May 5 - 9, 2025: Weekly economic update

Key market updates

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (m/m) (March): 0.1% (prev: 0.2%);

- Consumer Price Index (CPI) (m/m) (March): -0.1% (prev: 0.2%);

- Core Consumer Price Index (CPI) (y/y) (March): 2.8% (prev: 3.1%);

- Consumer Price Index (CPI) (y/y) (March): 2.4% (prev: 2.8%).

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (April): 6.5%, prev: 5.0%;

- 5-year expected inflation (April): 4.4%, prev: 4.1%.

GDP (Preliminary Estimate, BEA, Q1 2025 Annualized)

- Q1 2025: -0.3%

- Q4 2024 (revised): +2.4%

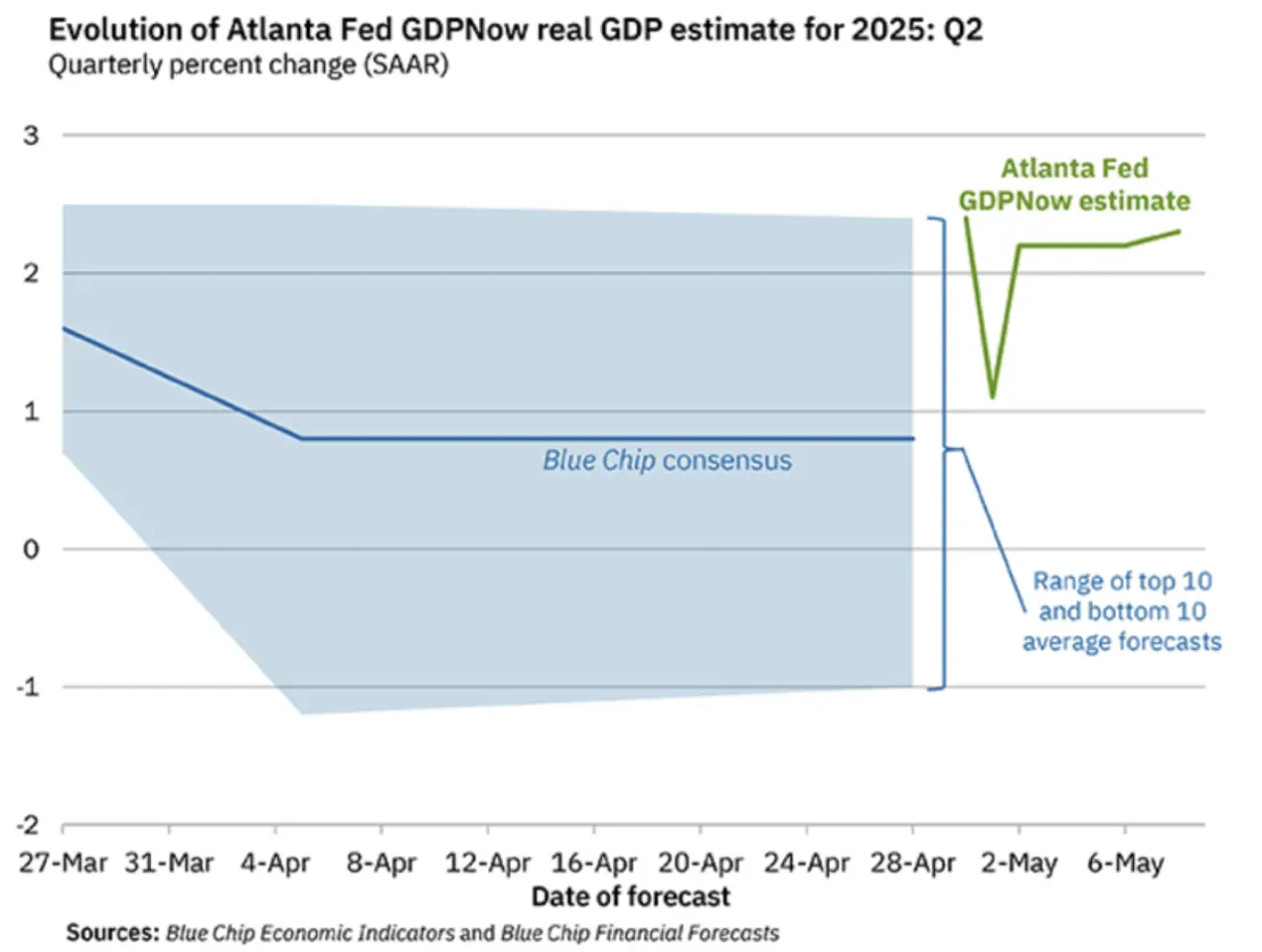

Atlanta Fed’s GDPNow estimate: 2.3% (vs -2.5%)

(The GDPNow forecasting model offers a "real-time" approximation of official GDP growth before its release, using methodology similar to that of the BEA.)

(The GDPNow forecasting model offers a "real-time" approximation of official GDP growth before its release, using methodology similar to that of the BEA.)

Business Activity Index (PMI, April)

- Services Sector (April): 50.8 (prev: 54.4)

- Manufacturing Sector (April): 50.7 (prev: 49.8)

- S&P Global Composite PMI (April): 50.6 (prev: 53.5)

LABOR MARKET:

- Unemployment Rate (April): 4.2% (unchanged)

- Nonfarm Payrolls (April): +177K (prior revised: +185K)

- Average Hourly Earnings (YoY, April): +3.8% (unchanged)

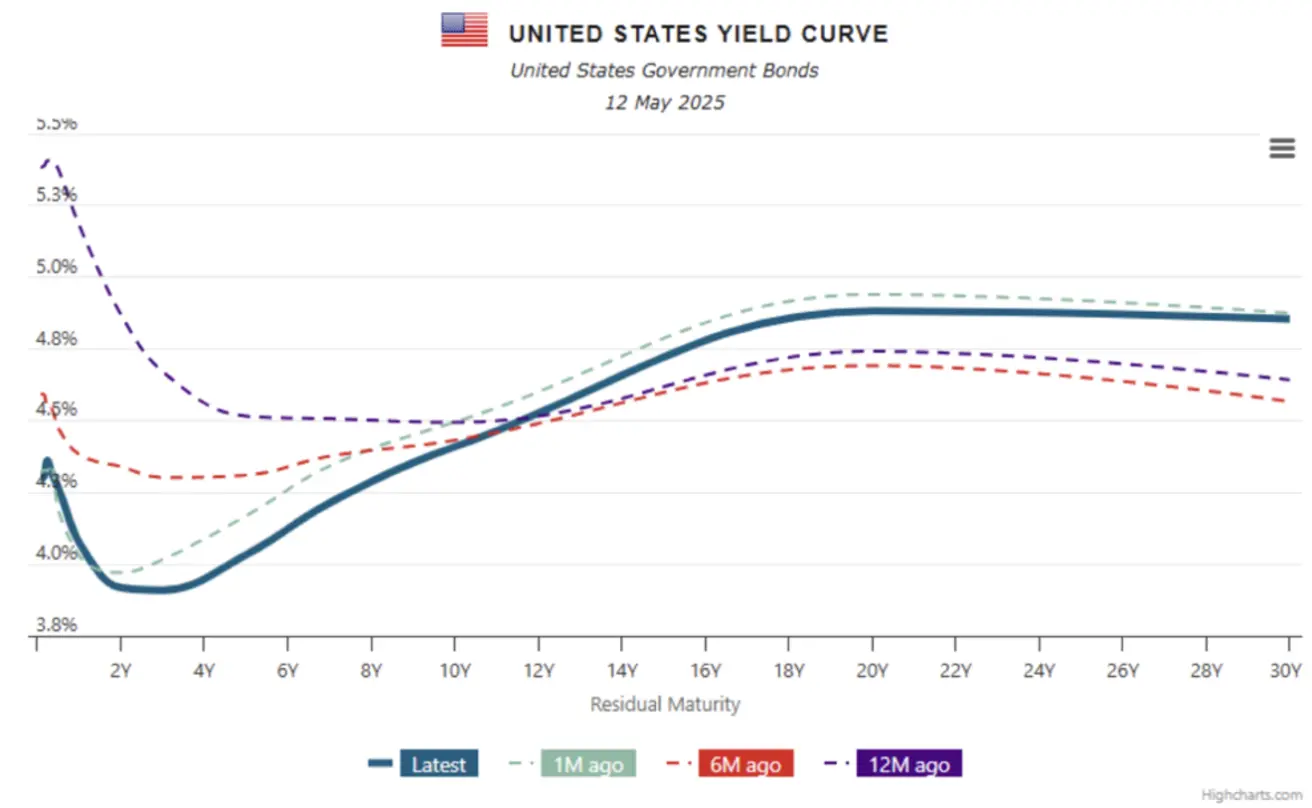

MONETARY POLICY

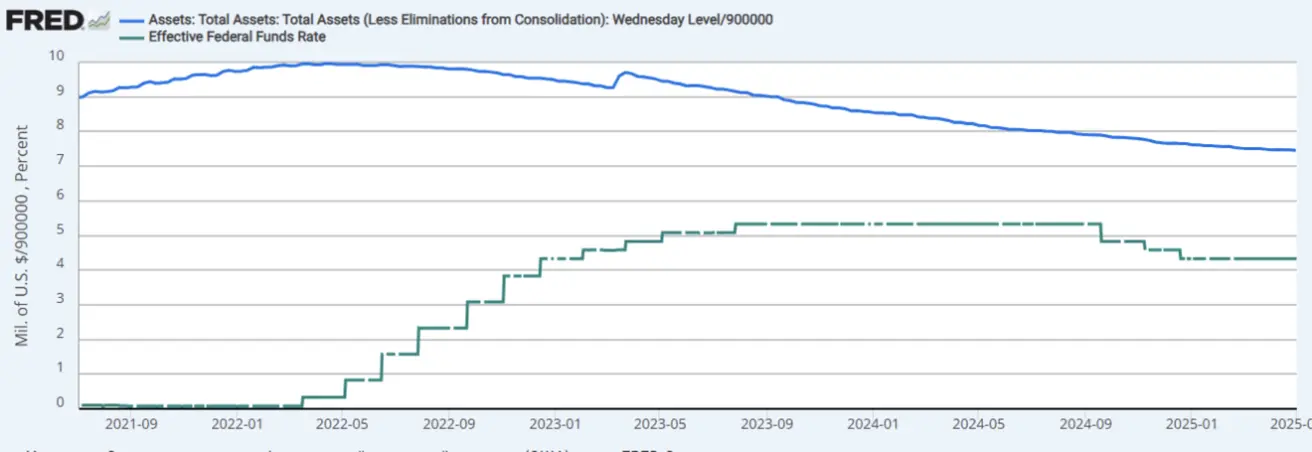

- Federal Funds Target Rate (EFFR): 4.25%–4.50% (unchanged)

- Fed Balance Sheet (blue line): increased by $10 billion to $6.710 trillion (vs $6.709 trillion last week)

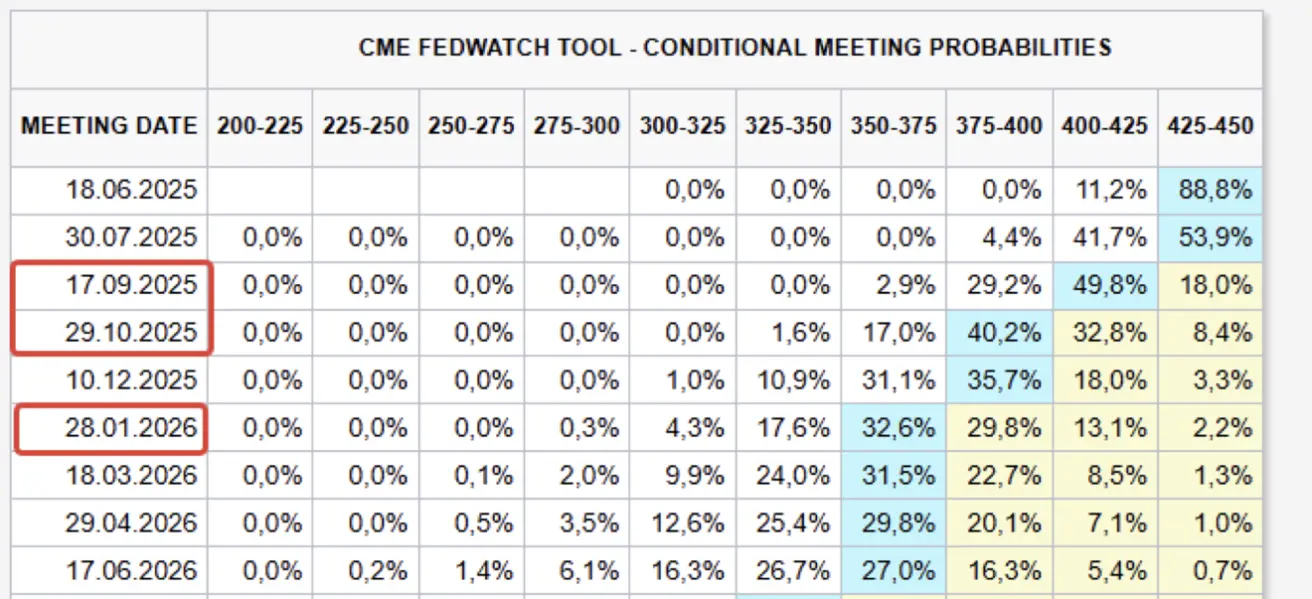

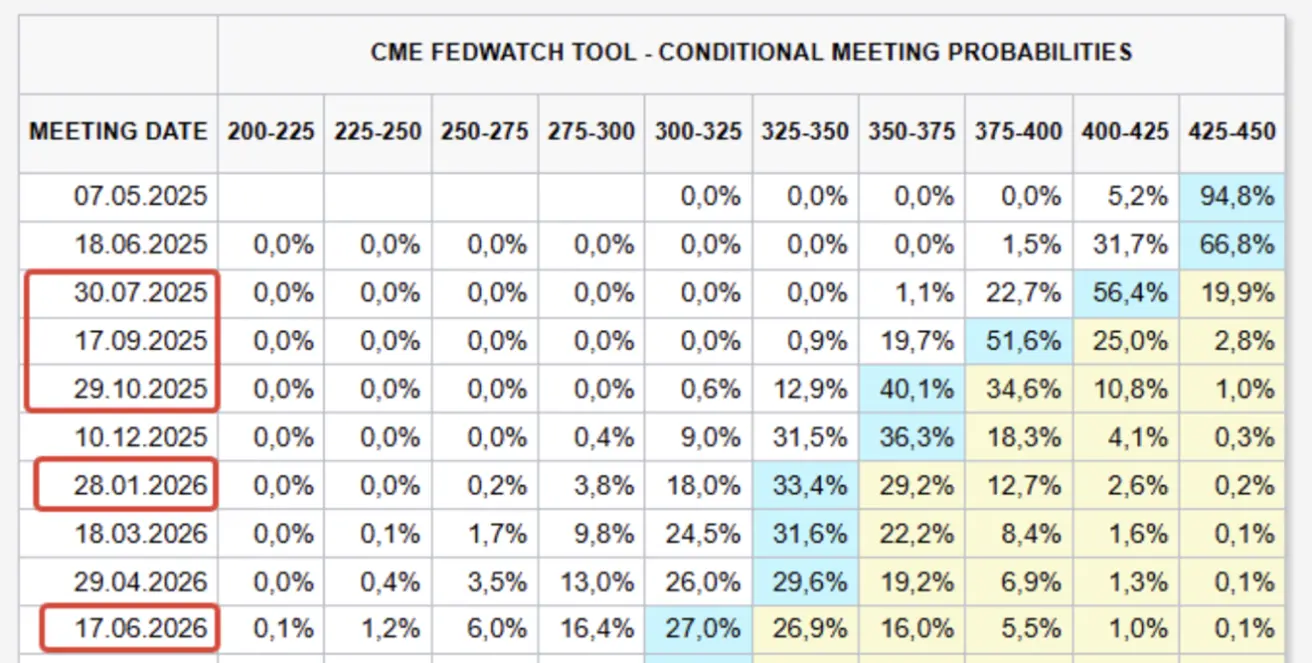

MARKET FORECAST FOR RATE

Today:

А week earlier:

Commentary The Atlanta Fed's GDPNow nowcast rebounded to +2.3% (vs -2.5%), signaling a return to positive momentum.

Fed Chair Jerome Powell stated during last week's press conference that the U.S. economy remains resilient despite the negative Q1 GDP figure. Current imbalances—such as a surge in imports—are temporarily distorting GDP measurement.

Key takeaways from the third Fed meeting:

- The Fed maintained the rate at 4.25–4.50% and continued the current pace of QT.

- The inflation impact may be temporary or more persistent, particularly if the recently imposed substantial tariffs remain in effect.

- The core uncertainty lies in when and how tariff policy will be resolved—and what its implications will be for growth, employment, and the broader economy. Powell's rhetoric reflected a wait-and-see approach.

Markets responded positively to U.S.–China negotiations held in Switzerland on Sunday. The Trump administration declared a breakthrough trade deal; however, no figures or details have been officially disclosed so far. The People's Bank of China reduced the reserve requirement ratio from 9.50% to 9.00%. This banking multiplier adjustment allows banks to increase lending capacity and boost economic stimulus—especially important amid ongoing deflation (YoY CPI in April: -0.1%).

The EU is preparing to impose €100 billion in tariffs on U.S. goods if talks break down.

Market expectations via FedWatch deteriorated: now pricing in three 25 bps rate cuts to a target range of 3.50–3.75% over the next 12 months. The next FOMC meeting is scheduled for June 18, with markets anticipating no change in the current rate range.

Equity Markets

The market exhibited moderate Risk-On sentiment. Median sector performance: +0.17%. Only defensive sectors (utilities, consumer defensive, real estate, and healthcare) posted negative returns.

Year-to-Date (YTD):

Median performance: -7.13%:

MARKET

SP500

Weekly performance: -0.47% (closing at 5659.9), 2025 performance: -4.12%

NASDAQ100

Weekly performance: -0.20% (closing at 20,061.45), 2025 performance: +5.01%

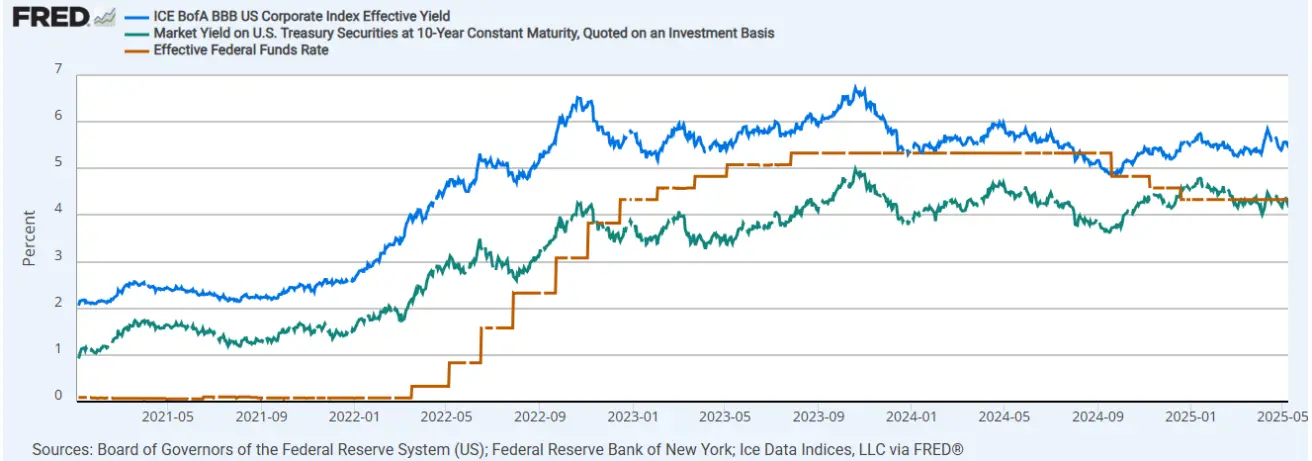

BOND MARKET

A slight uptick in yields across U.S. Treasury and corporate bonds.

iShares 20+ Year Treasury Bond ETF (TLT):

- Weekly: -0.78% (closed at $87.05)

- 2025 YTD: -0.85%

YIELDS AND SPREADS 2025/05/12 vs 2025/05/05

- 10-Year Treasury Yield: 4.409% (vs 4.316%)

- ICE BofA BBB U.S. Corporate Index Yield: 5.58% (vs 5.49%)

Yield Spreads:

- 10Y–2Y Spread: 49.1 bps (vs 49.2 bps)

- 10Y–3M Spread: 0.47 bps (vs 0.40 bps)

GOLD FUTURES (GC)

Weekly: +2.52% (closed at $3,329.1/oz)

YTD: +26.05%

Today: -1.71%

DOLLAR INDEX FUTURES (DX)

Weekly: +0.39% (closed at 100.255)

YTD: -7.45%

De-escalation of geopolitical tensions (e.g., India–Pakistan truce) and optimism around U.S.–China trade negotiations are lowering demand for safe-haven assets.

De-escalation of geopolitical tensions (e.g., India–Pakistan truce) and optimism around U.S.–China trade negotiations are lowering demand for safe-haven assets.

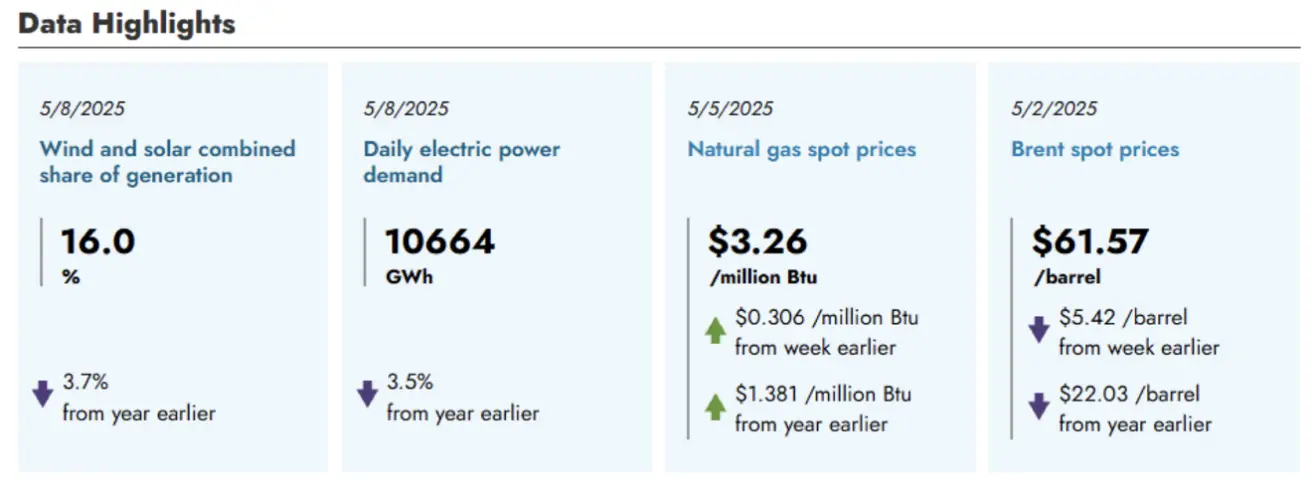

OIL FUTURES

Weekly: +4.59% (closed at $61.06/barrel)

YTD: -15.02%

Today’s open: +2.42%

Short-Term Energy Outlook (U.S. Energy Information Administration):

Key Points:

Key Points:

- U.S. Real GDP revised downward: +1.5% in 2025 (vs +2.0% in April), +1.6% in 2026 (vs +2.0%).

- Crude Oil: Global inventories expected to rise due to production outpacing demand (+1.0 million bpd annually); Brent forecast: $62/barrel (2H25), $59/barrel (2026).

- Liquids Production: Expected to grow by 1.3–1.4 million bpd in 2025–2026, mostly from non-OPEC+ countries.

- Natural Gas (Henry Hub): Fell to $3.44/MMBtu in April; prices expected to rise amid increased LNG exports and seasonal electricity sector demand.

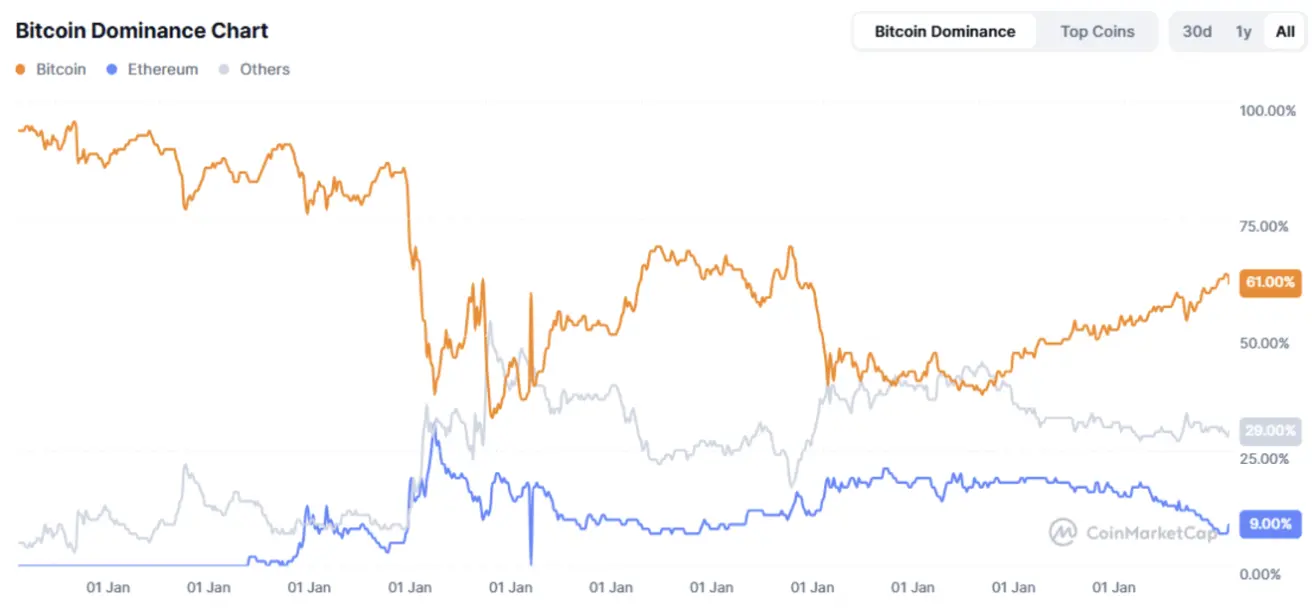

BTC FUTURES

Weekly: +6.10% (closed at $103,640)

YTD: +8.79%

ETH FUTURES

Weekly: +26.24% (closed at $2,350)

YTD: -30.56%

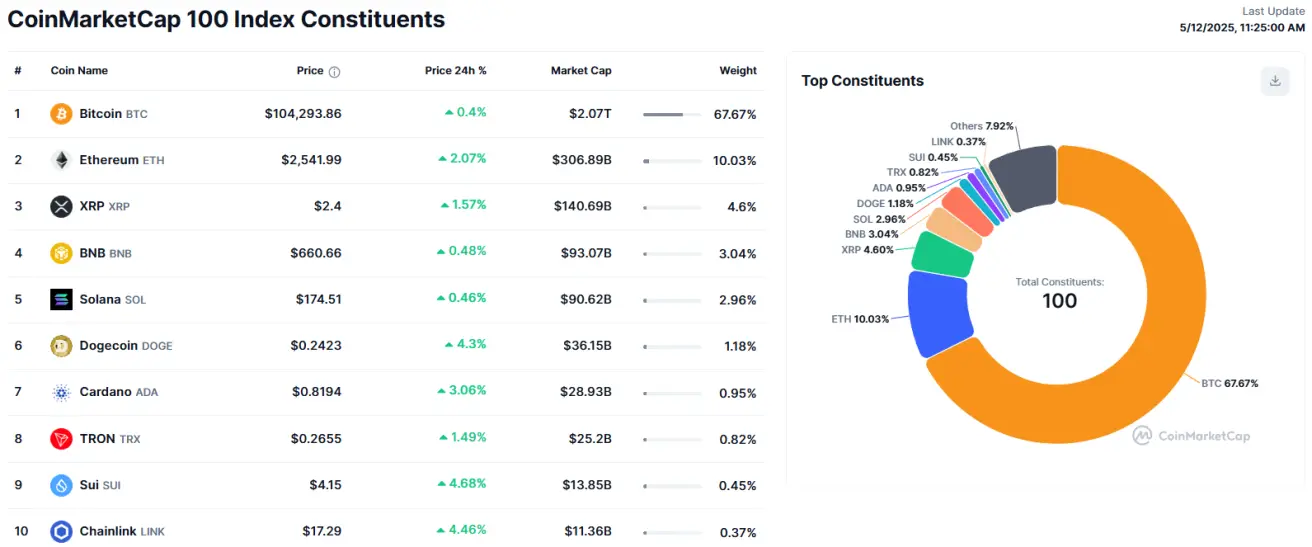

Total Market Capitalization: $3.35 trillion (vs $2.98 trillion previous week)

- Bitcoin dominance: 61.8% (vs 63.7%)

- Ethereum: 9.2% (vs 7.7%)

- Other: 29.1% (vs 28.9%)

Positive news:

- VanEck files for BNB ETF.

- SEC delays decision on spot Litecoin ETF (Canary).

- U.K. Treasury rules out creating a national Bitcoin reserve, citing market inappropriateness.

- ECB launches innovation hub with 70 participants to test the digital euro pilot.

- SEC and Ripple reach settlement: Ripple pays $50 million (vs initial $125 million fine); both waive appeals if injunction is lifted.

Қазақша

Қазақша