June 2 - 6, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core CPI (m/m) (April): 0.2% (previous: 0.1%)

- CPI (m/m) (April): 0.2% (previous: -0.1%)

- Core CPI (y/y) (April): 2.8% (previous: 2.8%)

- CPI (y/y) (April): 2.3% (previous: 2.4%)

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (May): 6.6% (previous: 6.5%)

- 5-year expected inflation (April): 4.2% (previous: 4.4%)

GDP (U.S. Bureau of Economic Analysis, BEA)

- -0.2%; (Q4 2024: 2.4%)

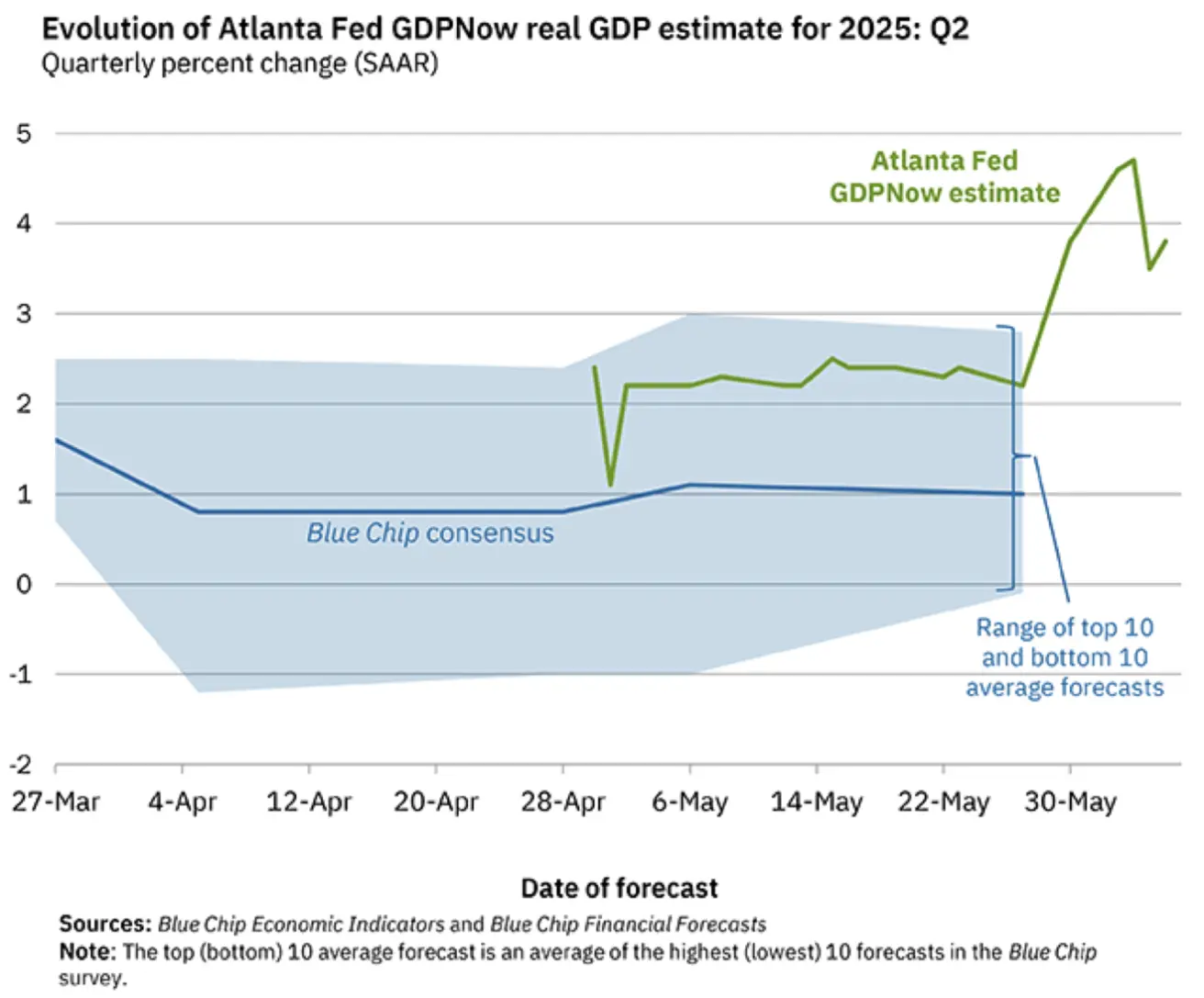

GDPNow indicator by the Federal Reserve Bank of Atlanta (Q2): 3.8% (vs 2.3%)

The GDPNow forecasting model provides a “real-time” estimate of official GDP growth prior to its publication, using a methodology similar to that of the US Bureau of Economic Analysis.

Business Activity Index (PMI):

(Above 50 indicates expansion; below 50 indicates contraction)

- Services sector (May): 53.7 (previous: 50.8)

- Manufacturing sector (May): 52.3 (previous: 50.7)

- S&P Global Composite (May): 53.0 (previous: 50.6)

LABOR MARKET

- Unemployment rate (April): 4.2% (previous: 4.2%)

- Nonfarm payroll employment change (May): 139K (previous: 147K revised)

- Average hourly earnings (May, y/y): 3.9% (previous: 3.8%)

MONETARY POLICY

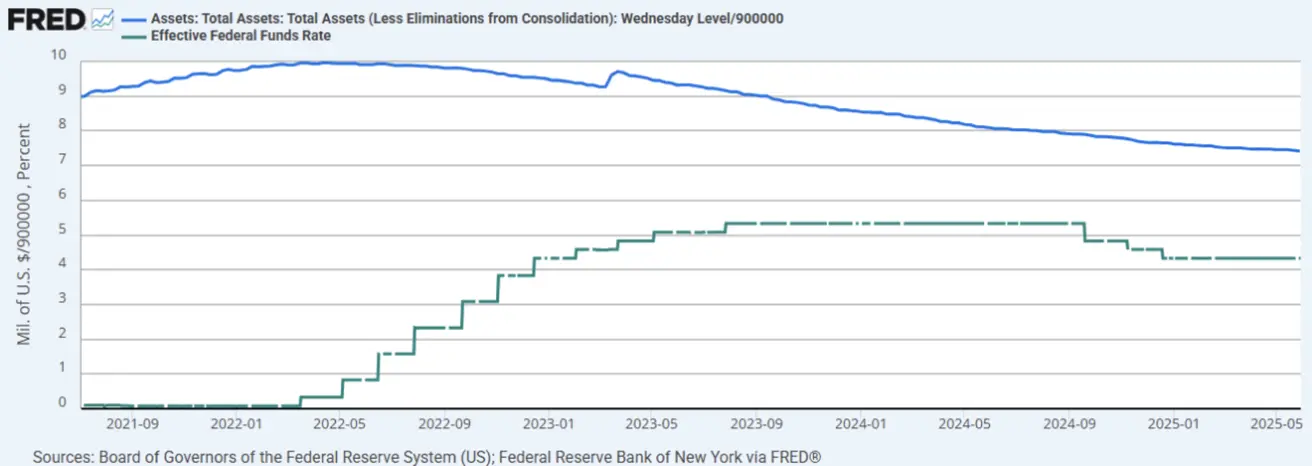

- EFFR: 4.25% - 4.50% (unchanged)

- Federal Reserve balance sheet: $6.673 trillion (vs previous week: $6.673 trillion)

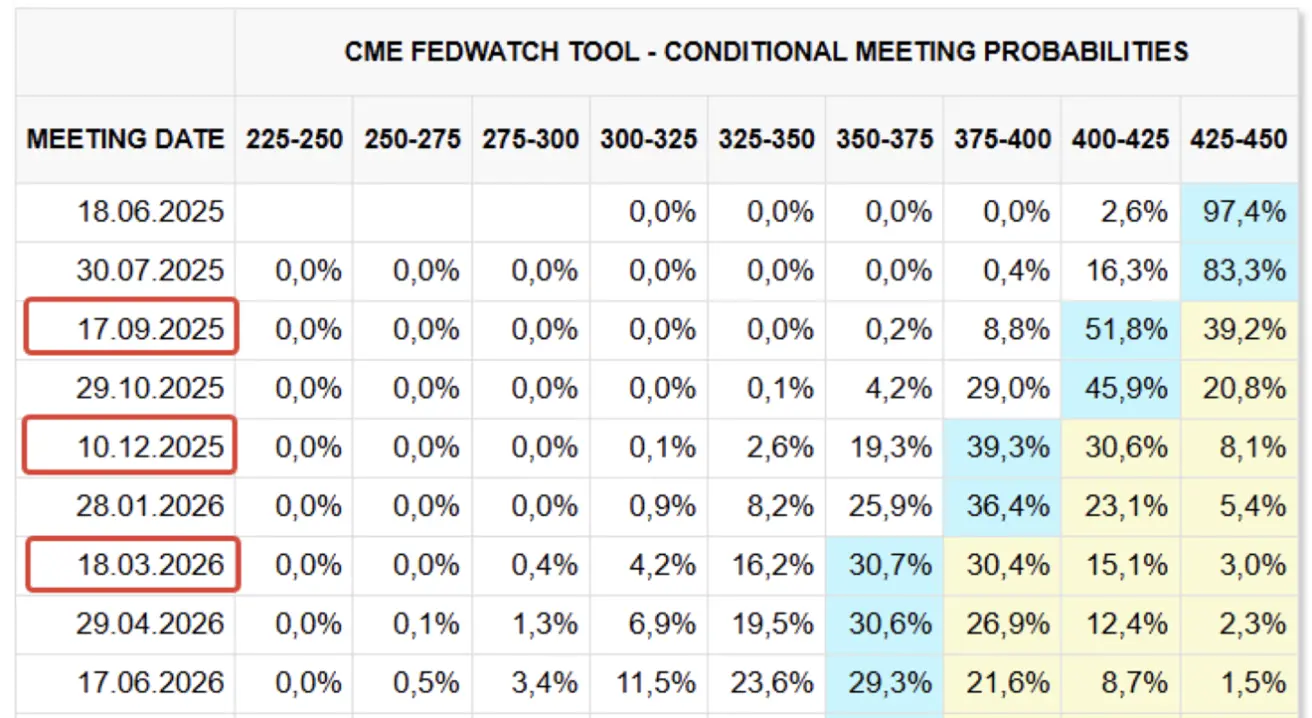

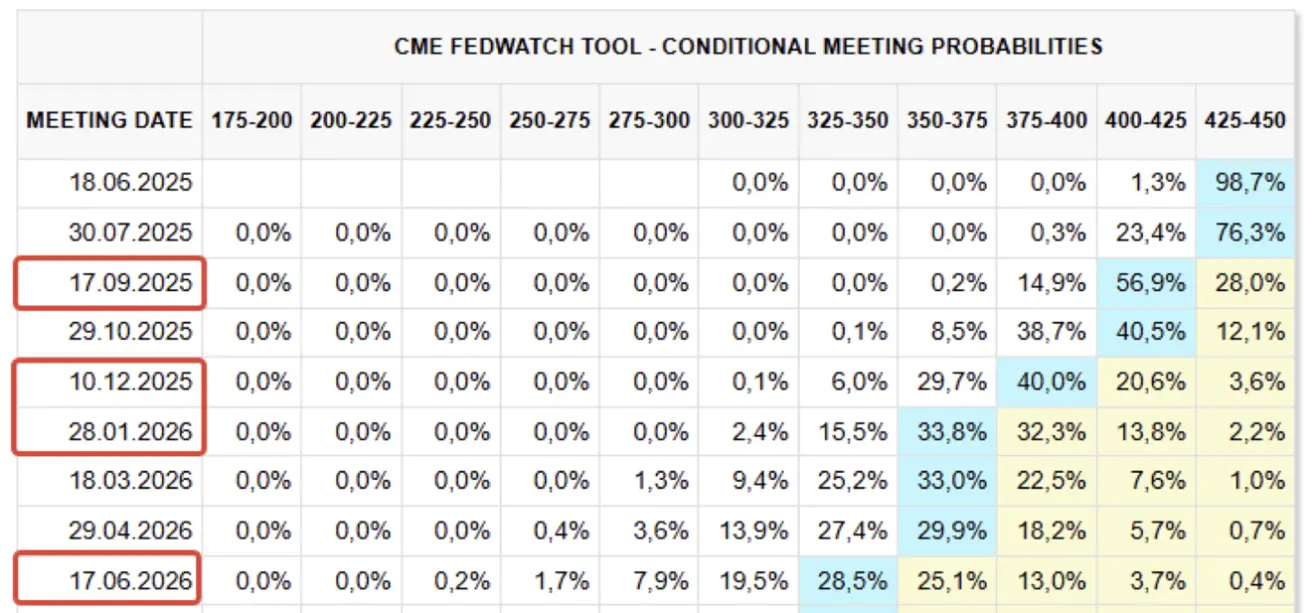

MARKET FORECAST FOR RATE

-

Today:

-

A week earlier:

Commentary

Let's begin with the Eurozone, where positive data was released across all major indicators (see table below):

- Monthly consumer inflation for May was flat, while annual growth reached 1.9%, down from 2.2% the previous month. The core index (y/y) rose by 2.3% (vs 2.7%).

- Business activity, according to the S&P Global Composite Index for May, declined to 50.2 but remains in expansion territory. Unemployment in April fell to 6.2% from 6.3%.

- Following this data, the ECB reduced its key rate by 0.25% to 2.15%. Deposit facility rate: 2.00% (vs 2.25%), ECB marginal lending facility rate: 2.40% (vs 2.65%).

- GDP (q/q) (Q1): 0.6% (vs 0.2%). Friday’s GDP data were also positive: annual GDP growth (Q1) was 1.5% (vs 1.2%).

ECB revised economic forecasts:

From the ECB press release "Monetary Policy Decisions":

- The decision to lower the deposit rate—the rate through which the Governing Council sets the monetary policy stance—was based on its updated assessment of inflation prospects, core inflation dynamics, and the strength of monetary policy transmission.

- In the baseline scenario of the new Eurosystem staff projections, average inflation is expected at 2.0% in 2025, 1.6% in 2026, and 2.0% in 2027.

- Real GDP growth is projected to average 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027. The unchanged 2025 growth forecast reflects a stronger-than-expected first quarter combined with weaker prospects for the remainder of the year.

US:

- Business activity saw stronger growth in the services sector, reaching 53.7, with the composite index at 53.

- GDPNow indicator by the Federal Reserve Bank of Atlanta (Q2): 3.8% (vs 2.3%). Unemployment rate remains unchanged at 4.2%.

- According to ADP Research, private sector employment increased by 37,000 last month—below all estimates in the Bloomberg economists’ survey. This marked the second consecutive month of significantly lower-than-expected figures.

- Economists expect the labor market to show further signs of cooling in the coming months.

Monetary Policy Outlook:

- Market expectations per FedWatch for the next 12 months: three rate cuts of 0.25%, bringing the range to 3.50-3.75%. The first cut is expected in September this year.

- The next FOMC meeting is scheduled for June 18, with markets currently expecting the rate to remain in the current 4.25-4.50% range. FedWatch probability for holding the rate: 97.4%.

Trade Wars:

- The US and Chinese presidents held a phone conversation on Thursday. Trump described it as a "very good call," but no official statements on substantive agreements have been released yet.

- Xi Jinping invited Trump to visit China, and Trump reciprocated. The next round of trade talks will take place in London on June 9.

- On Tuesday, India filed a complaint with the WTO, labeling the US's 25% tariffs on car and auto part imports as illegal safeguard measures harming its exporters.

- The tariff pause is set to expire in mid-July.

Equity Market

Markets were in Risk-On mode.

- Median market growth: +1.64%

- Only defensive sectors had negative returns.

YTD performance: -3.52%:

MARKET

-

SP500: +1.50% weekly (6000.37), YTD: +1.65%

-

NASDAQ100: +1.97% weekly (21761.79), YTD: +3.04%

-

Euro Stoxx 50: +1.06% weekly (5426), YTD: +11.10%

-

CSI 300: +0.86% weekly (3873), YTD: -1.48%

-

Hang Seng: +2.84% weekly (23792), YTD: +19.37%

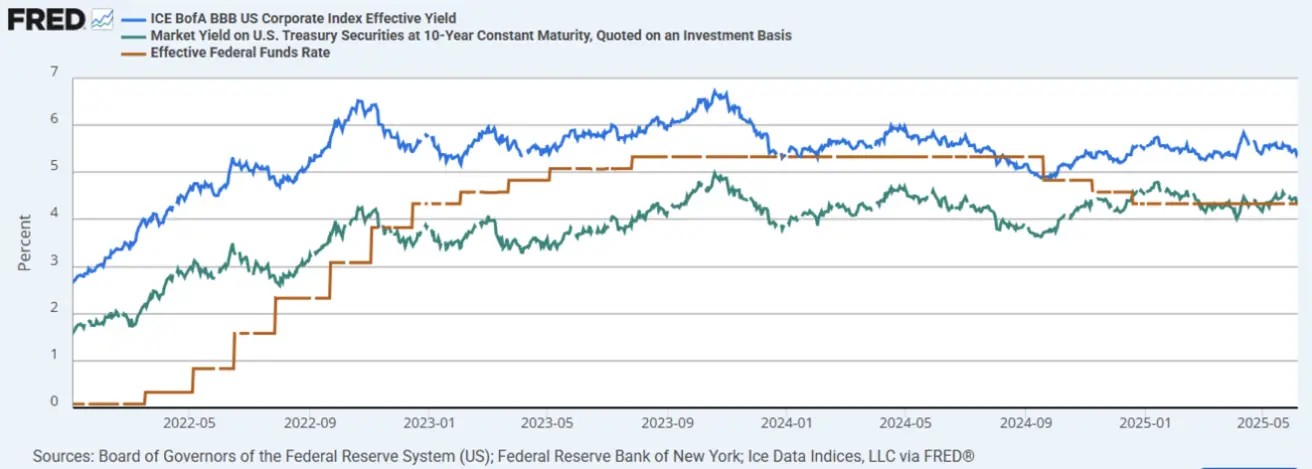

BOND MARKET

- TLT ETF: -1.08% (week close: $85.35), YTD: -2.79%

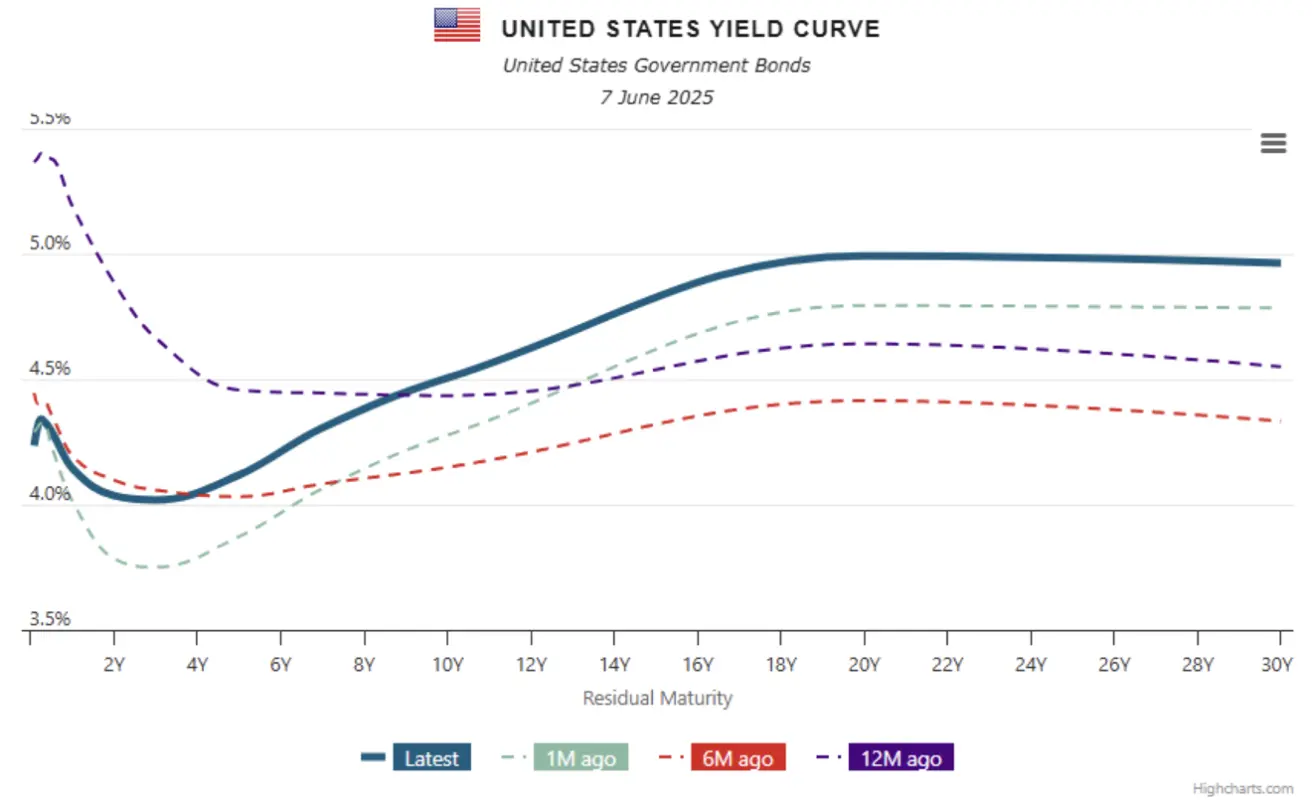

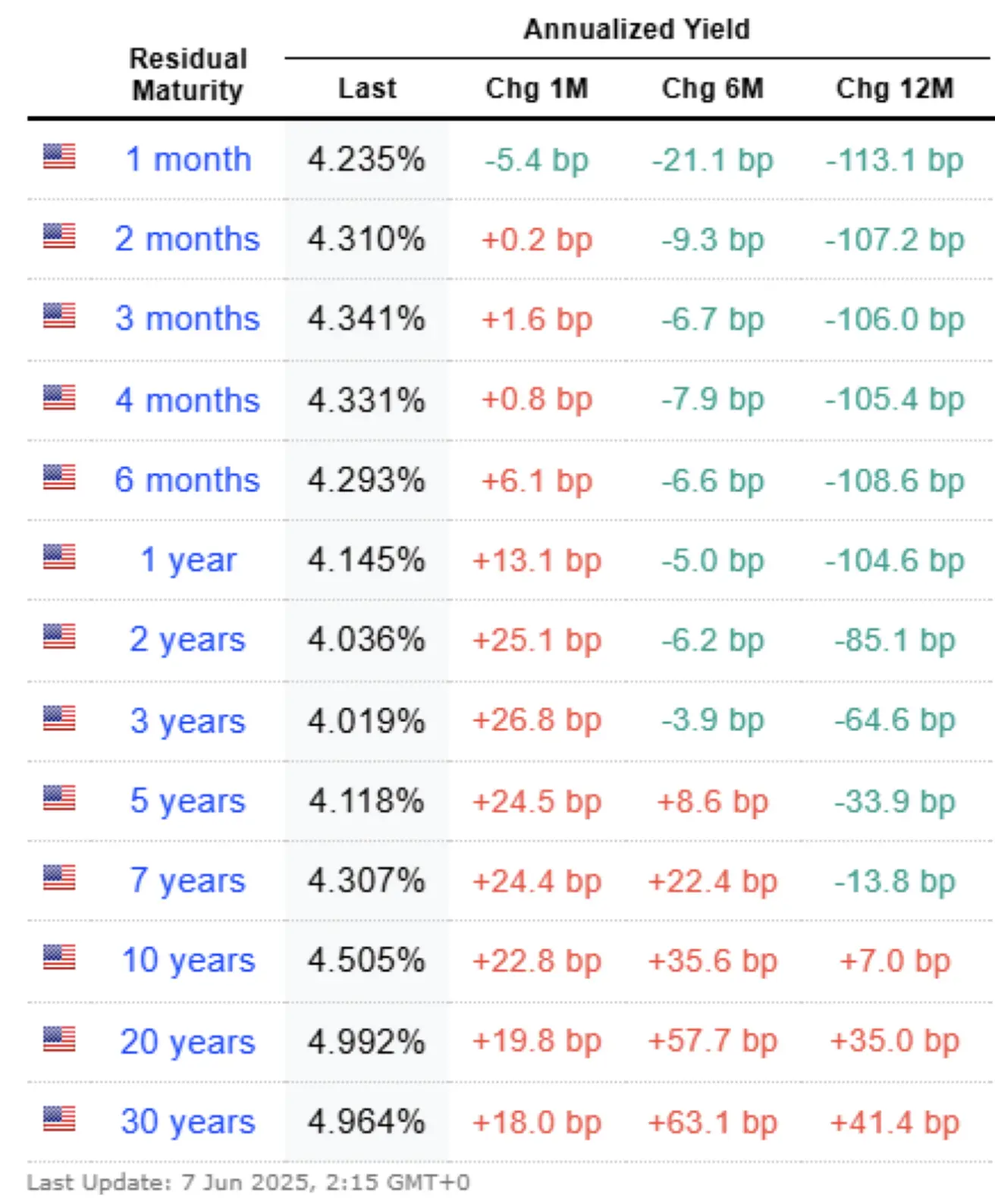

Yields and Spreads (2025/06/06 vs 2025/06/02):

- 10Y Treasury Yield: 4.505% (vs 4.417%)

- ICE BofA BBB Corporate Yield: 5.42% (vs 5.46%)

- 10Y-2Y Spread: 46.9 vs 50.7 bps

- 10Y-3M Spread: 16.4 vs 6.7 bps

COMMODITIES & CURRENCY

GOLD FUTURES (GC)

- Weekly: +0.54%, close: $3331/oz

- YTD: +26.13%

- Range: $3300–3400/oz

DOLLAR INDEX FUTURES (DX)

- Weekly: -0.20%, close: 99.17

- YTD: -8.46%

The dollar is trading near two-year lows. According to Bank of America, uncertainty in trade policy and high debt levels may continue to pressure the USD. High-frequency data suggest the economy may slow, potentially further weakening the dollar this summer.

OIL FUTURES

- Weekly: +6.55%, close: $64.77/barrel

- YTD: -9.85%

- Recovery from May lows despite oversupply concerns

CRYPTO MARKETS

Bitcoin (BTC)

- Weekly: 0%, close: $105,060

- YTD: +10.28%

Ethereum (ETH)

- Weekly: -3.37%, close: $2511.00

- YTD: -25.80%

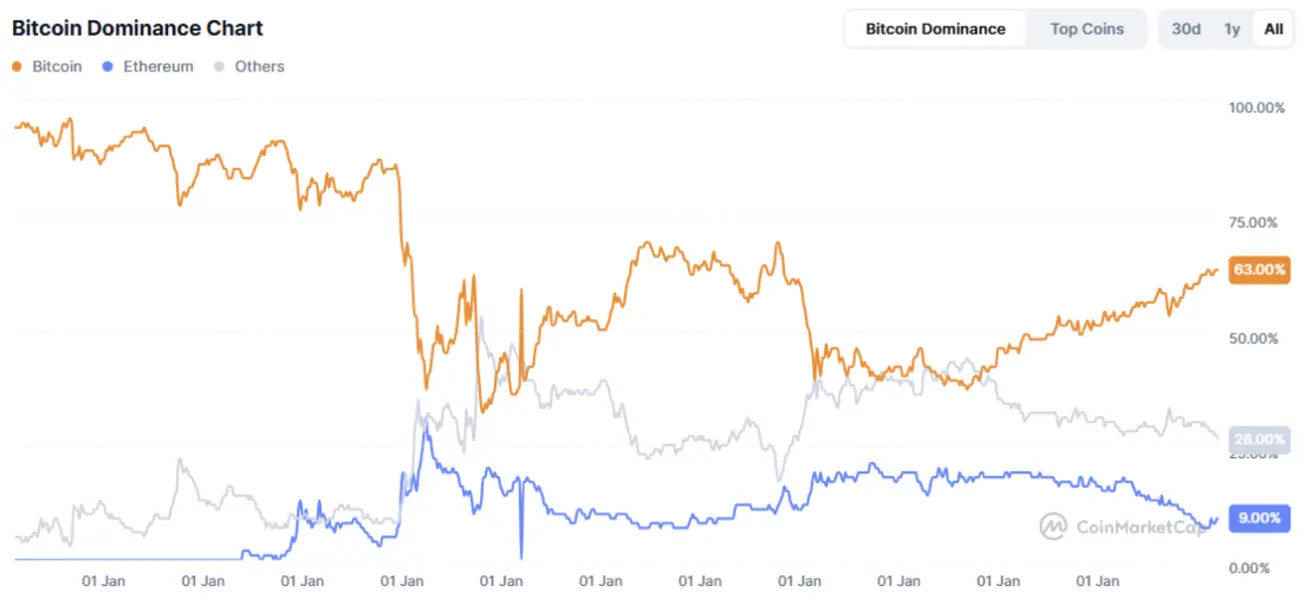

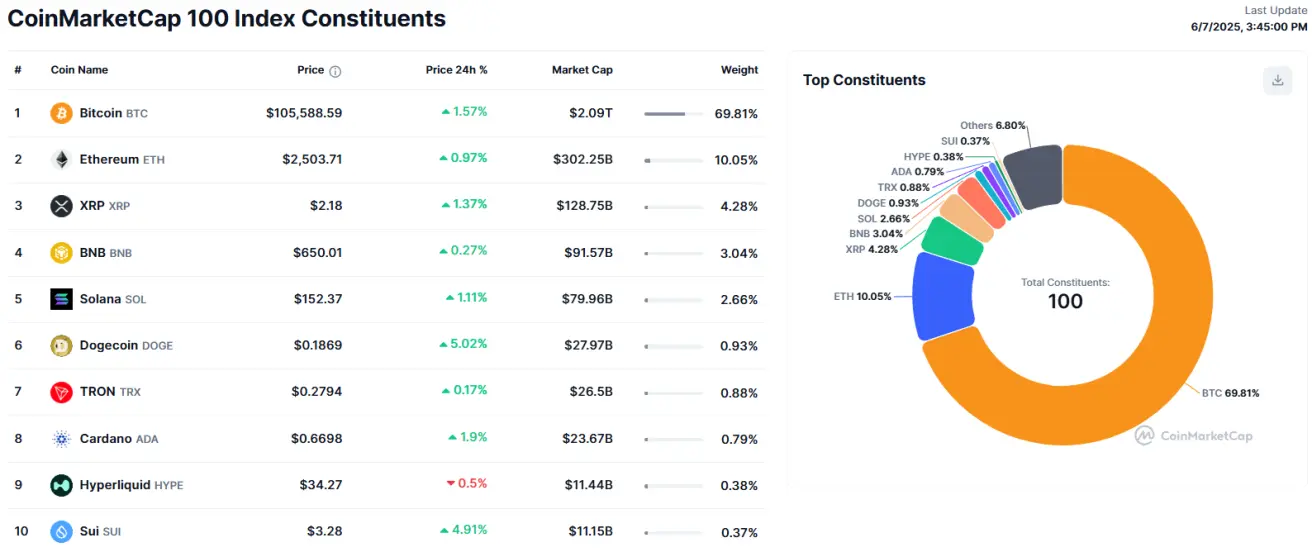

Total Market Cap: $3.29 trillion (vs $3.3T)

- BTC dominance: 63.7% (vs 63.0%)

- ETH dominance: 9.2% (unchanged)

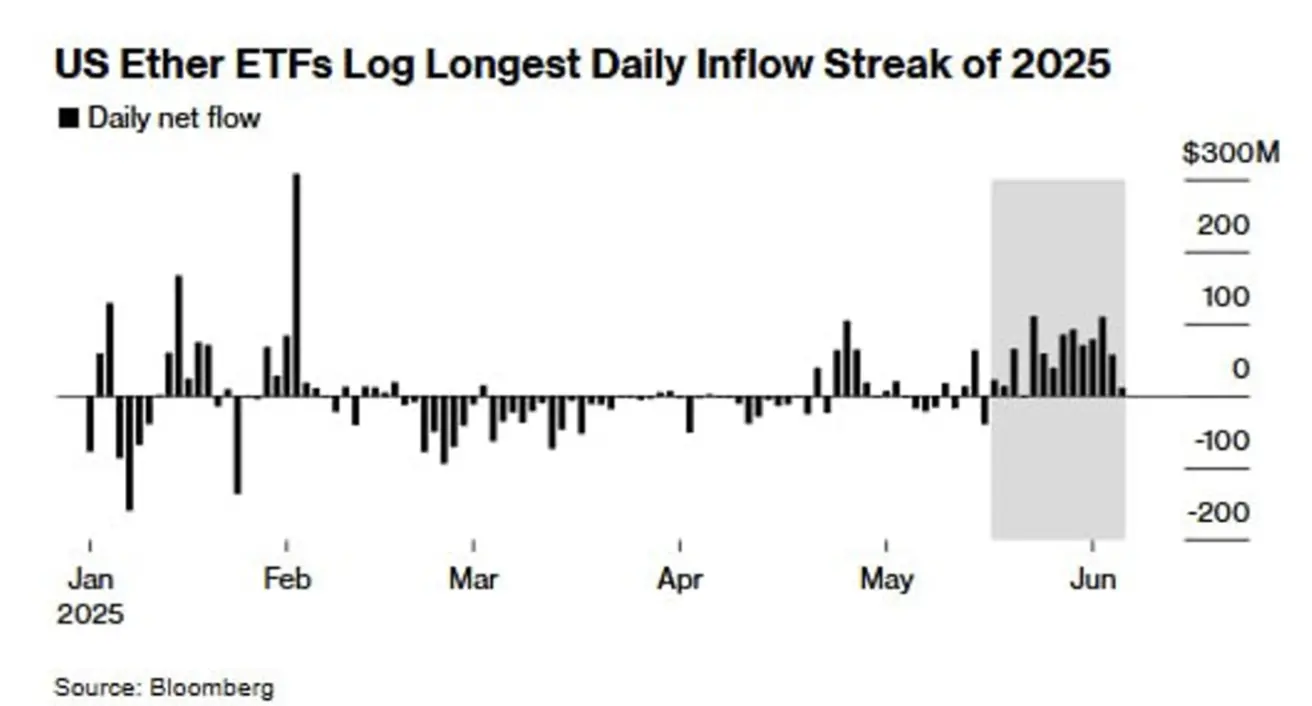

Ethereum ETFs saw 14 consecutive days of inflows.

Crypto market capitalization: $3.29 trillion (vs $3.3 trillion a week earlier) (coinmarketcap.com).

Bitcoin dominance: 63.7% (63.0%), Ethereum: 9.2% (9.2%), others: 27.1% (27.1%).

Since mid-May, Ethereum’s market share has stabilized and started to recover. After a three-month pause, Ethereum ETFs have seen inflows for 14 consecutive days.

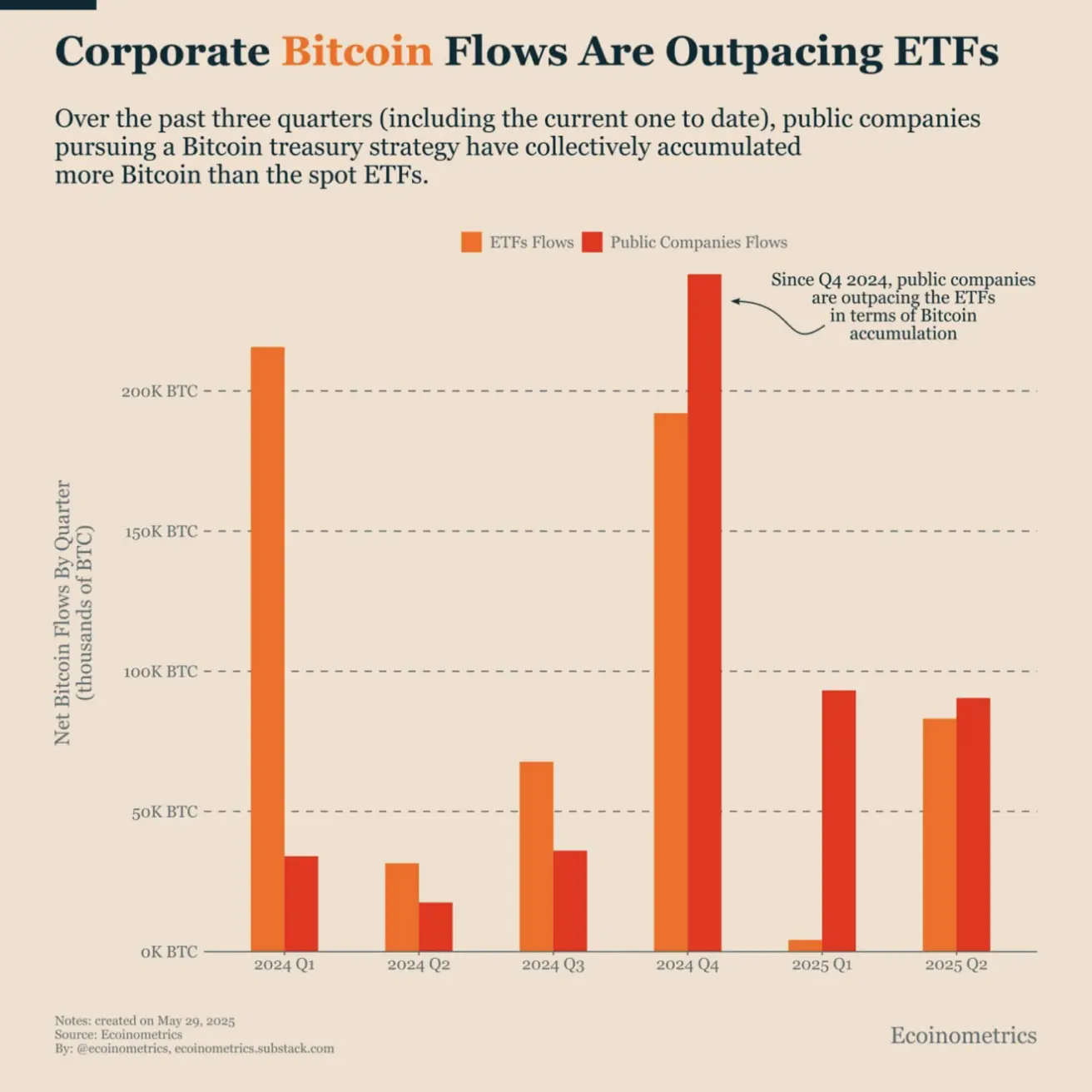

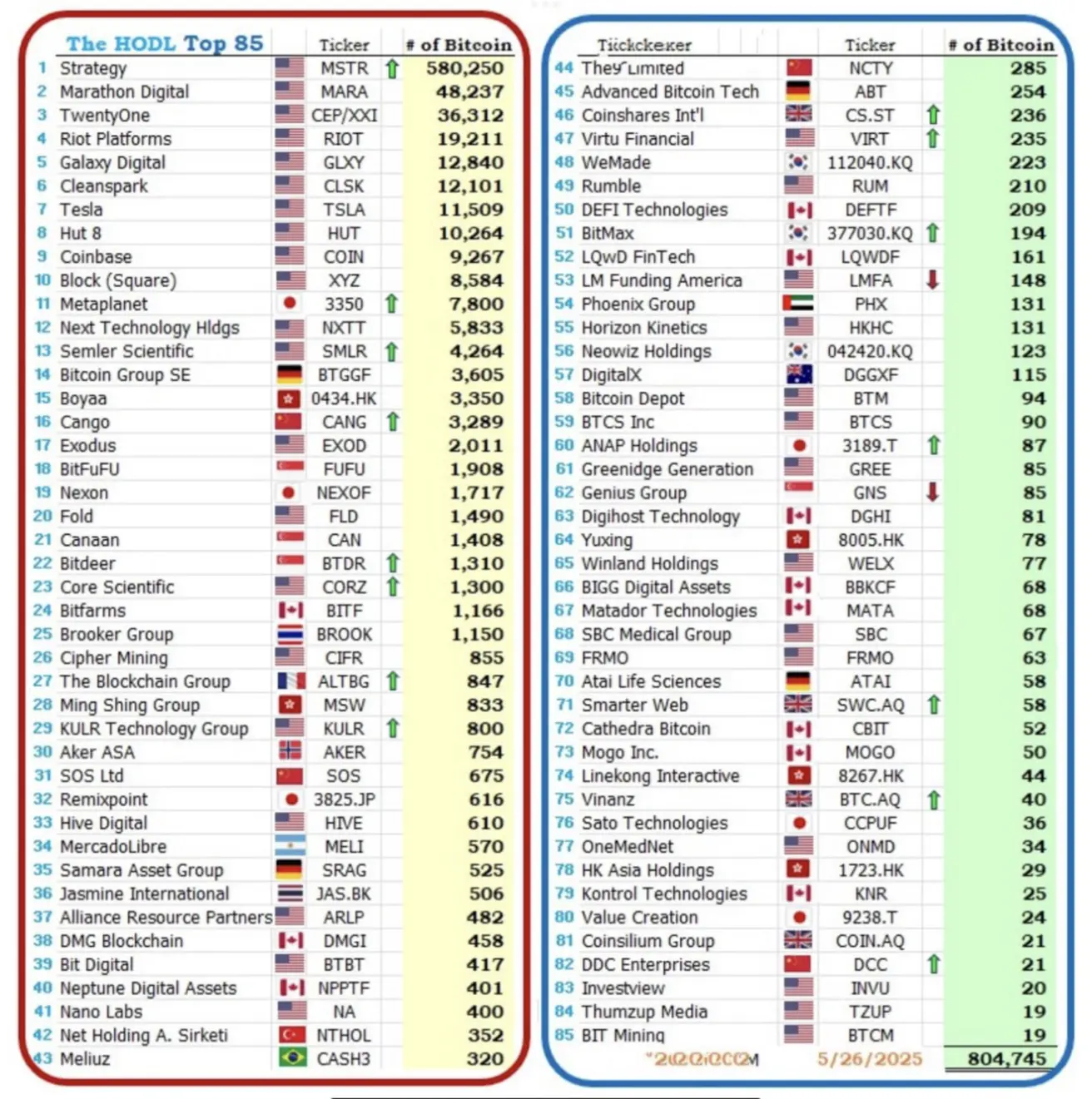

Institutional Trends

- Public companies > ETFs in BTC accumulation

- 804K BTC held by 85 largest companies

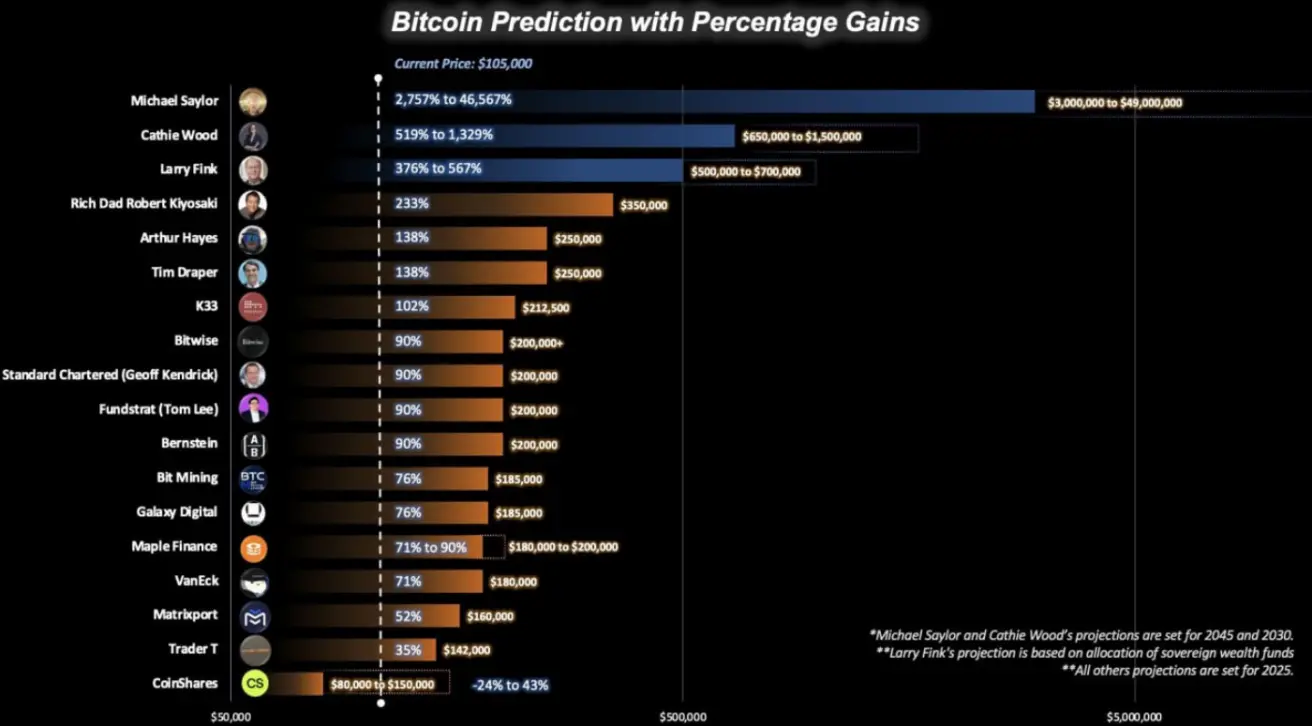

Bitcoin Forecasts

- Larry Fink (BlackRock): $500K by 2030

- Average 2025 target: $180K–200K

- Other forecasts: Bitwise, VanEck

IPO Market

Circle Internet Corp. (USDC Issuer)

- Book price: $31 (vs range: $24–$26)

- First market price: $64

- 2-day close: $107.7 (+247.42%)

- Pre-market (today): >$120

eToro Group Ltd.

- IPO in May

- Goldman Sachs: “Buy”, target: $76

Crypto Market News

- SEC delays spot Grayscale ETFs ($AVAX, $ADA): July 15 decision

- Thailand bans crypto exchanges: Bybit, 1000X, CoinEx, OKX, XT (from June 28)

- X to launch XChat: Bitcoin-like cryptographic architecture

- JPMorgan: Loans backed by crypto ETFs

Қазақша

Қазақша