Fifth FED meeting in 2024

Main economic theses of the meeting

Yesterday, the fifth Federal Reserve meeting of the year took place. The regulator's stance on monetary policy has verbally shifted towards easing.

Key economic points from the meeting:

-

Over the past two years, the economy has made significant progress in achieving maximum employment and stable prices. The labor market has become more balanced, with the unemployment rate remaining low at 4.1%. Inflation has significantly decreased from a peak of 7% to 2.5% (according to the PCE index).

-

Recent indicators suggest that economic activity continues to grow at a steady pace. GDP growth slowed to 2.1% in the first half of the year, down from 3.1% last year.

-

Consumer spending growth has slowed compared to last year's steady pace but remains stable.

-

In the housing sector, investment stalled in the second quarter after strong growth in the first.

Monetary Policy:

-

The committee decided to maintain the target range for the federal funds rate (EFFR) at 5.25-5.50%.

-

It will continue to reduce its securities holdings ($25 billion/month in Treasury securities and $35 billion/month in mortgage-backed securities).

-

As the labor market cools and inflation declines, the risks to achieving our employment and inflation goals continue to become more balanced.

Commentary on Fed Chair Jerome Powell's speech:

The main question the market wanted Powell to address was whether the rate would be cut in September. As usual, he stated that all future decisions would depend on incoming data. However, if inflation continues to slow as expected and the labor market continues to weaken, the committee is ready to consider a rate cut at the next meeting.

Unlike previous meetings (where rate cuts were not discussed), this meeting included a discussion about beginning to ease monetary policy and considered several scenarios for rate cuts this year.

It is important to note how the committee currently assesses the labor market and inflation:

-

"Labor market conditions have returned to roughly where they were before the pandemic — strong but not overheated." Essentially, this means that the goal for this mandate has been achieved, and further tightening of monetary policy (quote): "may unjustifiably weaken economic activity."

-

"Inflation figures in the second quarter have given us more confidence, and more positive data will further strengthen this confidence."

Conclusion: Considering the slowdown in consumer spending, the committee sees the risks shifting towards a stronger economic slowdown rather than the risk of rising inflation. This significantly increases the likelihood of a rate cut at upcoming meetings, possibly as early as September. Therefore, new releases of macroeconomic statistics and planned speeches by Fed governors will remain in the spotlight and will be key factors in market volatility.

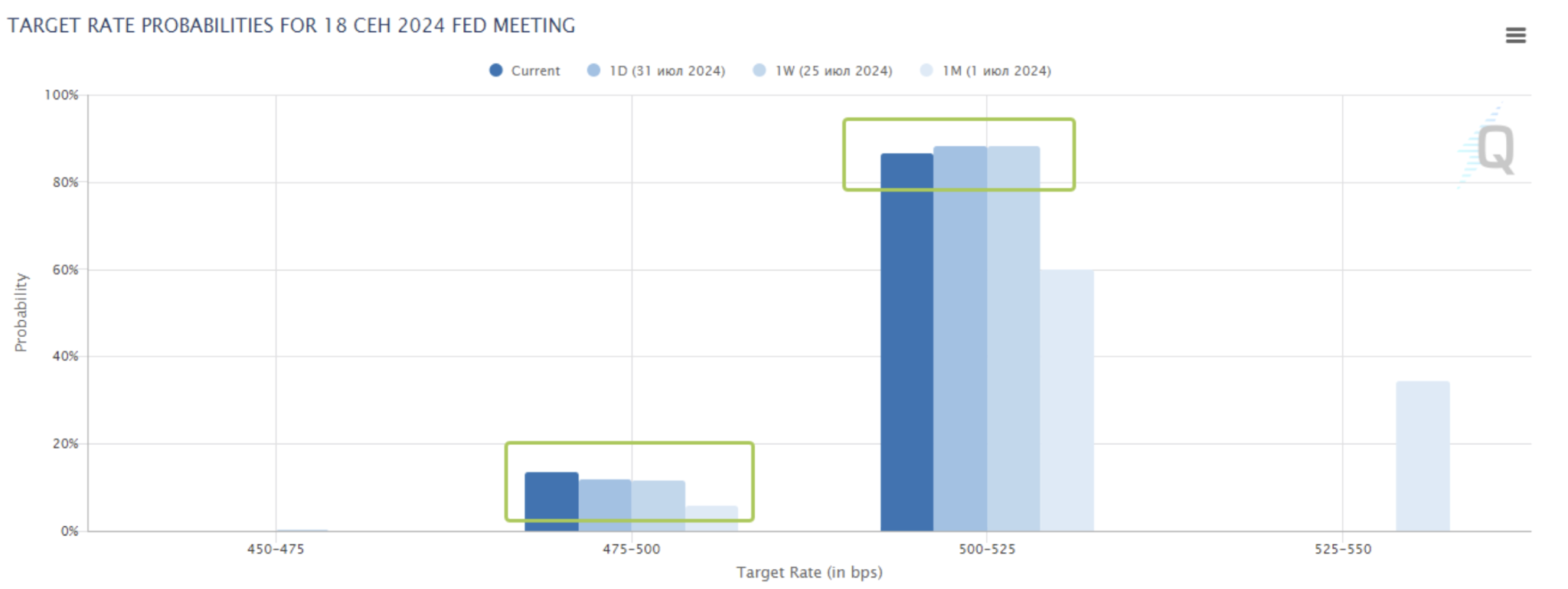

Market expectations after the meeting were solidified.

For September, according to FedWatch:

- A 0.25% rate cut has an 86.5% probability.

- A 0.5% rate cut has a slight increase in probability to 13.5%.

Market reactions by the end of the session:

- SP500: -0.07%;

- Nasdaq 100: -0.2%;

- Gold: +1.02%;

- Dollar Index (DX): -0.2%;

- 10-year Treasury bonds (US10Y): +0.48%.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша