FOMC Meeting Summary

Powell hints at pause as Fed shifts toward neutrality

The sixth (and penultimate) FOMC meeting took place, marking another step toward a more neutral policy stance: as expected, the rate was cut by 0.25 percentage points to a range of 3.75–4.00%, accompanied by the decision to end balance sheet reduction effective December 1 this year.

Powell’s key message at the press conference was clear: “A further rate cut in December is not a foregone conclusion. During this meeting, Committee members expressed markedly different views on possible actions in December. Over time, monetary policy should move toward a more neutral stance.”

Overall, Powell’s rhetoric was “neutral-dovish,” yet carried a clear signal of a potential pause ahead:

-

Powell: “Frankly speaking, the latest CPI release came in slightly weaker than expected. Tariffs — likely on Chinese goods — are having a one-off pro-inflationary effect, adding about 0.2–0.3 percentage points to inflation. Excluding tariffs, core PCE inflation is around 2.3–2.4%, which is actually not that far from our 2% target.”

-

On the labor market, Powell noted: “The balance of risks continues to shift from inflation toward employment: the labor market is weakening faster than we anticipated. We’re seeing slower hiring and an increase in layoffs — a sign of softening demand.” At the same time, he added: “Unemployment remains low — around 4.3% — and that’s not yet a cause for concern. The issue lies in reduced labor supply (immigration, lower participation rates). We’re not seeing a rise in jobless claims, which suggests that what we’re witnessing is a gradual cooling, nothing more — and that offers some reassurance. If we see signs of stabilization or renewed strength in the labor market, that will influence our future policy decisions.” In essence, the Fed acknowledges labor-market weakness but does not appear to see systemic recession risks. As Powell vividly put it: “We’re not running on autopilot — we’re slowing down in the fog.”

-

On the balance sheet, the move toward a “balance sheet freeze” and a gradual shift in asset composition toward short-term Treasuries (T-bills) can be viewed as an additional element of monetary easing. Powell explained: “At some point, reserves will begin to gradually grow in line with the size of the banking system and the economy, so we will be increasing reserves when the time comes.”

-

On subprime lending, Powell said: “We’ve been observing a rise in subprime credit defaults for some time. Several lenders in the subprime auto-loan segment have sustained significant losses, and some of those losses are reflected on bank balance sheets. We’re watching this closely. For now, I don’t see a broader default issue — it doesn’t appear to be widespread among financial institutions.”

-

On AI-driven investment, Powell admitted: “Investments directed toward building data centers and supporting AI infrastructure are undoubtedly among the key drivers of economic growth. Investments in AI infrastructure are not sensitive to interest rates.” He added: “The difference is that today’s highly valued companies actually have profits and viable business models. If you recall the 1990s and the dot-com era — those were ideas, not companies. That was clearly a bubble. So yes, this time, it’s genuinely different.”

-

Powell’s acknowledgment was striking: “Investments directed toward building data centers and supporting artificial intelligence are undoubtedly among the largest drivers of economic growth. Investments in AI infrastructure are not sensitive to interest rates.” He further emphasized: “The difference today is that these highly valued companies actually have profits and sustainable business models. If you think back to the 1990s and the dot-com era — those were ideas, not real companies. That was clearly a bubble. So yes, this time, it’s genuinely different.”

A signal for a pause: Powell stated, “I think for some members of the Committee, it’s time to take a step back and assess whether there are indeed risks of further deterioration in the labor market, or whether we’re actually seeing stronger growth. More and more people now believe that perhaps we should at least wait for one cycle — meaning one FOMC meeting — before making the next move.”

Market reaction at session close

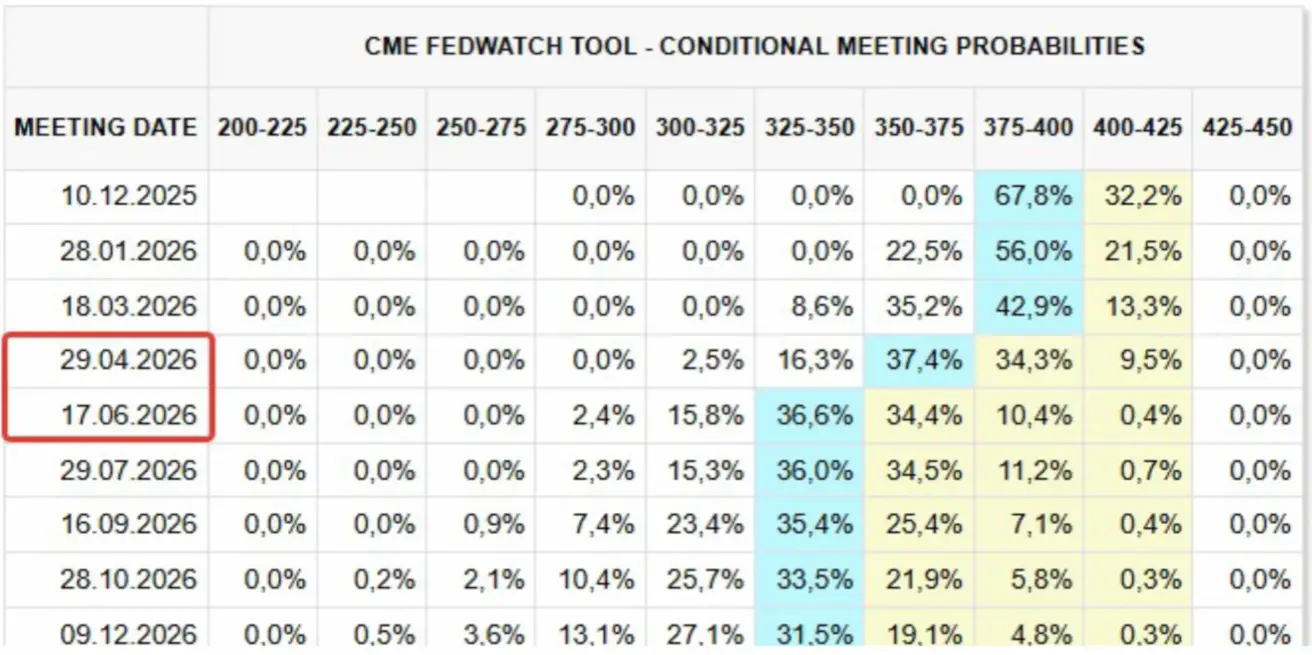

According to the swaps market (FedWatch), expectations now imply only two 25 bps rate cuts by the end of 2026, bringing the target range to 3.25–3.50%.

- S&P 500 futures: −0.32%

- VIX: +1.43% (at 16.91)

- Gold futures: −1.31%

- U.S. Dollar Index futures: +0.29%

- Bitcoin futures: nearly unchanged

- TLT ETF (20+ Year Treasuries): −0.39%

Қазақша

Қазақша