N26 vs. Revolut

The battleground for neo-banks is heating up as the industry continues to rise.

Neo-banks are continuously on the rise. The high consumer demand for more accessible and efficient ways to manage money allows the market to flourish in any conditions.

Neo-banks are digital-only banks with no physical branches. This business model allows companies to offer low-resource personal finance management features and superior user experiences—higher profitability and consumer attention pushing further the trend for digital-only banking services.

Source: Statista 2022, Number of downloads worldwide of European app-only banks

Source: Statista 2022, Number of downloads worldwide of European app-only banks

This trend is an excellent opportunity for investors to accumulate wealth from a long-term perspective. However, most neo-banks are private and are not traded on FTSE or Nasdaq.

Investment in private companies requires a lot of capital and is hardly available for retail investors. But with the help of blockchain technology, the barrier to entry has lowered dramatically, and private equity has become more affordable.

So to benefit from growing fintech unicorns, it is first vital to conduct a market and competitive analysis.

Neo-bank industry

According to GrandViewResearch, the global neo-bank market was valued at $35 billion in 2020 and is expected to reach $722 billion by 2028. The market is estimated to grow at a compound annual growth rate (CAGR) of 47%.

In 2021 alone, the largest eight neo-banks from Europe and the US earned more than $47 billion in revenue, according to Statista.

The European region dominated the neo-banking market in 2020 and 2021 and accounted for over 35.0% of global revenues.

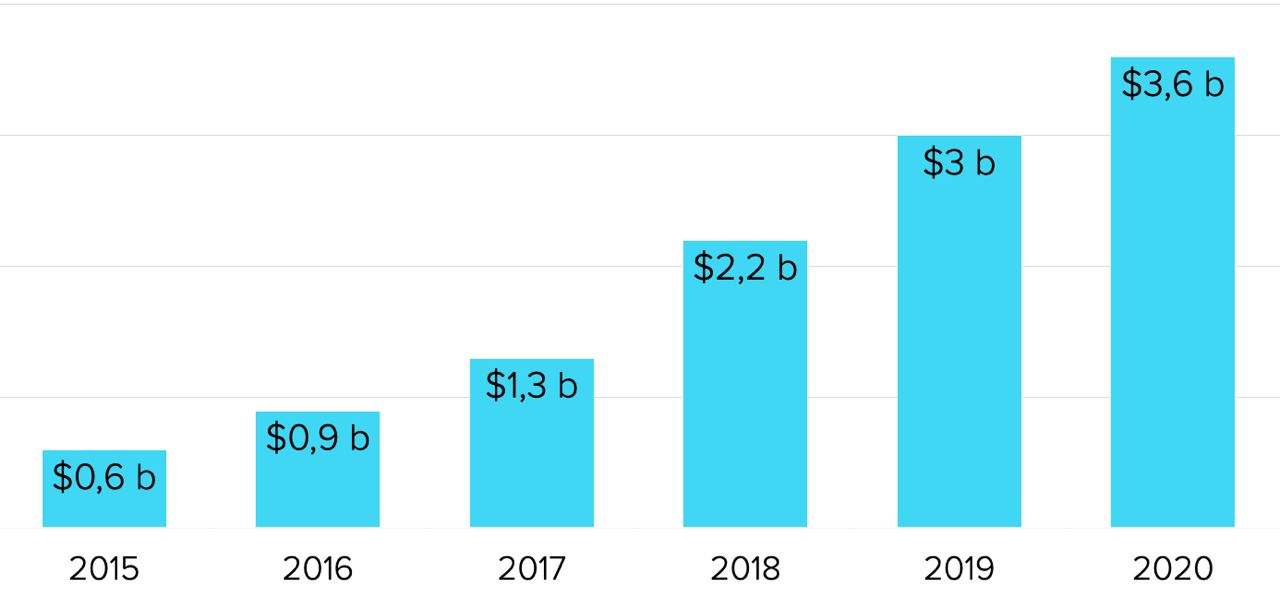

Source: MEDICI, Forbes, Company Data

Source: MEDICI, Forbes, Company Data

The most prominent players in the market are American Chime and SoFi, challenger banks from Great Britain: Revolut, Monzo, Starling, and European N26.

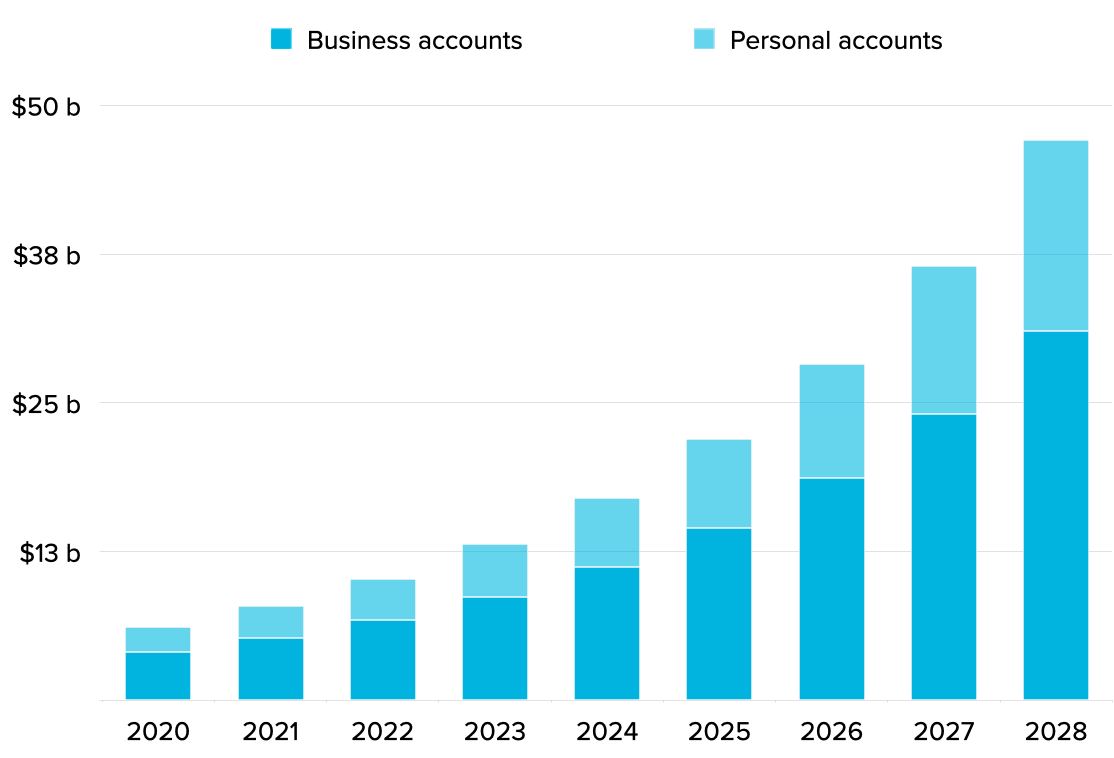

Neo-banks are now focusing on serving corporate clients. They accounted for more than half of new users among European neo-banks, according to GrandViewResearch. Neo-banks offer business solutions with advanced interfaces and valuable information for services such as accounts payable and receivable, payments, and bank statements.

Source: Forecasted American neo-bank industry size by account type, GrandViewResearch

Source: Forecasted American neo-bank industry size by account type, GrandViewResearch

Competitive analysis

Since US and Brazilian banks are only available in their home countries, the most international neo-banks are Revolut and N26. Both companies are present in 25+ countries worldwide and recently entered the US market.

N26

N26 is a leading European neo-bank that operates under the BaFin license. In 2021 the number of the bank's users exceeded 7 million.

In 2020 alone, 2 million new users were connected to the service. In October 2021, the company expanded its funding for Series E by an additional $900 million, rising to a $9B valuation.

The lead investors are Allianz X, Peter Thiel, and Tencent.

N26 was selected as the best international bank in 2021, according to research by Forbes and Statista.

Revolut

The startup was launched in the UK, offering money transfer and exchange services. Today, it has added several innovative products like the open banking system, gold futures, and cryptocurrencies wallet, including Bitcoin and Ethereum.

In 2020 Revolut decided to expand in the US market. Now the company operates in 37 countries, with more than 15 million accounts opened.

The last funding round made Revolut the second largest fintech startup in Europe, with a $35 billion valuation.

Risks

As in any other investment, there are related risks. First, without any physical branches and the highest competition, neo-banks can charge the lowest or even zero interest rates.

This translates into a low business margin, meaning that finding profitable products can take a long time. Moreover, there is additional competition from traditional banks that enter the space of digital banking.

The subsequent significant risk is international regulation.

The UK branch of N26 closed due to complications after Brexit, which led to a company losing about $26 million. Global regulations in the financial sector could negatively affect the development of the industry.

Conclusion

Nevertheless, Revolut and N26 are backed by the biggest venture funds and investment houses. The need for digital-only banking is increasing worldwide, meaning the demand for such service will only push the industry for further development.

For private equity investors, that means only one thing — a high investment return.

Қазақша

Қазақша