2026 Outlook: Business, Tech, and Economy

Key Takeaways from Global Institutional Forecasts

Our analytics department has conducted an in-depth study of key forecasts from the world’s leading institutions: a16z, Y Combinator, KPMG, BlackRock, Goldman Sachs, JPMorgan, and EY. We analyzed reports, charts, and key performance indicators to distill the most critical trends into a cohesive picture of the future.

Our conclusion is clear: 2026 will be the year technology touches down. We are saying goodbye to the era of presentations and entering a new phase. Now, AI effectiveness will be measured not by the number of chat dialogues, but by hours of human life saved and real profit on corporate balance sheets. Here is a detailed breakdown of the future that has already arrived.

Part 1. Artificial Intelligence

For the past two years, businesses have aggressively invested in AI: purchasing hardware, hiring specialists, and piloting neural networks across various departments. While these were once trial runs, 2026 marks the moment of practical ROI. Companies are moving beyond testing and beginning to demand real profit and resource optimization.

- Autonomy and Agent Coordination. Analysts predict that the key trend in 2026 will be autonomous communication among neural networks without human intervention. Complex tasks will be solved "collectively": your primary agent will independently coordinate the work of dozens of other specialized models.

- A New Standard for KPIs. Traditional efficiency metrics are giving way to hours of life saved. AI is shifting from mimicking human work to fully augmenting it. A prime example is the automated preparation of complex reports, freeing specialists to focus on sleep and strategic thinking. Efficiency will now be measured by employee quality of life, not by hours spent at a monitor.

- Multimodal Flow. The generation of text, code, video, and audio is merging into a single context. This is no longer a collection of disparate tools, but a unified flow for creating content and virtual worlds.

- New Developer Tools. AI evolution requires new infrastructure — Ultra-Large Database Management Systems (DBMS), specialized development environments, and simplified APIs for model training. These tools will be the shovels of the new gold rush, allowing for the configuration of complex systems without deep mathematical expertise. Much like cloud services once did, this infrastructure will pave the way for mass adoption of AI across corporations.

Part 2. The Physical World

Technology is finally moving beyond the screen. Analysts bet that in 2026, software will begin to directly manage physical reality.

- Robotics and Construction. Software is automating processes using drones, robots, and heavy machinery. 2026 is expected to see a significant shift toward physical systems that design, build, and maintain structures with minimal human involvement.

- Re-industrialization of Metallurgy. Analysts see potential for a revival in U.S. heavy industry — not through cheap labor, but through radical technological shifts. 2026 startups will focus on replacing outdated, energy-intensive processes in metallurgy and chemistry with new, eco-friendly methods. Here, AI serves as a critical tool for complex modeling and real-time production control.

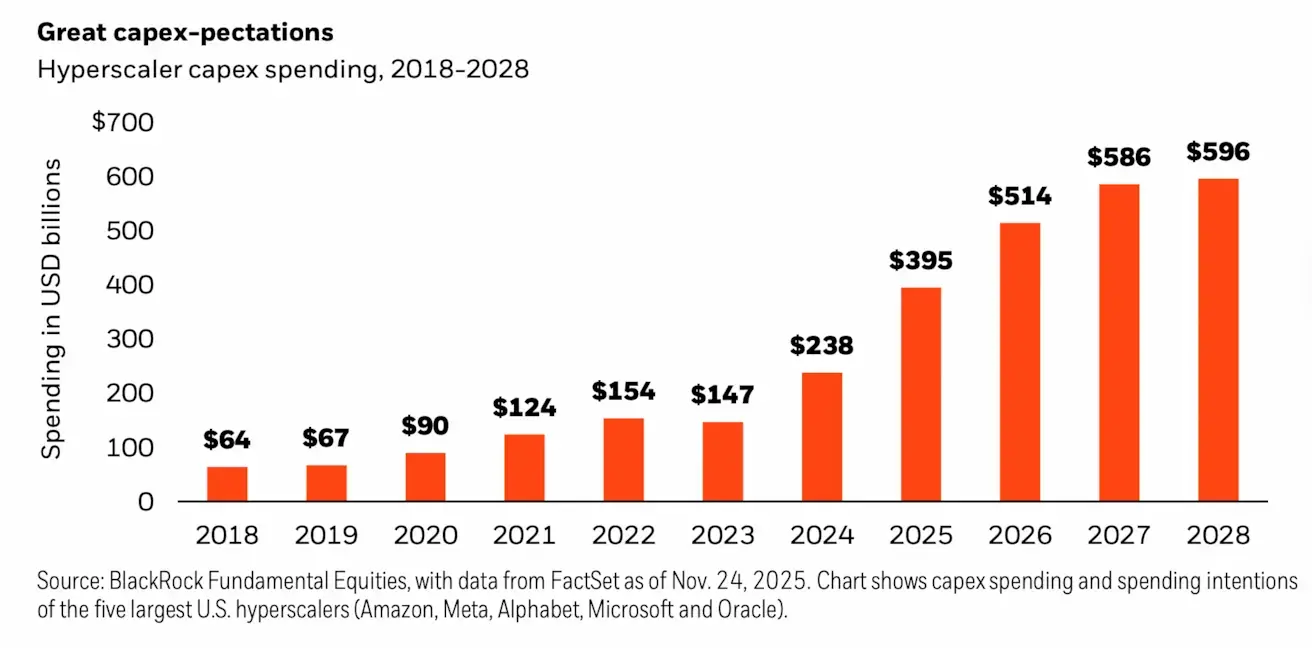

- Infrastructure Boom. Realizing these forecasts requires a colossal foundation. Hyperscalers (Google, Amazon, Microsoft) are scaling capital expenditures (CapEx) on data centers, chips, and energy at an unprecedented pace. Electricity demand is growing so rapidly that the energy sector has become a primary beneficiary of the tech surge.

Chart Insight: Hyperscaler CapEx for data centers and chips is projected to grow exponentially, reaching $514 billion in 2026. These investments turn AI adoption forecasts from theory into reality.

Part 3. Corporate Reality

While the market discusses possibilities, High Performers — companies with revenue exceeding $100M — are already restructuring their business processes. The KPMG report indicates that 2026 will mark the mass transition from strategy to full-scale technology adoption.

From Tests to Integration

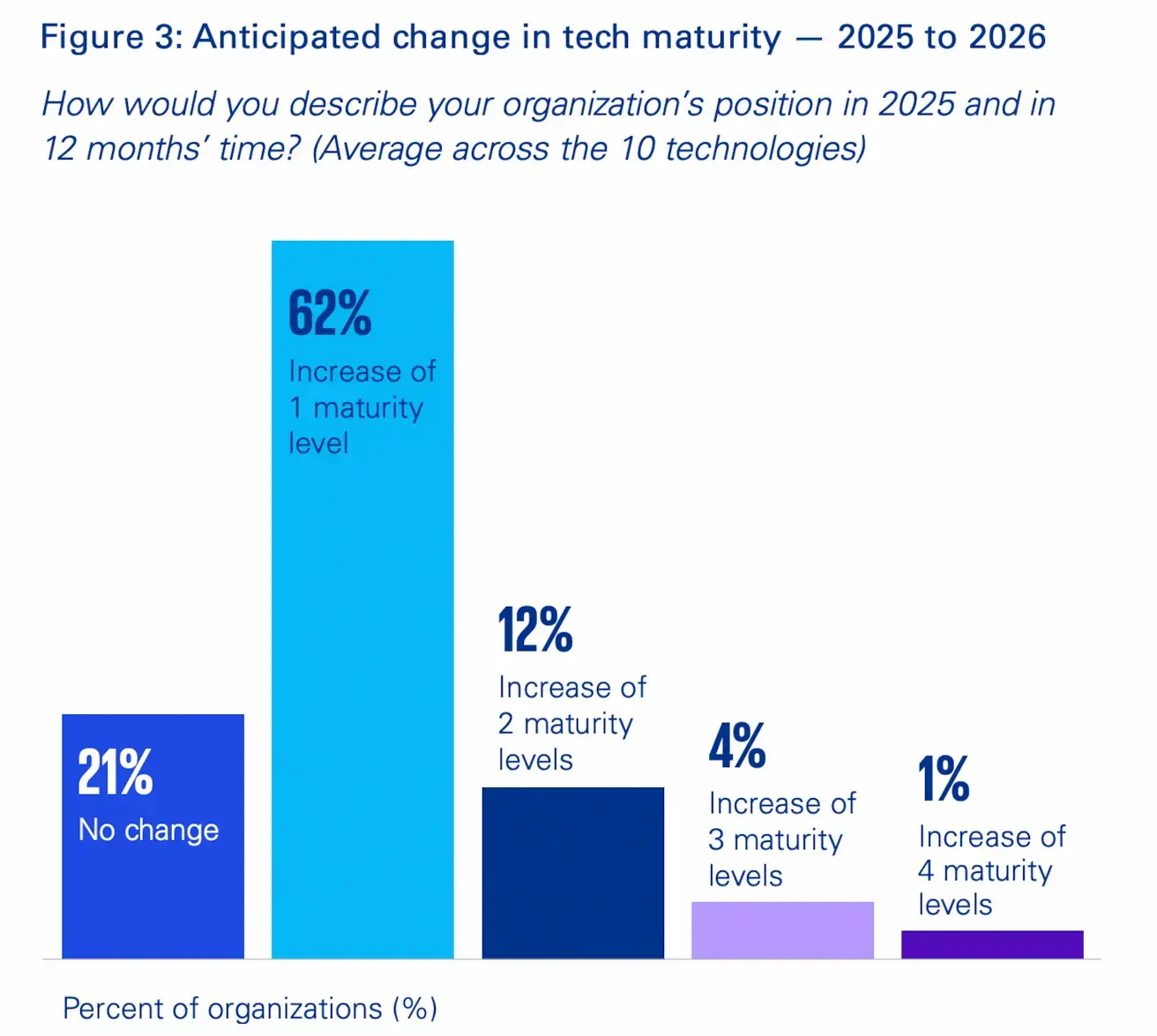

In 2025, 79% of companies had already funded tech-adoption strategies. 2026 promises a sharp leap: the share of companies with completed transformations is expected to hit 50%. This marks the end of the preparation period and the start of operation in a new technological reality.

Chart Insight: The bars show the percentage of companies planning to advance at least one maturity level within a year. This mass migration will result in every second major business (50%) becoming technologically mature by year-end.

From Experiments to Profit

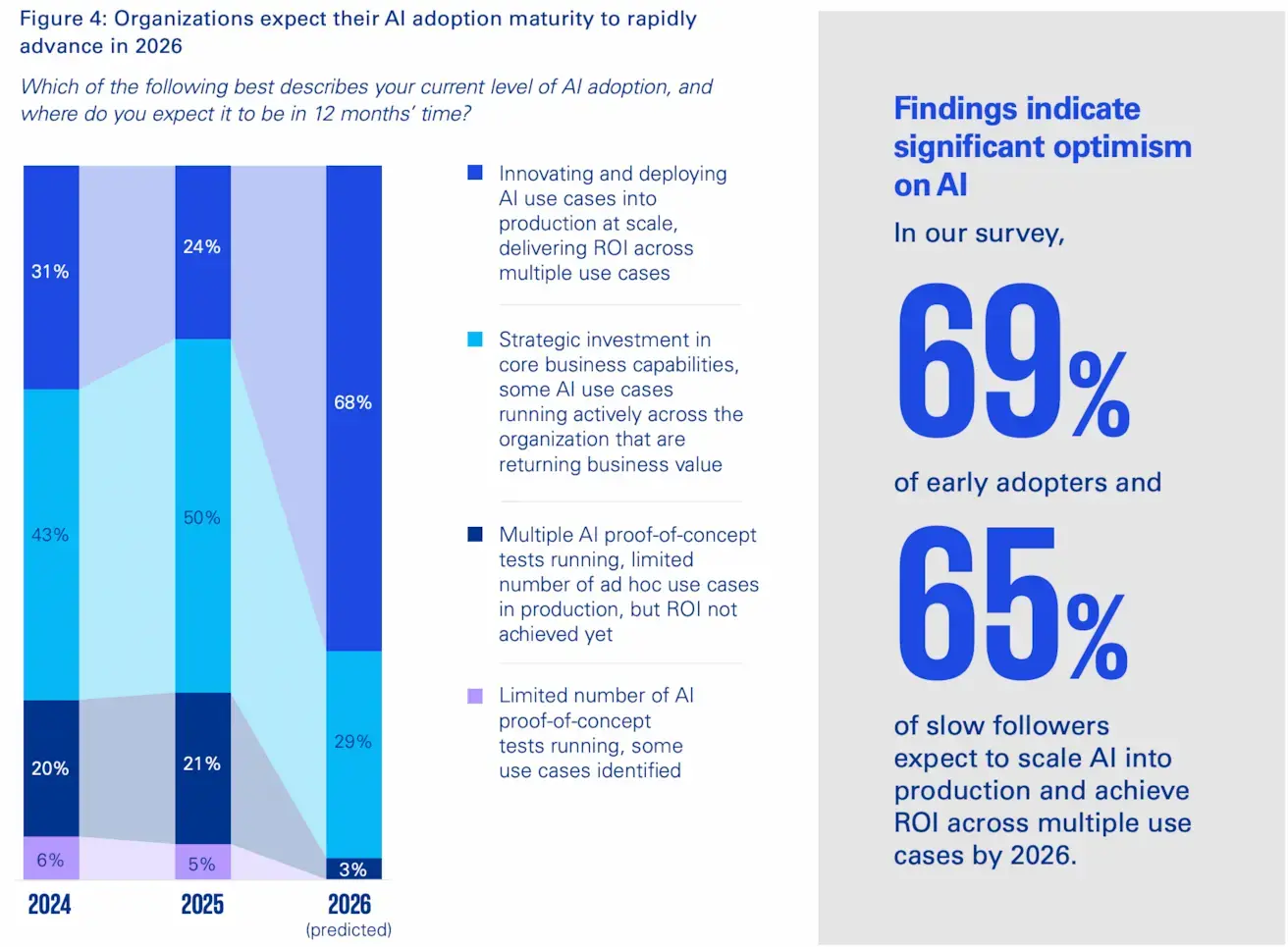

The era of experimentation is closing. While only 24–31% of companies reported returns on AI investments in 2024–2025, 68% expect to see real financial results (ROI) in 2026.

The Paradox of Proof

55% of executives admit difficulty in explaining AI's benefits to shareholders using legacy metrics. This reinforces the need for new indicators, such as hours of life saved. A paradox of faith versus evidence.

Chart Insight: A visualization of a fundamental shift: by 2026, two-thirds of companies will start profiting from AI rather than just investing in it.

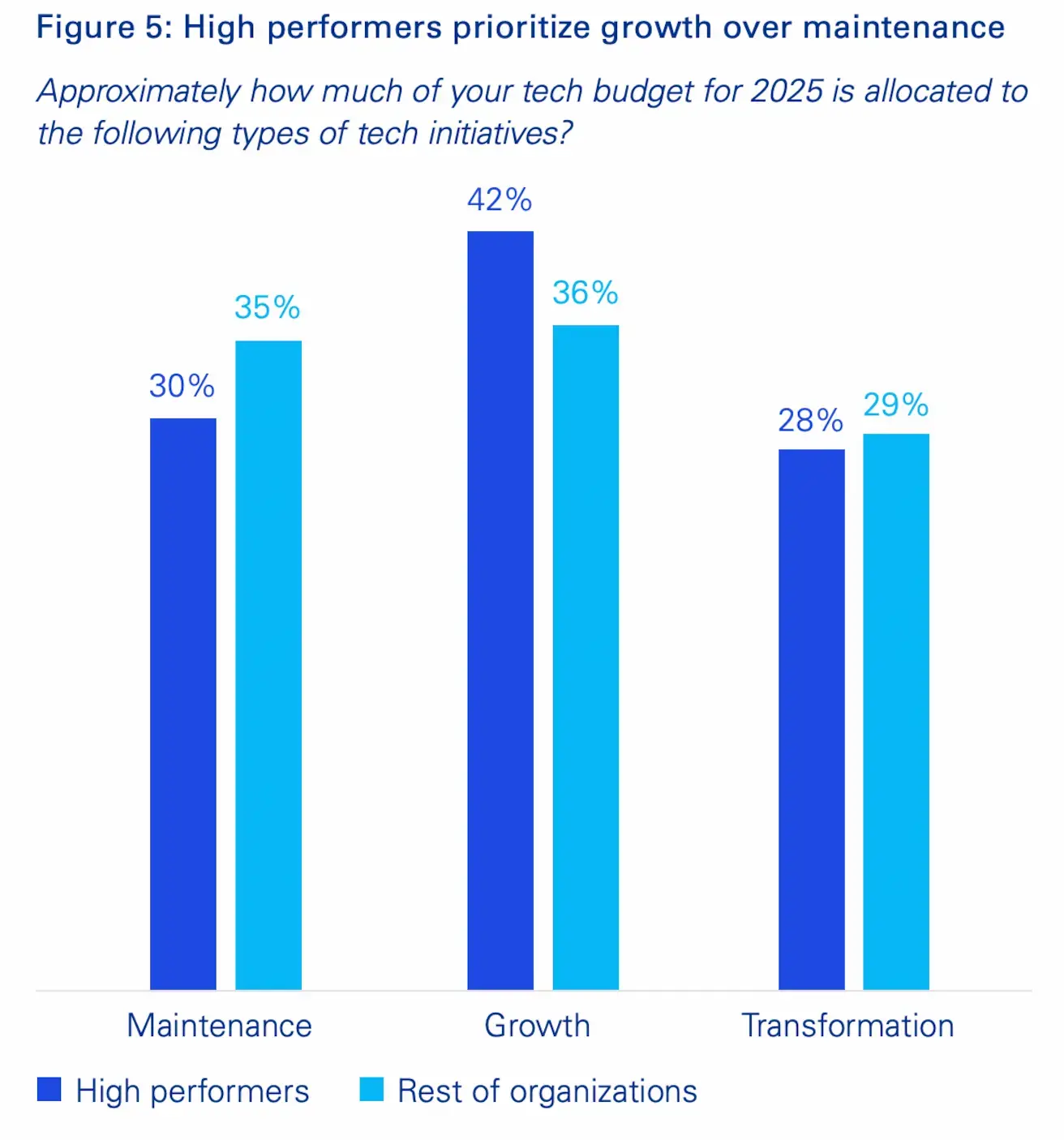

Budgets for Growth

Leading companies are spending significantly more on expanding new solutions (Growth) than on supporting legacy systems (Maintenance).

Chart Insight: High performers prioritize growth over maintenance. Budget allocation among market leaders favors innovation over "patching holes."

The Digital Workforce

By 2027, up to 36% of large companies' workforces will consist of AI agents — digital assistants that perform tasks alongside humans. They will handle routine work, analytics, and reporting, partially replacing operational staff and external consultants. This is not about mass layoffs but about a redistribution of roles: humans shift toward strategy and creativity, while agents operate 24/7 as full team members.

Part 4. Finance

The financial industry is on the brink of fundamental change. From AI-native hedge funds to the merger of TradFi and Crypto, 2026 promises to be revolutionary.

AI-Native Investment Funds

We are moving from algorithmic trading to intelligent trading. Where funds once used rigid mathematical formulas, 2026 sees their replacement by groups of AI agents. Over time, they will learn to listen to quarterly calls with top management, analyze the tone of their remarks, compare them with thousands of reports, and adjust the portfolio in real time. We can expect to see funds where artificial intelligence serves as the analyst and trader.

TradFi and Crypto Convergence

Analysts expect a closer union between traditional finance and the crypto industry. The headline trend is Asset Tokenization: stocks, bonds, and real estate moving to the blockchain for transparency, fractional ownership, and 24/7 liquidity. Stablecoins are increasingly integrated into the banking system.

Prediction Markets

Platforms where users bet on world events (from politics to SpaceX launches) are growing rapidly. Quotes in these markets are often more accurate than expert forecasts because participants vote with real capital.

Private Equity

Companies are staying private longer and raising large rounds in the private market at levels comparable to IPOs. Meanwhile, PE funds in 2026 are aggressively investing in AI for their portfolio companies; the technological lag has become too costly a risk.

Part 5. Macroeconomics

The final pieces of the puzzle come from Goldman Sachs and BlackRock, describing the structural anomalies the market will face in 2026. This is a year where old economic correlations are expected to break down.

The Productivity Paradox. Growth Without Jobs

We are seeing a unique phenomenon: excluding the healthcare sector, the U.S. economy has lost approximately 200,000 jobs despite robust GDP growth. The economy is gaining through explosive productivity leaps and AI integration rather than headcount expansion. In 2026, the labor market will become a more critical indicator for investors than inflation.

Fiscal Activism and Economic Nationalism

Analysts predict a surge in economic nationalism, where states move from being mere regulators to active market participants. Governments are supporting domestic industries through direct subsidies and tax incentives, willing to run significant budget deficits to ensure they don't fall behind in the global technological race.

Five Major Barriers for 2026:

- Trade Wars. Consumer tariffs have reached their highest levels since 1934. While businesses are currently adapting by restructuring logistics, the risk of systemic pressure on the global economy is mounting.

- Sovereign Debt. Chronic budget deficits in major economies are prompting investors to question the reliability of government bonds, pushing yields higher and raising borrowing costs.

- Market Concentration. Just 10 giants now account for 40% of the S&P 500. This concentration makes the entire market hypersensitive to any news, positive or negative, from the AI sector.

- Political Turbulence. Geopolitical tensions, the U.S. midterm elections, and the leadership transition at the Fed may create a backdrop of high volatility throughout the year.

- The AI Debt Bubble. Massive infrastructure investments (the $514B mentioned earlier) are significantly increasing corporate debt loads. If AI monetization lags behind these expenditures, the sector may face a liquidity crunch.

Where to Seek Growth: 2026 Catalysts

Despite the barriers, analysts highlight key pockets of opportunity for the coming year:

- Monetary Easing. Central banks in G10 countries are expected to continue cutting interest rates. This will boost sectors that rely on borrowed capital, including real estate and heavy manufacturing.

- The AI Ripple Effect. While 2025 saw gains concentrated in a few hands, 2026 will see profits spread across the entire value chain — from energy providers to end-user enterprises.

- The M&A Wave. Expect an active M&A market as companies acquire competitors for their tech stacks and talent.

- Deregulation and Tax Incentives. A shift toward reduced bureaucratic burdens and tax credits (in line with the Trump administration’s platform) is expected to provide U.S. businesses with greater flexibility and liquidity.

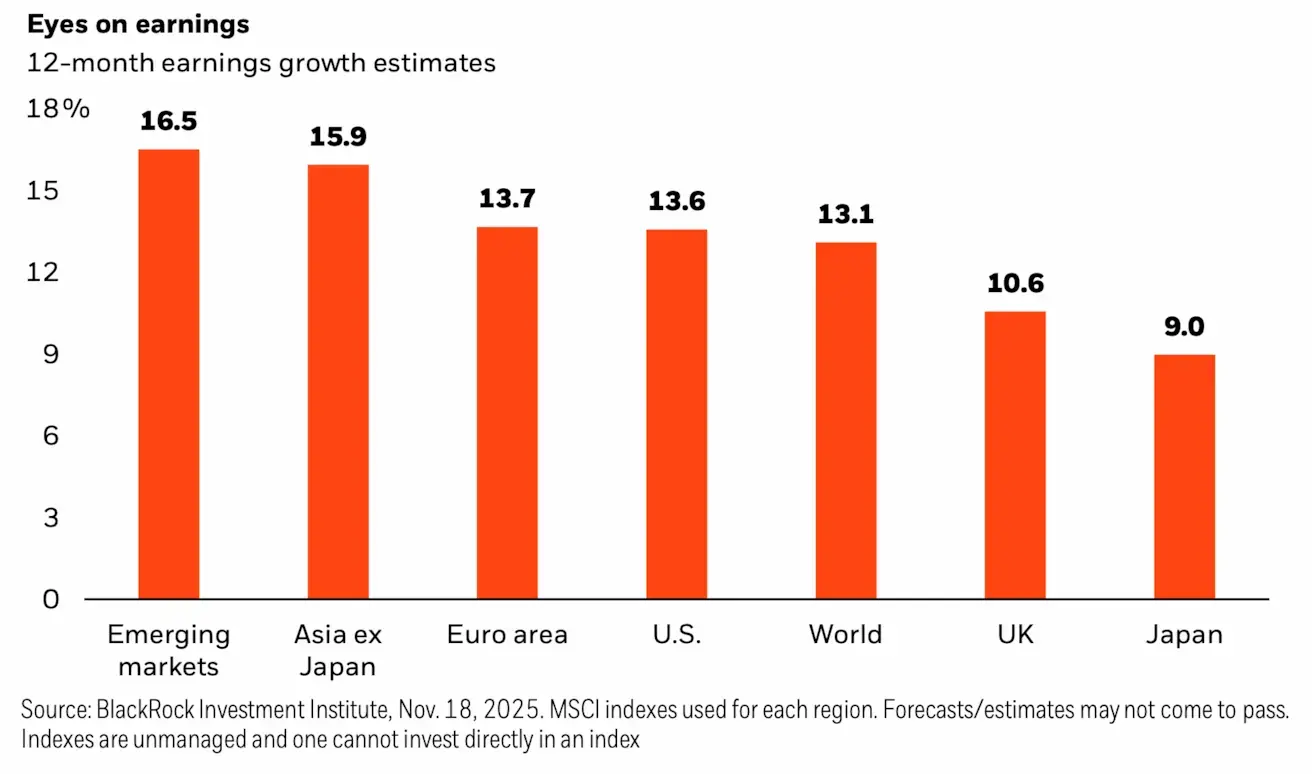

- The Bet on Asia. BlackRock suggests looking beyond the U.S. for yield, specifically in Emerging Markets and Asia (ex-Japan), where earnings growth estimates remain strong.

- Government Contracts. Record spending by developed nations on defense and infrastructure will ensure a stable stream of orders for major contractors and suppliers.

- Fixed-income returns. With current yields at 6% and inflation falling, real returns in this asset class have reached a 20-year high, making them highly attractive.

Chart Insight: BlackRock — Eyes on earnings. The data confirms this trend: Emerging Markets are currently leading the 12-month earnings growth estimates.

Chart Insight: BlackRock — Eyes on earnings. The data confirms this trend: Emerging Markets are currently leading the 12-month earnings growth estimates.

Summary: The Transition to Economic Reality

2026 is not about loud revolutions; it is about the transition to the practical utility of technology. Focus is shifting from experimentation to financial results. AI is moving beyond presentations and into operations — into documents, production, finance, and management. Its value is increasingly measured by time saved and impact on the bottom line.

In such a pragmatic environment, general forecasts give way to precise calculations. Large reports set the direction, but the final outcome depends on the selection of specific assets. At Raison, we turn macrotrends into investment strategies with clear entry logic and balanced risk. Our analytics and access to international deals allow us to build portfolios that account for the shifts of 2026 while remaining manageable.

Let us help you make an informed decision on where to invest today to grow tomorrow — submit a consultation request.

Sources:

- Andreessen Horowitz (a16z) Big Ideas 2026 (Part 1, 2, 3)

- Y Combinator Request For Startups (RFS)

- KPMG Global Tech Report 2026

- BlackRock Q1 2026 Equity Market Outlook

- BlackRock: 2026 Views: Income, Selectivity and Dispersion

- Goldman Sachs Investment Outlook 2026

- JP Morgan Asset Management 2026 LTCM Assumptions

- EY Private Equity Trends 2026

Қазақша

Қазақша