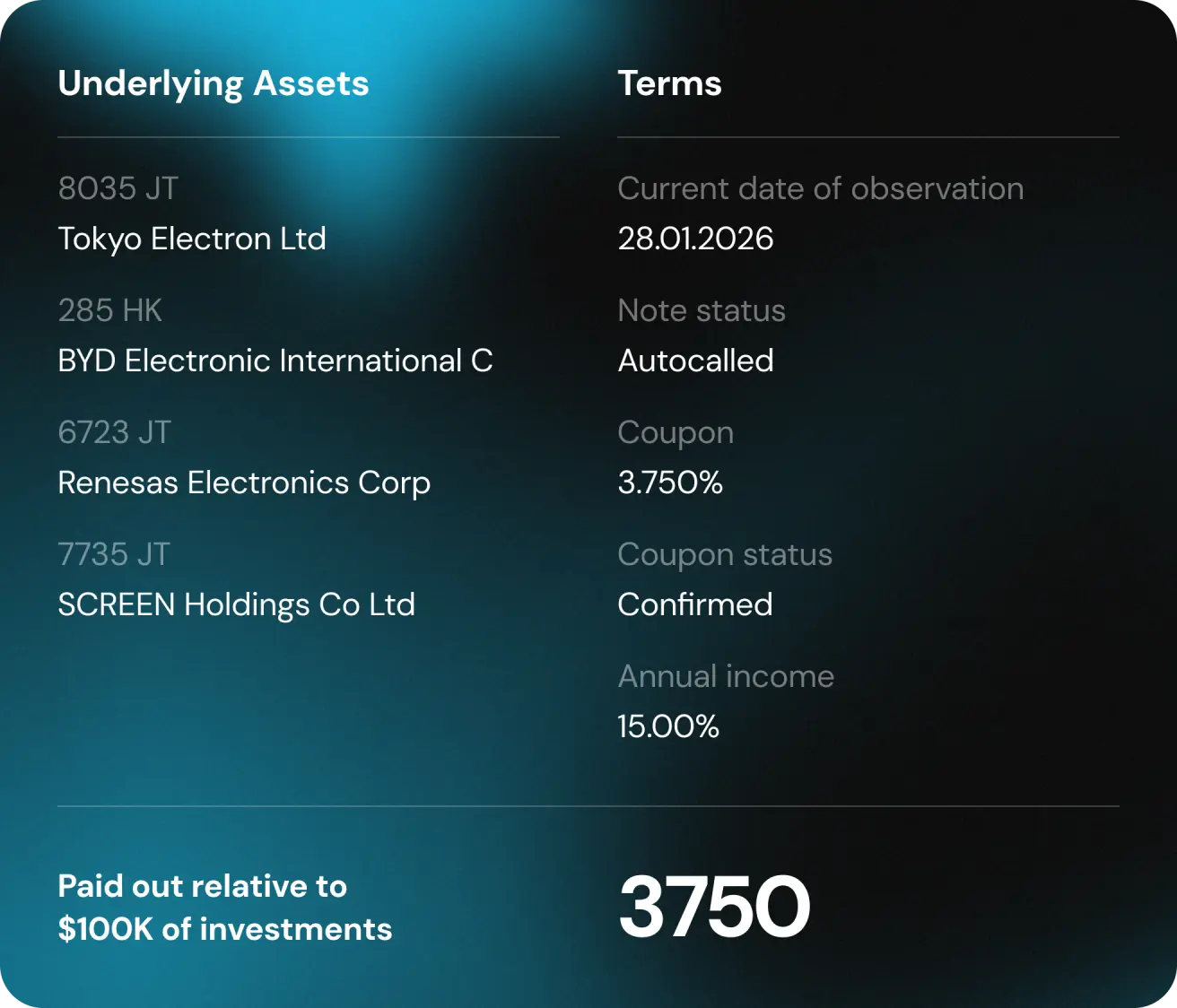

Autocalled (Redeemed Early)

Commodities | ISIN: XS2697202989

Next-Gen Driven Automation & AI Robotics | ISIN: XS3082755748

Robotics Infrastructure | ISIN: XS2984895461

Semiconductors | ISIN: XS2984894811

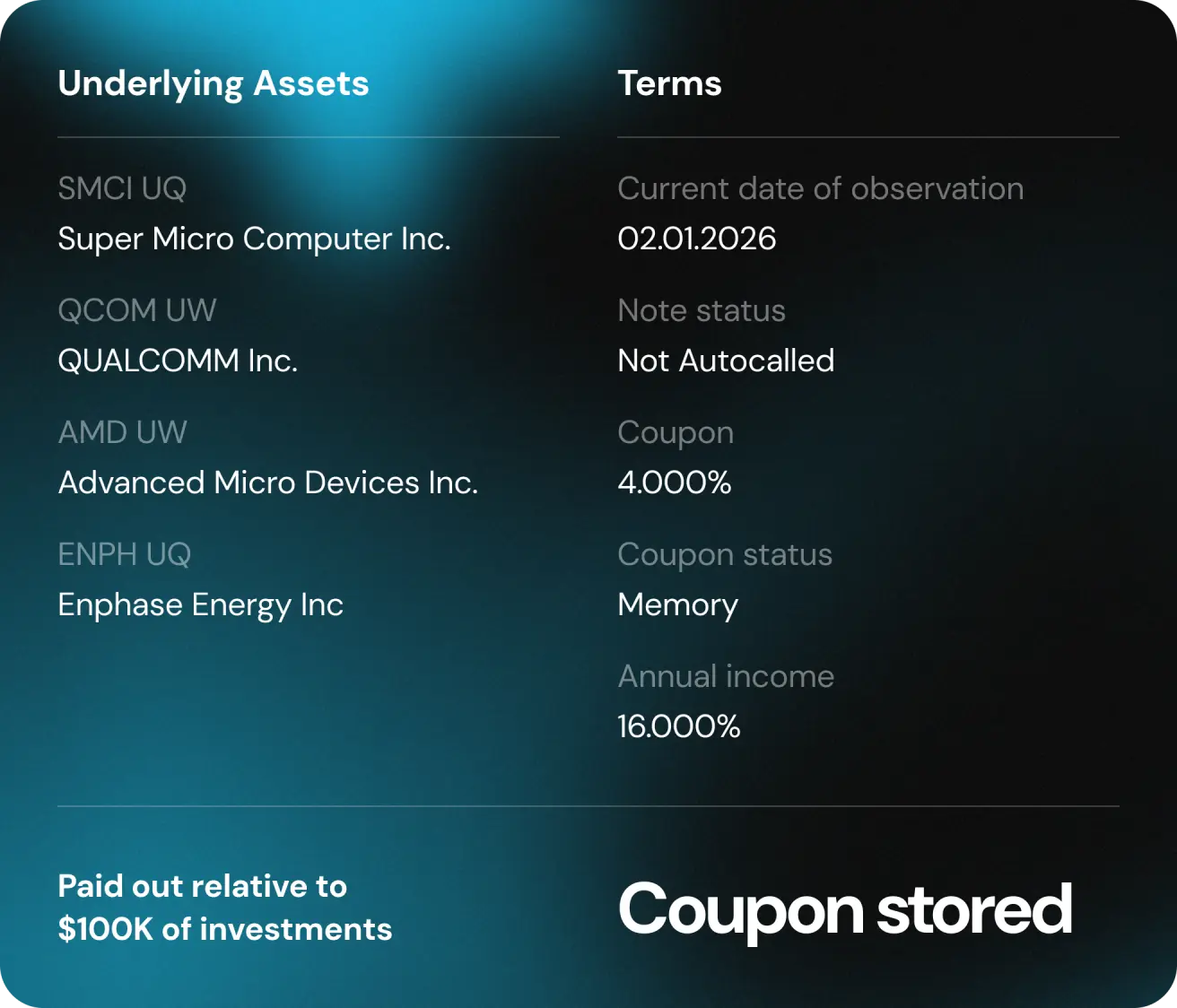

Memory Effect

Semiconductors | ISIN: XS2697202559

Why the Memory Effect Was Triggered

On the observation date, one of the underlying assets, Enphase Energy (ENPH), was temporarily below the coupon barrier. In accordance with the note’s terms, the coupon for the period was preserved and will be paid once asset prices recover above the barrier.

Looking Ahead

January confirmed the effectiveness of Raison’s protective strategies. Capital protection mechanisms and the coupon memory feature allowed the portfolio to deliver stable income despite localized volatility. A total of 7 coupons were paid during the month, 4 of which were associated with early redemptions via Autocall.

Even during temporary corrections in individual securities, the Memory Effect protects investors' income by preserving the coupon until market conditions normalize. We continue to structure products around key macro trends, maintaining a balance between attractive yield and robust downside protection. Interested in learning more about Raison structured notes? Complete a short form, and we will contact you to discuss solutions tailored to your investment objectives.

**Interested in learning more about Raison structured notes? Contact us, and we will provide all the details.

English

English Қазақша

Қазақша