April 14 — 17, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (March): 0.1% (prev: 0.2%);

- Consumer Price Index (CPI) (m/m) (March): -0.1% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (March): 2.8% (prev: 3.1%);

- Consumer Price Index (CPI) (y/y) (March): 2.4% (prev: 2.8%).

INFLATION EXPECTATIONS (MICHIGAN)

-

12-month expected inflation (March): 6.7%, prev: 5.0%;

-

5-year expected inflation (March): 4.4%, prev: 4.1%.

-

GDP (BEA – U.S. Bureau of Economic Analysis) (4Q24 annualized): (third estimate): 2.4%; second estimate: 2.3%; (3rd quarter: 3.1%).

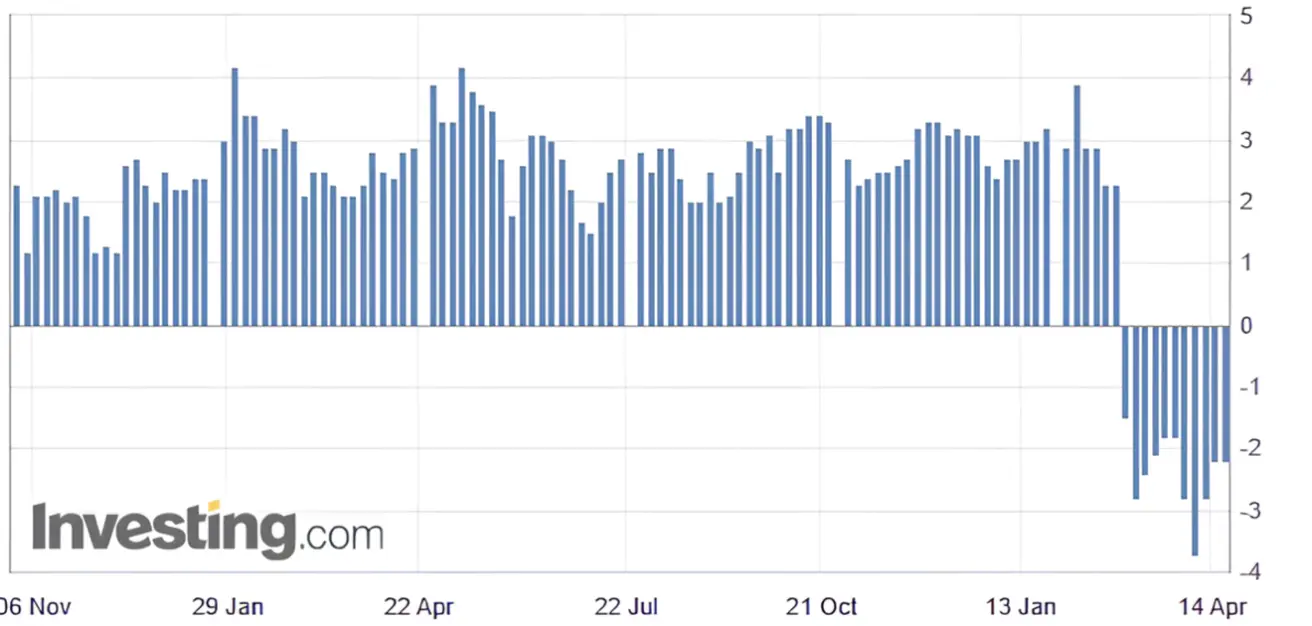

The GDPNow indicator published by the Federal Reserve Bank of Atlanta: -2.2% (vs. -2.8%).

The GDPNow forecasting model provides the "current" version of the official estimate prior to its release, evaluating GDP growth using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

BUSINESS ACTIVITY INDEX (PMI):

- Services Sector (March): 54.4 (prev: 51.0);

- Manufacturing Sector (March): 49.8 (prev: 52.7);

- S&P Global Composite (March): 53.5 (prev: 53.5).

LABOR MARKET:

- Unemployment Rate (February): 4.2% (prev: 4.1%);

- The change in non-agricultural employment for February stands at 228K (prev 117K);

- Average Hourly Earnings (March, y/y): 3.8% (prev: 4.0%). (>50 indicates expansion, <50 indicates contraction)

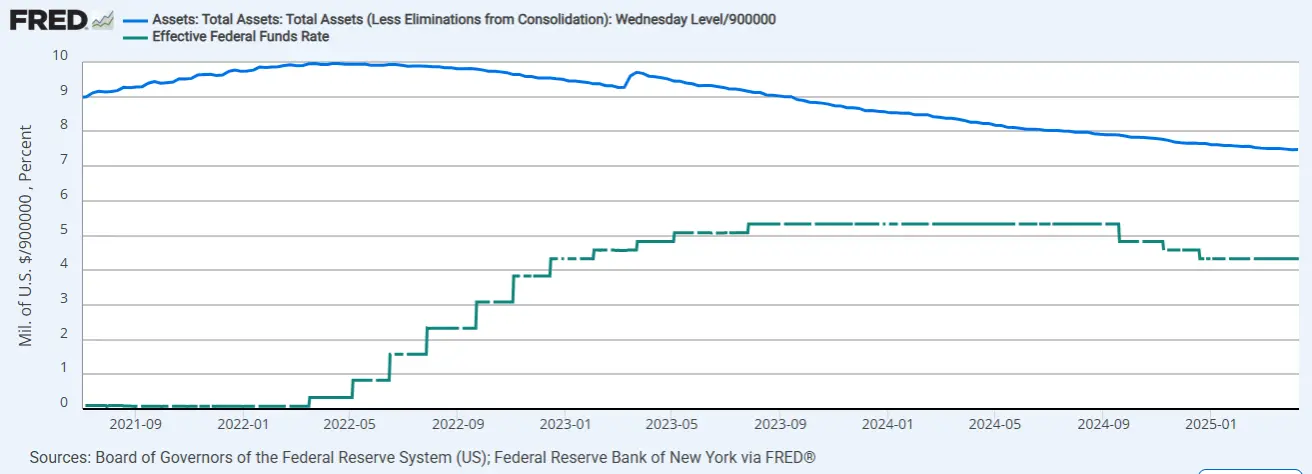

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.727 trillion (vs previous week: $6.727 trillion)

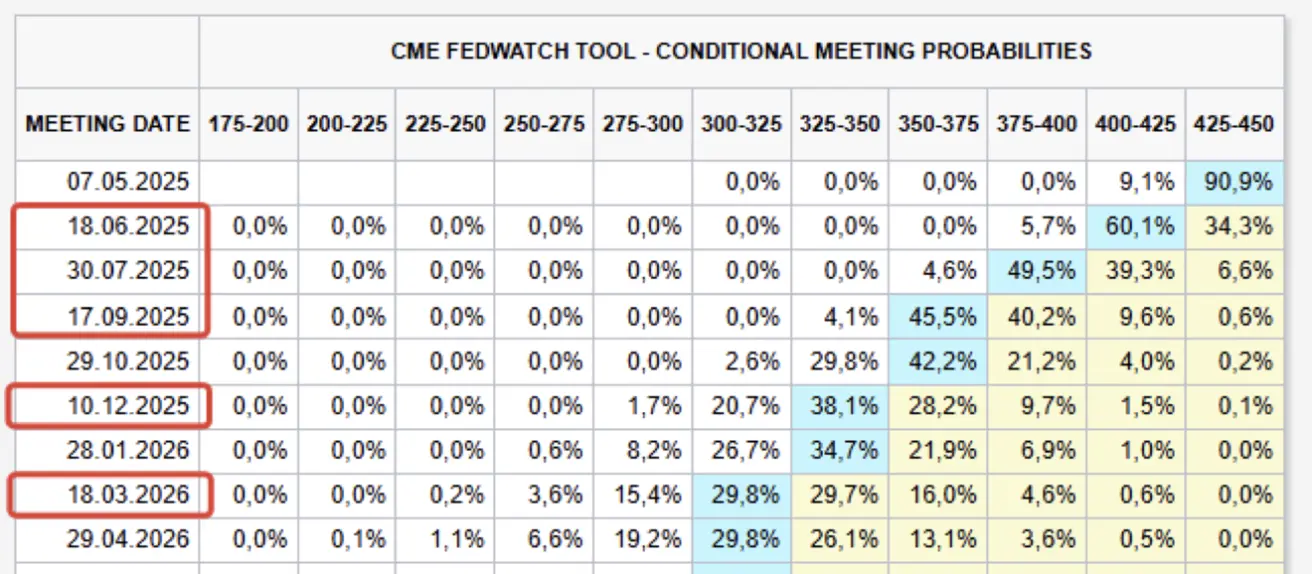

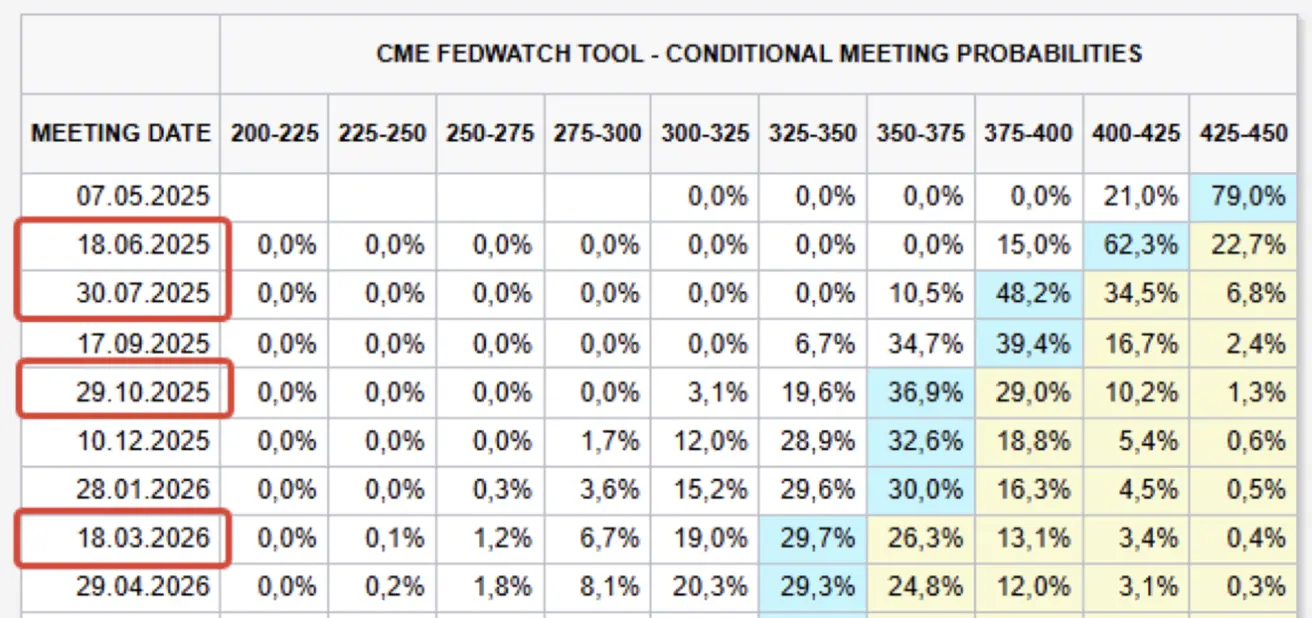

MARKET FORECAST FOR RATE

Today:

А week earlier:

А week earlier:

Commentary:

-

The ECB has cut rates for the 7th time since June last year to 2.25% to support the economy amidst escalating trade tensions. It had previously indicated a pause.

-

Atlanta Fed’s GDPNow indicator continues to signal contraction at -2.2%.

Trade Policy

-

The EU expects U.S. tariffs to remain in place as talks stall. The EU has proposed mutual removal of tariffs on industrial goods, which the U.S. rejected.

-

China added 7 rare earth metals, including terbium, yttrium, and dysprosium, to its export control list—critical to defense, nuclear, and mobile technologies.

-

China has halted further Boeing aircraft deliveries and banned purchases of U.S. aviation parts amid intensifying trade conflict.

-

Canada will temporarily waive tariffs for 6 months on U.S. imports used in food and beverage production.

-

The U.S. has banned NVIDIA from selling its H20 chip to China. NVIDIA expects a $5.5 billion loss in Q1 due to the ban, dragging markets lower mid-week.

Import Decline: U.S. imports dropped 64% from the last week of March to the first week of April — an historic collapse in global trade.

U.S. Import Dependency: The U.S. relies on foreign suppliers for 50–100% of several critical materials, suggesting scope for future trade agreements.

Fed Rhetoric: Hawkish

-

Christopher Waller: Persistent tariffs could push inflation back to 5%.

-

Raphael Bostic: The economy is stagnating; bold action “in either direction” would be unwise.

-

Fed Chair Jerome Powell warned of a dilemma between controlling inflation and supporting growth, indicating trade-offs between mandates.

-

Powell: Fed may deviate from inflation and labor targets this year, potentially revisiting them in 2026.

-

Chicago Fed’s Austan Goolsbee: Tariffs may trigger a U.S. economic crash by summer.

Market expectations via the FedWatch tool: Five rate cuts of 25 basis points each are anticipated over the next 12 months, bringing the federal funds rate down to a range of 3.25%–3.50%. The market is pricing in substantial action from the Federal Reserve in favor of supporting economic growth.

MARKET

SP500

-1.50% on the week (close: 5,282.69); YTD: -10.51%

NASDAQ100

-2.31% on the week (close: 18,258.09); YTD: -13.55%

S&P 500 Leadership Outlook:

-

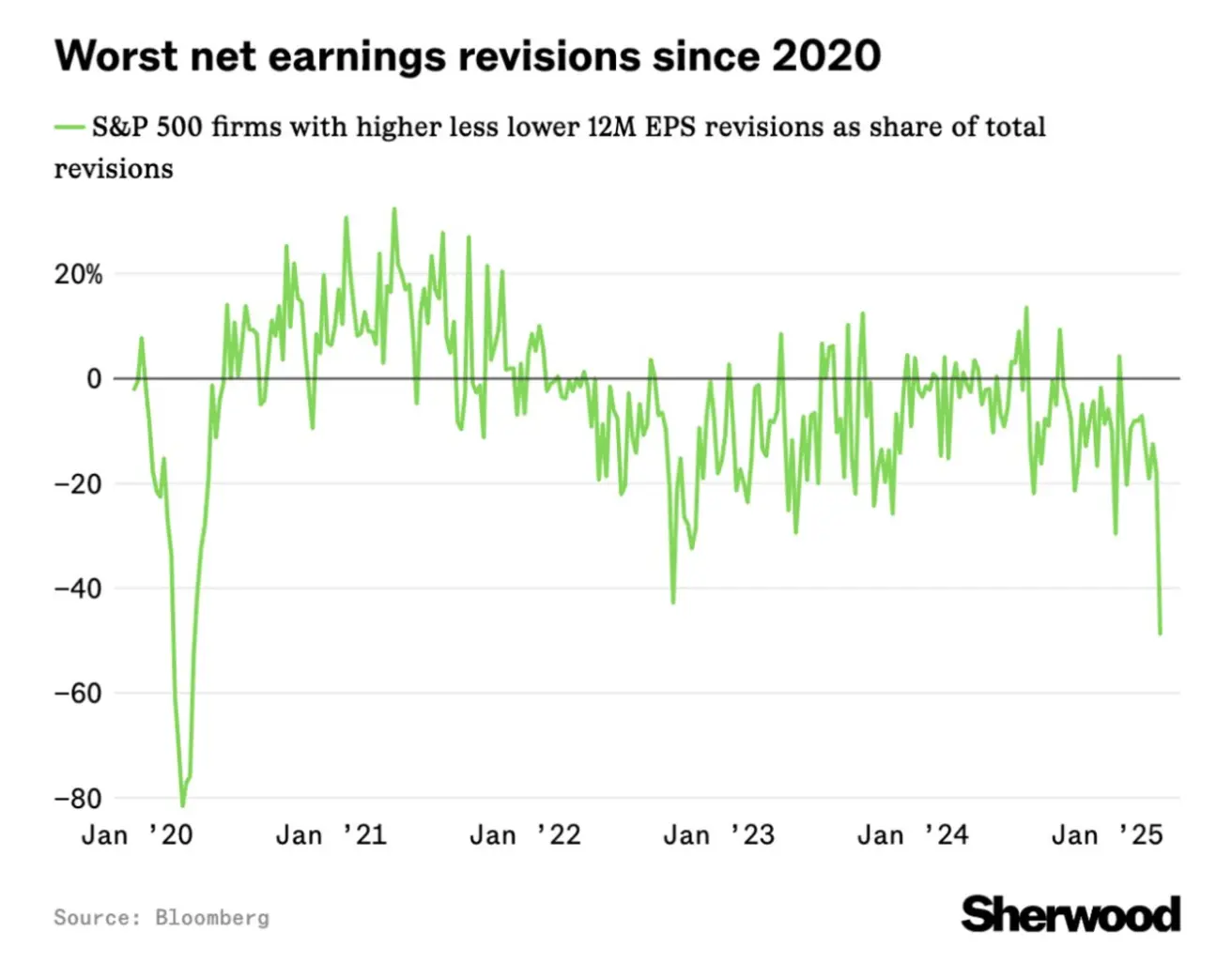

Worst 12-month forward earnings revisions since the COVID-19 pandemic.

-

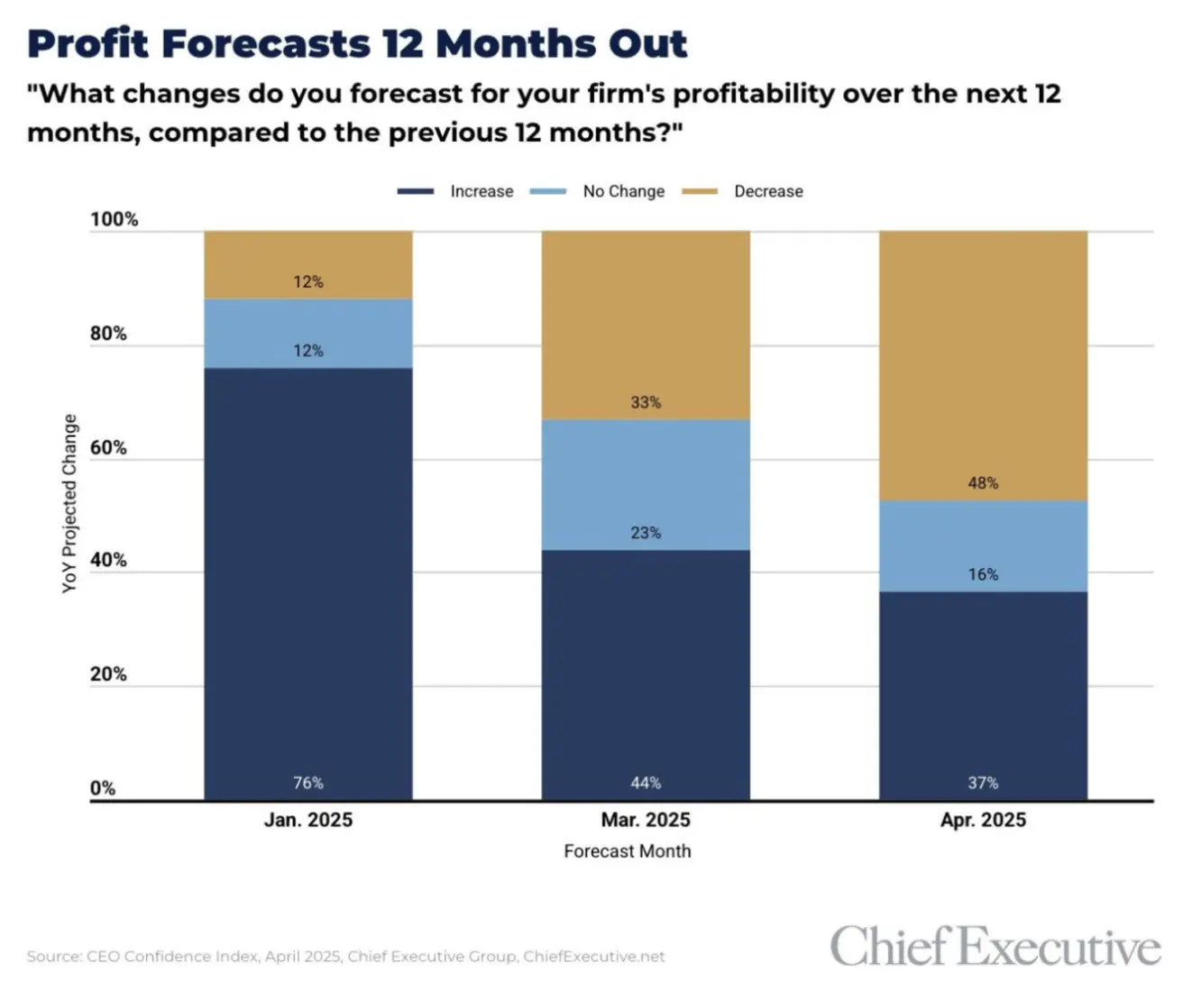

Management sentiment across sales, capex, and hiring is deteriorating.

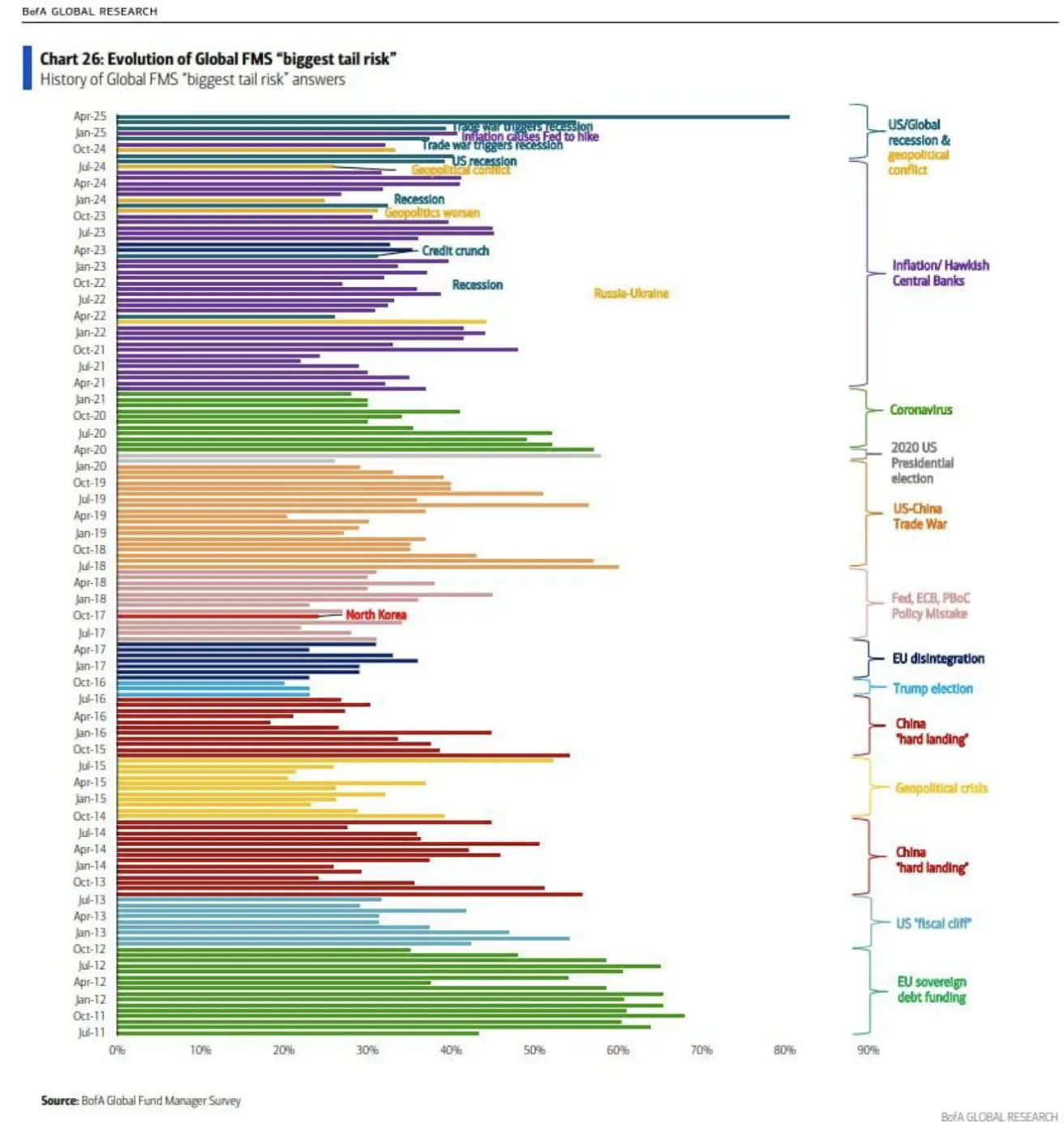

BofA Risk Assessment:

- Recession in the U.S. and globally is now ranked the highest risk in history:

Updated End-of-Year Targets: All major banks lowered their projections, though average target still exceeds current S&P 500 levels (range: 5,500–6,000).

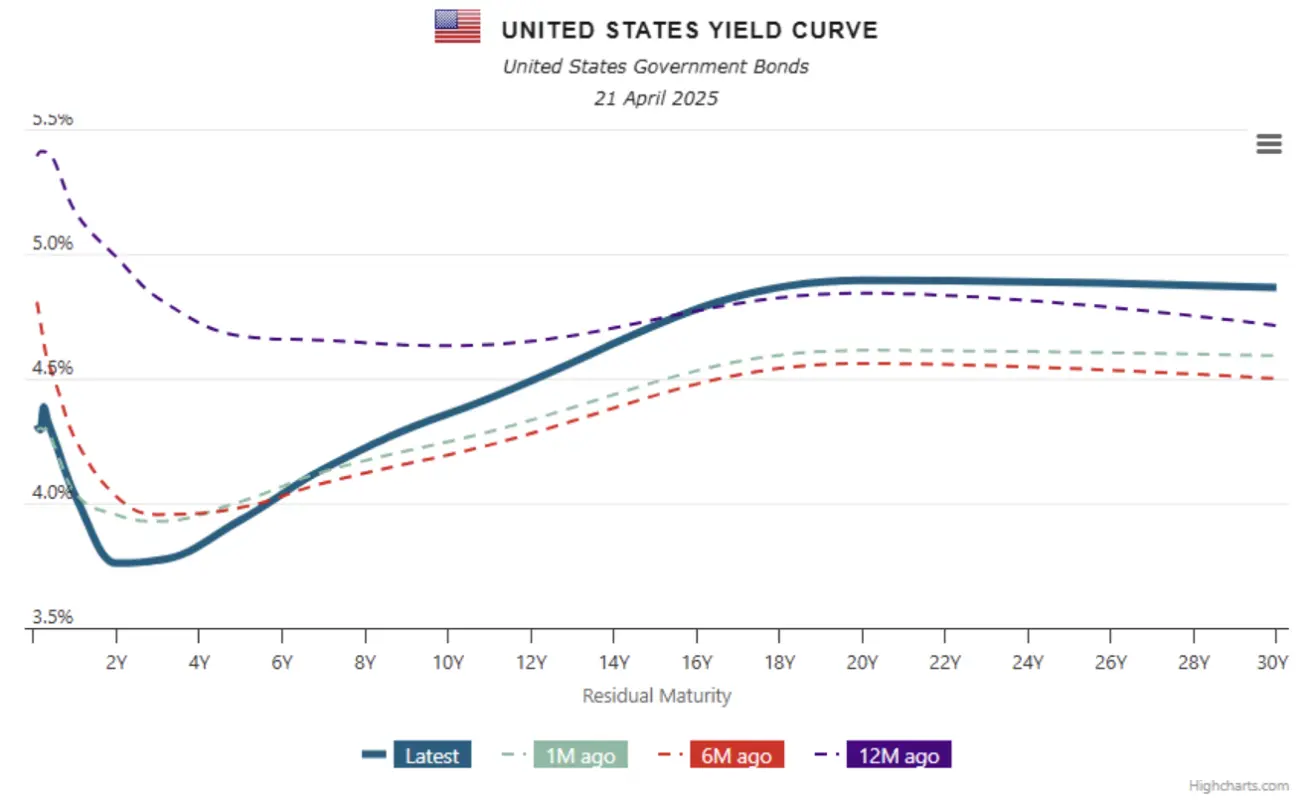

BOND MARKET

Modest recovery by the end of the week, driven by a decline in yields.

20+ Year Treasury Bonds (ETF TLT): +0.74% (weekly close at $87.53). Year-to-date for 2025: -0.31%.

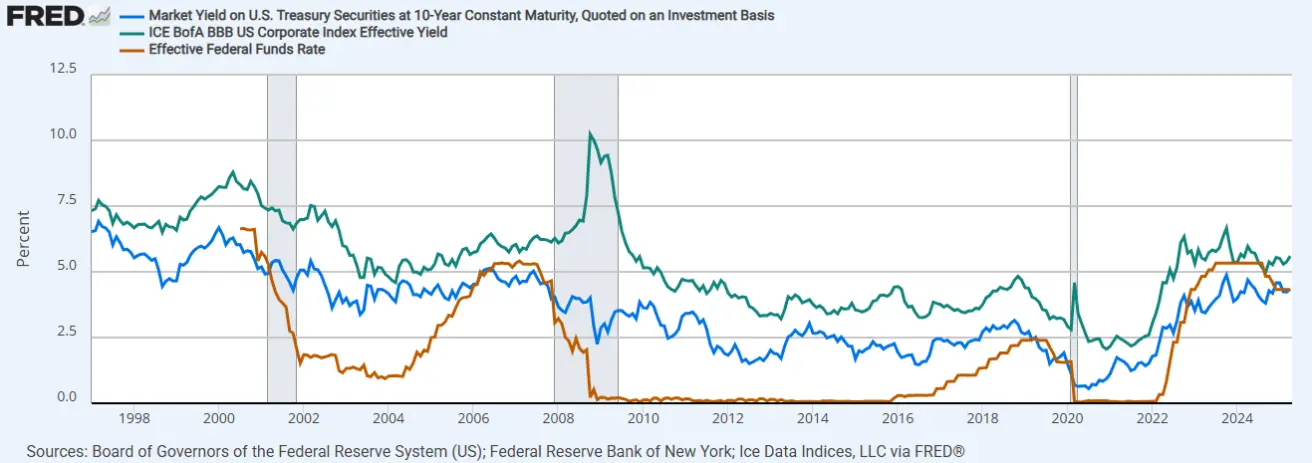

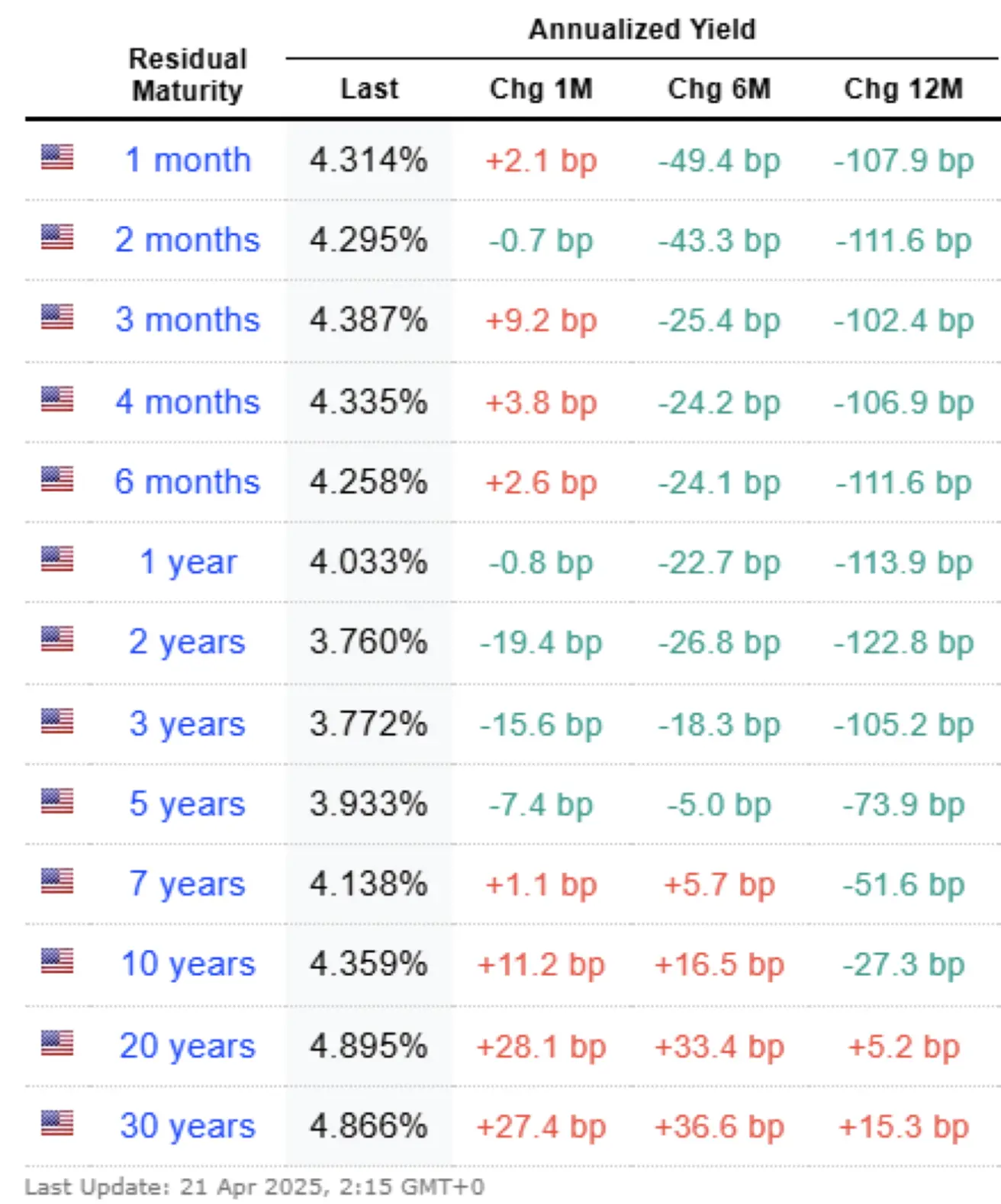

YIELDS AND SPREADS 2025/04/21 vs 2025/04/14

-

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4,359% (vs 4,465%);

-

ICE BofA BBB US Corporate Index Effective Yield: 5,60% (vs 5,77%):

Yield Spread between 10-Year and 2-Year U.S. Treasuries: 59.9 vs 52.1 basis points (reflecting the difference in returns between long-term and short-term debt).

Yield Spread between 10-Year and 3-Month U.S. Treasuries: -2.8 vs 14 basis points.

GOLD FUTURES (GC)

- Gold futures: +2,65%, weekly close at $3341,3 per troy ounce.

- Year-to-date 2025: +26,52%.

Goldman Sachs Group Inc. and UBS Group AG have released another round of bullish gold forecasts, citing stronger-than-expected demand from central banks and the metal’s role as a hedge against recession and geopolitical risks.

According to their projections, the price of gold is expected to reach $3,700 per ounce by the end of this year, and $4,000 by mid-2026.

UBS also anticipates robust demand across multiple market segments — including central banks, long-term asset managers, private equity, and retail investors.

DOLLAR INDEX FUTURES (DX)

- Continued to decline, -0.42%;

- Weekly close: 99.18;

- Year-to-date: -8.45%.

Current narrative: In light of recent developments, demand for dollar-denominated assets is declining as investors begin to price in the risk of stagflation—a slowdown in economic growth accompanied by rising inflation.

Additionally, there is growing concern over a potential resignation of Fed Chair Jerome Powell, as Trump is reportedly pushing for interest rate cuts.

OIL FUTURES

- Weekly performance: +3,69%, closing at $63,75 per barrel.

- Year-to-date performance: - 11,27%.

On April 14, OPEC released its monthly oil market report, in which the committee slightly revised down its forecast for global oil demand growth in 2026 — from 1.43 million barrels per day to 1.28 million barrels per day.

This modest adjustment is primarily based on the data received for Q1 2025 and the anticipated impact of newly announced U.S. tariffs on future oil demand.

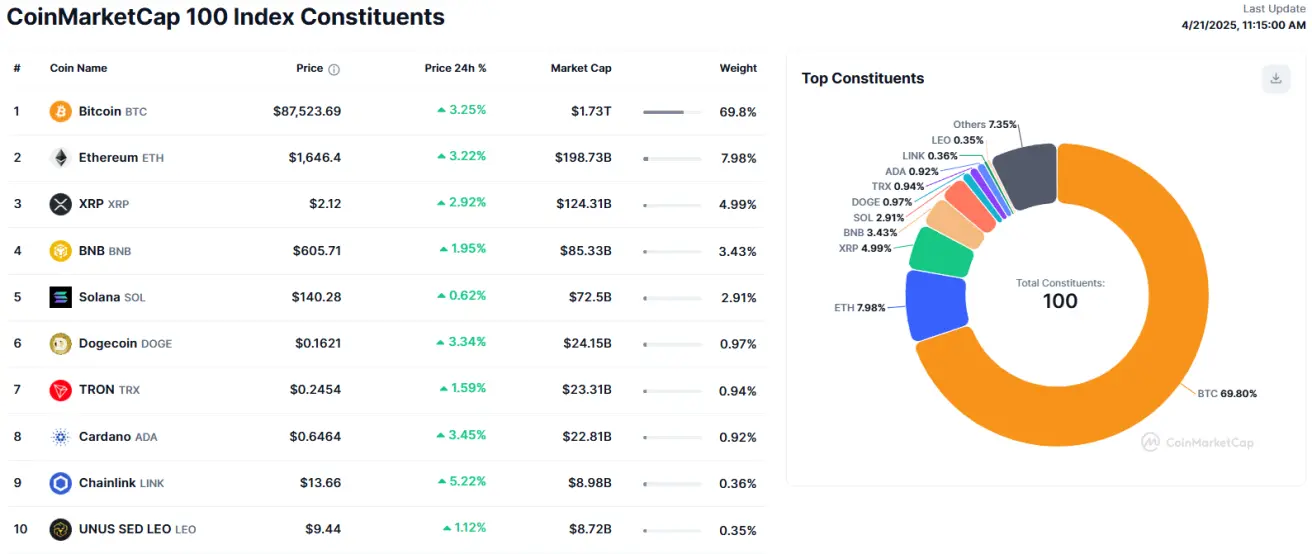

BTC FUTURES

- Weekly performance: -1,62%, weekly close at $85420

- Year-to-date performance in 2025: -10,34%:

ETH FUTURES

- Weekly performance: +0,41%, weekly close at $1584,0

- Year-to-date performance in 2025: -53,19%.

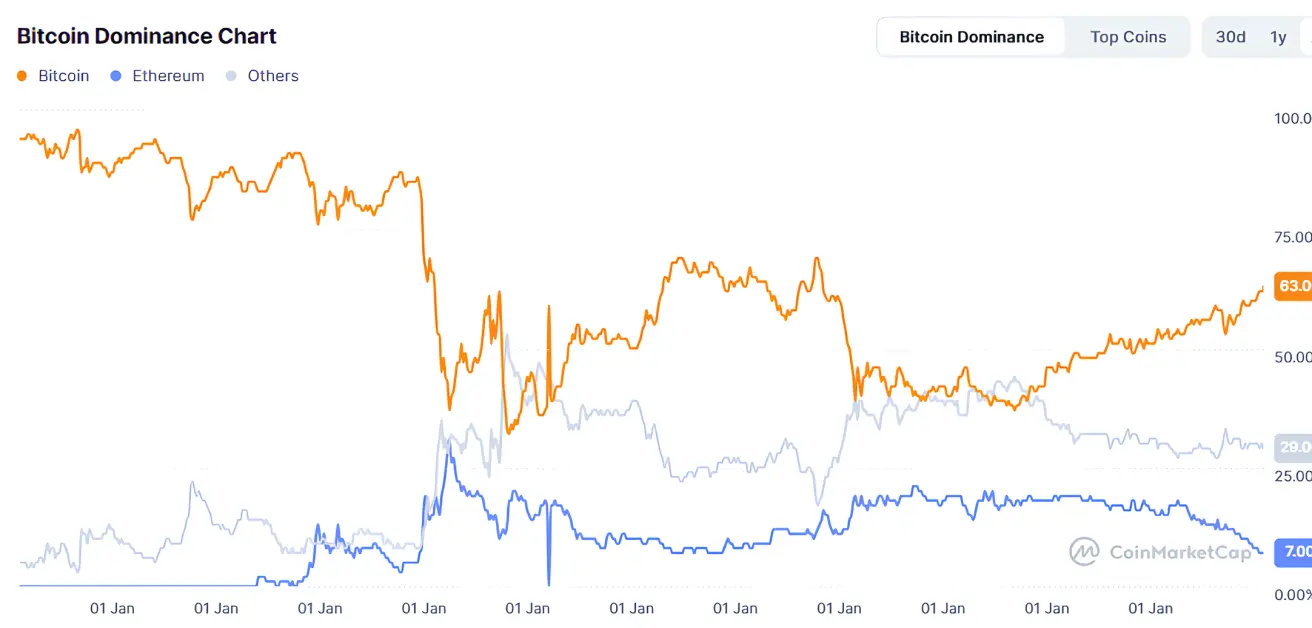

Total Crypto Market Capitalization: $2.76 trillion vs $2.68 trillion the previous week (coinmarketcap.com).

- Bitcoin: 63.1% (vs 62.6%)

- Ethereum: 7.2% (vs 7.4%)

- Others: 29.7% (vs 30.0%)

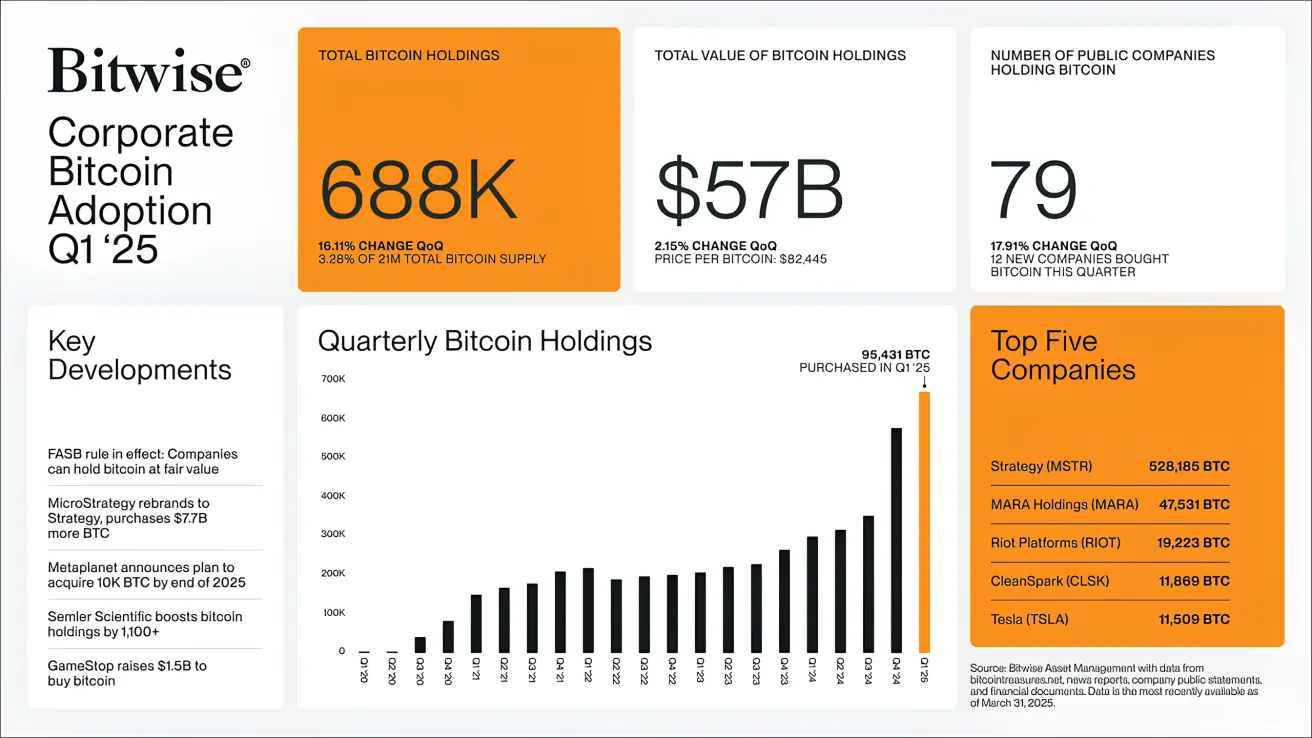

In Q1 2025:

-

Public companies added 95,431 BTC to their balance sheets, including 12 new entrants.

-

Total holdings now amount to 688,000 BTC, valued at $57 billion.

Regulatory easing in the U.S. crypto market continues:

-

Powell stated that banking regulations concerning cryptocurrencies will be relaxed.

-

North Carolina House Bill 92 has passed the House Committee on Pensions and Retirement, allowing the state treasury to invest in digital assets.

Қазақша

Қазақша