Venture Capital Market 2025

Recovery in Volumes and a New Capital Structure

2025 marked a year of recovery for the global venture capital market following the prolonged downturn of 2022–2024.

This rebound did not represent a return to the previous model, but rather the formation of a new, more concentrated capital structure.

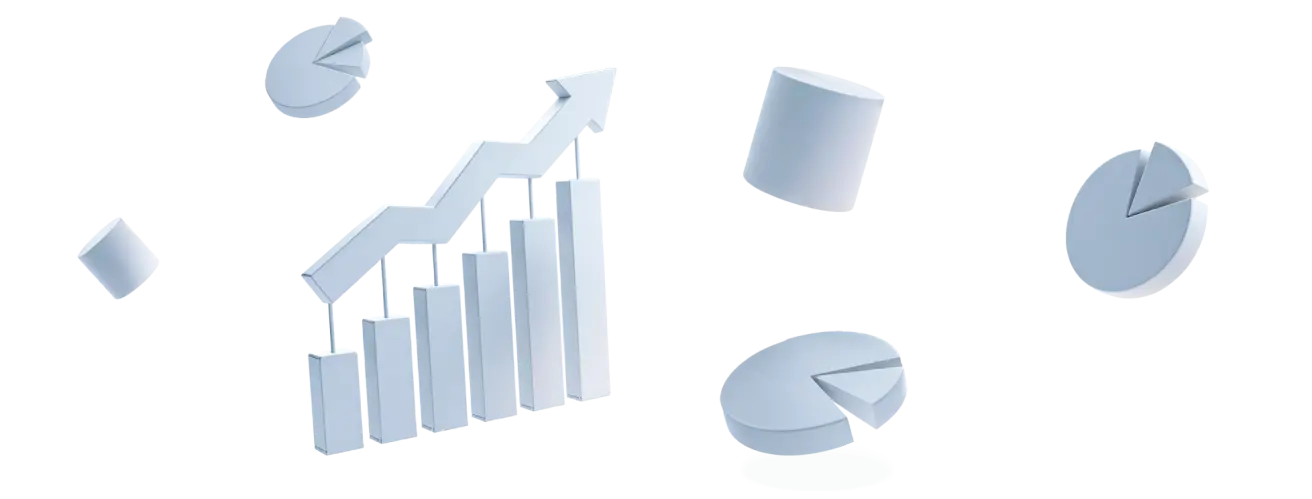

According to CBI, total global venture investment in 2025 increased by 46% year over year. In absolute terms, the market nearly returned to its 2022 level, with a gap of approximately 1.5%. This indicates a recovery in the scale of venture financing without a return to the extreme levels observed in 2021.

Chart: number of deals and aggregate deal value in 2025.

Chart: number of deals and aggregate deal value in 2025.

Decline in Deal Count and Rising Capital Concentration

Despite the increase in total investment volumes, the number of venture deals remains below the 2021 peak. In 2025, 29,501 deals were recorded, down from 35,441 in 2021, a decline of 16.7%.

At the same time, a significant share of capital has been concentrated in large funding rounds.

In 2025, 65% of total venture funding was allocated to mega-rounds—rounds exceeding $50 million. As a result, the market has become more selective: fewer companies are raising capital, while the average round size has increased substantially.

Artificial Intelligence as the Core Investment Vertical

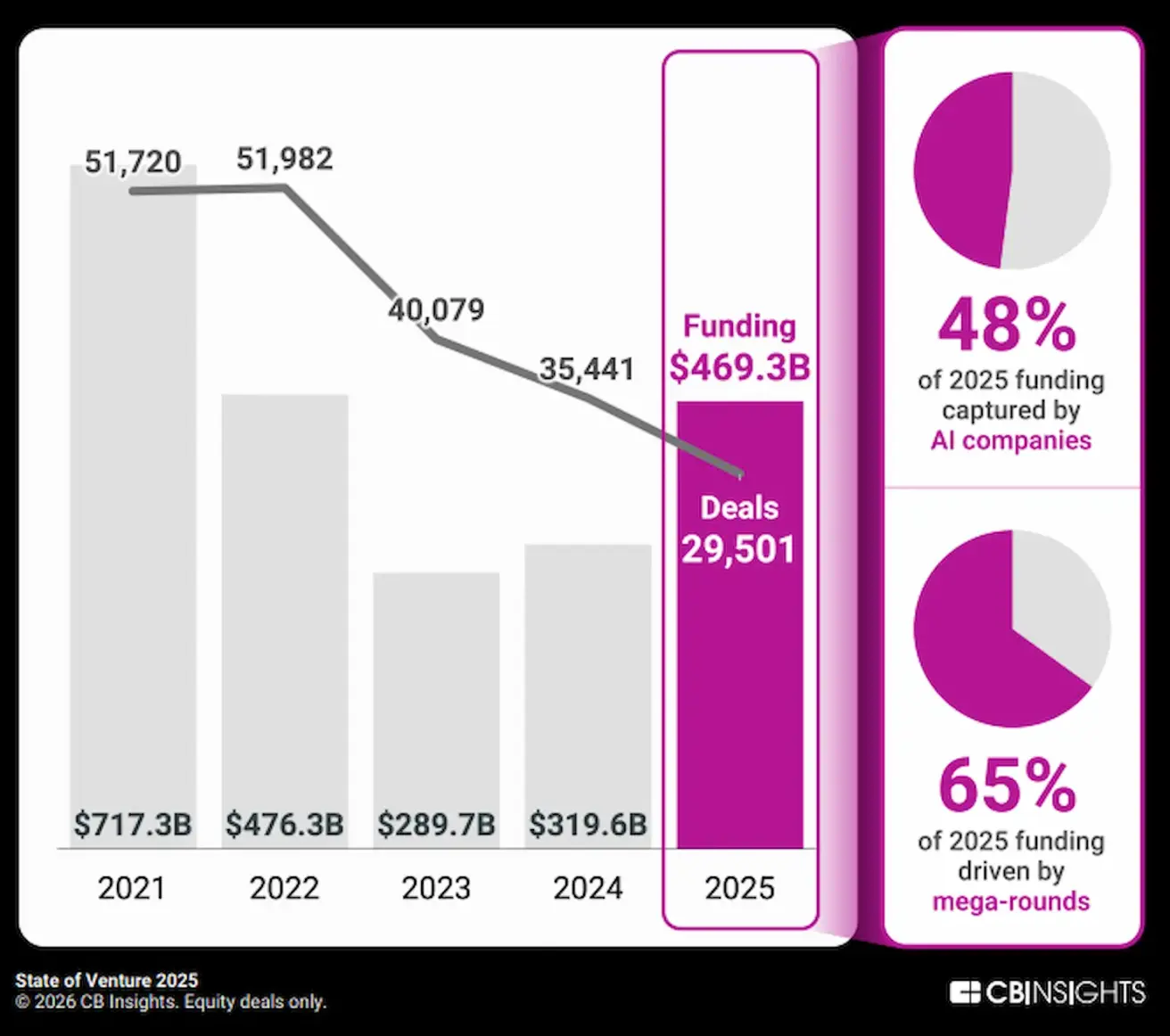

Artificial intelligence remains the primary driver of capital concentration.

In 2025, AI accounted for 48% of all venture investment, equivalent to $225.8 billion. This is the highest share ever recorded for a single vertical over the entire observation period.

Chart: AI share of total venture investment by dollar volume.

Chart: AI share of total venture investment by dollar volume.

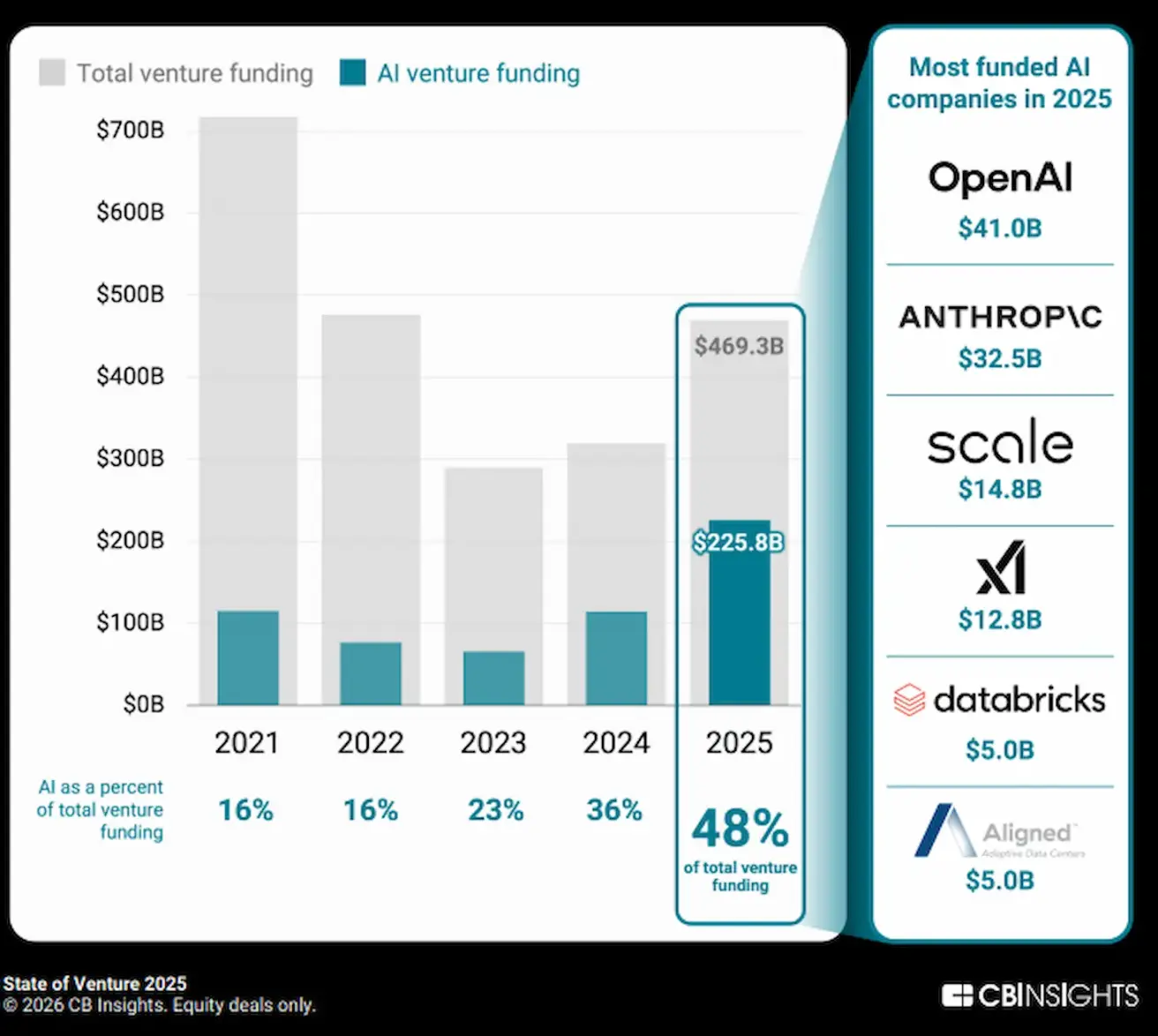

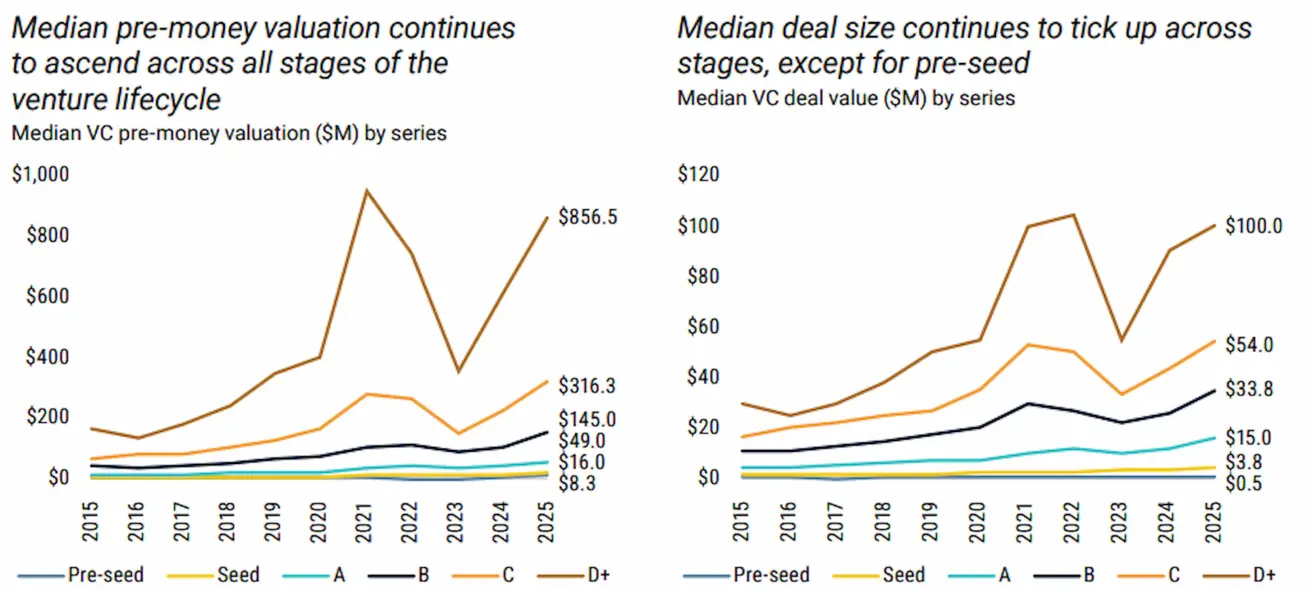

The growth in AI investment has been accompanied by rising valuations:

- Both average and median pre-money valuations in the AI sector have increased.

- This dynamic has contributed to higher average and median valuations across the venture market as a whole.

Charts: average and median AI pre-money valuations (2015–2025);

Charts: average and median AI pre-money valuations (2015–2025);

Charts: median pre-money valuation across the venture market; / median deal size by stage.

Charts: median pre-money valuation across the venture market; / median deal size by stage.

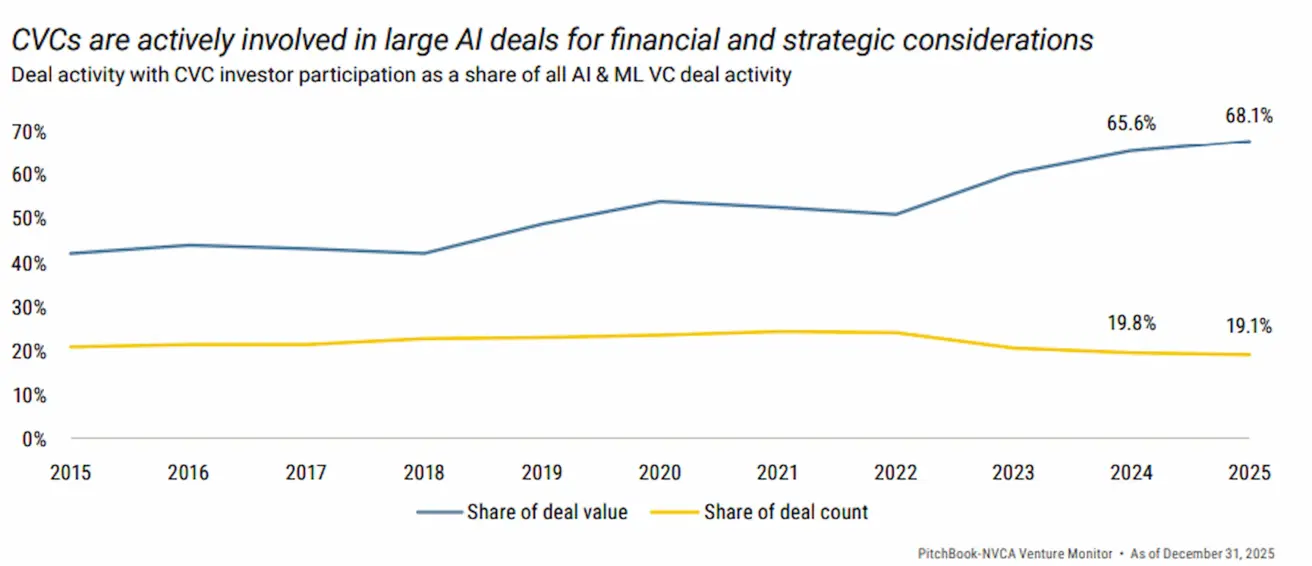

AI also:

- Represents the largest investment focus for corporate venture capital (CVC), i.e., strategic corporate

- Investments aimed at gaining access to technology and talent;

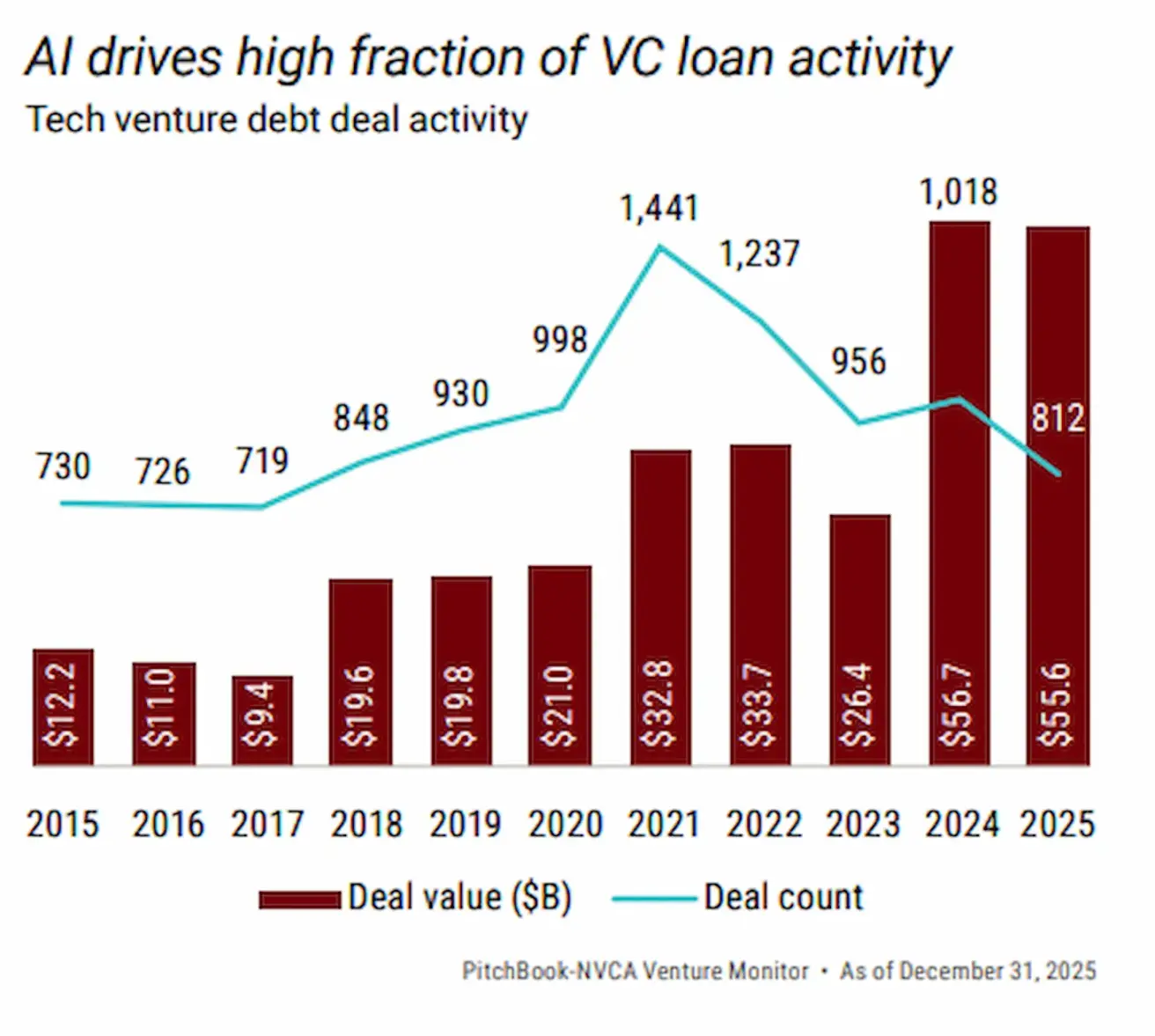

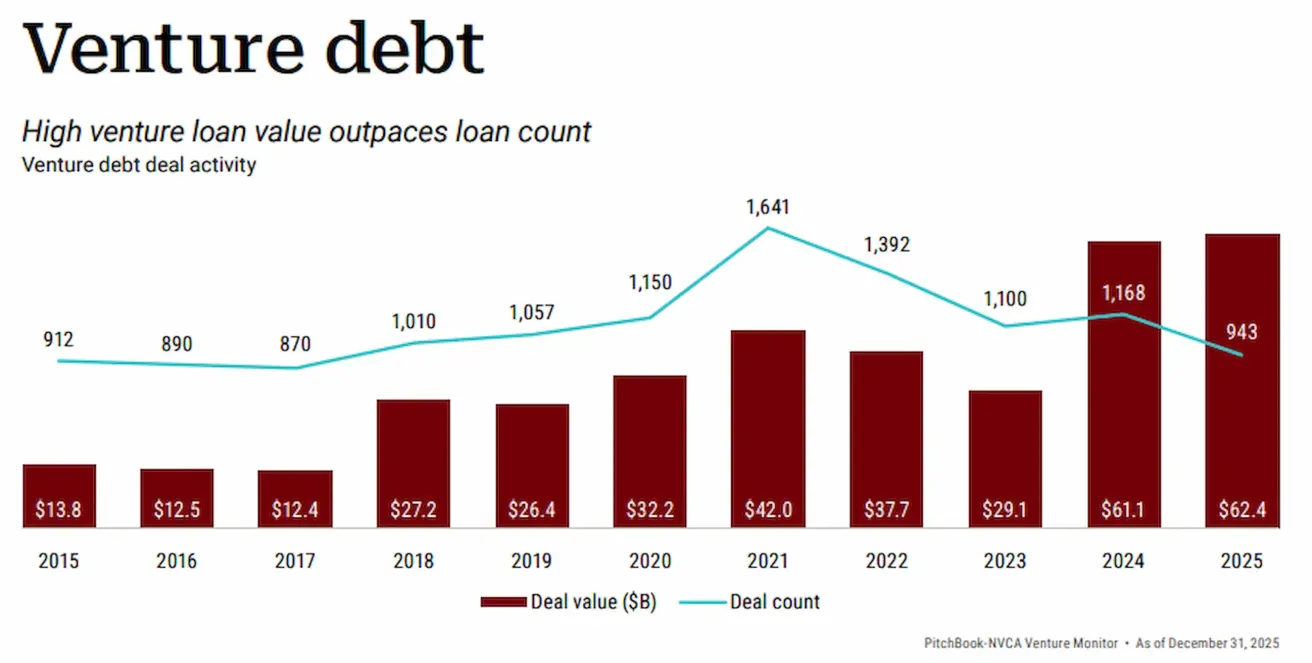

- Remains the primary driver of the venture debt market—debt financing for venture-backed companies;

- Leads in capital raised across all stages, from early to late stage.

Chart:AI CVCs deal count and value shares

Chart:AI CVCs deal count and value shares

Charts:AI related venture debt/ total venture debt

Charts:AI related venture debt/ total venture debt

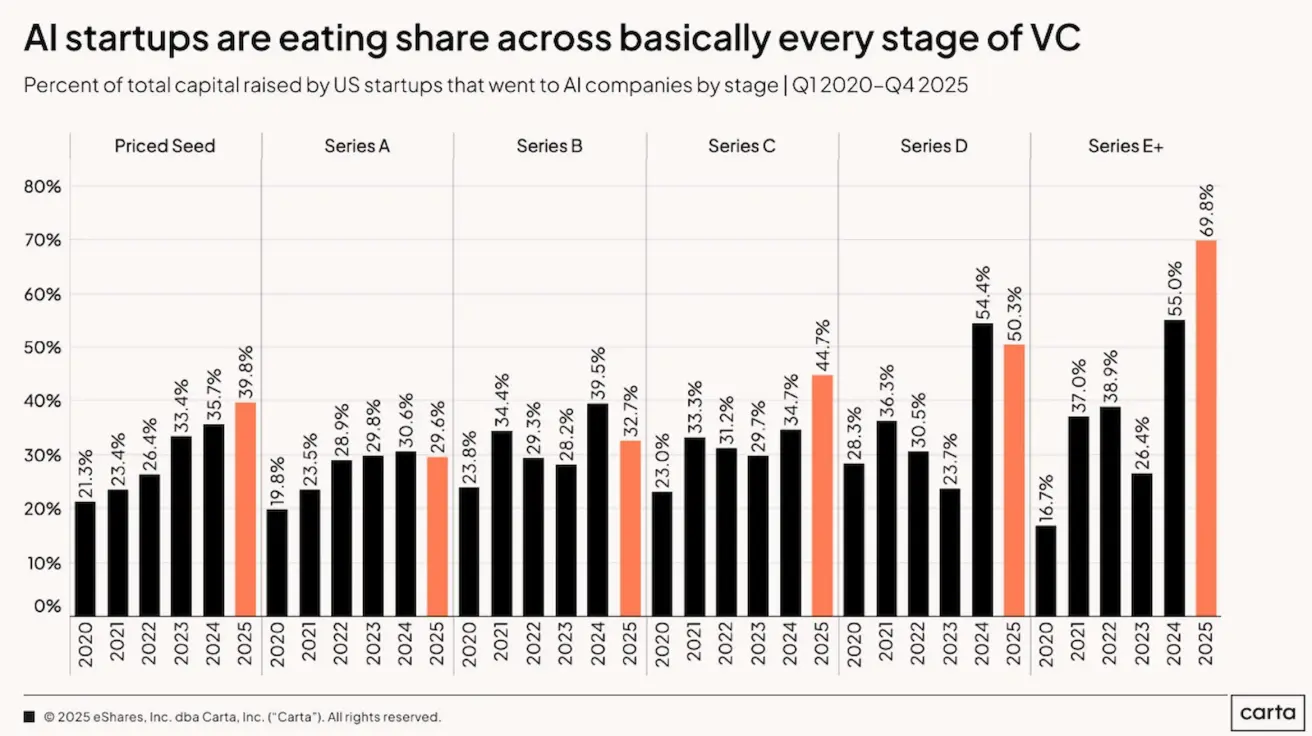

Chart:AI share of total investment raised by stage in the United States

Chart:AI share of total investment raised by stage in the United States

United States: Recovery of the Core Venture Market

The regional structure of the venture market in 2025 appears significantly more resilient than in 2022–2024.

In the United States—the largest and most strategically important venture market—investment volumes surged sharply:

- +66% compared with 2024;

- approximately +53% relative to 2022 levels.

At the same time, while deal counts in the U.S. remain below the 2021 peak, they have stabilized above pre-pandemic levels:

- 14,716 deals in 2025;

- 14,145 deals in 2020. This points to the emergence of a more stable, mature market, with no signs of overheating.

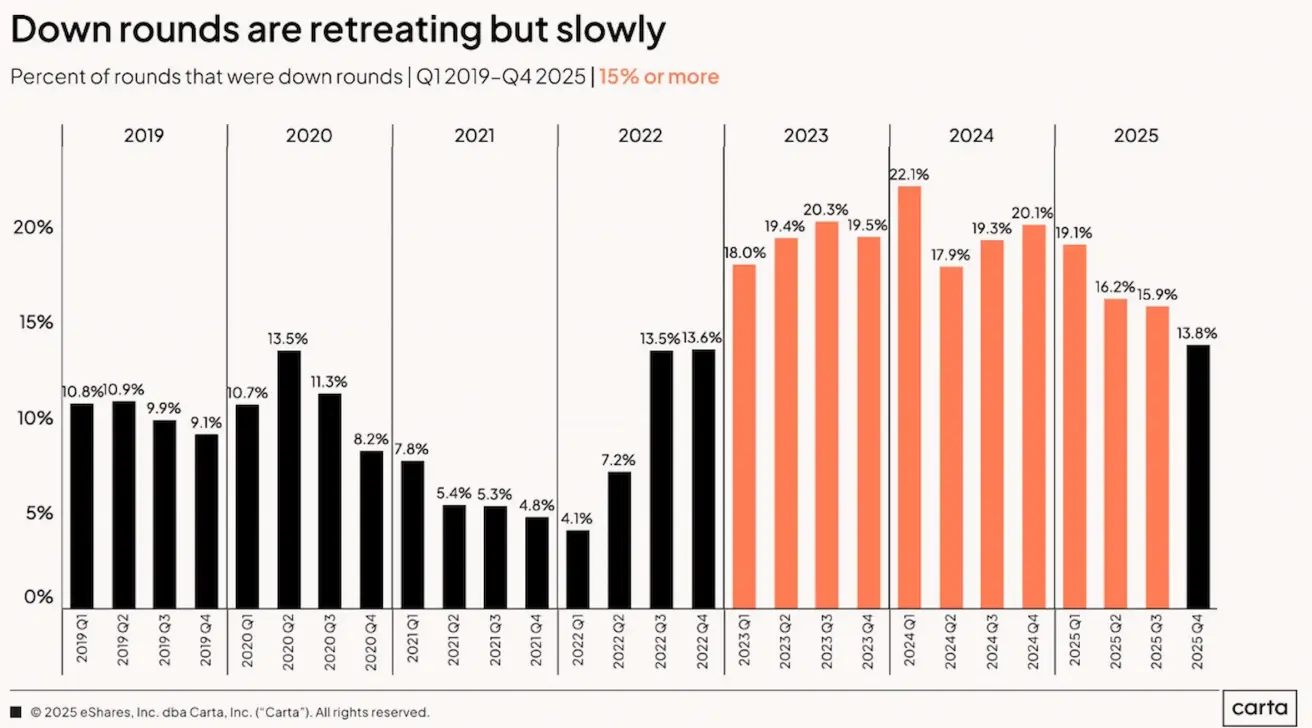

Decline in the Share of Down Rounds

Another positive signal has been the reduction in down rounds—funding rounds completed at lower valuations than the previous round.

According to Carta, the share of down rounds continued to decline in 2025.

Chart: share of down rounds as a percentage of total funding rounds

Chart: share of down rounds as a percentage of total funding rounds

This trend reflects the stabilization of expectations among both investors and companies, as well as reduced valuation pressure following the correction period.

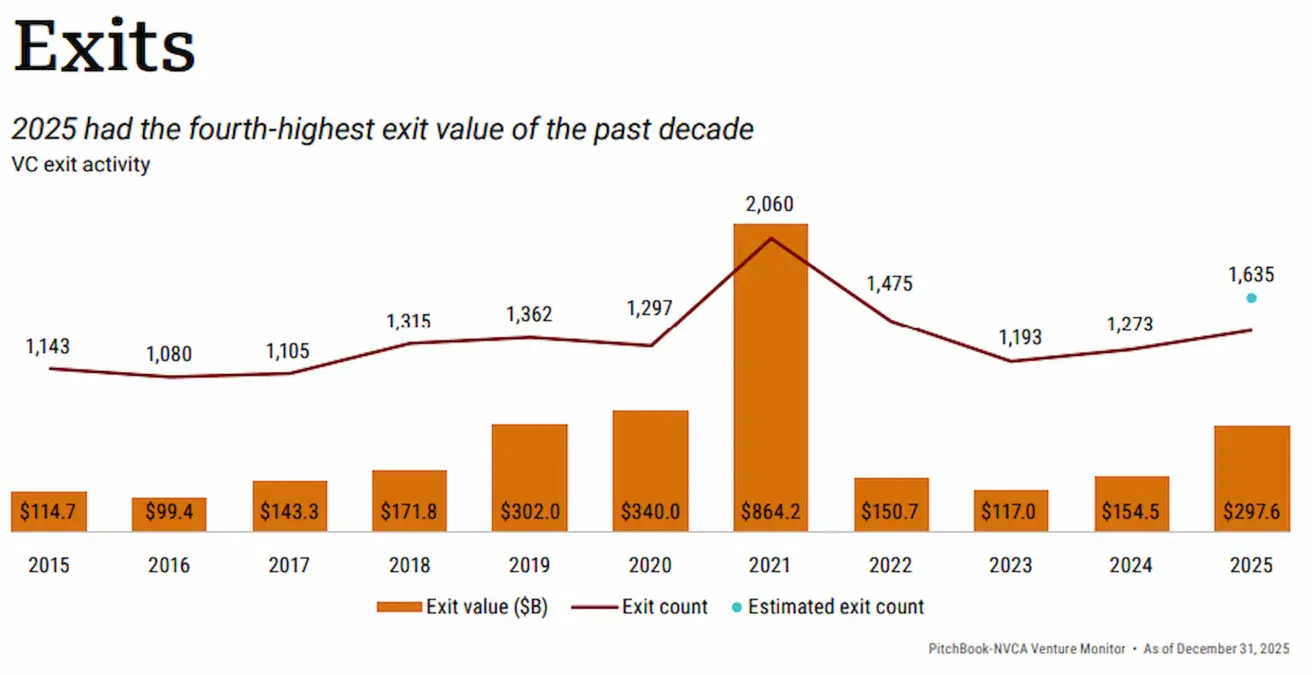

Exit Market: Rising Activity and IPO Recovery

After several years of subdued activity, the exit market began to recover.

Although aggregate exit volumes have not yet reached 2020 levels, the number of exits in 2025 exceeded that of 2020.

Compared with 2024:

- The number of exit transactions increased by 10.76%.

- The total exit value rose by 92.56%.

Chart: number and value of exit transactions, 2015–2025

Chart: number and value of exit transactions, 2015–2025

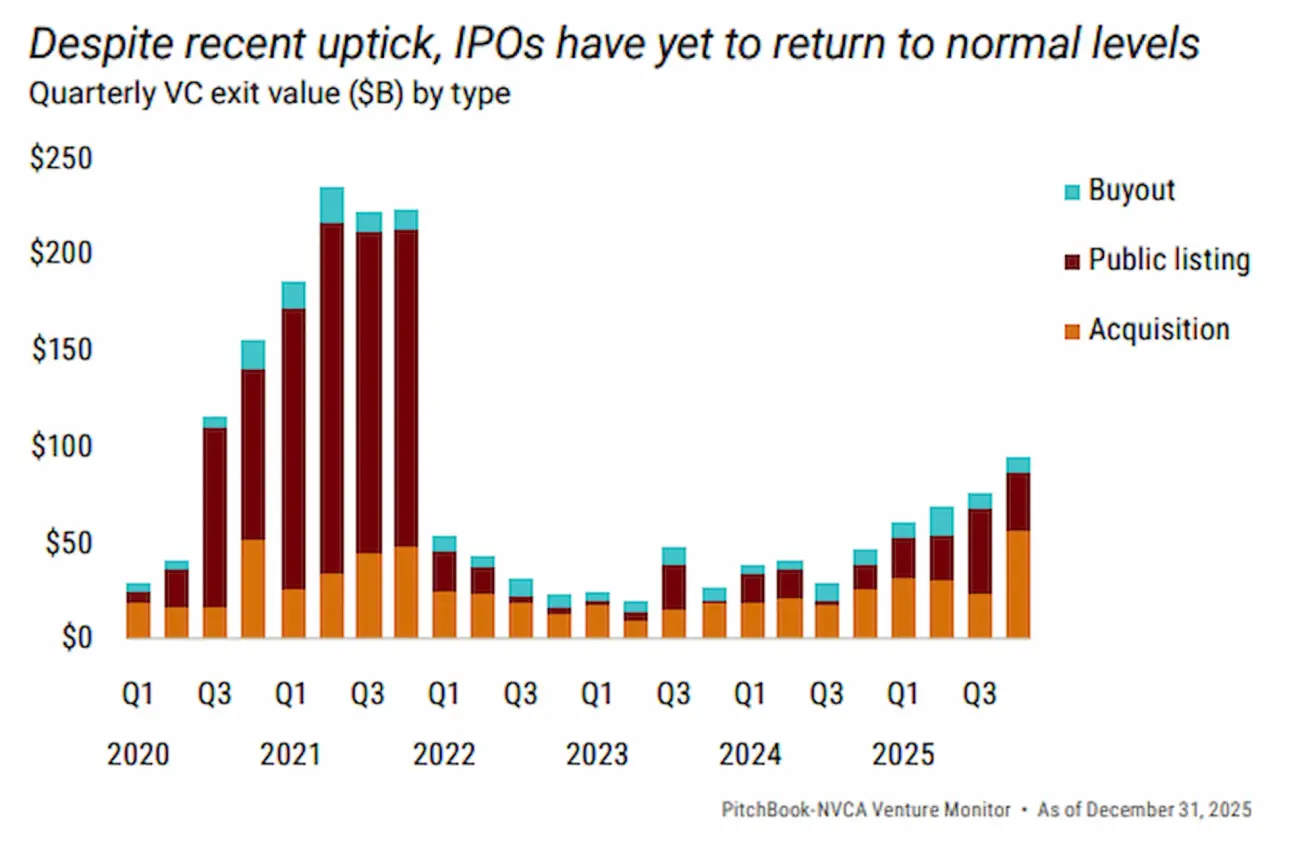

Quarterly analysis indicates a sustained recovery and a notable revival of the IPO market.

Total IPO volume in 2025 increased by 174% compared with 2024.

Chart: exit volumes by transaction type (IPO, M&A, etc.), quarters 2020–2025

Chart: exit volumes by transaction type (IPO, M&A, etc.), quarters 2020–2025

Against this backdrop, the trend is expected to continue into 2026. Several major private companies—including SpaceX, Anthropic, and Cohesity—have already announced IPO plans or are actively considering public listings.

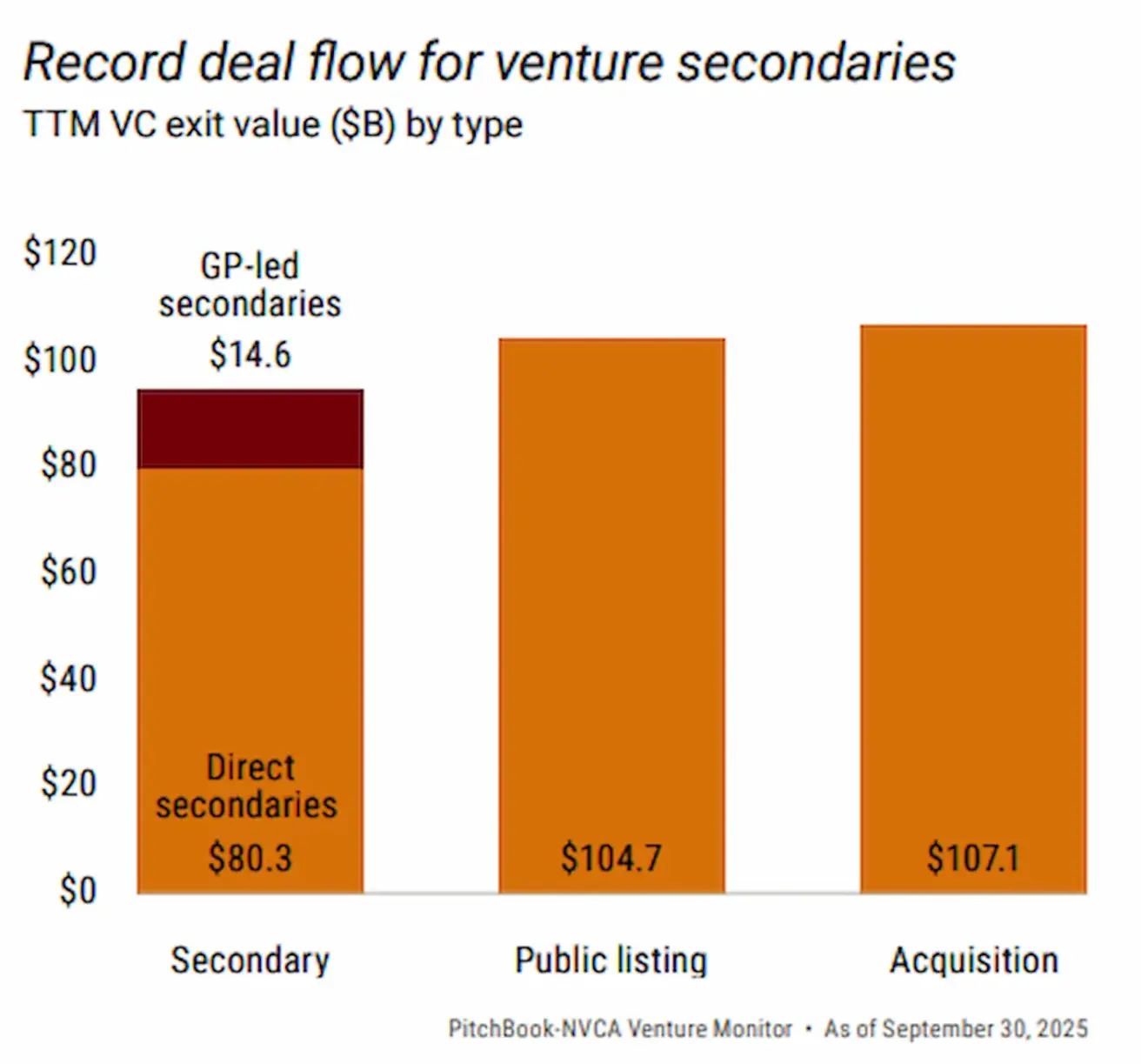

Secondaries as a Key Source of Liquidity

The secondary market—transactions involving the sale of stakes in private companies prior to an IPO—has evolved in recent years from a supplementary tool into one of the core liquidity channels.

According to Evercore Private Capital Advisory and industry sources:

- The secondary market reached record volumes in 2025.

- In the United States, deal volume totaled $94.9 billion in the first nine months of 2025.

By comparison, IPO volume over the same period amounted to $104.7 billion.

Chart: IPO, M&A, and secondary transaction volumes for the first nine months of 2025

Chart: IPO, M&A, and secondary transaction volumes for the first nine months of 2025

In effect, the secondary market has approached the scale of IPOs and has become a critical liquidity mechanism for venture funds, institutional investors, and private wealth clients.

Other High-Growth Verticals

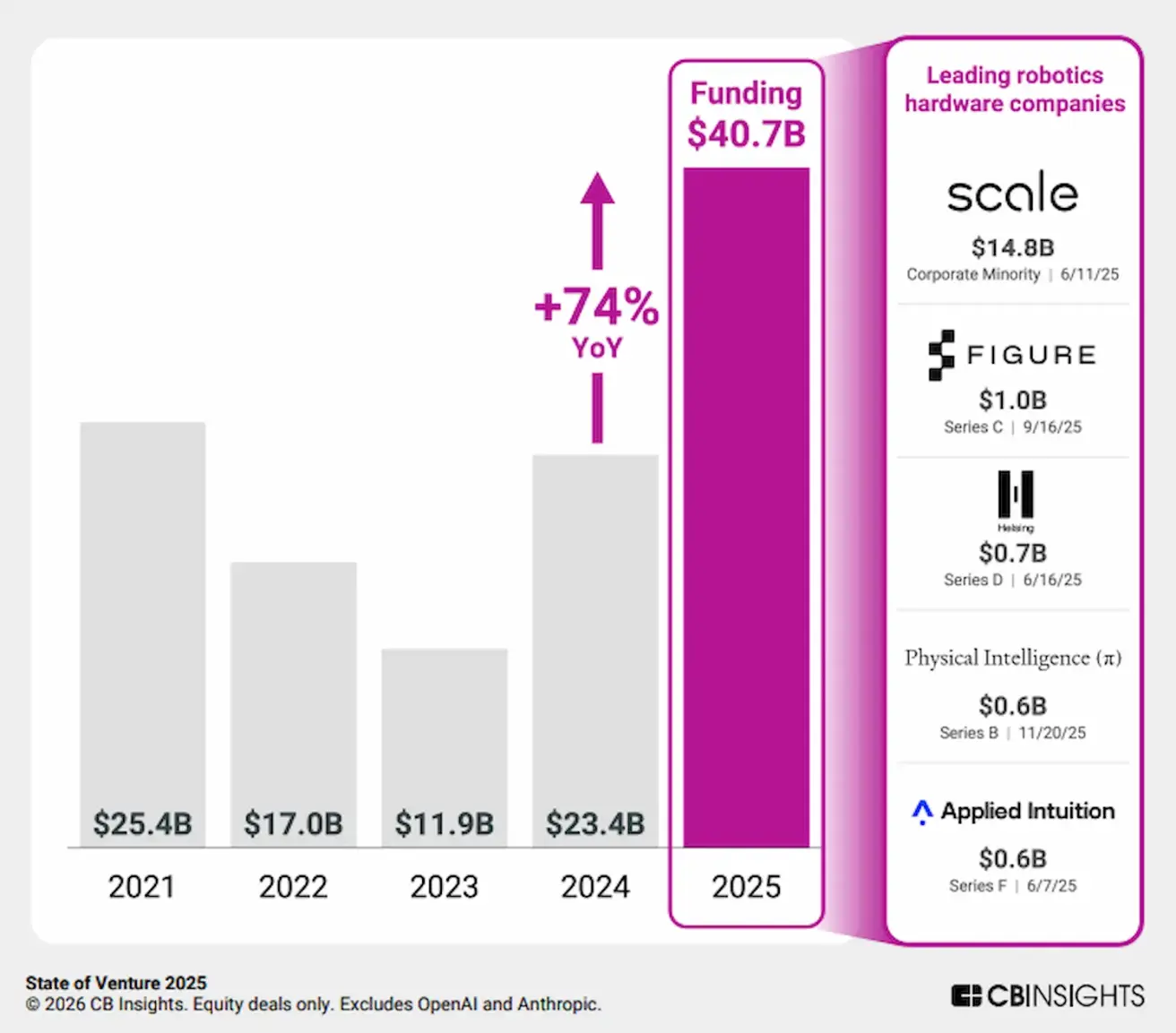

Despite AI's dominance, other technology sectors also demonstrated strong growth in 2025.

- Robotics: Venture investment volume increased by 74% year over year.

- Defense tech: growth ranged from 80% (Defence News) to 120% (PitchBook), depending on methodology.

According to Defence News, venture investment in defense technologies reached $49.1 billion, marking a record high for the sector.

Conclusions

2025 marked a year of recovery for the venture capital market:

- In investment volumes;

- In activity across all stages, including the exit market;

- Amid a moderately easing monetary policy environment in the United States.

The market has returned to scales comparable to the pre-correction period, but in a fundamentally different configuration. Capital has become more concentrated, the role of large rounds has increased, and AI and secondary liquidity markets have gained structural importance.

This reflects the transition of the venture capital market toward a more institutionalized and structured model.

Appendix

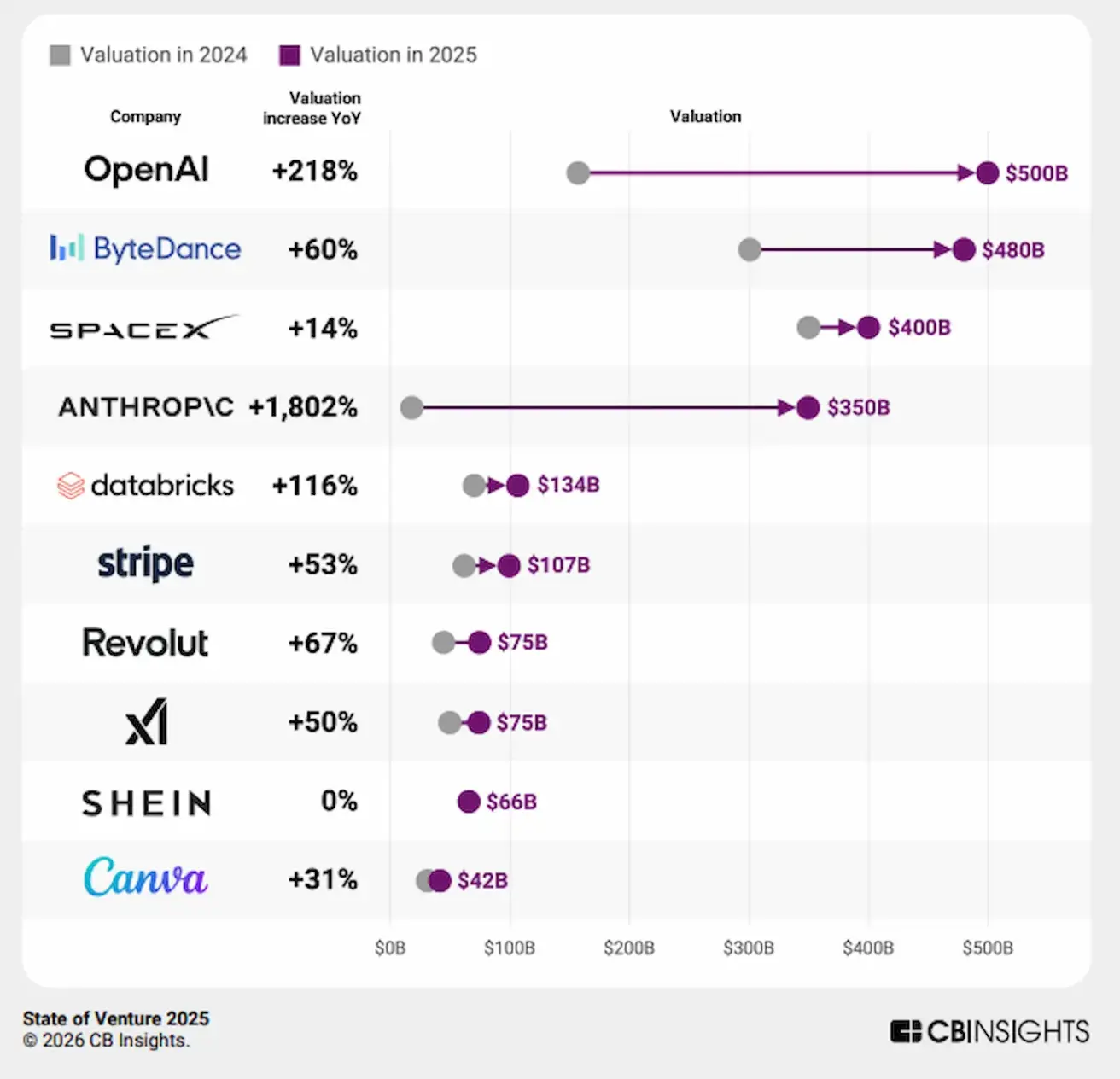

The ten most highly valued private companies of 2025 and changes in their valuations over 2024–2025

The ten most highly valued private companies of 2025 and changes in their valuations over 2024–2025

Қазақша

Қазақша