Venture Capital Market Q3 2025

Analytical Review by Raison

With fresh Q3 2025 data now released by leading analytical sources, such as KPMG Venture Pulse, NVCA, and CooleyGo, Raison’s team analyzed the latest numbers to highlight what’s driving today’s venture capital market.

Market Overview

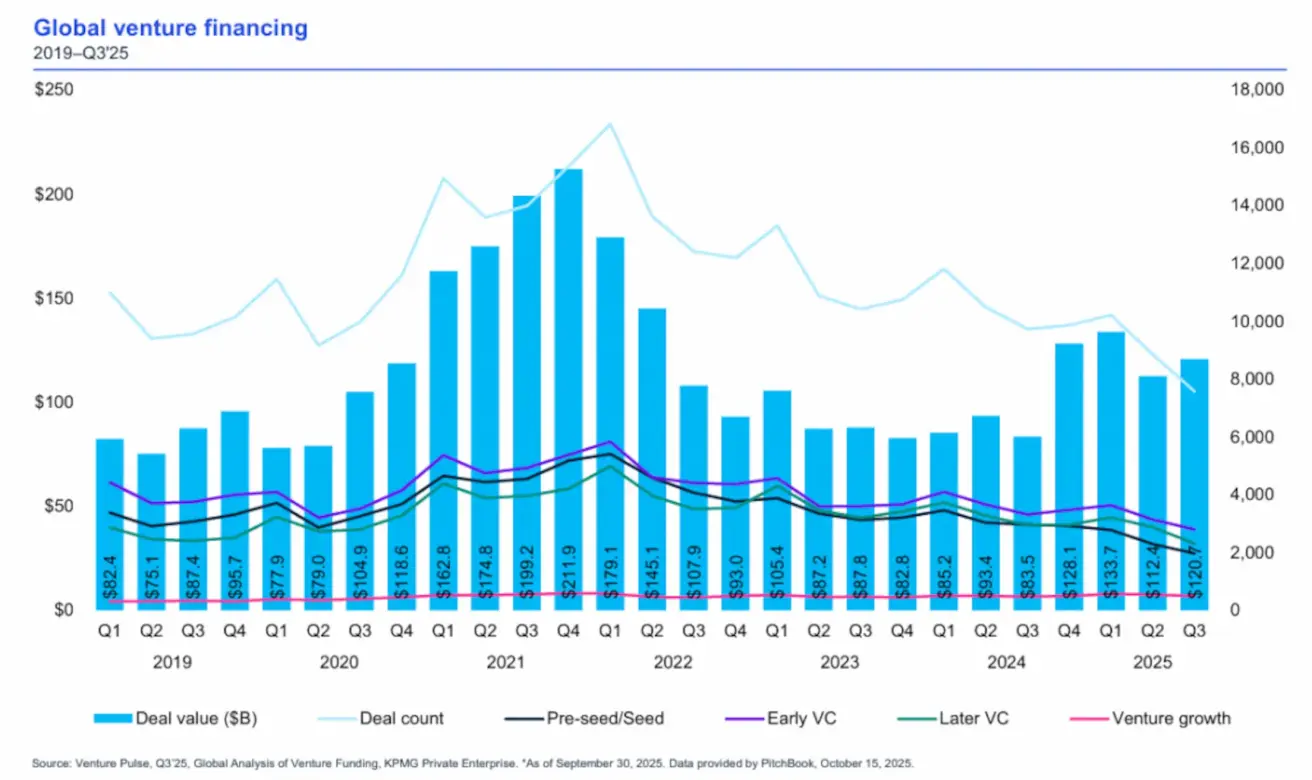

The number of venture deals continued to decline in Q3, yet total investment volume rose by 44.5% year-over-year and remained above the 2023–2024 levels.

Chart: Total Number of Deals by Quarter

Chart: Total Number of Deals by Quarter

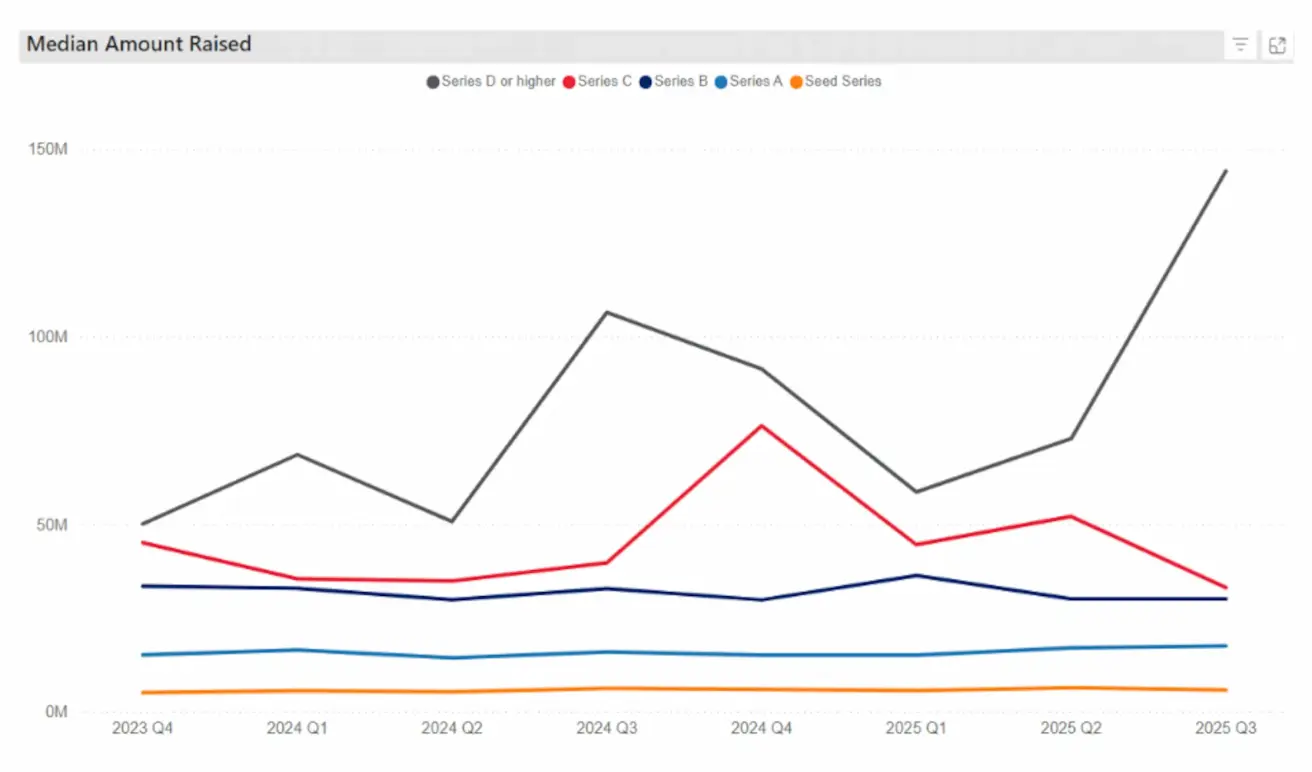

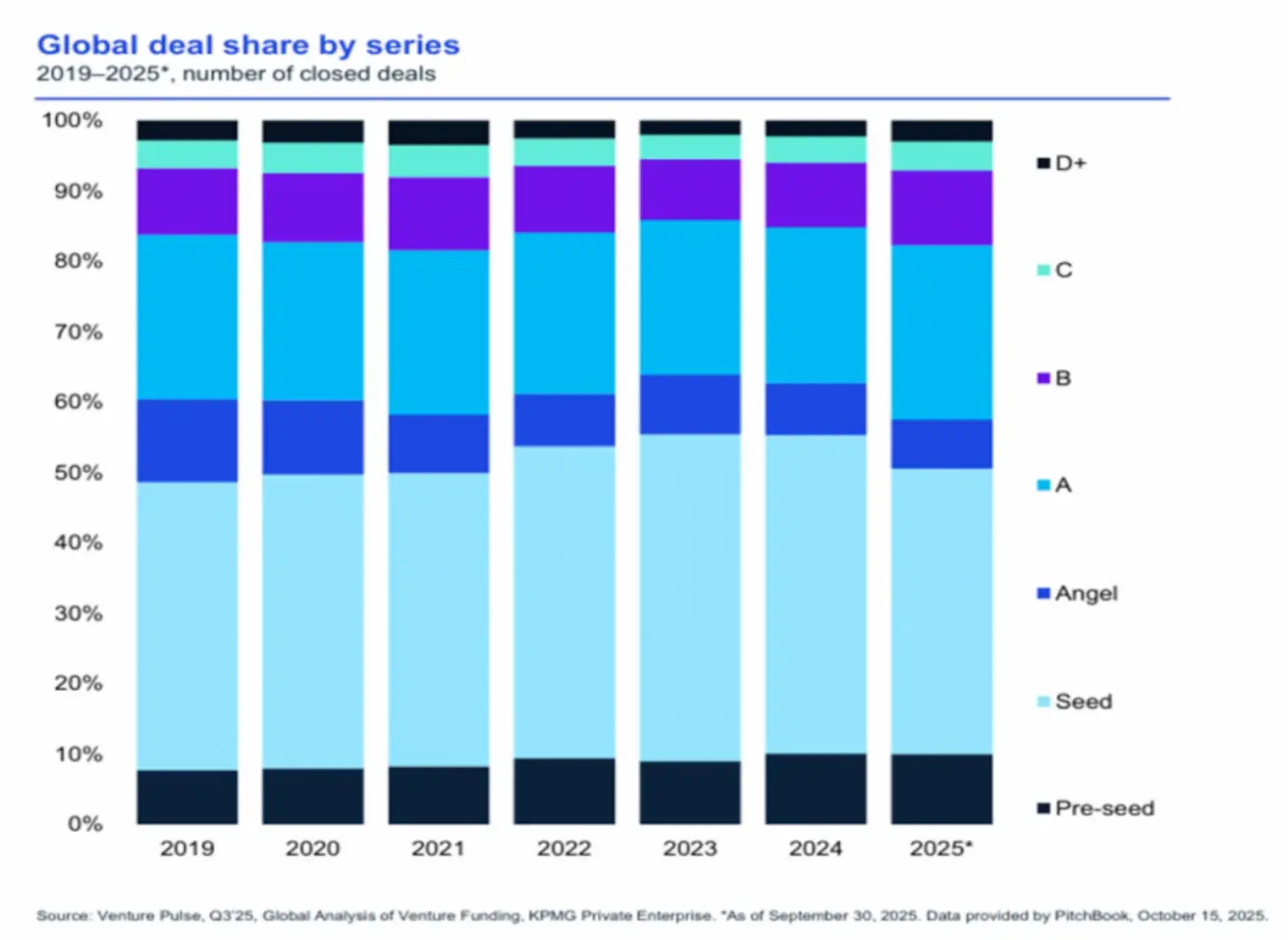

This contrast reflects a shift in focus toward later-stage funding — investors are channeling more capital into companies already in the growth and scaling phase. The market is becoming increasingly concentrated around mature businesses, primarily in the AI sector.

Chart: Median Deal Volume by Stage

Chart: Median Deal Volume by Stage

Chart: Distribution of Venture Deals by Stage (2019–2025)

Chart: Distribution of Venture Deals by Stage (2019–2025)

AI Remains the Strongest Growth Driver

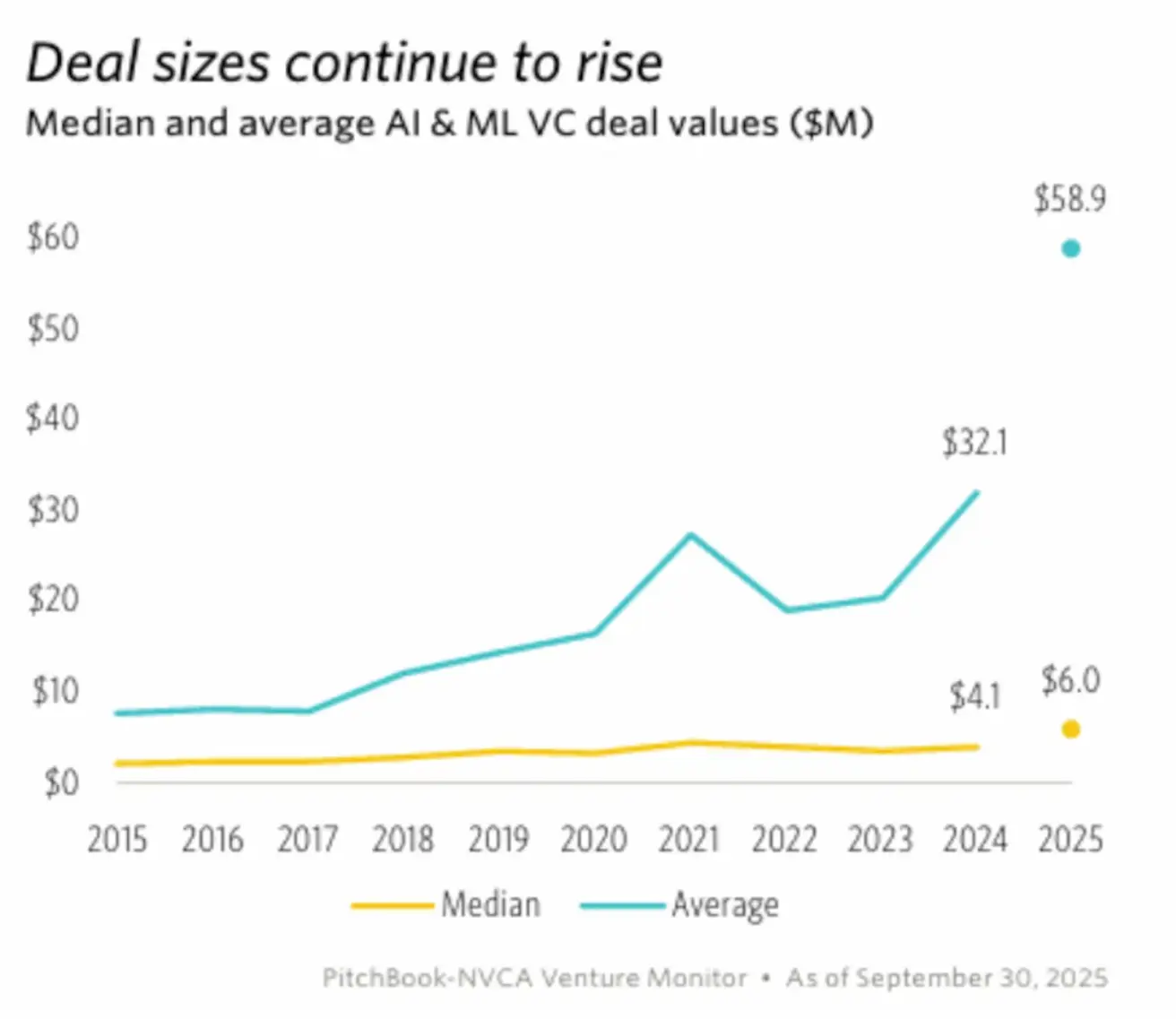

The artificial intelligence sector continues to set the pace for the venture market. By the end of Q3 2025, the median deal size reached $6 million, while the average climbed to nearly $59 million, fueled by mega-rounds from major AI players such as xAI and Anthropic.

Between October 27 and November 7, the 20 largest venture deals totaled $2.42 billion, with $1.76 billion going to AI-related companies.

An increasing number of startups are offering practical applications of AI technologies and influencing the value chain — not only creating AI-based products but also developing the infrastructure and tools that help other companies leverage artificial intelligence. Among such projects are Substrate and Harvey.

Growth in Average and Median Deal Size in the AI/ML Sector

Growth in Average and Median Deal Size in the AI/ML Sector

IPO and M&A: Indicators of a Cautious Recovery

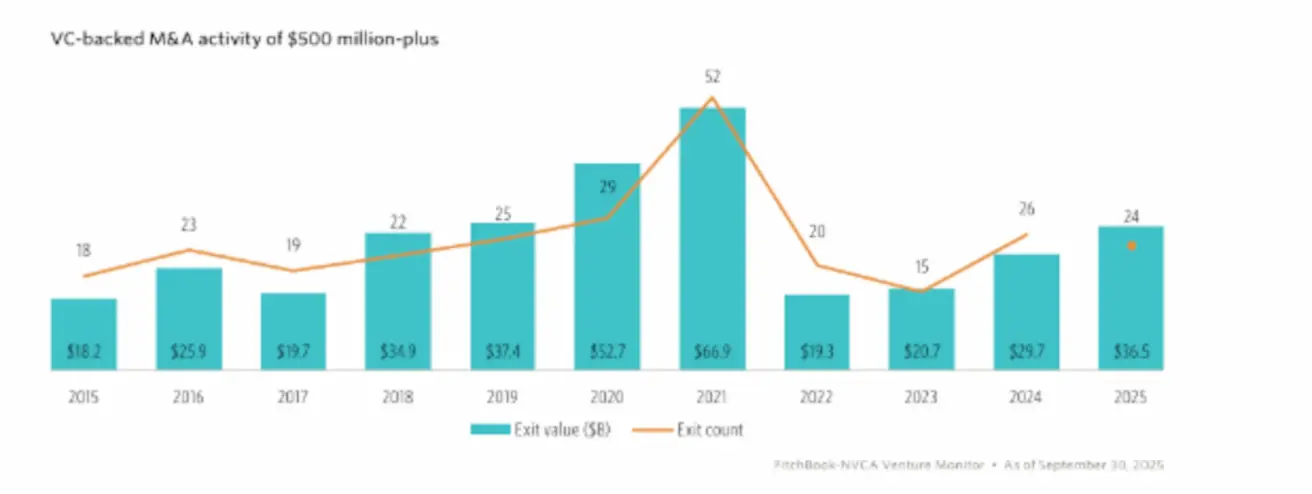

After an extended slowdown, the exit market is showing steady and cautious improvement — both in volume and the number of deals.

Chart: Major M&A Deals of Venture-Backed Companies ($500M+)

Chart: Major M&A Deals of Venture-Backed Companies ($500M+)

The IPO market has seen several successful listings, including Figma, Firefly Aerospace, and Gemini, which have strengthened investor confidence.

At the same time, the number of M&A deals exceeding $500 million in the first three quarters of 2025 has almost reached the full-year figure for 2024 and already surpassed it in total value.

Chart: IPO Activity of Venture-Backed Companies by Quarter

Chart: IPO Activity of Venture-Backed Companies by Quarter

Together, these developments signal a gradual recovery and a return of measured optimism among investors.

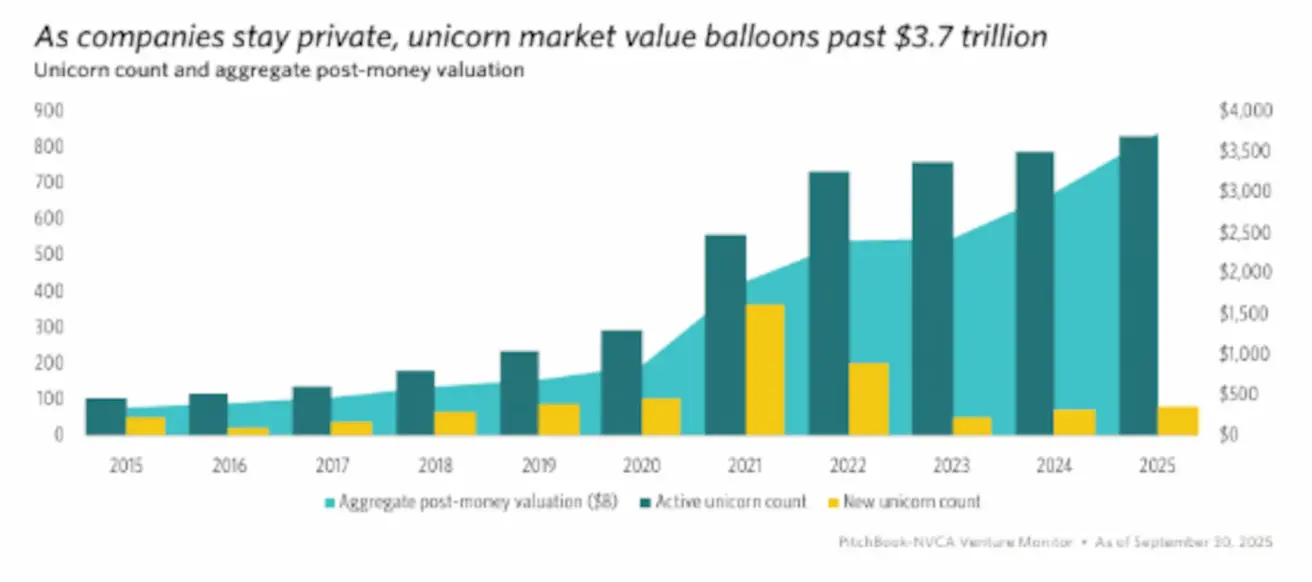

New Unicorns

The number of unicorns continues to grow at a moderate pace, exceeding 1,400 companies worldwide. The United States remains the clear leader, with around 750 unicorns based there.

Chart: Number of Unicorns by Region

Chart: Number of Unicorns by Region

Insights and Outlook

Following the slowdown of 2023–2024, the venture market is steadily recovering, approaching pre-pandemic levels. Investment volumes are rising, AI remains the key growth engine, and IPO and M&A activity is gaining momentum again.

At the same time, investors continue to take a selective and cautious approach, focusing primarily on mature and resilient companies.

Raison will continue to track developments and share insights on the evolving venture capital landscape. Stay tuned for our upcoming reports and market updates.

Қазақша

Қазақша