First FED meeting in 2024

Raison financial analyst's key insights

Yesterday marked the first US Federal Reserve System (FED) meeting of the year in the United States regarding monetary policy.

As the market expected, the Committee decided to keep the interest rate unchanged in the 5.25-5.5% range and continue reducing the stock of valuable papers. Powell's rhetoric was moderately “dovish” at the press conference, without any aggression. The main narrative of the speech: the interest rate is likely at its peak in this tightening cycle, and if the economy develops as expected, the FRS could move to lower the rate. However, Powell repeatedly emphasized that the Committee needs more confidence that inflation is steadily approaching 2%. As of today, almost every committee member deems it appropriate to lower rates this year, but starting to lower rates in March is not the base scenario. A new point appeared in the rhetoric: the Committee plans to begin an in-depth discussion of balance issues at the next meeting in March. This fact hints at a possible winding down of QT in the medium term. Powell's rhetoric on inflation expectations has noticeably changed.

“There are good inflation data for six months, and more is expected. If inflation unexpectedly rises, the Committee will react, but at this stage, it would be a surprise.” If outstanding inflation data are received shortly, the FRS might start acting sooner and move faster.

“Stronger economic growth is now not seen as a problem by the Committee.” This thesis reinforces the “dovish” rhetoric, the opposite of the rhetoric throughout the entire monetary policy tightening cycle. Of course, Powell clarified there is still a long way to go before a “soft landing,” and the FRS is not declaring victory yet.

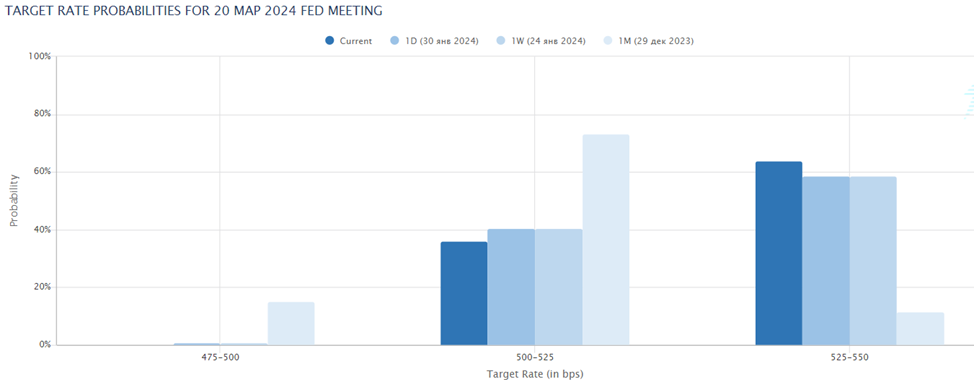

According to Fed Watch, at the end of the day, expectations of a rate cut continued to shift from March to May.

Қазақша

Қазақша