Weekly economic update

June 24-28

Weekly economic update from Raison. We collected key macroeconomic indicators covering several aspects of the situation: from inflation and GDP to stock market indicators.

Macroeconomic statistics

Inflation

- Core Consumer Price Index (CPI) (YoY) (Apr): 3.4%;

- Consumer Price Index (CPI) (YoY) (Apr): 3.3%.

The Fed's inflation target

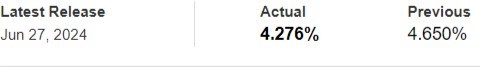

- The primary price index of personal consumption expenditures (YoY) (Apr): 2.6% (pre: 2.8%);

- Price index of personal consumption expenditures (YoY) (ida): 2.6%, (pre: 2.7%).

Inflation expectations

- 12-month expected inflation (May): 3.0%, pre: 3.3%;

- 5-year expected inflation (May) 3.0% pre: 3.0%.

GDP (QoQ) (Q1) (third estimate): 1.4% (second: 1.3%); GDP deflated (QoQ) (Q1): 3.1% (pre: 1.7%).

Business Activity Index (PMI) (above 50 — economic expansion, below — slowdown):

- In the service sector (May): 54.8 (pre: 51.3);

- In the manufacturing sector (May): 48.7 (pre: 51.3).

Labor market

- Unemployment rate (Apr): 4.0% (pre: 3.9%);

- Change in the number of people employed in the private non-agricultural sector (Apr): 229K;

- Number of initial applications for unemployment benefits: 233K (pre-239K).

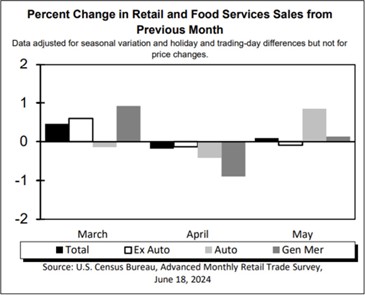

Retail sales are a leading indicator for the Fed's inflation target (PCE index).

Retail sales are a leading indicator for the Fed's inflation target (PCE index).

Monetary policy

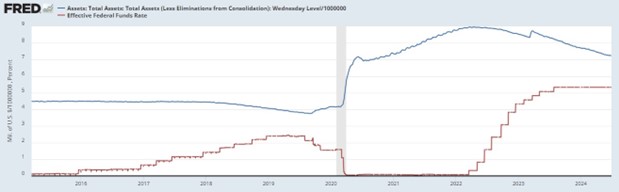

The current interest rate on federal funds (ETFs) is 5.50% (in red).

The balance of the Fed's highs ($8.965 trillion) decreased by -$1.734 trillion (-19.34%) (in blue).

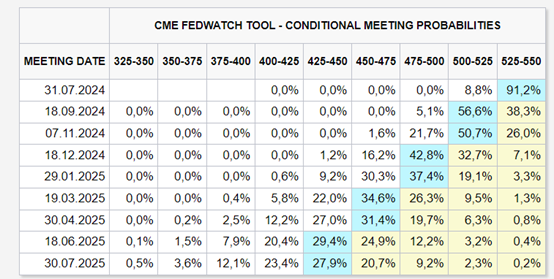

The rhetoric of the Fed representatives: one decline towards the end of the year. Market Rate Forecast (Fed Watch): 4.75%-5.00% (two decreases for December 2024):

Federal Reserve Balance Sheet

Federal Reserve Balance Sheet

Auctions for the sale of U.S. government bonds

2 year-olds:

5-year-olds:

7-year-olds:

Long-term treasure bonds

In the secondary debt market, despite the promising statistics, investor sentiment worsened during the week after the harsh rhetoric of Fed Board member Bowman, who said that if there was no progress in inflation, the Fed could raise the rate. So far, he does not expect a rate cut this year.

Market

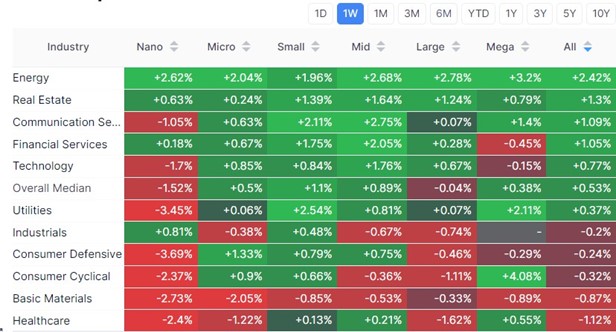

Market cap performance

The markets' dynamics were multidirectional. The median growth was half a percent, and the leaders were the energy, real estate, and financial sectors. Unlike last week, the outsiders were the defensive sectors: non-discretionary consumption and the utility sector. However, companies with small and micro capitalization have rarely shown positive dynamics in recent years.

This slightly noticeable Risk On is associated with good statistical data. Unlike the US treasury, the stock market does not react so sharply to the Fed's aggressive rhetoric in the current situation.

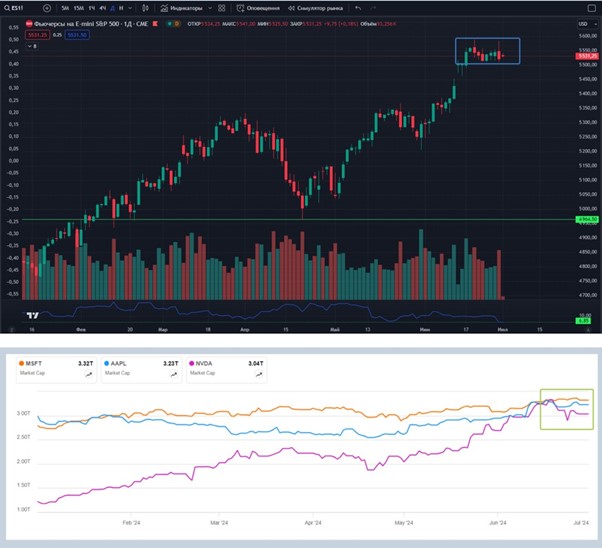

SP500

The SP500 index has traded with almost zero volatility in the narrow range of 5530-5500 for 9 consecutive sessions. The growth drivers of the MSFT, AAPL, and NVDA indices are also horizontally flat.

In addition to the previous forecasts, a forecast was released from Stifel, whose analysts expect the SGP500 index to grow by another 10% this year. The forecast is based on an analysis of past bull markets. However, by the end of the year, Stifel expects a correction in the stock market.

US Treasuries

The dollar has been trading in an ascending channel since December last year. The futures price is 105.205. The lower chart clearly shows how a high rate in the United States contributes to the dollar's growth and how this affects world currencies. Almost all are declining against the dollar.

Gold

Gold continues to trade above the 2300 support level. Geopolitics, particularly the escalation of the conflict between Israel and Lebanon, may act as a new trigger for the growth of the yellow metal. These countries may enter a state of open warfare.

From the news

SpaceX Tender Offer Said to Value Company at Record $210 Billion

- Price higher than discussed previously amid investor interest

- SpaceX valuation second only to Bytedance’s $268 billion

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша