European unicorns are on the rise

2022 is aiming to be a record year for new unicorns in Europe

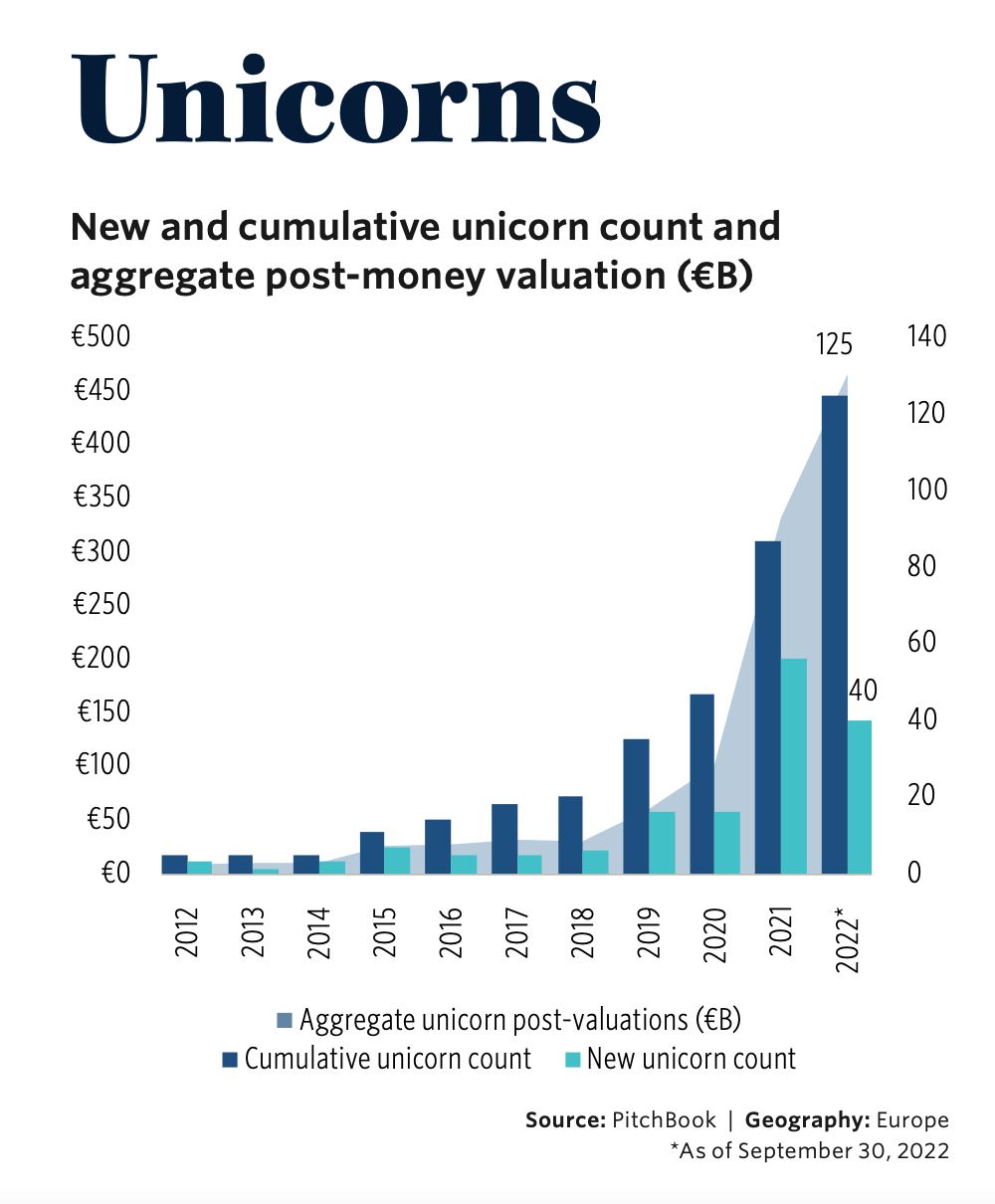

According to the Pitchbook's Q3 statistics, 40 European companies received a €1+ billion valuation from January to September, more than in the same period last year.

The report states, "this indicates the stability of the venture capital industry, given the current macroeconomic climate." Despite this, shares of European public technology companies have lost 33.1% since the beginning of this year.

It's also interesting to note that the median valuations of European Seed and Early Stage startups are up from last year's record highs. Thus, the median pre-money valuation of an Early Stage startup in Q32022 was €8 million, compared to €6 million a year earlier.

Late-stage startups are more sensitive to macroeconomic problems. Their estimates have declined since the beginning of the year but still turned out to be "higher than analysts' forecasts."

Source: PitchBook Q3 2022 European VC Valuations Report

Source: PitchBook Q3 2022 European VC Valuations Report

In some industries, there is no decline: for example, Late Stage valuations of software companies have even risen.

At the same time, Pitchbook analysts suggest that in the fourth quarter, unfavorable external economic conditions may worsen the situation on the European venture scene. On the other hand, a large amount of capital accumulated by VC funds (dry powder) will support the market.

How are EU startups from our Marketplace doing?

On the 12th of July, 2022, Klarna's valuation was downgraded from $45.6 billion in June to $6.7 billion in its latest funding round, turning the tide for one of Europe's most high-profile startups, according to Bloomberg. And back in February, the startup was valued at $60 billion.

Recently, Klarna released its third-quarter 2022 financial report. The company managed to significantly increase revenue and sales despite the overall slowdown in the online trading sector.

- +22% — growth in transaction volume y/y ($60.2 billion)

- +22% YoY revenue growth ($1.4bn)

- -42% — decrease in operating losses qoq

- -12% — decrease in credit losses q/q (to 0.7% of the volume of transactions)

The results in the US market were even better: +92% YoY in transaction volume and -16% QoQ in credit losses.

According to Klarna CEO Sebastian Siemiatkowski, the company is rapidly moving towards becoming "monthly profitable" and aims to achieve this goal in the second half of 2023.

And Drip Capital was included in the rating of "100 companies," according to the American magazine Red Herring. The candidates were evaluated according to revenue, innovation, quality of management, market share, etc. The rating is known for earlier its editors were among the first to recognize the merits of such companies as Facebook, Skype, and Salesforce.

What about the Estonian startup ecosystem?

The total turnover of Estonian startups in the three quarters of this year increased by 64% compared to the same period last year to 1.5 billion euros. Estonian startups have also attracted record investments – a total of 1.2 billion euros, of which 40 transactions were worth more than one million euros.

Our CEO recently gave his comments on the topic to The Recursive about the country's fintech sector.

The Fintech sector in Estonia is developed regarding virtual currencies, virtual assets service providers, and licensed funds facilitated by progressive legislation. Servicing a company in Estonia is also more accessible than in other European countries. One of the advantages of Estonia is a favorable tax regime; there is no income tax in case of non-distribution of dividends.

Alexander Zaytsev

CEO of Raison for The Recursive

He adds that such examples also prompt the rest of Europe to follow Estonia's practices.

In many ways, this is happening: Europe, for example, follows Estonia in developing virtual currencies. In this sense, Estonia has become a kind of regulatory sandbox, the experience of which formed the basis of the recently approved Markets in Crypto-assets regulation (MiCA) of the European Union, Zaytsev also notes.

Fintech is the second largest sector of activity for Estonian startups - 170 startups, or 13% of the total number of companies, according to Startup Estonia. Safe to say that the industry continues its steady growth.

Қазақша

Қазақша