FOMC Meeting Commentary

Key takeaways

The Federal Reserve held its sixth meeting of the year, during which the regulator moved from words to action by reducing the interest rate by 0.5 percentage points.

Key Economic Takeaways from the Meeting:

- Economic activity continues to grow at a steady pace;

- Job growth has slowed, and the unemployment rate has risen, but remains low;

- The reduction in policy tightening reflects growing confidence that inflation is steadily moving towards 2%, and the regulator believes that the risks to achieving its employment and inflation goals are roughly balanced;

- The Committee will continue to shrink its balance sheet.

Forecasts:

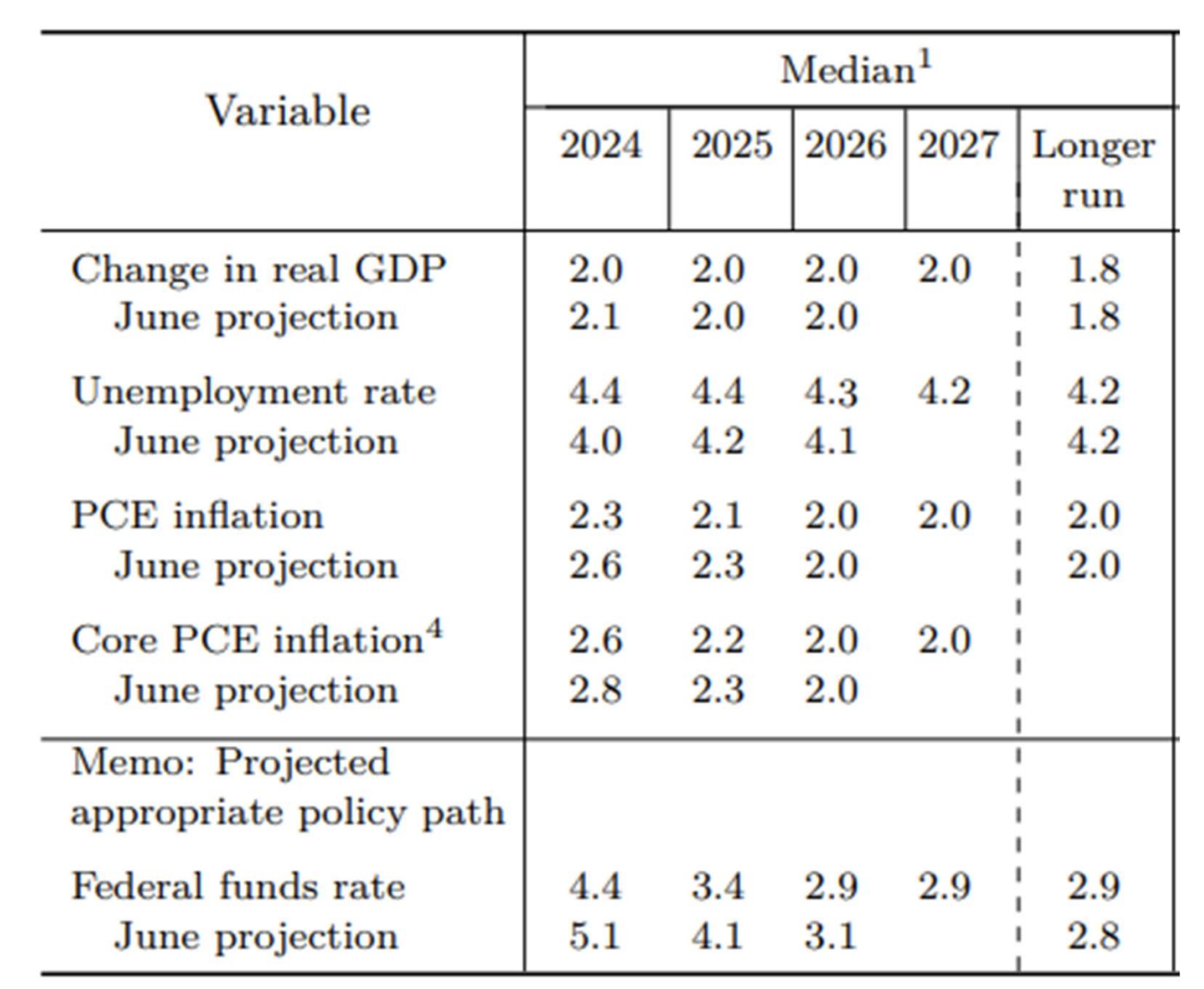

- The Fed expects GDP growth to remain stable with an average forecast of 2% over the next two years.

- The median unemployment rate is expected to be 4.4% in 2025.

- The target of 2.0% for the PCE and Core PCE indices is forecast to be reached by 2026.

The EFFR rate forecast has been lowered:

- 4.4% in 2024 (down from 5.1% at the July meeting), implying another 0.5% cut by the end of the year;

- 3.4% by the end of 2025 (-1.5% from the current range);

- Long-term forecast: 2.9%.

At the press conference, Powell stated:

"Recalibrating monetary policy will help maintain the strength of the labor market and ensure further progress in fighting inflation, as the Fed begins the transition to a more neutral stance. We believe this is timely. I don’t see anything in the economy indicating an increased likelihood of recession or downturn; overall, the economy is strong."

Commentary

From a monetary theory perspective, a central bank lowers interest rates to stimulate the economy in the face of slowing growth, the threat of recession, or financial instability. The main narrative of the Fed’s rhetoric since the start of the tightening cycle and until the July meeting has been the unwavering fight against inflation and achieving the 2% target.

However, the Fed began a rate-cutting cycle without reaching that goal, and with a sharp step of 0.5%. Historically, such rate cuts by the Fed have only occurred during crises. This is a rather drastic decision, especially given that the Fed only began discussing easing at the previous meeting.

The question arises: how appropriate was this decision, considering that the Personal Consumption Expenditures (PCE) indices (which the Fed has focused on in this cycle) are not showing a slowing trend? August PCE Price Index data (year-over-year) is above the level from February 2024, and the current value is only 0.05% below the seven-month average. The Core PCE Price Index (year-over-year) has remained unchanged for the past three months.

It's important to note that the risks of a second wave of inflation are still present today. A rapid rate cut is an inflationary factor, especially amid ongoing money printing and escalating trade wars.

Furthermore, if economic activity continues to grow at a steady pace and unemployment remains low (according to the regulator), wouldn’t it have been more prudent to reduce the rate by 0.25%?

The results of the meeting suggest that the regulator sees greater risks in the economy than the official narrative indicates.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша