November 4 — November 8: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.2%),

- Consumer Price Index (CPI) (YoY) (Sept): 2.4%, (pre: 2.5%).

THE FED'S INFLATION TARGET

- Core Personal Consumption Expenditures (PCE) Index (YoY) (September): 2.7% (previous: 2.7%);

- Personal Consumption Expenditures Index (YoY) (September): 2.1%, (previous: 2.3%);

- Disposable Personal Income (DPI) (September 2024): +0.3%;

- Personal Consumption Expenditures (sum of personal consumer expenditures (PCE)) (September 2024): +0.5%;

- Personal Savings (as a percentage of disposable personal income): +4.6%.

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (Sept): 2.7%, pre: 2.7%;

- 5-year expected inflation (Sept): 3.1% pre: 3.0%.

BEA GDP (U.S. Bureau of Economic Analysis): (q/q) (3Q.) (preliminary estimate): 2.8%, (prev: 3.0%), GDP Deflator (q/q) (3Q.): 1.8% (prev: 2.5%). Atlanta Fed GDP short-term forecast: up to 2.5%.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (October): 55.0 (pre: 52.5).

- Manufacturing sector (October): 46.5 (pre: 47.2, revised).

- S&P Global Composite (September): (October): 54.1 (pre: 54.0, revised).

LABOR MARKET

- Unemployment rate (August): 4.1% (previous: 4.1%);

- Change in employment in the private non-farm sector (October): -28K, (previous 192K revised);

- Average hourly earnings (August, YoY): 4.0% (previous: 3.9%).

MONETARY POLICY

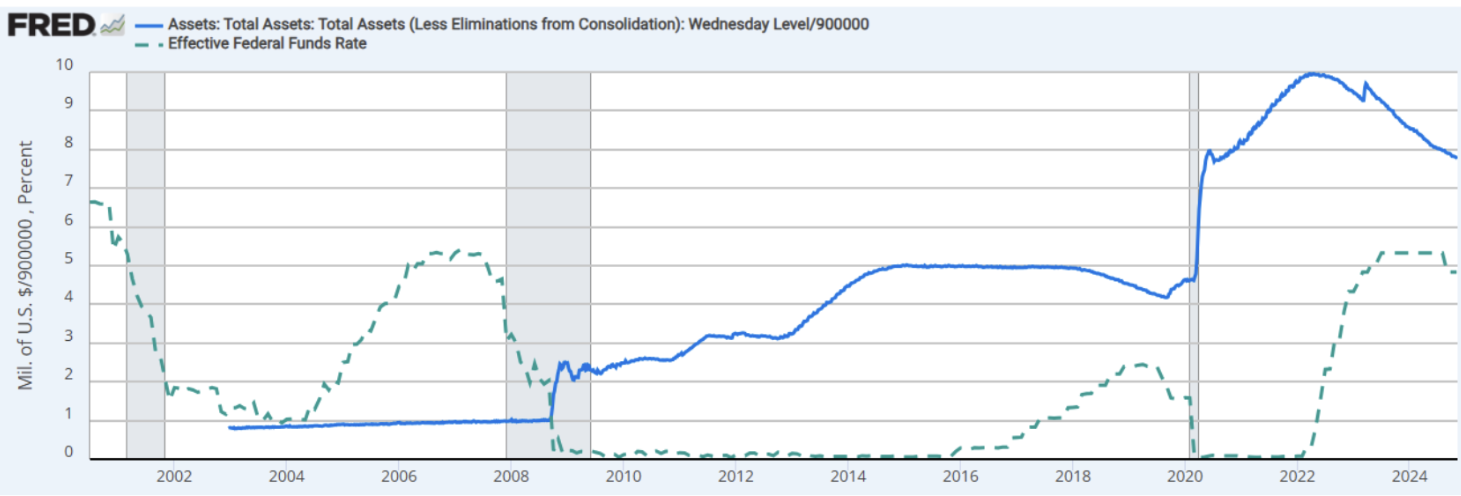

- Federal Funds Rate (EFFR): 4.50% – 4.75% (in red);

- Fed Balance Sheet (in blue): $6.994 trillion (vs previous week: $7.013 trillion).

MARKET FORECAST FOR RATE

Today:

A week earlier:

Commentary:

The Fed cut rates by 0.25% to a range of 4.50-4.75%.

Summary of the FOMC meeting:

At the press conference, Powell expressed confidence that inflation would continue to decline towards two percent, but emphasized that all further actions would depend on incoming macroeconomic data. The committee will be ready to either accelerate or slow the pace of rate cuts as needed. A new factor was introduced – the Fed will now consider the fiscal policy of the new administration.

Powell’s rhetoric did not change significantly compared to the previous meeting, but it is worth noting that the phrase "the committee confidently sees further gradual inflation decline" was removed from the FOMC press release.

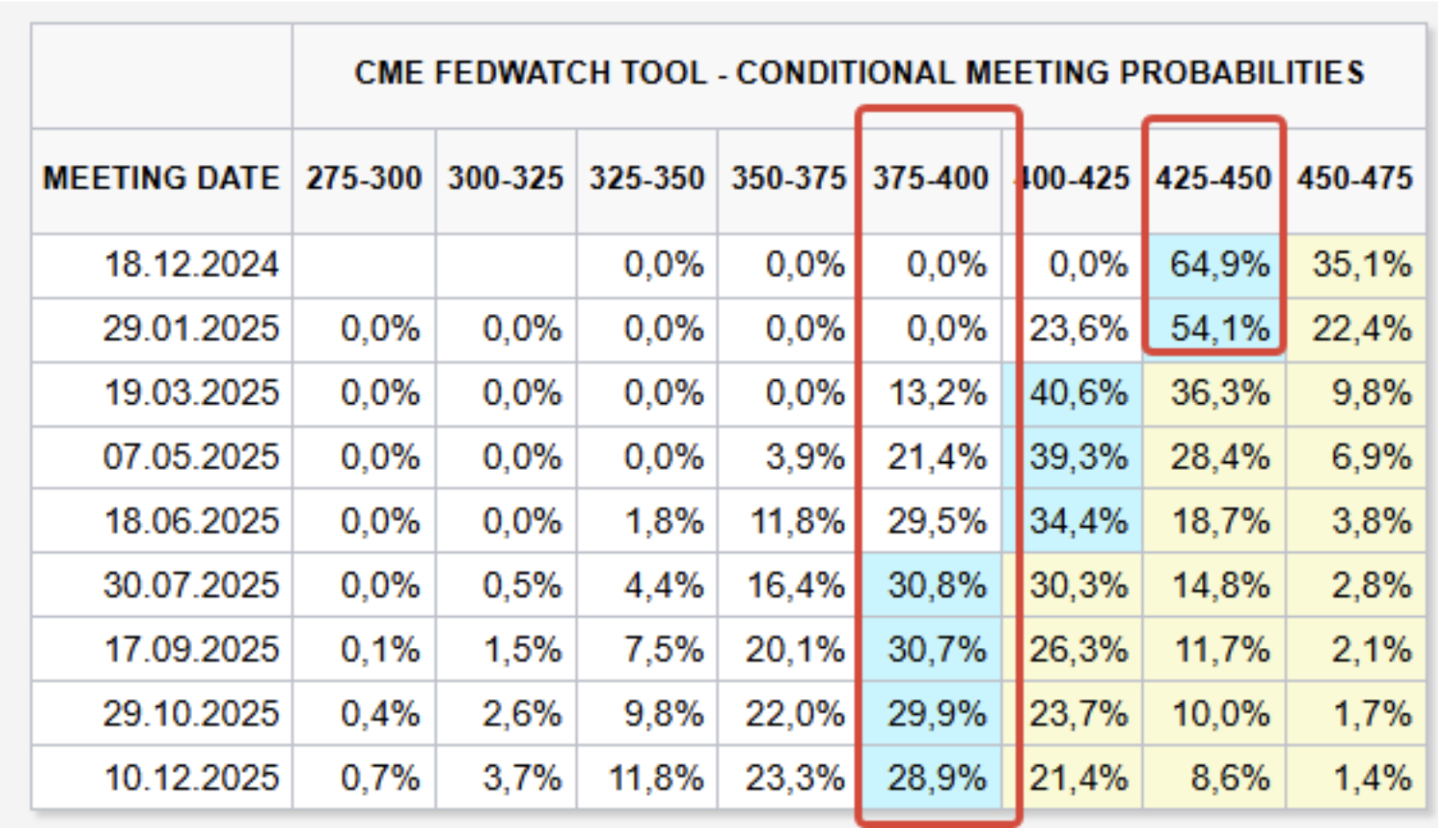

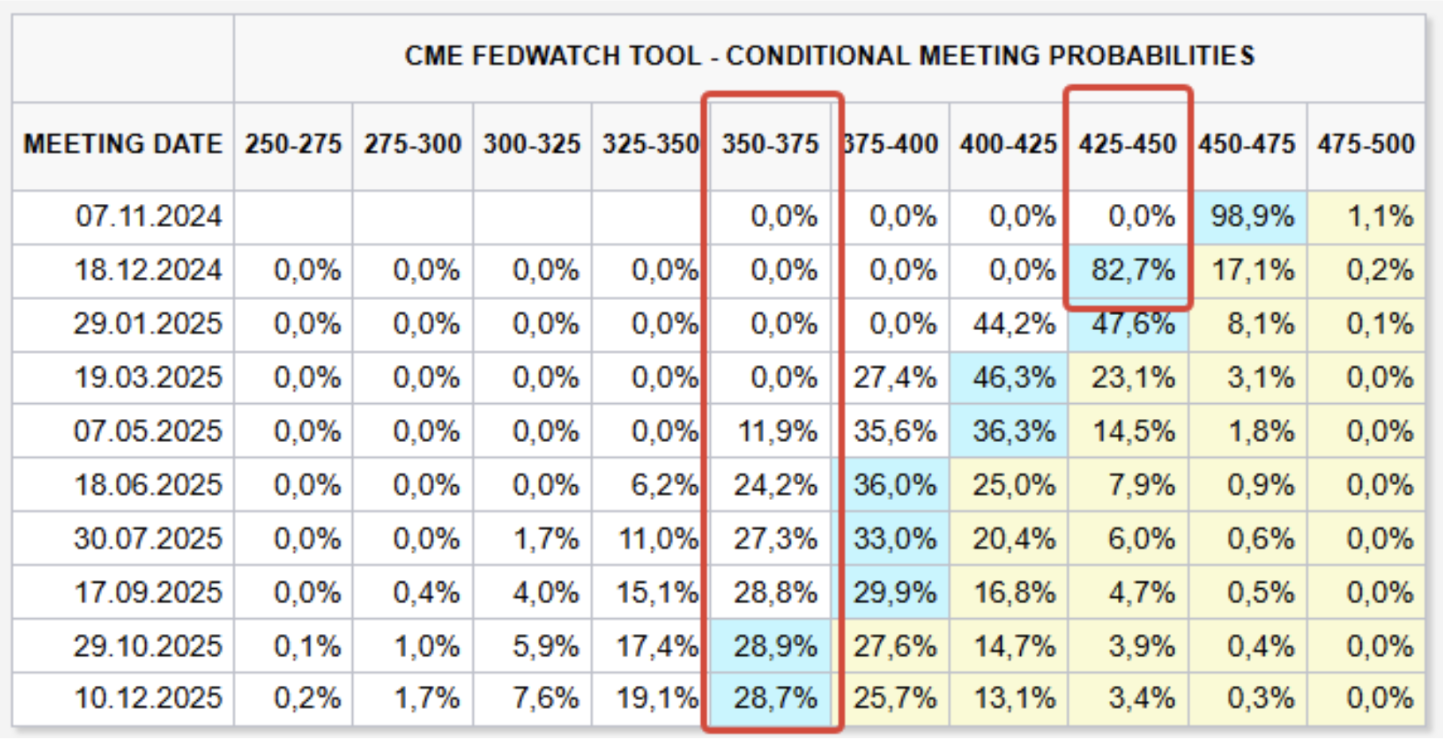

FedWatch expectations for the end of the year: one more rate cut to a range of 4.25%-4.50%. Long-term expectations: only two 0.25% cuts to a range of 3.75-4.00%.

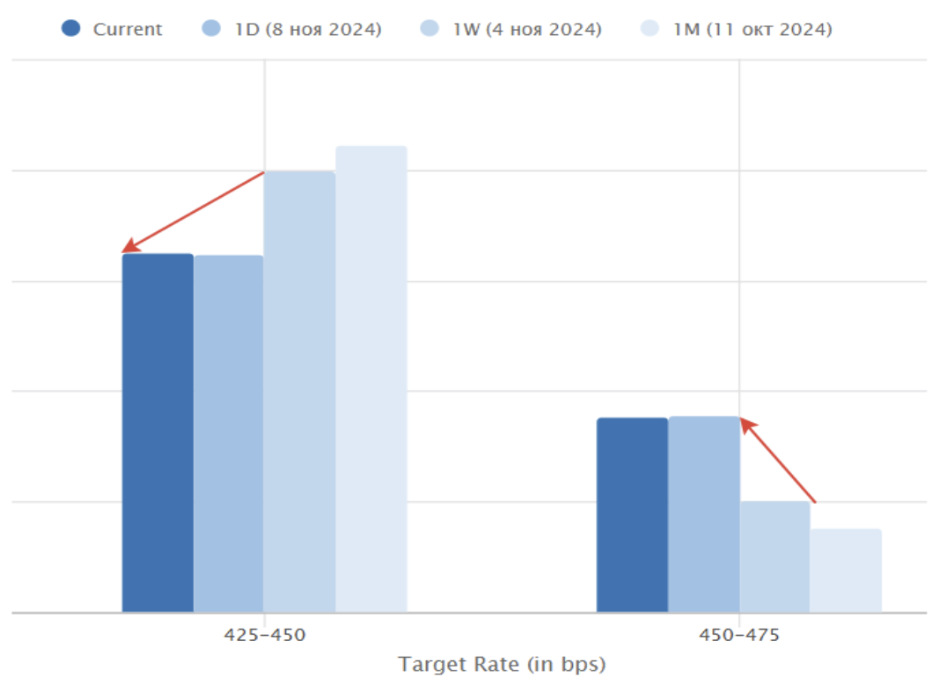

The next FOMC meeting will be held on December 17-18. Over the past week, rate cut expectations for the next meeting have dropped from 82% to 65%. The market views the Republican policy course as inflationary.

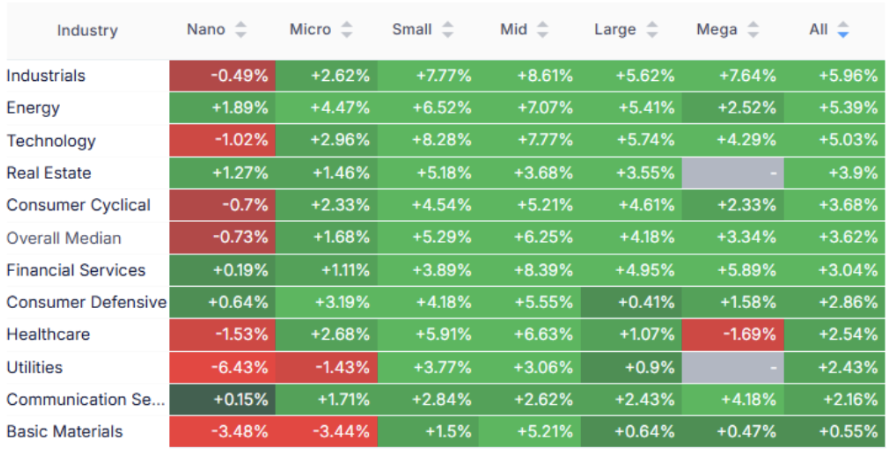

Trump’s victory triggered a "Risk On" in the markets. The median growth was 3.62%, with industrial, energy, and technology sectors leading.

MARKET

MARKET CAP PERFORMANCE

The stock market:

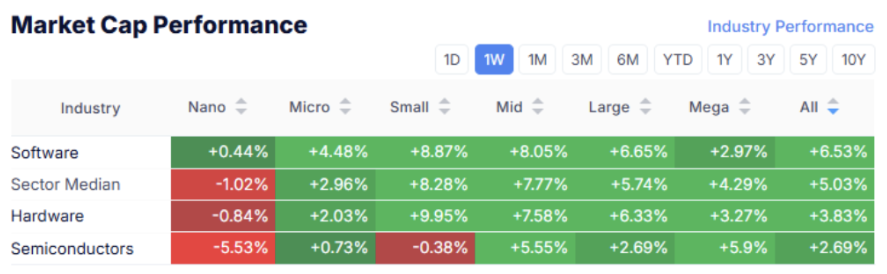

Technology market

SP500

S&P 500 Index: +4.74%

NASDAQ100

Nasdaq100: +5.57%

TREASURY MARKET

Treasury Bonds UST10:

Treasury Bonds UST2:

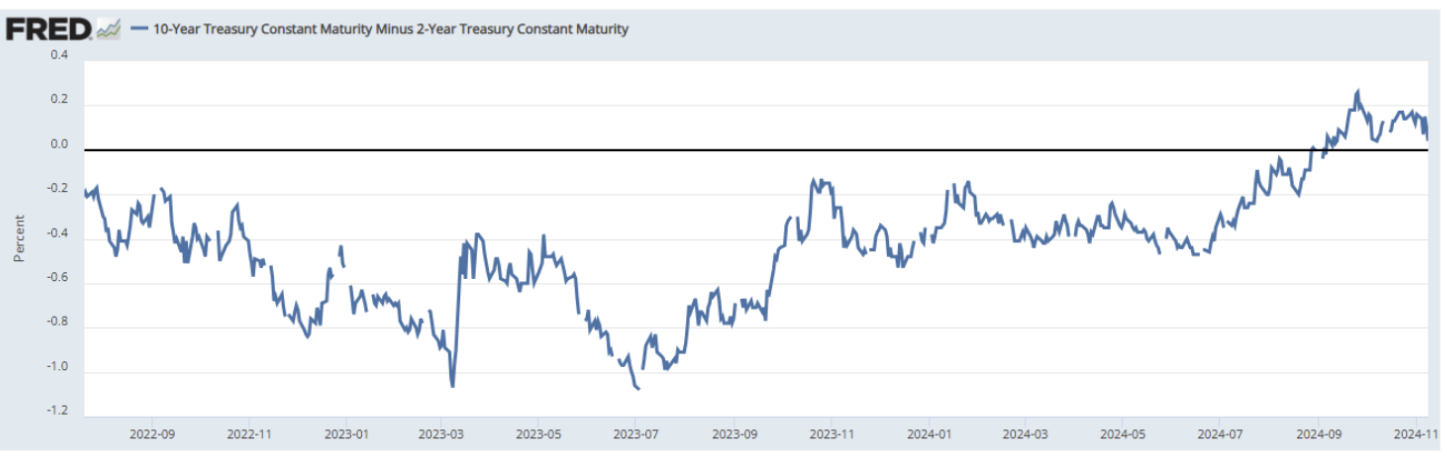

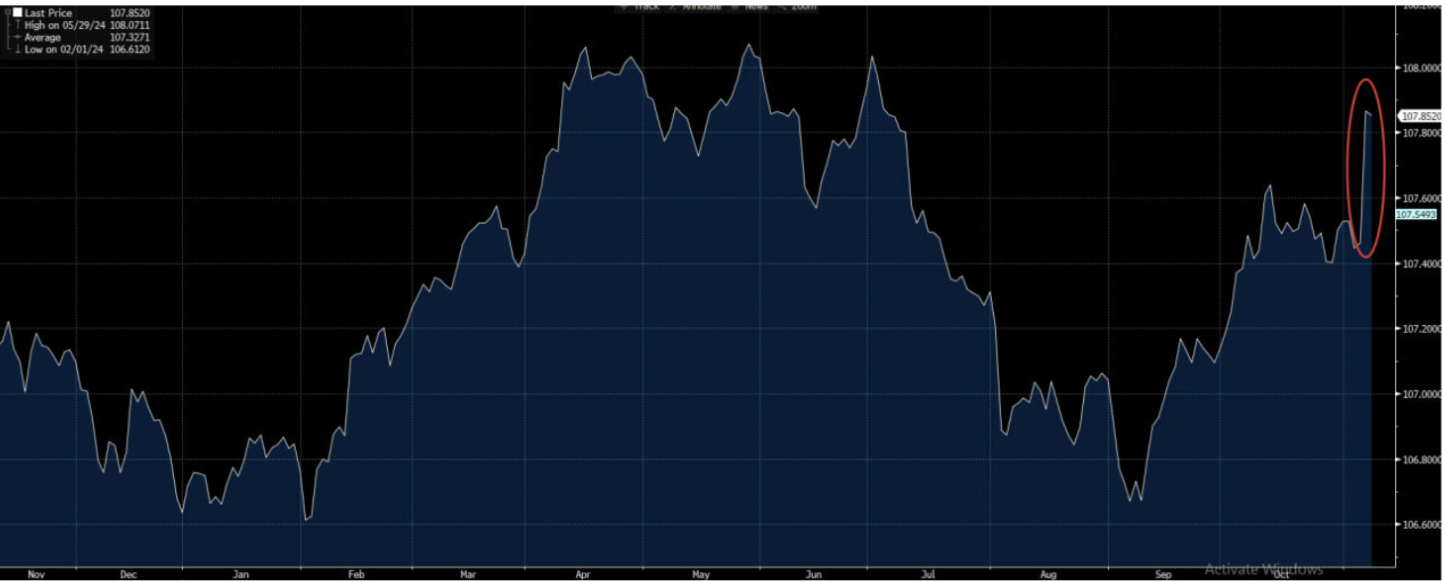

Treasury bonds continued to decline last week. 10-year yields fell by 0.20%, and 2-year yields dropped by -0.22%. The probability of a slower pace of monetary easing is increasing.

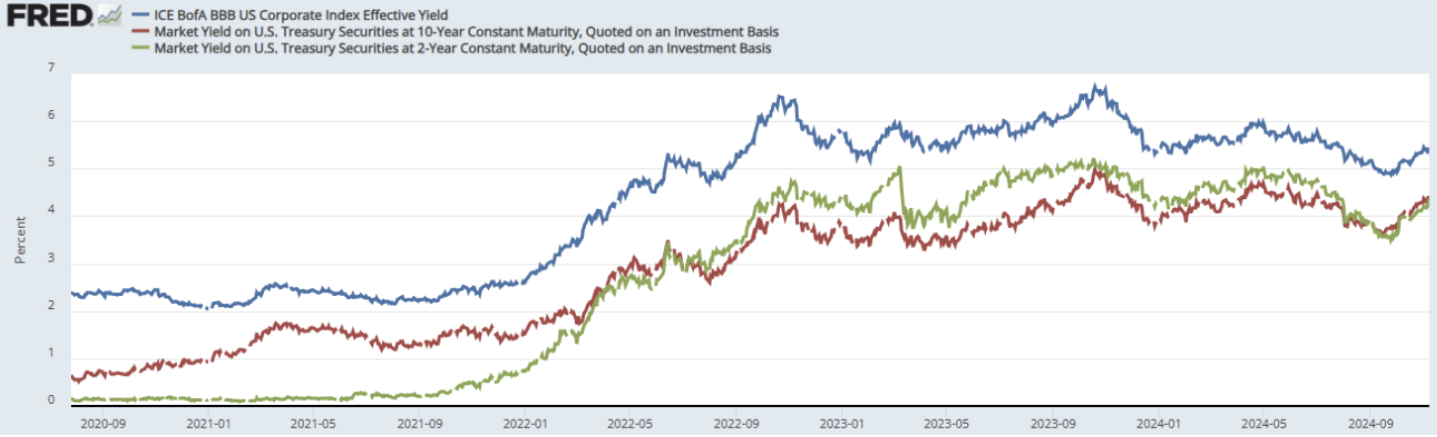

Yields and Spreads

- 10-year Treasuries: 4.31% (last week: 4.28%);

- 2-year Treasuries: 4.21% (last week: 4.16%);

- Corporate BBB-rated index: 5.33% (last week 5.38%).

10-Year Treasury minus 2-Year Treasury = 0.04%.

GOLD

-2.62%: correction amid dollar growth

DOLLAR FUTURES (DX)

+1.3%. Dollar growth triggers:

- Plans to return production to the U.S. and reduce import dependency;

- Expectations that the Fed will need to keep rates higher.

BTC

Bitcoin Futures hit an all-time high, rising to $81,910 (up 18.58% for the week).

ETH

Ethereum Futures broke out of a three-month range, rising to $3,170 (+ 27.47% for the week).

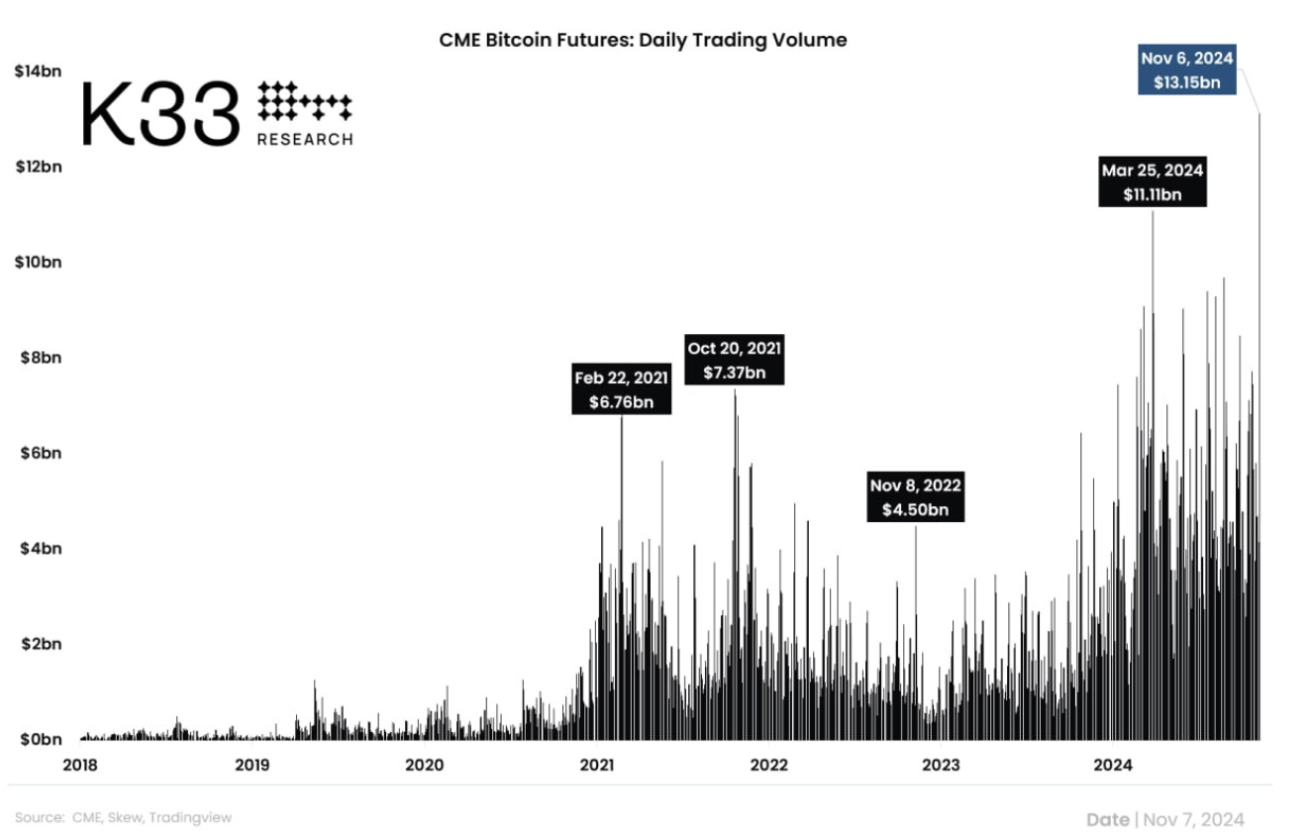

Last week, BTC futures trading volume on CME reached an all-time high of $13.15 billion. Republicans now control the Senate and Congress, and most of them support cryptocurrencies.

Senator Cynthia Lummis proposed a bill to create a strategic bitcoin reserve: the U.S. should buy 1 million BTC over 5 years – a strong factor for further growth.

MARKET OUTLOOK

Economic uncertainty in the markets will increase, awaiting Trump’s real actions (intensification of protectionism and trade isolation).

Campaign Rhetoric:

- Introduce a base tariff of 10% on all imported goods, and up to 60% on Chinese goods;

- Impose 100% tariffs on cars produced outside the U.S.;

- Return production to the U.S. and reduce import dependency;

- Reduce taxes for manufacturers investing in the U.S. economy;

- Increase fossil fuel production, including oil, gas, and coal, aiming for U.S. energy independence. Remove restrictions on oil and gas production on federal lands and offshore, and reduce environmental regulations.

The issue of the Fed’s independence is being raised. During Trump’s previous term (2017-2021), he pressured the Fed to maintain easy monetary policy, even as the Fed raised rates.

At the press conference, Powell said he would not leave office until the end of his term, even if Trump insists on his early dismissal (by law, the president cannot fire the Fed chair).

The main market narrative is the real risk of a sharp rise in inflation under Trump’s presidency, which could eventually shift the Fed’s course towards lowering rates.

Long-term inflation expectations – a sharp increase over the last election week.

Stock Market Prospects: briefly – positive may persist in the medium term. However, if signs of inflation appear in the macro statistics, we will hear a tightening of the Fed's rhetoric, which will put pressure on stock and bond markets.

For the first time since early 2019, hedge funds have gone net long on the VIX volatility index, indicating increased protection against a stock market correction.

Қазақша

Қазақша