October 21 — 25: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.2%)

- Consumer Price Index (CPI) (YoY) (Sept): 2.4%, (pre: 2.5%).

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (Aug): 2.7% (pre: 2.6%);

- The price index of personal consumption expenditures (YoY) (July): 2.2%, (pre: 2.5%).

INFLATION EXPECTATIONS

- 12-month expected inflation (Sept): 2.7%, pre: 2.7%;

- 5-year expected inflation (Sept): 3.0% pre: 3.1%.

BEA (U.S. Bureau of Economic Analysis) GDP: (q/q) (2Q.) (third estimate): 3.0%, (pre: 1.6%, revised), GDP Deflator (q/q) (3Q.): 2.5% (pre: 3.0%, revised):

GDP (Bank of Atlanta): short-term forecast was downgraded to 3.2% from prior indicator 3.4%.

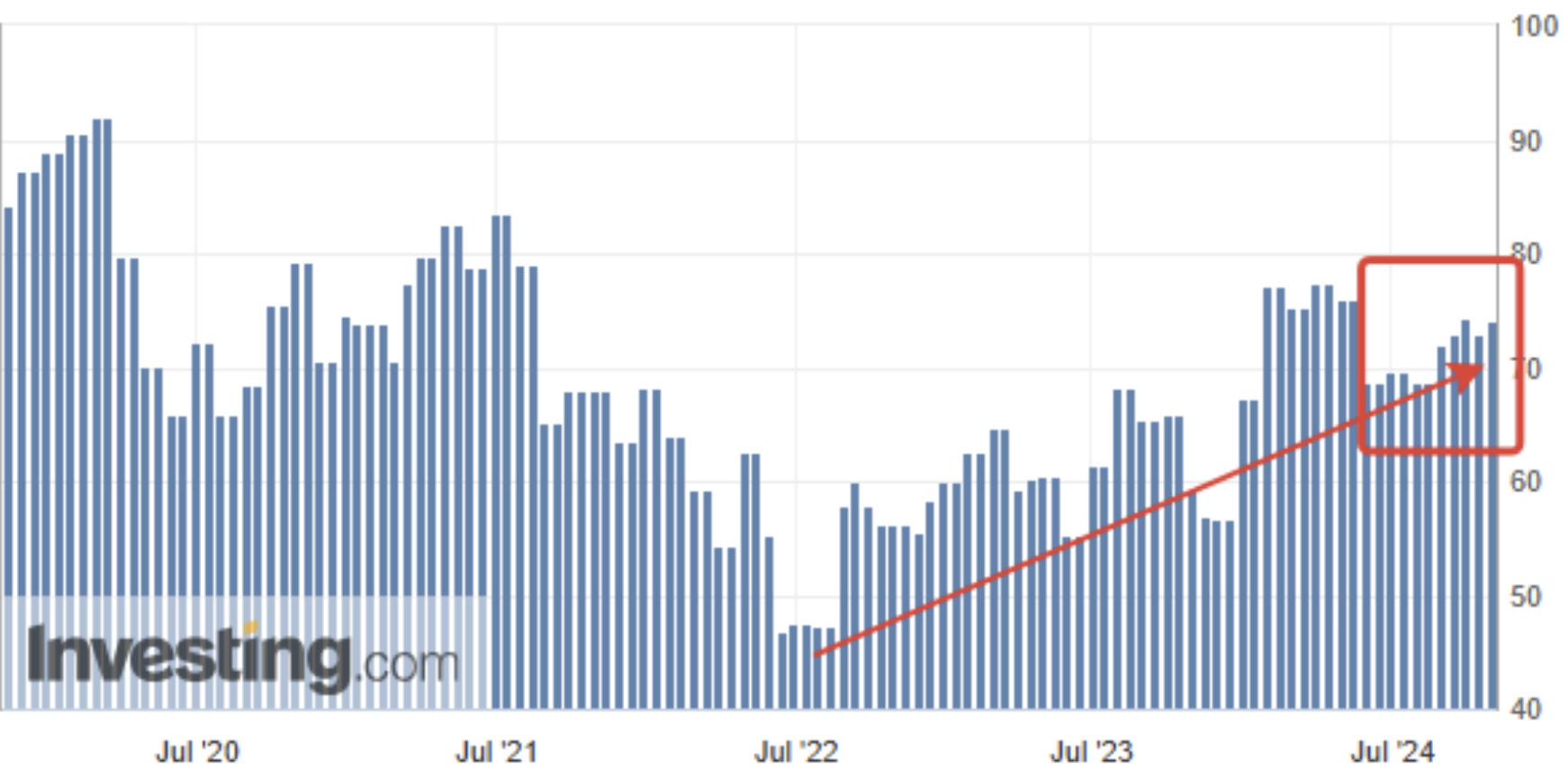

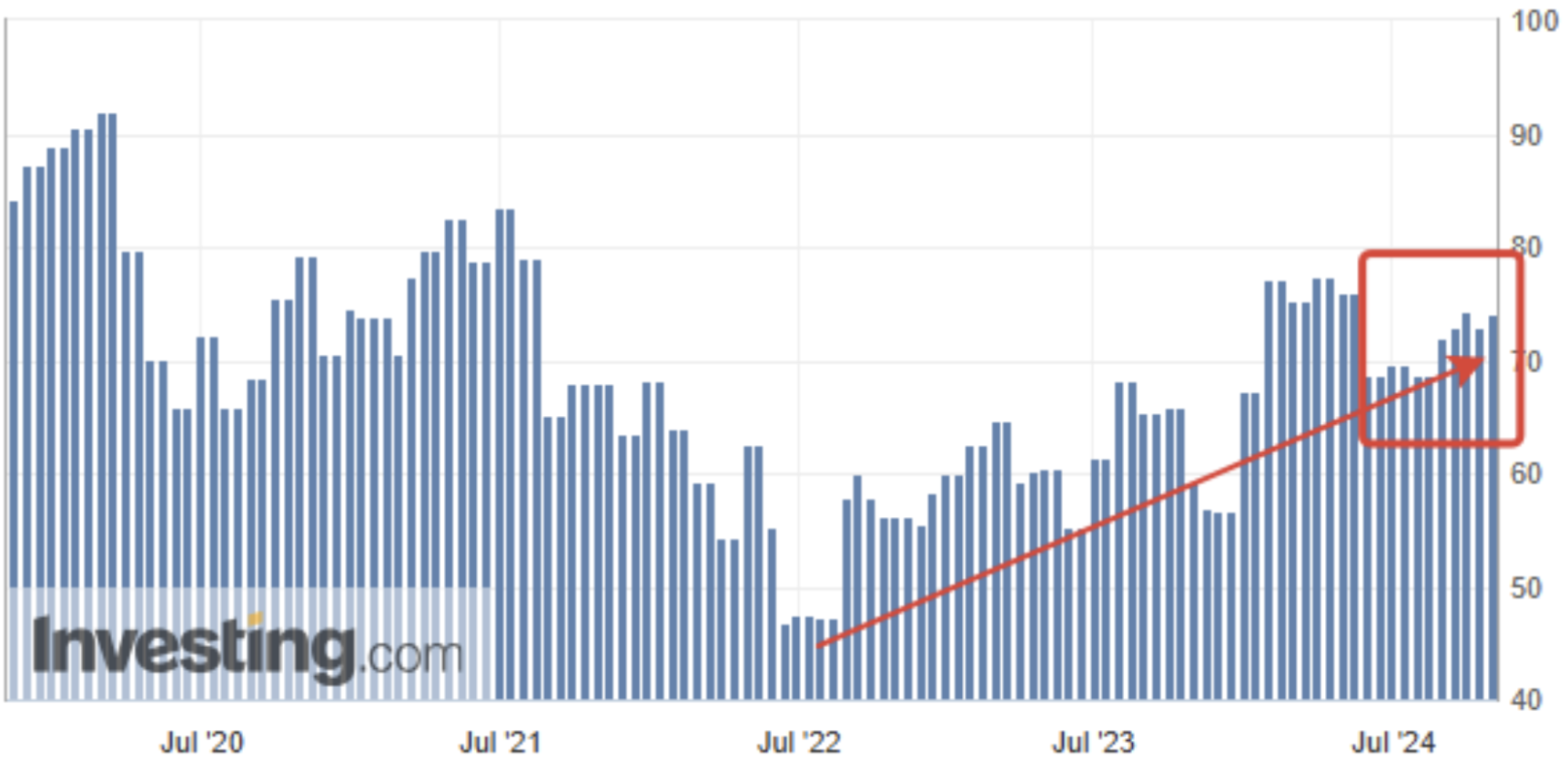

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (October): 55.3 (pre: 52.5);

- Manufacturing sector (October): 47.8 (pre: 47.3, revised);

- S&P Global Composite (September): (October): 54.3 (pre: 54.0, revised).

Consumer Expectations (University Of Michigan): 74.1 (pre 74.4):

Consumer Sentiment (University Of Michigan): 70.5 (pre 70.1):

LABOR MARKET

- Unemployment rate (August): 4.1% (pre: 4.2%);

- Non-farm Payrolls (August): 254K (pre: 159K revision);

- Change in nonfarm private sector employment (August): 223K, (pre 114K, revised);

- Average hourly earnings (August, YoY): 4.0% (pre: 3.9%).

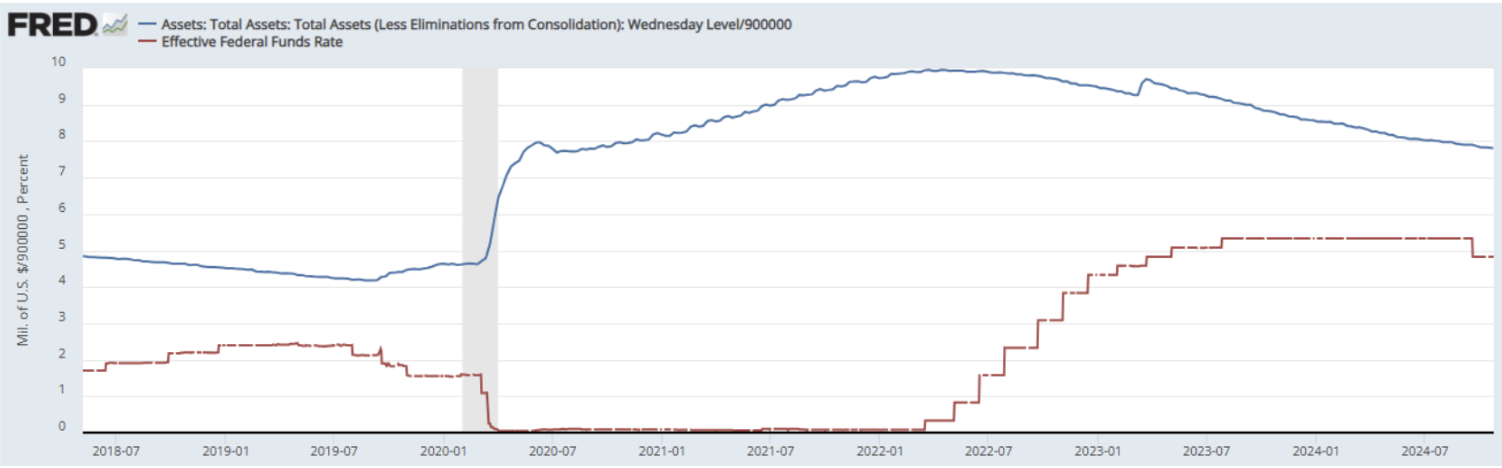

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.75% – 5.00% (in red);

- Fed Balance Sheet (in blue): $7.029 trillion (vs last week: $7.039 trillion):

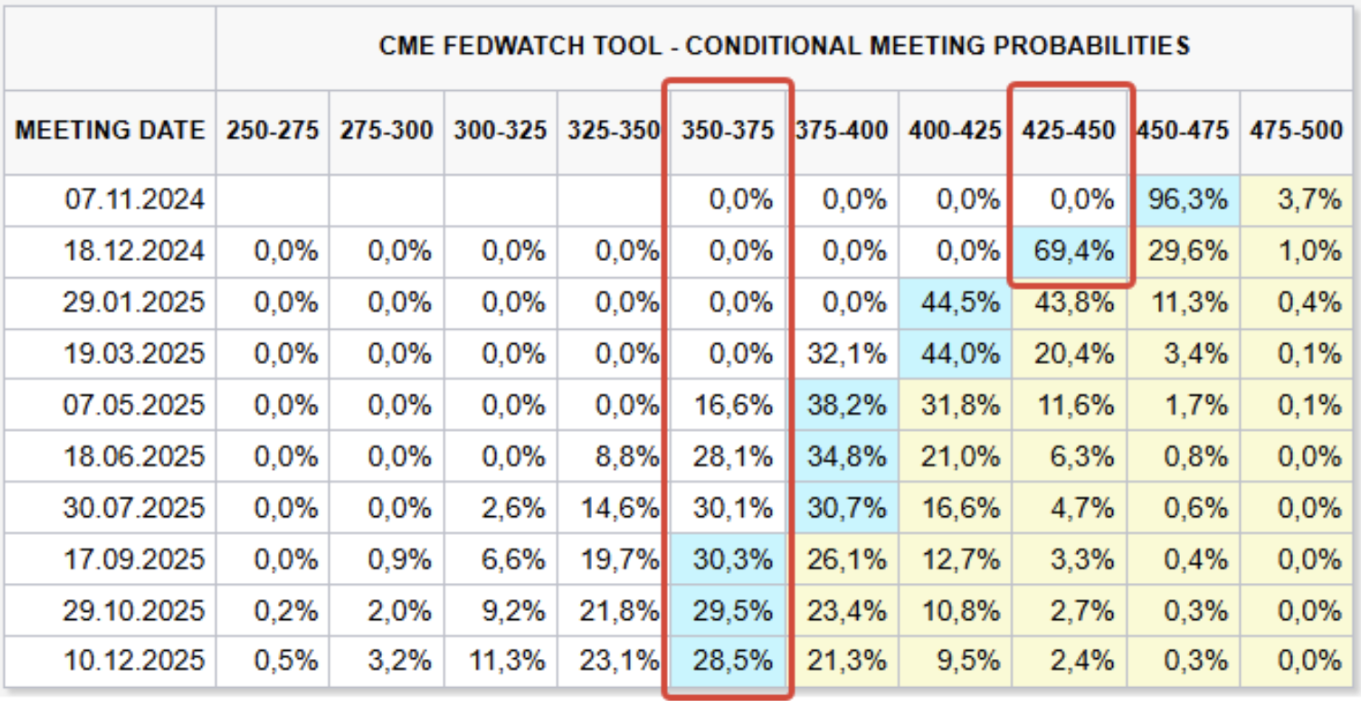

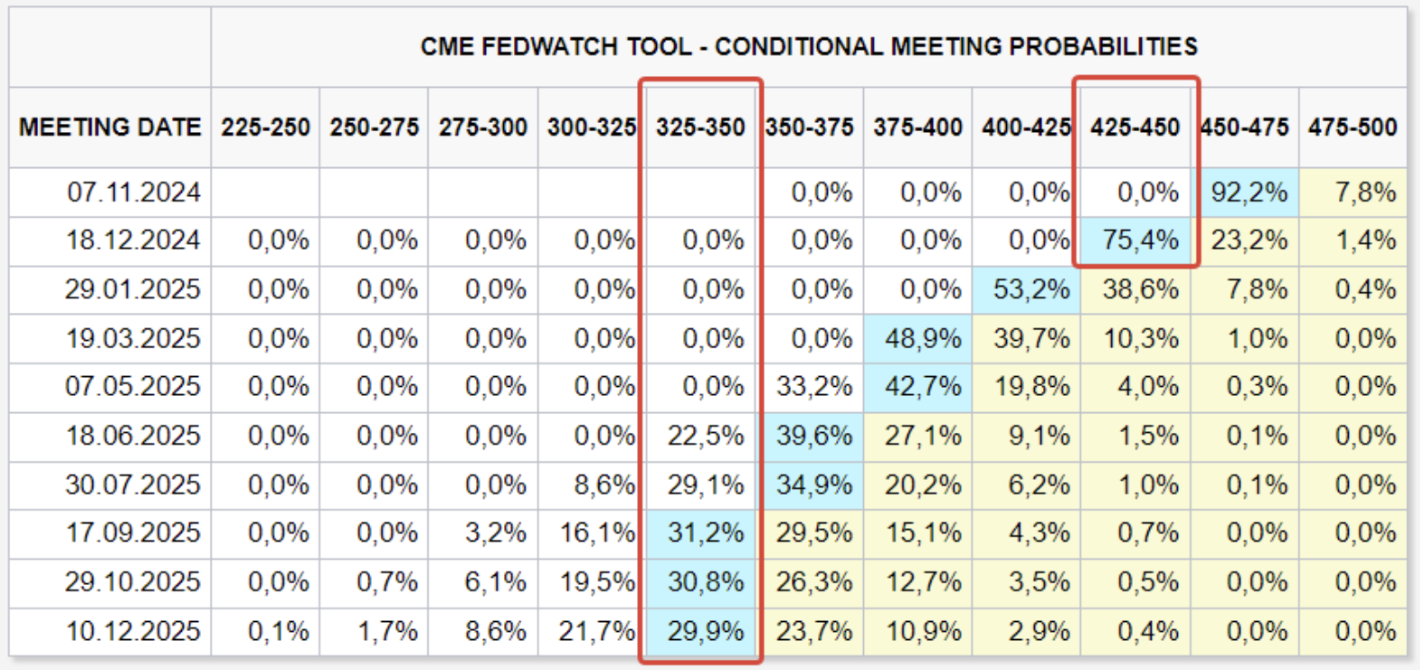

MARKET FORECAST FOR RATE

Today:

A week earlier:

Commentary:

Inflation expectations for the year didn't change from last month and amounted to 2.7%. The current value lies within the 2.3%-3.0% range seen in the two years prior to the pandemic. Long-term inflation expectations fell from 3.1% last month to 3.0% this month and remain slightly elevated.

Consumer sentiment in the short-term phase rose for the third consecutive month. The consumer sentiment indicator is now more than 40% higher than its June 2022 minimum. The rise in October was primarily driven by a modest improvement in durable goods purchasing conditions, and partially driven by lowered interest rates.

Overall, the data on consumer sentiment and expectations is quite strong, which does not favor a quick rate cut; accordingly, the Fed may slow down the pace of rate reductions.

FedWatch expectations for the end of the year remain unchanged, with two rate cuts projected to bring the range to 4.25%-4.50%. However, long-term expectations (over 12 months) have increased, anticipating a 1.25% cut to a range of 3.50%-3.75%.

MARKET

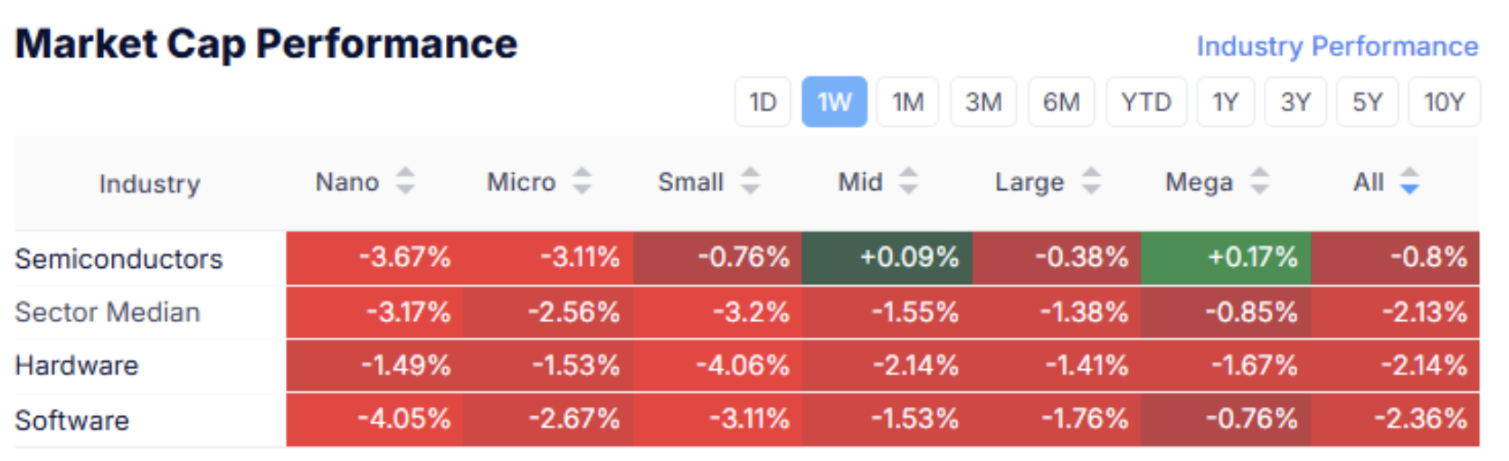

MARKET CAP PERFORMANCE

The stock market:

Technological market:

Last week the US stock market saw negative dynamics in all sectors. Short-term total Risk OFF. Both risky sectors and defensive sectors were sold off. The median market decline amounted to 2.24%.

SP500

NASDAQ100

Accordingly, the main indices also saw declines. The S&P 500 index fell by 1.12% over the week, and the Nasdaq 100 by 0.23%. This index performance is explained by strong releases on consumer expectations, which indicate a slower pace of rate cuts.

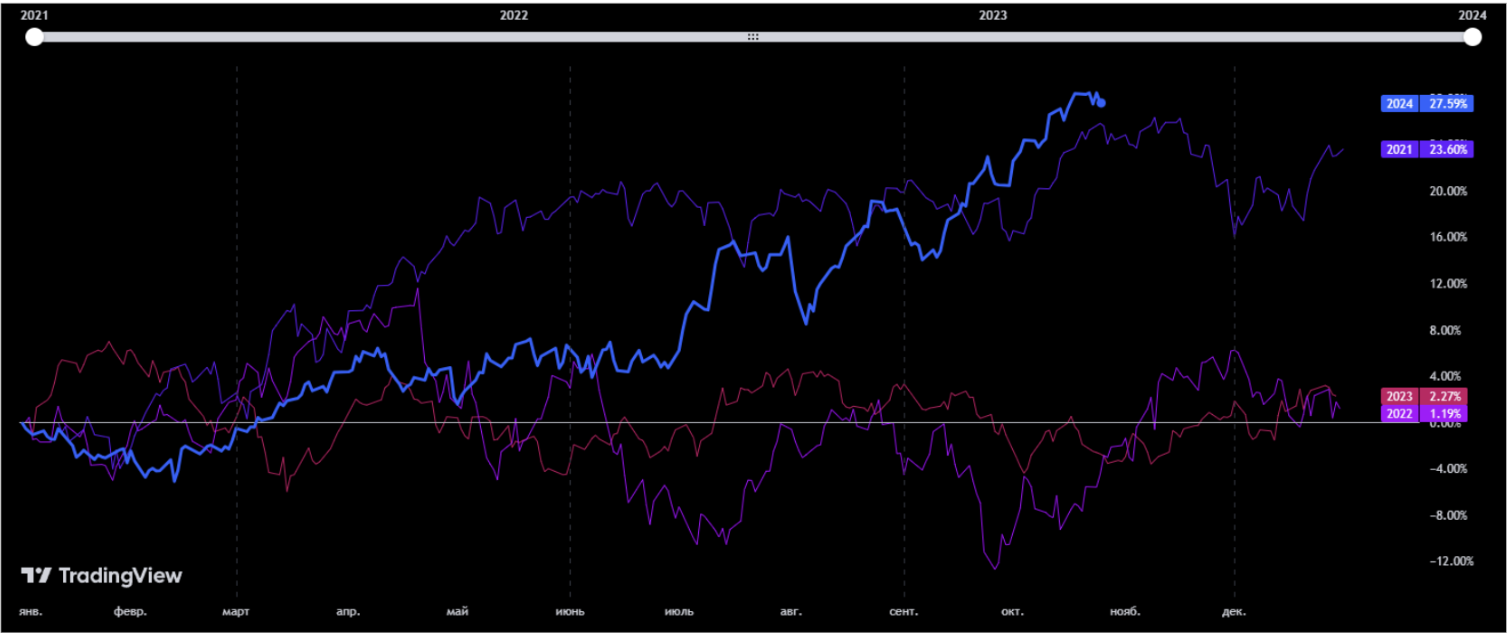

Horizon Kinetics Inflation Beneficiaries ETF (tracks assets whose revenues grow with inflation):

This ETF's portfolio includes companies with stable commodity value assets, such as land, real estate, energy facilities, and mineral deposits. The fund can be considered an indicator of inflation expectations in the economy. The 2024 chart outpaces even the highly bullish year of 2021, which saw record-high monetary stimulus and near-zero rates.

Conclusion: Inflation expectations remain elevated today, despite high rates.

TSLA

Tesla’s stock rose by over 25% following a strong Q3 earnings report. EPS was $0.72 (up 21.34%) with revenue at $25.18 billion, a year-over-year revenue increase of +7.85%.

On Wednesday, during the earnings conference, Tesla CEO Elon Musk described the business as strong. Musk noted that Tesla had just released its 7 millionth vehicle and expects vehicle sales to grow by 20-30% in 2025 compared to 2024. Tesla’s potential valuation in 2025 could exceed $1 trillion (current valuation: $864 billion).

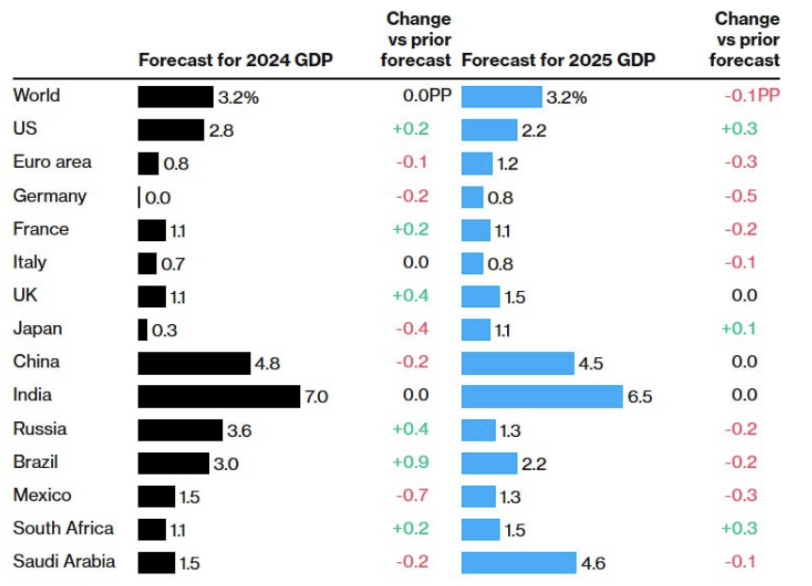

Forecasts

The IMF projects economic growth for the U.S., Japan, and South Africa in 2025. A recession is forecasted in the European Union, including leading economies.

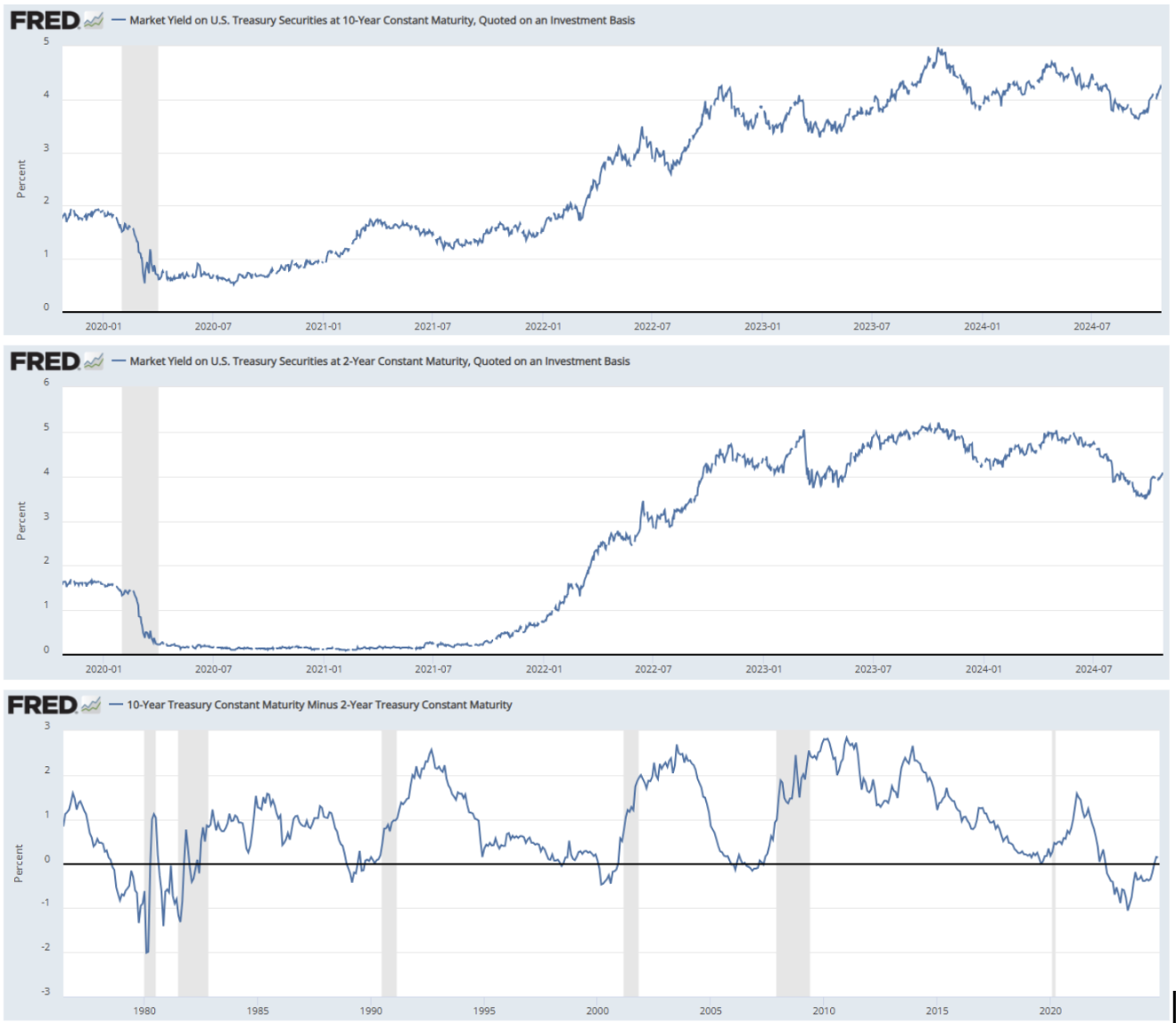

TREASURY MARKET

Treasury Bonds UST10:

Treasury Bonds UST2:

Treasury bonds continued to decline last week. The 10-year bonds dropped by 1.27%, and the 2-year bonds fell by 0.37%.

Yields and Spreads

The 10-year bond market yield was 4.21%, and the 2-year yield was 4.07%, with a spread of +0.14%.

The corporate index yield for bonds rated BBB was 5.29%. The interest spread between CorpBBB and UST10 was 1.08%.

GOLD

OIL

The gold market rally continues. The futures price at the end of the week was $2,761 per troy ounce.

Oil continues to decline, trading near its support level with futures priced at $67.45 per barrel. Recent OPEC+ and International Energy Agency data forecast slower global oil demand in 2024-25.

BTC

ETH

The shift of investors away from risk also affected major cryptocurrencies. BTC declined by 1.44%, and ETH by 8.79%.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша