Forge Q2 2025: Private Market Revival

Fintech, AI, IPO momentum and record unicorns

The private capital market showed clear signs of resurgence in the second quarter of 2025, driven by renewed momentum in the fintech sector, sustained investor enthusiasm around artificial intelligence (AI), and a rebound in IPO activity not seen in more than two years.

Overall Trends

- The private capital market in Q2 2025 demonstrated resilience despite macroeconomic uncertainty, including inflation and trade risks.

- Fintech and AI emerged as the primary growth drivers, reinforcing positive investor sentiment.

- The Forge Accuidity Index (FAPMI) surged +26.6%, outperforming both SPY and QQQ, fueled by strong results from Circle and CoreWeave.

Fintech

After several years of stagnation, fintech has regained investor attention.

Despite a still-challenging interest rate environment, the fintech rally is firmly underpinned by fundamentals: revenue and profitability growth, cost optimization, and regulatory support (including the easing of restrictions for crypto and banking).

Fintech companies led the gains in the Forge Private Market Index (FPMI), outperforming all other sectors. Successful IPOs (Circle, eToro) underscored fintech’s position as a strategic pillar in the future of finance.

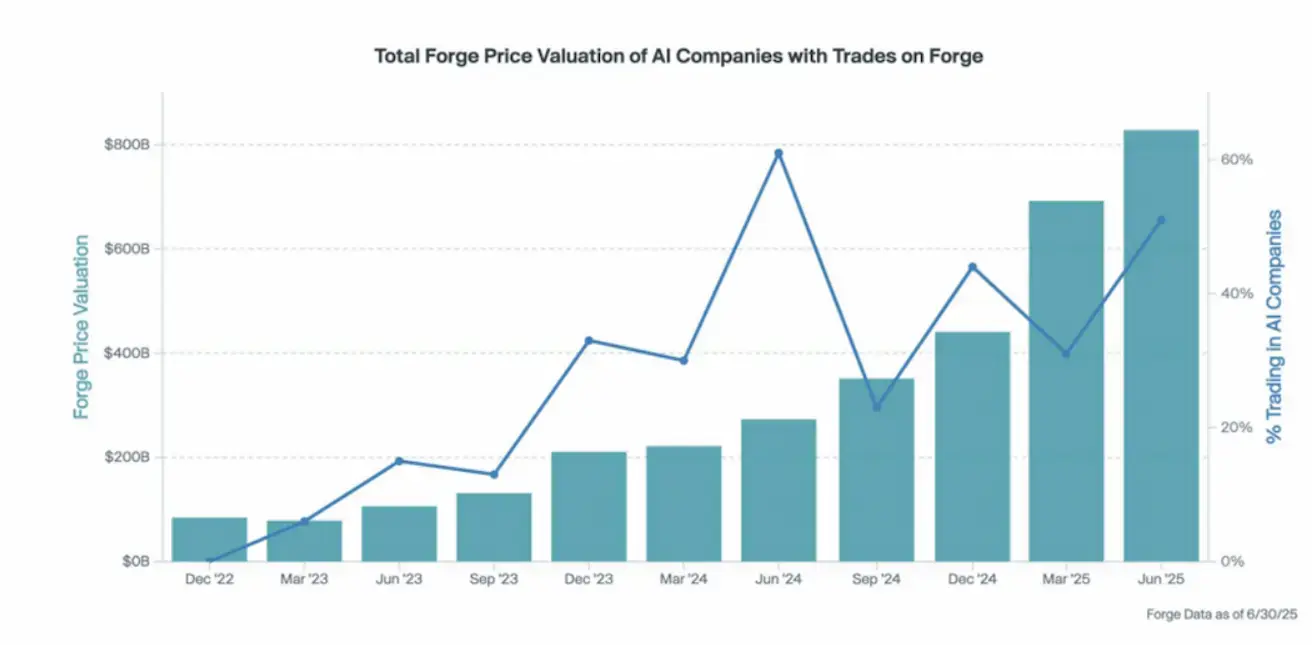

Artificial Intelligence

AI remains one of the most dominant themes in the private market, with investor appetite showing no signs of slowing. Unlike prior cycles, where capital poured into a single AI subsector, today’s landscape is marked by broader allocation across the ecosystem—from foundation model developers to enterprise SaaS solutions, infrastructure orchestration, and vertical applications in healthcare, law, and financial services.

AI’s dominance continues: 51% of total trading volume on Forge in Q2 2025 was concentrated in AI companies.

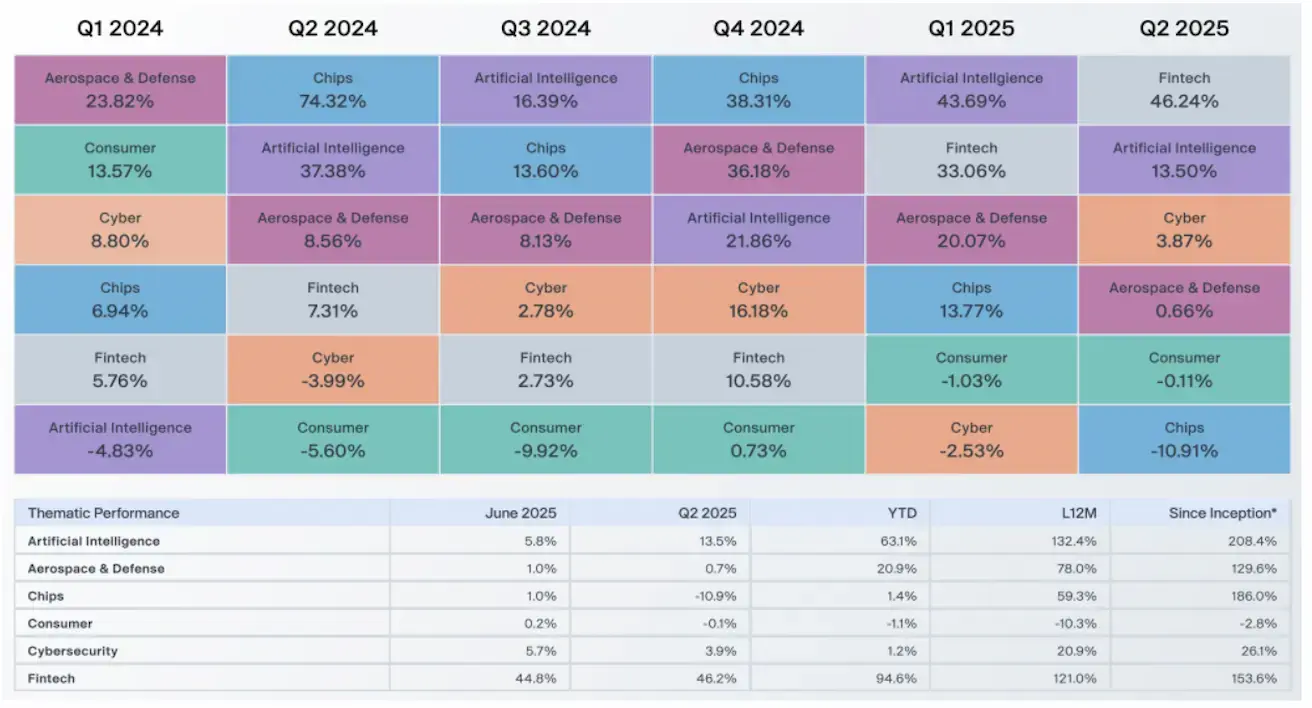

Performance of Forge Private Thematic Baskets (Company Valuation Dynamics):

The IPO Market Enters a New Phase of Revival

In Q2 2025, IPO activity returned, highlighted by strong debuts such as Circle (+113%) and CoreWeave (+133% at the time of writing).

Robust post-listing performance—marked by upward revisions of offering ranges, rapid price stabilization after IPOs, and in several cases, sustained gains—has created a positive feedback loop for late-stage private companies and their investors.

On the Forge marketplace, this dynamic translated into rising valuations and improved liquidity for companies expected to go public within the next twelve months. Among them are Klarna, Navan, and Wealthfront, which may be eyeing IPOs after the summer.

While the quality gap between venture-backed startups remains significant, investor readiness is clearly rebounding—particularly in categories offering higher liquidity.

IPO filing: the official submission of documentation to regulators for a company’s public listing.

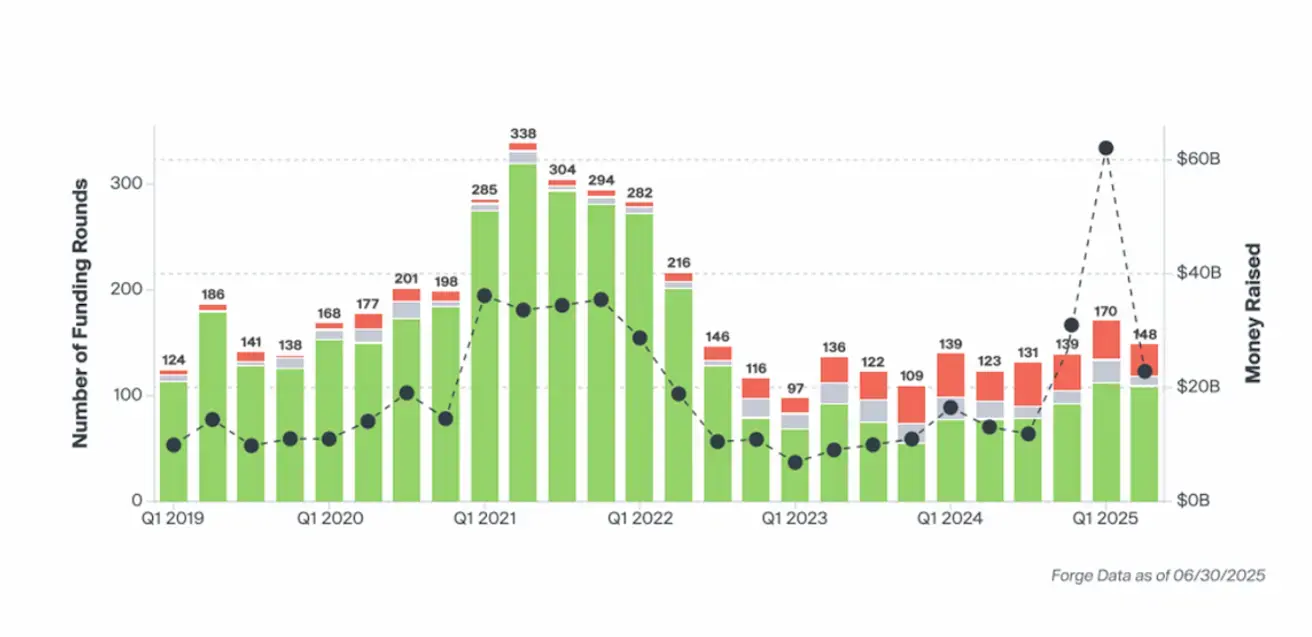

Private Capital Market: Funding and Unicorns

In Q2 2025, a total of $22 billion was raised across 148 rounds—slightly below Q1 levels, yet still marking one of the strongest quarters since mid-2022.

A total of 21 new unicorns were created in Q2 2025—the highest number since 2022. Notable examples include Thinking Machines Lab (valued at $10 billion at a seed round of $2 billion), Gecko Robotics, and Impulse Space. Many existing unicorns also recorded significant Step-Up rounds, in some cases doubling or even tripling their valuations (e.g., ClickHouse, Applied Intuition)—a clear signal of strong investor confidence.

Secondary Market

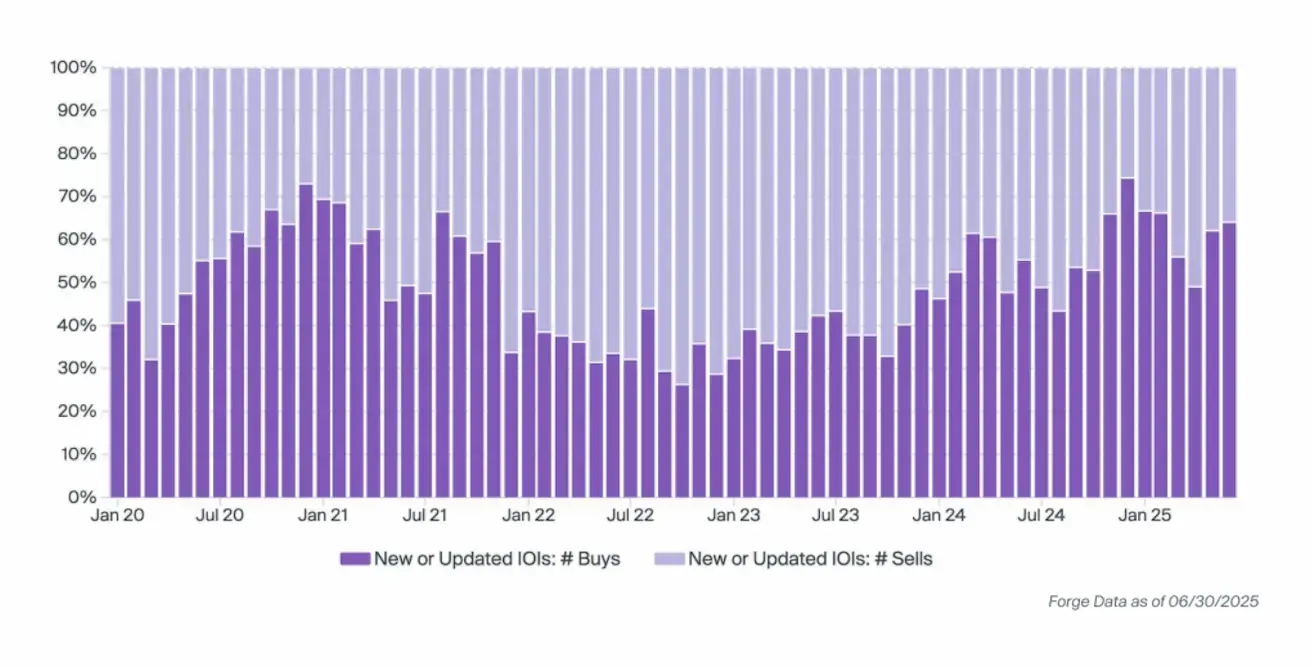

Buyer interest rebounded after April’s slowdown. Having bottomed out in October 2022, indicators of interest in purchasing (IOI), expressed as a percentage of total interest, have gradually returned to levels last seen during 2020–2021.

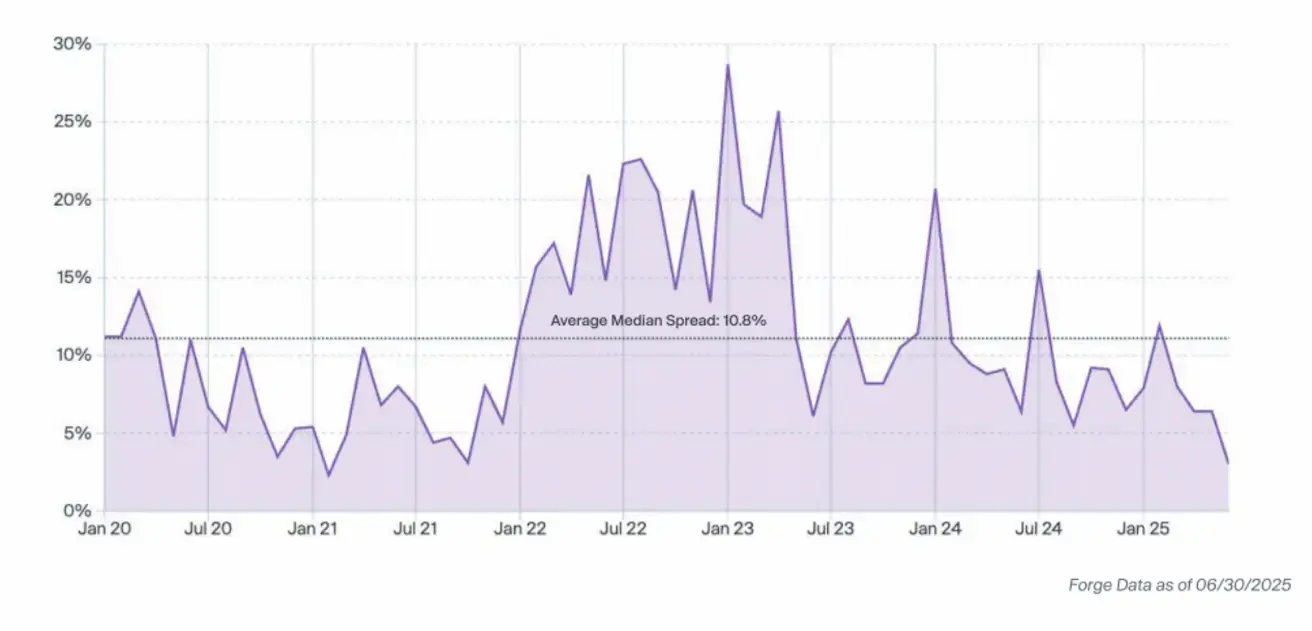

The median bid-ask spread continued to narrow, reaching 3% in June 2025—its lowest level since February 2021. Tighter bid-ask spreads reflect a more active market characterized by strong demand.

Risks

At present, the threat of large-scale tariffs has receded; however, their potential introduction could still impact global capital flows, production costs, and sector rotation. The private market is inherently long-term in orientation, which means that shifts in tariff policy tend to produce primarily short-term effects—most notably on supply chains, consumer demand, and cost structures.

Қазақша

Қазақша