FOMC Meeting Commentary

Key takeaways on 19.03.2025

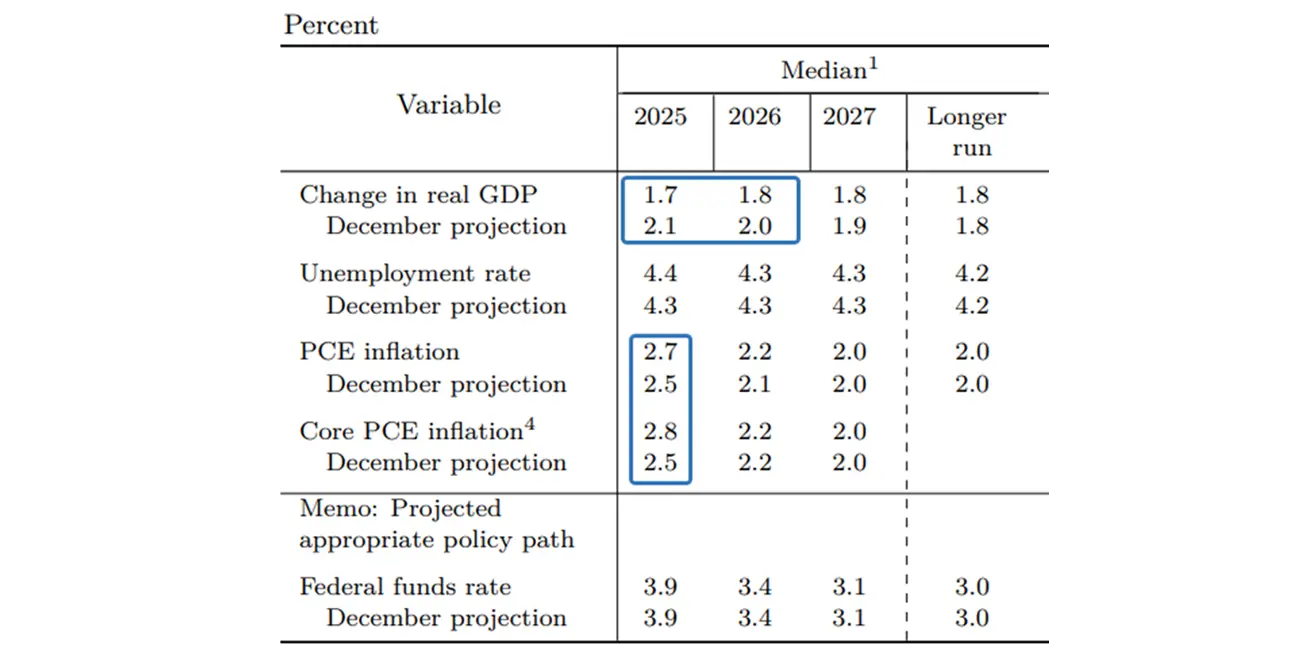

Yesterday, the second FOMC meeting of the year took place, during which the interest rate was kept unchanged at 4.25–4.50%, with a plan to slow the pace of quantitative tightening (QT). The Committee has significantly downgraded its GDP forecasts for the next two years, projecting growth of 1.7% in 2025 and 1.8% in 2026. Inflation forecasts for 2025 have also been revised upward to 2.7% and 2.8% for the PCE and core PCE indices, respectively. Long-term projections remain essentially unchanged. The effective federal funds rate (EFFR) forecast has been maintained at 3.9% for 2025, implying two rate cuts of 0.25% each by year-end.

Key Takeaways from Powell's Press Conference:

- "It is tough to precisely assess how much of inflation is driven by tariffs and how much by other factors. Inflation has started to rise, partly in response to tariffs, and there may be a delay in further progress toward its decline."

- "Survey data from households and businesses indicate a significant rise in uncertainty and serious concerns about the risk of a deteriorating outlook."

- "We continue to believe that job creation remains healthy, meaning that the labor market is in balance and the economy remains resilient."

- "Our monetary policy stance is well-positioned to allow for further clarity. There is an inflationary impulse that may dissipate on its own."

- "The probability of a recession has risen, but it remains low."

- "We have slowed the pace of balance sheet reduction, but it is clear that we have not yet reached the desired level and will move toward it more gradually."

Commentary

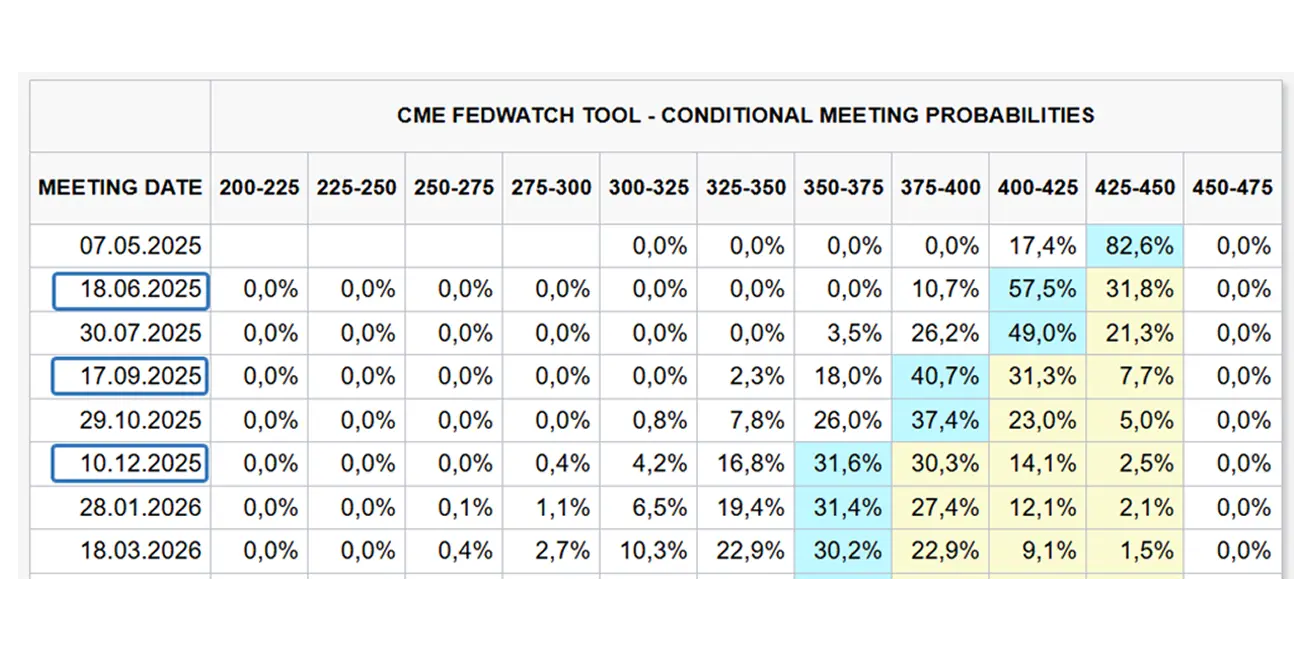

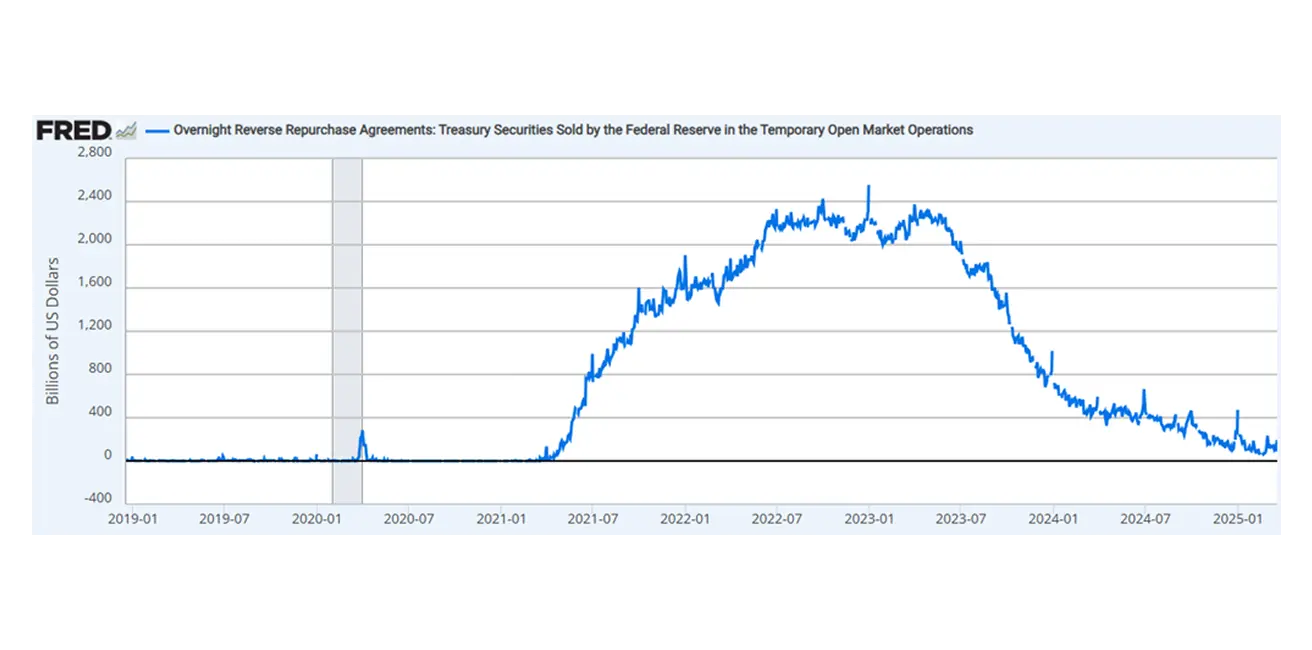

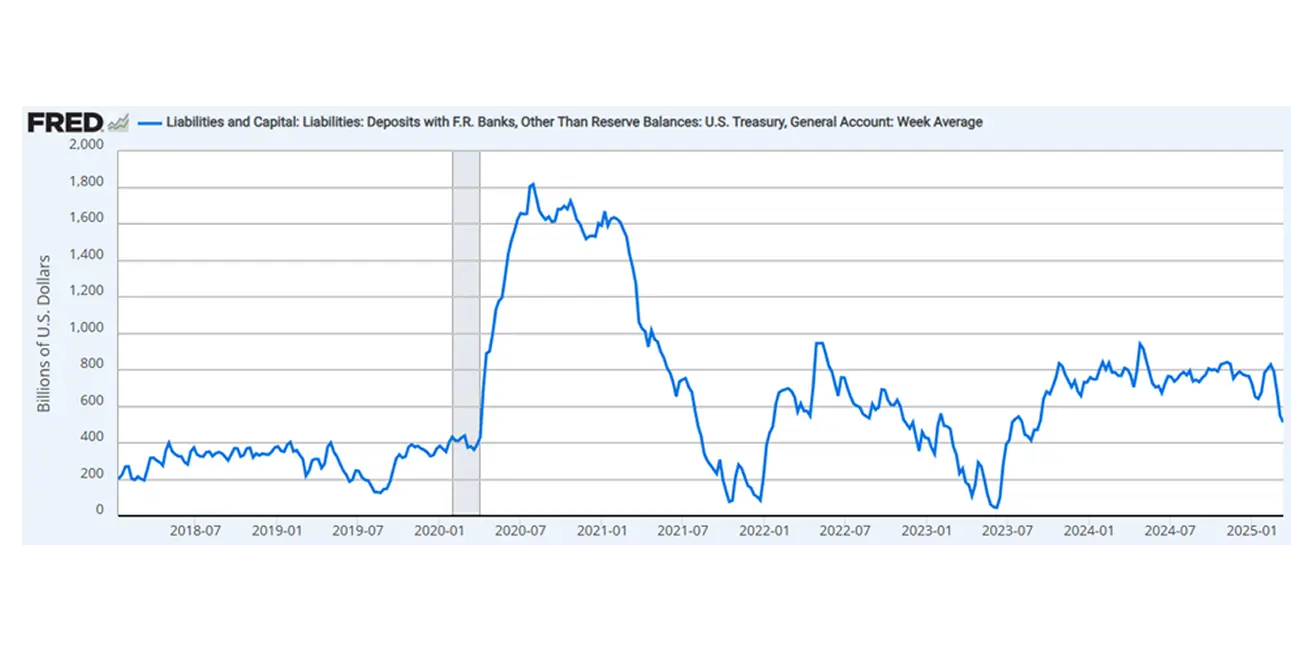

In its economic analysis today, the Federal Reserve prioritized complex data—labor market and inflation releases—while placing less emphasis on soft data, such as expectations. Although the Fed acknowledges the rise in negative sentiment among households, it tends to view these concerns as temporary. Powell recognizes the growing uncertainty but highlights the resilience of the labor market and the economy's overall strength. However, despite the "strong" economy and the Fed's projections indicating higher inflation, the central bank still expects two rate cuts this year. This suggests a significant shift in risk perception—tilting more toward concerns about economic downturn rather than inflation risks. The FOMC's statement also removed a key phrase that previously emphasized a balanced approach to financial stability and inflation risks. Moreover, the Fed has lowered the monthly cap on Treasury roll-offs from $25 billion to $5 billion while maintaining the limit for agency and mortgage-backed securities at $35 billion. As a result, the total balance sheet reduction has slowed from $90 billion to $40 billion per month since the start of the tightening cycle. Powell emphasized that the QT slowdown has no hidden agenda, noting that the Treasury General Account (TGA) is being depleted (see chart below). The reduction in QT is tied to potential future liquidity risks. First, the latest U.S. budget release shows a record deficit of $1.146 trillion since the beginning of the 2025 fiscal year. The current TGA balance is $512 billion, which is insufficient to cover the budget deficit. Against this backdrop, government revenues could decline further if Trump pursues his proposed tax cuts (a key campaign pledge). Of course, the widening fiscal gap will continue to be financed through increased government debt issuance. Given the high borrowing pace of 2023-2024, the missing demand for U.S. Treasuries was previously covered by reverse repo balances, which have primarily evaporated (falling from $2.3 trillion to $193 billion; see chart below). Additionally, due to the new administration's aggressive trade policies, foreign investors may decline to invest in U.S. government debt. A combination of high supply and insufficient demand could ultimately lead to the monetization of government debt via the Fed's balance sheet—shifting from QT back to QE.

Key Takeaways

Summarizing Powell's remarks and the FOMC outlook, it is evident that the Fed will not raise rates in response to minor inflation spikes. The shift in focus toward financial stability suggests that the central bank is likely to proactively ease monetary policy in the second half of the year. Markets expect more aggressive action from the Fed—three rate cuts this year, bringing the target range down to 3.50–3.75%.

Reverse Repo Agreements:

U.S. Treasury General Account (TGA):

Қазақша

Қазақша