FOMC Meeting Summary

The Fed Maintains Its Pause Amid a Resilient U.S. Economy

Yesterday, the Federal Open Market Committee (FOMC) held its first meeting of the year. As widely expected, the Committee kept the policy rate unchanged at 3.50%–3.75%, with 10 out of 12 members voting in favor of the decision.

Jerome Powell’s press conference struck a moderately hawkish tone, reinforcing the Fed’s intention to extend the current policy pause.

Key Takeaways

-

Monetary policy is no longer “significantly restrictive,” but not accommodative. The policy rate is now assessed to be within the range consistent with a neutral monetary stance.

-

The macroeconomic backdrop remains resilient. The U.S. economy entered 2026 on a “solid footing”: GDP growth is holding up, business investment continues to expand, and the outlook for economic activity has improved meaningfully since the previous meeting.

-

Consumer spending remains broadly stable. While consumer sentiment surveys continue to reflect pessimism, hard data on household spending remain strong, highlighting a persistent divergence between sentiment indicators and actual economic behavior.

-

Risks to both sides of the Fed’s dual mandate have eased slightly. The labor market is showing signs of stabilization: slower employment growth is being driven by reduced demand for labor rather than a sharp deterioration in conditions. Powell emphasized that current dynamics do not warrant urgent policy stimulus.

-

The inflation backdrop also supports a pause. Inflation remains modestly above the 2% target, with a significant portion of the overshoot attributable to tariffs rather than excess demand. Excluding tariff effects, core inflation is close to target, while both short- and long-term inflation expectations have normalized — a key signal for the Fed.

In summary, the Fed made it clear that rate hikes are not part of the base-case scenario, while also refraining from signaling any imminent or automatic easing. Political pressure is likely to persist as the Trump administration continues to advocate for a more accommodative stance — a factor that could ultimately shorten the pause, given the Fed’s current rhetoric.

Market Expectations

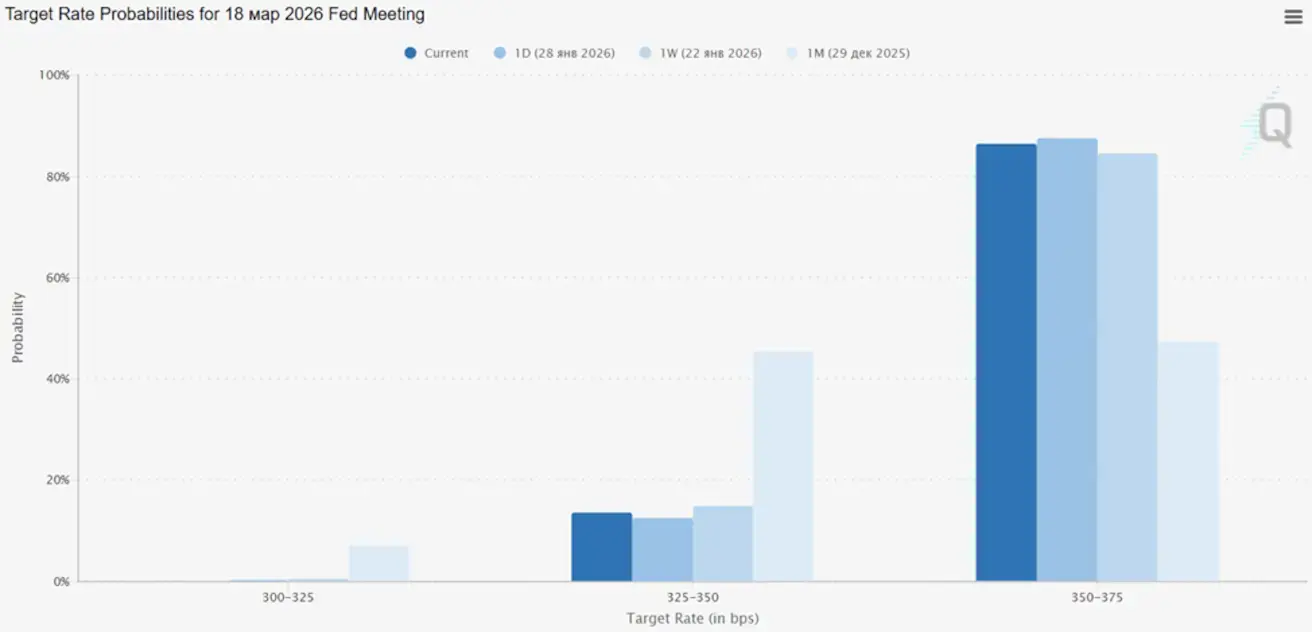

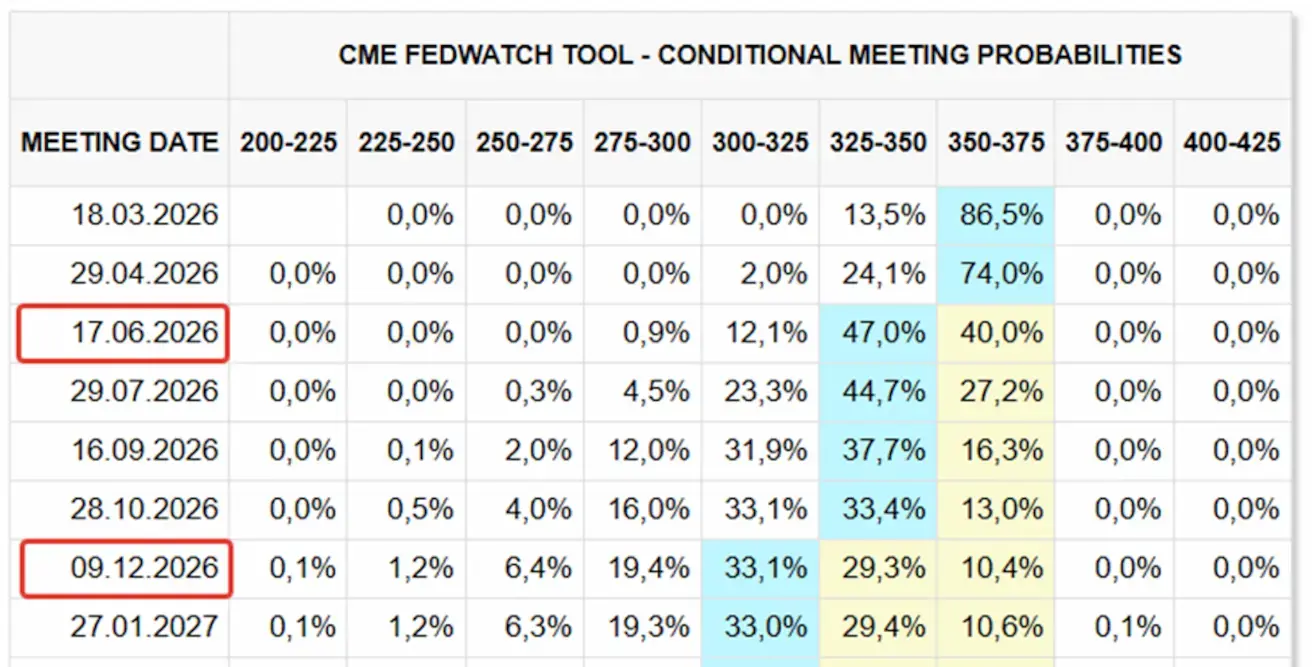

For the next meeting on March 18, the implied probability of a 25 bp rate cut stands at 13.52%.

Over the next 12 months, markets are pricing in two 25 bp rate cuts, which would bring the policy rate to a 3.00%–3.25% range. The first cut is expected in July, after three additional meetings.

Market Reaction

-

S&P 500 futures (ESH26): +0.34%

-

VIX: +1.78%

-

Gold futures (GC): +4.34%

-

U.S. Dollar Index futures (DXY): −0.37%

-

ETF TLT (20+ Treasuries): +0.26%

-

Bitcoin futures (BTC): −1.59%

Why Monitor FOMC Meetings?

Federal Reserve policy decisions directly shape the cost of capital across the global economy. They influence equity and bond valuations, the U.S. dollar, investment returns, and overall risk appetite. Even when rates remain unchanged, the Fed’s guidance can set the direction for markets for months ahead — signaling whether the environment will be one of tight financial conditions, policy pause, or eventual easing.

Markets received a clear no-surprises message: policy rates are set to remain stable for now, while future moves will remain firmly data-dependent.

Қазақша

Қазақша