October 27–31, 2025: Weekly economic update

Key market updates

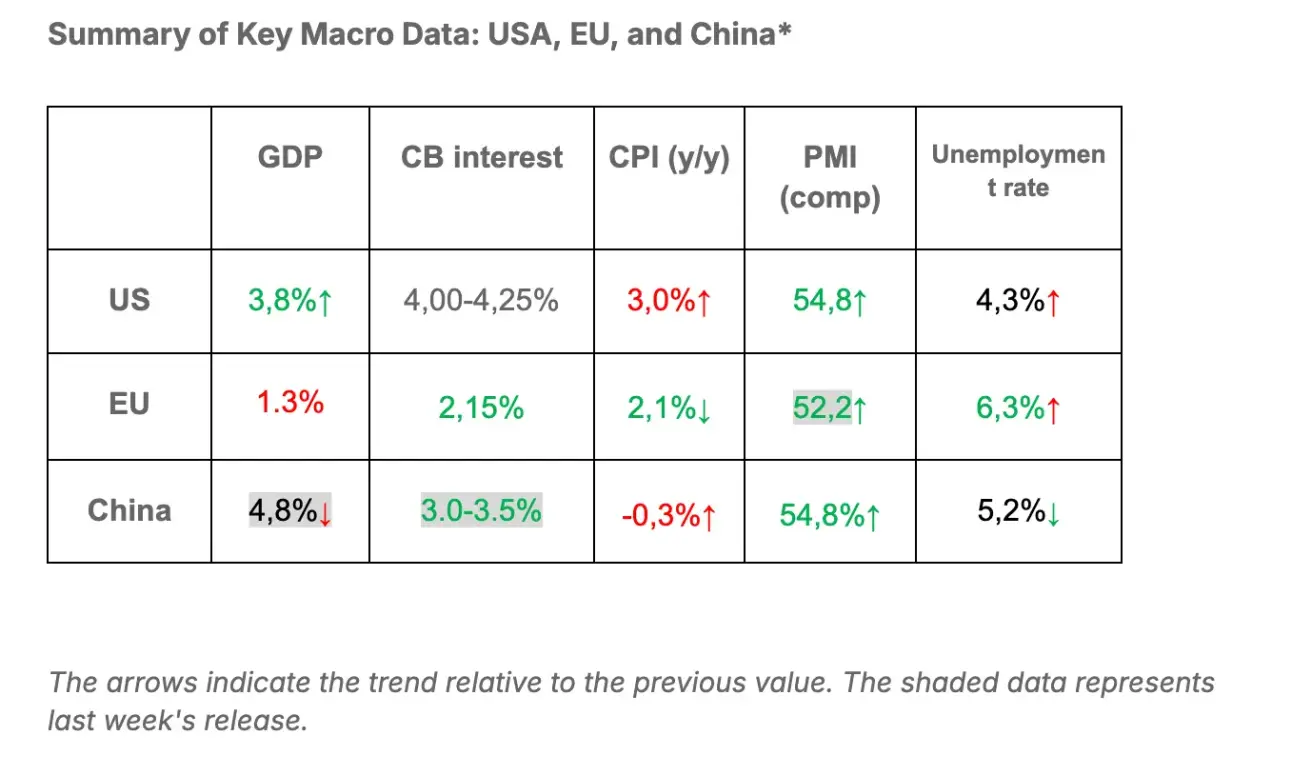

Macroeconomic Statistics

INFLATION

- Core Consumer Price Index (CPI) (m/m) (August): 0,2% (previous: 0.3%)

- Consumer Price Index (CPI) (m/m) (August): 0.3% (previous: 0.4%)

- Core Consumer Price Index (CPI) (y/y) (August): 3.0% (previous: 3.1%)

- Consumer Price Index (CPI) (y/y) (August): 3.0% (previous: 2.9%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (August): 4.6% (prev: 4.7%)

- 5-year expected inflation (August): 3.9% (prev: 3.7%)

PRODUCER PRICE INDEX (PPI):

- PPI (m/m) (August): -0.1%, prev: 0.7%

- Core PPI (m/m) (August): -0.1%, prev: 0.7%

*** GDP (U.S. Bureau of Economic Analysis, BEA) (Q2 2025, annualized, second estimate): +3.8% (advance estimate: 3.30%; Q1 2024: – 0.5%)

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (September): 55.2 (previous: 54.2)

- Manufacturing sector (September): 52.2 (previous: 52.0)

- S&P Global Composite (September): 54.8 (previous: 53.9)

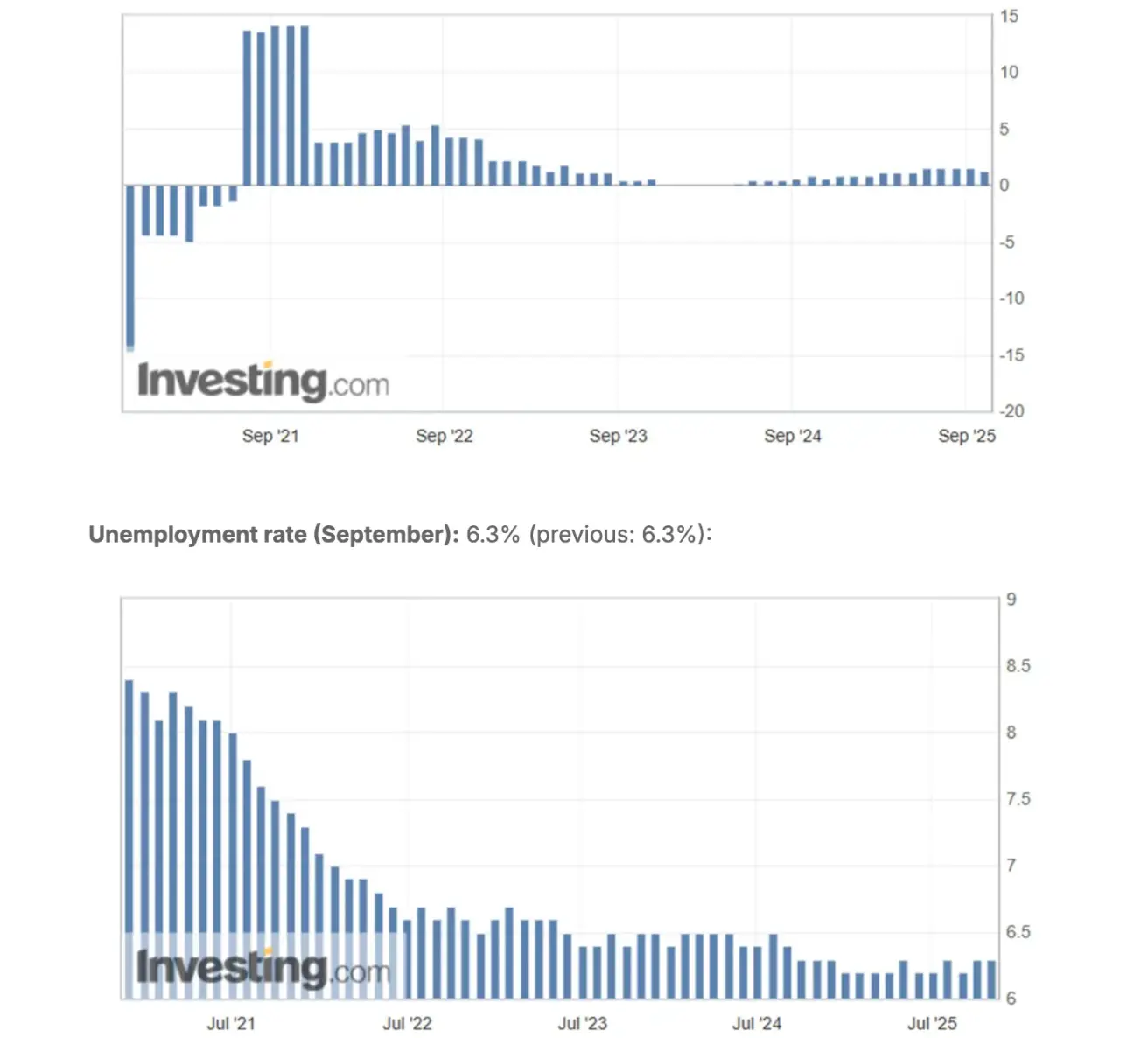

LABOR MARKET:

- Unemployment rate (August): 4.3% (previous: 4.2%)

- Total number of individuals receiving unemployment benefits in the US: 1,926K (vs 1,920K).

- Change in nonfarm payrolls (August): 22K (previously revised: 79K)

- Change in U.S. private nonfarm payrolls: 38K (previous: 77K)

- Average hourly earnings: 3.7% (previous: 3.9%)

- JOLTS job openings: 7.227M (vs. 7.181M)

- ADP Nonfarm Employment Change (Sep): -32K (vs -3K)

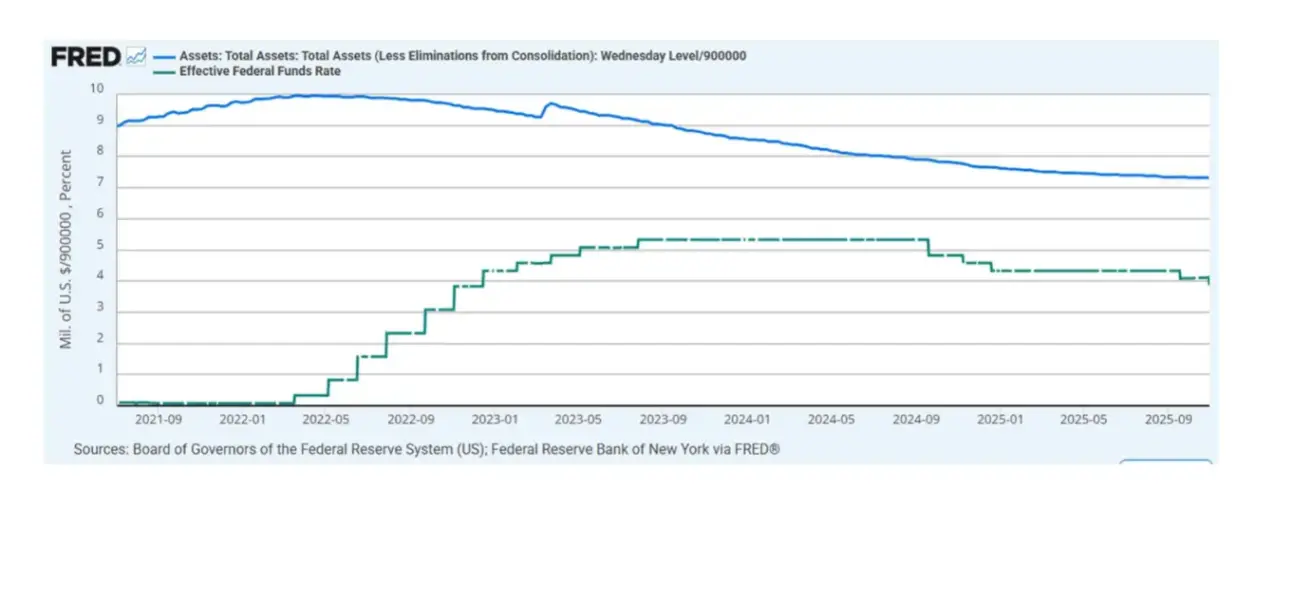

MONETARY POLICY

- Federal Funds Effective Rate (EFFR): 3.75% - 4.0%

- Federal Reserve balance sheet increased: $6,587T (vs. previous week: $6,589T)

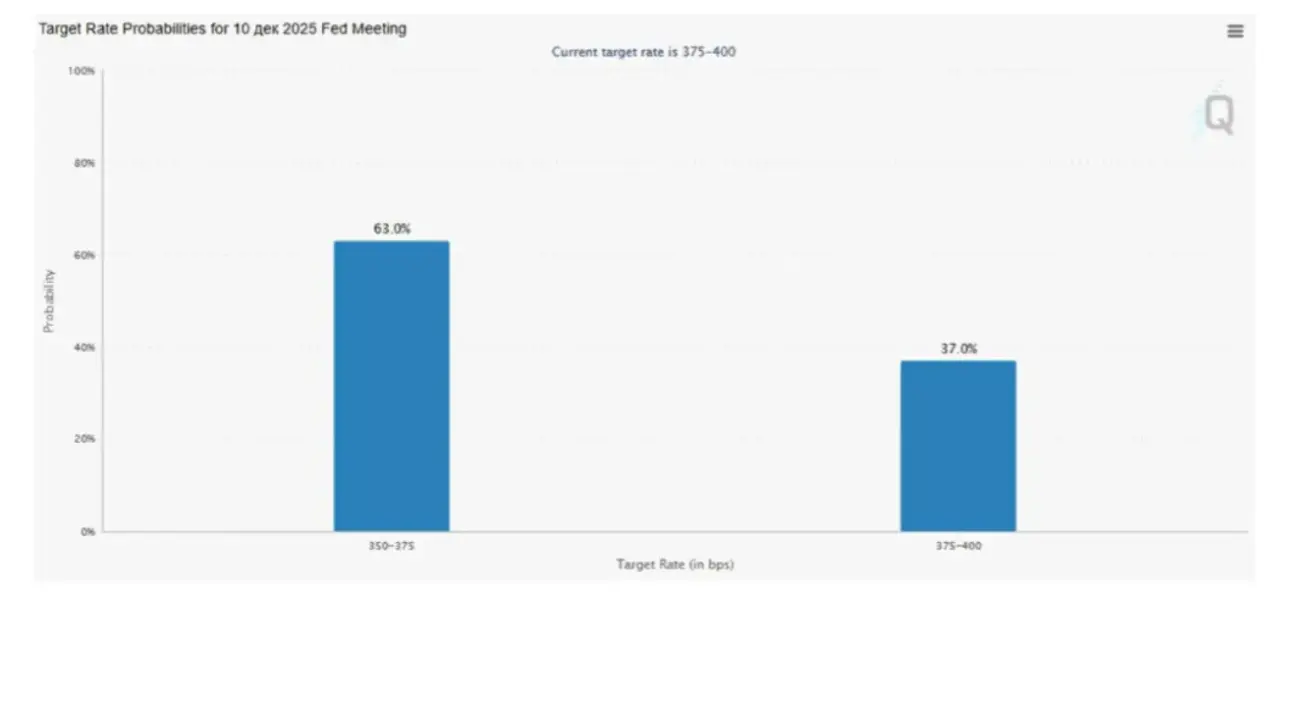

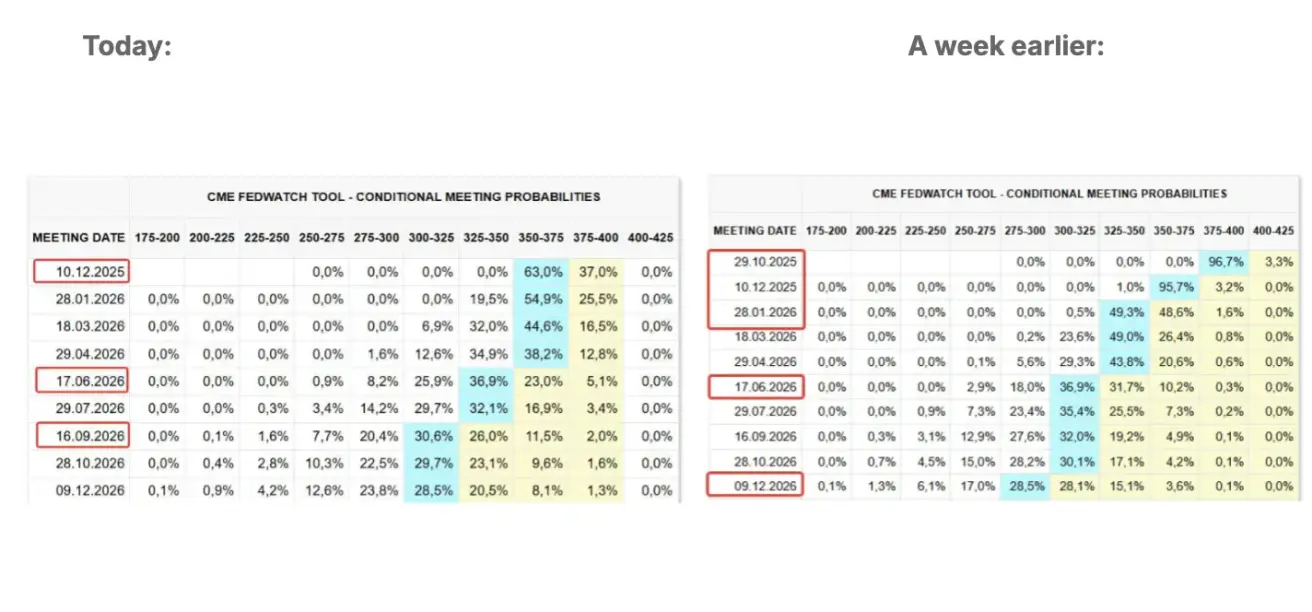

MARKET FORECAST FOR RATE (FEDWATCH)

- Expectations for the upcoming FOMC meeting on October 29:

Commentary:

The sixth FOMC meeting took place, marking another step toward a more neutral monetary policy stance. The interest rate was lowered by 25 basis points, as expected, to a range of 3.75–4.00%, alongside a decision to end balance sheet reduction starting December 1 of this year.

The key message: a rate cut in December remains uncertain, but monetary policy is expected to gradually shift toward a more neutral stance.

In its baseline scenario, the Fed still expects the recent tariff measures to have a one-off inflationary effect. On the labor market side, the regulator sees gradual cooling, “but nothing more” — this has become the main rationale for a potential pause in rate cuts in December.

The Fed believes there are conditions for further gradual policy easing without jeopardizing price stability. Meanwhile, markets are still pricing in a 63% probability of a rate cut at the December meeting. Market expectations according to FedWatch:

- At the next meeting on December 10, the estimated probability of a 25 basis point rate cut stands at 63.0%.

- Over the next 12 months, markets are pricing in three additional 25 basis point cuts, bringing the target range down to 3.00–3.25%. Key outcomes of the Trump–Xi Jinping meeting:

- Tariffs related to fentanyl will be reduced from 20% to 10%;

- Other tariffs on Chinese goods will be lowered from 57% to 47%;

- China will lift restrictions on rare earth metal exports;

- China will resume purchases of soybeans;

- Upcoming negotiations will focus on semiconductor trade.

Market

SP500

Growth for the week: +0.71% (week closed at 6 840.19). Year-to-date performance for 2025: +15.87%.

NASDAQ100

Weekly performance: +1.97% (week closed at 25858,13). Year-to-date performance: +22.43%.

Russel 2000

Weekly performance: -1,36% (week closed at 2,479.38). Year-to-date performance: +10.63%.

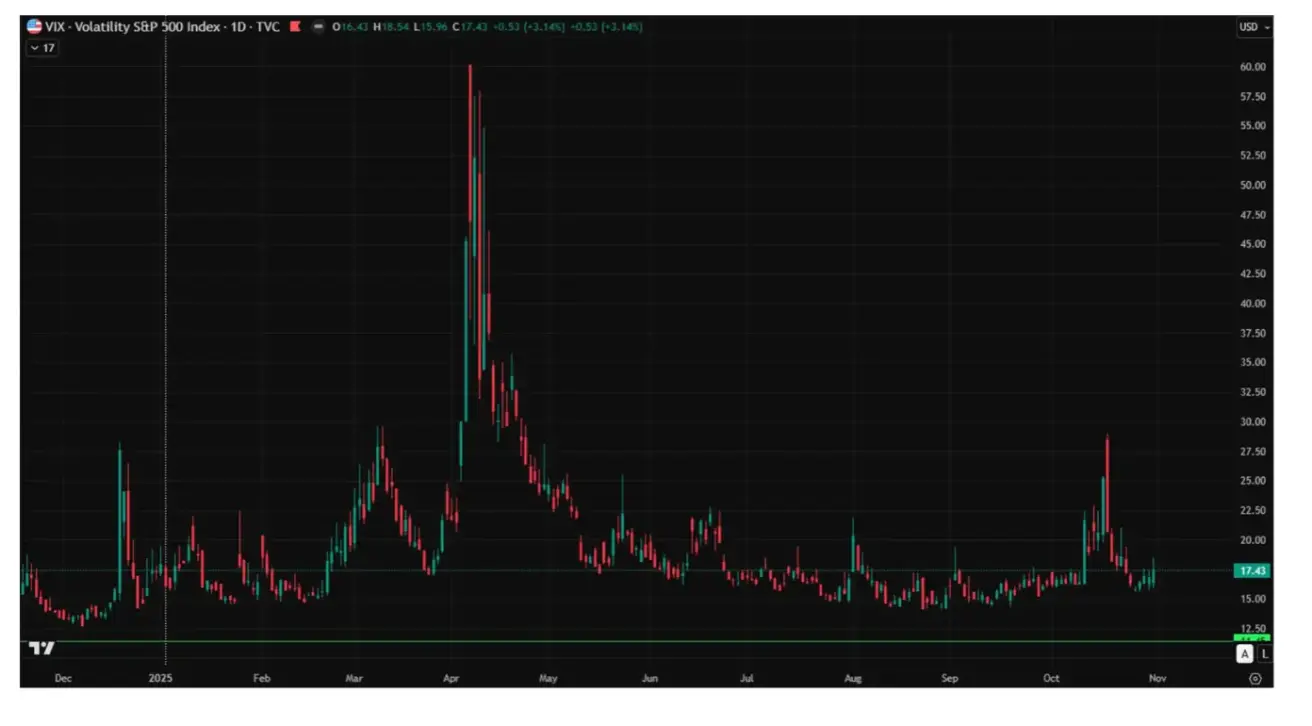

VIX

Week closed at: 17.43

Eurozone

The ECB kept interest rates unchanged, viewing current policy as sufficient to maintain inflation close to the target level.

- Deposit rate: 2.0% (previously 2.0%)

- Marginal lending rate: 2.4% (previously 2.4%)

- Main refinancing rate: 2.15% (previously 2.15%)

- Core Consumer Price Index (YoY, October): 2.4% (previous: 2.4%)

- Consumer Price Index (YoY, October): 2.1% (previous: 2.2%) GDP for Q3:

- Quarter-over-quarter: 0.2% (previous: 0.1%)

- Year-over-year: 1.3% (previous: 1.5%)

Euro Stoxx 600

Weekly performance: +0.47% (week closed at 573.1). Year-to-date growth: +13.35%.

CSI 300 Index

Weekly performance: -0.43% (week closed at 4,640.66). Year-to-date growth: +18.05%.

Hang Seng TECH Index (HSTECH.HK)

Weekly performance: -2.51% (week closed at 5908,08). Year-to-date growth: +33.16%.

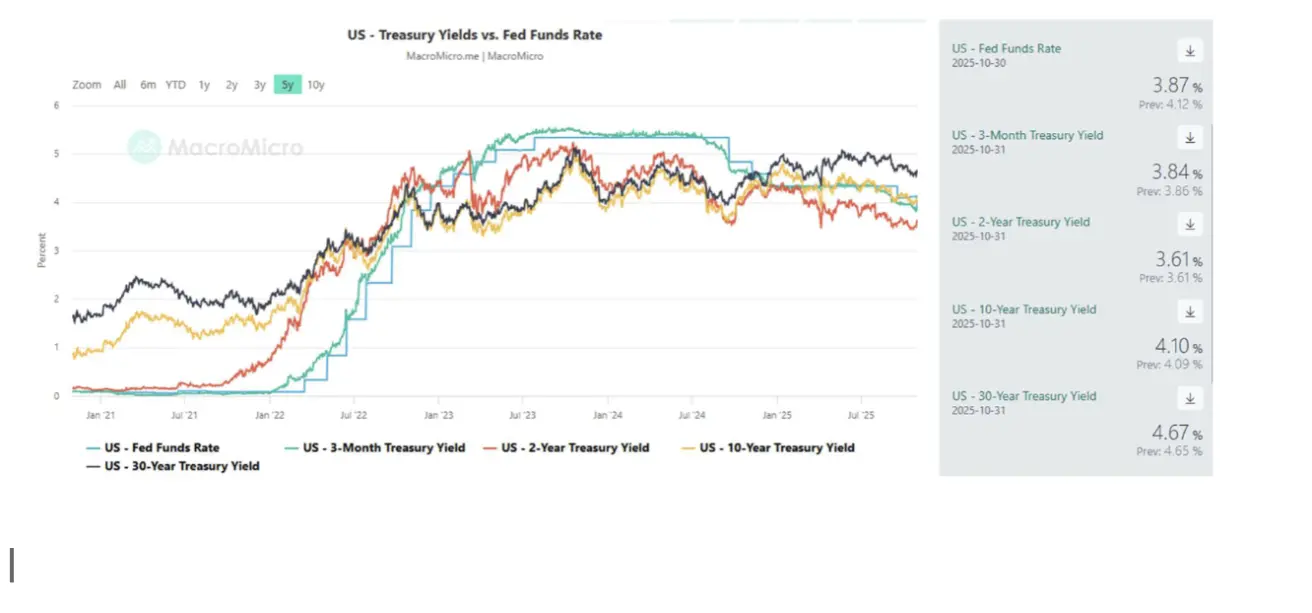

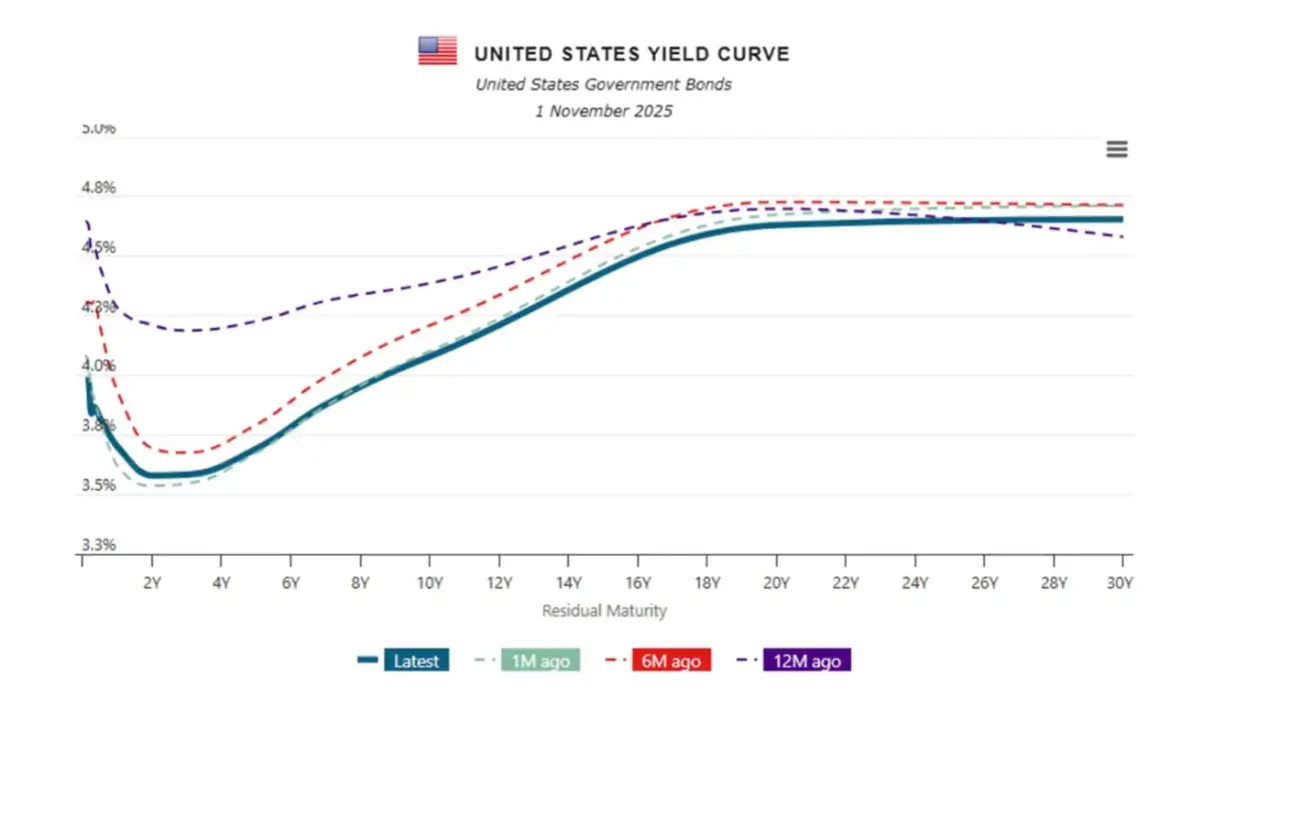

BOND MARKET

Bond Market – Yields Rise Following the Fed Meeting U.S. Treasury Bonds 20+ (ETF: TLT): ended the week down 1.29% (weekly close: 90.29). Year-to-date performance: +2.84%.

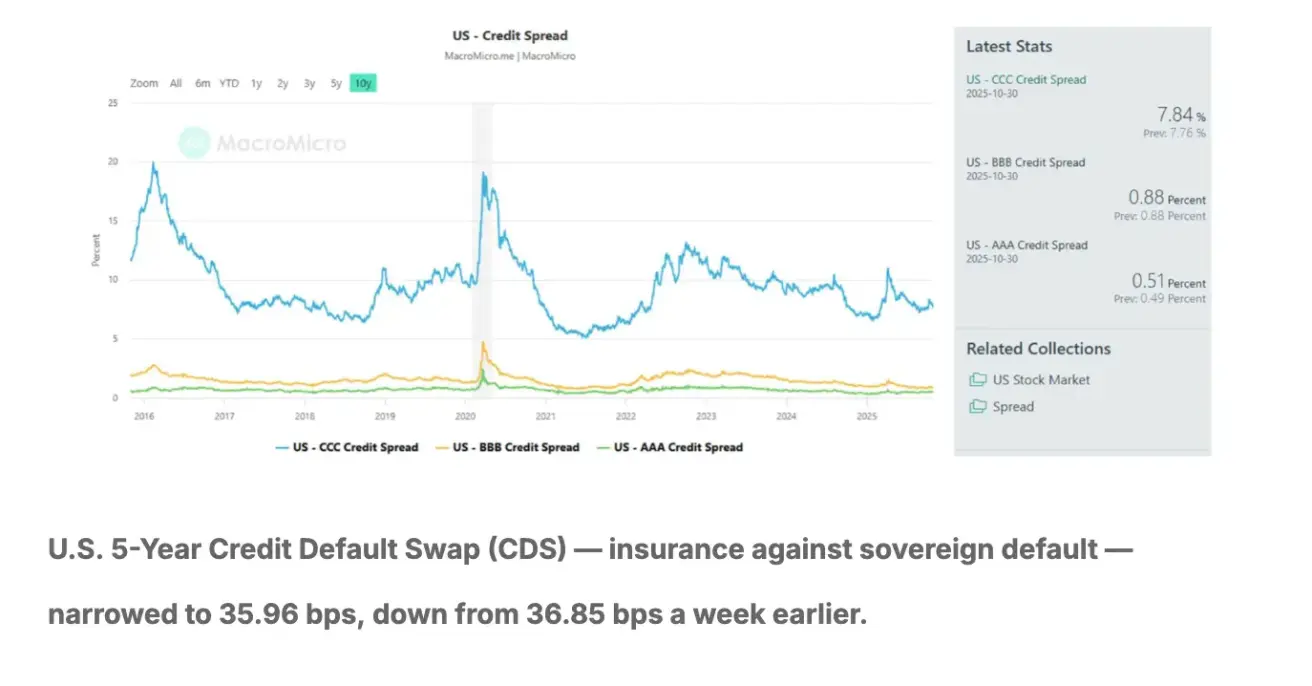

YIELDS AND SPREADS

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4.10% (vs 4.03%). 2-Year Treasury Yield: 3.61% (vs 3.51%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 4.97% (vs 4.90%)

- The yield spread between 10-year and 2-year U.S. Treasuries is 52.0 bps (vs 55.0 bps),

- while the spread between 10-year and 3-month Treasuries is 15.0 bps (vs 8.0 bps).

GOLD FUTURES (GC)

Gold futures (GC) ended the week down -2.75%, closing at $4,013.4 per troy ounce. Year-to-date performance remains strong at +51.97%.

DOLLAR INDEX FUTURES (DX)

Weekly performance: +0.81% (week closed at 99.545).Year-to-date performance: –8.11%. Political uncertainty risks remain elevated.

OIL FUTURES

Weekly performance: -0,91% (week closed at $60.88 per barrel).Year-to-date performance: –15.27%.

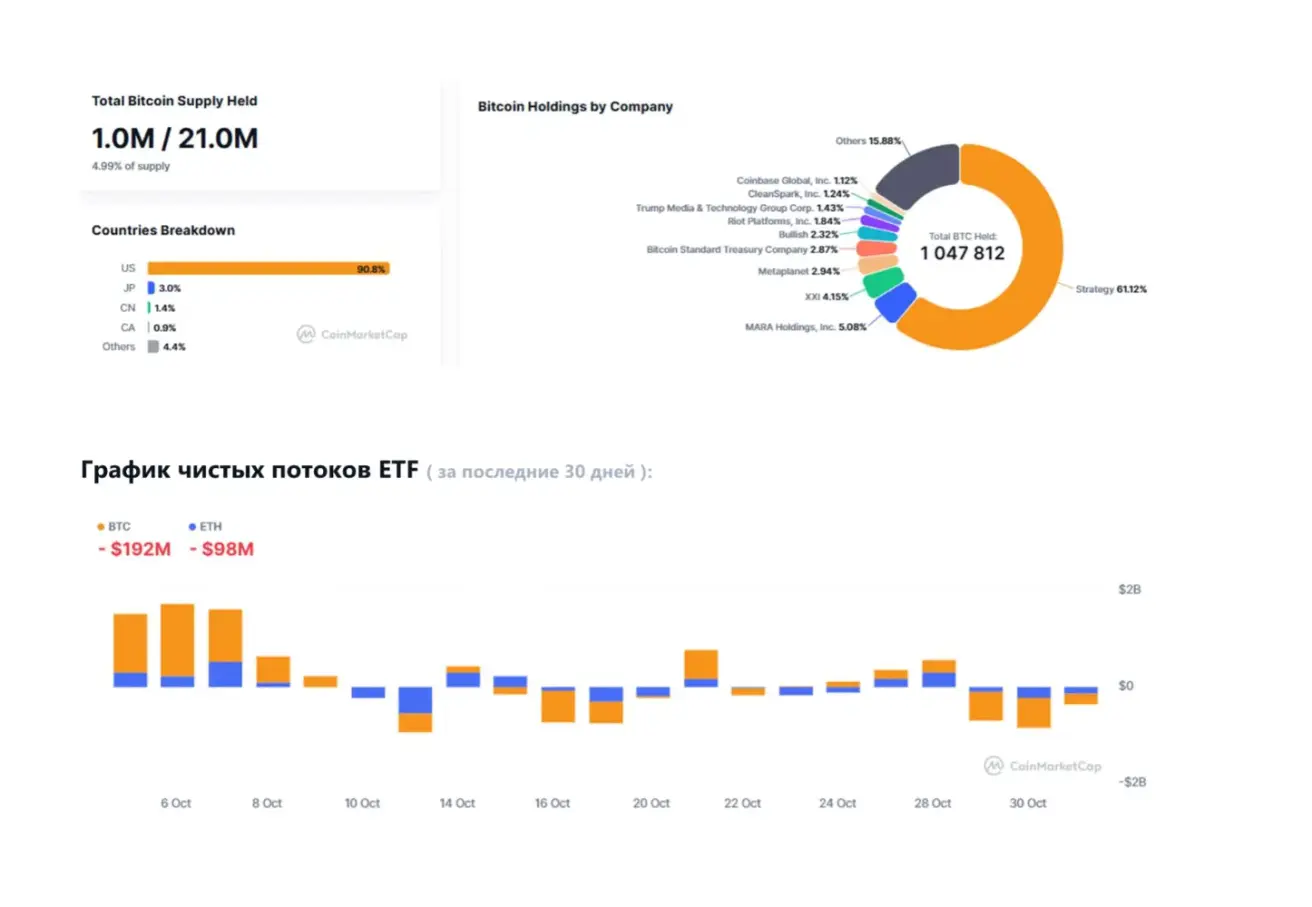

BTC FUTURES

Weekly performance: -4.09% (week closed at $109,820). Year-to-date return: +17.13%.

ETH FUTURES

Weekly performance: -7.22% (week closed at $3855.60). Year-to-date performance: +15.29%.

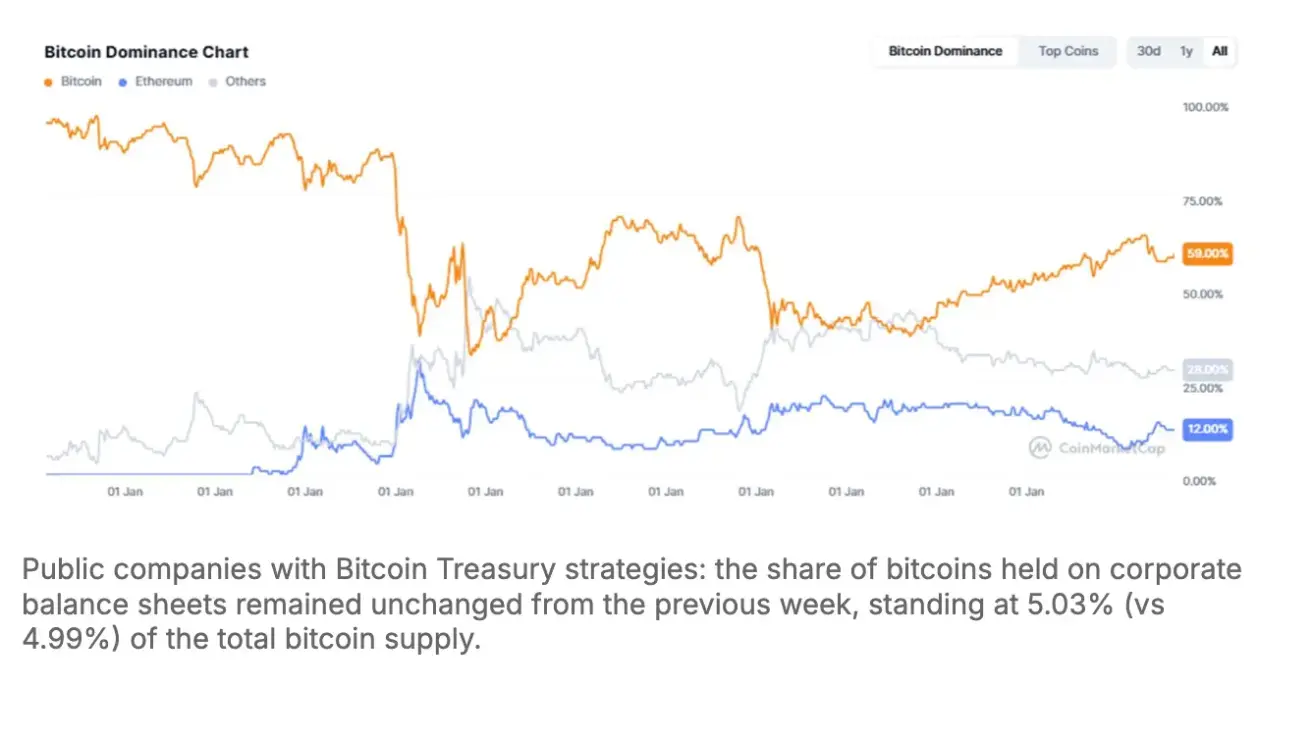

Total cryptocurrency market capitalization: $3.70 trillion (vs $3.89 trillion a week earlier) — source: coinmarketcap.com.

Market share by asset:

- Bitcoin: 59.2% (vs 59.2%),

- Ethereum: 12.6% (vs 12.9%),

- others: 28.2% (vs 27.9%).

Қазақша

Қазақша