December 30,2024 — January 5: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

No changes in key indicators over the past two weeks

INFLATION

- Core Consumer Price Index (CPI) (m/m) (November): 0.3% (prev: 0.3%);

- Consumer Price Index (CPI) (m/m) (November): 0.3% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (November): 3.3% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (November): 2.7% (prev: 2.6%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (October): 2.8%, prev: 2.6%;

- 5-year expected inflation (October): 3.0%, prev: 3.2%.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (November): 58.5 (October: 56.1);

- Manufacturing sector: 48.3 (October: 49.7);

- S&P Global Composite: 56.6 (October: 54.9).

GDP BEA (U.S. Bureau of Economic Analysis):

- Real GDP: 3.1% (prev: 3.0%);

- GDP Deflator (q/q) (Q3): 1.9% (prev: 2.5%)

Federal Reserve Inflation Target (PCE Index):

- U.S. Personal Consumption Expenditures Price Index (y/y) (November): 2.4% (prev: 2.3%);

- U.S. Core Personal Consumption Expenditures Price Index (y/y) (November): 2.8% (prev: 2.8%).

LABOR MARKET

- Unemployment rate (August): 4.2% (prev: 4.1%);

- Nonfarm payroll change (November): 227K (prev: 36K);

- Private nonfarm payroll change (November): 194K (prev: -2K revised);

- Average hourly earnings (y/y) (November): 4.0% (prev: 4.0%).

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%-4.50% (indicative);

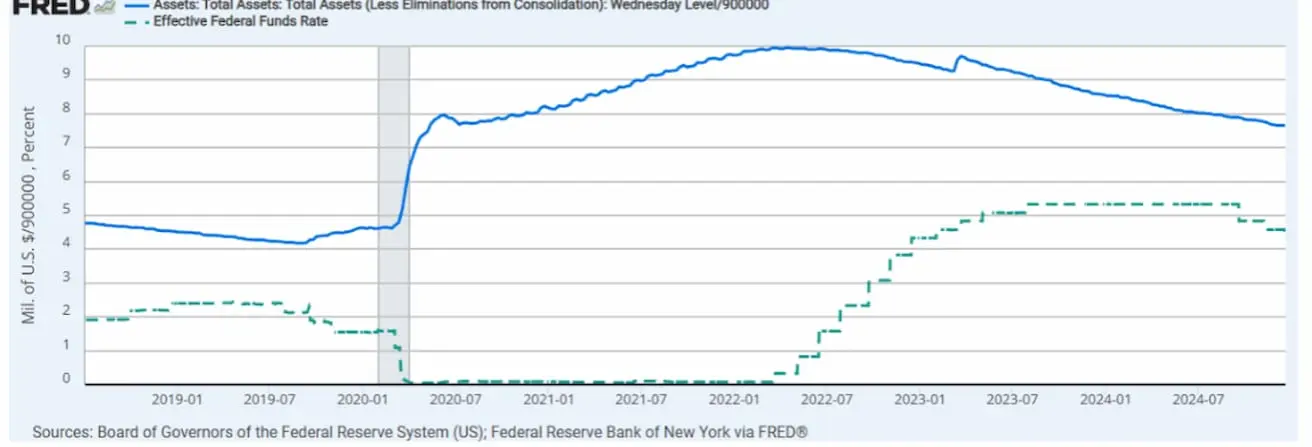

- Federal Reserve Balance Sheet (blue): decreased to $6.853 trillion (vs. $6.889 trillion last week).

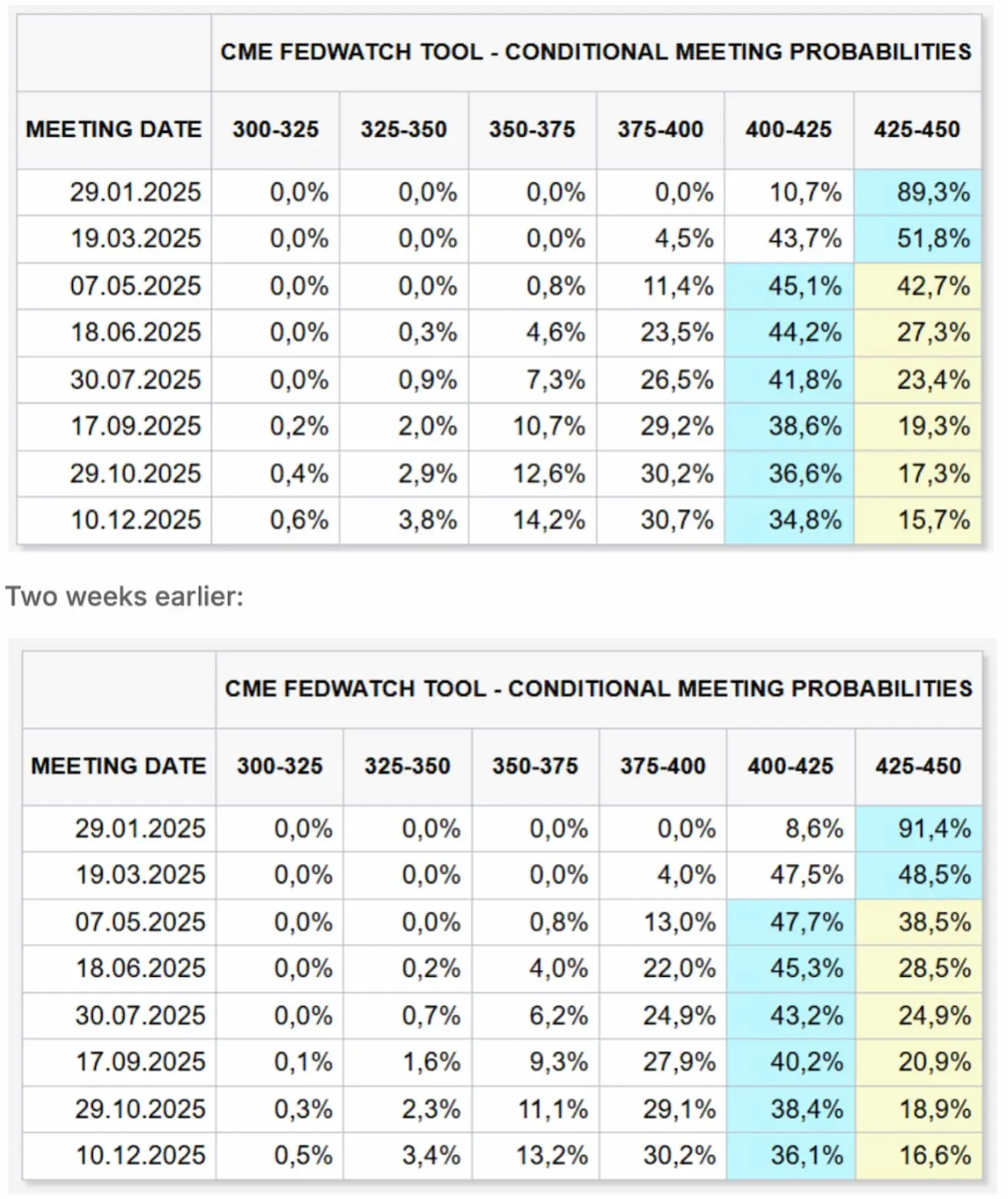

MARKET FORECAST FOR RATE

Today:

Commentary:

The next Federal Reserve meeting is on January 25. It is expected that the regulator will leave the rate unchanged. Over the next 12 months, one rate cut of 0.25% to the range of 4.00%-4.25% is anticipated in May.

MARKET

MARKET CAP PERFORMANCE

Stock market:

Last week saw an unusual trend. Except for the energy sector, large-cap companies across other sectors faced sell-offs. Mid-, small-, and micro-cap companies, however, were bought up, supporting stock indices. Median stock market growth: +0.81%.

SP500

+0.40% (week close: 5942.46);

NASDAQ100

+0.64% (week close: 21326.16);

TREASURY MARKET

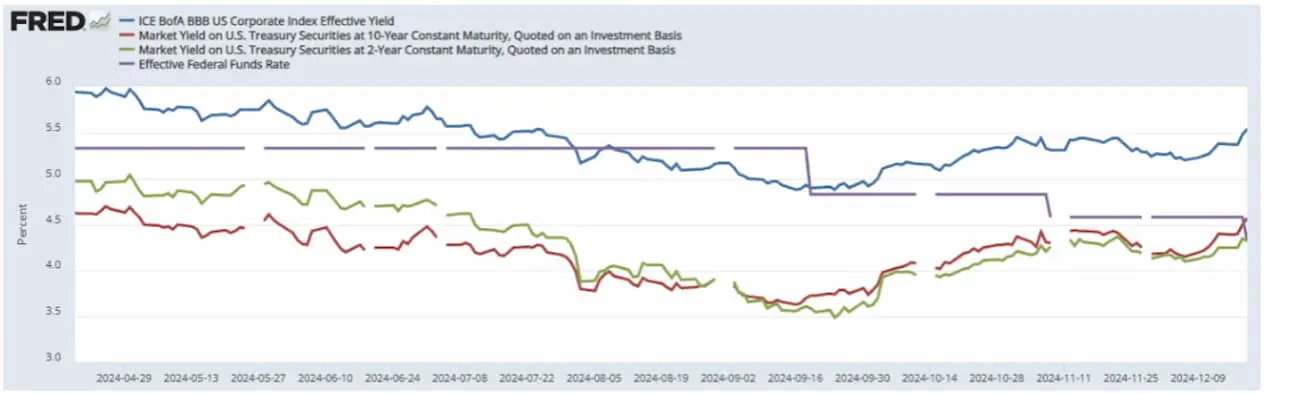

U.S. 10-Year Treasury Bonds (UST10): +0.16%.

YIELS AND SPREADS

Yields and Spreads (2024/12/05 vs 2024/12/05):

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4.57% (prev: 4.57%);

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.55% (prev: 5.55%);

- US - AAA Credit Spread: 0,36% (0,36%);

- US - BBB Credit Spread: 0,98% (0,97%);

- US - CCC Credit Spread: 7,15% (7,11%)

GOLD FUTURES

Last week growth: +0.63% (week close: $2652.7/oz).

OIL FUTURES

Growth: +5.33%, closing at $74.11.

In December, Berkshire Hathaway increased its position in Occidental Petroleum Corporation (OXY) by $409 million to 28.1%. Warren Buffett, in general, has been reducing his stock portfolio in favor of the money market (short-term U.S. bonds).

BTC FUTURES

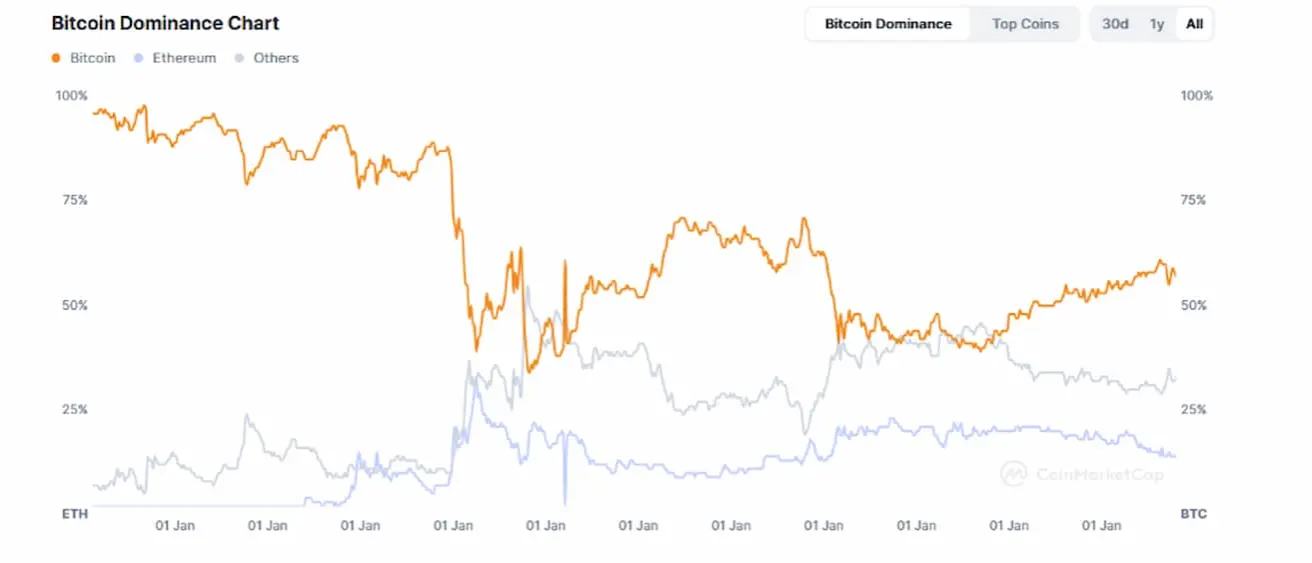

Testing a local resistance level. Weekly growth: +5.49% (week close: $99130).

ETH

Weekly growth: +8.16% (week close: $3652.5).

CRYPTO MARKET CAPITALIZATION

Total: $3.66 trillion (prev: $3.32 trillion) (coinmarketcap.com);

- Bitcoin Market Cap: 55.7% (prev: 57.3%);

- Ethereum Market Cap: 12.6% (prev: 12.1%);

- Others: 31.8%.

Қазақша

Қазақша