Guide to venture investing

A case of how the democratization of the private equity market is disrupting the industry.

Overview

Venture investments are also known as private equity. Investors like financial institutions, hedge or venture funds buy large shares of private companies before going public.

Due to the size of the investment and risk involved, shares sell at a significant discount, making this type of investment extremely profitable.

Capital obtained by private companies is usually utilized to fund new technology development, workforce expansion, or new market entry.

The private equity market has shown some unbelievable profits in the last decades. However, this market is still relatively sealed for non-accredited (also known as retail) investors.

Due to regulations, retail investors cannot participate in funding rounds. Moreover, private companies are more willing to sell big shares at once to only a few selected investors with high checks. Therefore, the venture market is private and not accessible to investors with low capital.

Recently, fintech companies started to offer marketplaces and brokerage services where investors could participate in funding rounds of such companies as Klarna, Neuralink, Patreon, and other giants of the private equity market.

Other platforms started to offer a secondary market for shares in private companies (obtained from employees or investment funds). However, the entry ticket through such platforms varies from $10k to $50k — still out of reach for regular people.

Blockchain and fintech

But with the help of the blockchain, fintech startups started to emerge, ready to disrupt the industry.

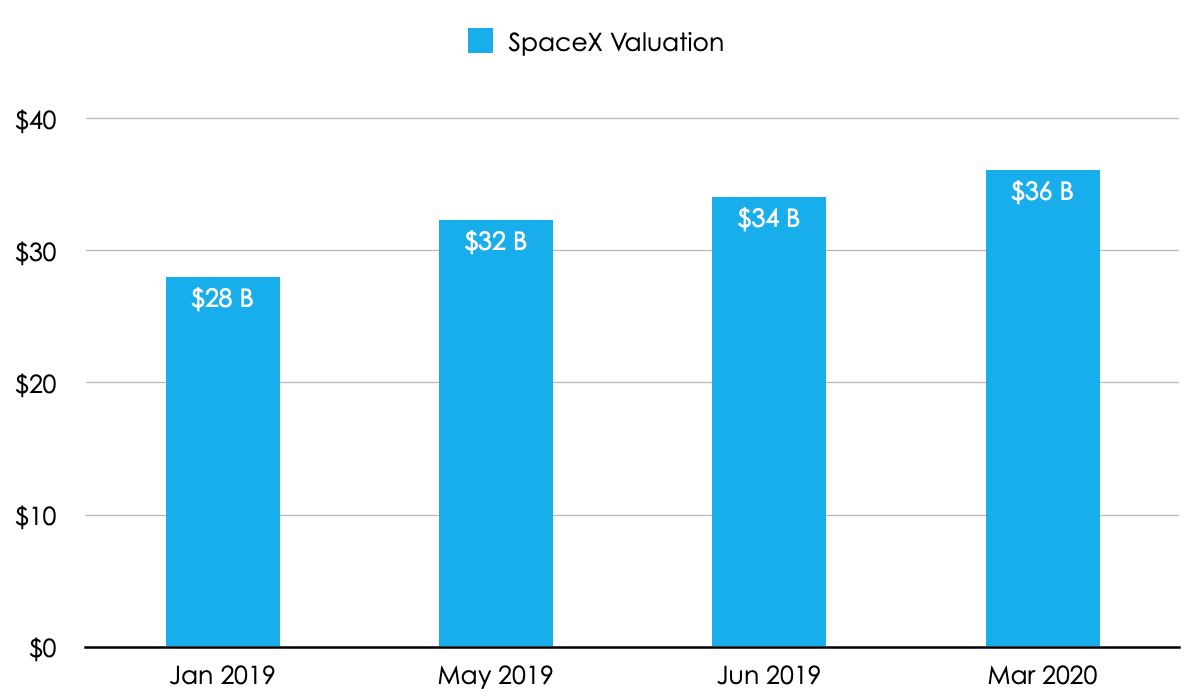

For example, in 2019 Raison app entered the market with its pilot offer – pre-IPO shares of SpaceX. Since then, the Estonian startup has expanded its Marketplace with more than 17 companies: Neuralink, Klarna, Patreon, Rappi, and others.

Using blockchain technology and fractional shares integration, the company created a unique legal structure for venture investments with a low entry ticket of $1 for non-accredited investors.

Let's go over the basics of venture investing, the benefits, the risks, and how to invest.

Venture investing: the basics of Pre-IPO

Pre-IPO is a private sale of a large share of a company before it goes public or another funding round of a company big enough to conduct an IPO. For example, SpaceX never announced an upcoming IPO, and the Raison pre-IPO was just another round of funding. Therefore, any private firm could conduct pre-IPOs; however, they might never go public and continue to attract investments as a private company.

It is an excellent way for companies to gain capital for further development, avoiding various costs and challenges related to IPO.

A company has to spend a few years preparing with financial and legal advisors to go public. An IPO team is created to develop the emission prospects, plan and execute advertising campaigns (also known as a roadshow), and constantly carry out third-party audits.

This expensive and time-consuming process also holds fundamental risks:

- What if there is not enough interest from the public?

- What if the financial regulator finds a violation, which will cause a delay?

- What if the company's quarterly results do not meet the market expectations?

The requirements to become a publicly-traded company are very high. After going public, companies must report financial and corporate results to stakeholders, including financial regulators. As a result, they prefer to stay private as long as possible and focus on development.

According to Jay Ritter, an IPO expert at the University of Florida, the median age for tech companies going public in 2000 was 4,5 years, compared with 12 years in 2018. This trend has transformed the private equity market and provided new opportunities for investors.

Source: Capital IQ, Pitchbook

Source: Capital IQ, Pitchbook

Venture opportunities

For investors, the venture market is an excellent alternative investment as it includes several advantages over public equity:

Long-term growth potential

Over an extended period, private companies may show higher profitability, especially during the stage of active growth. These periods are followed by a relatively high number of funding rounds during a short period or simply by the inflow of substantial capital at once.

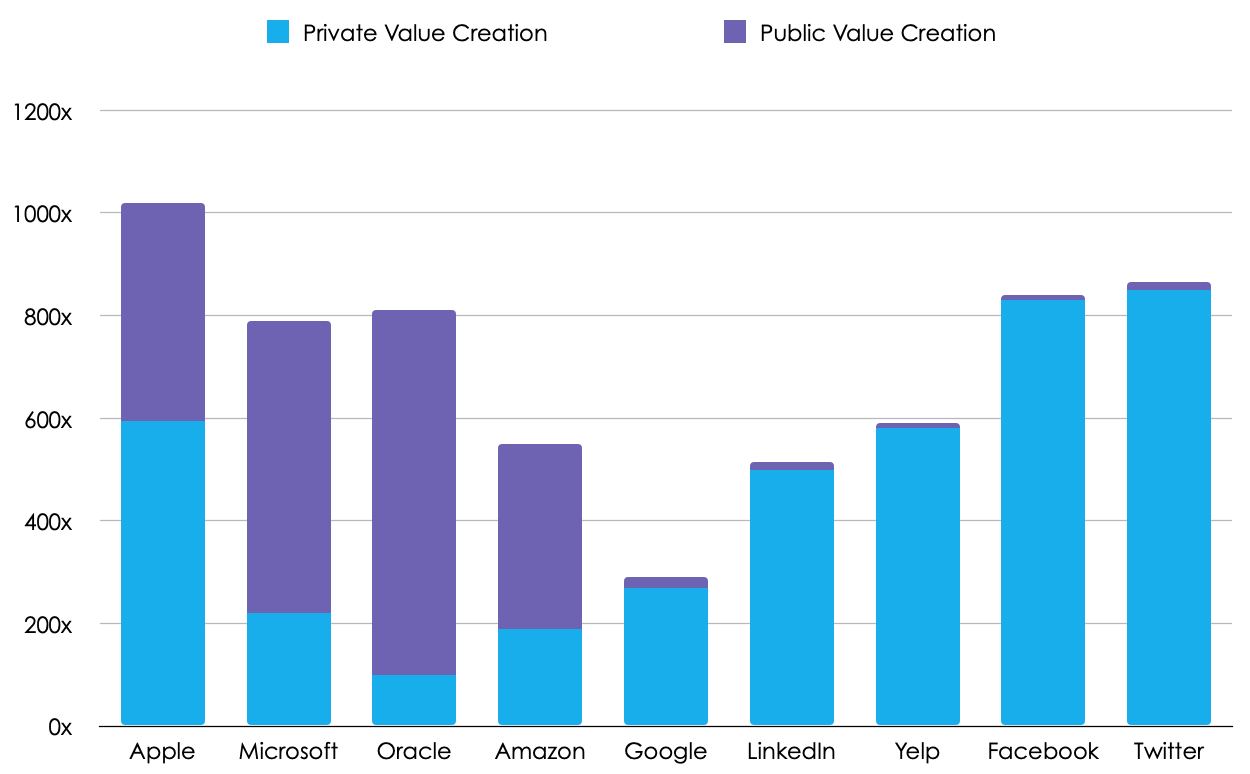

To illustrate the difference, let's take the example of financial companies like Visa and Stripe. In 2010, when Stripe received its first funding, reaching a $22M valuation, Visa stock traded on public markets at 21$ per share.

Ten years later, Visa rose by roughly 850%, making it an excellent investment with more than 80% of annual return. At the same time, the financial market was transforming, and early investors of Stripe have seen the dramatic rise of a private company with today's valuation equal to $95B.

That makes the total return equal to 430,000%.

Of course, early investors take a significant risk, so let's compare the same indicator for the last five years when Stripe was a $5B fintech startup with a sustainable business model. Since 2015 Visa has grown by 185% ( 36% annual return) while Stripe investment has appreciated by 1800% (360% of annual return).

Diversification

Factors that drive returns in the public equity market, such as volatility, investor sentiment, quarterly reporting, and seasonality, have little or no effect on the private market. Venture investments are less manipulative, as the valuation is based on assessing the business and the company's prospects, making it an excellent diversification tool.

Let's look at the relatively recent example of a pandemic crisis in financial markets and compare two companies from the aerospace industry.

Lockheed Martin depreciated by more than 30% during a panic sell-off in March 2020, while SpaceX's valuation was unaffected by the crisis. Moreover, after the Series L funding round in June 2019, all investors earned at least 5,8% of the return.

According to the Bain & Co. report, over the past 30 years, U.S. buyouts (considered the largest subset of private equity investments) have generated an average net return of 13.1%, compared with the 8.1% return of the public markets.

Watch out Youtube video on the importance of Diversification and how to do it using the Raison app:

Going public: benefits for companies and investors

Going public has its advantages over the private equity market. For companies, the primary goal of an initial offering is to raise capital for further growth. Some companies invest money into research and development, while others spend it on expansion or paying back their loan.

Benefits for companies

- IPO provides a company with a high amount of accessible capital

- A publicly-traded company is implied to be transparent to the stakeholders. Transparency attracts more prestigious clients, partners, and talent.

- For companies staying private for too long, IPO is a great way to create liquidity for their stock. Venture investors would use it as an exit strategy, and shareholders would have more options to manage capital.

Benefits for investors

You should be a long-standing, established, high-net-worth customer at some famous brokerage like Goldman Sachs to participate in an IPO.

Other IPOs with lower capitalization and less potential are more accessible to investors with different capital levels. These investments become risky due to several factors:

- A deep analysis of the market, competitors, and macro environment

- The only informative document about a company is a prospectus (written by the company)

- If you have easy access to the IPO, there is probably a reason behind the high number of available shares.

- Even after successful participation, there is a risk of becoming a victim of manipulation.

- At the very beginning of a trading session, some shareholders would want to execute an exit strategy, and the price of a stock will dump.

- A company might not meet market expectations when it reveals its financial and corporate performance.

A similar case happened to Snapchat's IPO when the number of active users wasn't enough for public investors, and the stock depreciated dramatically. Snapchat stock has overcome its initial price only three and a half years later.

IPO investment strategy could still be highly profitable despite all the negative aspects. A number of the hottest IPOs in 2021 have gained some handsome returns:

- Airbnb +113%

- Ozon +52%

- C3.AI +228%

- Affirm +101%

- Poshmark +66%

But you can also find some relatively unprofitable cases even with well-known companies like Deliveroo IPO on the London exchange. The stock bottomed by almost 30% on the first trading day, forcing significant investors to buy a large block of shares to prevent further decrease.

At the same time, the average return of the 2021 IPO portfolio was 190%, which is not the best performance you could have earned in this market.

The IPO market is a long-standing and well-known type of investment, which provides its participants with a great return correlated with the amount of risk.

What are the risks of venture investing?

The private equity market also has a lot of pitfalls and risks attached. Venture funds invest in hundreds and thousands of private companies to increase the chance of becoming a shareholder of a future Facebook or Amazon.

Even though it is still possible to catch a lucky ticket, there are a lot of risks:

Capital loss

A private company could go bankrupt due to various reasons. A partial or complete capital loss is typically subject to a lack of professional management. For example, a company could follow an inefficient expenditure policy, and invested capital might be misused.

Lack of liquidity

It is pretty hard to quickly sell your share in a company in the private equity market. Liquidity occasionally increases during another funding round or at the cash-out event (IPO). Other ways to sell the asset are more time-consuming or less financially beneficial. But with the help of new fintech platforms, the liquidity for private equity assets is constantly increasing.

Scarcity of dividends

Private companies rarely pay dividends compared to the public market as investors and company management prefer to reinvest all of the income. That usually depends on how far the company can expand. For every new region entry and side-project development, a company needs financial capital; therefore, expenditures will always surpass revenues.

Lock-up period

Investing in late-stage pre-IPO also brings the risk of the lock-up period, when investors are not allowed to redeem or sell the shares in a company after IPO. An issuing company sets the lock-up; for example, Airbnb has put a period of 121 days from IPO. In this case, the risk has paid off, and the investment has doubled since the initial offering.

When the lock-up period is over, the fund will sell underlying shares and distribute proceeds among unitholders.

Valuation of a private company

The valuation process is vital for investor returns, corporate governance, the ability to hire and retain talent, and the ability to raise future funds. The evaluation process combines several steps:

Market analysis

Most startups operate in innovative and growing industries; however, many submarkets have different performances. Investors aiming for the short term should investigate fintech or edtech markets. At the same time, long-term investors may be interested in biotech or artificial intelligence startups.

Comparable public companies

The easiest way to understand a company's level is to look at similar companies and valuations. The most common metrics for comparison are the size of a company, operating markets, number of active users/clients, partners, etc.

Financial and operating performance

Private companies keep this information out of the public eye, and only potential investors like venture funds can access it. Thus, it could be helpful to see the list of investors and check on their legitimacy. Also, some famous names in venture capital include Sequoia Capital and Y Combinator. So if you see them on a list of investors, be sure they have checked the financial and operation performances.

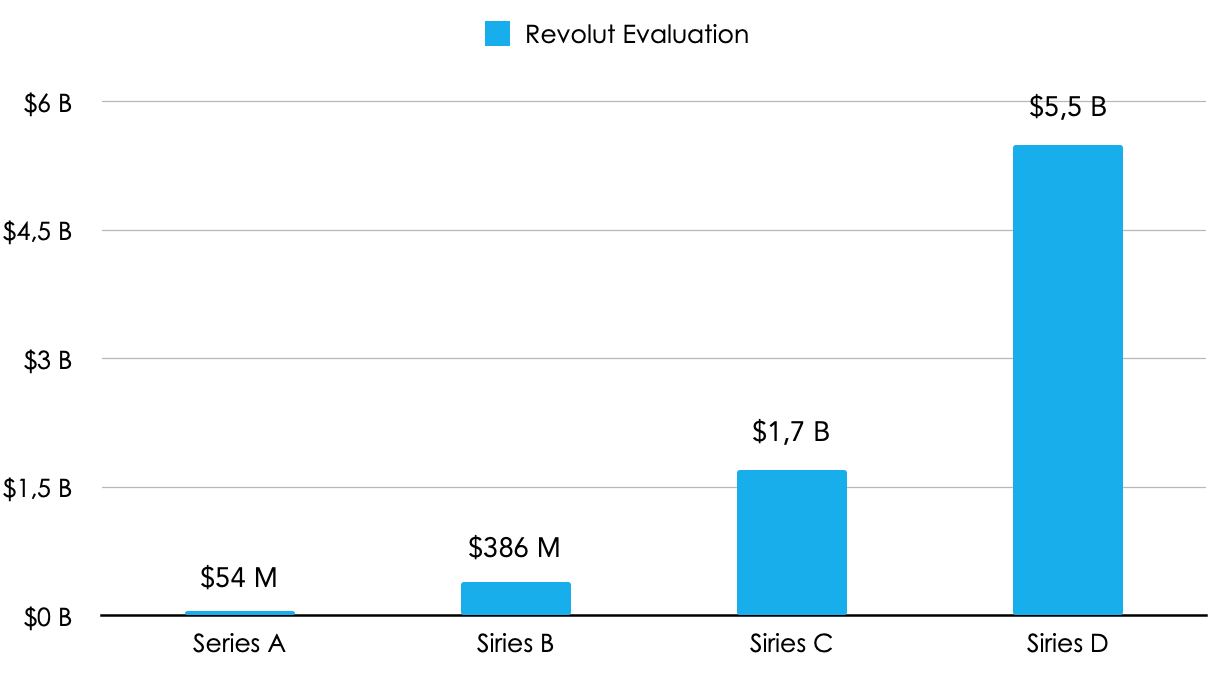

Let's take a well-known company Revolut with a capitalization equal to $5.5 billion to understand the valuation mechanism. Revolut has conducted four funding rounds with a total investment worth $900 million. We can conclude that venture funds have purchased around 16% of a company remaining 84% to the founders by a simple calculation.

How to invest in venture

We have already mentioned how recently fintech startups have emerged, disrupting the venture market, and making it more accessible to non-accredited investors with any amount of capital.

Let's go into details of the Raison app case and how the startup gives access to venture deals of its Marketplace for such low-entry tickets.

Is it all legal?

The startup lists all of its licenses, including virtual currency and investment services, on its website in the footer area.

With this strong regulation, the startup integrated fractional shares using blockchain technology and created the world's first legal structure for secure venture investments available for everyone.

The startup uses a special investment fund to purchase companies' shares.

Their parent company – Raison Asset Management, regulated by US SEC – manages the fund. To offer the shares on their Marketplace, small fractions of the fund are created using blockchain protocol ( ERC – 20) and deployed into smart contracts to list units of a particular company.

What do you get when investing?

Unit's smart contract guarantees that 1 unit is equal to 1 share and secures the right of your ownership. The process is transparent, again, due to blockchain technology. Users can double-check their ownership on explorer.celo.org, the blockchain network that Raison uses to list their units.

The fund itself is in the shareholders' register of a private company — for example, SpaceX. Thus, the holder of funds units becomes the holder of the company's shares on its balance sheet. As unitholders are direct shareholders in the fund, they do not get voting or information rights from the private company. However, unitholders have a right to dividends if the company pays them.

How are profits received?

In general, venture investors get profit when the company they invested in increases its valuation through the funding round or when it goes public, initiating a liquidity (exit) event. Unitholders on the Raison app profit similarly, either when an underlying company increases its valuation or goes public.

To fix profit, Raison users have two exit strategies:

- Wait for the company's Public Listing. When a company goes public, and after the lock-up period ends, according to offering details, the fund sells shares on the public market and distributes returns among all unitholders. Users receive a euro payment equal to the number of units multiplied by the new share price.

- After the unit sale, a secondary market is launched for the units. If a company never goes public, users will be able to sell the units on a secondary market.

Today, there have been three successful cases of a company going public from Raison Marketplace and users receiving their profits: Airbnb, Digital Ocean, and Robinhood.

Who can invest?

Raison app is all about the democratization of venture capital investments. You don't have to be an accredited investor or have a lot of capital

Alexander Zaitsev

CEO of Raison app

There are still some restrictions like users must be 18 years old to be able to use the app and a few geographical restrictions listed in their Terms of Use.

If non of the restrictions apply, to invest using Raison, you have to:

- Sign up using your phone number and email.

- Complete the quick onboarding process – you will be requested to verify yourself and your residence by uploading relevant documents.

- Choose a deposit method – the app supports Credit or Debit cards, SEPA, SWIFT wire, or cryptocurrency transactions.

- Review the Marketplace and find a company or few you are interested in.

- Choose the amount you wish to invest.

And that's it; you are now a venture investor in just a few clicks.

Conclusion

Investments in large private tech companies performed several times better over the last years than the broad market index – S&P 500. Moreover, venture investments have almost no volatility as companies' valuation changes only during the funding rounds.

Late venture investments are also considered less risky than Seed and Early stages. Late-stage companies usually have working technology and proven business models backed by leading venture capital firms.

Such companies disclose information regarding their metrics, development, and financial performance.

For investors, it is essential to make an informed decision before investing in a particular company.

On Raison Marketplace, anyone can create a portfolio of late venture companies starting from $1 with all available public information for each investment opportunity in the app.

Elena Milosheska

Customer Success Manager of Raison app

Q&A with Raison app founder

You can find more information on venture investing, pre-IPO units, and the Raison in our Q&A session with Raison app founder — Alexander Zaytsev.

Қазақша

Қазақша