March 17 - 21, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (February): 0.2% (prev: 0.4%);

- Consumer Price Index (CPI) (m/m) (February): 0.2% (prev: 0.5%);

- Core Consumer Price Index (CPI) (y/y) (February): 3.1% (prev: 3.3%);

- Consumer Price Index (CPI) (y/y) (February): 2.8% (prev: 3.0%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (February): 4.9%, prev: 4.3%;

- 5-year expected inflation (February): 3.9%, prev: 3.5%.

GDP (BEA – U.S. Bureau of Economic Analysis) (q/q) (Q) (Preliminary Estimate)

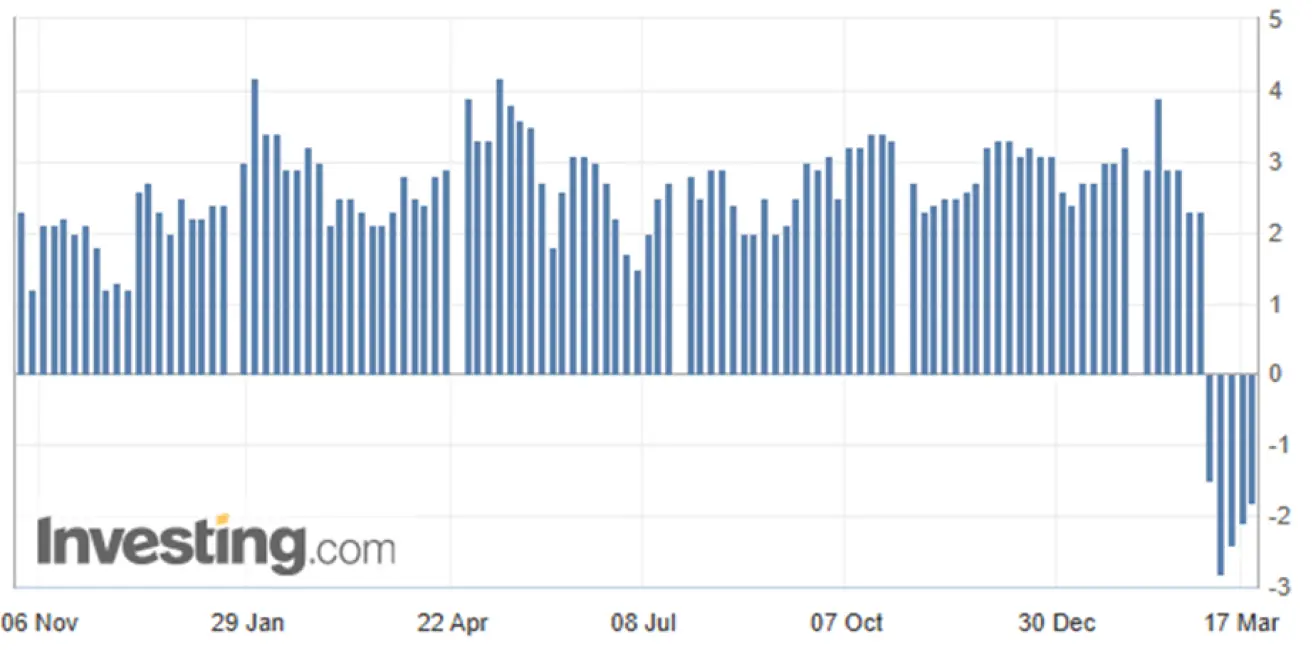

- 2.3% (prev: 3.1%) The Atlanta Fed’s GDPNow indicator: -1.8%.

*The GDPNow forecasting model provides a "real-time" estimate of official GDP growth ahead of its release, using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

*The GDPNow forecasting model provides a "real-time" estimate of official GDP growth ahead of its release, using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

BUSINESS ACTIVITY INDEX (PMI):

- Services Sector (February): 51 (prev: 49.7);

- Manufacturing Sector (February): 52.7 (prev: 51.6);

- S&P Global Composite (February): 51.6 (prev: 50.4).

LABOR MARKET:

- Unemployment Rate (February): 4.1% (prev: 4.0%);

- The change in non-agricultural employment for February stands at 151K (prev 81K);

- Average Hourly Earnings (February, y/y): 4.0% (prev: 3.9%).

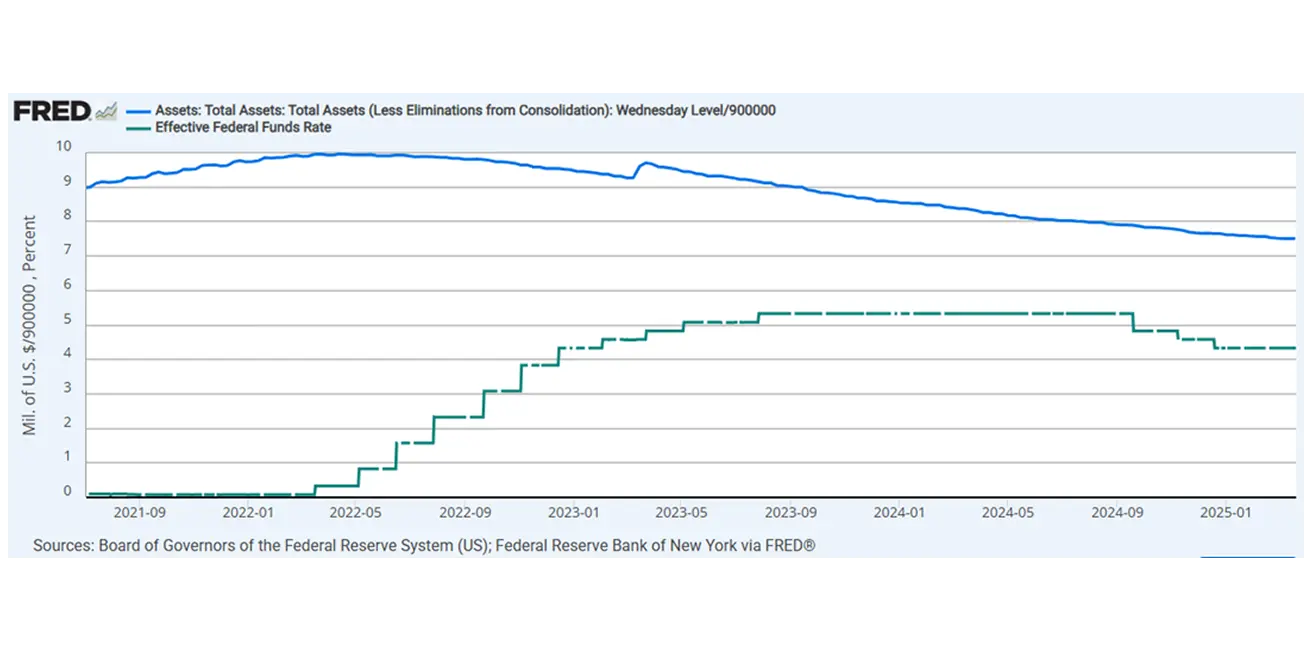

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.756 trillion (vs previous week: $6.759 trillion)

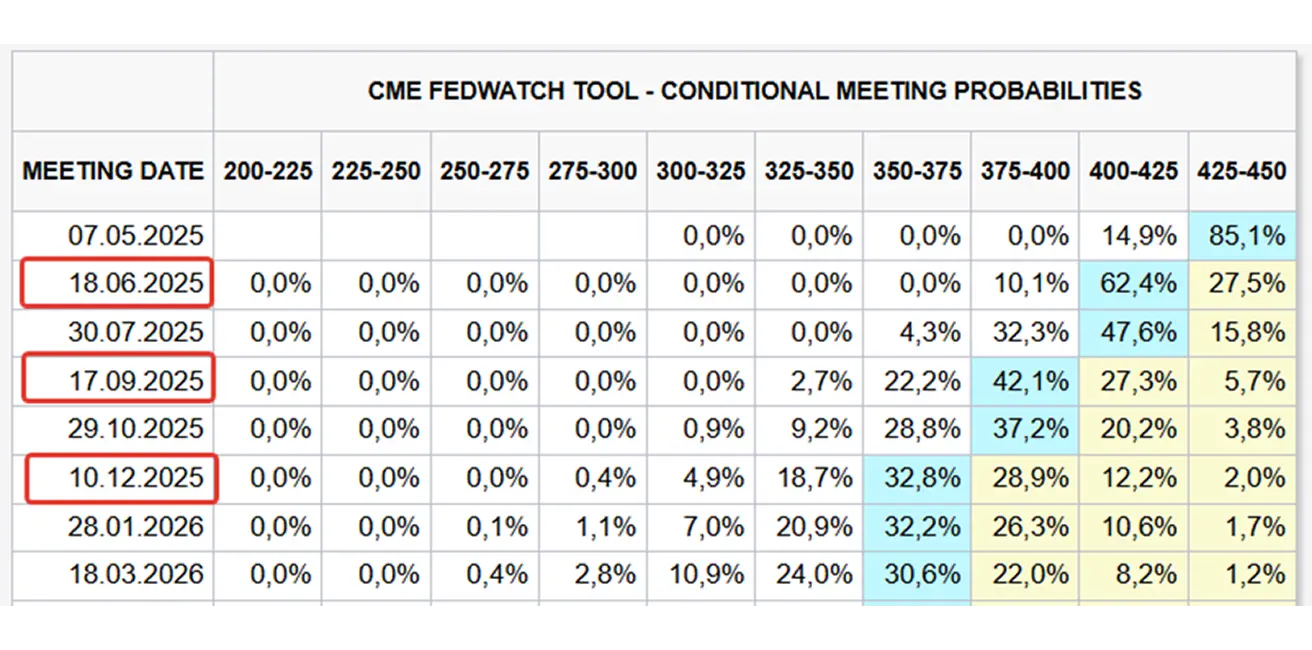

MARKET FORECAST FOR RATE

Today:

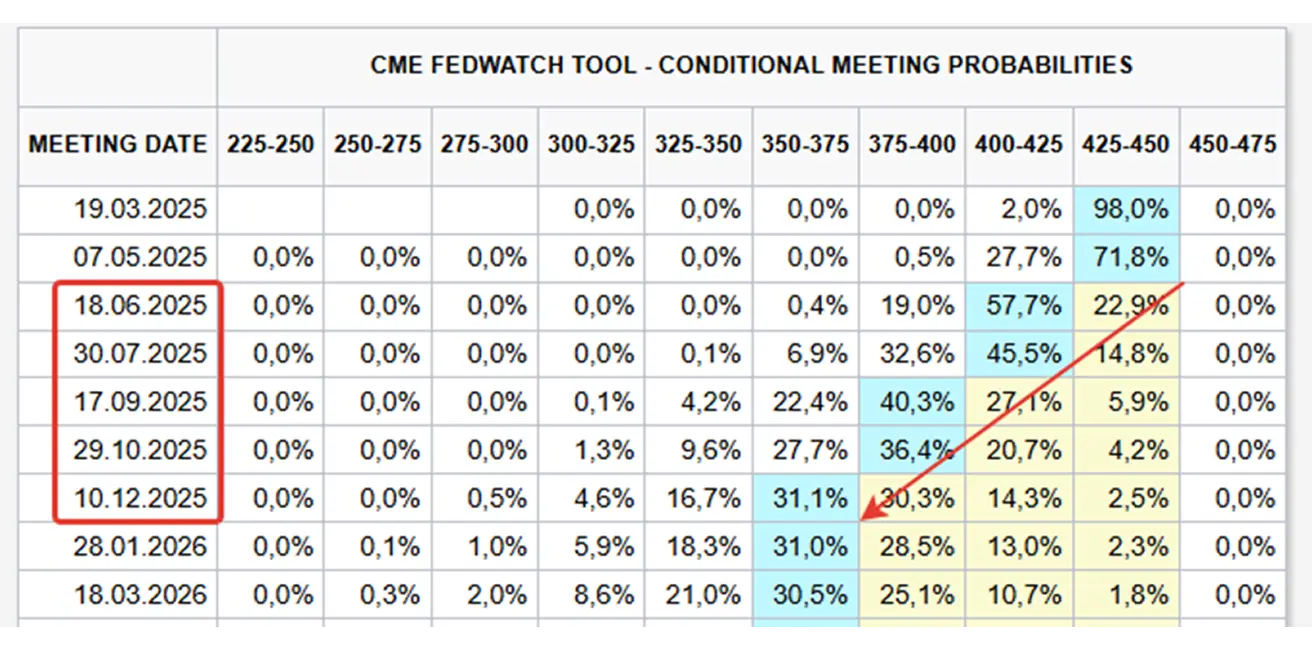

А week earlier:

А week earlier:

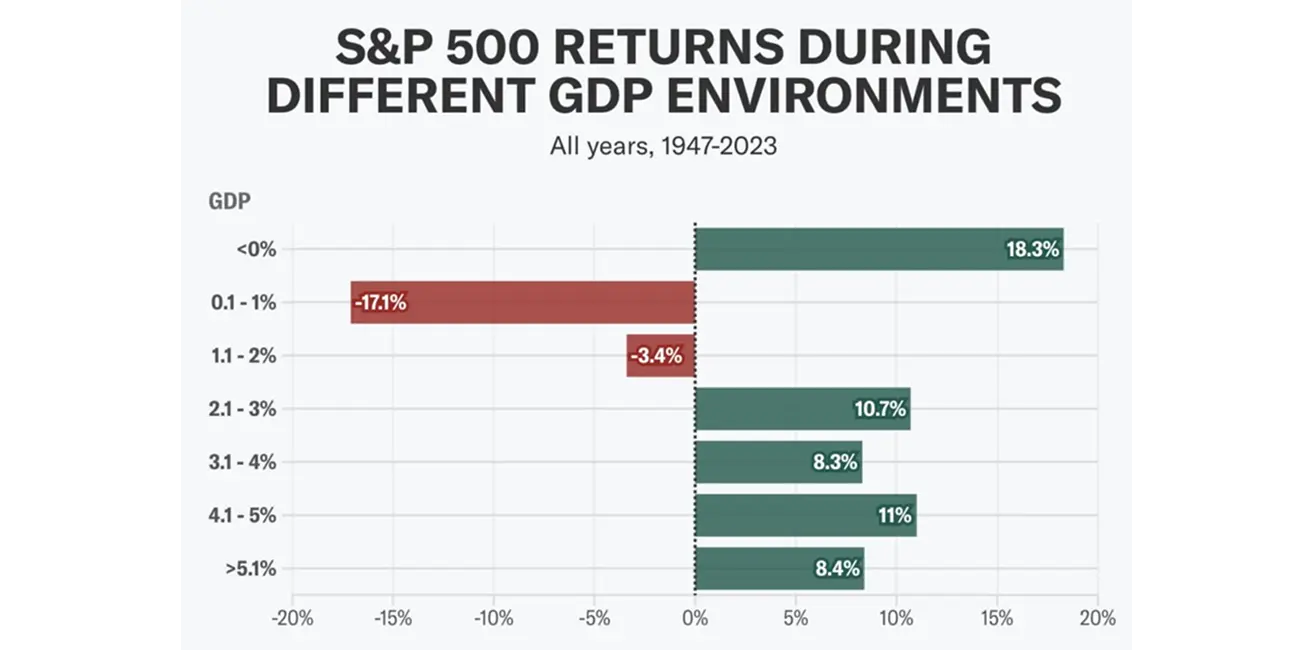

Commentary: The Atlanta Federal Reserve’s current estimate for real GDP growth in Q1 2025 stands at -1.8%. The Federal Open Market Committee (FOMC) also projects a broader economic slowdown, forecasting full-year growth of just 1.7% for 2025.

At its latest meeting, the FOMC revised its inflation outlook upward to 2.7% based on the Personal Consumption Expenditures (PCE) index. Simultaneously, it signaled two potential 25 basis point cuts to the federal funds rate (EFFR), bringing it down to a range of 3.75–4.00%.

The Federal Reserve’s stance on monetary policy remains cautious, with a clear tilt toward downside risks for economic activity.

Market expectations, as reflected in the CME FedWatch tool, currently price in three rate cuts of 25 basis points each between June and December, implying an anticipated policy rate of 3.50–3.75% by year-end 2025.

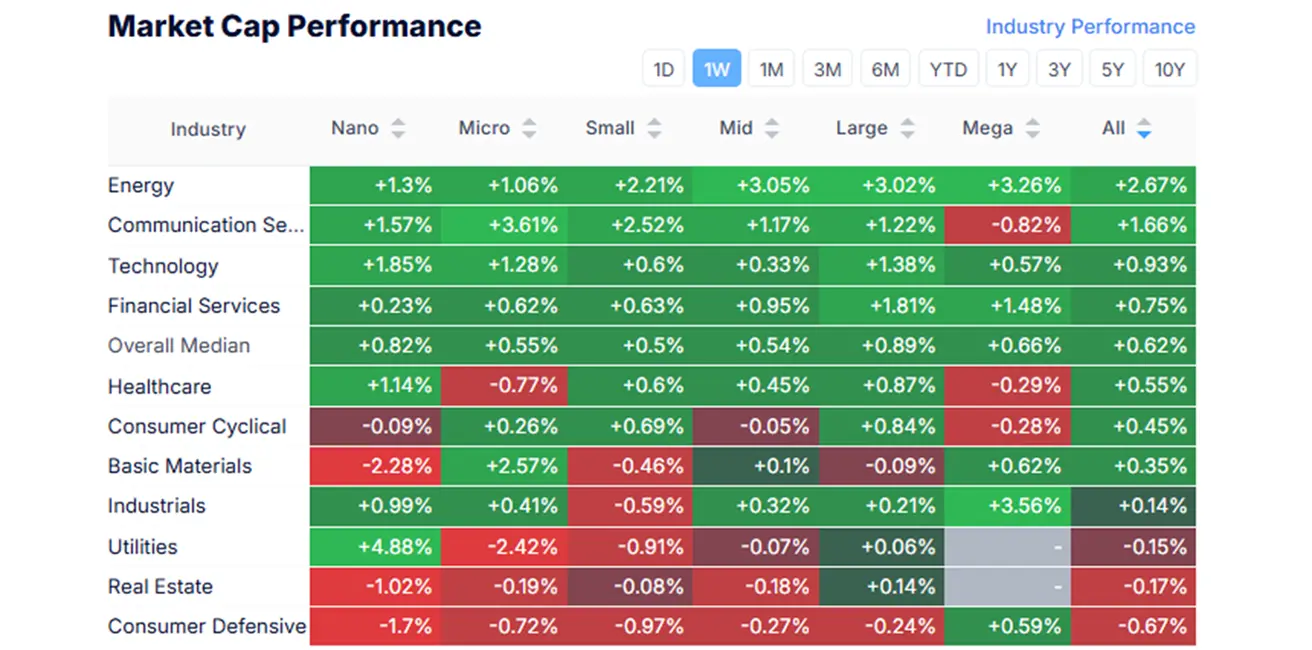

Equity Markets Last week, equity markets continued to recover from the recent correction. The median gain came in at 0.62%. Defensive sectors such as utilities, real estate, and consumer staples posted negative returns—signaling a tentative shift back toward a risk-on sentiment.

Market

MARKET CAP PERFORMANCE

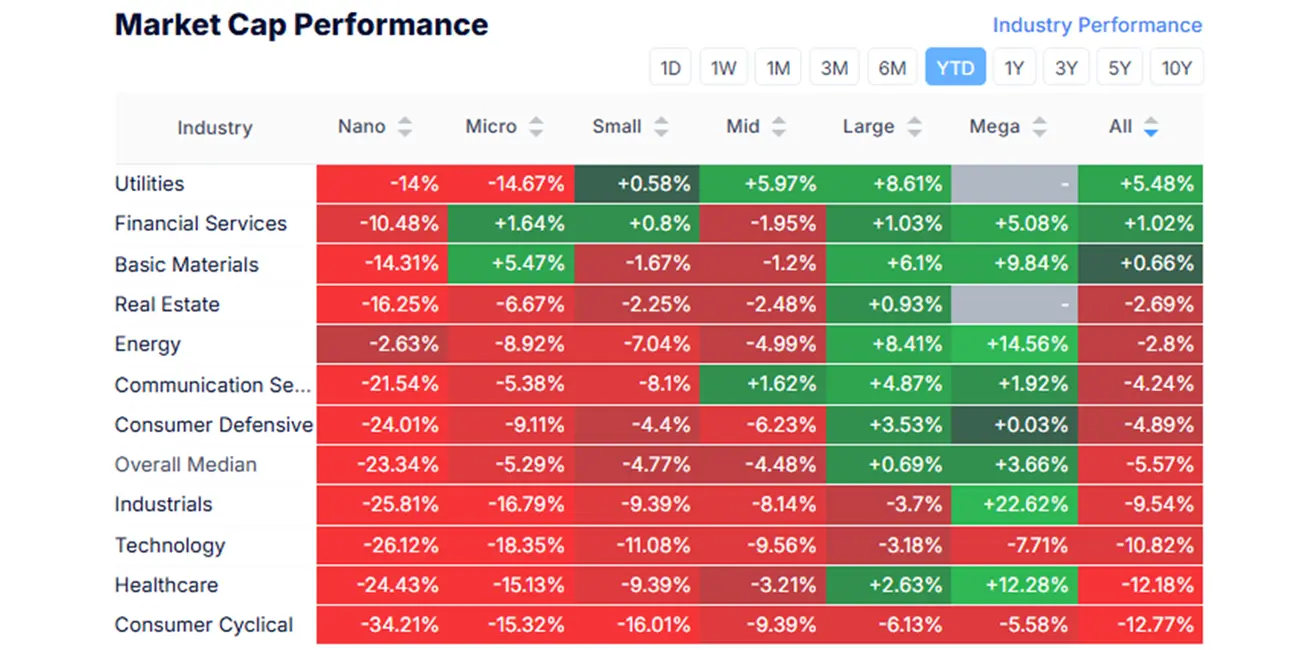

YTD (Year-to-Date: the period from the beginning of the year to the present date).

As of year-end, the median decline stands at 5.57%. The technology, healthcare, and consumer discretionary sectors continue to lag, remaining the primary underperformers.

YTD (Year-to-Date: the period from the beginning of the year to the present date).

As of year-end, the median decline stands at 5.57%. The technology, healthcare, and consumer discretionary sectors continue to lag, remaining the primary underperformers.

SP500

Weekly performance: +0,55% (week's closing at 5 669,68). Year-to-date fall in 2025: -3,96%.

Historical S&P 500 returns across varying levels of GDP growth:

NASDAQ100

Nasdaq 100: Weekly performance: +0,25% (week’s closing at 19 753,97). Year-to-date decline in 2025: -6,47%.

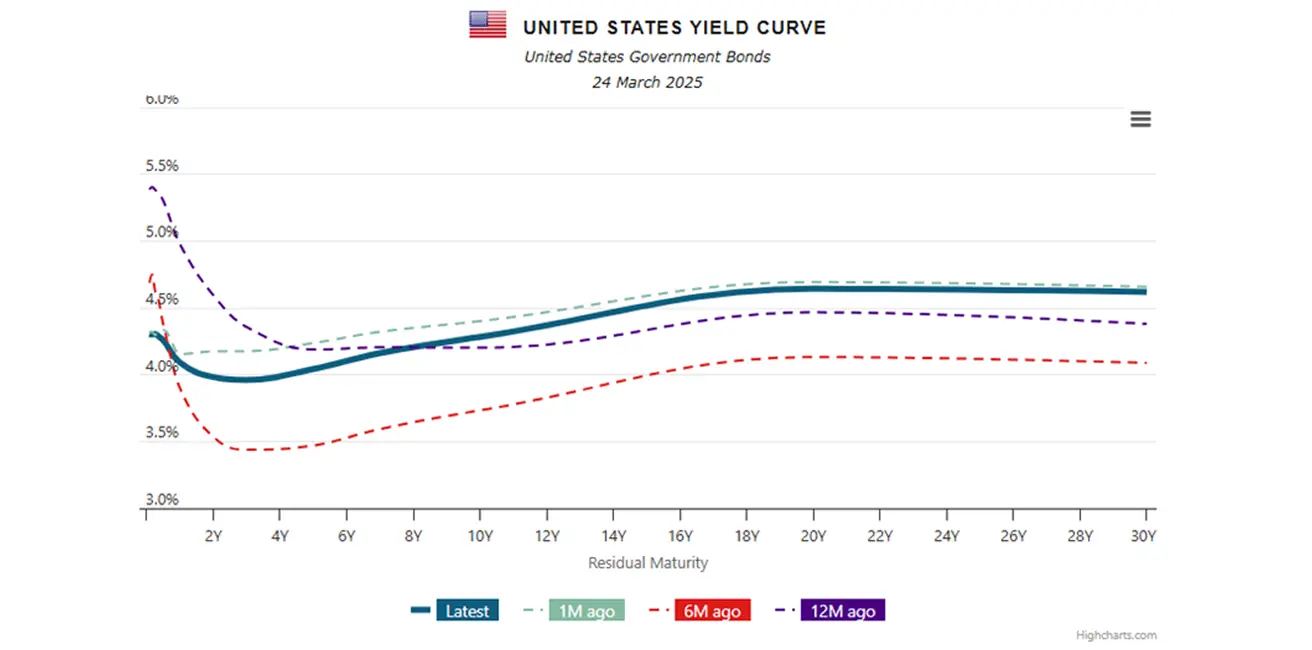

BOND MARKET

Treasury Bonds 20+ (ETF TLT): +0,59% (week’s closing at $90,70). Year-to-date performance in 2025: +3,30% .

The MOVE Index — which tracks implied volatility in short-term U.S. Treasury options — continued to decline following the FOMC meeting, reflecting growing expectations of rate cuts.

YIELDS AND SPREADS 2025/03/16 vs 2024/03/09

The yield spread between 10-year and 2-year U.S. Treasury bonds stands at 30.1 vs 29.7 basis points, reflecting the difference in yields between long- and short-term government debt.

- Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity: 4.283% (vs 4.318%)

- ICE BofA BBB U.S. Corporate Index Effective Yield: 5.32% (vs 5.42%)

GOLD FUTURES (GC)

- Gold futures: +1,16%, weekly close at $3 028,2 per troy ounce.

- Year-to-date 2025: +14,66%.

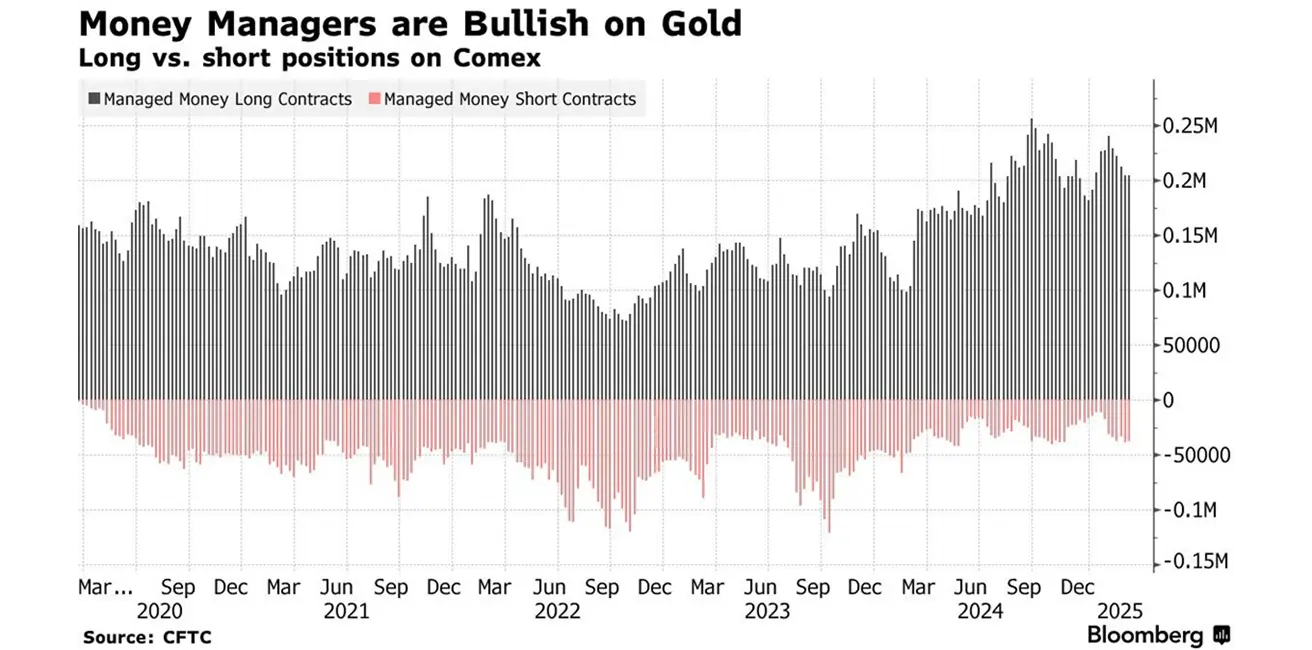

According to the CFTC (Commodity Futures Trading Commission), asset managers maintain a bullish outlook on gold.

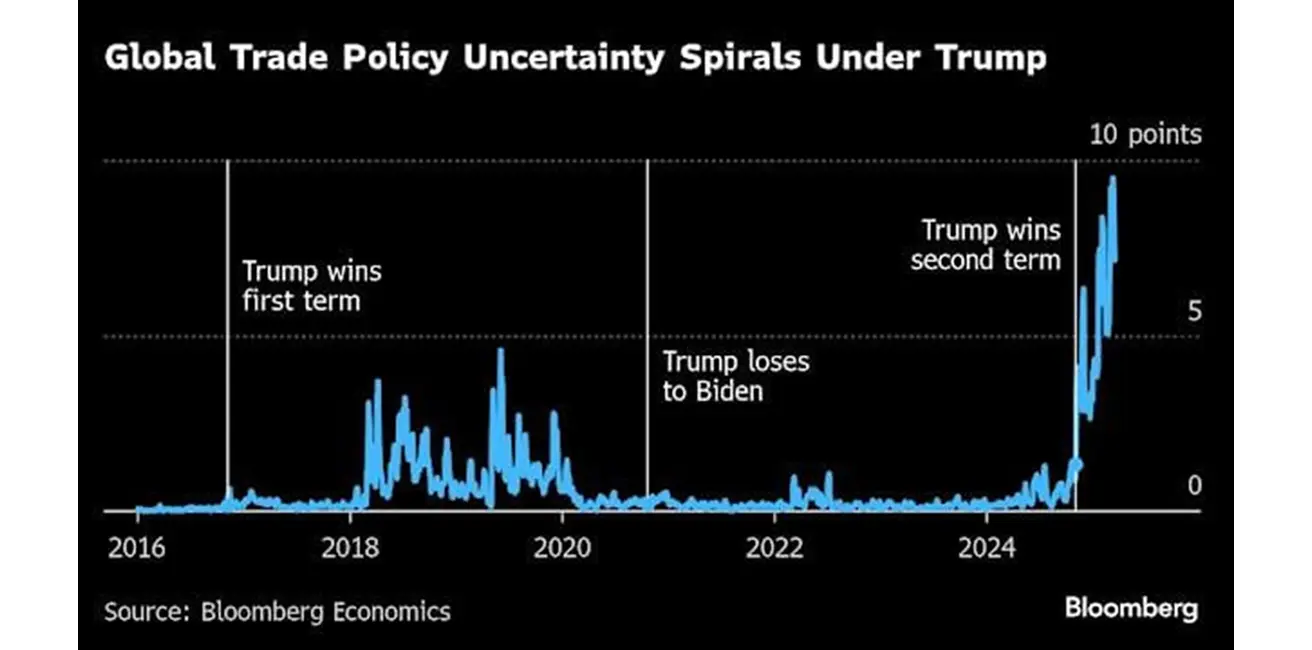

Uncertainty in global trade policy under a Trump presidency:

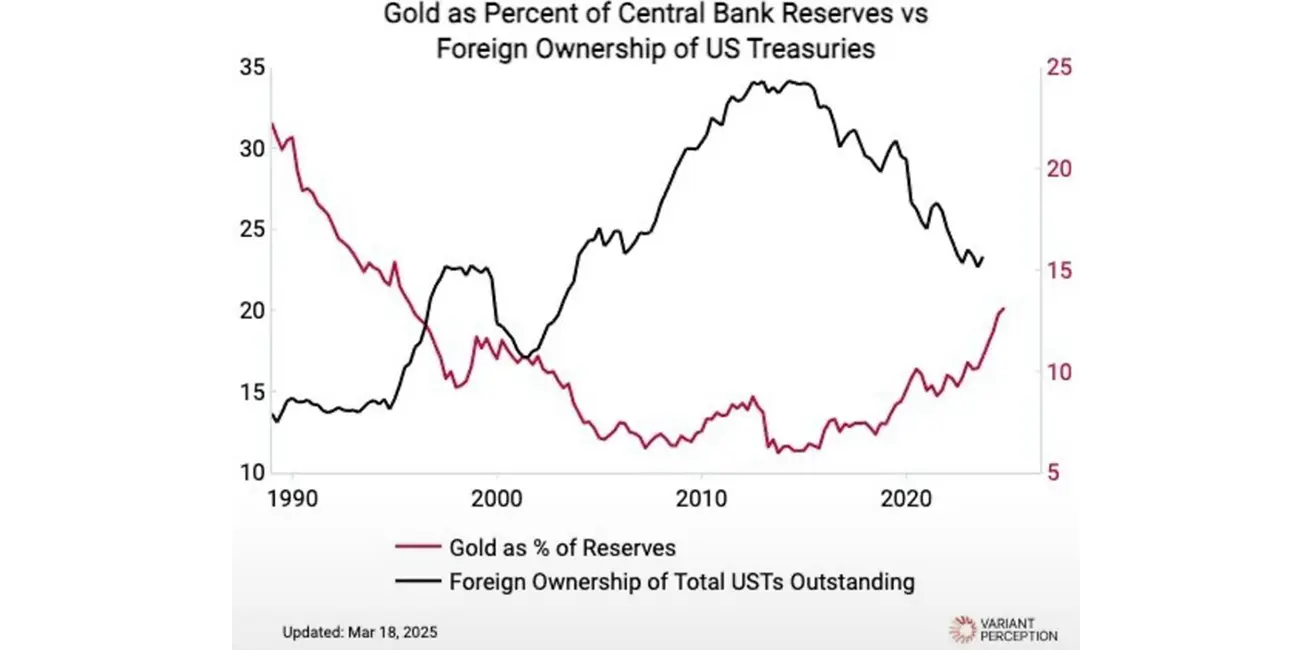

Central banks are increasing their gold reserves while simultaneously reducing their holdings of U.S. Treasury securities.

DOLLAR INDEX FUTURES (DX)

- U.S. Dollar Index futures (DX): +0,41%, weekly close at 103,79.

- Year-to-date 2025: -4,19%.

OIL FUTURES

- Weekly performance: +1,64%, closing at $68,29 per barrel.

- Year-to-date performance: - 4,95%.

Recent forecasts:

- Goldman Sachs has revised its outlook downward to $65–80 per barrel, citing mounting pressure on U.S. economic growth. The firm no longer considers $70 as a price floor.

- Morgan Stanley and Bank of America have lowered their projections to $60 per barrel.

- Citigroup and JPMorgan now forecast prices in the $50–60 per barrel range.

BTC FUTURES

- Weekly performance: -0,26% ($84185).

- Year-to-date performance in 2025: -11,64%.

ETH FUTURES

- Weekly performance: +2,38% ($1975,0).

- Year-to-date performance in 2025: -41,63%.

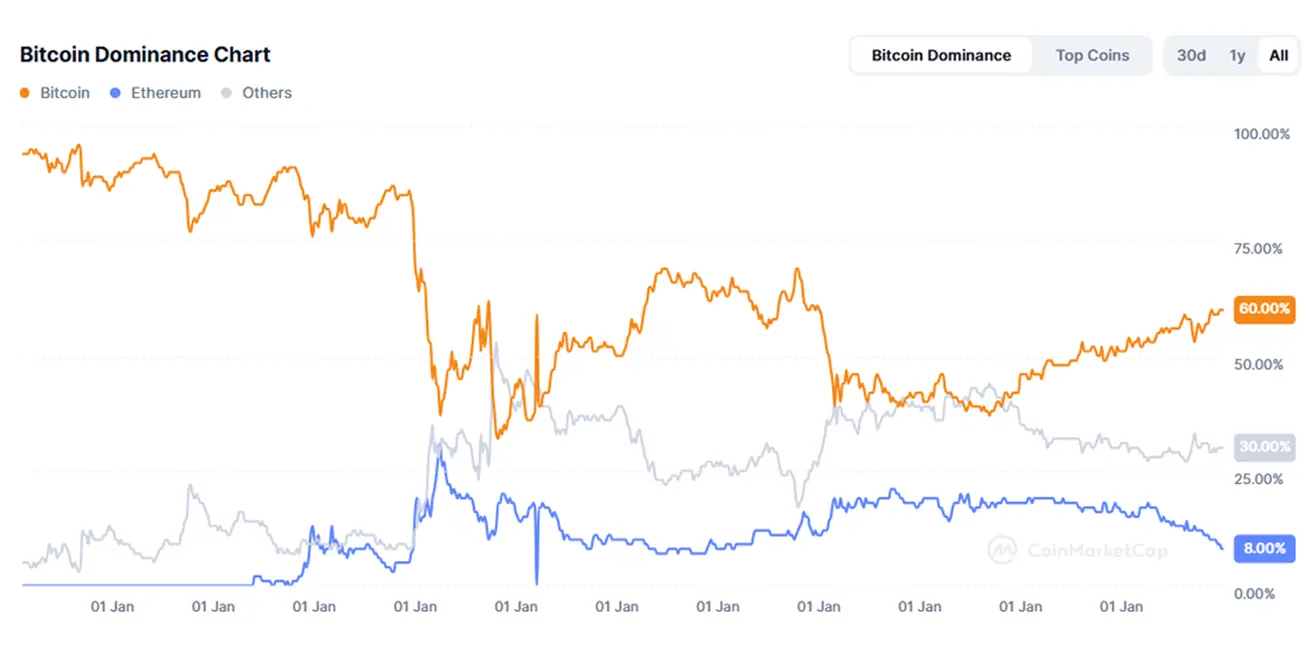

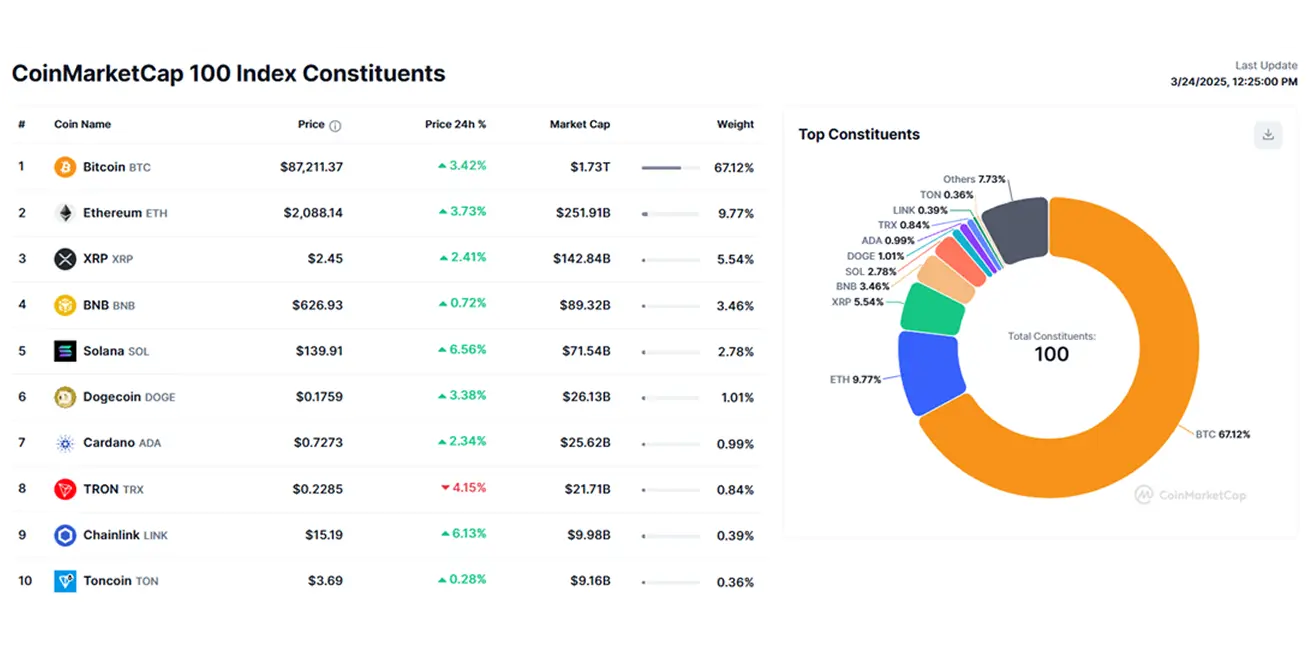

Cryptocurrency market capitalization stands at $2.86 trillion (up from $2.74 trillion the previous week) (source: coinmarketcap.com).

-

Bitcoin dominance: 60.6% (previously 61.0%),

-

Ethereum dominance: 8.8% (up from 8.4%),

-

Others: 30.5% (down from 30.6%).

-

On March 17, the CME launched futures trading for Solana (SOLH2025), which surged +10.90% in the first two trading days.

-

North Carolina has proposed Bill SB327, allowing up to 10% of the state’s funds to be allocated to Bitcoin.

-

The SEC issued a statement (see sec.gov for details) clarifying that mining activities under the Proof-of-Work (PoW) mechanism do not constitute a securities offering.

-

The International Monetary Fund (IMF) has included Bitcoin and other cryptocurrencies in the international balance of payments statistics in its latest Balance of Payments Manual (7th edition, BPM7, dated March 20, 2025).

-

BlackRock CEO Larry Fink stated that Bitcoin could reach $500,000 to $700,000.

Қазақша

Қазақша