April 21 — 25, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (March): 0.1% (prev: 0.2%);

- Consumer Price Index (CPI) (m/m) (March): -0.1% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (March): 2.8% (prev: 3.1%);

- Consumer Price Index (CPI) (y/y) (March): 2.4% (prev: 2.8%).

INFLATION EXPECTATIONS (MICHIGAN)

-

12-month expected inflation (April): 6.5%, prev: 5.0%;

-

5-year expected inflation (April): 4.4%, prev: 4.1%.

-

GDP (BEA – U.S. Bureau of Economic Analysis) (4Q24 annualized): (third estimate): 2.4%; second estimate: 2.3%; (3rd quarter: 3.1%).

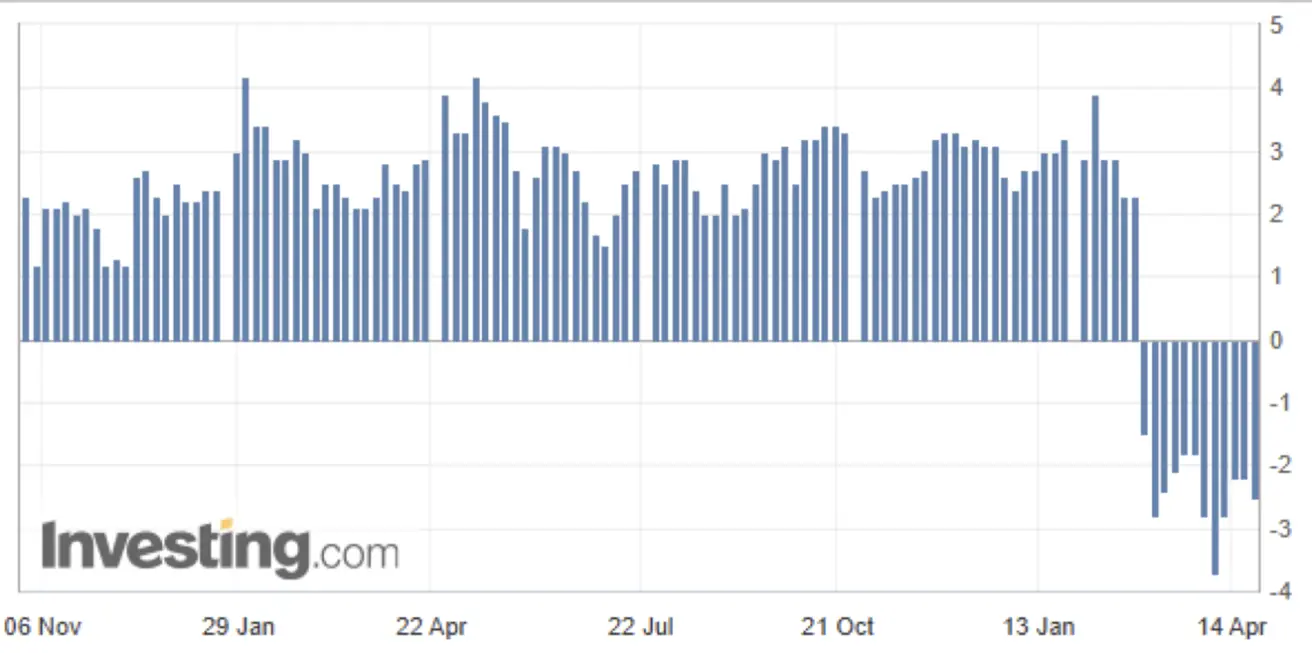

The GDPNow indicator published by the Federal Reserve Bank of Atlanta: -2.5% (vs. -2.2%).

The GDPNow forecasting model provides the "current" version of the official estimate prior to its release, evaluating GDP growth using a methodology similar to that employed by the U.S. Bureau of Economic Analysis.

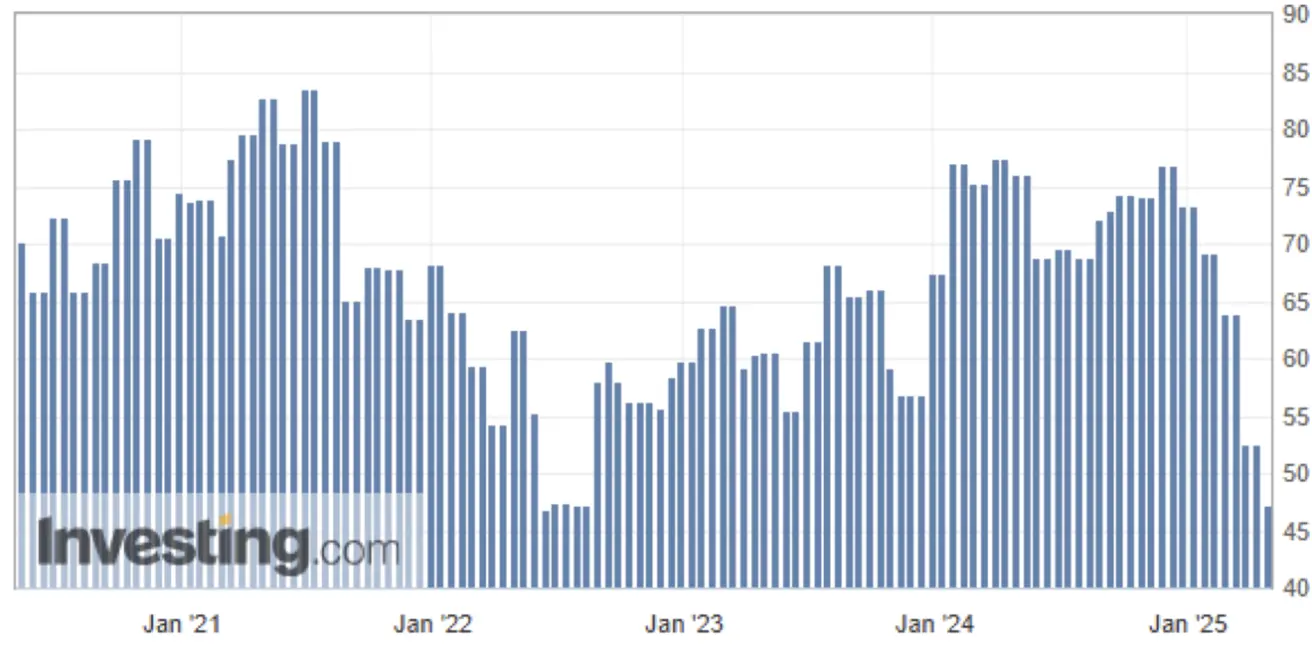

Consumer Sentiment (University of Michigan):

-

Expectations Index (April): 47.3 (prev: 52.6)

-

Sentiment Index: 52.2 (prev: 57)

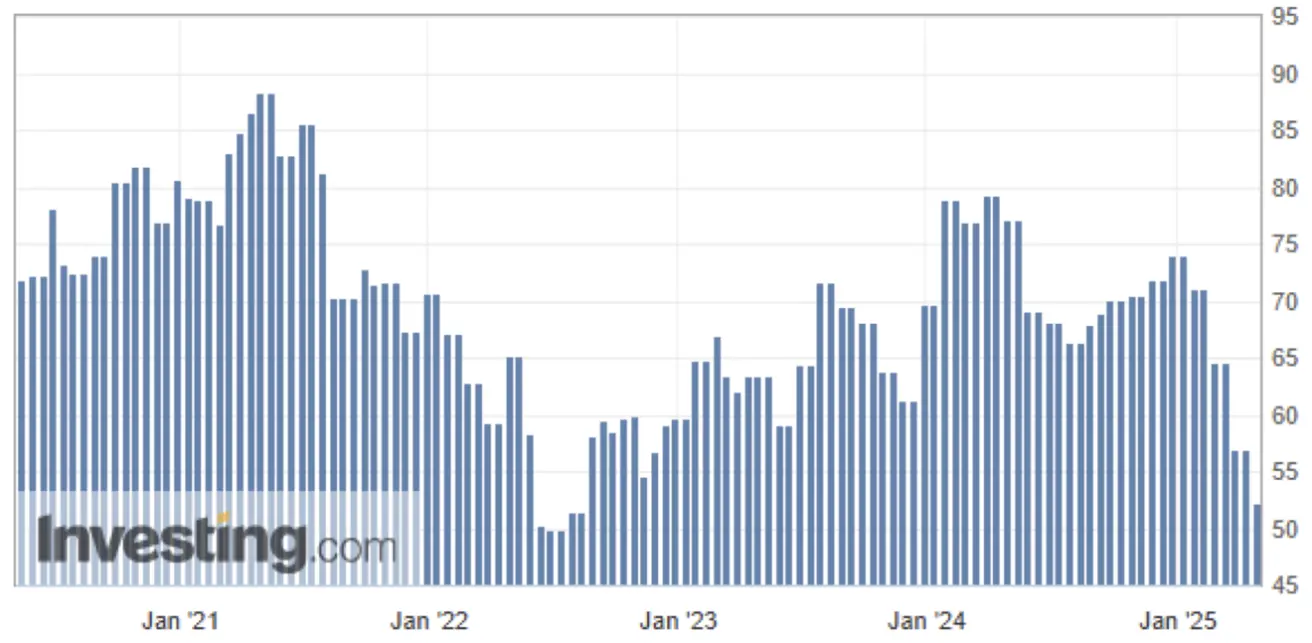

BUSINESS ACTIVITY INDEX (PMI):

- Services Sector (April): 51.4 (prev: 54.4);

- Manufacturing Sector (April): 50.7 (prev: 49.8);

- S&P Global Composite (April): 51.2 (prev: 53.5).

Durable Goods Orders:

- MoM Growth: 9.2% (prev: 0.9%)

LABOR MARKET:

- Unemployment Rate (March): 4.2% (prev: 4.1%)

- Nonfarm Payrolls (March): +228K (prev: +117K)

- Average Hourly Earnings (y/y, March): 3.8% (prev: 4.0%)

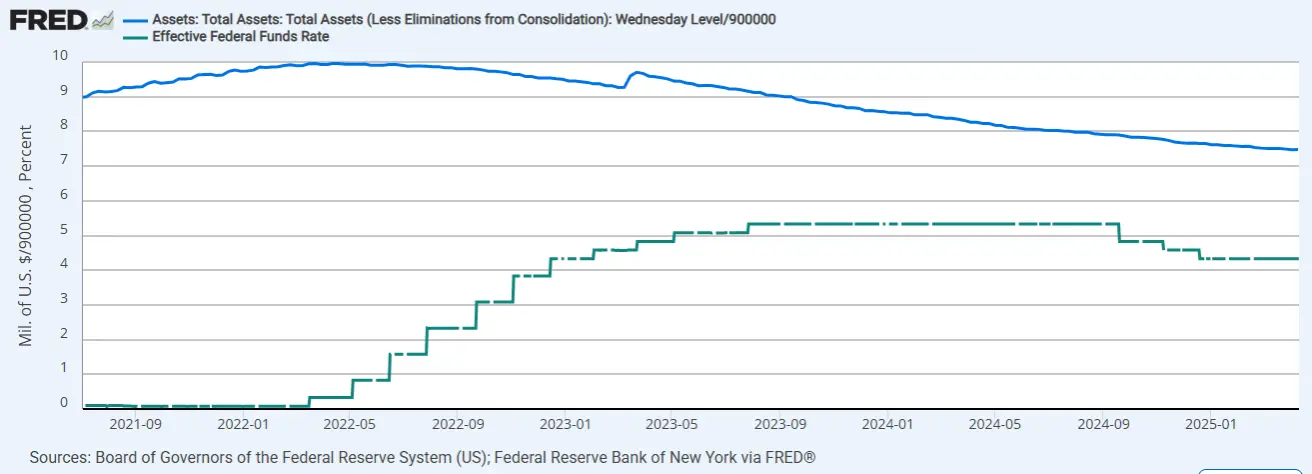

MONETARY POLICY

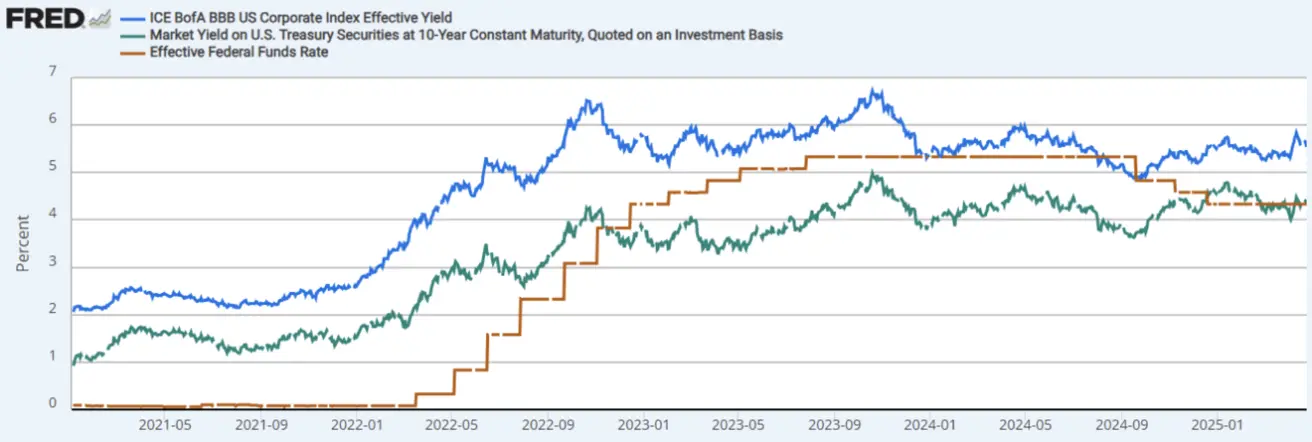

- Federal Funds Rate (EFFR): 4.25%–4.50% (dotted line);

- Fed Balance Sheet (blue): $6.726 trillion (vs previous week: $6.727 trillion)

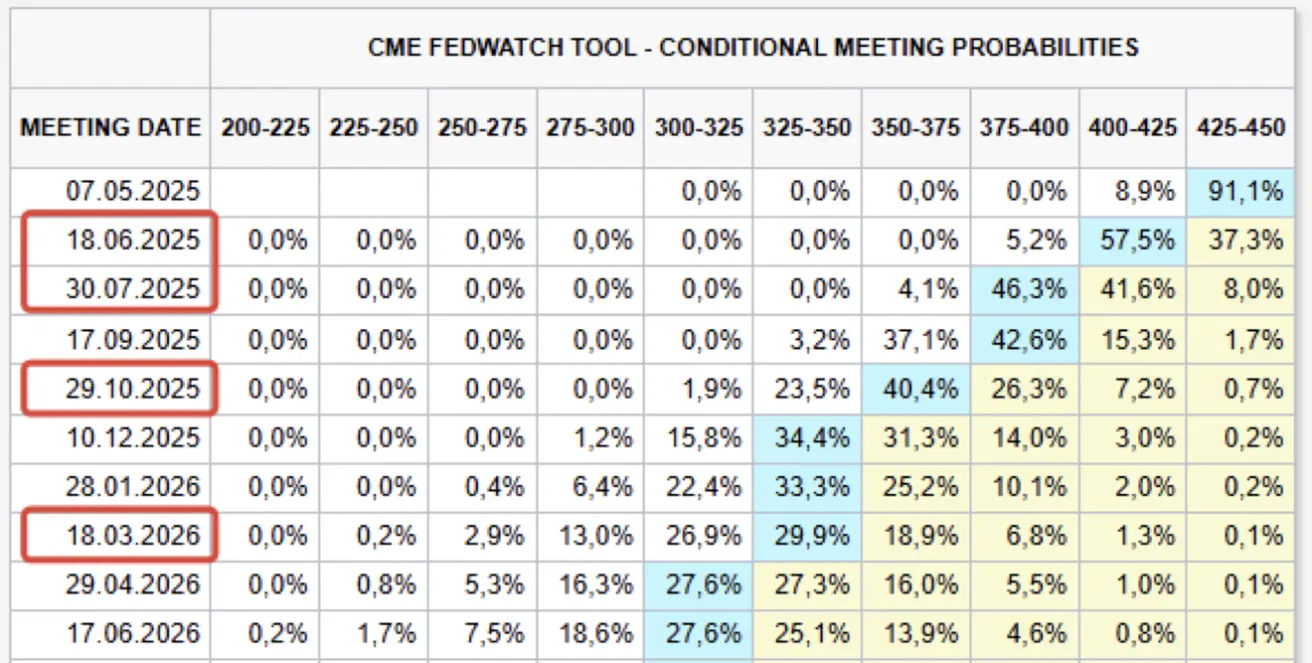

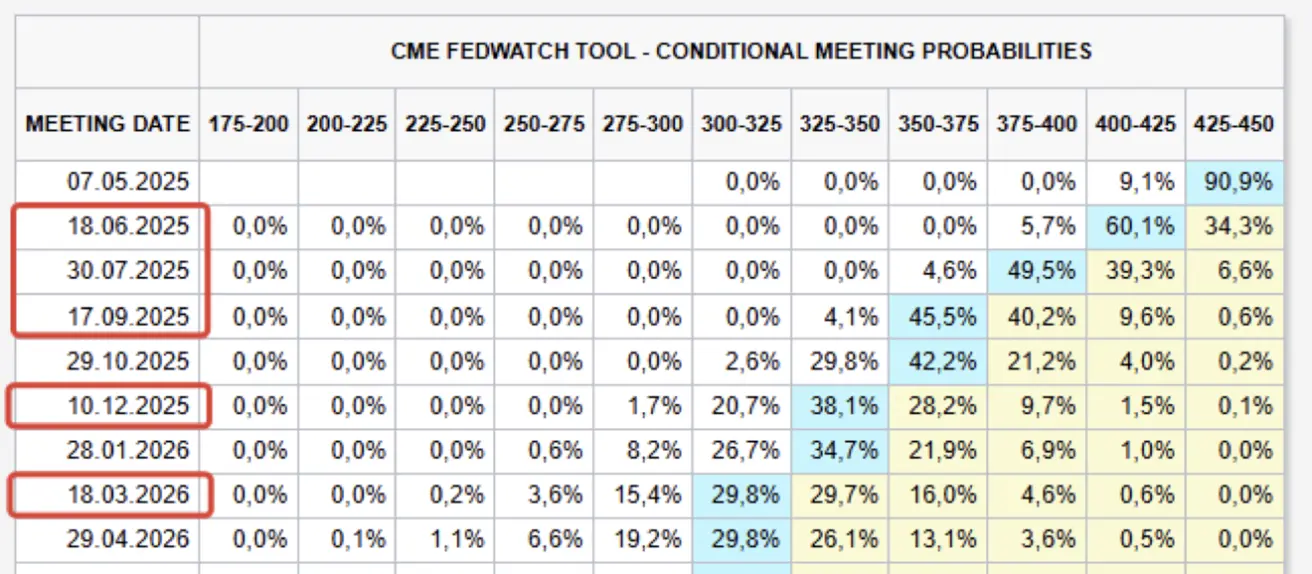

MARKET FORECAST FOR RATE

Today:

А week earlier:

А week earlier:

Commentary: University of Michigan Survey: Consumer sentiment has fallen for the fourth consecutive month, declining by 8% since March. Although the drop in current conditions was moderate, the expectations index plummeted due to worsening personal finances and business conditions. Expectations have fallen 32% since January — the sharpest three-month decline since the 1990 recession.

GDPNow: Atlanta Fed's real-time GDP model signals a contraction of -2.5% (previously -2.2%).

Business Activity: US manufacturing PMI climbed above the expansion threshold (50.7 vs. 49.8). However, service sector activity dropped notably (51.4 vs. 54.4), suggesting potential disinflation ahead, as lower service sector inflation would offset goods inflation.

Durable Goods Orders: Orders surged by 9.2% month-over-month, typically reflecting consumer anticipation of future price increases amid rising tariffs.

China's Policy Moves:

- PBOC held base rates steady but hinted at possible rate cuts.

- China's Finance Ministry to issue ¥286 billion ($39 billion) of special sovereign bonds to stimulate the economy.

Fed Beige Book Highlights:

- Widespread uncertainty about trade policy across all 12 districts.

- Economic outlooks deteriorated in several districts due to rising uncertainties.

- Some firms have halted hiring; others are preparing for layoffs.

Monetary Policy

Market expectations via the FedWatch tool remain unchanged: five cuts of 0.25% each over the next 12 months, targeting a range of 3.00–3.25%.

The Fed’s balance sheet has not declined for the second consecutive week.

Regarding trade policy:

- 35% tariffs are maintained on Chinese goods deemed non-critical to U.S. national security;

- Tariffs of at least 100% on strategically important Chinese imports remain;

- China is considering suspending a 125% tariff on U.S. imports, including medical equipment, chemicals, and aircraft leases.

Formal trade negotiations between the U.S. and China have yet to begin.

More than ten U.S. states filed lawsuits against the Trump administration to halt tariff policies. Plaintiffs include Oregon, Arizona, Colorado, Connecticut, Delaware, Illinois, Maine, Minnesota, Nevada, New Mexico, New York, and Vermont.

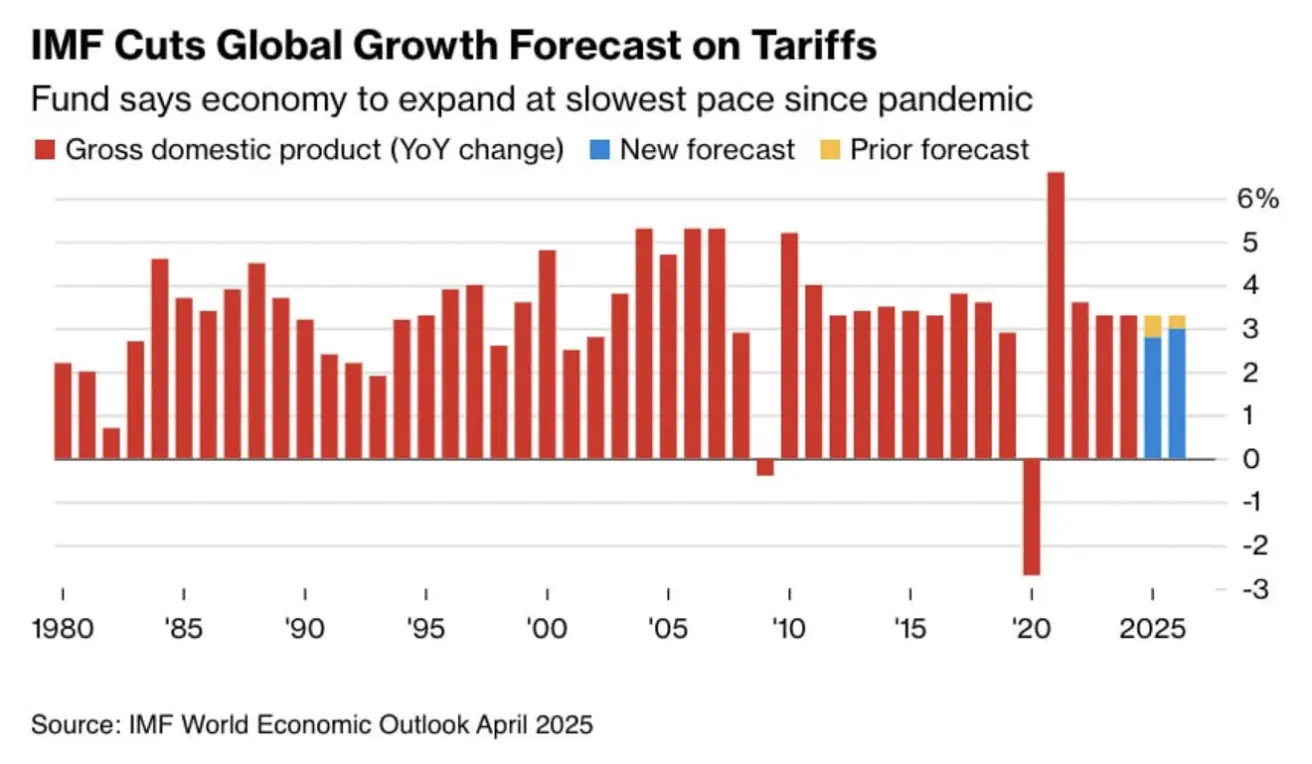

IMF Annual Report

The IMF published its Annual Economic Report, highlighting:

- Global growth forecasts have been significantly revised downward compared to the January 2025 WEO Update, reflecting tariff levels unseen in a century and an extremely unpredictable environment;

- Global headline inflation is expected to decrease more slowly than previously forecast.

Revisions:

- World trade growth forecast for 2025 lowered by 0.15% to 1.7%;

- A slight inflation uptick (~0.1%) is projected for 2025–2026, followed by declines;

- World GDP growth for 2025 downgraded to 2.8% (from 3.3%), 2026: 3.0% (from 3.3%);

- U.S.: 2025 downgraded to 1.8% (from 2.7%), 2026: 1.7% (from 2.1%);

- China: 2025 downgraded to 4.0% (from 4.6%), 2026: 4.0% (from 4.5%); Eurozone: 2025 downgraded to 0.8% (from 1.0%), 2026: 1.2% (from 1.4%).

The IMF warns that forecasts could worsen further if tariffs escalate into a global trade war.

Stock Market

Performance Last Week:

- Median gain of 3.55%;

- Almost all sectors closed in positive territory, except utilities;

- Technology and healthcare sectors led the gains.

Year-to-Date (YTD):

- Market median decline: -9.79%:

MARKET

SP500

+4.59% for the week (weekly close: 5525.22); 2025 decline: -6.40%:

NASDAQ100

+6.43% for the week (weekly close: 19432.56); 2025 decline: -7.99%:

Last week, the U.S. stock market rebounded after President Donald Trump stated he had "no intention" of dismissing Federal Reserve Chair Jerome Powell before his term ends next year. This reassured investors about the Fed’s independence and policy stability.

Last week, the U.S. stock market rebounded after President Donald Trump stated he had "no intention" of dismissing Federal Reserve Chair Jerome Powell before his term ends next year. This reassured investors about the Fed’s independence and policy stability.

Markets were also buoyed by Treasury Secretary Scott Bessette’s remarks hinting at a potential de-escalation of the ongoing trade dispute with China, although he later cautioned that negotiations could be protracted.

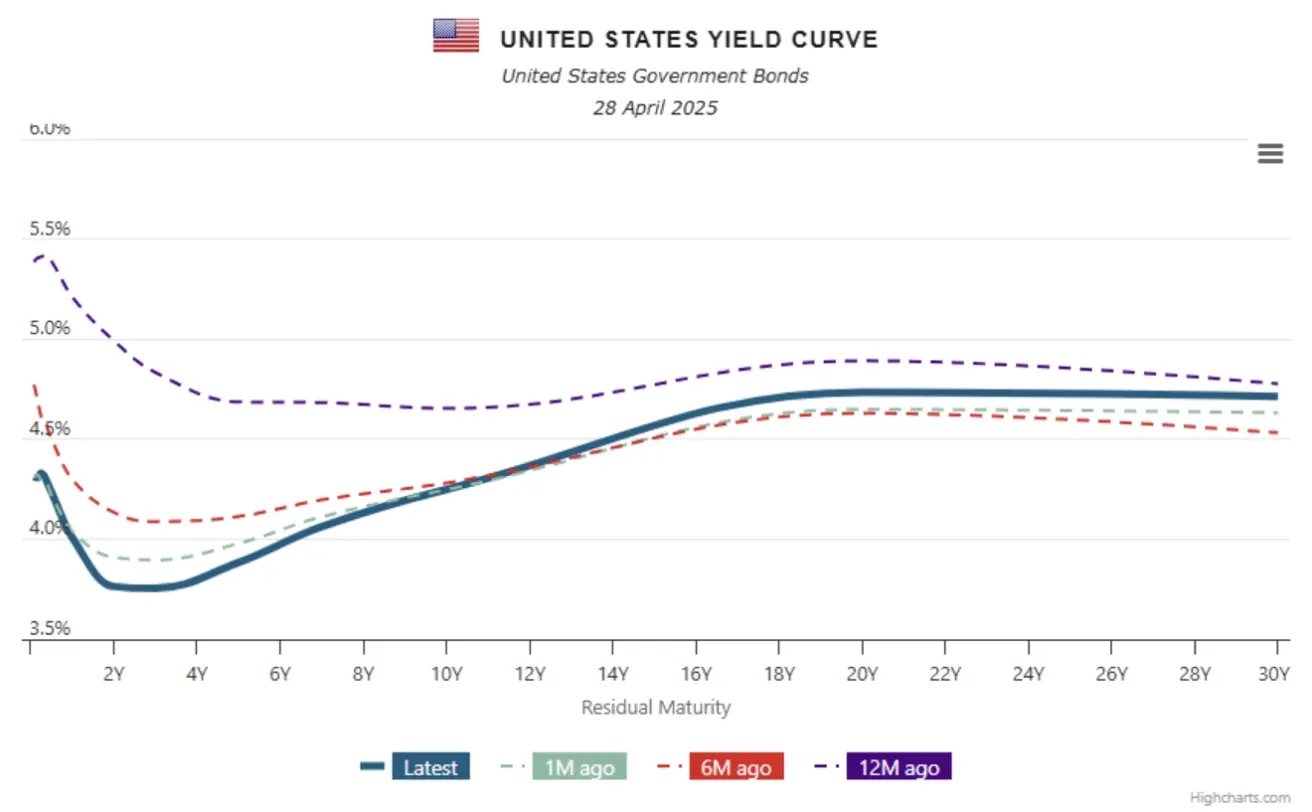

BOND MARKET

Weekly Performance:

- Treasuries gained (yields fell);

- 20+ Year Treasury Bond ETF (TLT): +1.55% (weekly close: $88.89);

- YTD 2025 performance: +1.24%.

YIELDS AND SPREADS 2025/04/21 vs 2025/04/14

-

U.S. 10-Year Treasury Yield: 4.249% (previous: 4.359%);

-

ICE BofA BBB Corporate Bond Yield: 5.54% (previous: 5.60%):

-

Yield spread between 10-Year and 2-Year Treasuries: 48.5 bps (previous: 59.9 bps);

-

Yield spread between 10-Year and 3-Month Treasuries: -0.8 bps (previous: -2.8 bps).

GOLD FUTURES (GC)

Gold futures: -0,33%, weekly close at $3330,2 per troy ounce. Year-to-date 2025: +26,1%.

- Record high reached at $3509 during the week;

- Ongoing geopolitical tensions between Pakistan and India could support gold prices.

DOLLAR INDEX FUTURES (DX)

Weekly: +0.19%, closing at 99.37;

YTD: -8.27%.

OIL FUTURES

Weekly: -0.91%, closing at $63.17/barrel;

YTD: -12.08%.

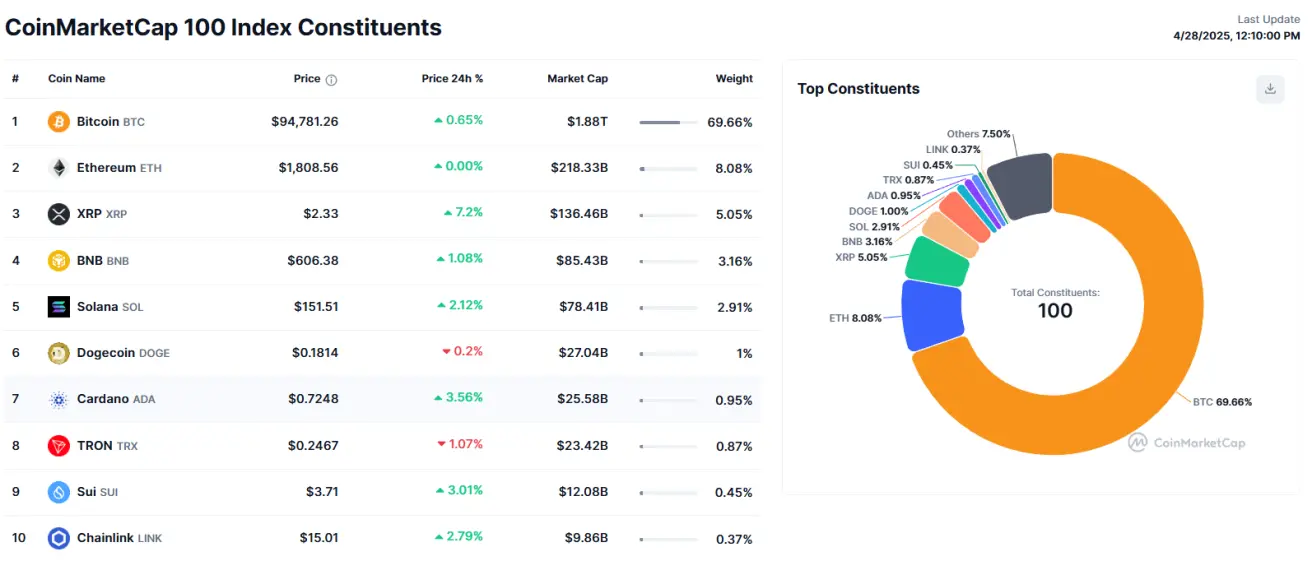

BTC FUTURES

Weekly surge: +12.16%;

Weekly close: $95,810;

YTD return positive at +0.57%.

ETH FUTURES

Weekly surge: +14.84%;

Weekly close: $1819.0;

YTD: -46.25%.

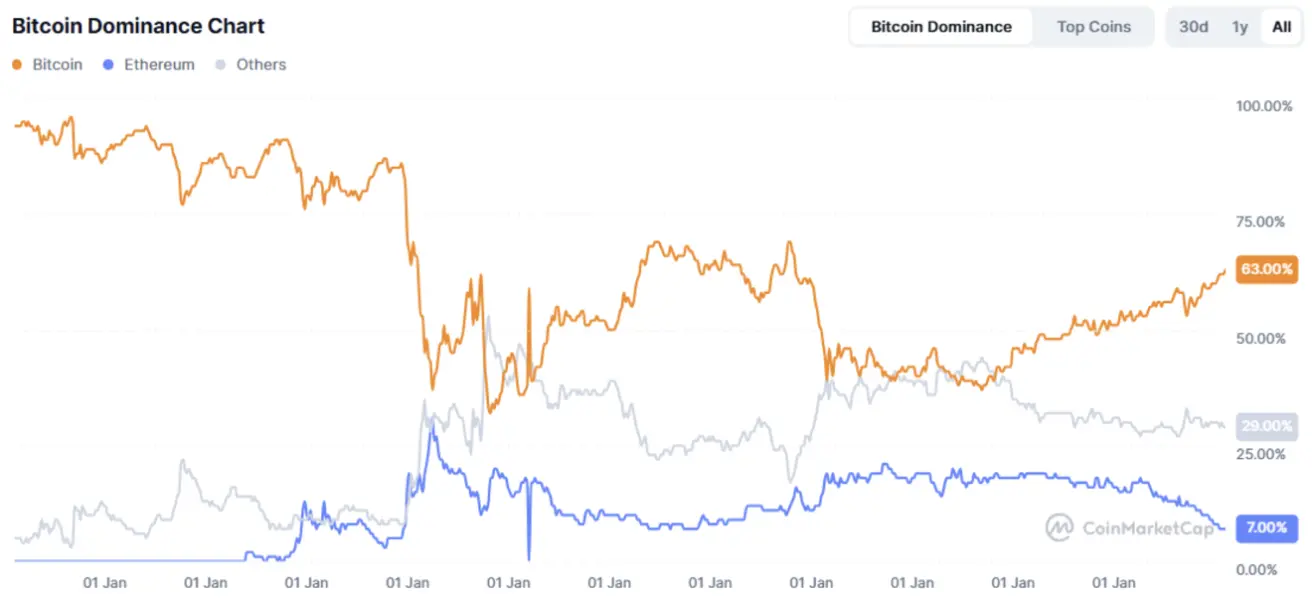

Total Crypto Market Capitalization: $2.98 trillion vs $2.76 trillion the previous week (coinmarketcap.com).

- Bitcoin: 63.2% (vs 63.1%)

- Ethereum: 7.3% (vs 7.2%)

- Others: 29.5% (vs 29.7%)

Positive News:

Paul Atkins was officially sworn in as the 34th Chairman of the SEC. He is a strong advocate for cryptocurrencies.

Қазақша

Қазақша