July 8-13: Weekly economic update

Key market insights

Weekly economic update from Raison. In our weekly economic update for July 8-13, we have gathered key macroeconomic indicators, including inflation rates, GDP, and labor market statistics.

Macroeconomic Statistics

INFLATION

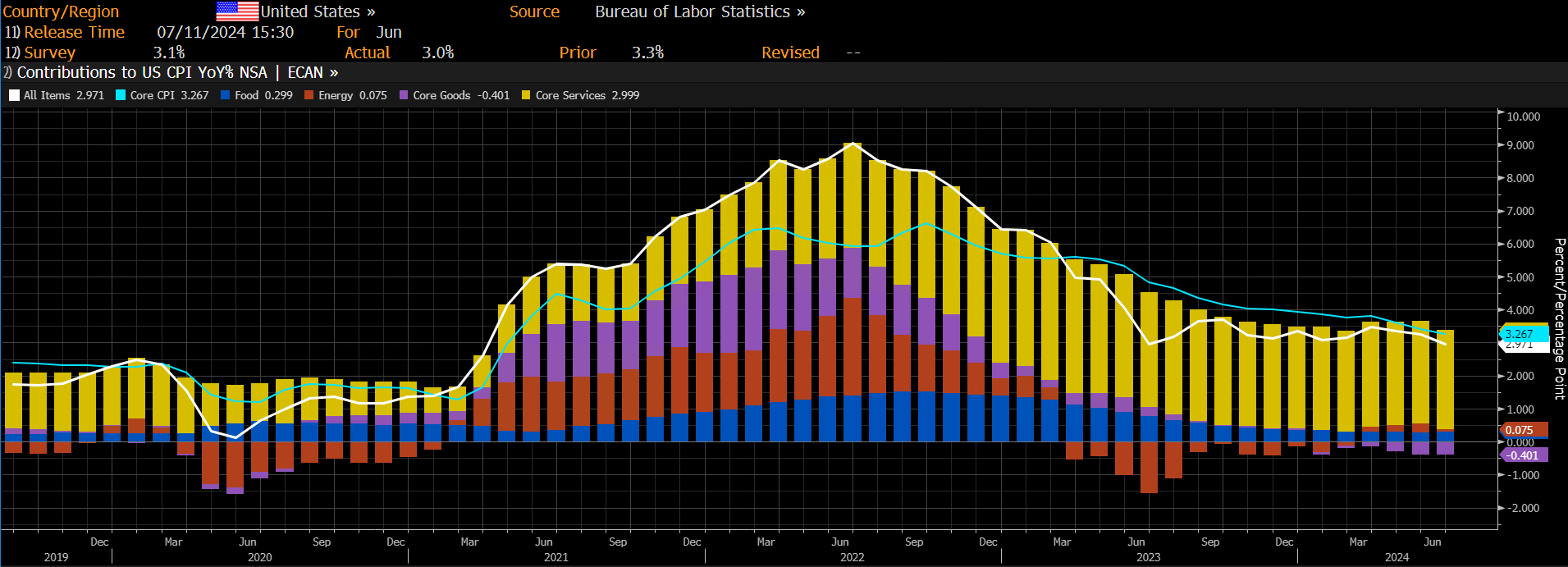

U.S. inflation in June significantly decreased, falling below forecasts:

- Core Consumer Price Index (CPI) (YoY) (June): 3.0%, pre: 3.3%

- Consumer Price Index (CPI) (YoY) (June): 3.3%, pre: 3.4%

Goods showed a deflationary trend (highlighted in purple), while the primary contribution to inflation continues to come from the services sector (highlighted in yellow).

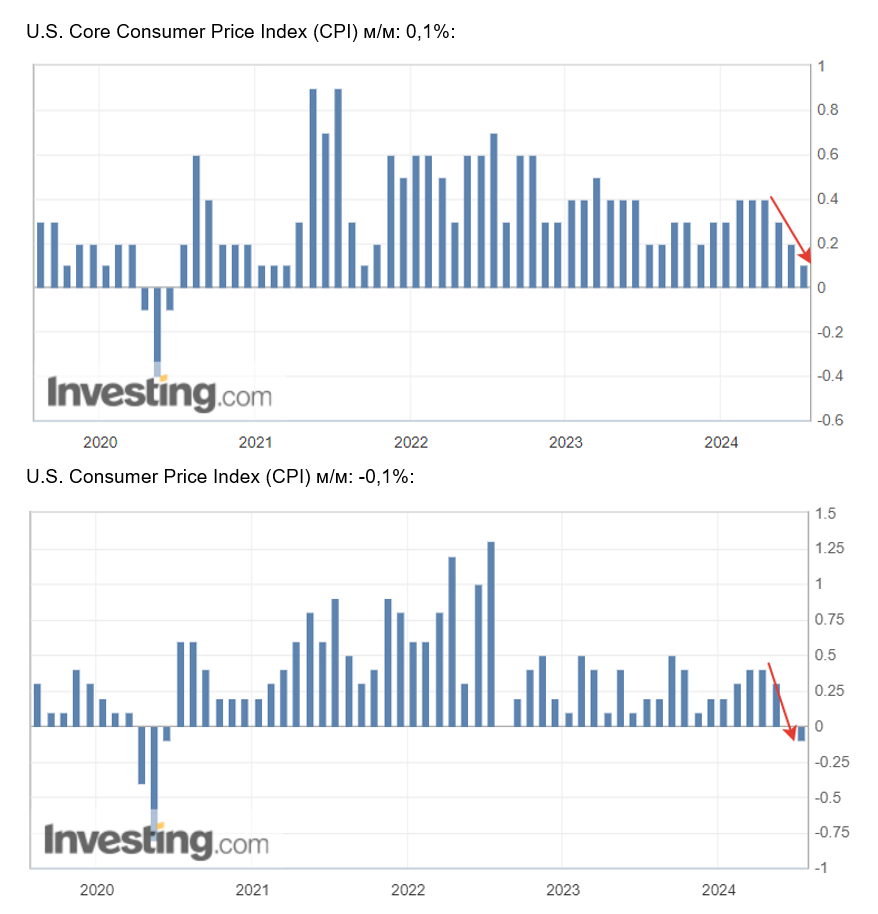

It's important to note the monthly dynamics of the index, which shows a decline in both CPI and core CPI for the fourth consecutive month.

This trend, coupled with the latest labor market release (where the unemployment rate increased to 4.1%), significantly raises the likelihood of a rate cut as early as September.

THE FED'S INFLATION TARGET

- Basic personal consumption expenditures price index (YoY) (June): 2.6% (pre: 2.8%)

- Personal consumption expenditures price index (YoY) (June): 2.6%, (pre: 2.7%)

INFLATION EXPECTATIONS

- 12-month expected inflation (June): 2.9%, pre: 3.0%

- 3-year expected inflation (June): 2.9%, pre: 2.8%

- 5-year expected inflation (June) 2.9%, pre: 3.0%

GDP (QoQ) (Q1)(third valuation): 1.4% (second: 1.3%) GDP deflator (QoQ) (Q1): 3.1% (pre: 1.7%)

Business Activity Index (PMI) (above the 50% mark - economic expansion, below - slowdown):

- In the service sector (June): 55.3 (pre: 51.8)

- In the manufacturing sector (S&P Global Composite)(June): 54.8 (pre: 54.5)

LABOR MARKET

- Unemployment rate (June): 4.1% (pre: 4.0%)

- Change in the number of people employed in the private non-agricultural sector (June): 136K, pre: 193K

- Average Hourly Earnings (June, YoY): 3.9%, pre: 4.1%

- Total initial applications to unemployment benefits: 238K, pre: 234K

MONETARY POLICY

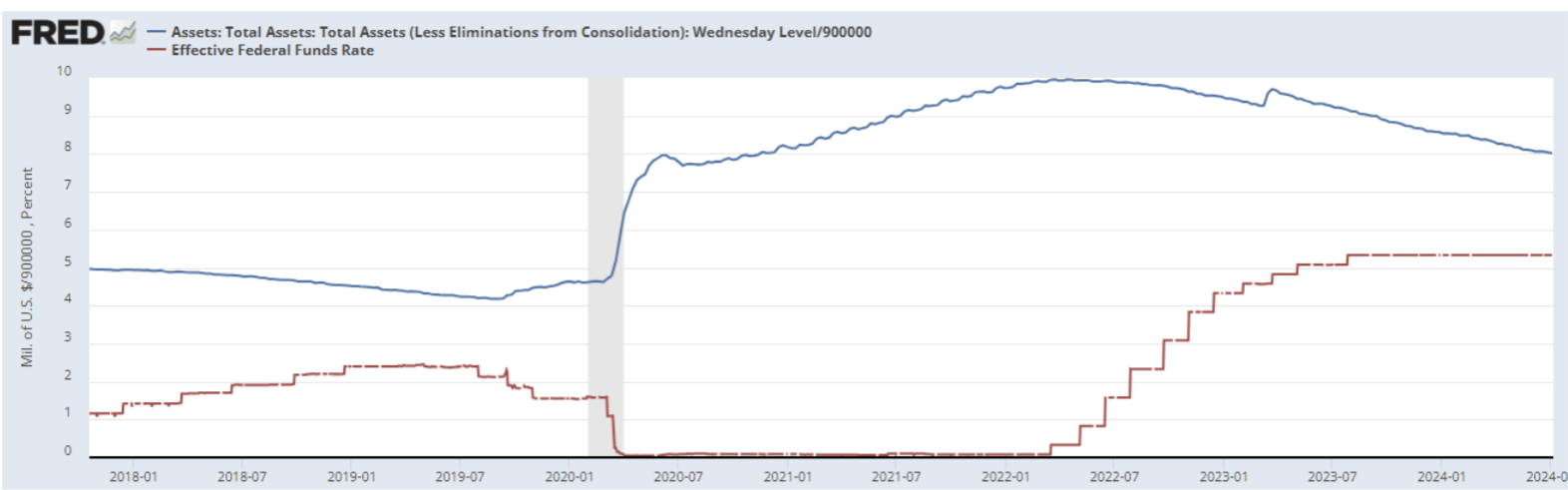

The federal funds effective rate (EFFR) is 5.50% (highlighted in red).

The Federal Reserve's balance sheet increased by $3 billion over the past week, compared to a decrease of $10 billion the previous week. It currently stands at $7.28 trillion.

From its peak of $9.015 trillion, the balance has decreased by $1.74 trillion:

RHETORIC OF FEDERAL RESERVE REPRESENTATIVES

Key points from Federal Reserve Chairman Jerome Powell's speech before the Senate Banking Committee in Washington on Tuesday (prior to CPI data):

Main Highlights:

- The question of when the Federal Reserve will lower interest rates remains open;

- I do not expect the next step to be a rate hike;

- I am not going to give any signals about the timing of future actions (i.e., the rate is likely to be maintained at the current level at the July meeting).

Additionally, he noted that:

- Holding high rates for too long could jeopardize U.S. economic growth, and the regulator may lower the rate before inflation reaches 2%.

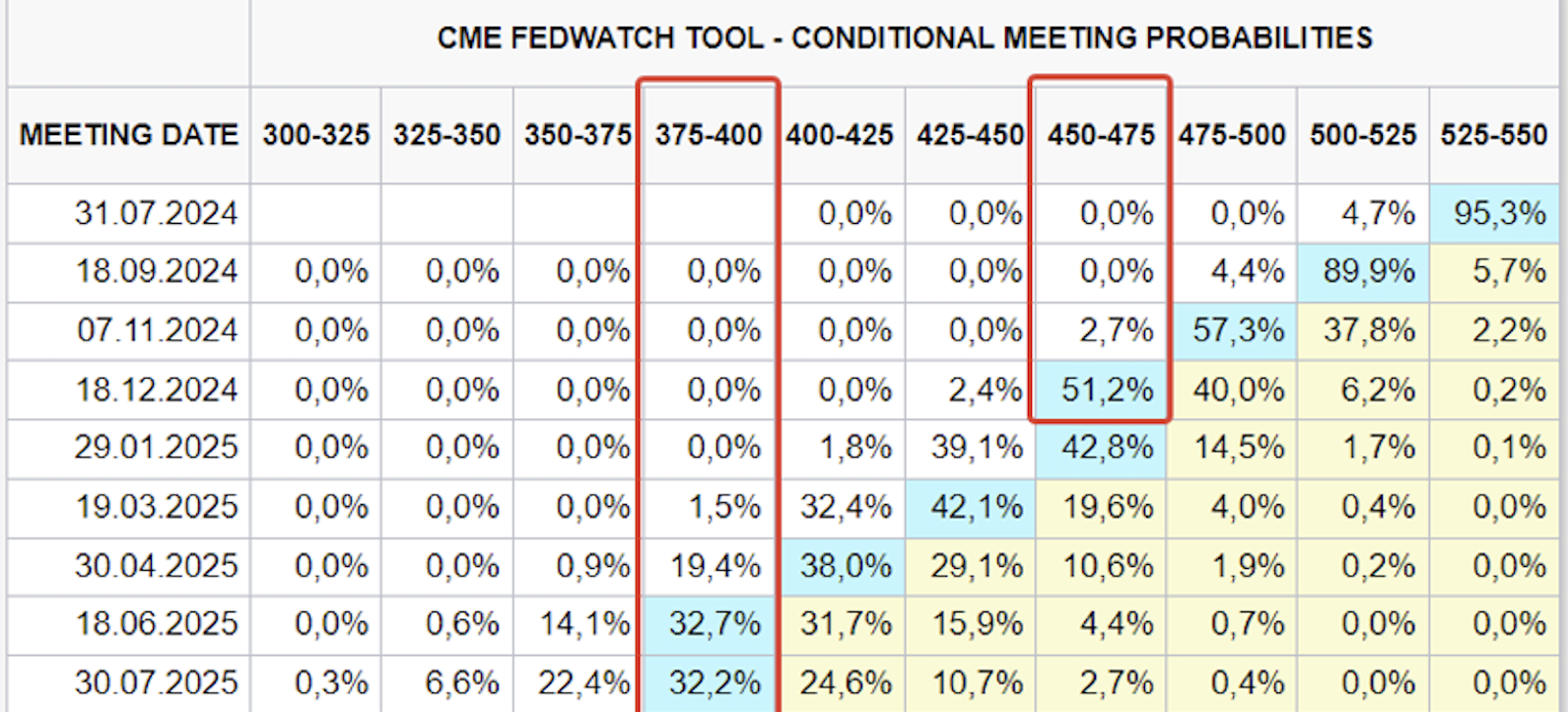

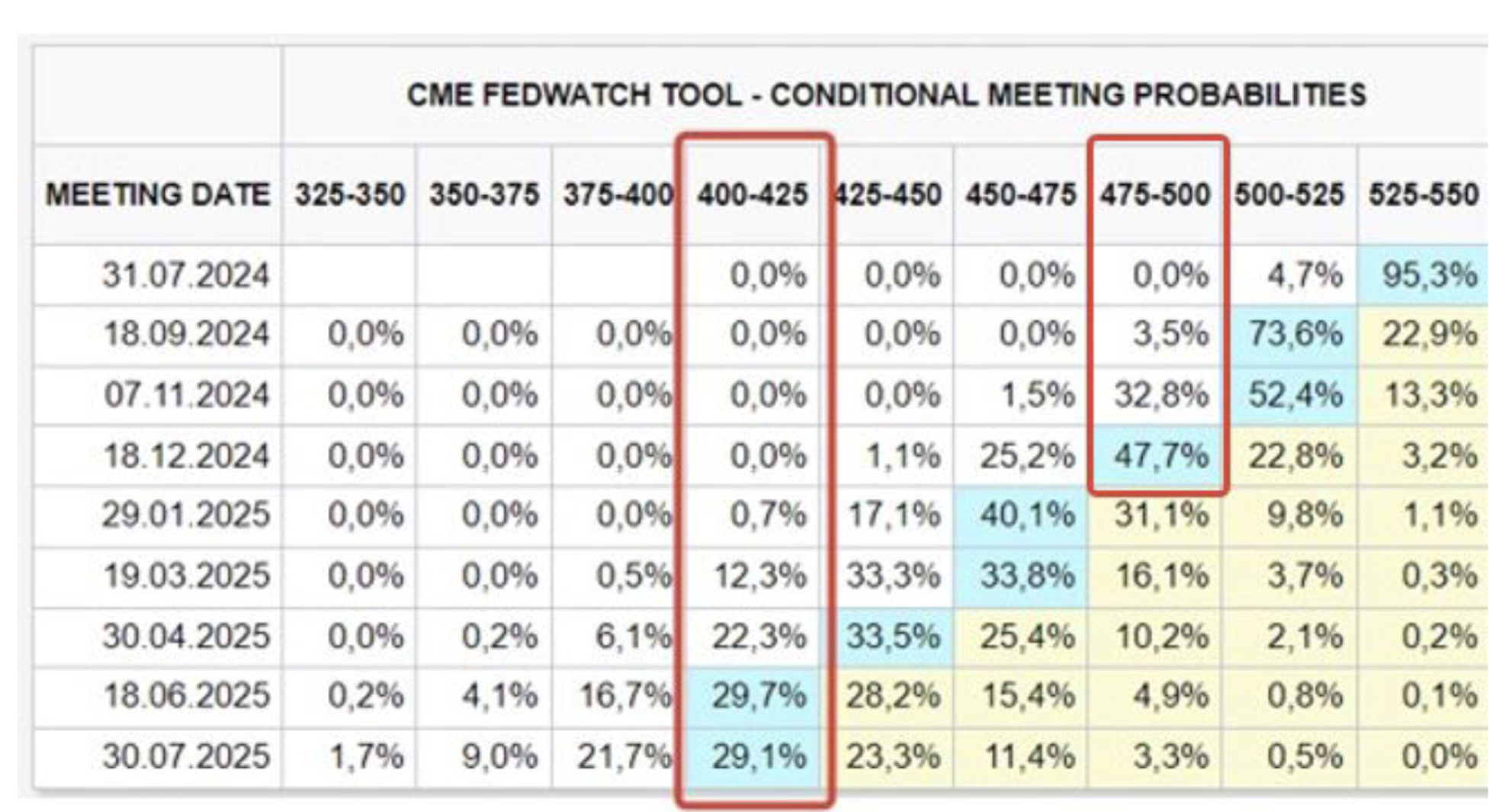

MARKET FORECAST RATE (FEDWATCH)

Today:

A week ago:

The statistics improved market expectations.

As of December this year, the expectations for the rate are: 4.50% - 4.75% (three cuts); Long-term expectations (for the year ahead): 3.75 - 4.00% (six rate cuts).

The market expects the first rate cut in September with a probability of 90.3%.

JPMorgan Chase and Citigroup banks have published their forecasts for the rate. Now they also expect the Fed to start cutting rates in September, rather than in November, as previously thought.

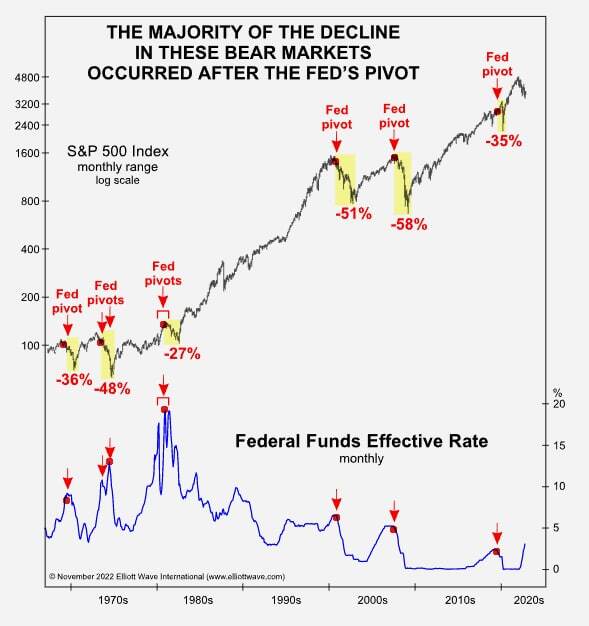

HISTORICAL DYNAMICS OF THE SP500 AND FEDERAL FUNDS RATE

Historically, rate cuts have often been accompanied by declines in the index. The primary reason is that the start of rate cuts is typically associated with a significant cooling of the economy. Predicting the outcome this time is challenging due to certain factors that support stock indices. Despite the labor market cooling, it remains relatively strong, and the AI hype continues.

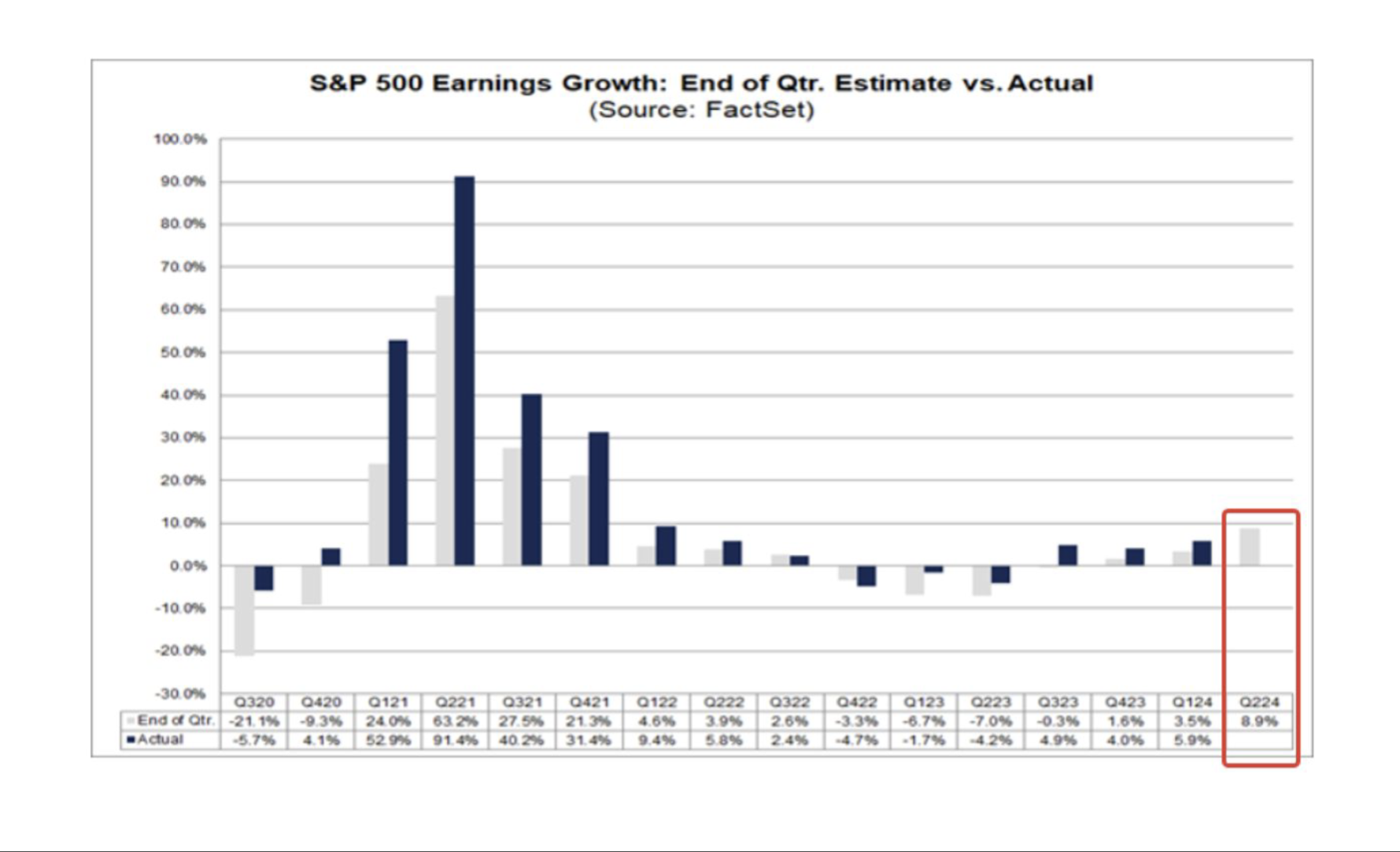

Moreover, company earnings forecasts for the second quarter of this year, according to Factset report, are quite positive. An 8.9% growth in earnings is projected compared to 3.5% in the previous quarter.

Different opinions: Powell says that a prolonged rate hold could call into question further economic growth, while there are revenue forecasts twice as high compared to the previous quarter.

MARKET

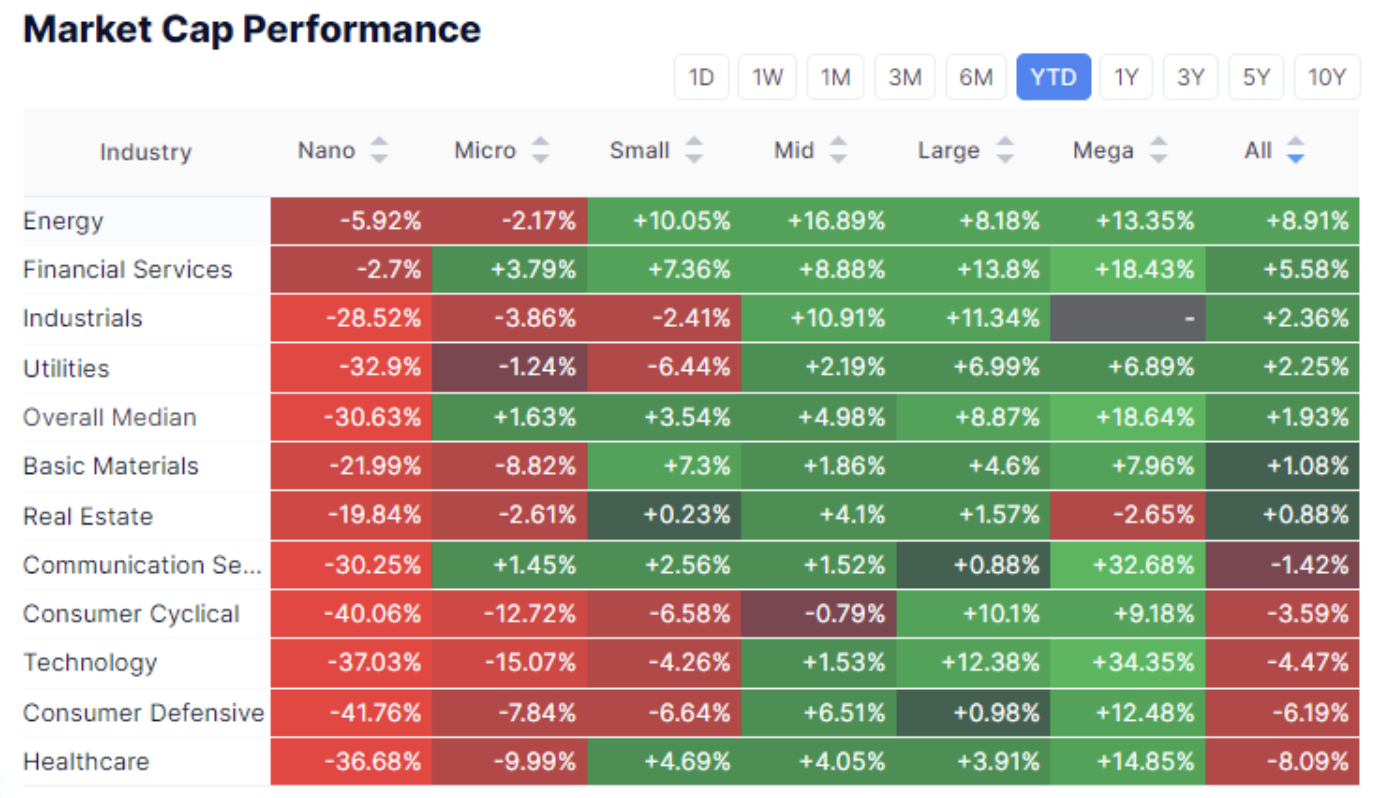

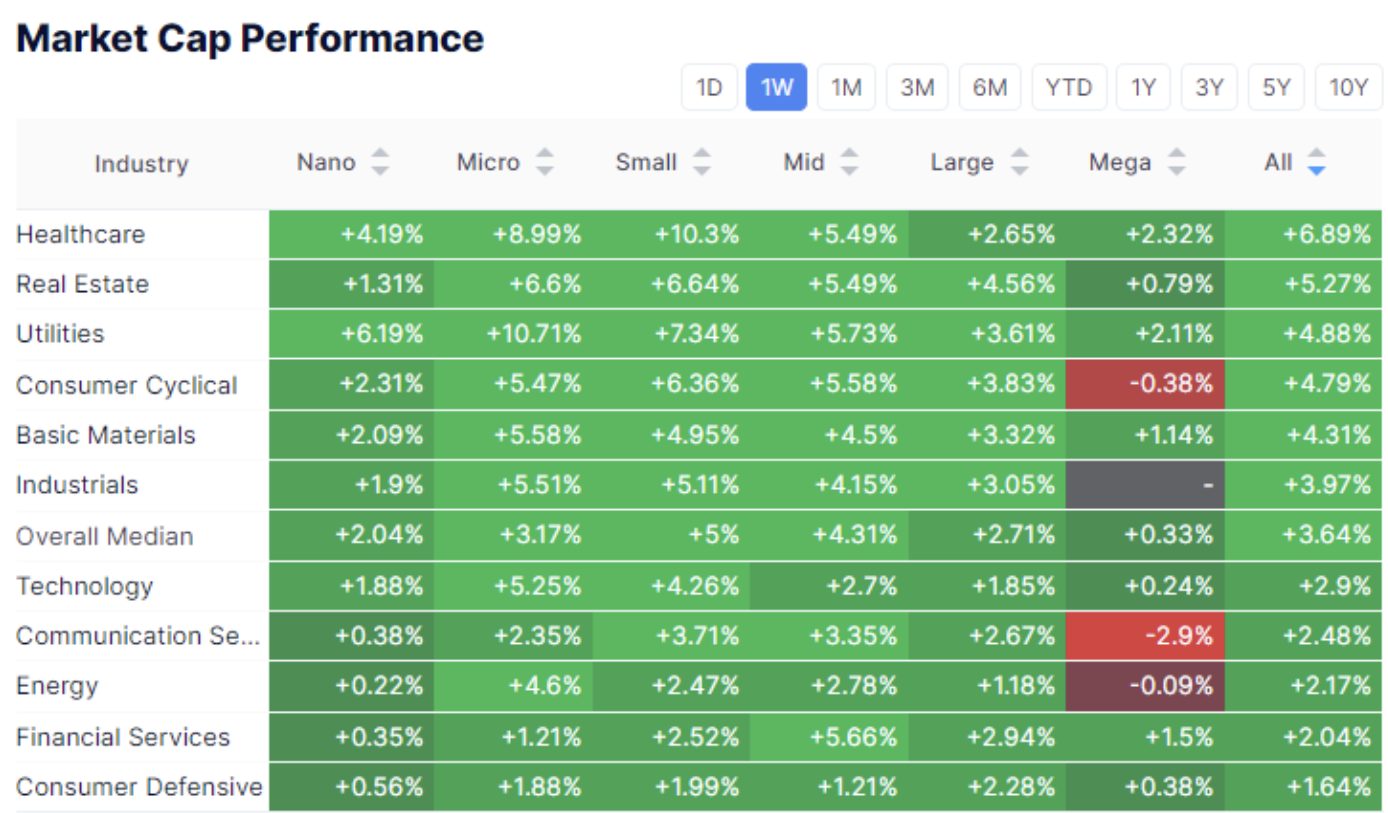

MARKET CAP PERFORMANCE

The dynamics of the sectors of mega-capitalized companies since the beginning of the year has been ahead of the entire market by a large margin. But, the dynamics of last week, on the contrary, showed the outperformance of small-cap companies. On average, the growth was more than 5%, which indicates an increase in risk appetite at the moment.

SP500

The growth of the index for the week amounted to 1.41%, at the moment on Friday another maximum of 5655 was beaten. The growth since the beginning of the year was 18.5%.

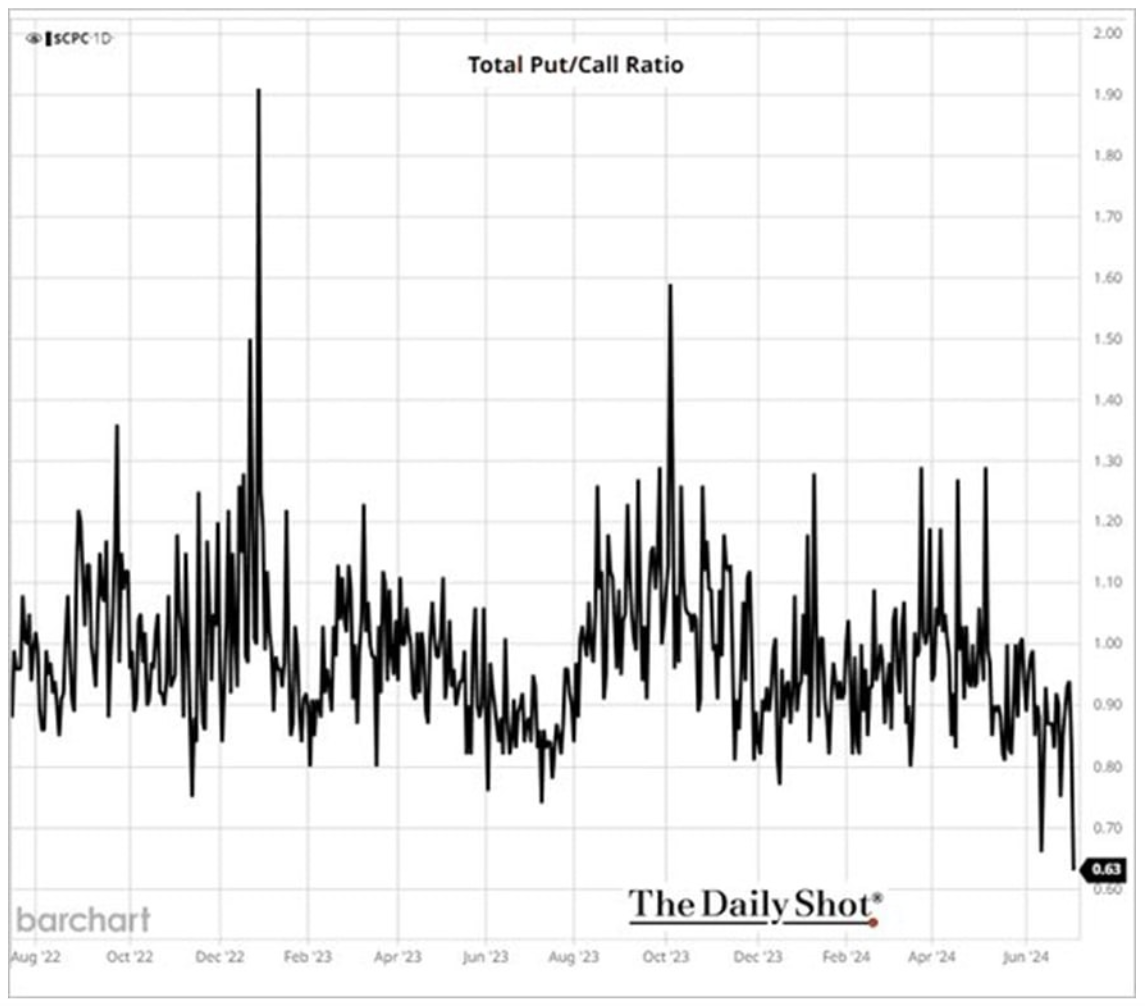

PUT/CALL

The PUT/CALL options ratio, an indirect indicator of market sentiment, is at a minimum. This indicator is a contrarian one, but in the current situation, we can say that PUTTS are bought to insure against falling prices, and CALLS are in anticipation of growth. The minimum values indicate that the market is not expecting a serious drop in the index today.

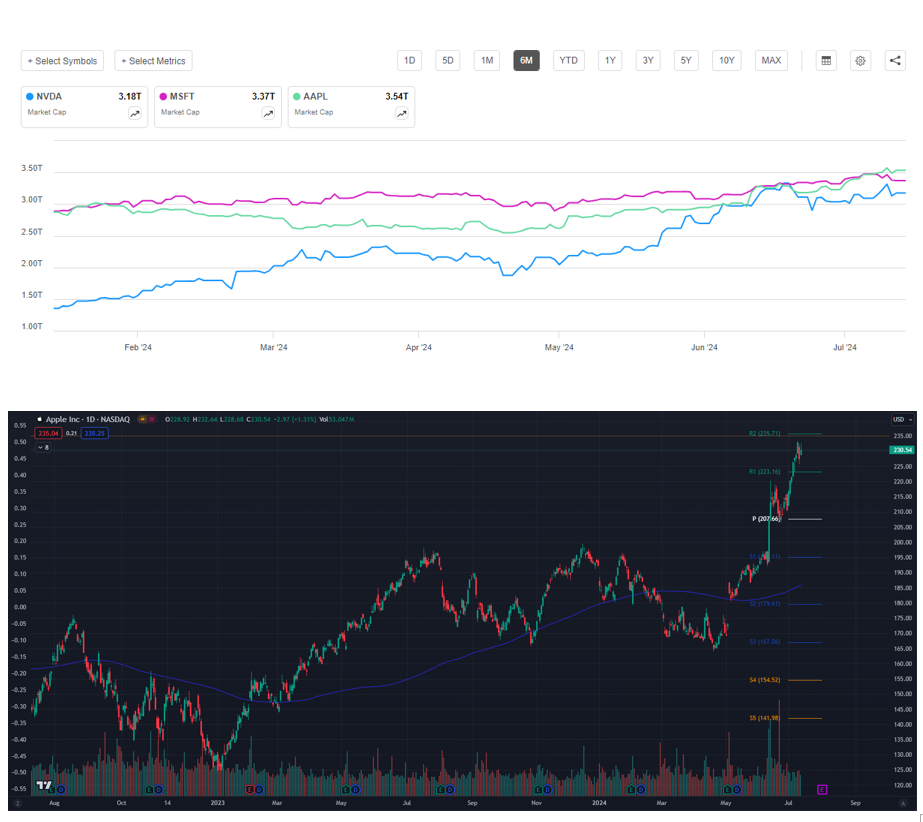

MARKET LEADERS

APPLE took the 1st place in capitalization, overtaking MSFT and NVDA amid forecasts of iPhone sales growth by 10% and the introduction of the AI function. The growth since April has been more than 40%.

TREASURY BONDS

The reaction of US Treasury bonds was unequivocal. The yield at the moment fell sharply along the entire curve. According to the results of the week, long-term bonds increased by 1%. It is highly likely that the rate will not be lowered in July, so the dynamics of the US treasury before the September meeting will depend on macro data and the most important thing is that the focus will be on the next rhetoric of the Fed.

DOLLAR INDEX (DXY)

The dollar index broke through the lower limit of the ascending channel – the reason for the increase in expectations of a rate cut:

USDKZT Update

The USDKZT cross-rate decreased by 1.4% from its local peak. On July 12, the National Bank of Kazakhstan decided to lower the key interest rate by 25 basis points to 14.25% annually, as the annual inflation rate continued to decline, reaching 8.4% compared to 8.5% the previous year.

However, the regulator notes that inflationary pressure persists in the domestic economy due to sustained internal demand, supported by fiscal stimulus and consumer lending. Monetary conditions will remain moderately tight for an extended period to reinforce the trend of slowing price growth and achieve the inflation target of 5.00%.

Such rhetoric about maintaining strict conditions for an extended period, in contrast to the Federal Reserve's rhetoric about the risks of holding high rates for too long, could support the tenge in the medium term.

The main conclusion on the markets is that macroeconomic statistics are positive in the context of the possibility of a rate cut, but the key factor for market sentiment will be precisely the Fed's rhetoric, in particular whether it changes or not.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша