How to drop college and build a $7 billion startup

The story of Alex Wang, the 25-year-old founder of Scale A.I.

When Alexandr Wang founded Scale A.I.. in 2016 at age 19, his company's reputation was questionable. After all, with only three employees, Scale had yet to scale up.

Now, the company has more than 300 employees and is worth $7.3 billion, making Wang the CEO of one of the biggest A.I. companies in Silicon Valley at 25.

After dropping out of MIT and joining Y Combinator's spring 2016 batch, Wang didn't know what kind of startup he would create. According to the interview for B2, he had a breakthrough: companies wanted to integrate machine learning, but most didn't have the tools or resources that Big Tech did for their in-house A.I. projects.

That's when Wang got the idea for Scale, which makes A.I. infrastructure for developers to build from.

What is Scale?

Scale A.I. accelerates the development of A.I. applications by helping machine learning teams generate high-quality ground truth data. The startup specializes in data labeling, which allows companies like Lyft, OpenAI, Zoox, Pinterest, and Airbnb to focus on product development rather than labeling and identifying data.

Scale A.I. has also developed a platform — Nucleus, which helps companies manage their data and makes recommendations for improving data quality before submitting it to Scale A.I. for labeling.

The platform also has ready-made solutions in autonomous cars, drones, content and language, document processing, retail and e-commerce, robotics, and government.

Development and performance

Among Scale A.I. clients are Toyota, General Motors, U.S. Airforce Department, PayPal, Square, Samsung, and Standard Cognition.

For autonomous vehicles, Toyota uses Scale product, which helped to improve Toyota's annotation throughput by 10X in a matter of weeks.

Scale has partnered with Deloitte, an awardee of the Joint Artificial Intelligence Center's Data Readiness Artificial Intelligence Development (DRAID) Basic Ordering Agreement (BOA).

The JAIC DRAID is a five-year, $241 million BOA that enables Scale and Deloitte to support A.I. data preparation for the U.S. government. This partnership brings nearly $500M in total JAIC ceiling value to Scale.

Scale's technology will be readily available to all federal agencies and will empower the government to feel confident in leveraging A.I. and ML in their most essential workflows.

Lead investors

Scale AI plans to use attracted capital for further development of existing products and possible enlargement into other industries like healthcare.

Scale AI plans to use attracted capital for further development of existing products and possible enlargement into other industries like healthcare.

Scale A.I. funding rounds

Scale A.I. funding rounds

Market overview

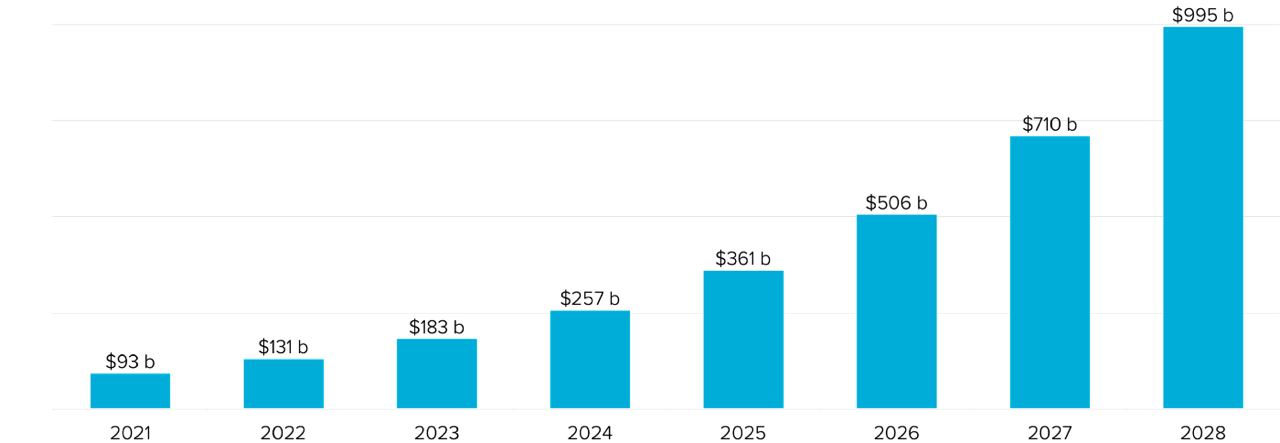

The global market for artificial intelligence was estimated at 62.35 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 40.2% from 2021 to 2028. At this growth rate, the market will be valued at nearly a trillion U.S. dollars by 2028.

Global Artificial Intelligence market size 2021–2028

Global Artificial Intelligence market size 2021–2028

Due to the large market size and promising technology, venture capital also shows great interest in this area. According to PitchBook, V.C. funding in A.I. and machine learning startups demonstrated weakness in 2021 and grew less robustly than software V.C. overall. Startups in the sector collected $115 billion in 2021, rising only 87.2% year-over-year from $61.4 billion in 2020.

Scale is the largest artificial intelligence startup in the United States. The main competitors are Hive and Labelbox. While Hive only deals with data labeling, Labelbox, like Scale A.I., has developed a data management platform for its clients, which is very rare in the industry.

The company has the most capital for labeling high-quality data, which gives the advantage of reaching the largest customers in the niche.

Potential ROI

Most likely scenario (80%):

- Based on recent top management hires, the company will become public through SPAC or IPO in 2–3 years.

- Based on no alternatives in a public market, the valuation has an opportunity to grow from 150% to 200% before the public listing.

Less likely scenario (20%):

- Acquisition by one of the big tech companies showing activity in AI-related startups M&A: Google, Microsoft, and Apple.

In this case, the acquisition will be made approximately with a 100% — 150% premium from the current valuation.

Risks

Data processing and storage legislation can complicate the development of artificial intelligence technology in various fields where the company operates.

As the leader of the data labeling market, the company is at risk of losing its lead amid growing competition from smaller startups.

Conclusion

Scale A.I.'s mission is to accelerate the development of A.I. applications. To enable teams to progress faster, we began with data - the foundation of all A.I. applications.

You can access more detailed analytics on the company directly in the Raison app, as well as invest in this promising company!

Қазақша

Қазақша