October 28 — November 2: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.2%),

- Consumer Price Index (CPI) (YoY) (Sept): 2.4%, (pre: 2.5%).

THE FED'S INFLATION TARGET

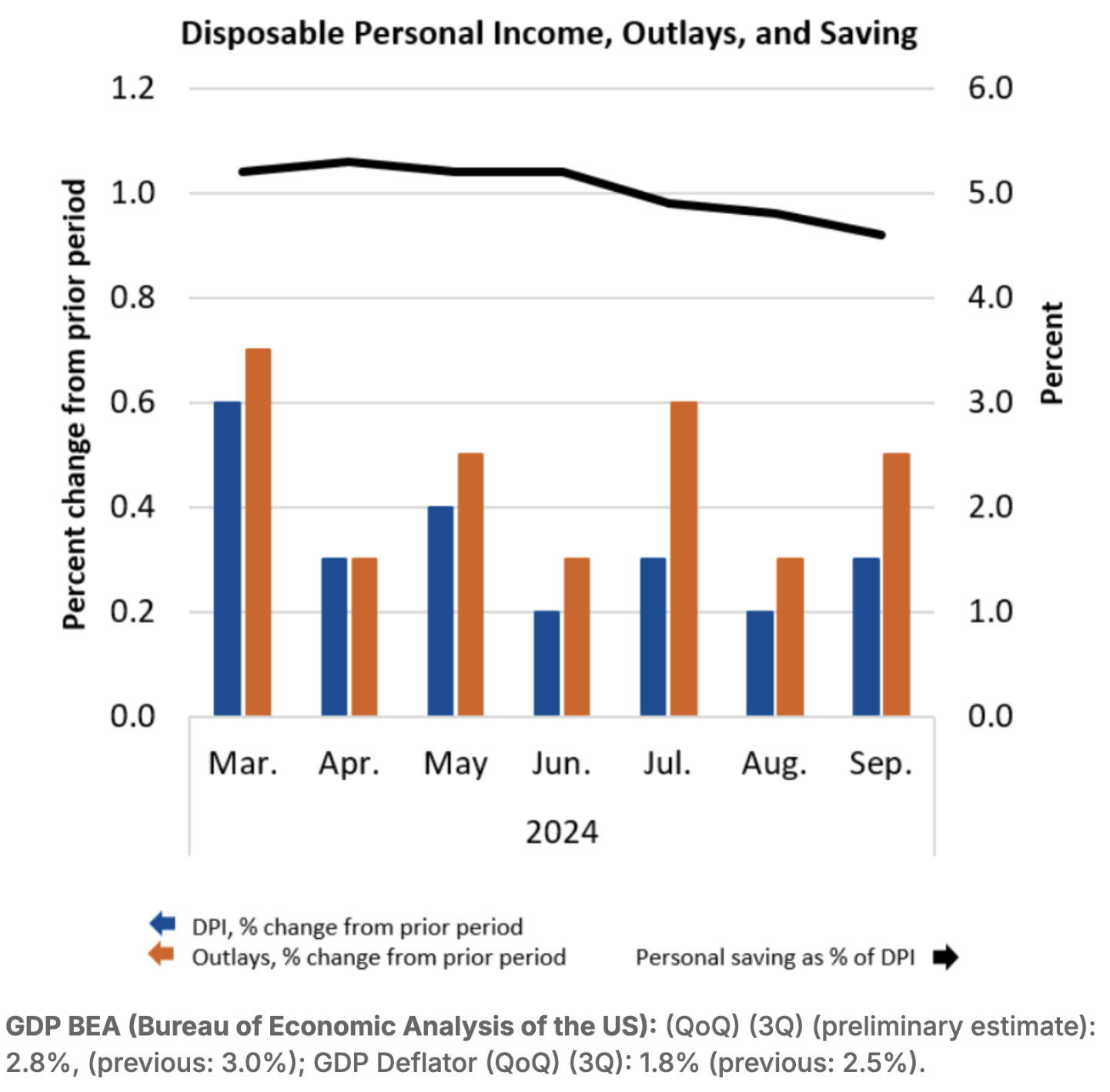

- Core Personal Consumption Expenditures (PCE) Index (YoY) (September): 2.7% (previous: 2.7%);

- Personal Consumption Expenditures Index (YoY) (September): 2.1%, (previous: 2.3%);

- Disposable Personal Income (DPI) (September 2024): +0.3%;

- Personal Consumption Expenditures (sum of personal consumer expenditures (PCE)) (September 2024): +0.5%;

- Personal Savings (as a percentage of disposable personal income): +4.6%.

INFLATION EXPECTATIONS (MICHIGAN)

- 12-month expected inflation (Sept): 2.7%, pre: 2.7%;

- 5-year expected inflation (Sept): 3.0% pre: 3.1%.

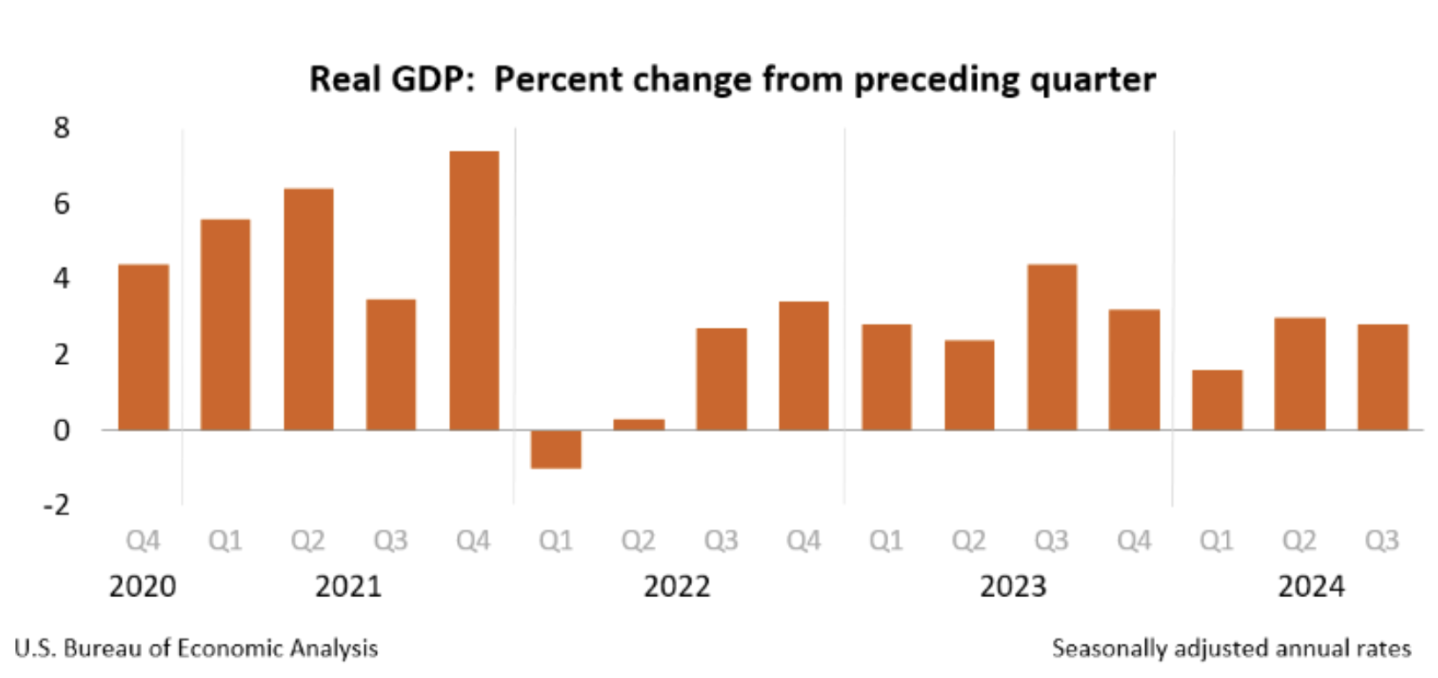

GDP BEA (Bureau of Economic Analysis of the US): (QoQ) (3Q) (preliminary estimate): 2.8%, (previous: 3.0%); GDP Deflator (QoQ) (3Q): 1.8% (previous: 2.5%).

GDP (Bank of Atlanta): downgraded short-term forecast to 2.3%.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (October): 55.3 (pre: 52.5).

- Manufacturing sector (October): 46.5 (pre: 47.2, revised).

- S&P Global Composite (September): (October): 54.3 (pre: 54.0, revised).

LABOR MARKET

- Unemployment rate (August): 4.1% (previous: 4.1%);

- Change in employment in the private non-farm sector (October): -28K, (previous 192K revised);

- Average hourly earnings (August, YoY): 4.0% (previous: 3.9%).

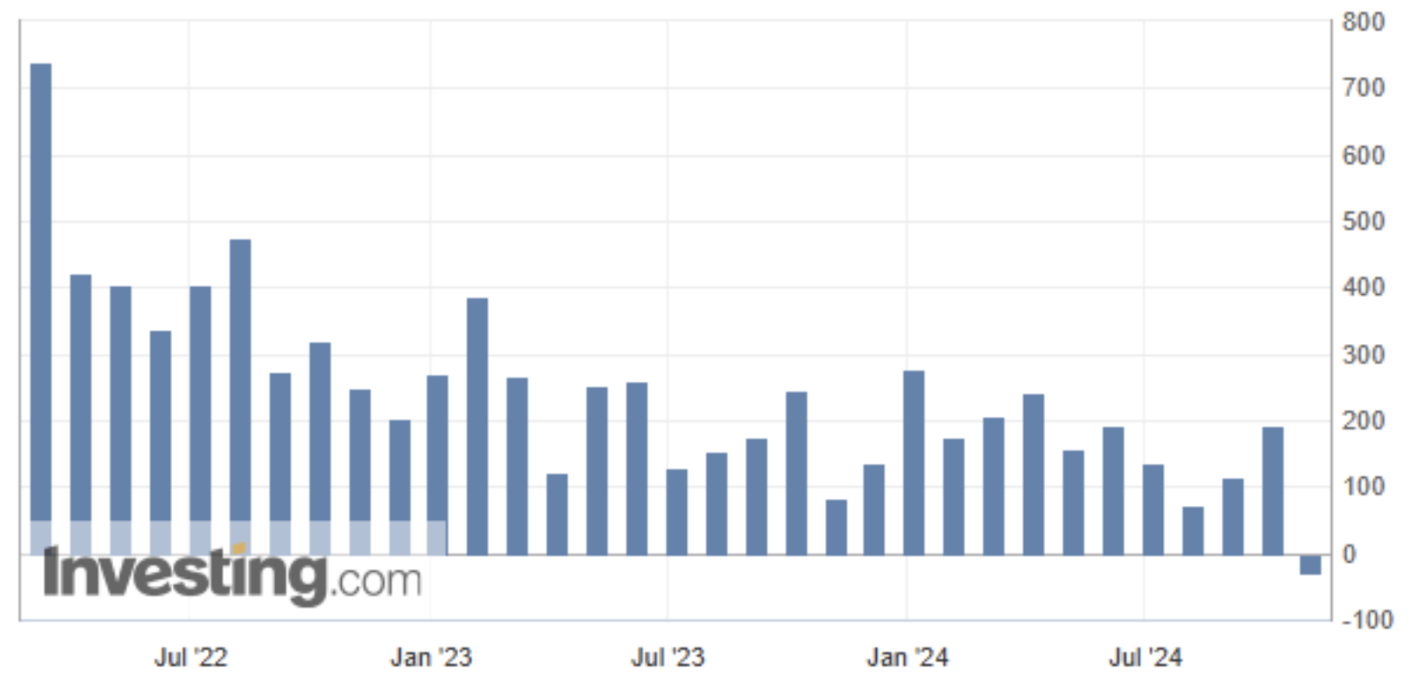

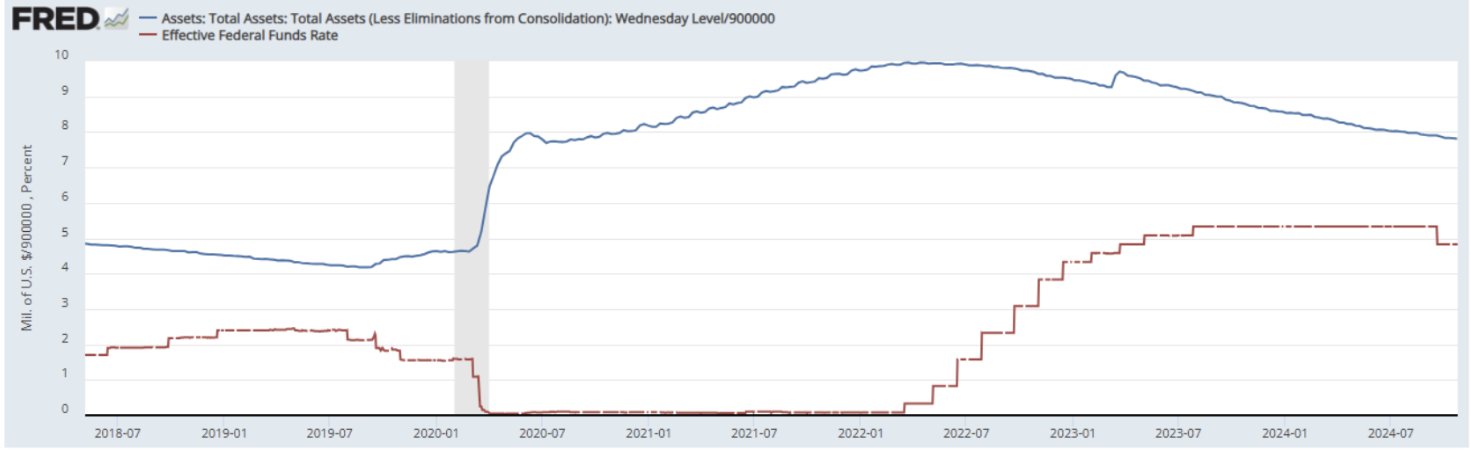

MONETARY POLICY

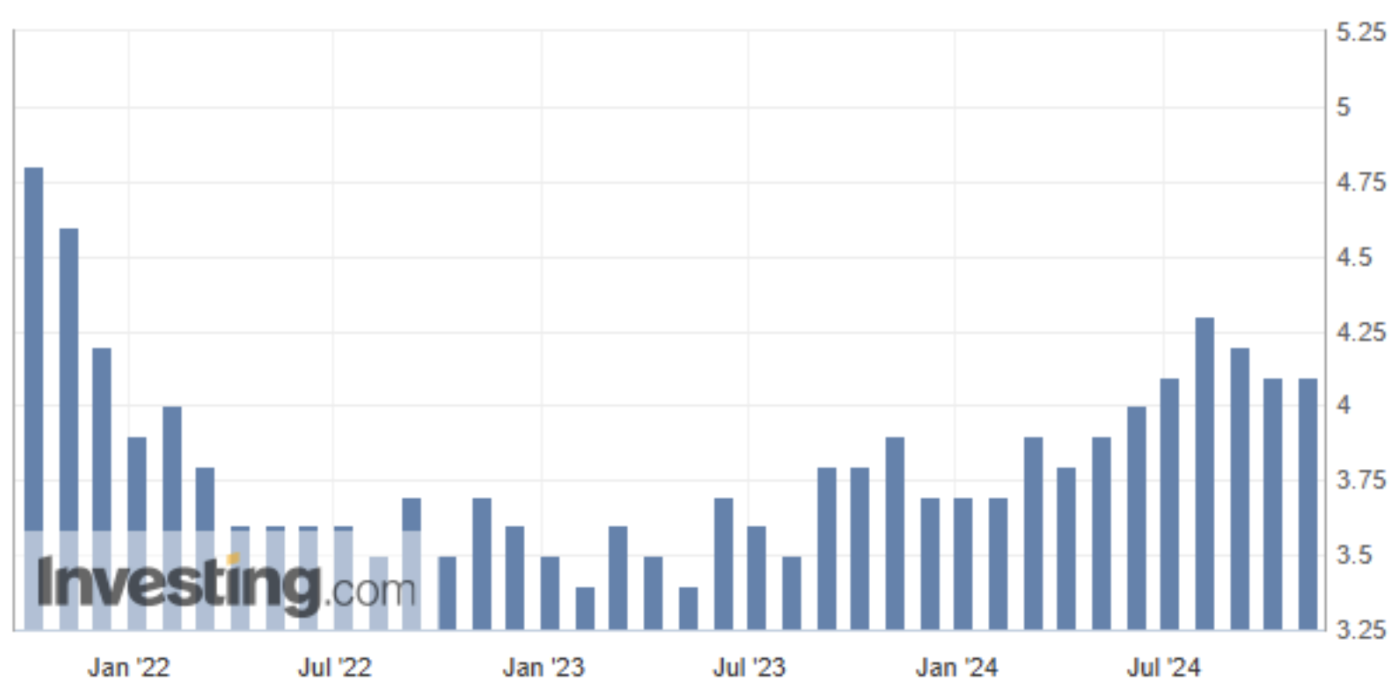

- Federal Funds Rate (EFFR): 4.75% – 5.00% (in red);

- Fed Balance Sheet (in blue): $7.013 trillion (vs last week: $7.029 trillion).

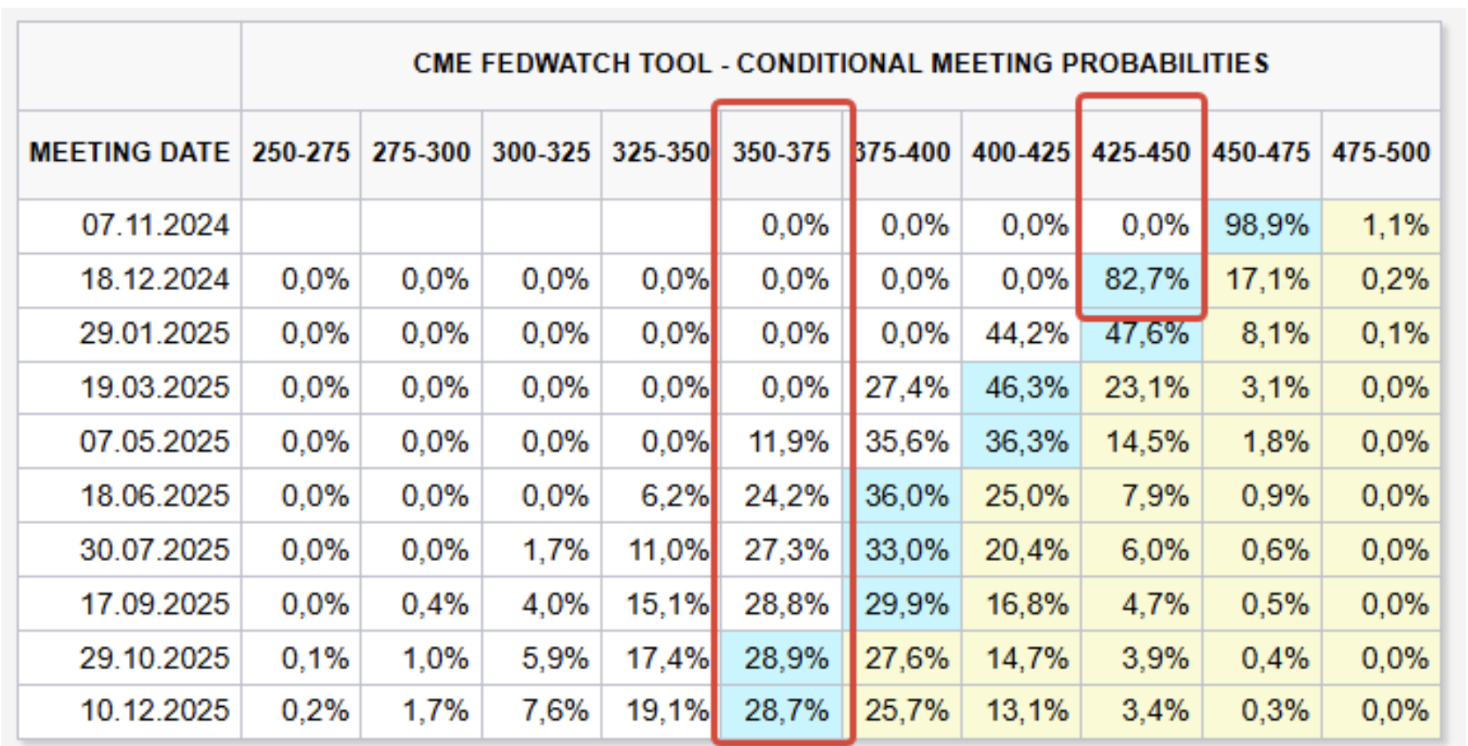

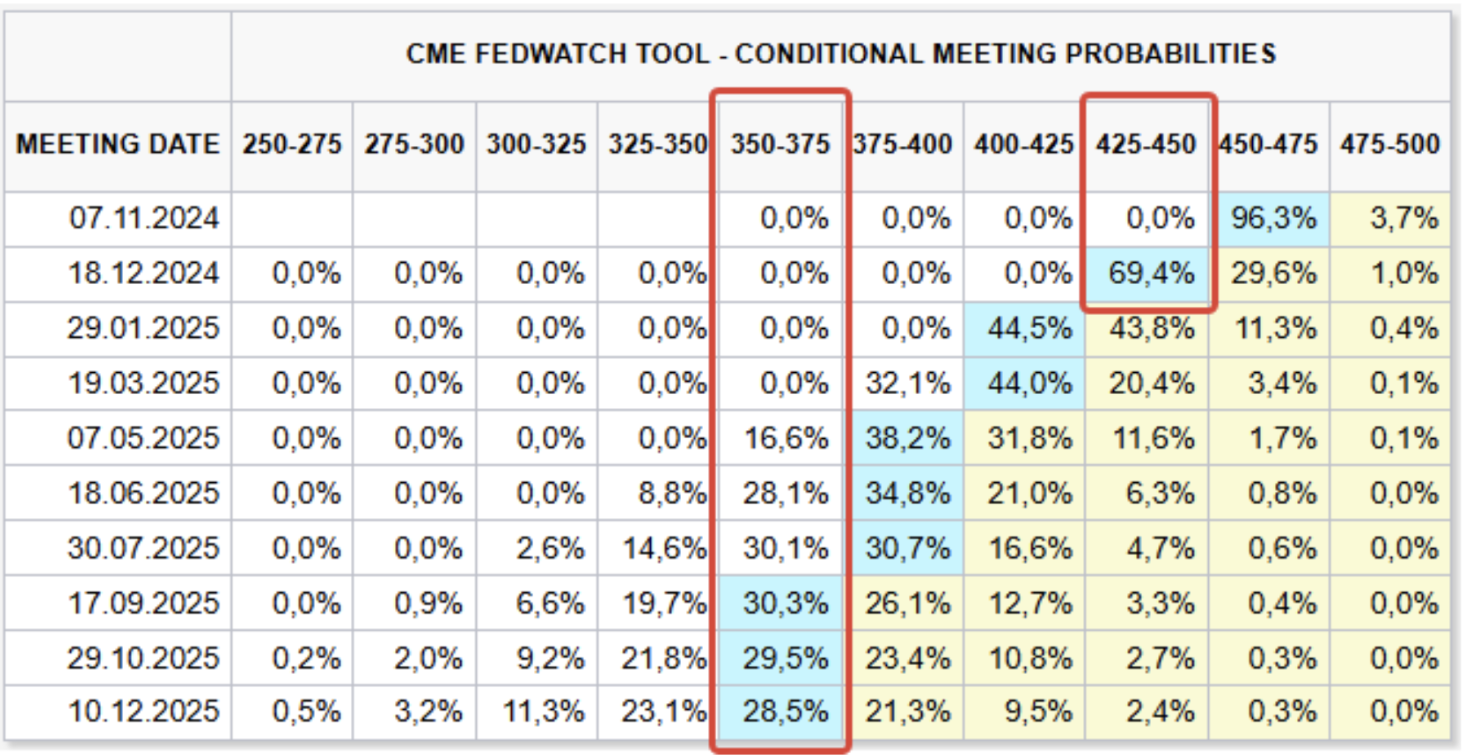

MARKET FORECAST FOR RATE

Today:

A week earlier:

Commentary

According to the "preliminary" estimate, real Gross Domestic Product (GDP) increased by an annualized rate of 2.8% in the third quarter of 2024. The primary contributors were consumer spending, exports, and government spending.

The unemployment rate remained unchanged at 4.1%, with the number of unemployed standing at 7.0 million people. These figures are higher than a year ago when the unemployment rate was 3.8%, with 6.4 million unemployed.

The October employment report showed that wages grew faster than expected. Employment continued to grow in healthcare and government sectors. Employment in manufacturing declined due to strike activity. Employment in the private non-farm sector decreased by 28,000 people. The U.S. Bureau of Labor Statistics stated that "it is likely that hurricanes Helen and Milton impacted employment estimates in certain industries."

Despite mixed labor market data, elevated personal consumer expenditures and continued wage growth point to increasing inflationary pressures. Overall, last week's macroeconomic data weighed on stock markets and drove up bond yields.

No speeches by Fed representatives took place last week (silent week). The penultimate FOMC meeting will be held next week on November 7, where a 0.25% reduction in the federal funds rate (EFFR) is expected.

FedWatch expectations for the end of the year remain unchanged: two rate cuts to a range of 4.25%-4.50%. Long-term expectations also remain unchanged: a reduction of 1.25% to a range of 3.50 - 3.75%.

MARKET

MARKET CAP PERFORMANCE

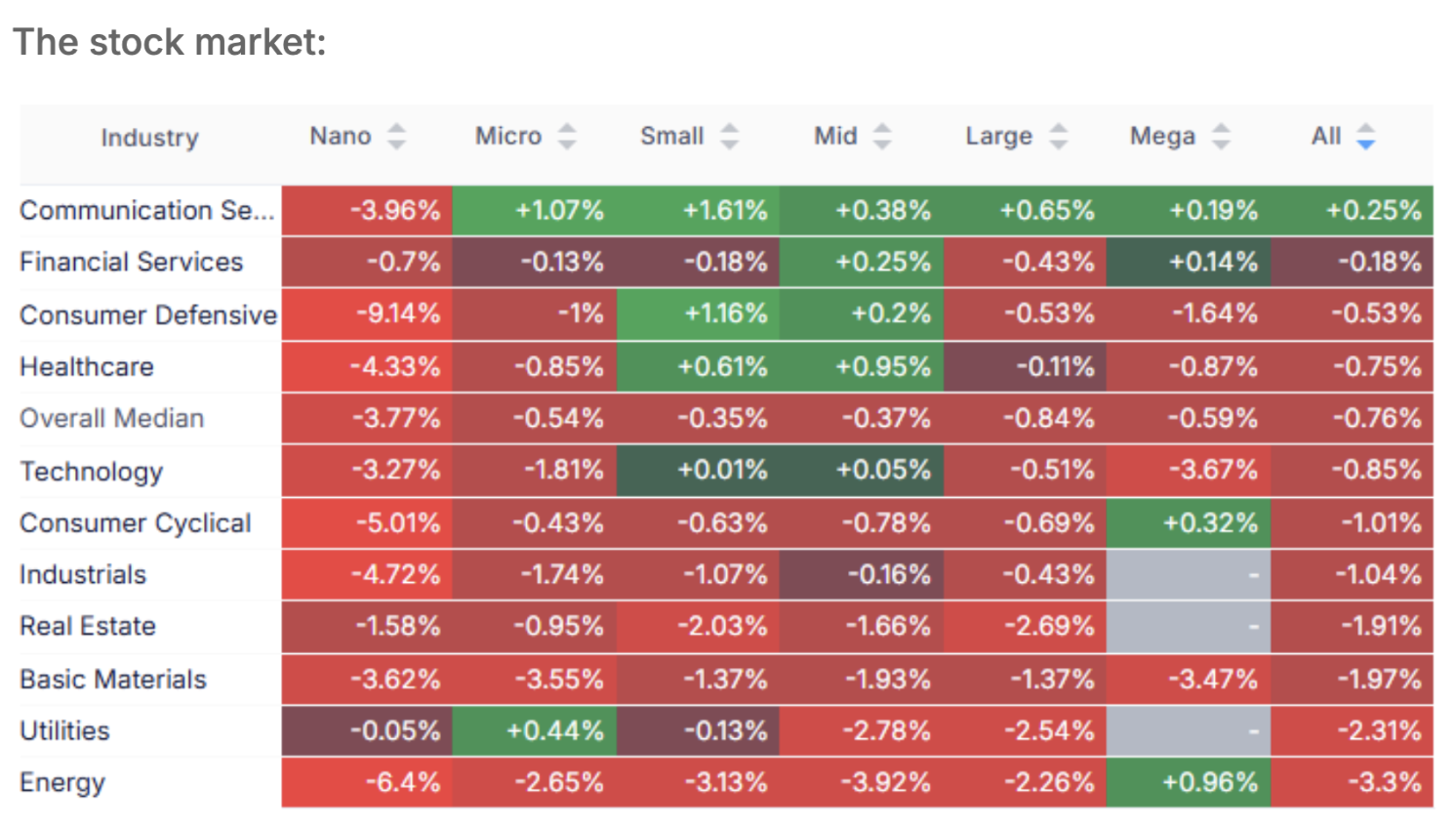

The stock market:

The median decline was 0.76%, with the main sell-offs in basic materials, utilities, and the energy sector.

SP500

SP500 index declined by 1.56% over the week:

NASDAQ100

- 2,04%:

TREASURY MARKET

Treasury Bonds UST10:

Treasury Bonds UST2:

Treasury bonds continued to decline last week against the backdrop of macroeconomic data. The 10-year bonds fell by 0.65%, while 2-year bonds decreased by 0.13%. The likelihood of slowing the pace of monetary easing is increasing.

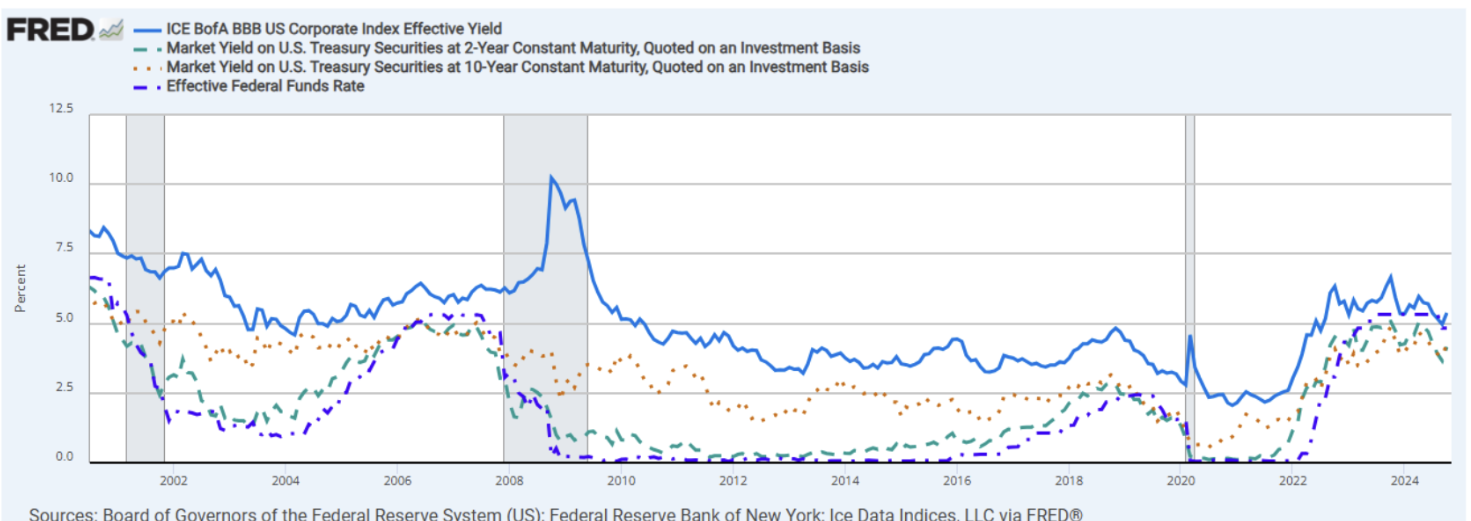

Yields and Spreads

Market yield on 10-year bonds: 4.28%, 2-year bonds: 4.16%. Yield on the corporate index with a BBB rating was 5.38%.

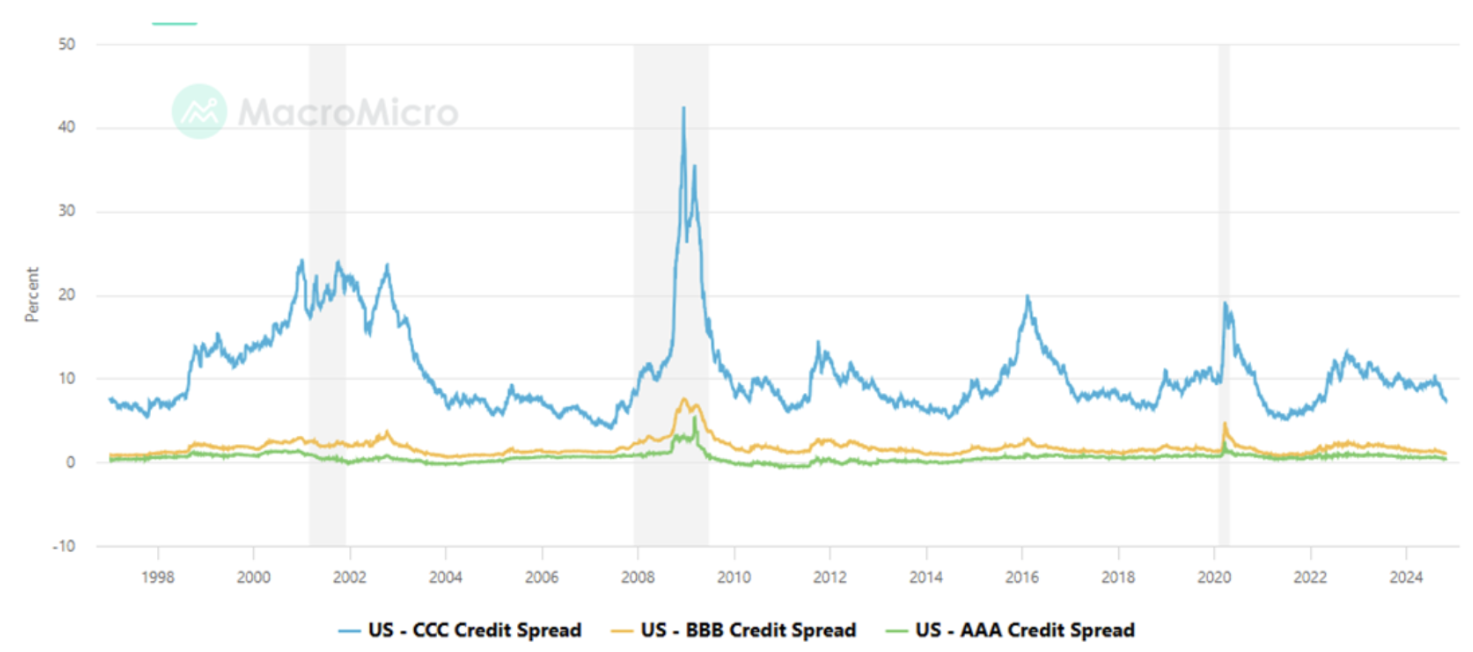

- US - AAA Credit Spread: 0,42%;

- US - BBB Credit Spread: 1,10%;

- US - CCC Credit Spread: 7,42%:

GOLD

Gold futures also retreated from historical highs following the statistical data, decreasing by 1.83%. Growth since the beginning of the year: 32.67%.

Goldman Sachs predicts an increase in gold prices to $3,000 per troy ounce (+9% from the current level).

OIL

Oil futures are trading near a strong support level at $69.49 per barrel. Market pressure factors include downward revisions in oil demand forecasts and the scenario of a Trump victory, with plans to increase U.S. production from 12-13 million barrels per day to 16 million barrels per day.

BTC

Bitcoin futures failed to break the historical high, declining from the resistance level by 6.30% to $69,810.

ETH

Ethereum futures are trading within a 3-month range at $2,530.

Қазақша

Қазақша