FOMC Meeting Summary

Federal Reserve shifts focus to labor market, cuts interest rates

The Federal Open Market Committee (FOMC) held its fifth meeting of 2025, delivering a 25 bps interest rate cut to a range of 4.00–4.25% and signaling the approaching end of quantitative tightening (QT).

Chair Jerome Powell highlighted a policy shift: the Federal Reserve is now prioritizing labor market stability while maintaining vigilance on inflation risks.

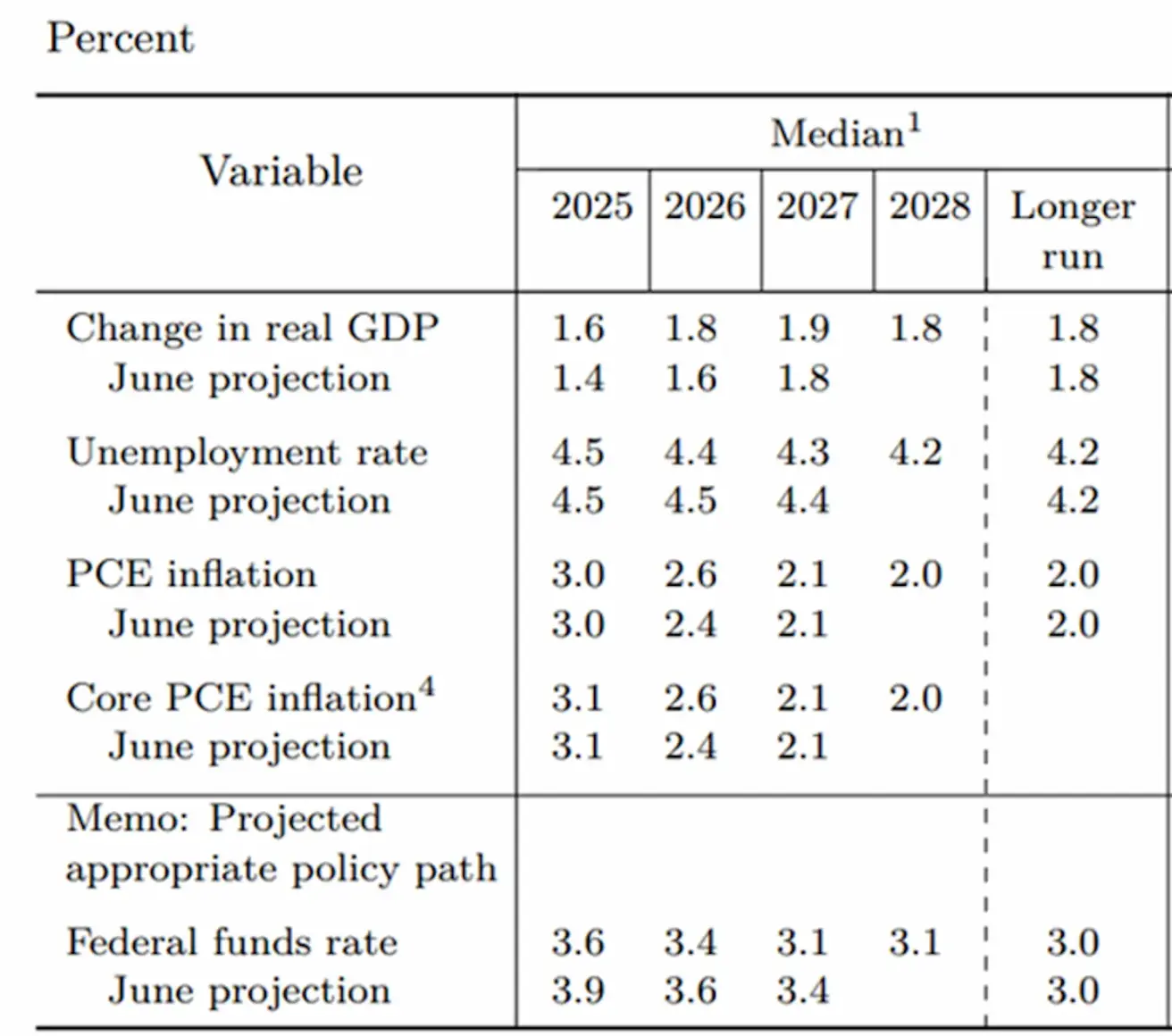

Key Forecasts and Projections

- Fed rate outlook (EFRR): reduced by 30 bps annually through 2027. By year-end 2025, the median rate is expected at 3.6%, implying two more 25 bp cuts.

- PCE inflation forecast: unchanged for 2025 and 2027, with only a small 0.2% upward revision in 2026. This suggests the Fed does not anticipate a persistent inflation rebound.

- GDP and unemployment forecasts: upgraded, reflecting stronger growth and improved labor market conditions.

Policy Rhetoric Shift

At Jackson Hole a month ago, Powell underscored inflation risks and tolerated further labor market cooling. Yesterday’s FOMC press conference marked a clear pivot: emphasis shifted toward labor market risks, underpinning the rate cut.

Key Insights from the Fed Meeting

- Labor market outlook: unemployment remains low, but labor supply is stagnant while demand has weakened. Risks of declining employment have increased.

- U.S. economic activity: recent data show slowing momentum.

- Inflation outlook: inflation is well below its 2022 peak but remains moderately elevated. Goods prices are rising again, while disinflation in services continues.

- Long-term inflation expectations: anchored near 2%, with tariff pass-through fading.

- Monetary policy approach: decisions will be driven by realized data rather than expectations.

- Balance sheet reduction: runoff continues, nearing the “slightly above excess reserves” target.

Market Reaction and FedWatch Outlook

Markets responded moderately positively to the Fed’s rate decision and updated forecasts. Yet, balancing risks remains a challenge, as the Federal Reserve has not committed to a fixed long-term policy path. Future decisions will be made on a meeting-by-meeting basis.

Upcoming U.S. macroeconomic releases will be crucial drivers of market sentiment. Any significant shift in risks tied to the Fed’s dual mandate could trigger heightened volatility.

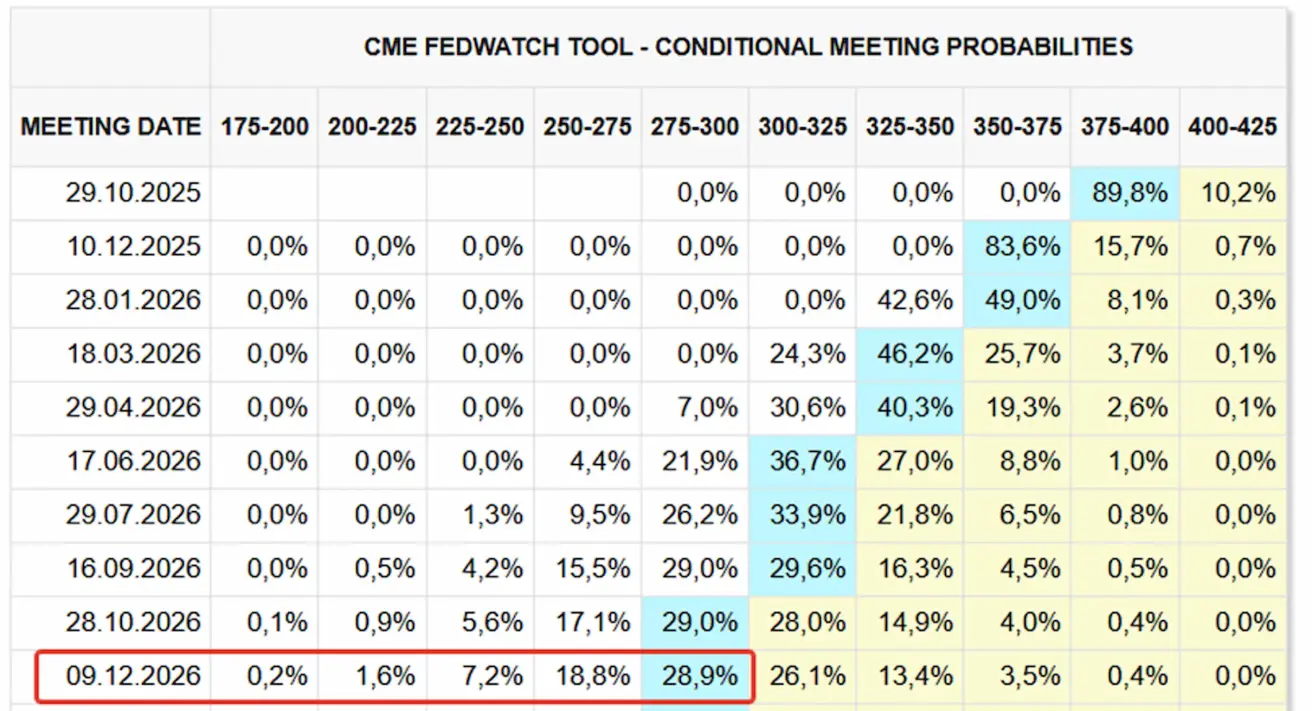

The FedWatch swap market still prices faster easing: for 2026, 2.75–3.00% versus the Fed’s own 3.25–3.50% projection.

Market Moves After the Fed Meeting

- S&P 500 futures: +0.74%

- VIX index: –10%

- Gold futures: –0.41%

- U.S. Dollar Index futures: +0.2%

- Bitcoin futures: +1.46%

- ETF TLT (20+ Treasuries): +0.02%

Қазақша

Қазақша