Key Takeaways from the Fourth FOMC Meeting

Fed Holds Rates Steady, Maintains Hawkish Stance

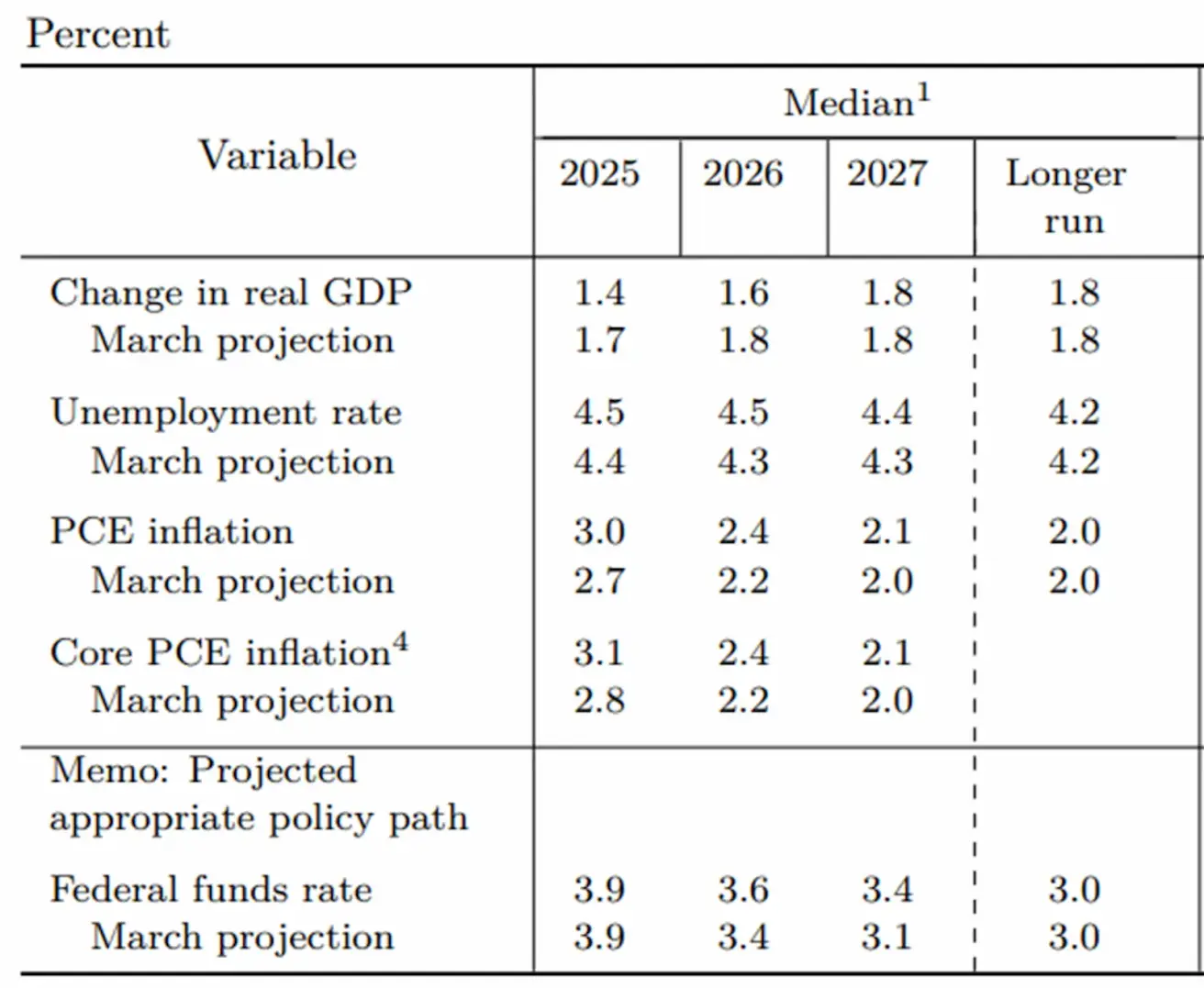

Yesterday, the Federal Open Market Committee (FOMC) held its fourth meeting of the year, maintaining the federal funds rate at 4.25–4.50%. Alongside this decision, the Fed also signaled a slowdown in the pace of quantitative tightening (QT). More notably, the Committee revised downward its economic forecasts for 2025 and 2026—marking the second consecutive downgrade since December. The evolution of projections offers telling insight into the Fed's changing outlook:

- GDP Growth: Now expected at 1.4% in 2025 and 1.6% in 2026, compared to 1.7% and 1.8% in March and 2.1% and 2.0% in December.

- Unemployment Rate: Projected at 4.5% for both years, versus 4.4% and 4.3% in March, and 4.3% for both years in December.

- PCE Inflation: Anticipated at 3.0% in 2025 and 2.4% in 2026, higher than 2.7% and 2.4% in March and 2.5% and 2.1% in December.

- The forecast for the federal funds rate (EFFR) remains unchanged for 2025 at 3.9%, while the projection for 2026 has been revised upward to 3.6% (from 3.4% in both March and December).

Key Takeaways from Chair Powell’s Press Conference

Opening Remarks (Largely Unchanged in Tone and Content):

- “Despite ongoing uncertainty, the U.S. economy remains on solid footing.” Chair Powell emphasized that a broad range of indicators continues to reflect a resilient and balanced labor market aligned with the Fed’s maximum employment mandate.

- The unemployment rate, currently at 4.2%, remains low and has fluctuated within a narrow range over the past year. Wage growth has remained moderate, still outpacing inflation—a sign that the labor market is not generating material upward pressure on prices.

- Inflation has come down significantly, though it still slightly exceeds the Fed’s long-term 2% target. Notably, short-term inflation expectations have risen.

- Consumer spending has shown signs of cooling, while business investment—particularly in equipment and intangible assets—has rebounded following weakness in Q4.

Powell’s Responses to Journalist Questions: A Cautious Tone Amid Uncertainty

- “The scope and duration of tariff-related effects remain highly uncertain.” Powell acknowledged that the economic consequences of recently imposed tariffs are difficult to quantify at this stage.

- The transmission of tariffs into consumer price inflation is complex and non-linear. “There are many players in this chain—producers, exporters, importers, retailers, and consumers. Each will try to avoid absorbing the cost, but ultimately someone—or several parties—will bear it.” He added that this process is hard to predict and unlike anything the Fed has recently faced, hence the need for more real-world data: “We’re forecasting in a fog.”

- Some early signs of price increases are already visible, particularly in categories like personal computers, audiovisual equipment, and related goods—sectors likely affected by tariff hikes.

- The Fed, along with most external forecasters, anticipates elevated inflation levels in the coming months. One of the key concerns, Powell noted, is ensuring that a one-time inflation spike does not become entrenched. “We must keep rates elevated to contain inflation. These are not extremely high rates—the stance is moderately restrictive. The labor market does not warrant a rate cut at this point.”

- The broader economy remains resilient, Powell emphasized, adding: “We are well-positioned to respond to major economic developments. That is what matters most.”

- When asked about the potential impact of the Israel–Iran conflict on the U.S. economy, Powell declined to speculate. However, he addressed concerns about energy prices, noting that short-term fluctuations in oil tend not to have lasting inflationary effects, barring extreme shocks like those seen in the 1970s. “The U.S. economy is far less dependent on foreign oil today,” he added.

Raison Analyst Commentary

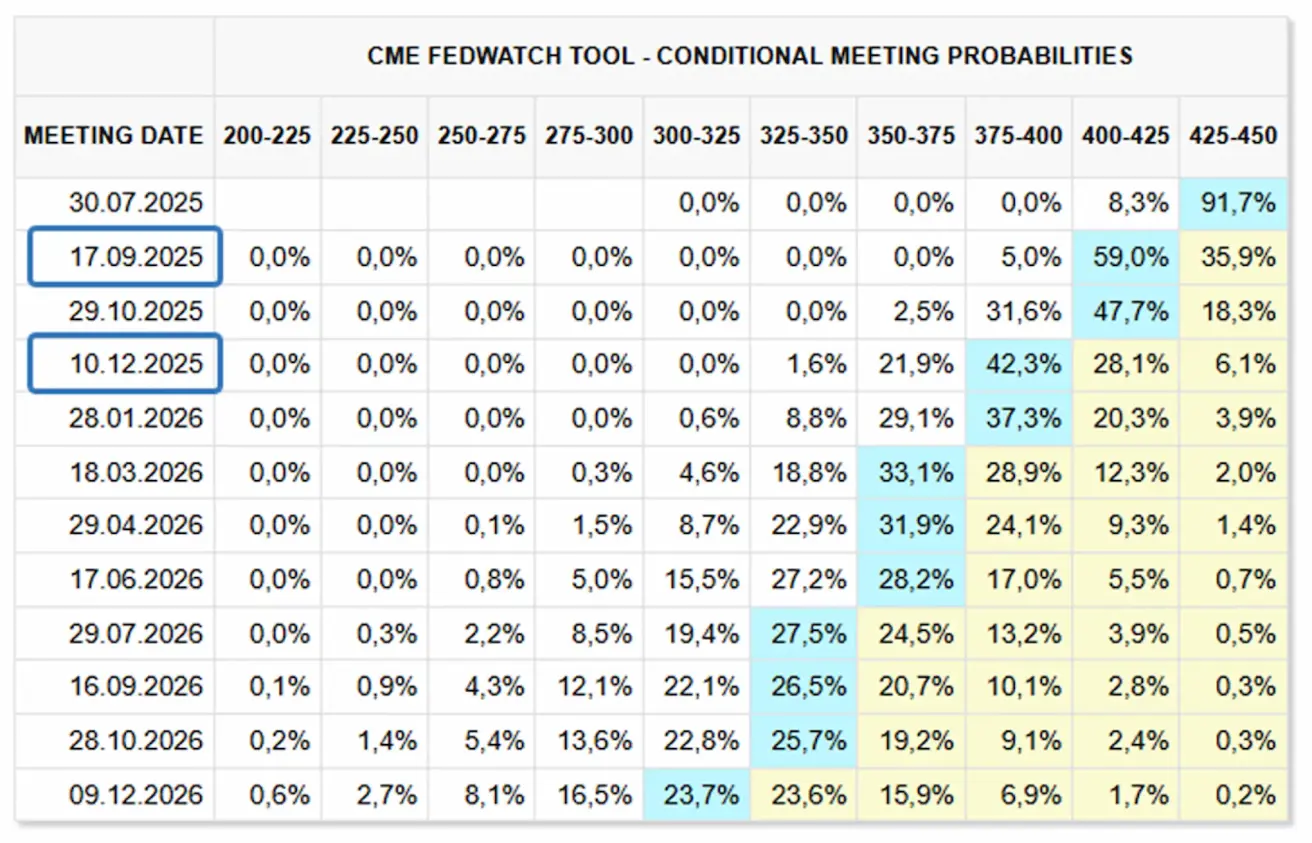

Despite intense political pressure—including personal attacks—from former President Trump, Chair Powell maintained a markedly hawkish tone regarding the timeline for potential rate cuts. The Federal Reserve, as a result, remains firmly in wait-and-see mode. In its baseline scenario, the Fed still anticipates two rate cuts later this year, likely in September and December. However, as Powell has repeatedly emphasized, data will drive every decision. Should the labor market remain resilient and inflationary pressures persist, the Fed may opt to hold rates higher for longer. This aligns with its overarching objective to avoid prematurely loosening financial conditions. Adding further uncertainty is the looming expiration of the current tariff pause on July 9. It remains unclear which direction Trump will take should he resume tariff escalations. While a full reversion to the initial tariff regimes seems unlikely, any upward adjustment from current levels could reignite inflation risks and amplify market volatility. For now, market expectations for 2025 remain aligned with the Fed’s outlook: two 25 basis point cuts, one in September and another in December.

Market Reaction

- S&P 500 Futures: –0.75%

- VIX: Largely unchanged, holding in a tight range of 20–20.5

- Gold Futures: –0.38%

- U.S. Dollar Index Futures: +0.27%

- Bitcoin Futures: +0.52%

- TLT ETF (20+ Year Treasuries): +0.08%

Қазақша

Қазақша