December 16 — 20: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (November): 0.3% (prev: 0.3%);

- Consumer Price Index (CPI) (m/m) (November): 0.3% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (November): 3.3% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (November): 2.7% (prev: 2.6%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (October): 2.8%, prev: 2.6%;

- 5-year expected inflation (October): 3.0%, prev: 3.2%.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (November): 58.5 (October: 56.1);

- Manufacturing sector: 48.3 (October: 49.7);

- S&P Global Composite: 56.6 (October: 54.9).

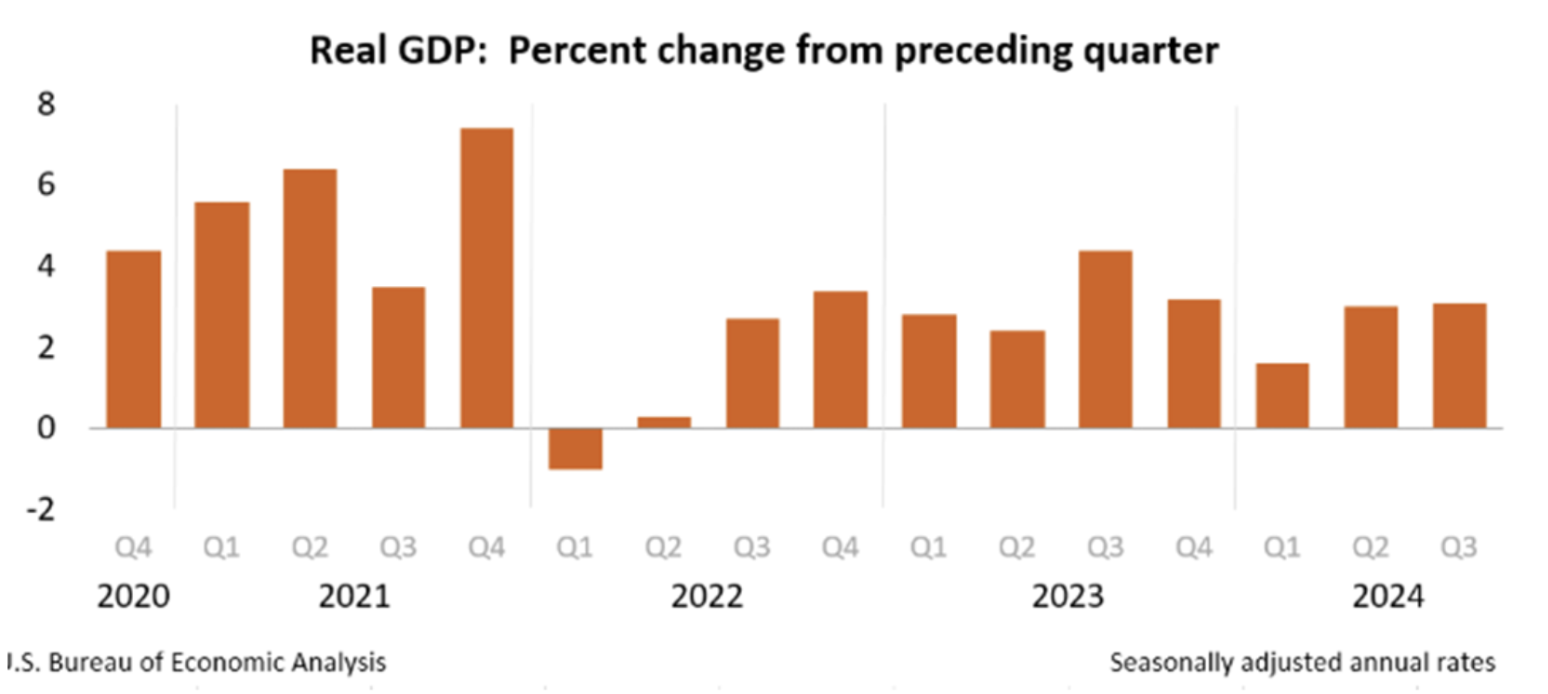

GDP BEA (U.S. Bureau of Economic Analysis):

- Real GDP: 3.1% (prev: 3.0%);

- GDP Deflator (q/q) (Q3): 1.9% (prev: 2.5%).

- GDP Forecast (Atlanta Fed): Short-term forecast: 3.1%.

Federal Reserve Inflation Target (PCE Index):

- U.S. Personal Consumption Expenditures Price Index (y/y) (November): 2.4% (prev: 2.3%);

- U.S. Core Personal Consumption Expenditures Price Index (y/y) (November): 2.8% (prev: 2.8%).

LABOR MARKET

- Unemployment rate (August): 4.2% (prev: 4.1%);

- Nonfarm payroll change (November): 227K (prev: 36K);

- Private nonfarm payroll change (November): 194K (prev: -2K revised);

- Average hourly earnings (y/y) (November): 4.0% (prev: 4.0%).

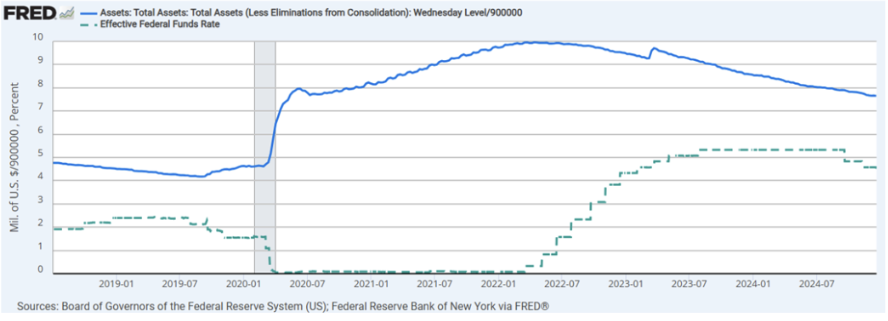

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%-4.50% (indicative);

- Federal Reserve Balance Sheet (blue): Increased to $6.889 trillion (vs last week: $6.897 trillion).

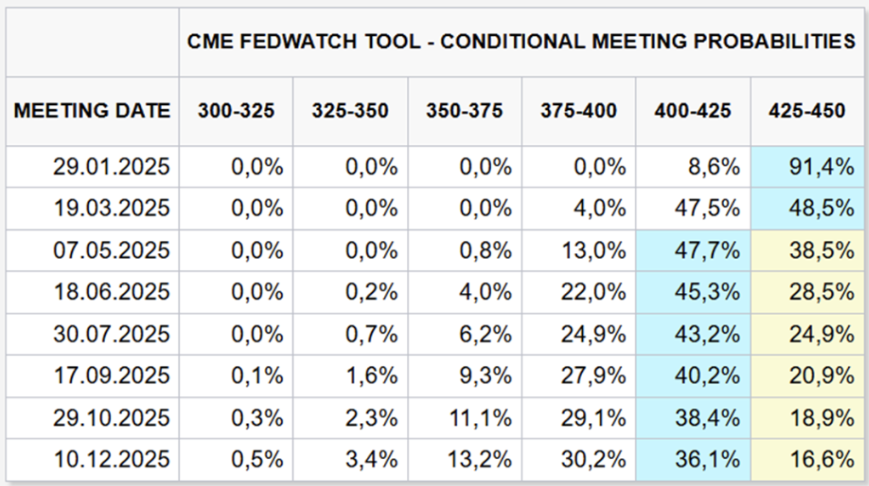

MARKET FORECAST FOR RATE

Donald Trump stated that Congress must abolish the debt ceiling.

Commentary:

Macroeconomic data last week was positive, with GDP growth exceeding earlier estimates.

According to the third estimate, real GDP grew at an annual rate of 3.1% in Q3 2024. The revision mainly reflects upward adjustments in exports and consumer spending, partially offset by downward revisions in private inventory investment. Imports, subtracted in GDP calculations, were revised upward.

PMI business activity indices showed continued expansion in the services sector but deceleration in manufacturing. The composite PMI reached a record high in April 2022.

The U.S. GDP Deflator (GDP Price Index) (q/q) has been declining since July this year, while the PCE indices (Federal Reserve inflation benchmark) reflect dynamics similar to CPI inflation. Core PCE and overall PCE have been rising since September.

Markets focused on last week's FOMC meeting, during which the interest rate was lowered by 0.25% to the 4.25%-4.50% range, and a plan for balance sheet reduction was continued.

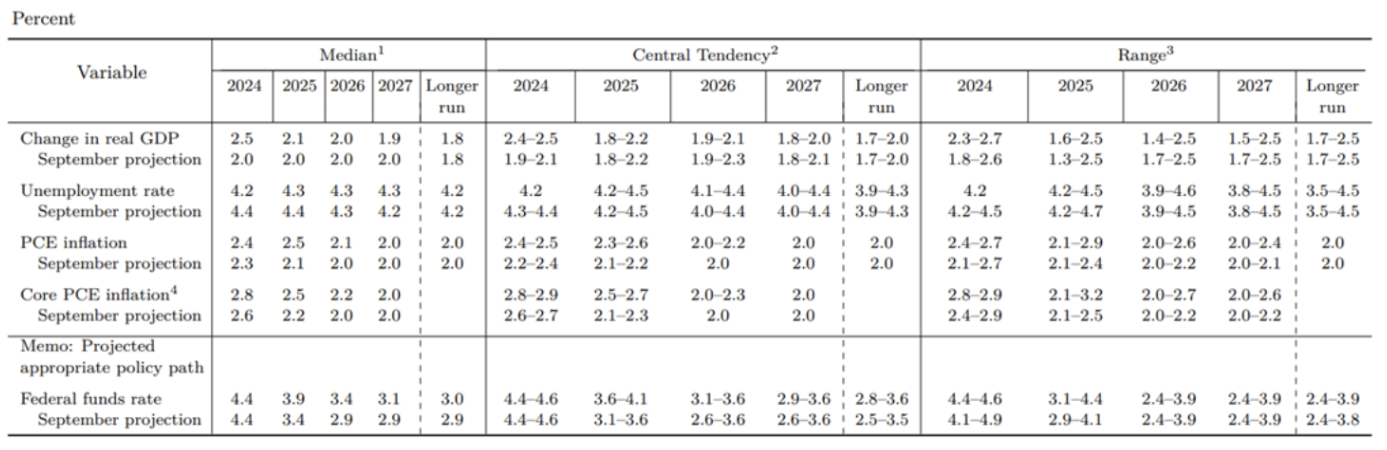

The committee significantly downgraded its inflation forecasts (PCE and core PCE) 2025 to 2.5%. Federal funds rate (EFFR) projections rose by 0.5% to 3.9% for 2025:

MARKET

MARKET CAP PERFORMANCE

The markets' reaction to the meeting results was adverse for all major asset classes, respectively, except for the dollar index.

The stock market:

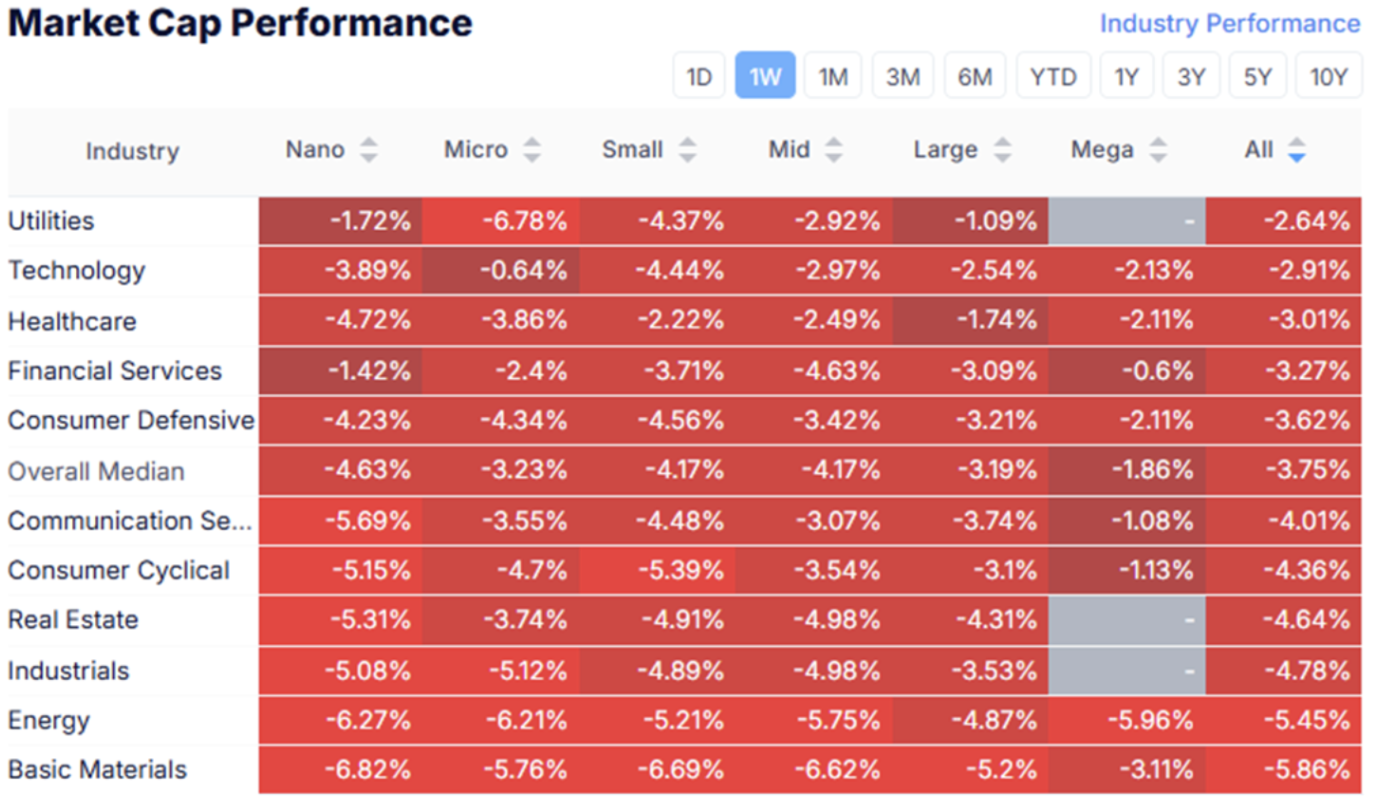

Last week, the market was in the red zone across all sectors (median decline: - 3.75%).

SP500

-2,20%:

NASDAQ100

+2.76%, with the historical maximum of 22096 set on December 16.

TREASURY MARKET

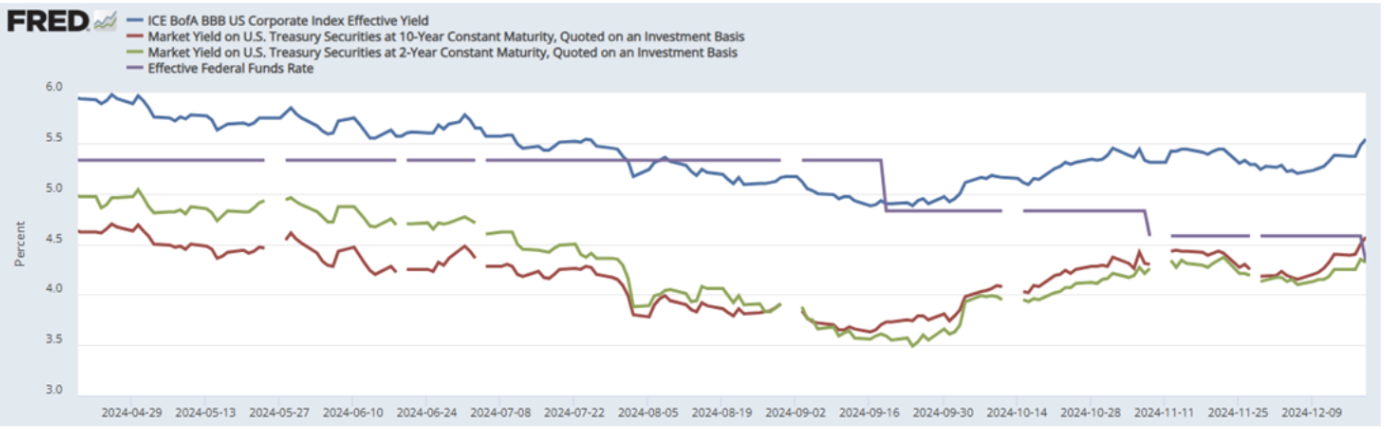

UST 2 Treasury bonds: -0,15%

Treasury Bonds UST10: -0,83%

Yields and Spreads

- Market Yield on U.S. Treasury Securities at 2-Year Constant Maturity: 4,32% (4,18%);

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4,57% (4,32)%;

- ICE BofA BBB US Corporate Index Effective Yield: 5,54% (5,32%):

- US - AAA Credit Spread: 0,36% (0,39%);

- US - BBB Credit Spread: 0,97% (0,98%);

- US - CCC Credit Spread: 7,11% (6,97%)

GOLD FUTURES

Gold Futures (GC): Last week: -1.02%, closing at $2,640.50/troy ounce

DOLLAR FUTURES (DX)

Dollar Futures (DX): +0.95 (107.555)% - November 2022 level:

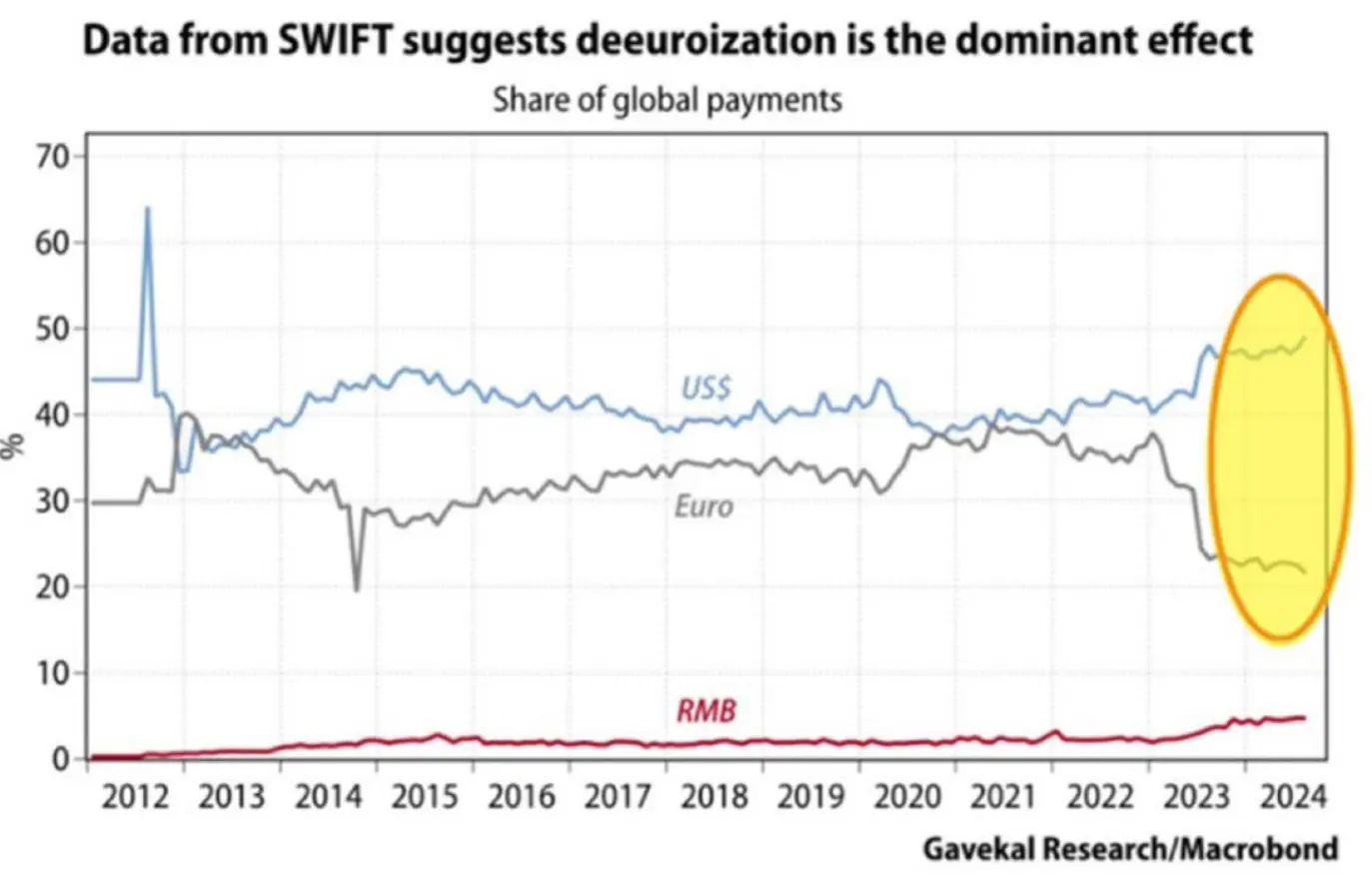

The dollar's share in global payments is approaching 50%, with a mirror decrease in the share.

EURO

BTC

Bitcoin futures: close of the week at $96685 (decrease by 6.72%):

ETH

Ethereum futures close the week at $3,928.0 (-12.28%):

THE CAPITALIZATION OF THE CRYPTO MARKET

Bitcoin Market Capitalization: 57.3% (56.4%), Ethereum: 12.1% (12.9%), Others: 30.5%:

Қазақша

Қазақша