April 7 - 11, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

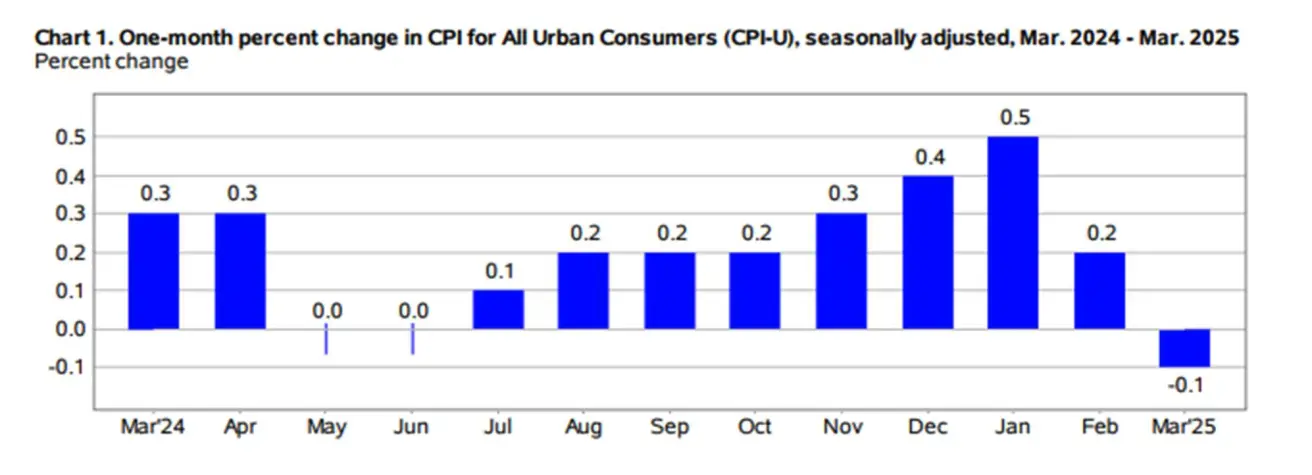

- Core Consumer Price Index (CPI) (m/m) (March): 0.1% (prev: 0.2%);

- Consumer Price Index (CPI) (m/m) (March): -0.1% (prev: 0.2%);

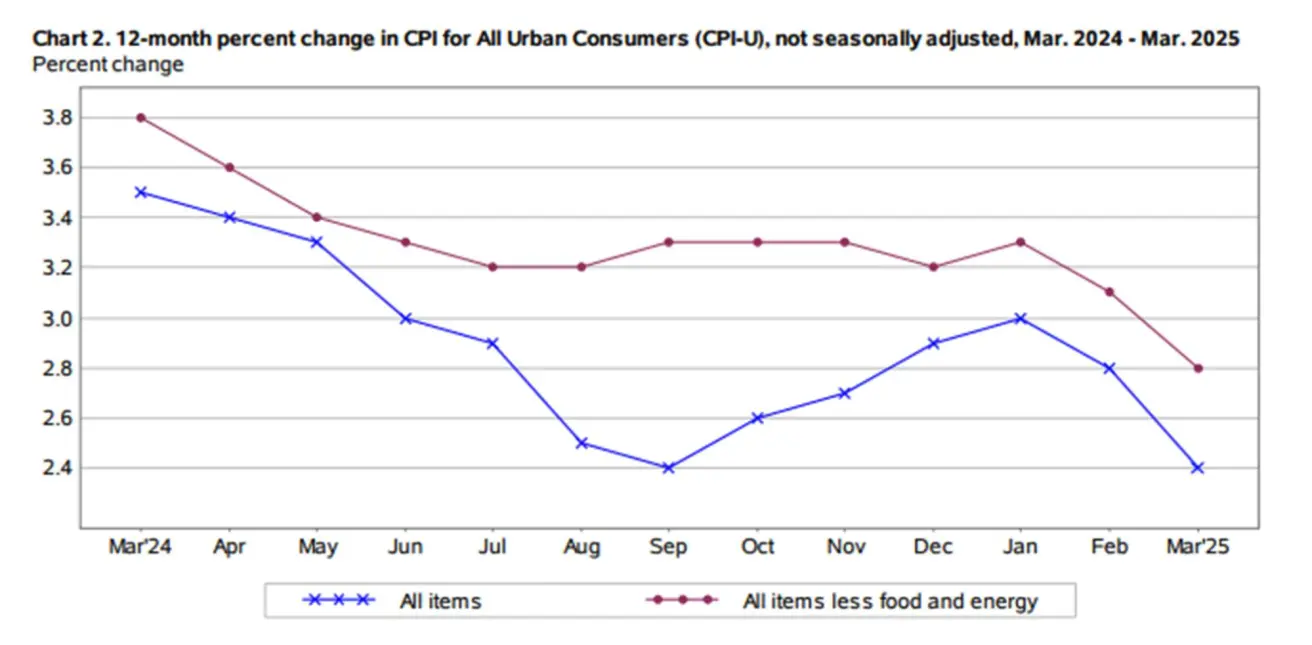

- Core Consumer Price Index (CPI) (y/y) (March): 2.8% (prev: 3.1%);

- Consumer Price Index (CPI) (y/y) (March): 2.4% (prev: 2.8%).

INFLATION EXPECTATIONS (MICHIGAN)

-

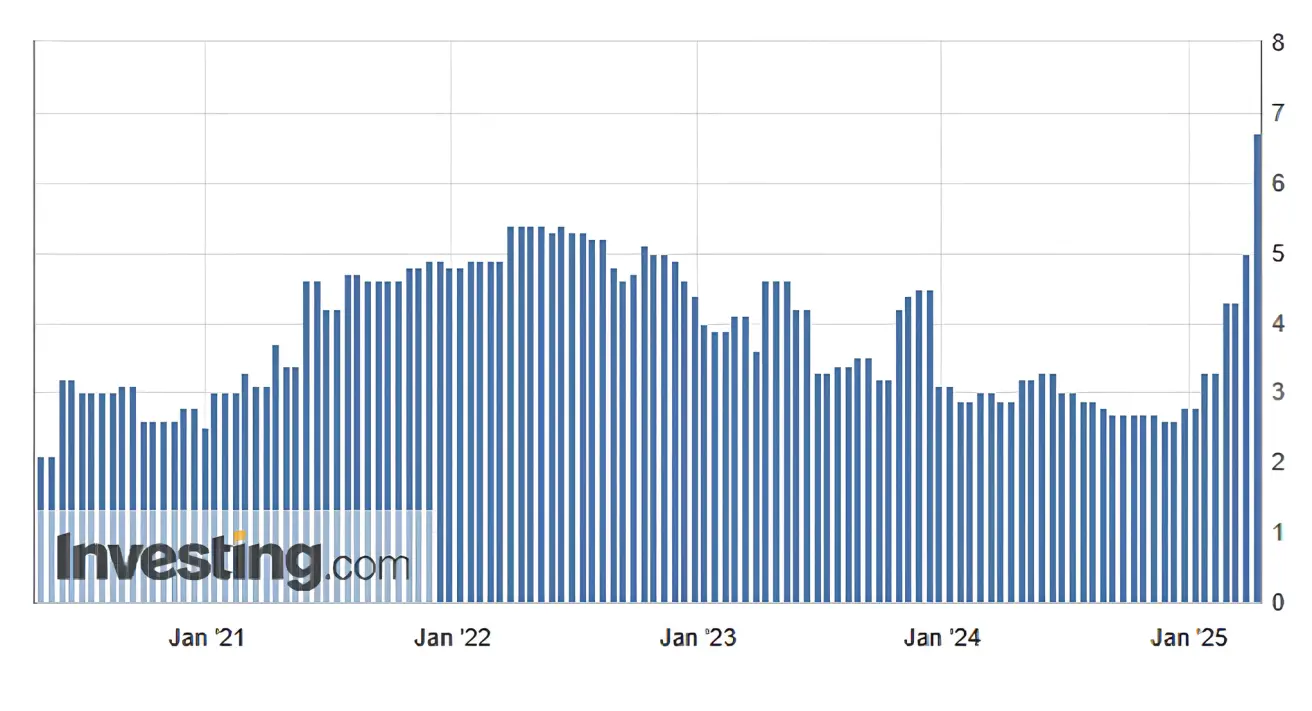

12-month expected inflation (March): 6.7%, prev: 5.0%;

-

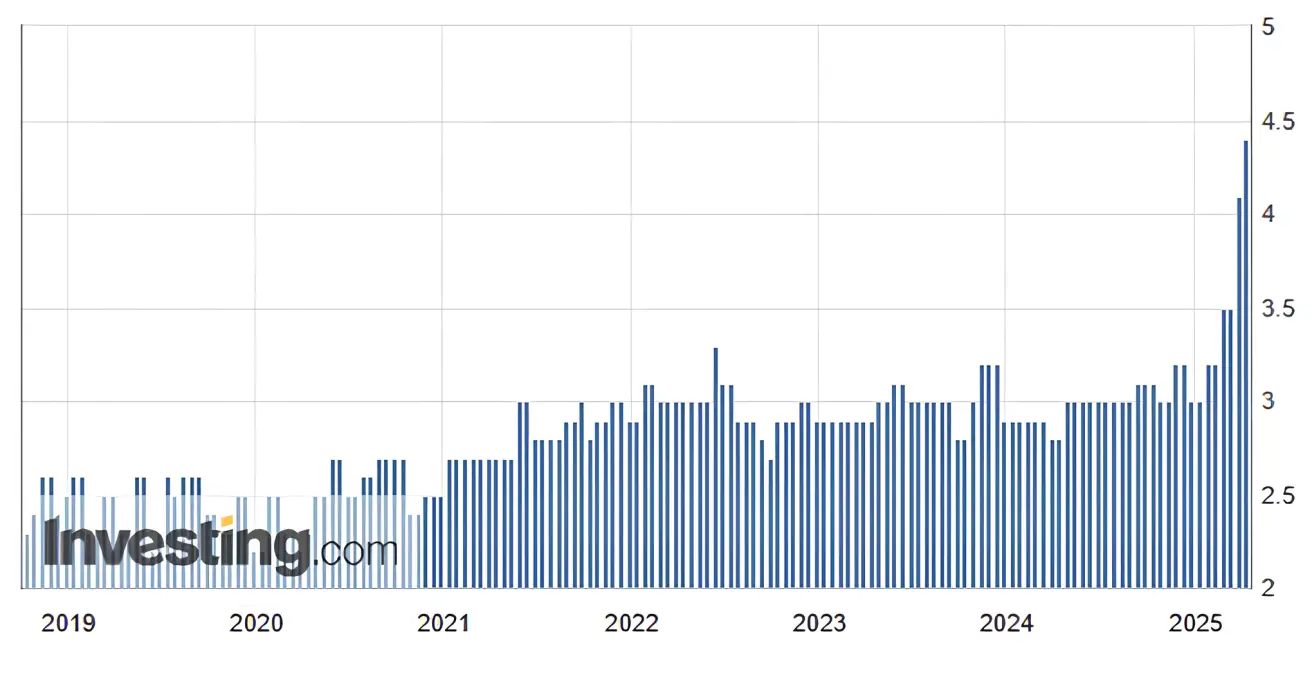

5-year expected inflation (March): 4.4%, prev: 4.1%.

-

GDP (BEA – U.S. Bureau of Economic Analysis) (4Q24 annualized): (third estimate): 2.4%; second estimate: 2.3%; (3rd quarter: 3.1%). The GDPNow indicator published by the Federal Reserve Bank of Atlanta: -2.8% (vs. -3.7%).

The GDPNow forecasting model provides the "current" version of the official estimate prior to its release, evaluating GDP growth using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

BUSINESS ACTIVITY INDEX (PMI):

- Services Sector (March): 54.4 (prev: 51.0);

- Manufacturing Sector (March): 49.8 (prev: 52.7);

- S&P Global Composite (March): 53.5 (prev: 53.5).

LABOR MARKET:

- Unemployment Rate (February): 4.2% (prev: 4.1%);

- The change in non-agricultural employment for February stands at 228K (prev 117K);

- Average Hourly Earnings (March, y/y): 3.8% (prev: 4.0%).

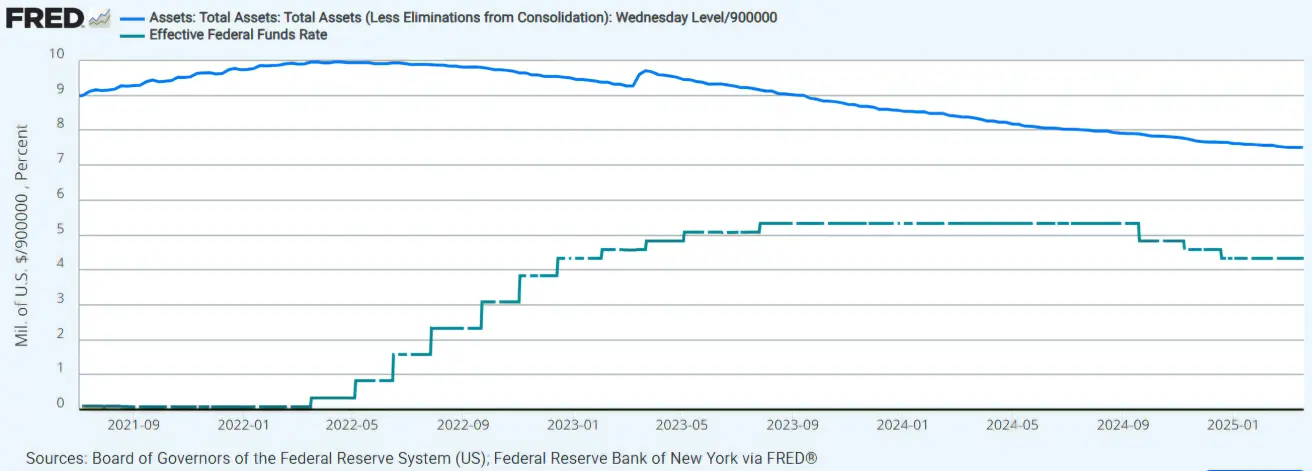

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.727 trillion (vs previous week: $6.723 trillion)

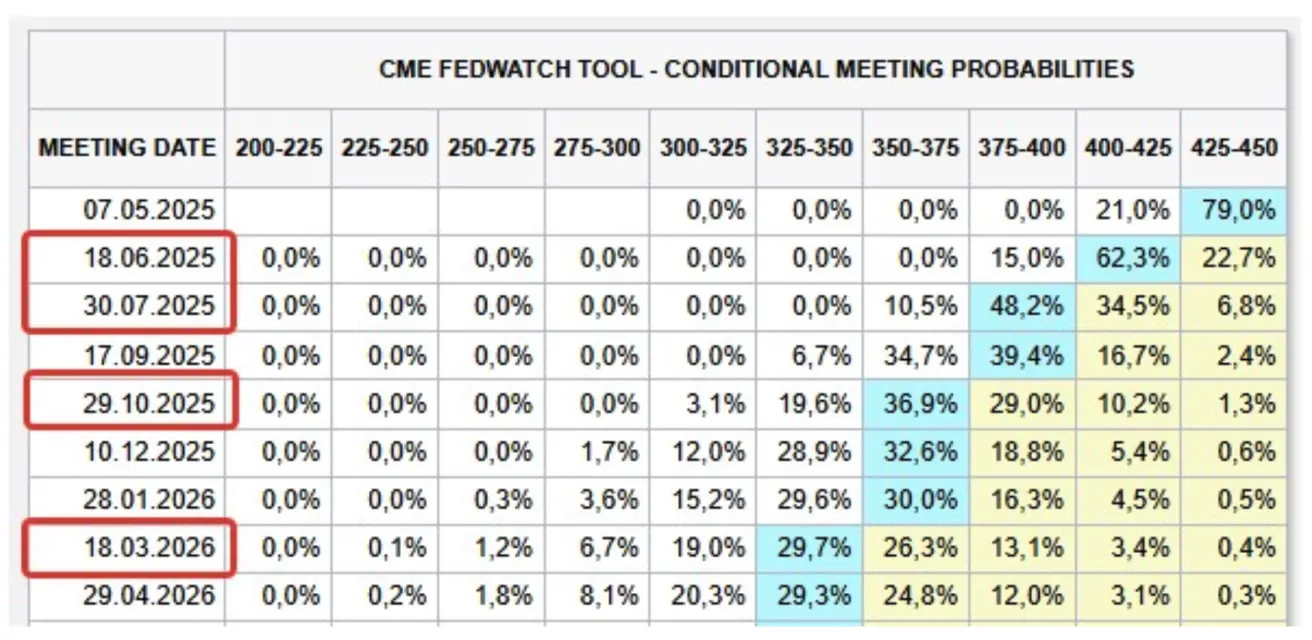

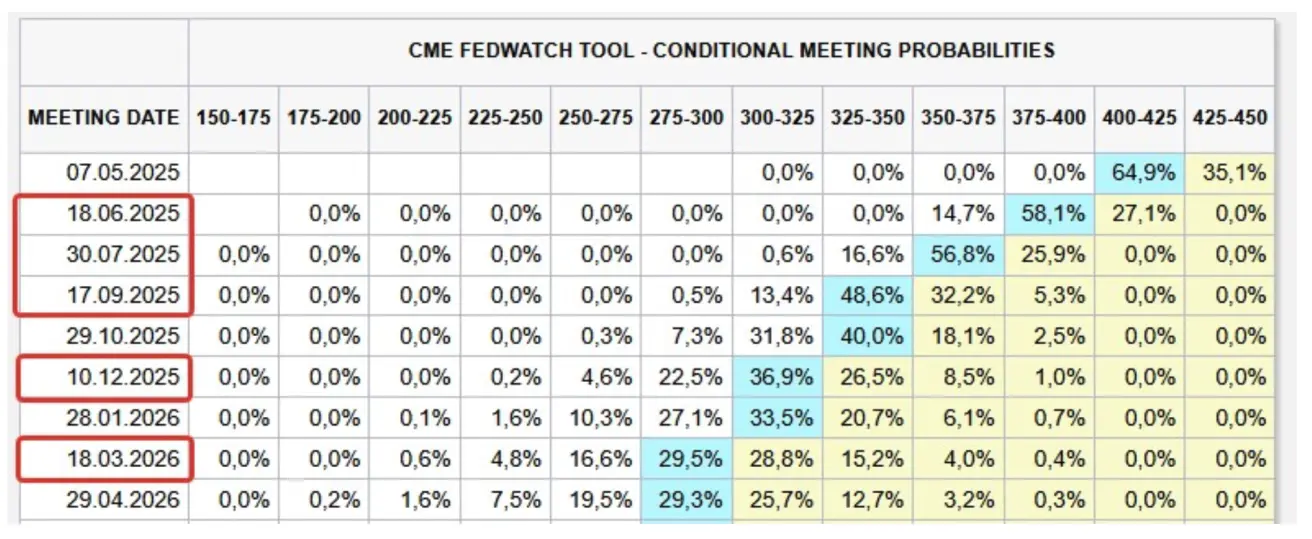

MARKET FORECAST FOR RATE

Today:

А week earlier:

А week earlier:

Commentary: The consumer inflation data came in rather optimistic. The release indicates a sharp decline in both the core and more volatile calculations. On a monthly basis, the CPI registered outright deflation at -0.1%. Prior to the events of April 2nd, such figures would have triggered a strong market rally. Unfortunately, with the introduction of tariffs, the world has already entered a new reality, and this release has, for the time being, lost its relevance.

Despite the Federal Reserve's decision at its most recent meeting to rely on hard data (i.e., retrospective releases), under current circumstances, it is likely to place greater emphasis on forward-looking expectations—since inflationary pressures will not be immediately visible in the statistics. Twelve-month inflation expectations surged from 5.0% to 6.7% this month, marking the highest level since 1981 and the fourth consecutive month of unusually large increases of 0.5% or more. Long-term inflation expectations also rose, climbing from 4.1% in March to 4.4% in April, reflecting another significant jump.

According to the Aston Business School, the long-term impact of 25% tariffs on countries could include an additional 5.5% rise in inflation as a result of the trade war. The model's calculations are based on the assumption of 25% tariffs:

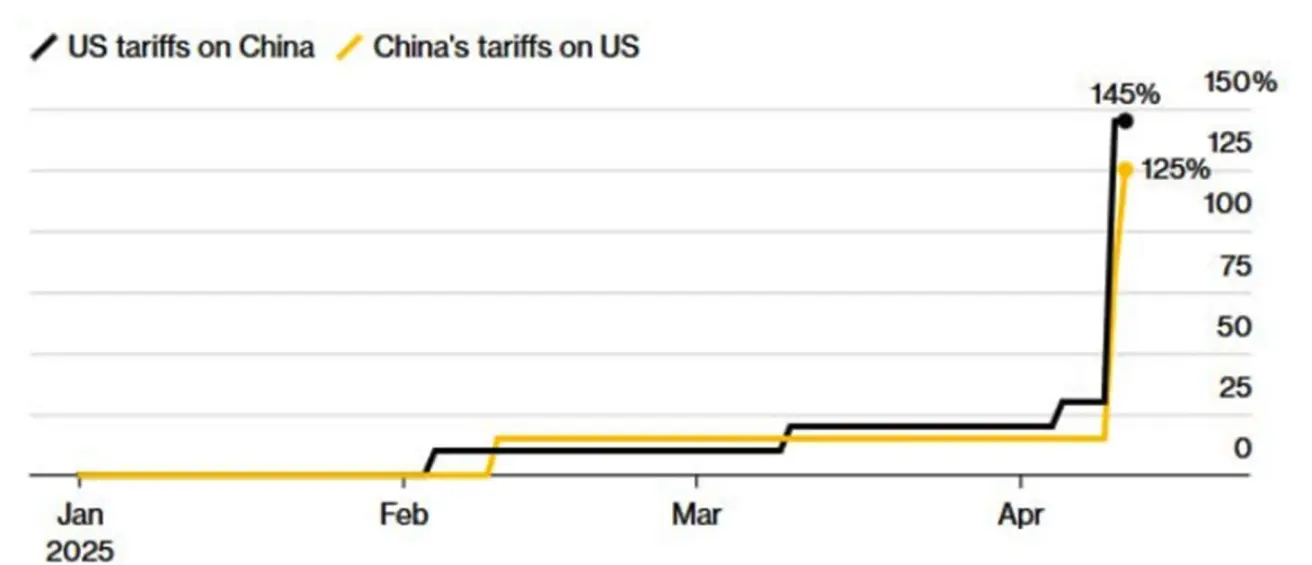

Trade Policy (as of April 14):

-

Donald Trump has taken a sharp turn in trade policy, reducing tariffs to a universal rate of 10% for all trade partners, with the exception of China, for which a 90-day pause has been introduced (April 10: Trump stated the U.S. may extend its 90-day pause in raising tariffs). White House Press Secretary Livitt reported that more than 75 countries have approached the Trump administration with the intention of resolving trade-related issues.

-

The tariff rate on Chinese imports has risen to 145%. China, at this stage, has no intention of making concessions and has responded with retaliatory tariffs of 125%. Meanwhile, China’s Ministry of Finance stated that if the U.S. imposes further tariff hikes on Chinese exports, such measures will be disregarded entirely by Beijing.

On April 12, President Trump rolled back tariffs on dozens of Chinese products, reducing them from 145% to just 10%. The list includes: mobile phones, computers, electronic chips, televisions, and solar panels.

Overall, high tariffs remain in place for the majority of goods. The figures—145% and 125%—essentially amount to a full-scale bilateral embargo, effectively constituting a ban on trade. This currently represents the primary risk to the global economy. Both countries will ultimately experience a significant slowdown in economic activity, making further negotiations inevitable. A reduction in these figures is likely in the near term. China and the European Union have agreed to initiate talks on eliminating EU tariffs on Chinese electric vehicles.

Federal Reserve Rhetoric:

- Neel Kashkari (Federal Reserve Bank of Minnesota): There is currently no consideration of rate cuts.

- Austan Goolsbee (Federal Reserve): The Fed should pause its interest rate adjustments for now and adopt a wait-and-see approach.

Market Expectations (FedWatch Tool): four 0.25% rate cuts over the next 12 months, bringing the range down to 3.25–3.50%.

MARKET

MARKET CAP PERFORMANCE

Last week’s results: a 0.6% gain at the median, with almost all sectors moving into positive territory, except for financials, consumer cyclicals, and non-real estate sectors.

YTD (Year-to-Date: the period from the beginning of the year to the present date): The market is down with a median decline of -14.87%.

SP500

Volatility during the past week was extreme. Weekly result: +5.70% (weekly close at 5363.35). Year-to-date decline for 2025: -9.15%.

NASDAQ100

Weekly result: +7.43% (weekly close at 18390.05). Year-to-date decline for 2025: -11.51%.

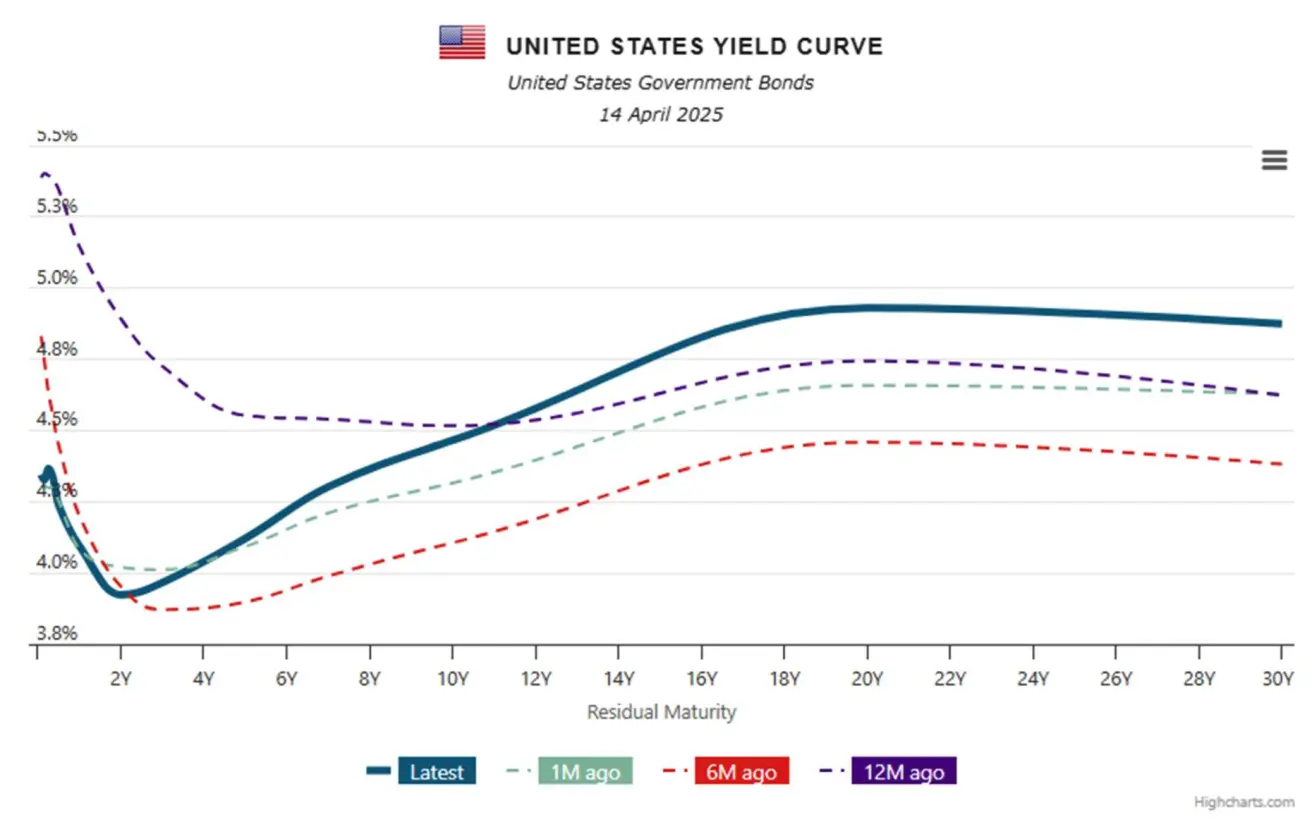

BOND MARKET

Weekly surge in yields, primarily in Treasuries (China and Japan have been reducing their positions in U.S. government debt).

20+ Year Treasury Bonds (ETF TLT): -6.42% (weekly close at $86.89). Year-to-date for 2025: -1.04%.

10-Year Treasury Yields: +0.6%.

YIELDS AND SPREADS 2025/04/14 vs 2025/04/07

A sharp increase in yields for long-duration instruments

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4,465% (vs 3,939%);

- ICE BofA BBB US Corporate Index Effective Yield: 5,77% (vs 5,32%):

Yield Spread between 10-Year and 2-Year U.S. Treasuries: 0.52 vs 41.3 basis points (reflecting the difference in returns between long-term and short-term debt).

Yield Spread between 10-Year and 2-Year U.S. Treasuries: 0.52 vs 41.3 basis points (reflecting the difference in returns between long-term and short-term debt).

Yield Spread between 10-Year and 3-Month U.S. Treasuries: 0.14 vs -31.3 basis points.

GOLD FUTURES (GC)

- Gold futures: +6,42%, weekly close at $3254,9 per troy ounce.

- Year-to-date 2025: +23,24%.

DOLLAR INDEX FUTURES (DX)

- Continued to decline, -3.46%;

- Weekly close: 99.135;

- Year-to-date: -8.49%.

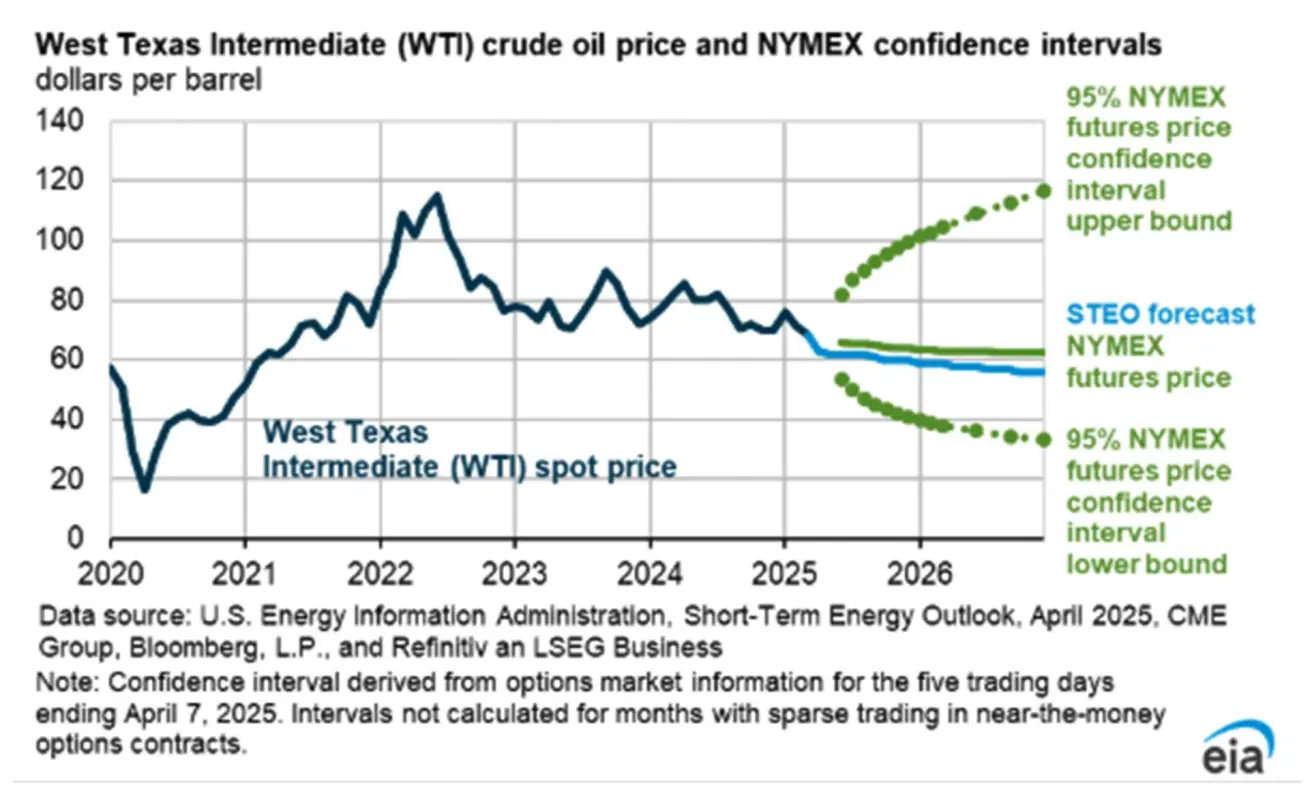

OIL FUTURES

- Weekly performance: -1,35%, closing at $61,48 per barrel.

- Year-to-date performance: - 14,43%.

Short-Term Outlook on Energy Markets from the EIA:

The IEA estimates that oil demand growth may be lower and has therefore revised down its forecast for global oil demand. The agency now expects global oil consumption to rise by 0.9 million barrels per day (mb/d) in 2025 and by 1.0 mb/d in 2026, which is 0.4 mb/d and 0.1 mb/d lower, respectively, than the previous month’s forecast.

The IEA estimates that oil demand growth may be lower and has therefore revised down its forecast for global oil demand. The agency now expects global oil consumption to rise by 0.9 million barrels per day (mb/d) in 2025 and by 1.0 mb/d in 2026, which is 0.4 mb/d and 0.1 mb/d lower, respectively, than the previous month’s forecast.

However, since recent updates in trade policy have broadened the range of potential GDP growth outcomes, the agency noted that this forecast is subject to significant uncertainty.

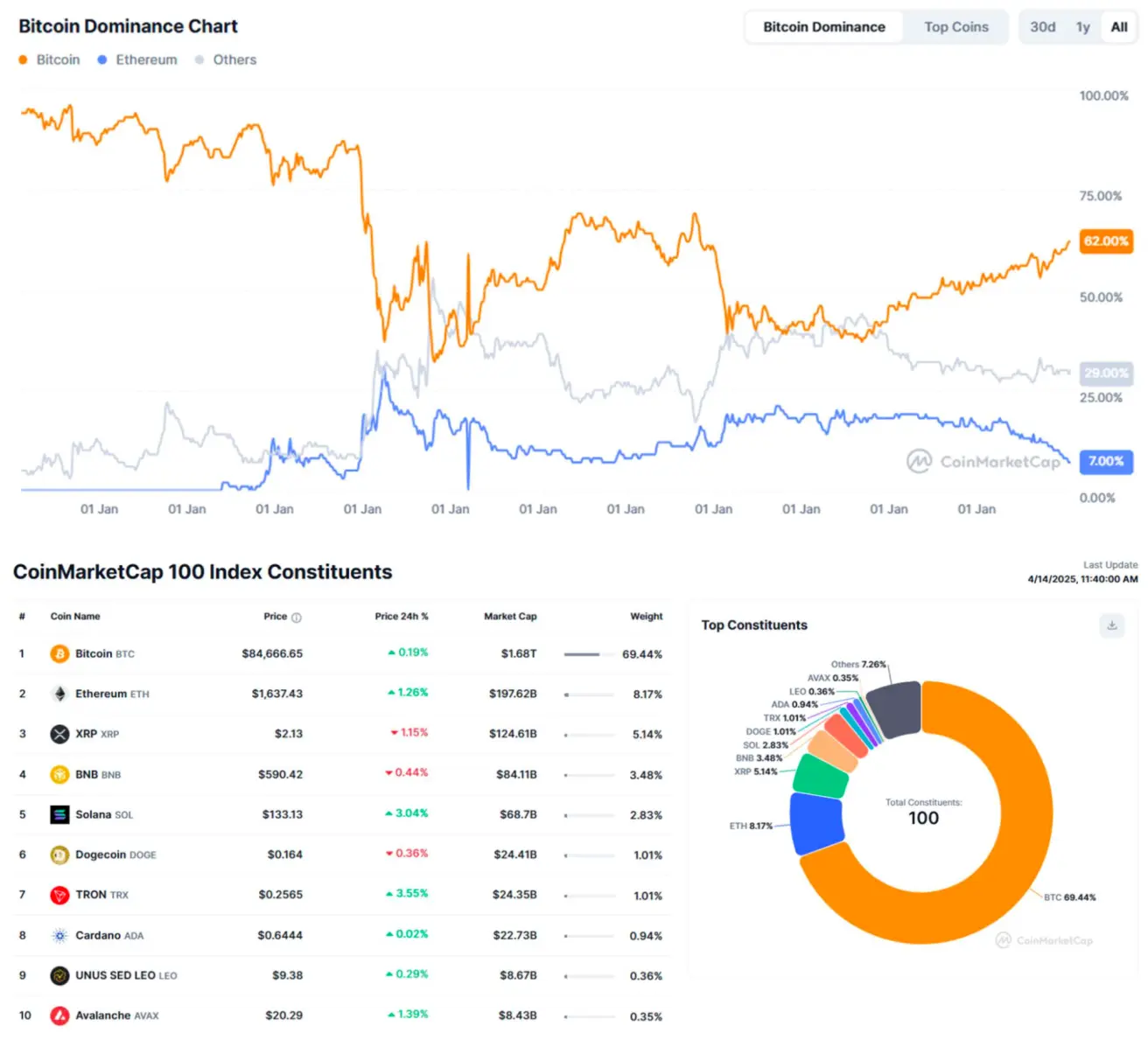

BTC FUTURES

- Weekly performance: -0,50%, weekly close at $84055

- Year-to-date performance in 2025: -11,77%:

ETH FUTURES

- Weekly performance: -13,54%, weekly close at $1577,5

- Year-to-date performance in 2025: -53,38%.

Total Crypto Market Capitalization: $2.68 trillion vs $2.44 trillion the previous week (coinmarketcap.com).

- Bitcoin: 62.6% (vs 62.9%)

- Ethereum: 7.4% (vs 7.4%)

- Others: 30.0% (vs 29.7%)

Ongoing Political Easing in the U.S. Crypto Market:

- The Florida House Banking and Insurance Committee unanimously passed a bill (HB 487) allowing the state to invest public funds in Bitcoin.

- The New Hampshire House of Representatives passed a bill on Bitcoin reserves.

- A new bill has been introduced in New York allowing the state government to accept cryptocurrencies as a form of payment.

Қазақша

Қазақша