July 22nd-28th: Weekly economic update

Key market insights

INFLATION

- Core Consumer Price Index (CPI) (YoY) (June): 3.3% (pre: 3.4%)

- Consumer Price Index (CPI) (YoY) (June): 3.0% (pre: 3.3%)

THE FED'S INFLATION TARGET

- Basic price index of personal consumption expenditure PCE (YoY) (June): 2.63% (pre: 2.62%)

- Price index of personal consumption expenditures (YoY) (May): 2.51% (pre: 2.6%)

INFLATION EXPECTATIONS

- 12-month expected inflation (June): 2.9% (pre: 3.0%)

- 3-year expected inflation (June): 2.9% (pre: 2.8%)

- 5-year expected inflation (June): 2.9% (pre: 3.0%)

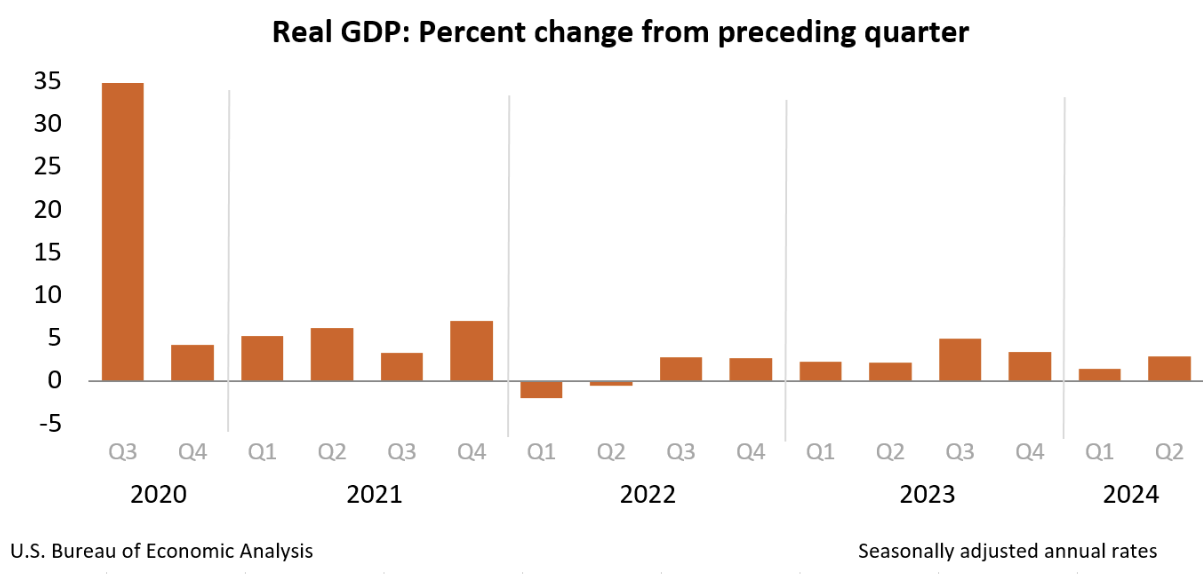

GDP (q/q) (2Q preliminary estimate): 2.8% (approx: 1.4%), GDP deflator (q/q) (1 Q.): 2.3% (approx: 3.1%).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 56.0 (pre: 55.3)

- Manufacturing sector (June): 49.5 (pre: 55.6)

- S&P Global Composite (June): 55.0 (pre: 54.8)

LABOR MARKET

- Unemployment rate (April): 4.1% (pre: 4.0%)

- Change in private non-agricultural employment (June): 136K (pre: 193K)

- Average hourly earnings (June, YoY): 3.9% (pre: 4.1%)

- Initial applications for unemployment benefits: 235K (pre: 245K – revised)

COMMENT ON STATISTICS

Real gross domestic product (GDP) increased by 2.8% year-on-year in the second quarter of 2024, according to a “preliminary” estimate. The indicator came out higher than forecasts, and the release of the 1st quarter: growth of 2.0% was expected, the first quarter of 1.4%.

Based on more complete initial data, the second quarter's second estimate will be published on August 29, 2024.

Breakdown by main GDP items:

- Personal consumption: 1.57 (pre: 0.98)

- Investments: 1.46 (pre: 0.77)

- Government expenditures: 0.53 (pre: 0.31)

There has been no economic slowdown yet; however, good growth in the second quarter was due to consumption and investment. The PMI business activity indices also showed economic expansion in the composite index and the services sector, with a slight slowdown in the manufacturing sector. The base deflator of PCE consumption was 2.9% (previous: 3.7%). Price growth decreased relative to the first quarter, but the June data on the underlying PCE deflator slightly increased.

MONETARY POLICY

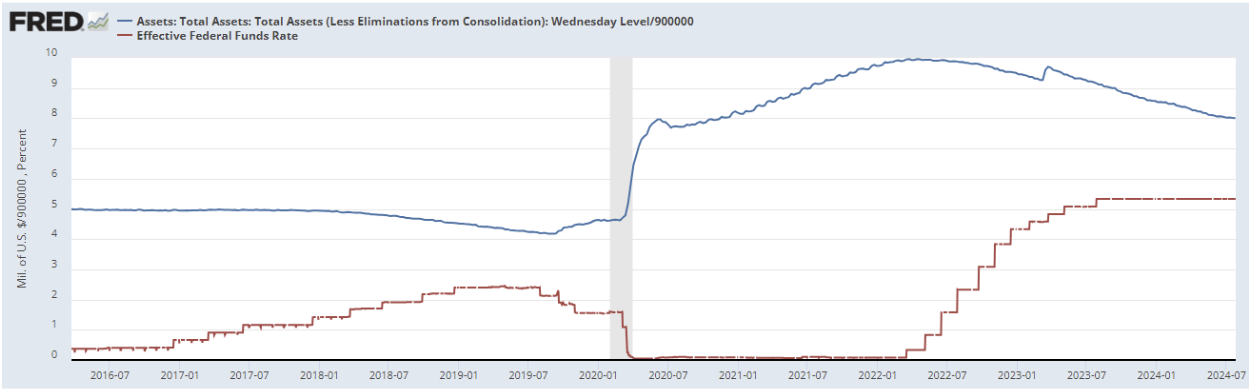

- The interest rate on federal funds (ETFs): 5.50% (in red)

- The Fed's balance sheet continues to decline with a slowdown: $7,205 trillion

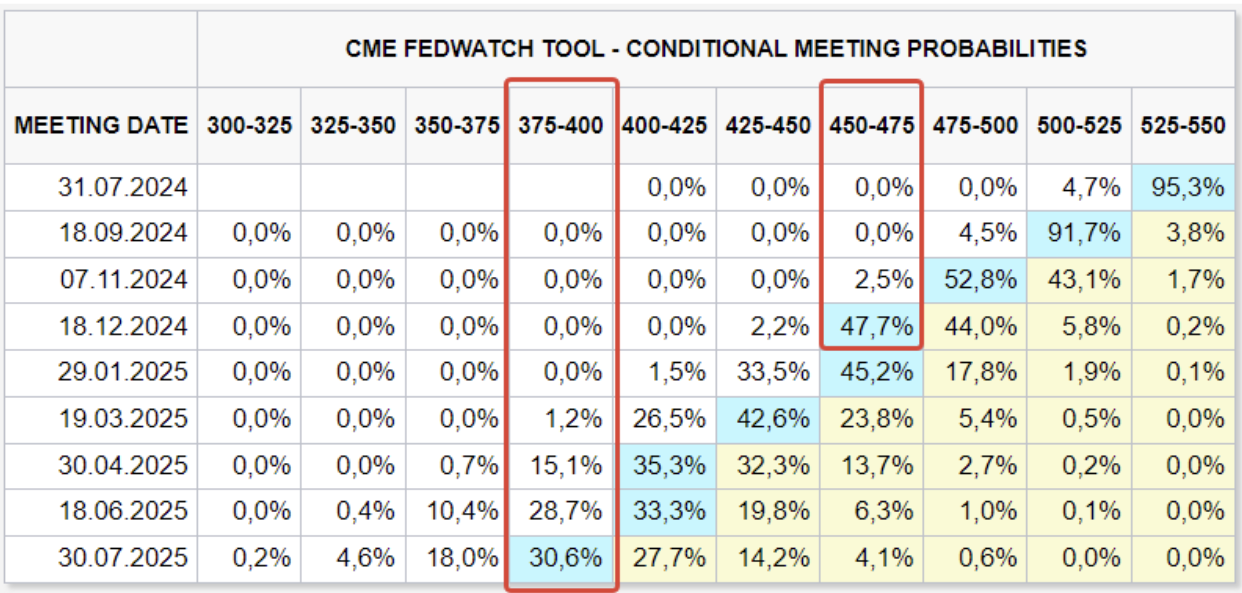

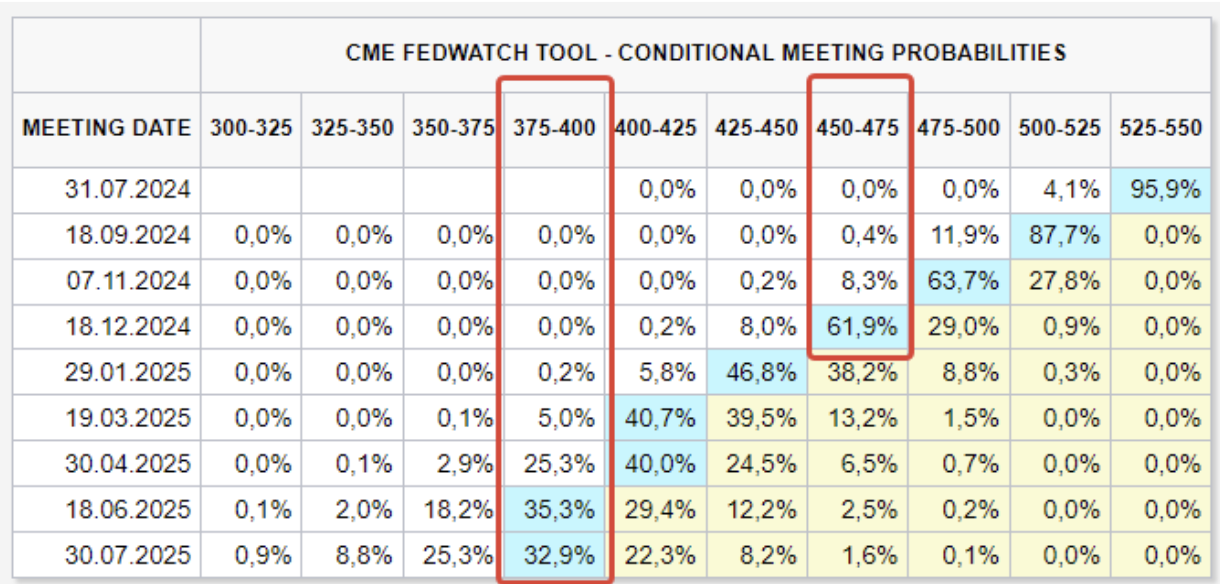

MARKET FORECAST RATE (FEDWATCH)

Today:

A week ago:

The Fed began raising the rate in March 2022 due to an intense round of inflation. Today, the rate corridor is 5.25-5.5% per annum, and the Fed continues (with an apparent slowdown) to withdraw liquidity, reducing the volume of bonds on the balance sheet.

The phase of more than 2 years of tightening is ending, and the Fed may give some information about its plans to lower interest rates at the FOMC meeting this Wednesday. Market expectations (FedWatch) for the rate over the past week are unchanged:

- As of December this year: 4.50-4.75% (three decreases)

- Long-term expectations (for the year ahead): 3.75-4.00% (six declines)

The market expects the first-rate cut in September with a probability of 96% and then a further rate cut at each meeting.

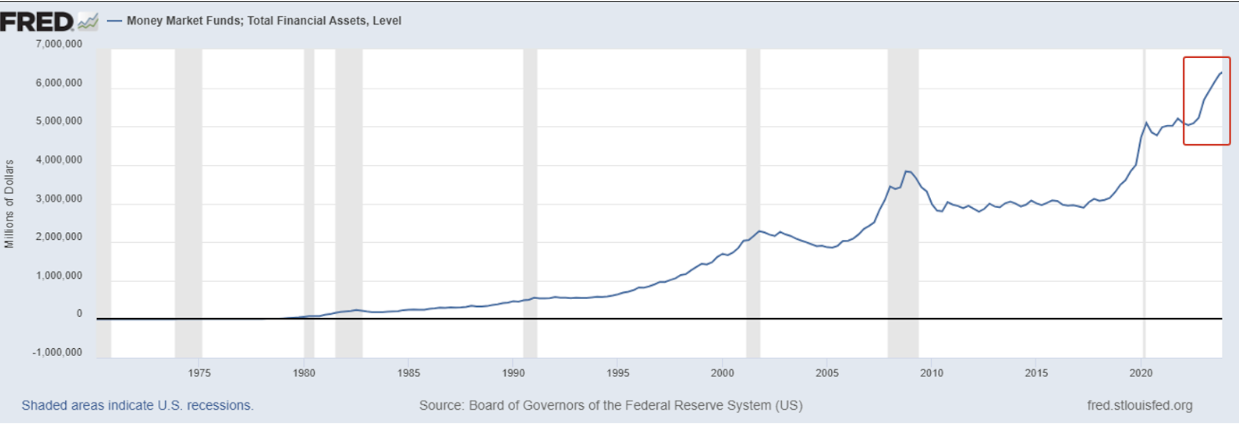

MONEY MARKET

Since the second quarter of 2022, money market funds have seen high capital inflows (over $6.3 trillion), attracted by high rates in the near part of the yield curve (due to its inversion).

This is a safety cushion for markets. This means that when the cycle of lower interest rates begins, capital in search of higher yields will start to flow into other assets, possibly including equities.

MARKET

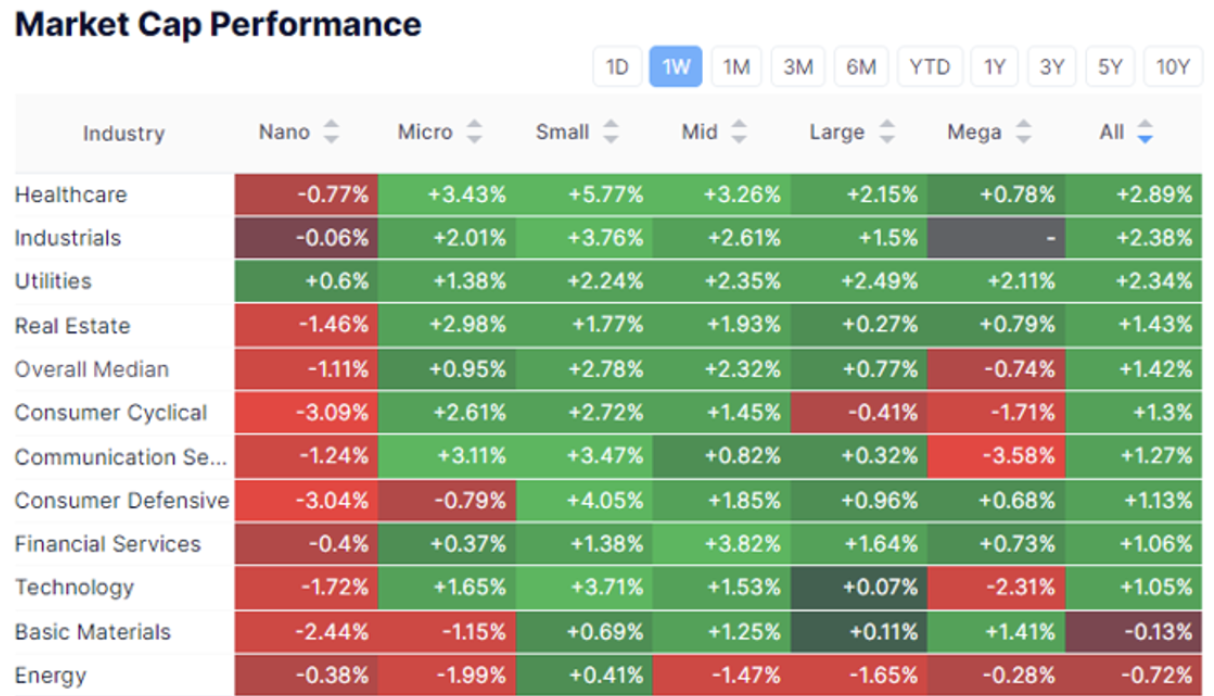

MARKET CAP PERFORMANCE

The stock market:

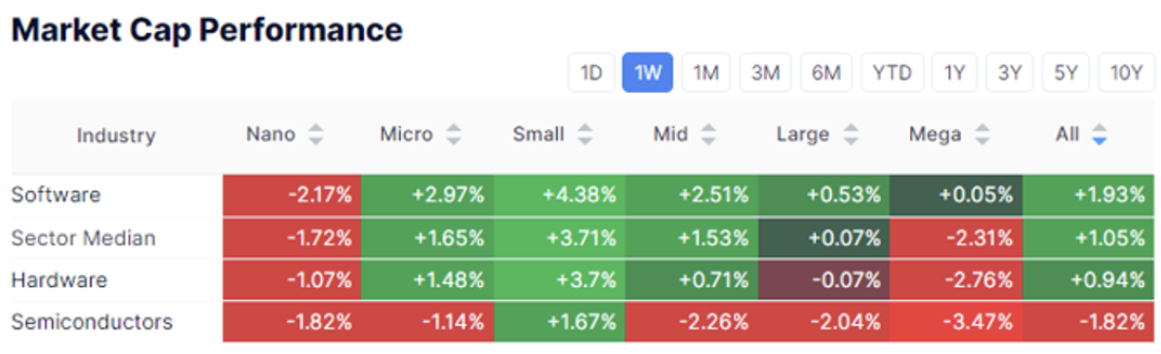

Technology sector:

On average, the stock market lost 0.74%.

For the second week, the Technology sector was the worst performer, down 2.31%, followed by the Communications Services and Consumer Discretionary sectors, down 3.58% and 1.71%, respectively.

The FAANG stocks ended the week down 11% from their extreme peaks.

SP500

Nasdaq100

Small Cap 2000

Off the peak: SP500 -4.5%, Nasdaq100 -7.61%, RUT - on the contrary, growth. The transfer of assets to small caps and the sale of US tech stocks suggest overbought conditions in the locomotive group, including the artificial intelligence (AI) segment.

A failure to update the Falcon Sensor platform caused disruptions in various industries worldwide, including airlines, banks, and hospitals.

The company's shares fell 25% from their peak to the 200-day moving average. Further declines are possible as some clients may be lost, but it's important to note that CrowdStrike is a leading player in the cloud cybersecurity sector and will not exit the market.

TREASURY BONDS

MOVE

The short-term bond volatility index (bottom chart) continues to fall and is trading near the bottom of its range. The index's downward trend indicates an improvement in expectations for a rate cut. Long-term US Treasuries ended the week slightly higher.

The positive sentiment in this market will increase if economic statistics do not show an increase in inflation.

The FOMC meeting will take place on July 31st. The basic scenario is that rates will remain on hold with a softening of the rhetoric. The market is waiting for Powell to announce the timing of the first-rate hike.

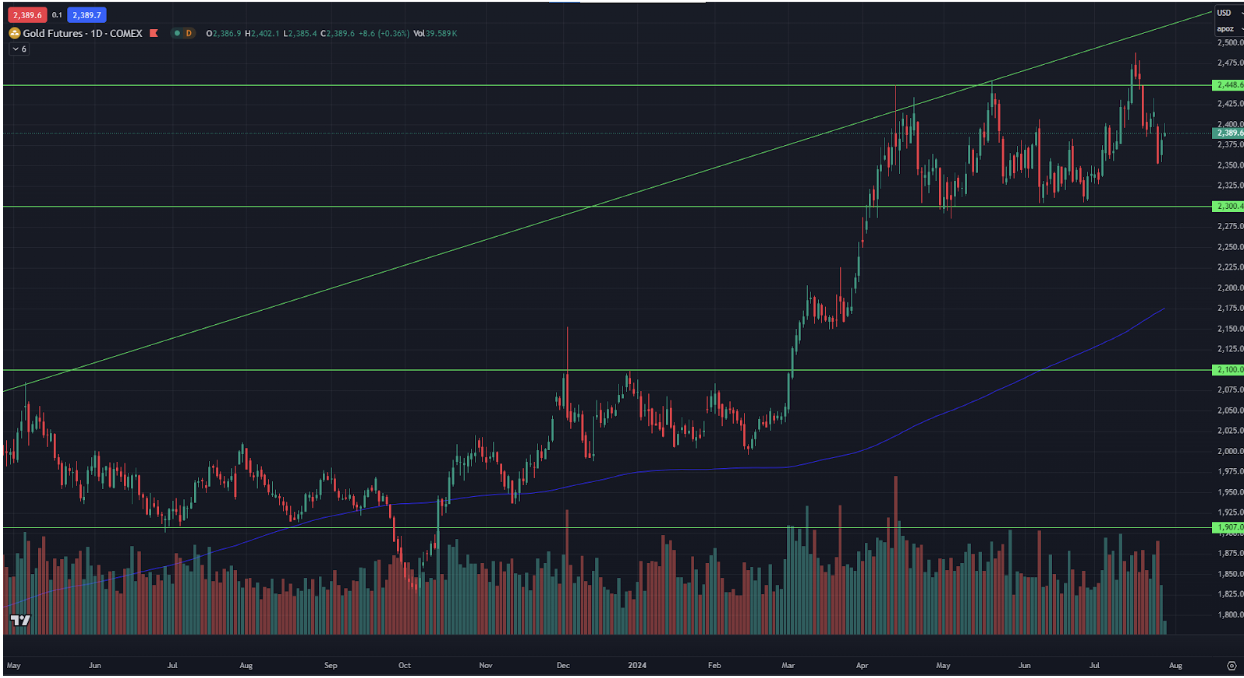

GOLD

Gold has returned to the horizontal 4-month range.

The triggers for gold's rise are not diminishing. The first is, of course, the geopolitical escalation in the Middle East.

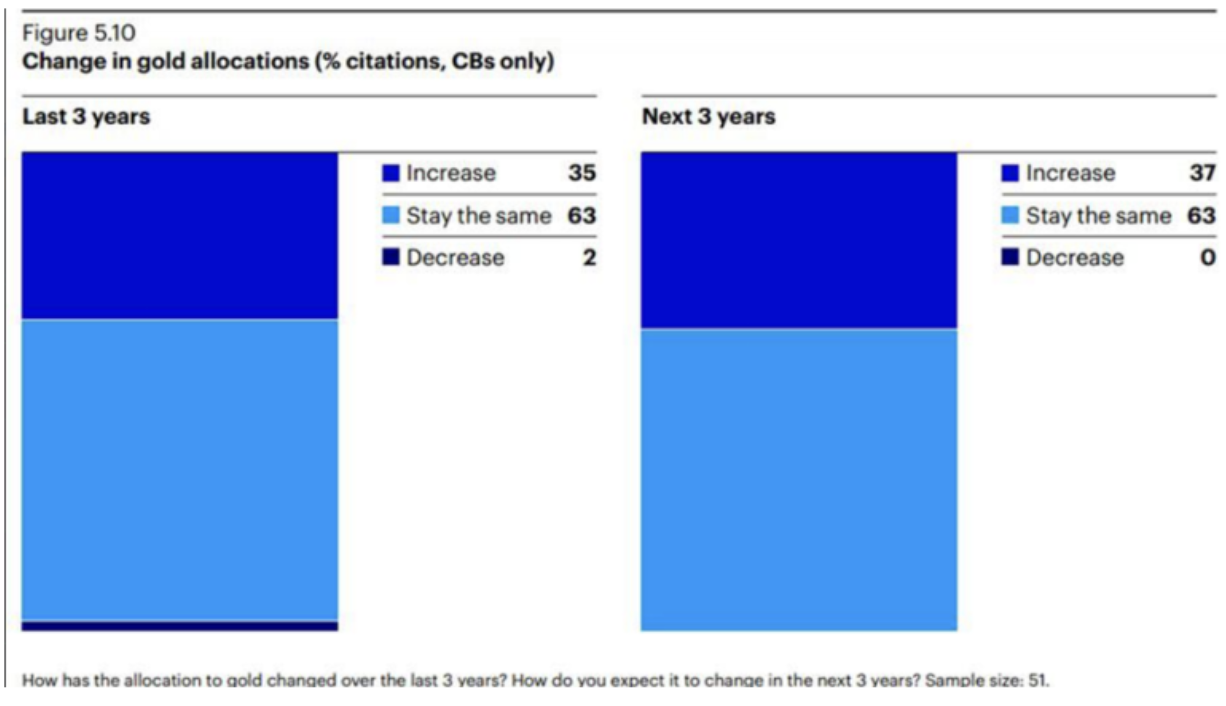

The results of the Invesco central bank survey:

- 37% of central banks will increase the proportion of gold in their reserves over the next three years;

- No bank is considering selling gold in the same period.

When officials meet on Wednesday, the Federal Reserve is widely expected to keep its key interest rate at its current 23-year high. Inflation eased in the second quarter, and the labor market has continued to weaken, factors that are likely to encourage the Fed to cut rates in the coming months. Market participants widely expect the Fed to start cutting the Fed Funds rate in September, and they'll be looking for signals from the central bank next week about the timing of the cuts.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша