Private Markets 2025: Trends and 2026 Outlook

An analytical overview by Raison

2025 marked a transitional year for private markets: a combination of declining interest rates, improving macroeconomic conditions, and rising demand for alternative investments reshaped the dynamics across all segments — from private equity to venture capital (VC).

BlackRock, Goldman Sachs, PitchBook, and other industry sources have published updated data on market conditions. Based on this information, we have prepared an overview of the key trends shaping the current landscape and those likely to influence the development of private markets in 2026.

Glossary: Brief Definitions

- Private Markets — non-public assets, including private equity, private credit, venture capital, infrastructure, etc.

- Secondary Market (Secondaries) — transactions involving the purchase or sale of existing fund interests or stakes in private companies.

- Exit Markets — mechanisms through which investors realize returns: IPOs, mergers and acquisitions (M&A), and increasingly, transactions on the secondary market.

- Private Equity (PE) — investment funds that acquire stakes in mature, privately held companies.

- Venture Capital (VC) — funding for startups at early and late stages of development.

- Private Credit — loans provided to companies by private and institutional investors through PE funds.

- Real Assets — tangible assets, including real estate, infrastructure, and natural resources.

Exit Markets: From Concern to Early Signs of Recovery

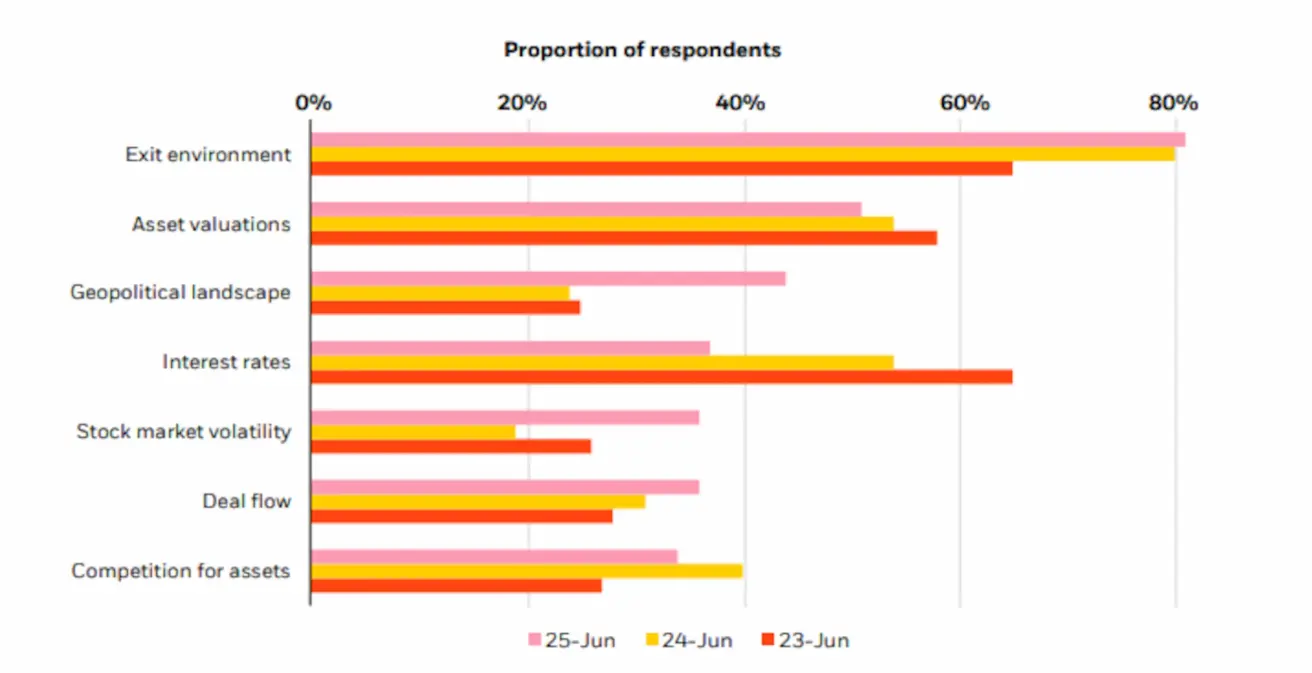

According to BlackRock surveys, at the start of 2025, investors viewed exit markets — IPOs and mergers and acquisitions (M&A) — as the main risk to expected returns.

Yet the year also brought encouraging signals. Analysts point to improvements in IPO activity (covered in detail in our previous report), as well as a pickup in M&A. These trends suggest that liquidity mechanisms are beginning to recover — a crucial factor for the overall functioning of private markets.

Chart: Investor Survey — Key Risks for Returns in the Next 12 Months

More Funds Enter the Market: The Private Equity Infrastructure Expands

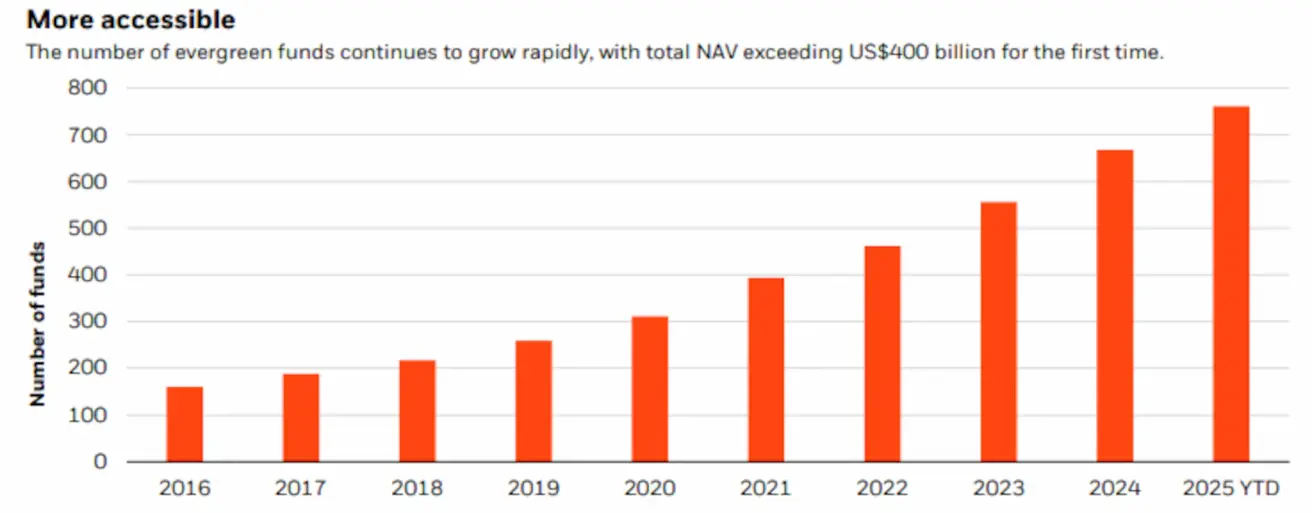

2025 saw a continued expansion of the private equity landscape, marked by an increase in the number of active funds and the total volume of assets under management. According to the report, the number of PE funds surpassed 700, while their combined net asset value (NAV) exceeded $400 billion.

The growing scale of the private equity segment influences not only its own market but also the venture capital ecosystem. PE funds are now more frequently participating in late-stage VC rounds, which increases deal sizes and strengthens the overall stability of financing. This trend supports higher aggregate returns in the venture sector and reduces the risk of underfunding for mature, scaling-stage companies.

Chart: Number of Active PE Funds by Year

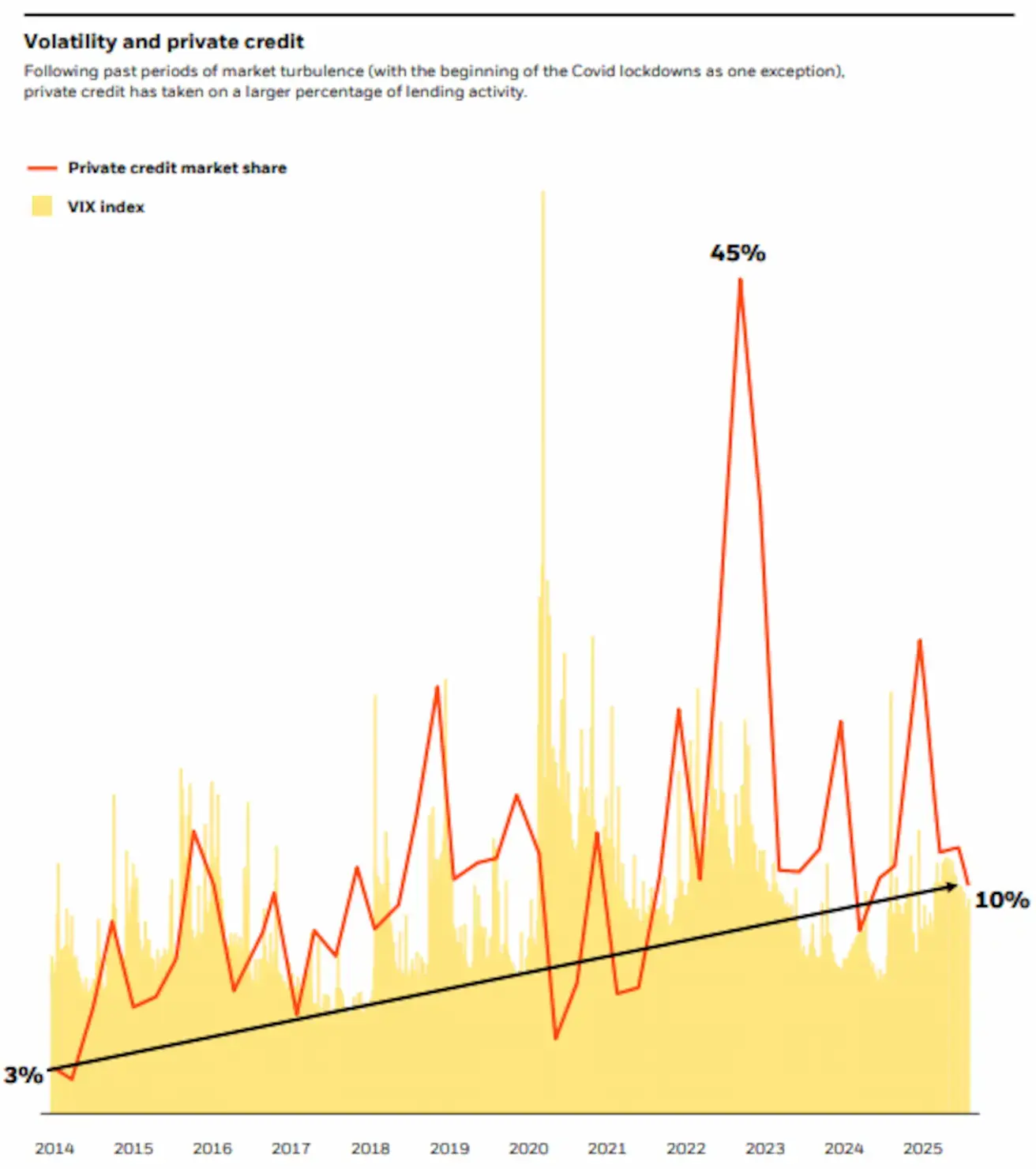

Private Credit Declines for the First Time After a Decade of Growth

Over the past ten years, the share of private credit has been steadily rising, closely tracking the movements of the VIX index — a common gauge of market volatility and uncertainty. By the end of 2025, however, the trend reversed for the first time: the share of private credit within the broader debt market began to decline.

Two key factors drive this shift:

- The Federal Reserve’s continued reduction of interest rates.

- An overall improvement in macroeconomic conditions.

Although still at an early stage, this reversal is a positive signal. It suggests a decrease in systemic risk, lower borrowing costs, and a more resilient environment for companies. While it is too soon to determine whether this trend will be sustained, it lays the groundwork for cautious optimism.

Chart: Private Credit Share vs. VIX Index Over 10 Years

A Steady Expansion of the Secondary Market

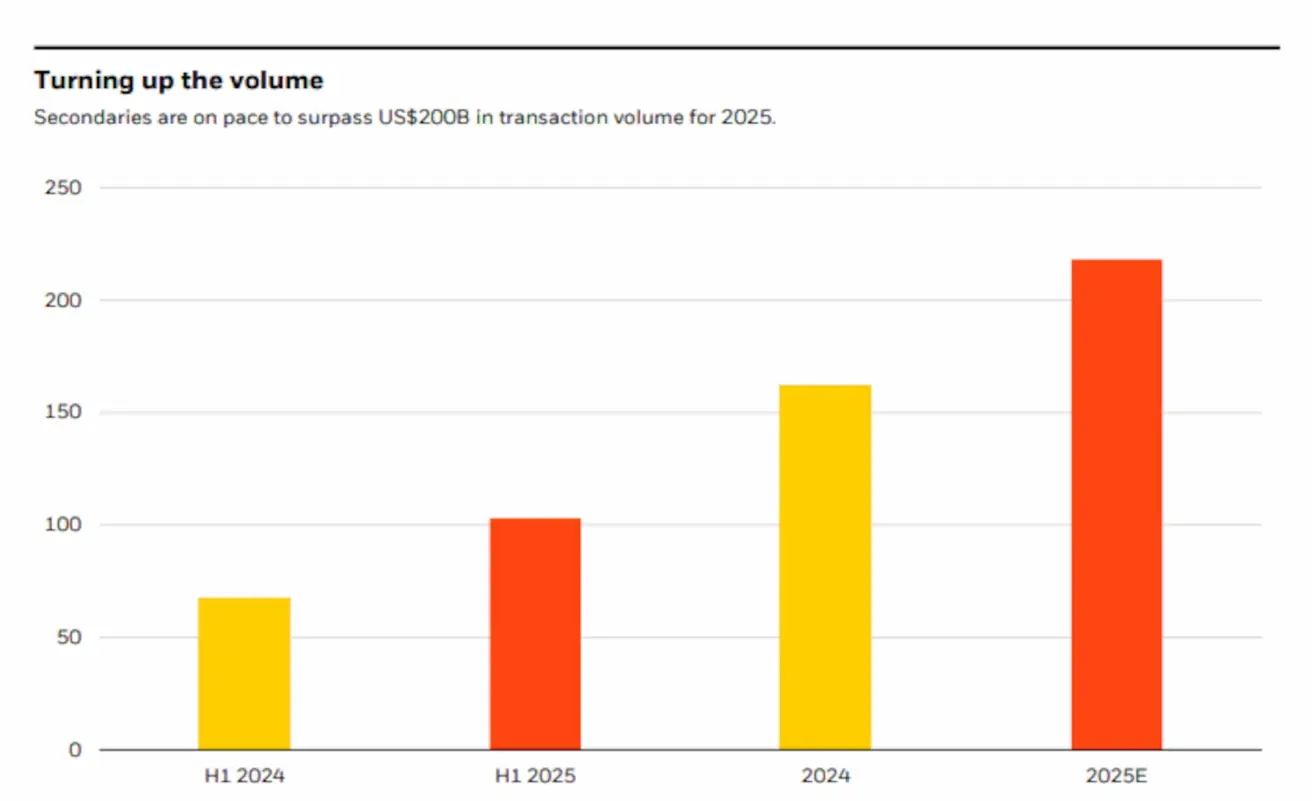

Since 2023, the secondary market has shown consistent growth, and according to current projections, its total volume is expected to exceed $200 billion by the end of 2025 — setting a new historical high.

Chart: Secondary Market Transaction Volumes — First Half-Year Results and Full-Year 2024–2025

Structural shifts are driving this expansion:

- More participants are entering the market.

- Liquidity needs are becoming more diverse.

- Secondaries are increasingly used as a flexible portfolio-management tool.

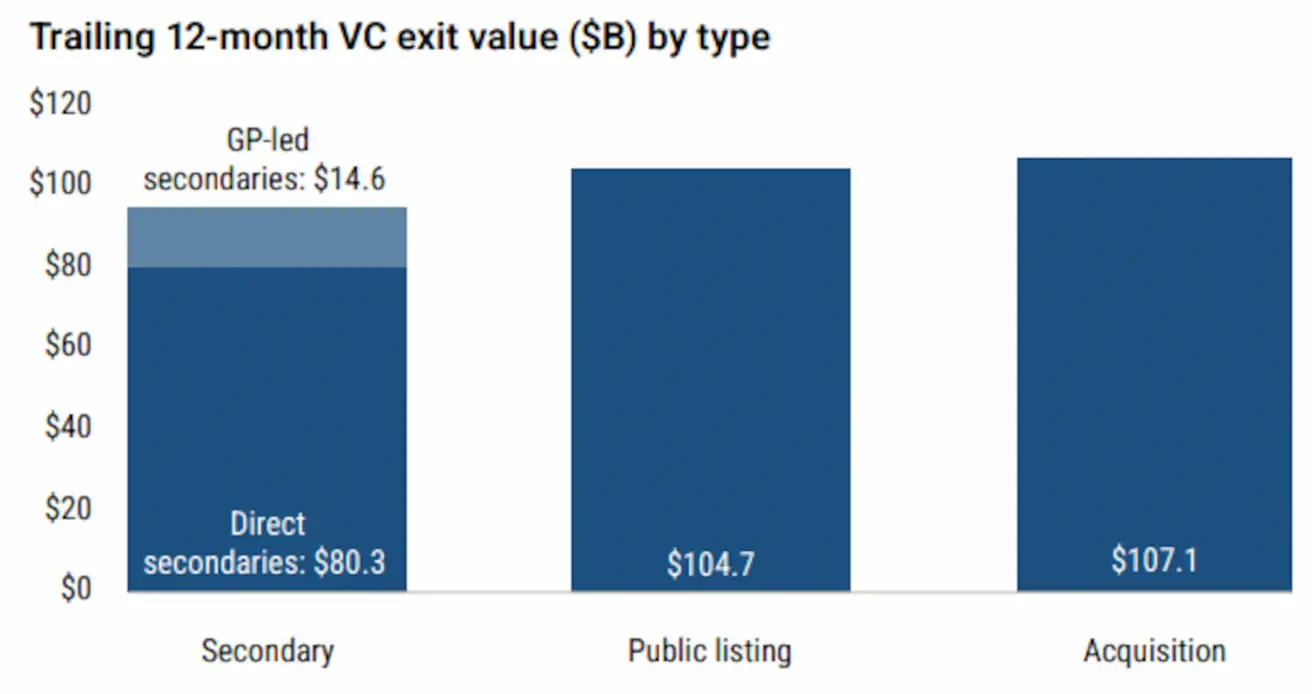

The chart below illustrates how secondary transactions have effectively become a full-fledged exit channel. Their combined value over the past 12 months ($94.9 billion) is now comparable to IPOs ($104.7 billion) and M&A exits ($107.1 billion). This demonstrates that secondaries are evolving into a stable, scalable liquidity mechanism for investors.

Chart: Total Exit Value by Category, Last 12 Months

BlackRock separately notes that in 2025, wealth management became the fastest-growing segment of the secondary market.

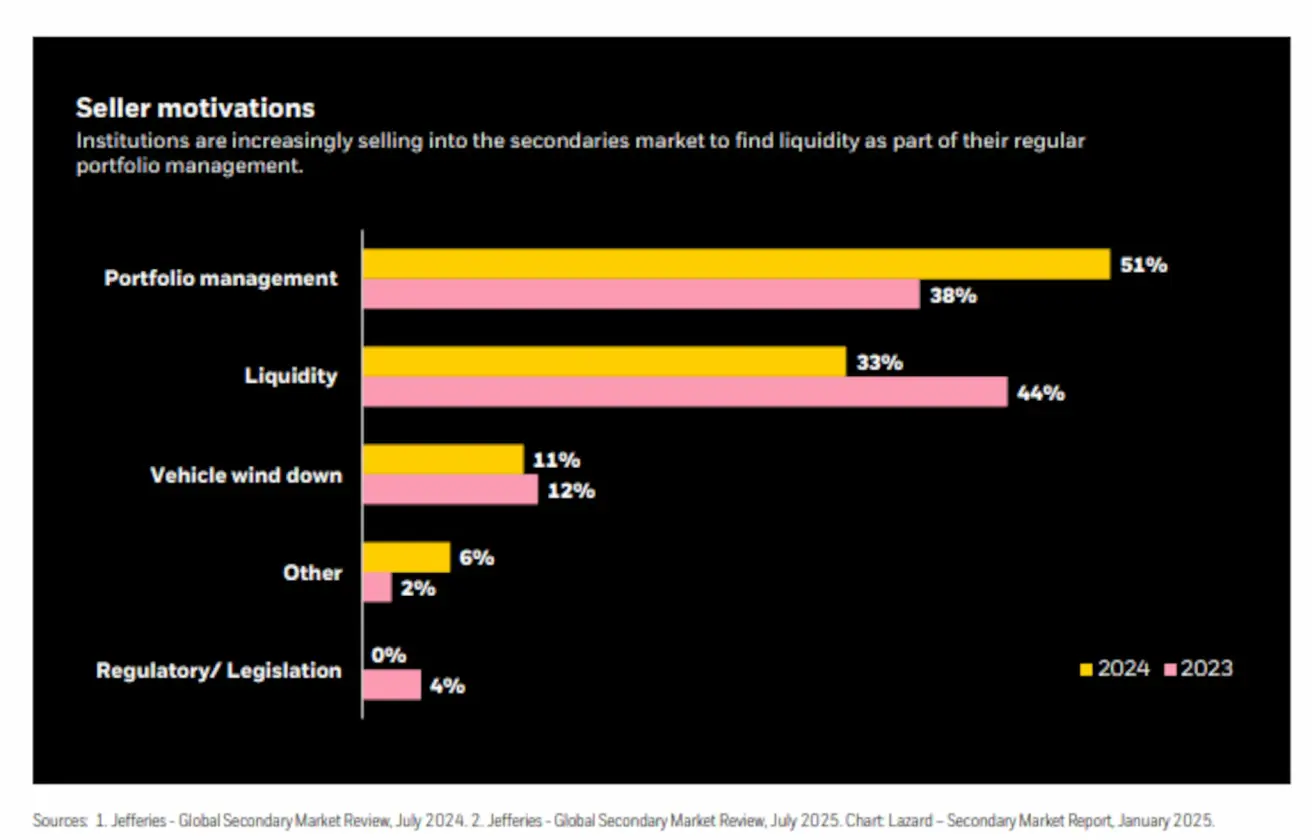

Chart: Survey — Primary Reasons for Using the Secondary Market

Survey data shows that in 2024, the secondary market was increasingly used as a planned portfolio management tool: 51% of sellers cited portfolio adjustments as their primary motivation (up from 38% a year earlier). The share of respondents selling assets to free up liquidity also increased to 44%. Together, these trends indicate that secondaries are becoming a regular mechanism for portfolio rebalancing and capital redistribution rather than a response to stress or regulatory pressure.

Macroeconomic Conditions Accelerate Interest in Private Markets

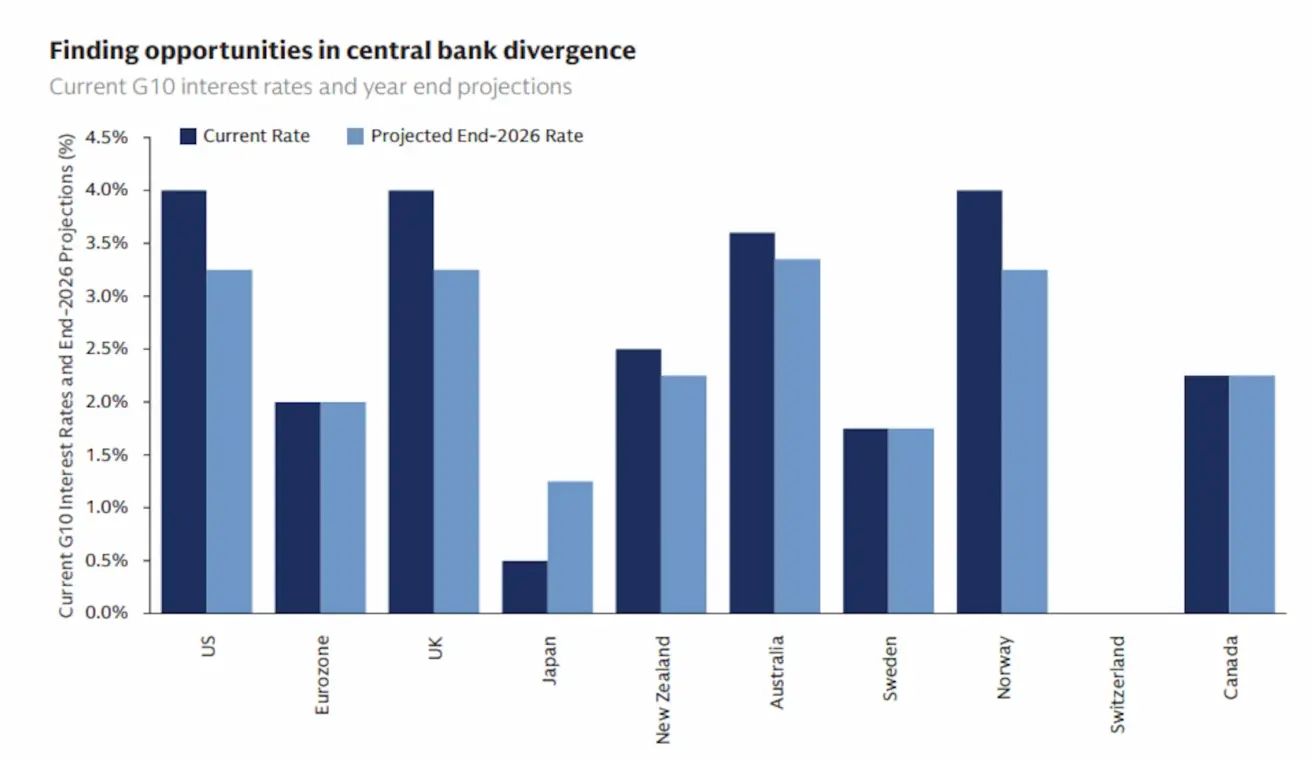

Improving macroeconomic conditions have enabled central banks to begin a cycle of interest-rate cuts. Goldman Sachs forecasts that this trend will continue into 2026.

Chart: Forecast for Key Interest Rate Reductions in Major Western Economies in 2026 (Goldman Sachs, October 2025)

Lower interest rates reduce the appeal of government bonds, traditionally the safest and most liquid assets. As their yields fall, investors begin seeking higher returns in other markets, primarily public, which in turn supports broader investment activity, including within private markets.

At the same time, overall risk levels decrease: cheaper borrowing reduces the financial burden on companies, as less of their operating income is spent on servicing debt. This makes corporate profits more stable and simplifies the financing of new projects and capital investments.

Who Drives Demand: A Generational View of Alternative Investments

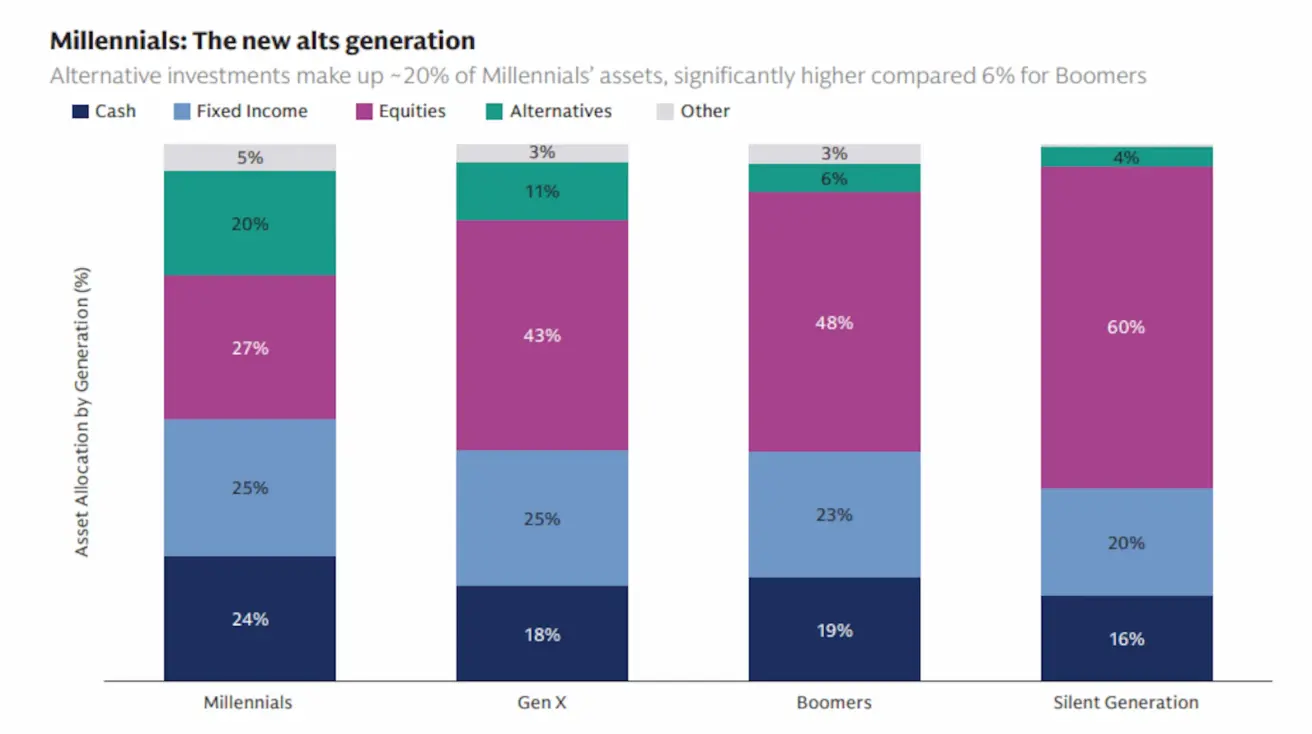

Interest in alternative assets is rising across all generations, but millennials stand out as the most active participants. Millennials, born between 1981 and 1996, are now the most economically active generation. With rising incomes and growing investment capacity, they play a key role in shaping demand for alternative assets, investing in private markets more actively than other age groups.

Chart: Investment Allocation by Generation

Chart: Investment Allocation by Generation

A Goldman Sachs survey of 1,000 High-Net-Worth Individuals (HNWI) found that millennials are the most active investors in alternative assets — meaning investments outside public markets, including venture funds.

Several factors explain this trend:

- The rise of mass-market investment platforms such as Robinhood, a service that made buying stocks and funds accessible to users without professional financial experience.

- The emergence of new asset classes, including cryptocurrencies.

- The extended time companies now spend in private ownership is increasing opportunities to invest before an IPO.

- The overall expansion of private markets.

Together, these shifts contribute to a more sustainable, long-term demand profile for private market investments.

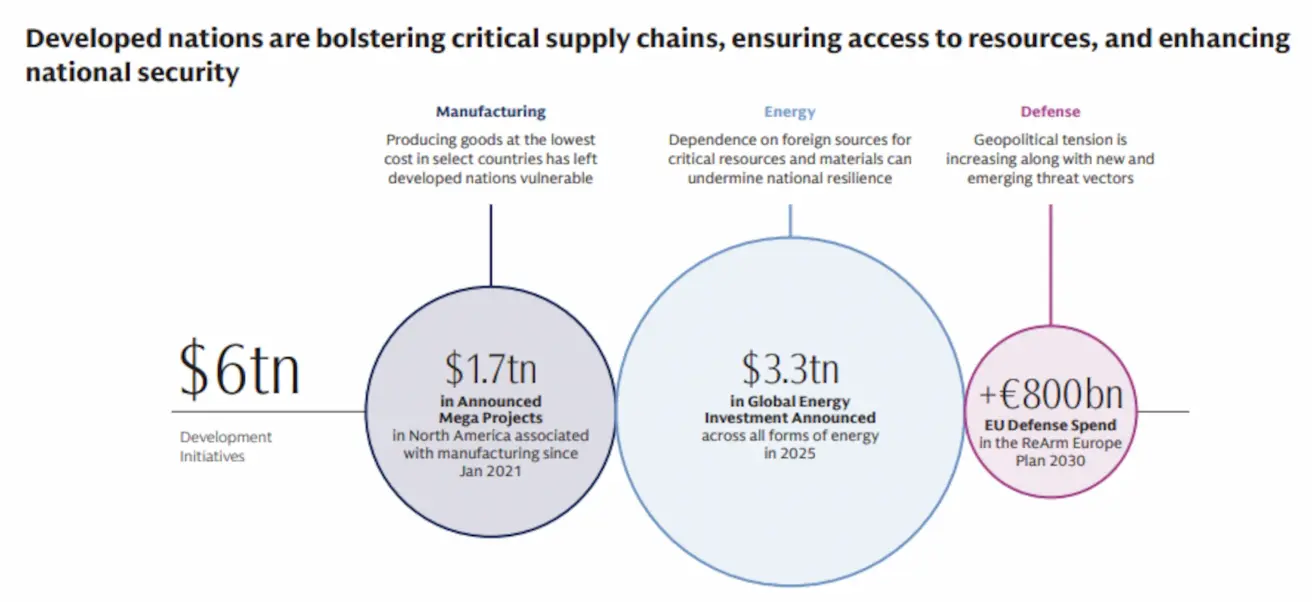

Infrastructure, Manufacturing, Defense: Where Government Capital Is Flowing

Amid ongoing geopolitical uncertainty, governments in major economies are increasing investment in strategic sectors — most notably energy, infrastructure, manufacturing, and defense.

Diagram: Global Government Investments in Infrastructure, Energy, Manufacturing, and Defense

Another powerful driver is the accelerating race in artificial intelligence, which analysts increasingly compare to a modern “space race.”

These shifts are stimulating interest not only in government programs but also in startups operating in AI, deep tech (science- and engineering-driven technologies), and deftech (defense technologies).

Strong Growth in the Venture Market

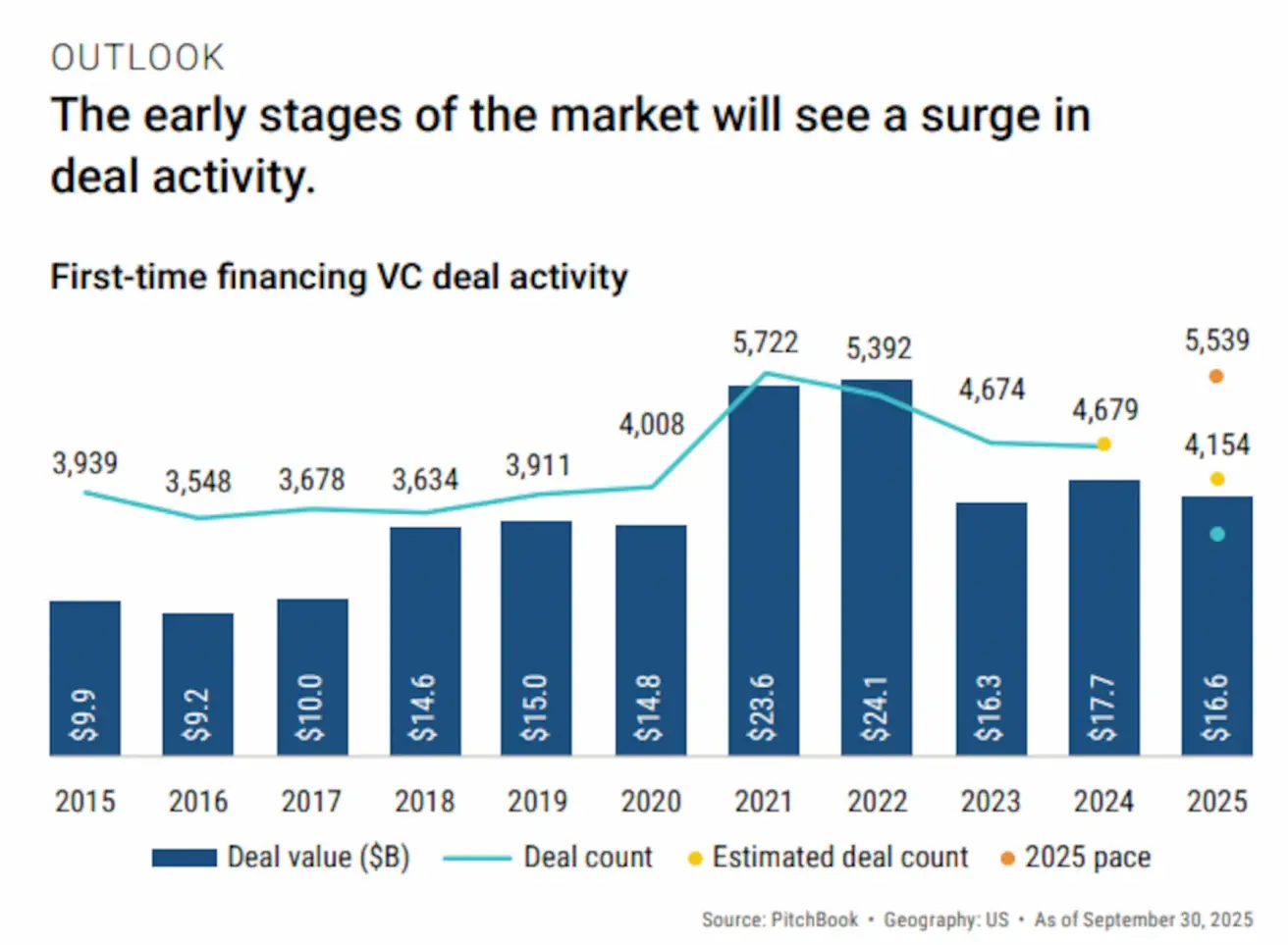

PitchBook data indicates that both the number and total value of VC deals in 2025 are expected to exceed 2024 levels.

Chart: Number and Value of Venture Deals, 2025 Forecast

The key drivers remain:

- Artificial intelligence

- Defense technologies

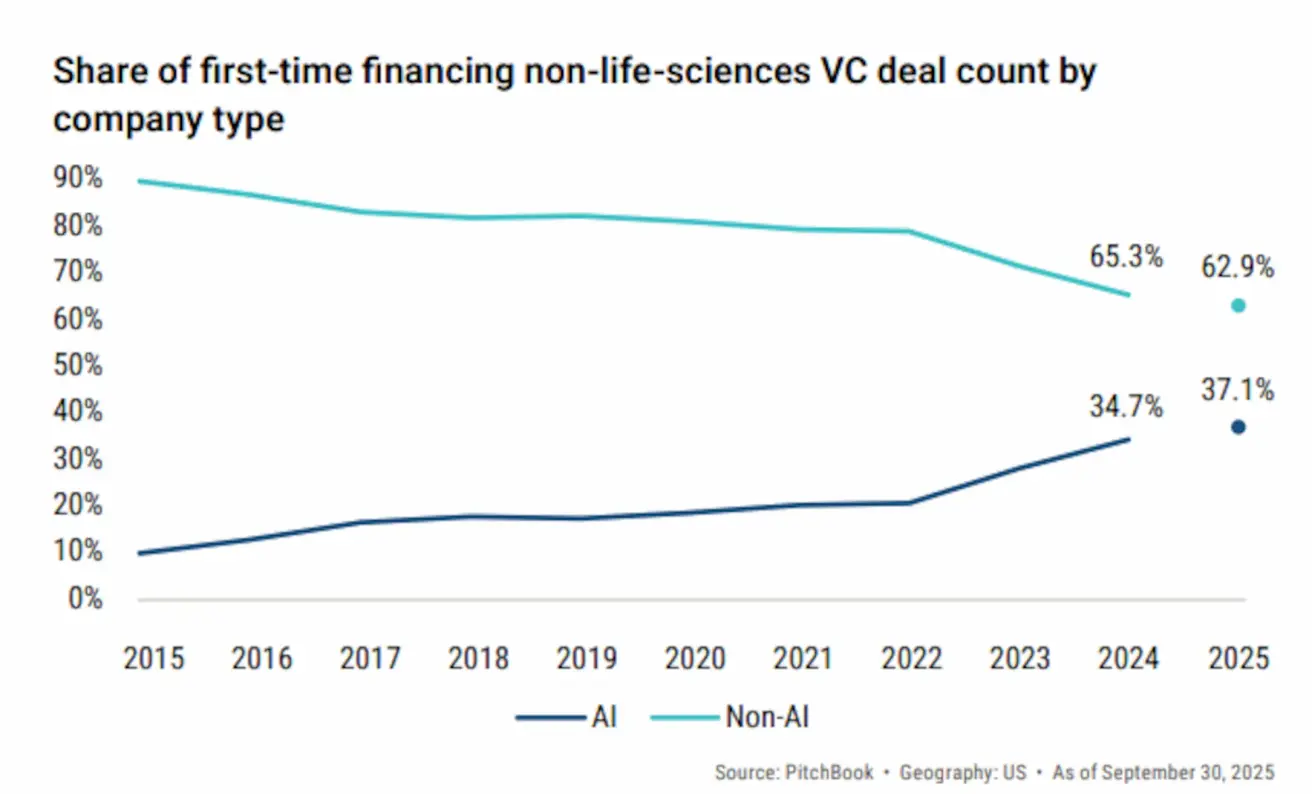

Chart: Share of AI Startups in Venture Funding

Chart: Share of AI Startups in Venture Funding

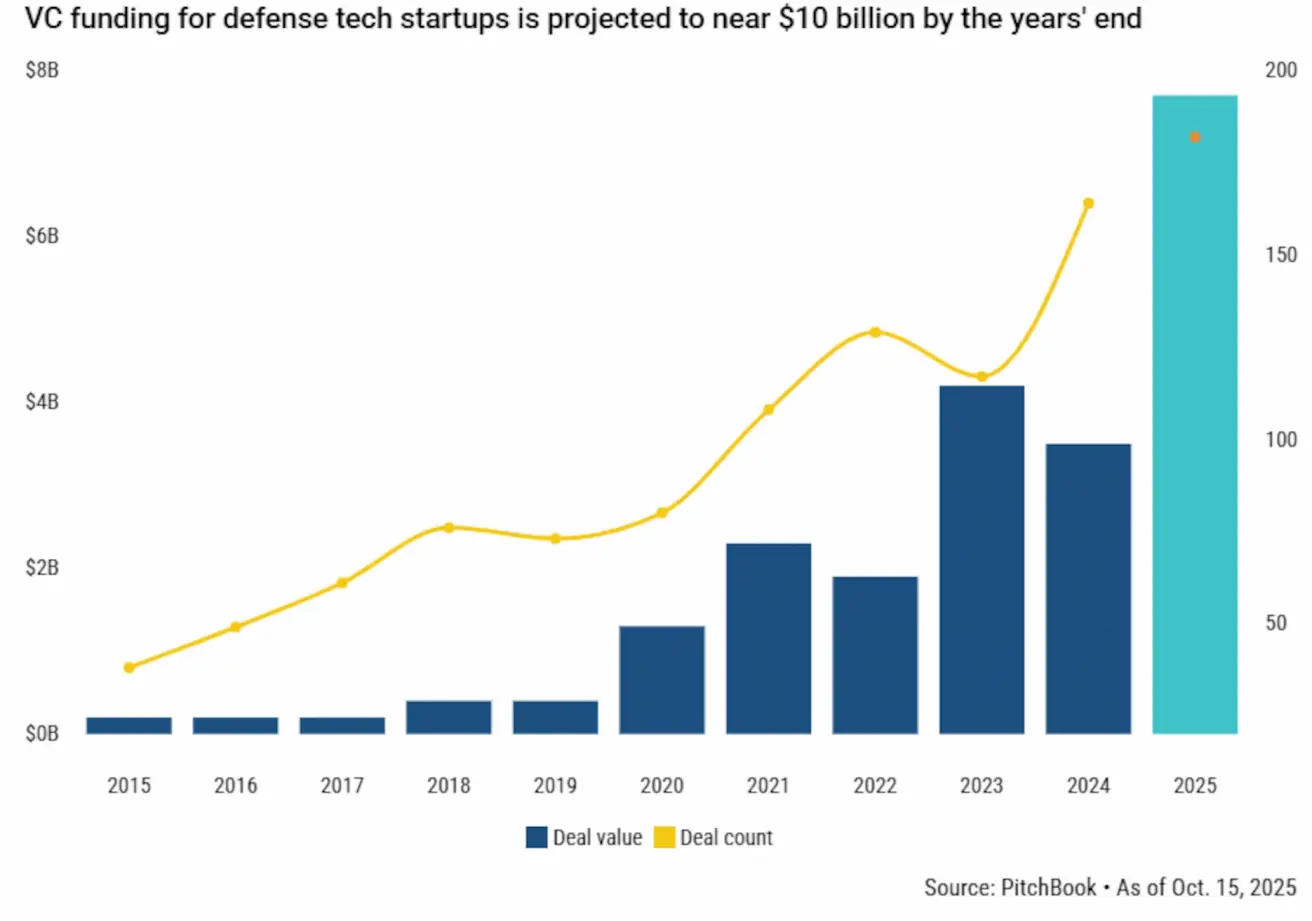

Chart: Number of Deals and Investment Volume in Deftech by Year

Chart: Number of Deals and Investment Volume in Deftech by Year

AI remains one of the key areas of capital concentration, but deftech is showing the most dynamic growth trajectory.

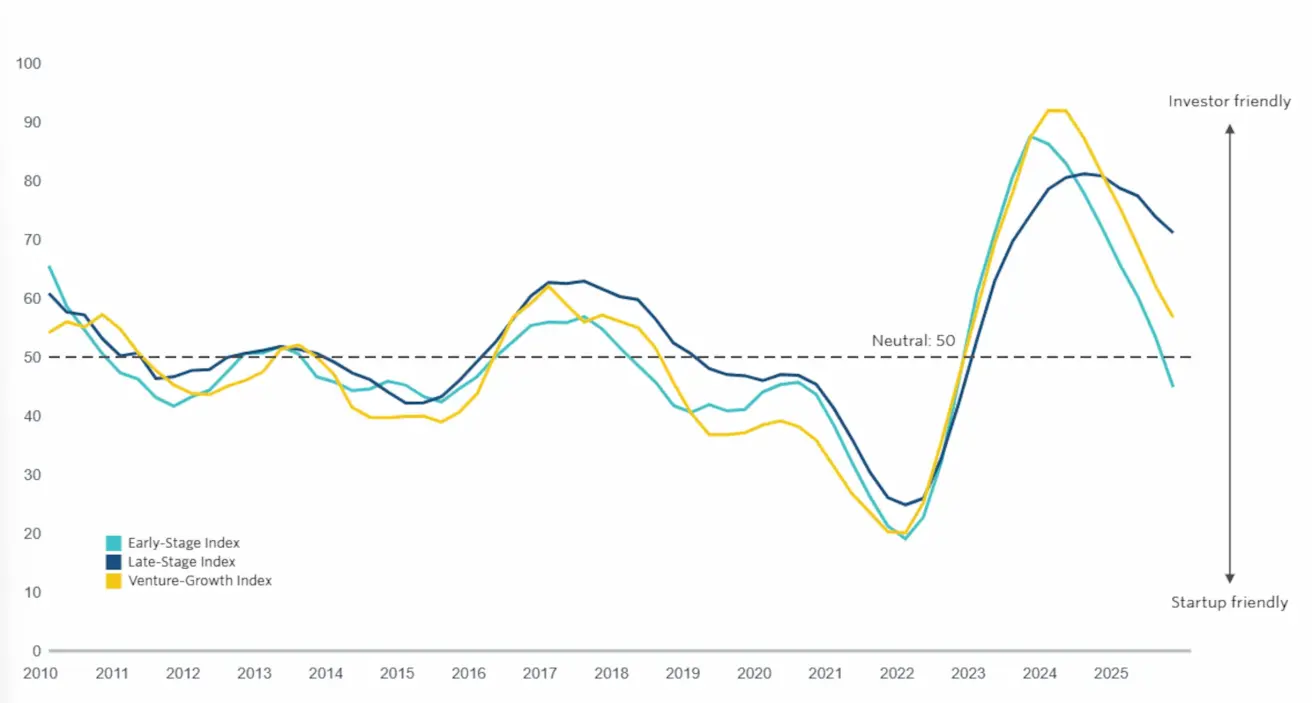

Chart: PitchBook Dealmaking Index by Stage (2010–2025)

The PitchBook Dealmaking Index shows a shift toward a neutral zone after the “liquidity drought” of 2023–2024, when most investors had limited capital and large funds held stronger negotiating power. This movement reflects two parallel developments: an increase in available capital and a decline in the number of untapped startups in high-demand areas such as AI and defense technology. As a result, the balance between investors and companies is stabilizing, and fundraising conditions are becoming more predictable.

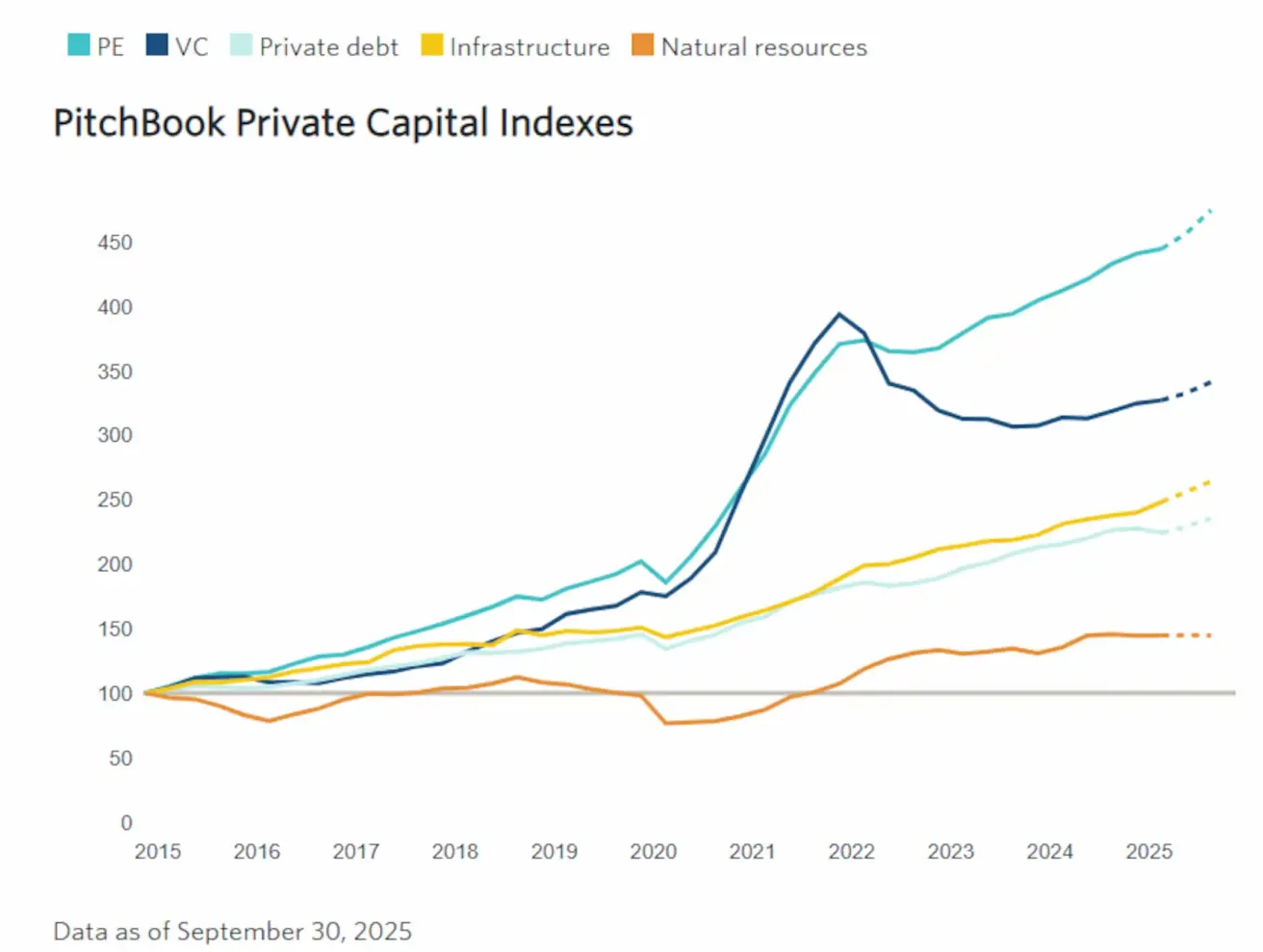

Chart: Growth of Investments Across All Private Market Segments

A similar pattern is visible in the broader PitchBook Private Capital Indexes: investment levels are rising across nearly all major private-market segments — from Private Equity and Venture Capital to infrastructure and natural resources. This long-term upward trend suggests expanding capital availability and strengthening investor interest in alternative assets.

Summary: 2025 Marked a Recovery, and 2026 May Mark an Acceleration

Against the backdrop of accommodative monetary policy, declining key interest rates, the expansion of the secondary market, and a growing number of active investors, private markets are showing clear signs of sustained recovery.

The venture market has also responded to the improved macro environment: deal volumes and frequency have increased, late-stage financing has become more resilient, and investor interest in AI and defense technologies continues to strengthen.

If current trends continue, 2026 could mark the beginning of a new growth cycle for private markets.

Raison will continue to monitor market developments and share key analytical insights.

Қазақша

Қазақша