December 2 — 6: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

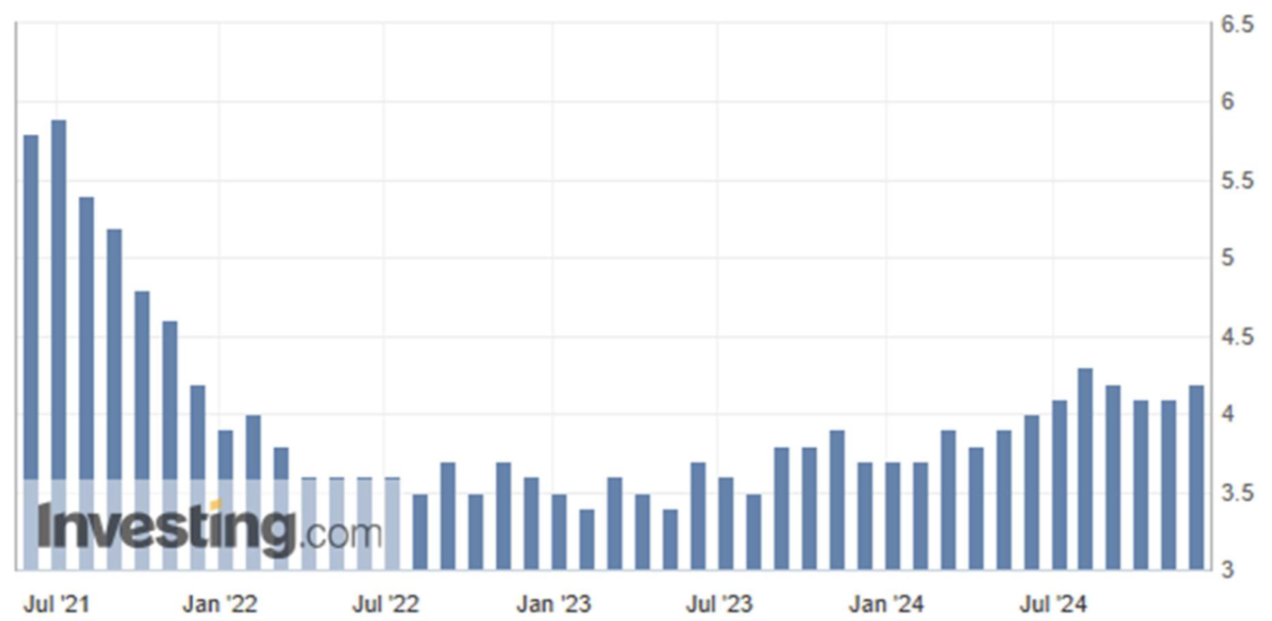

- Core Consumer Price Index (CPI) (YoY) (October): 3.3% (prev: 3.3%)

- Consumer Price Index (CPI) (YoY) (October): 2.6% (prev: 2.4%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (October): 2.9% (prev: 2.6%);

- 5-year expected inflation (October): 3.1% (prev: 3.2%).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (November): 56.1 (Oct: 55.0);

- Manufacturing sector (November): 49.7 (Oct: 46.5 revised);

- S&P Global Composite (November): 54.9 (Oct: 54.1).

LABOR MARKET

- Unemployment rate (August): 4.2% (prev: 4.1%);

- Nonfarm payroll employment change (November): 227K (prev: 36K);

- Private sector nonfarm employment change (November): 194K (prev: -2K revised);

- Average hourly earnings (November, YoY): 4.0% (prev: 4.0%).

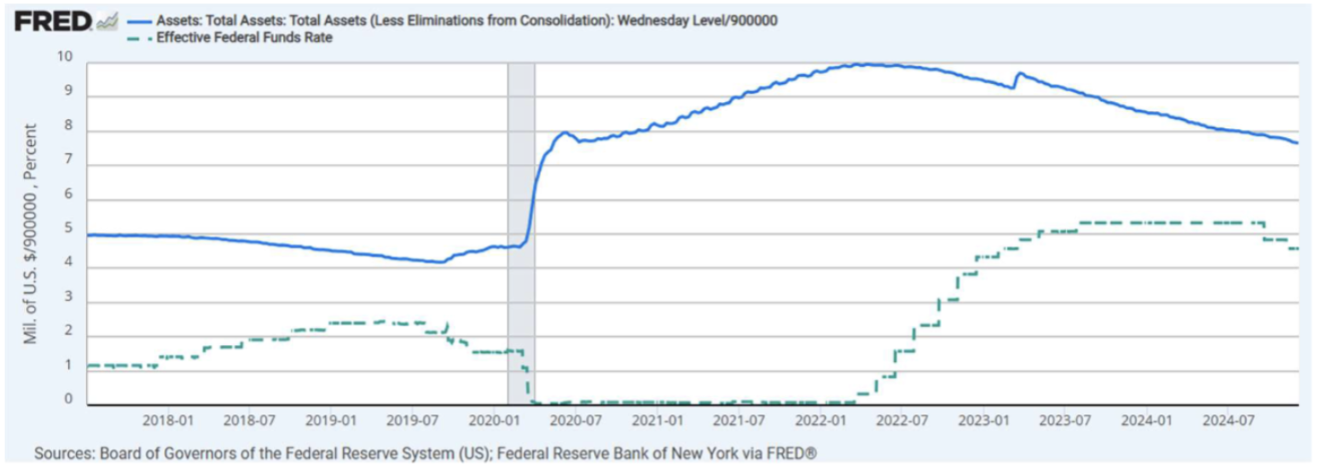

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.50% - 4.75% (estimated);

- Fed Balance Sheet: $6.895 trillion (vs. $6.923 trillion last week).

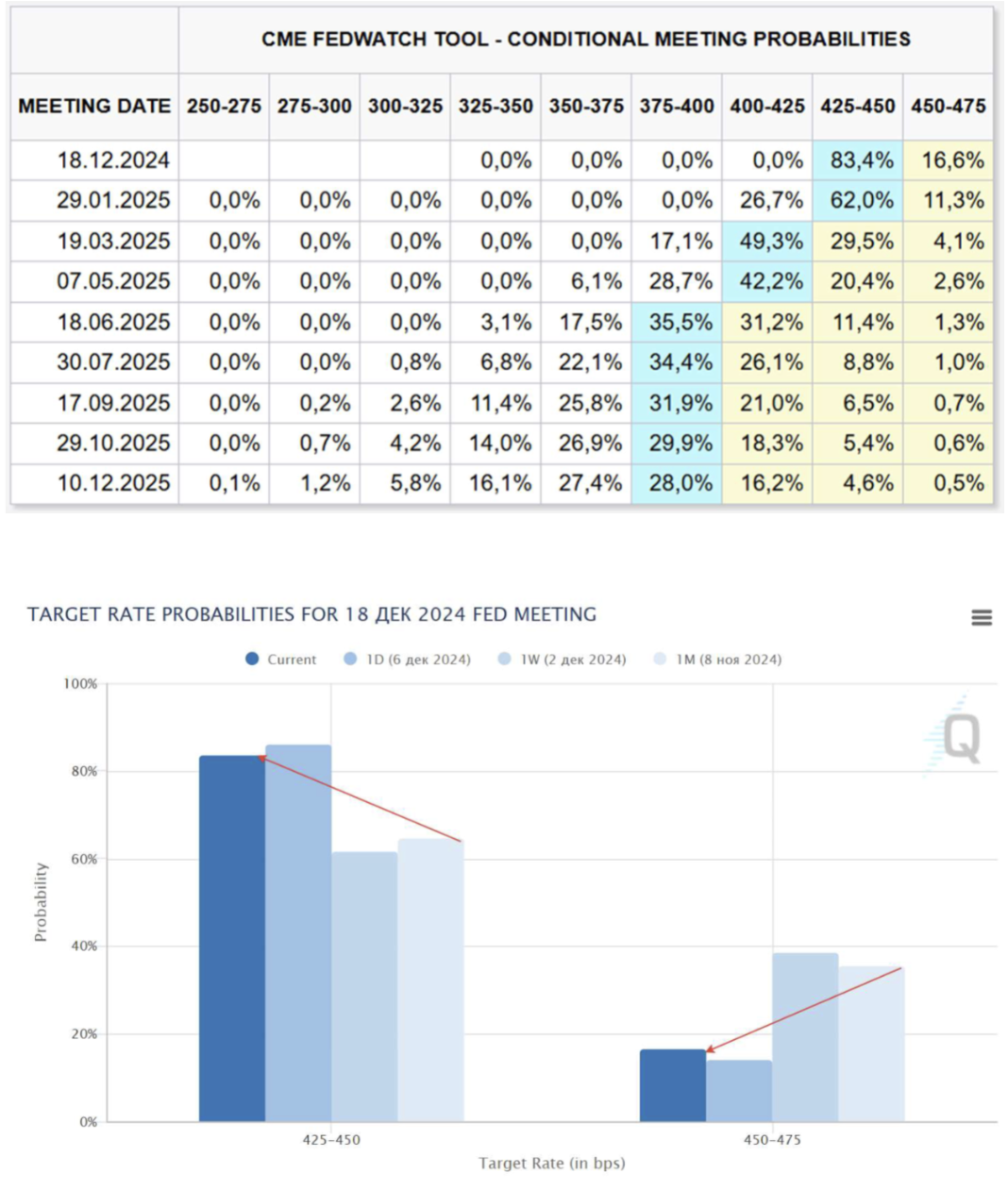

MARKET FORECAST FOR RATE

Expectations lean towards another rate cut at the December meeting to a range of 4.25%-4.50%. Long-term expectations: two more cuts of 0.25% each, bringing the range to 3.75%-4.00% by mid-2025.

Commentary:

The unemployment rate rose by 0.1% to 4.2%. At the same time, the labor market has recovered in terms of the number of new jobs (after the Boeing strike and the devZastation caused by hurricanes Helene and Milton): 227K vs 36K in October. The private sector has also recovered: 194K vs -2K. Employment increased in healthcare (+54K), recreation and hospitality (+53K), public administration (+33K), and social assistance (+19K).

The rhetoric of the Fed board members was quite positive:

- Fed Chairman Jerome Powell reduced the likelihood of future tensions in the relations with the Trump administration. Trump, in turn, said he would only seek Powell's resignation after his term expires in May 2026.

- Powell: The Fed will act cautiously by continuing to cut interest rates;

- The head of the Federal Reserve Bank of San Francisco, Daly, said that the rate cut this month is not final;

- Waller (Fed) supports the idea of a reduction at the next meeting. But he warned that progress in curbing inflation "may stall";

- Williams (Fed): The Fed should continue to cut rates; there are no signs of a recession in the United States.

Fedwatch for the following December meeting: another rate cut to the range of 4.25%- 4.50%. Last week's expectations dynamics were in favor of a rate cut. Long-term expectations: two more declines of 0.25% to 3.75-4.00% by mid-2025.

MARKET

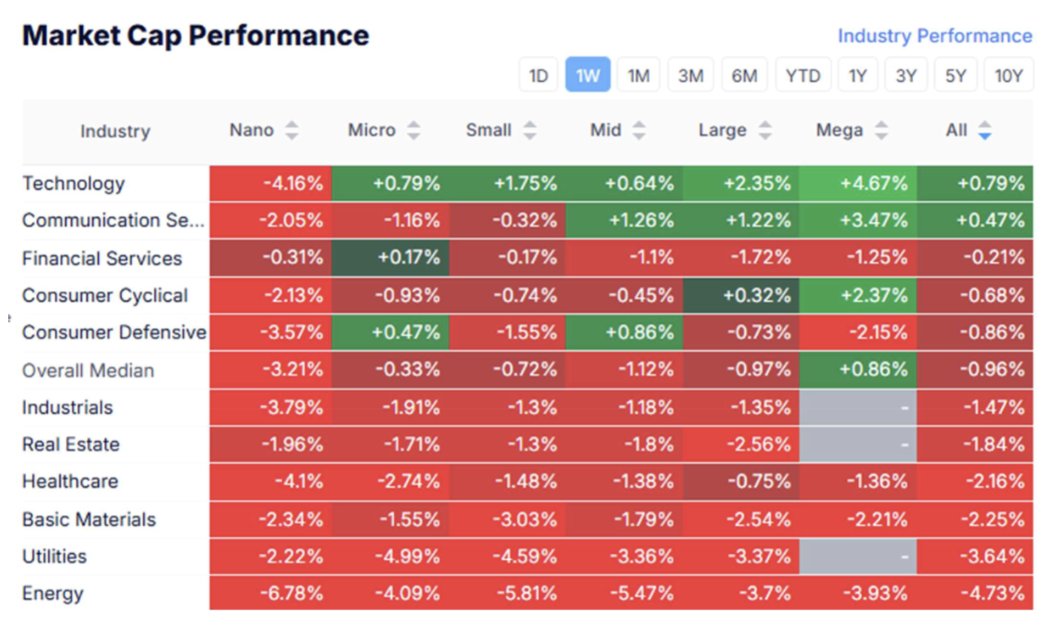

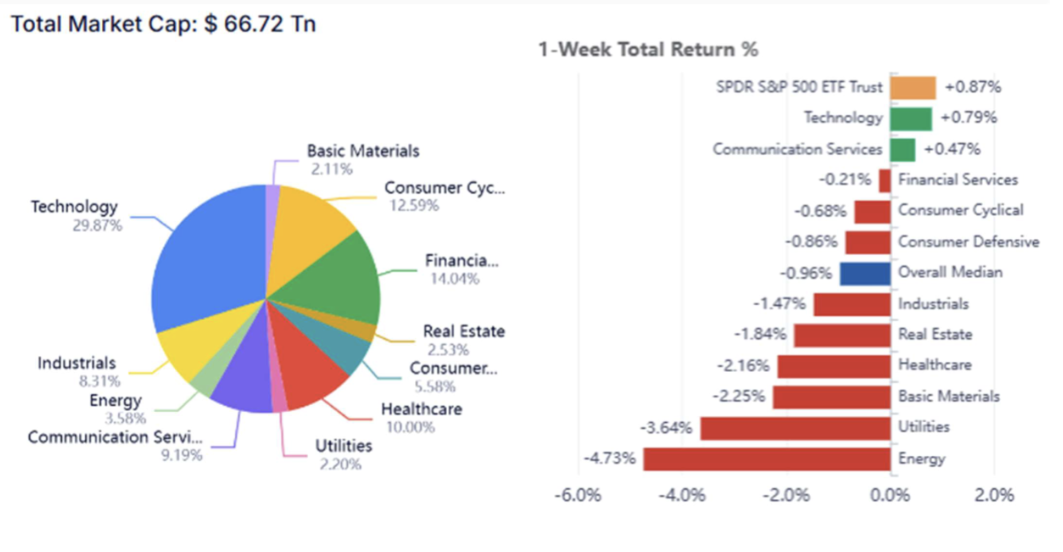

MARKET CAP PERFORMANCE

The stock market:

Last week, the market declined (median: - 0.96%). Some growth was observed in the technology and communications services sectors. The outsiders were basic materials, utilities, and the energy sector. The stock market capitalization is $66.72 trillion, with strong technology and financial sector dominance.

SP500

+0,84%. Another high of 6099.97 was broken on Friday:

NASDAQ100

+3.13% - another high of 21626.31:

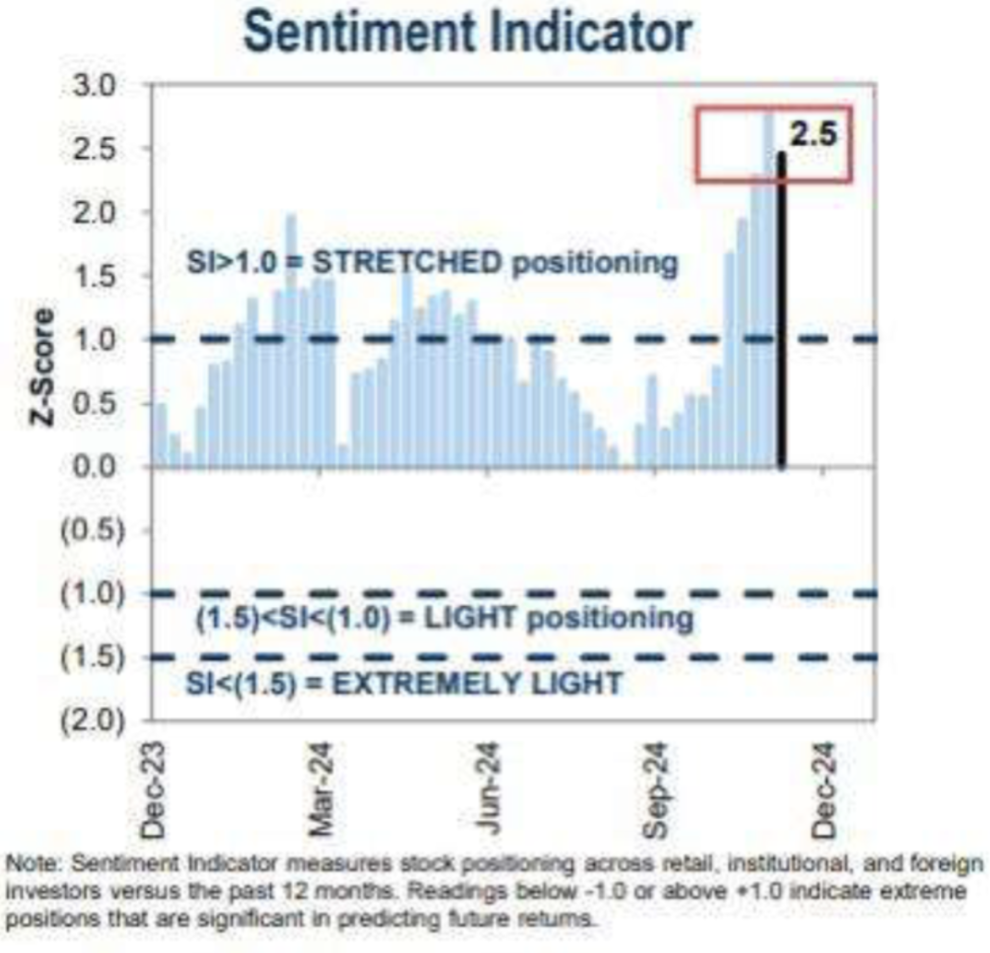

According to Goldman Sachs estimates, the mood in the stock market is at a highly optimistic level (a state of euphoria):

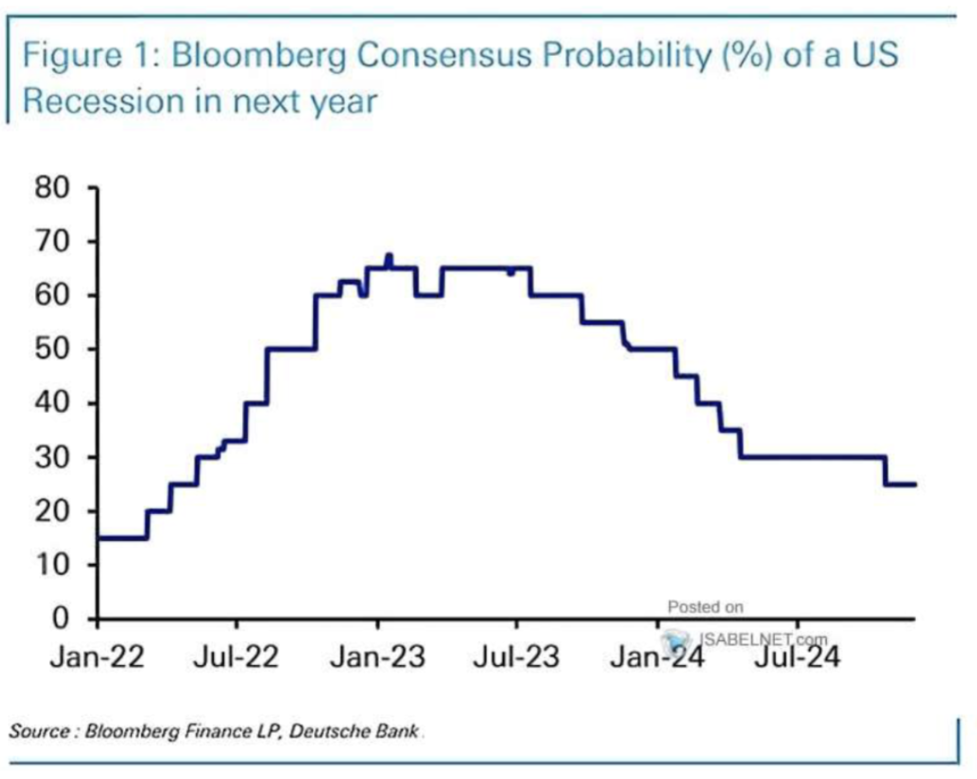

According to Bloomberg and DB estimates, the probability of a recession in the United States next year is about 25% (moderate risk of an economic downturn). The model shows a halving of the probability in 2023 and no change in 2024:

TREASURY MARKET

Treasury Bonds UST2: the price broke through the resistance level, and the growth, taking into account the gap, amounted to 0.34%:

Treasury Bonds UST10: +0.35%

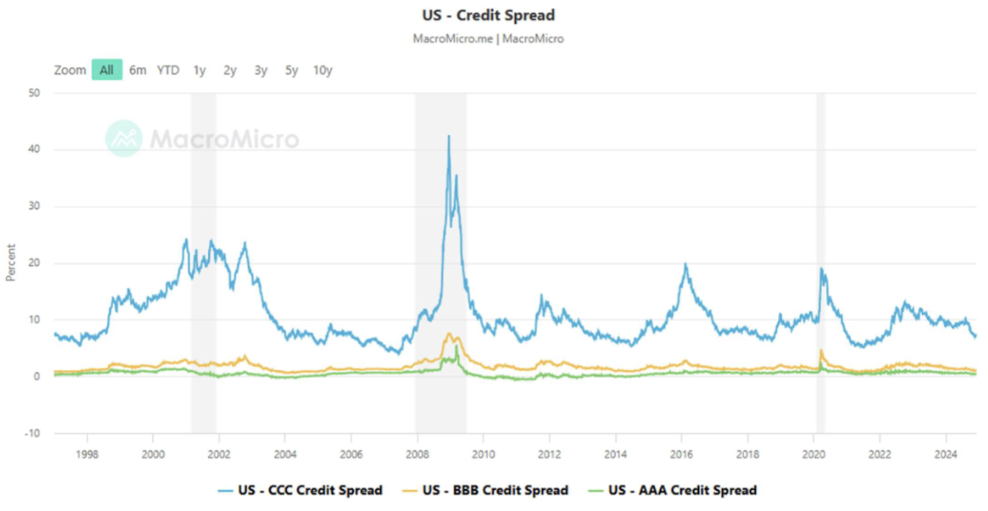

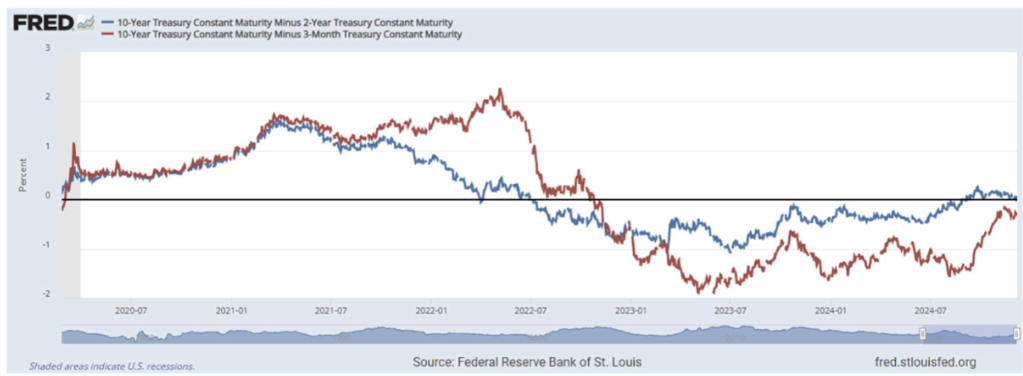

Yields and Spreads

A decline in Treasury bond yields is observed despite the regulator's cautious rhetoric—this is likely more related to the increase in market uncertainty.

-

Market yield of US Treasury securities with a fixed maturity of 2 years: 4.15%;

-

Market yield of US Treasury securities with a fixed maturity of 10 years: 4.17%;

-

The effective yield of the ICE BofA BB corporate index in the USA is 5.23%;

-

US - AAA credit spread: 0.42%;

-

US - BBB credit spread: 1.06%;

-

US - CCC credit spread: 7.22%

- 10-Year Treasury minus 2-Year Treasury: 0,05%;

- 10-Year Treasury Constant Maturity Minus 3-Month Treasury: -0,27%:

GOLD FUTURES

Gold Futures (GC): Last week: -0.73%, closing at $2,655/tr.oz.

DOLLAR FUTURES (DX)

Dollar Futures (DX): +0.14 (105.93)%

BTC

Bitcoin futures: historical high of $105,325 (December 05), week close of $101,580 (growth: +2.75%):

ETH

Ethereum futures: tested the upper resistance level while setting another high at $ 4142.5 (December 6). Closing of the week $4068.5 (growth: +7.70%):

THE CAPITALIZATION OF THE CRYPTO MARKET

The capitalization of the crypto market is $3.62 trillion (coinmarketcap.com). Last week, the share of Bitcoin decreased with the growth of ether (54.5% and 13.0%, respectively):

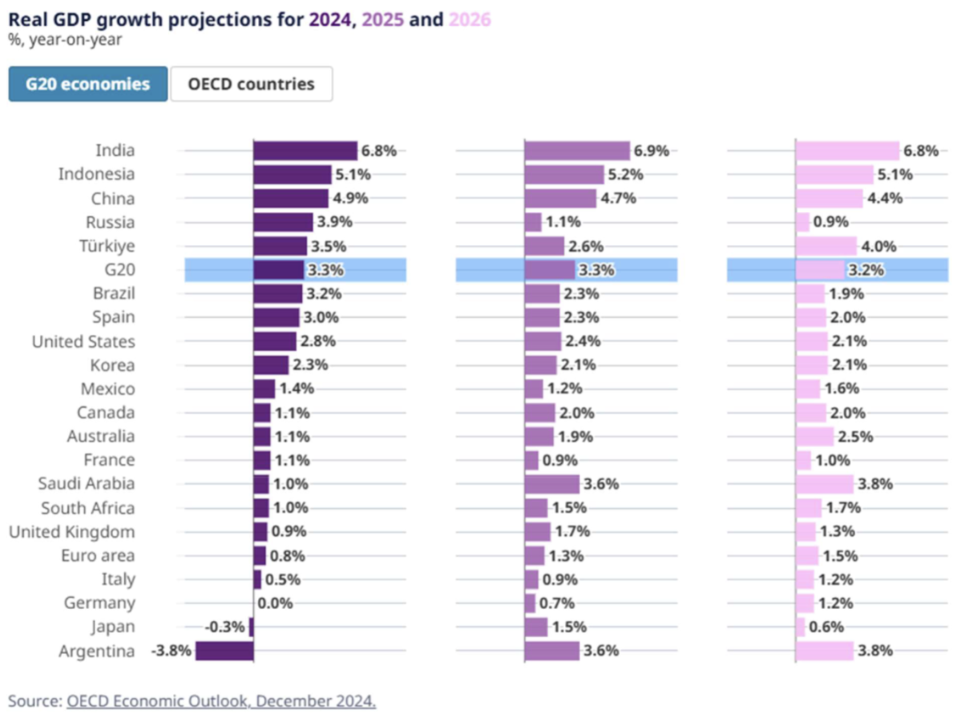

WORLD

The OECD (Organization for Economic Cooperation and Development) predicts that global GDP growth will accelerate slightly to 3.3% in 2025 and remain stable until 2026.

In the OECD countries, GDP growth is projected to be modest compared to the period before the pandemic — 1.9% in 2025 and 2026. In non-OECD countries, aggregate growth is also expected to remain broadly stable at current rates, with developing Asian countries continuing to make the most significant contribution to global growth.

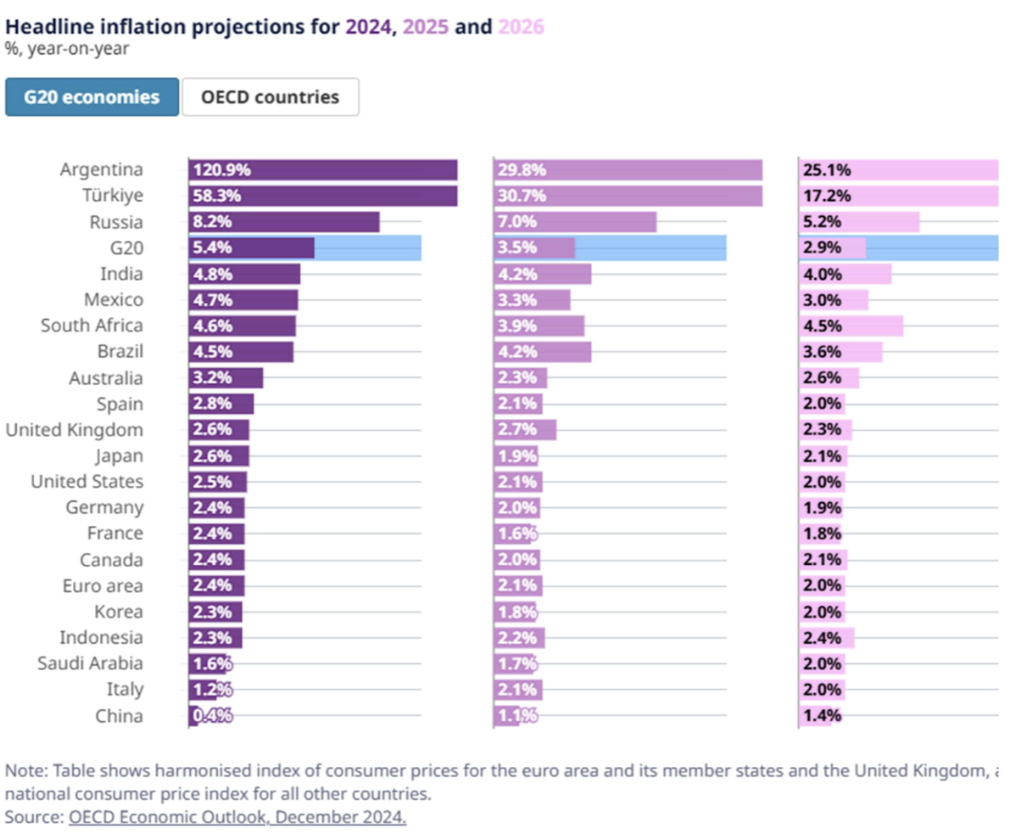

Inflation continued to decline in most countries until 2024 due to further falls in food, energy, and commodity prices. The report noted that service price inflation remains stable and amounted to about 4% in the OECD median economy in September. Annual consumer price inflation in the G20 countries is expected to continue. Inflation is expected to return to target levels in almost all remaining significant economies by the end of 2025 or early 2026.

This forecast is slightly higher than the October release from the IMF (World Monetary Fund) by an average of 0.1-0.2%. Still, they both generally reflect further economic growth with a slowdown but without a global recession.

Қазақша

Қазақша