Down rounds: what does this mean for Venture?

Venture investors are getting more selective as the venture market comes to a dramatic halt.

Venture deals that used to be founder-friendly at high prices have been replaced by hallmarks of a downbeat climate, such as decreasing valuations and investor-protective terms.

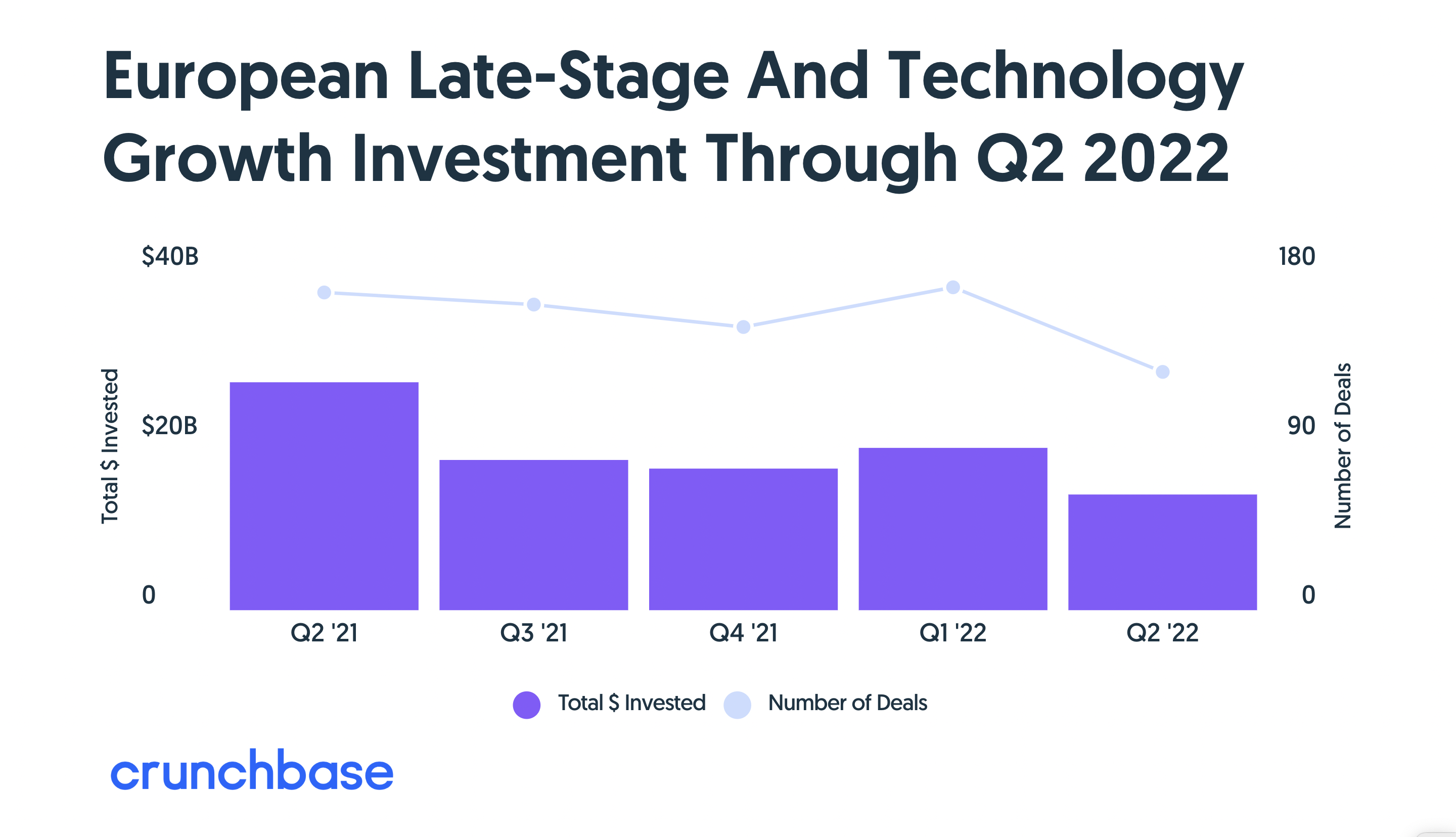

According to Crunchbase, funding to European startups across all stages reached $23.7 billion last quarter—down 38% from the peak of $38 billion a year earlier.

Source: Q2 European Startup Funding Drops 38% From A Year Earlier, Gené Teare, Crunchbase, July 12, 2022

Source: Q2 European Startup Funding Drops 38% From A Year Earlier, Gené Teare, Crunchbase, July 12, 2022

The current global funding downturn comes amid a reckoning for private and public company valuations directly impacting prominent late-stage startups.

On the 12th of July, 2022, Klarna's valuation was downgraded from $45.6 billion in June to $6.7 billion in its latest funding round turning the tide for one of Europe's most high-profile startups, according to Bloomberg. And back in February, the startup was valued at $60 billion.

According to a statement released Monday, the buy-now-pay-later financial giant has raised $800 million from new and existing investors.

However, the startup's valuation has significantly decreased since Klarna lowered its ambitions several times during the last negotiations with investors.

According to the managing director at Insight Partners, Teddie Wardi, Venture capitalists are now emphasizing growth in terms of profitability.

Assuming that the company [that meets the Rule of 40] is operating in an attractive market and [its] unit economics are in good order, these companies can attract financing in any market

The Rule of 40 is when a company's growth rate combined with its profit margin should be 40% or more.

Despite the pullback in late-stage funding, European startup funding has held up at the earlier stages. This is an indication of the strong pipeline of startups from the continent to come.

The EU market

For many startups worth $1 billion or more, the new market conditions could force hard decisions in the near future. If the current trends continue, the pressure on late-stage startups will significantly increase.

But it is not a forecast of doom, so don't panic. There isn't anything special happening right now in the market that indicates that the startup fundraising market is completely collapsing; indeed, there's plenty of strength to be found in select markets and regions.

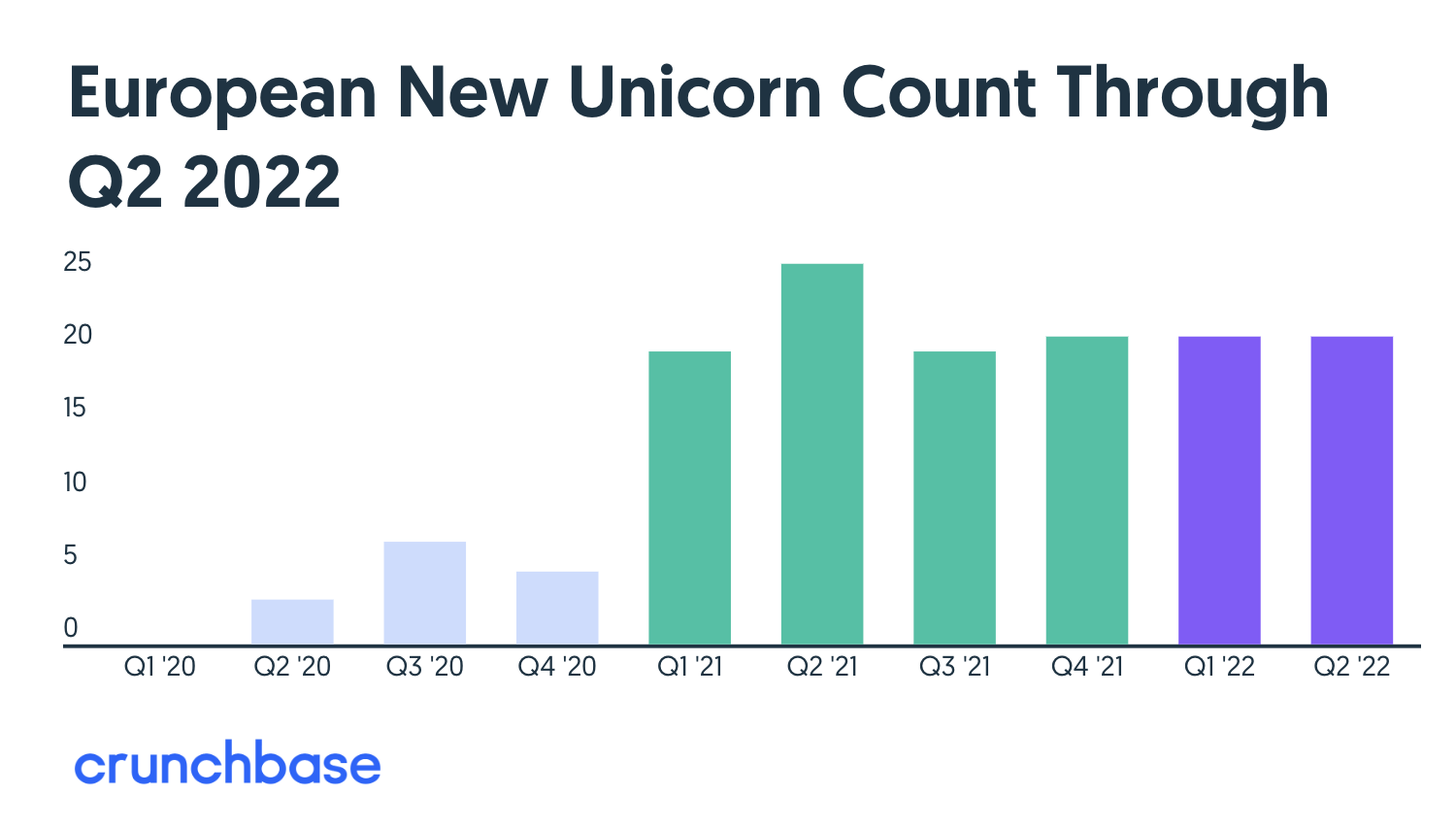

For example, a total of 21 new companies from Europe joined the Unicorn Board in the second quarter of 2022, bringing the continent's total to 187 companies.

Source: Q2 European Startup Funding Drops 38% From A Year Earlier, Gené Teare, Crunchbase, July 12, 2022

Source: Q2 European Startup Funding Drops 38% From A Year Earlier, Gené Teare, Crunchbase, July 12, 2022

And the numbers are not too far off from the first quarter and last year when more than 20 startups were minted each quarter.

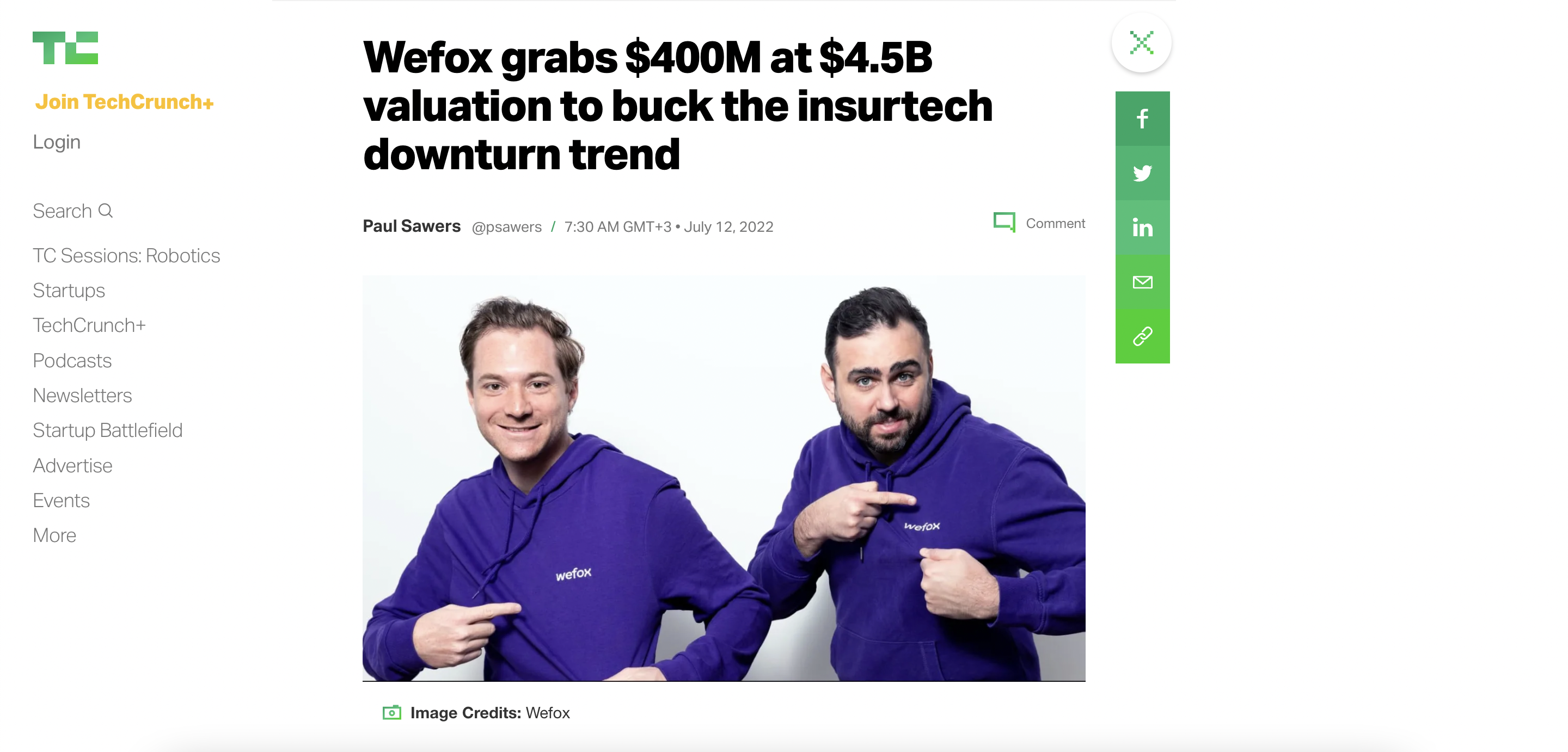

Along with Klarnas's down round, a European insurance tech startup, Wefox raised $400 million in a Series D round of funding, rising to a $4.5 billion valuation, a 50% increase on last year's $3 billion valuation.

Source: TechCrunch 2022

Source: TechCrunch 2022

What's next?

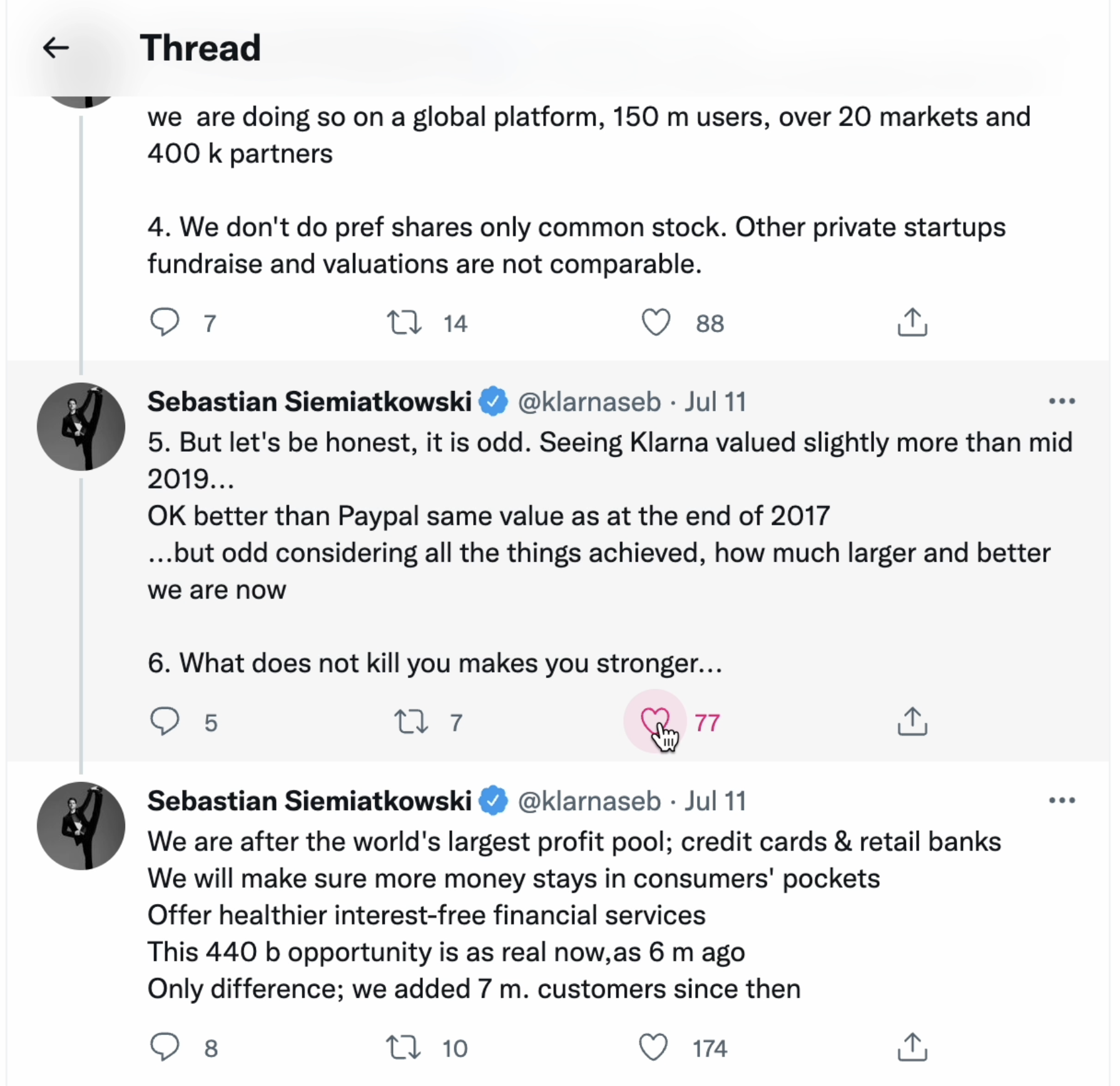

In a series of tweets, Klarna CEO Sebastian Siemiatkowski said the company is "not immune" to the pressures facing its peers and planned to "return to profitability" after racking up hefty losses due to aggressive international expansion.

In conclusion, he states – "What does not kill you makes you stronger."

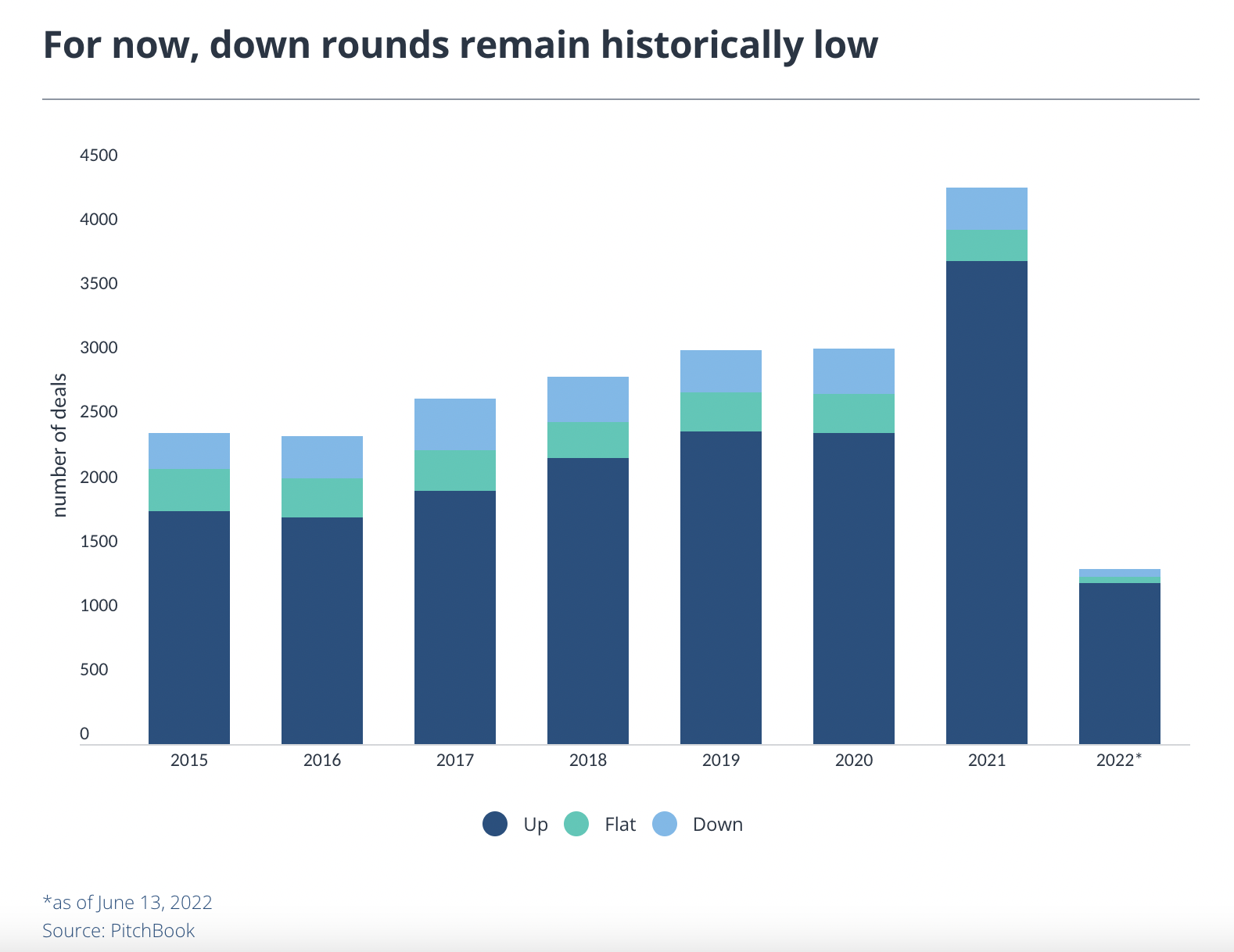

For now, down rounds remain historically low.

And not all late-stage companies will hold down rounds. The companies do so because under the pressure of the stock market, once the economy and markets are back up, the late-stage unicorns will be the first to start raising their valuation back.

Source: Down rounds, structured terms and focus on profitability are making a comeback, Marina Temkin, Pitchbook, June 13, 2022

Source: Down rounds, structured terms and focus on profitability are making a comeback, Marina Temkin, Pitchbook, June 13, 2022

As for the early-stage startups, many that raised capital last year will use the funding to stabilize and "survive the year" and continue growing and developing, increasing their capitalization if they are smart with their money.

Қазақша

Қазақша