April 28 — May 2, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (March): 0.1% (prev: 0.2%);

- Consumer Price Index (CPI) (m/m) (March): -0.1% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (March): 2.8% (prev: 3.1%);

- Consumer Price Index (CPI) (y/y) (March): 2.4% (prev: 2.8%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (April): 6.5%, prev: 5.0%;

- 5-year expected inflation (April): 4.4%, prev: 4.1%.

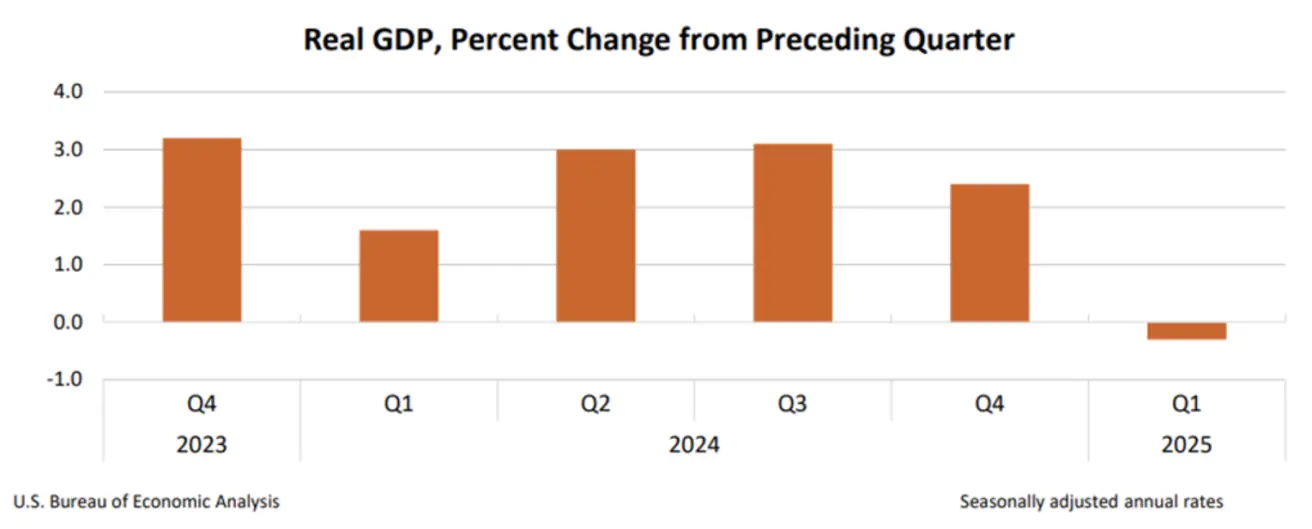

GDP (Preliminary Estimate, BEA, Q1 2025 Annualized)

- Q1 2025: -0.3%

- Q4 2024 (revised): +2.4%

LABOR MARKET:

- Unemployment Rate (April): 4.2% (unchanged)

- Nonfarm Payrolls (April): +177K (prior revised: +185K)

- Average Hourly Earnings (YoY, April): +3.8% (unchanged)

Business Activity (PMI, April)

- Services PMI: 51.4 (prior: 54.4)

- Manufacturing PMI: 50.7 (prior: 49.8)

- S&P Global Composite: 51.2 (prior: 53.5)

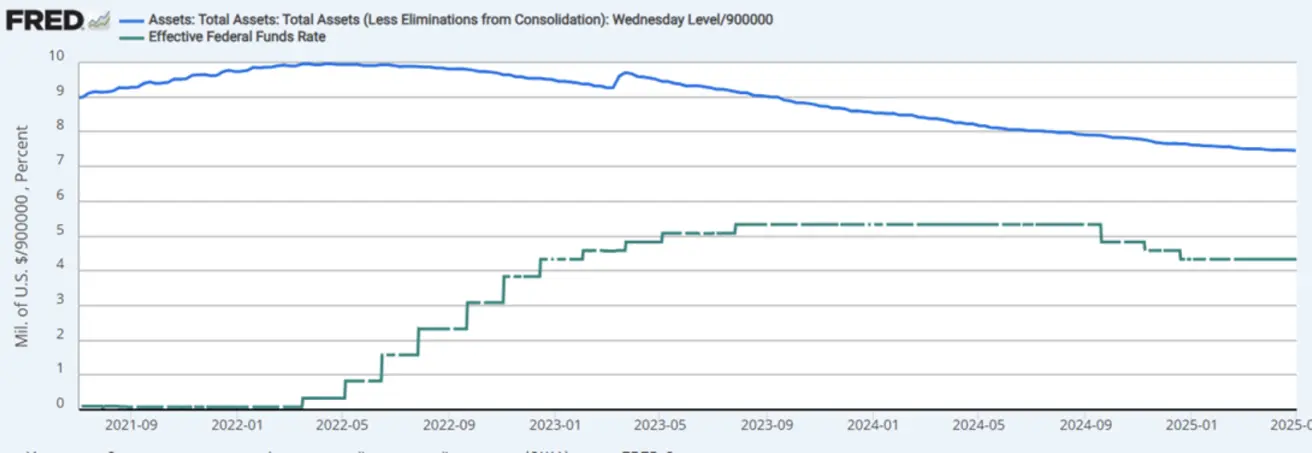

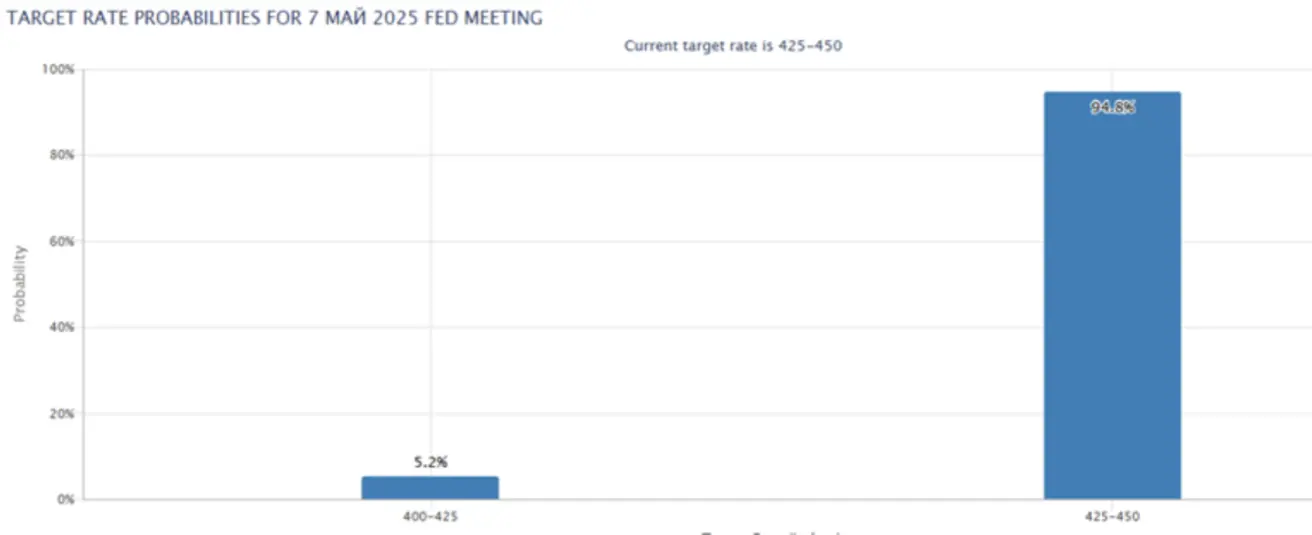

MONETARY POLICY

- Effective Federal Funds Rate (EFFR): 4.25–4.50%

- Federal Reserve Balance Sheet: $6.709T (previous week: $6.729T)

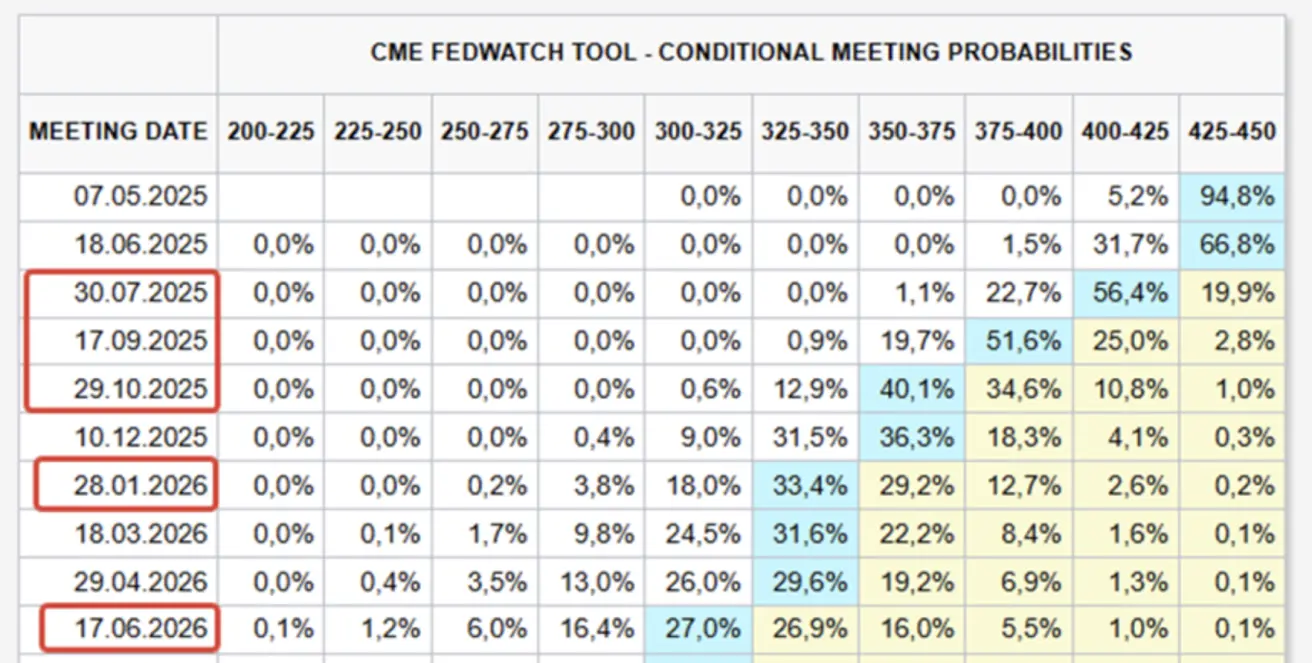

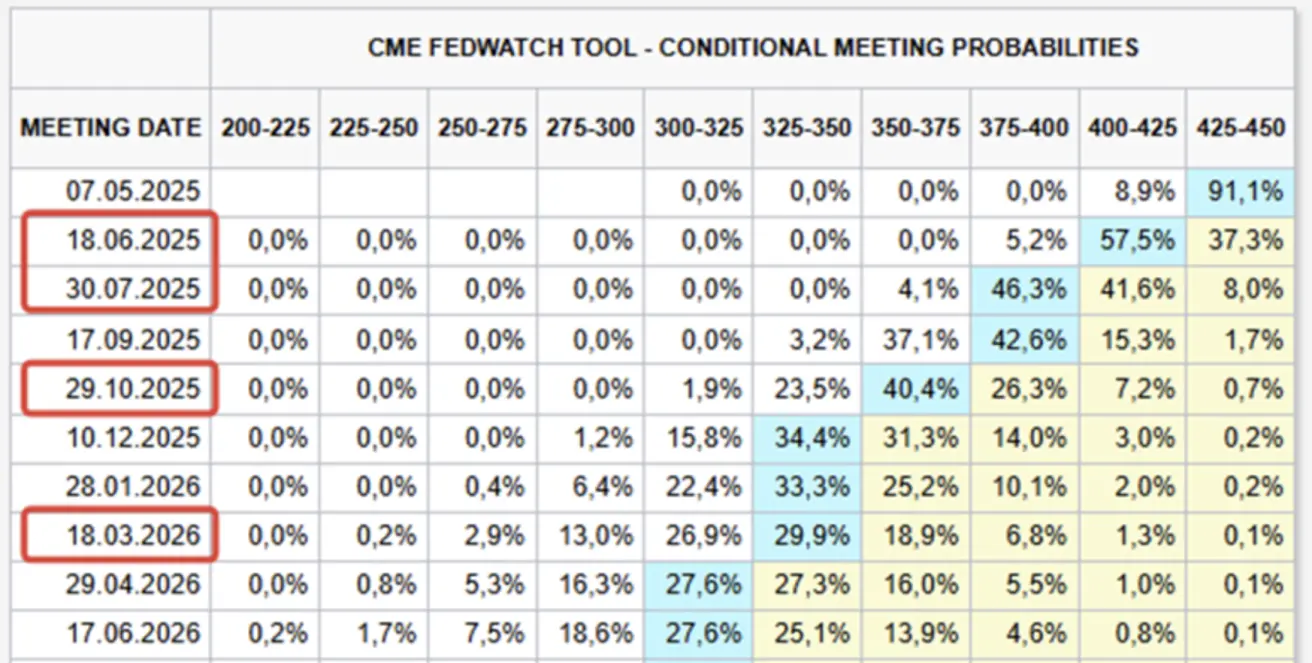

MARKET FORECAST FOR RATE

Today:

А week earlier:

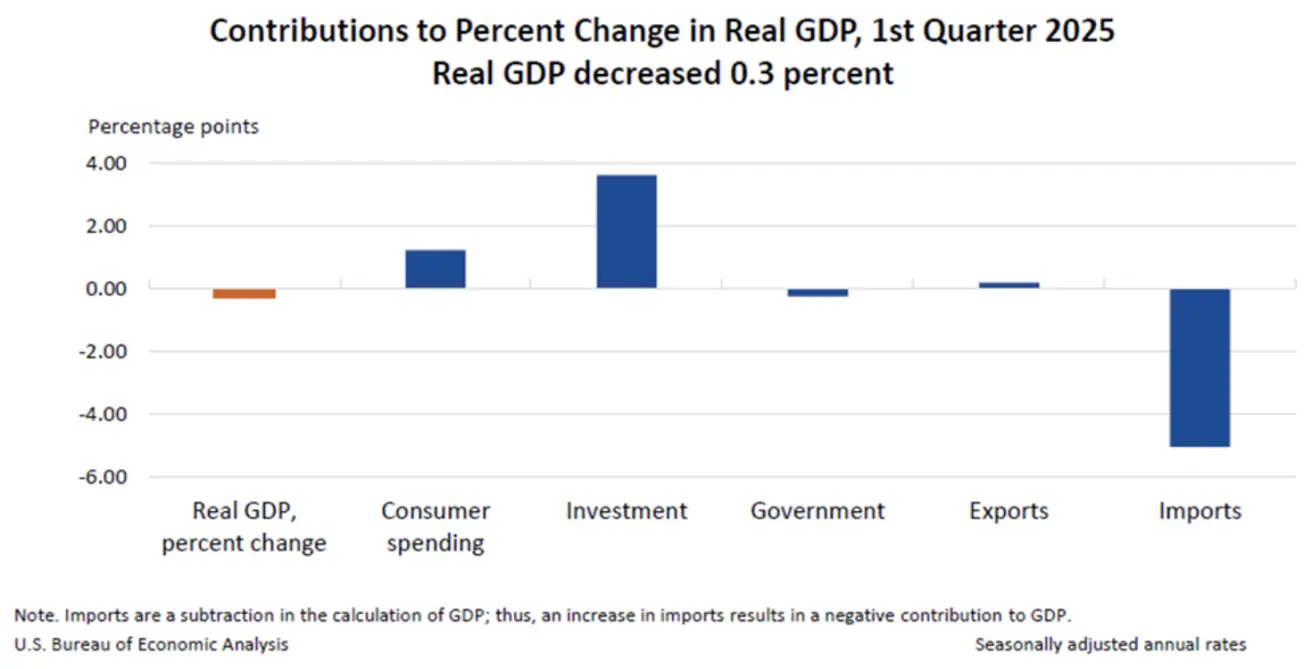

Commentary: US GDP Contraction Real GDP declined by 0.3% in Q1 2025, reversing a 2.4% expansion in Q4 2024. The contraction was driven by:

- Sharp rise in imports (subtracts from GDP)

- Decline in government expenditures

- Slowing consumer spending

Offsetting factors included:

- Higher capital investment

- Modest export growth

Breakdown vs Q4 2024:

- Personal Consumption: +1.21 pp (vs +2.70 pp)

- Investment: +3.6 pp (vs -1.03 pp)

- Net Exports: -4.83 pp (vs +0.26 pp)

- Government Spending: -0.25 pp (vs +0.52 pp)

Markets largely shrugged off the GDP contraction.

Labor Market Resilience

- Nonfarm job creation: +177K

- Job openings fell by 288K to 7.192M — lowest in six months and well below the 7.48M estimate

- Unemployment rate held steady at 4.2%

Labor market remains robust despite trade policy uncertainty.

Trade Developments

- China expressed willingness to resume trade talks with the US

- According to Bloomberg (citing customs data), China exempted 131 product categories — including pharmaceuticals and industrial chemicals — from tariffs. These represent ~$40B or 24% of US imports in 2024

- China's exports are down 10% YoY — the steepest drop in 15 years

US Port Disruption Concerns

- West Coast port officials warn of a potential 40% drop in freight volumes by end of May

- They urge Congress to revoke tariffs, citing risks of job losses and rising costs

Equity Markets

- Broad-based rally; median gain: +1.51%

- All sectors posted gains, led by Industrials, Consumer Discretionary, and Technology

Year-to-Date (YTD):

- Median index return: -7.55%

MARKET

SP500

+2.92% (weekly); -3.67% (YTD); closes at 5686.66

NASDAQ100

+3.45% (weekly); -4.82% (YTD); closes at 20102.61

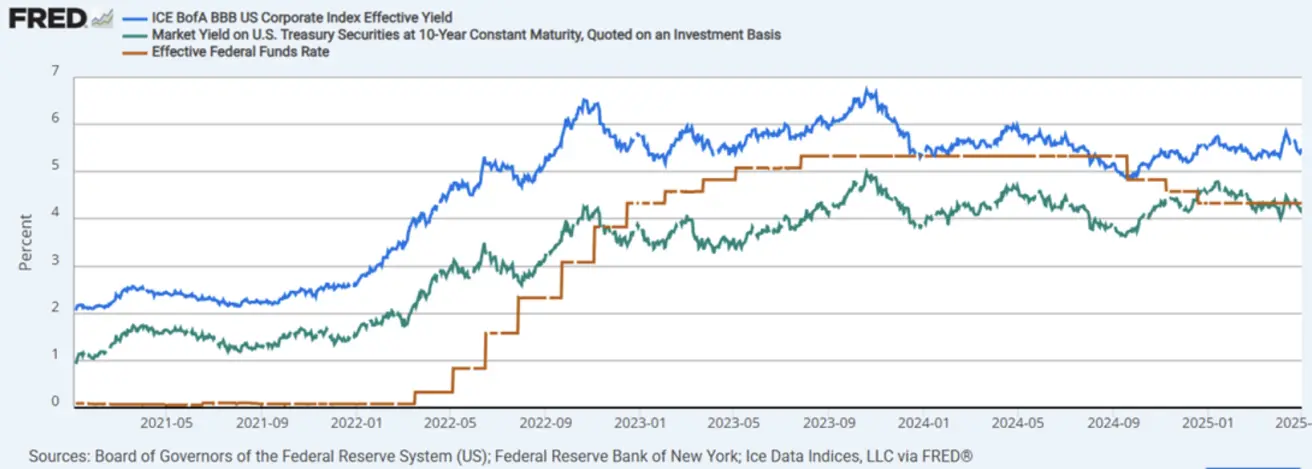

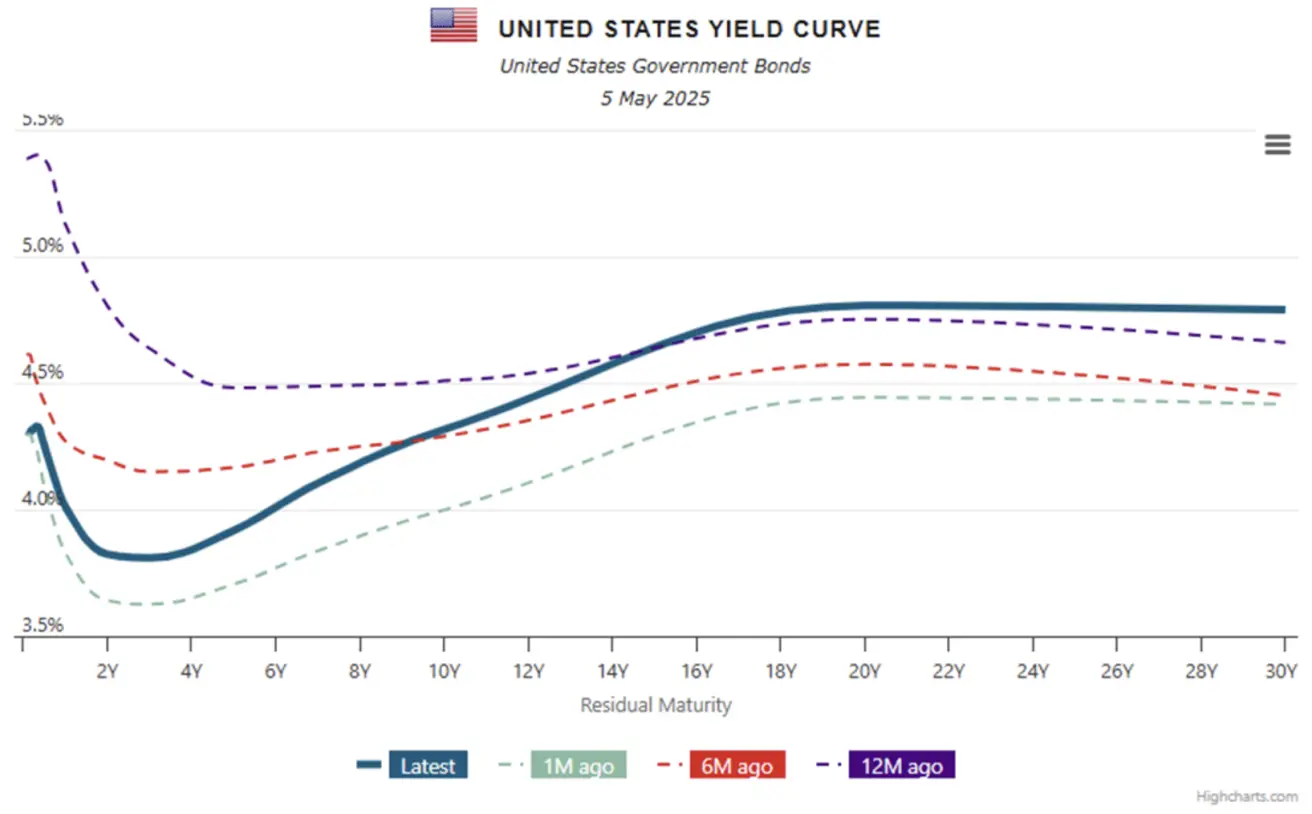

BOND MARKET

- Continued volatility in Treasuries

- TLT (20+ year Treasury ETF): -1.30% (weekly); -0.08% (YTD); closes at $87.83

YIELDS AND SPREADS 2025/05/02 vs 2025/04/28

- 10-Year Treasury Yield: 4.316% (vs 4.249%)

- ICE BofA BBB Corp Yield: 5.49% (vs 5.54%)

Yield Spreads:

- 10Y–2Y: 49.2 bps (vs 48.5 bps)

- 10Y–3M: +0.4 bps (vs -0.8 bps)

GOLD FUTURES (GC)

-2.49% (weekly); +22.96% (YTD); closes at $3,247.4/oz

DOLLAR INDEX FUTURES (DX)

+0.50% (weekly); -7.81% (YTD); closes at 99.86.

OIL FUTURES

-7.58% (weekly); -18.75% (YTD); closes at $58.38/bbl

- Oil prices declined further (-4%) on Monday to $56.17/bbl, falling below most forecasts

- OPEC+ signaled potential output increases: +411K bpd in May, +400K bpd in June

- Trump threatened sanctions against nations importing Iranian oil after Iran-Oman nuclear talks stalled

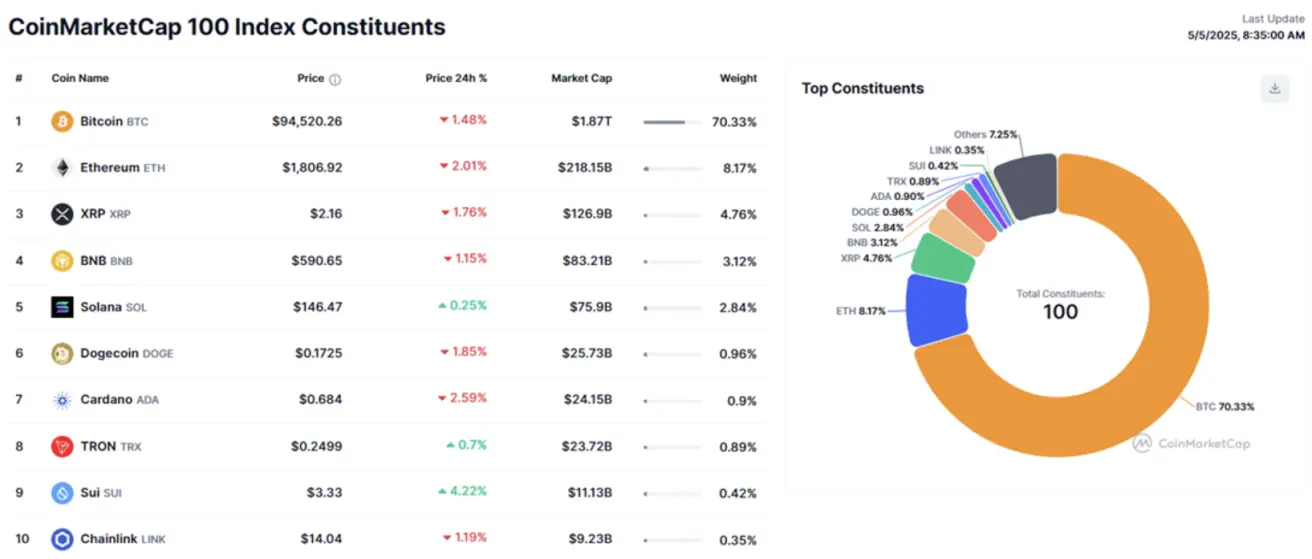

BTC FUTURES

+1.95% (weekly); +2.53% (YTD); closes at $97,680

ETH FUTURES

+2.34% (weekly); -44.99% (YTD); closes at $1,861.5

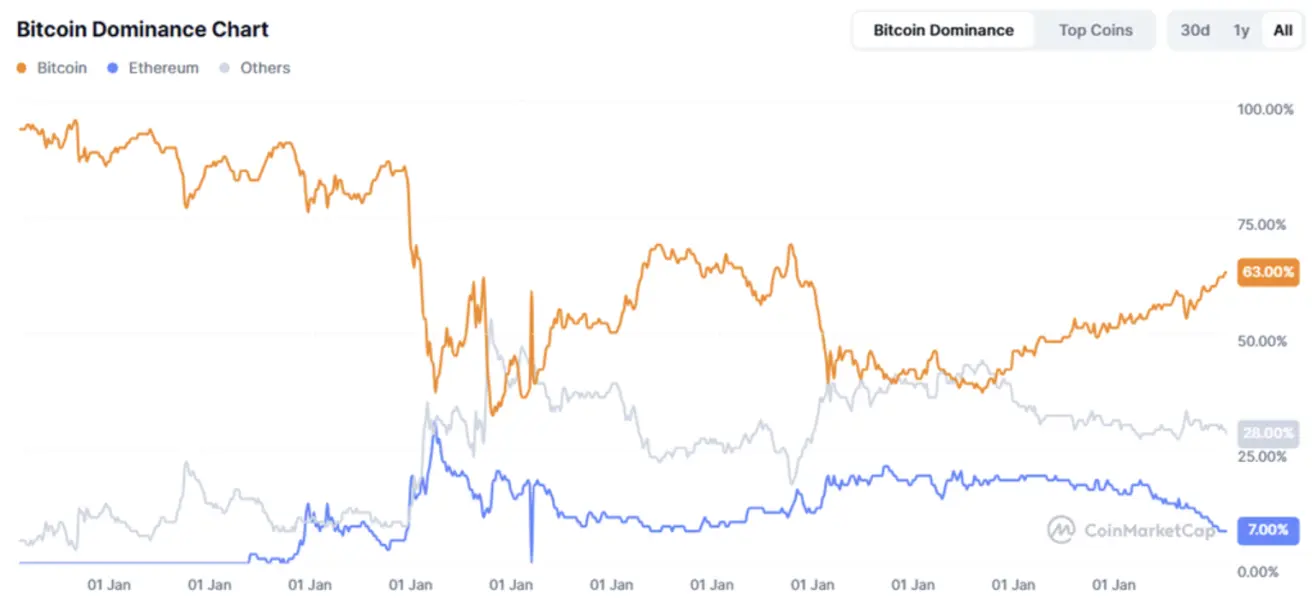

Market Dominance:

- Bitcoin: 63.7% (prior: 63.2%)

- Ethereum: 7.7% (prior: 7.3%)

- Other assets: 28.9% (prior: 29.5%)

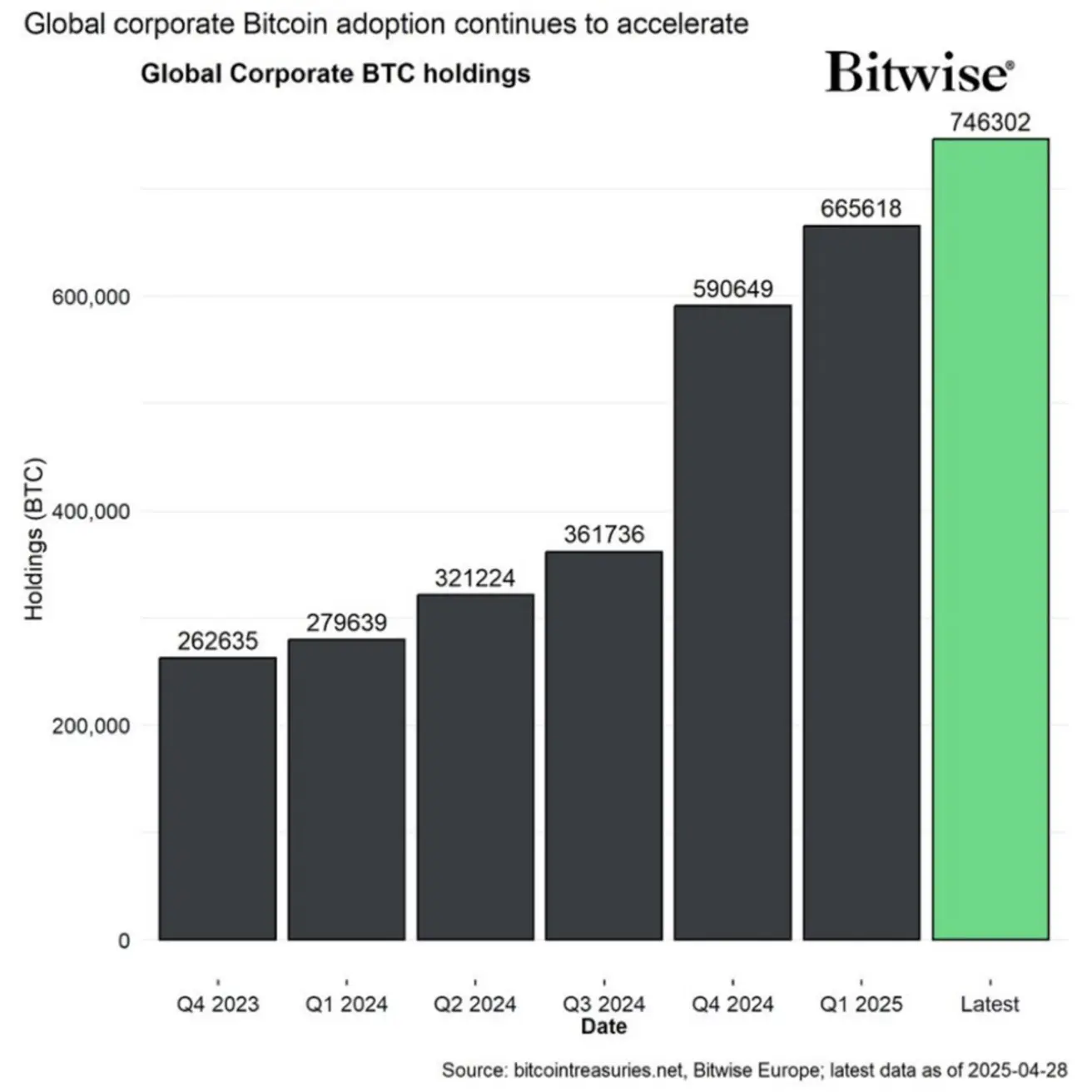

Institutional Crypto Adoption

- Over 80K BTC added to corporate treasuries last month (Bitwise)

Positive News:

- Roswell, NM, created the first municipal BTC reserve

- North Carolina Senate advanced a BTC reserve bill

- SEC approved a ProShares Trust $XRP ETF

- EU plans to ban anonymous crypto assets by 2027

- Arizona Governor vetoed the proposed BTC reserve law, calling Bitcoin “an unproven investment”

Қазақша

Қазақша