October 7 — 13: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

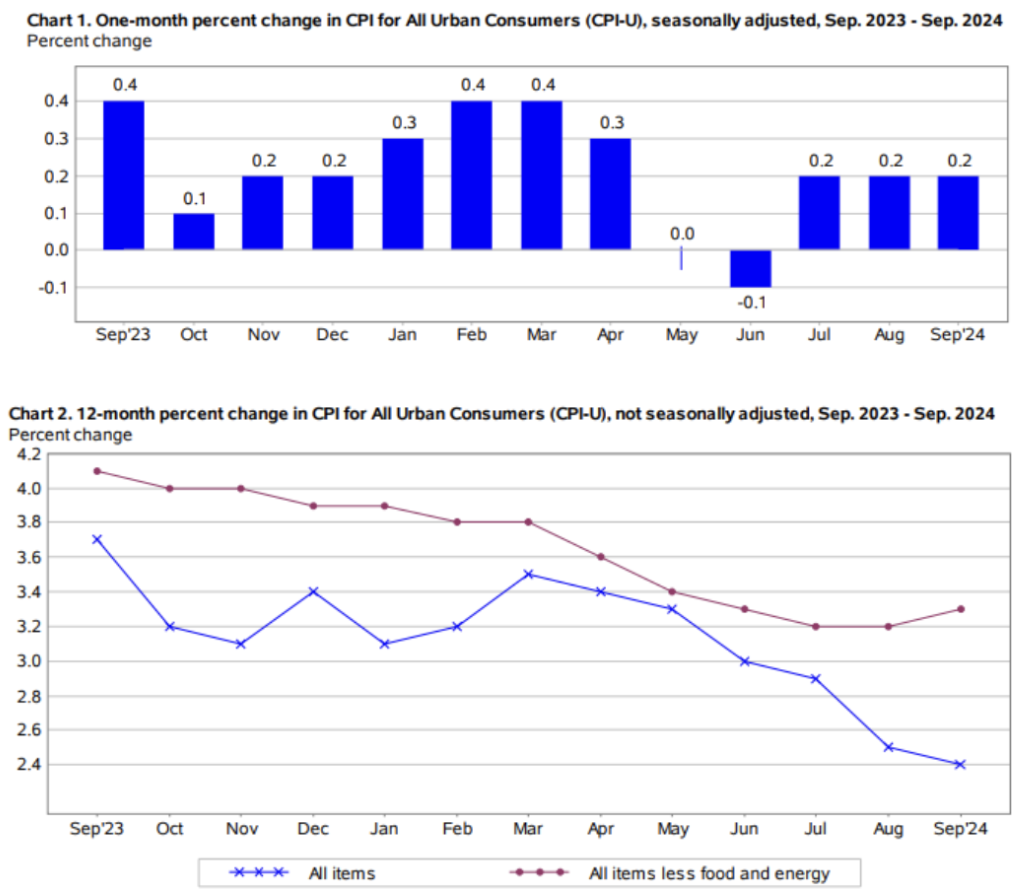

- Core Consumer Price Index (CPI) (YoY) (Sept): 3.3%, (pre: 3.2%);

- Consumer Price Index (CPI) (YoY) (Sept): 2.4%, (pre: 2.5%).

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (Aug): 2.7% (pre: 2.6%);

- The price index of personal consumption expenditures (YoY) (July): 2.2%, (pre: 2.5%).

INFLATION EXPECTATIONS

-

12-month expected inflation (Sept): 2.9%, pre: 2.7%;

-

5-year expected inflation (Sept): 3.0% pre: 3.1%.

-

BEA (U.S. Bureau of Economic Analysis) GDP: (q/q) (2Q.) (third estimate): 3.0%, (pre: 1.6% revision),

-

GDP Deflator (q/q) (3Q.): 2.5% (pre: 3.0% revision),

-

GDP (Bank of Atlanta): 3.2% short-term forecast.

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 55.4 (pre: 55.7);

- Manufacturing sector (September): 47.0 (pre:47.9 revision);

- S&P Global Composite (September): 54.4 (pre: 54.6 revision).

LABOR MARKET

- Unemployment rate (August): 4.1% (pre: 4.2%);

- Non-farm Payrolls (August): 254K (pre: 159K revision);

- Change in nonfarm private sector employment (August): 223K, (pre 114K revision);

- Average hourly earnings (August, YoY): 4.0% (pre: 3.9%).

MONETARY POLICY

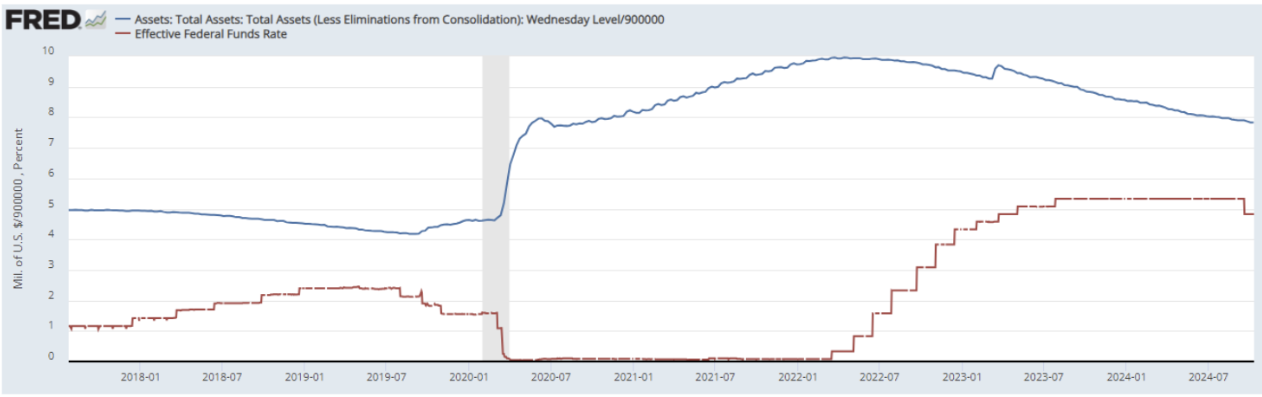

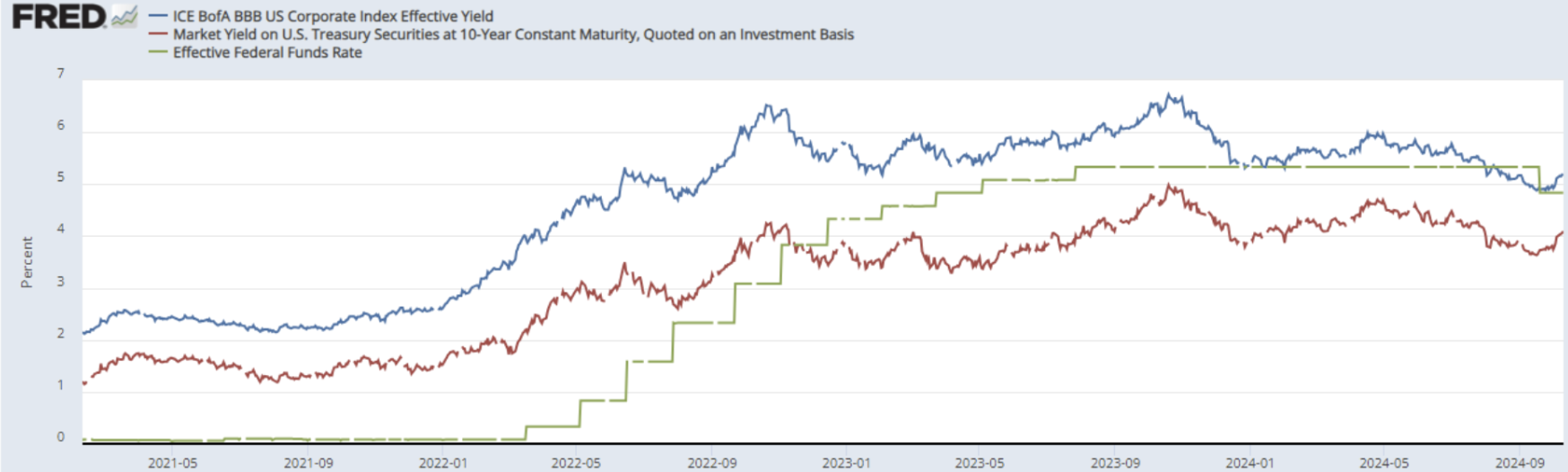

- Federal Funds Rate (EFFR): 4.75% – 5.00% (in red);

- Fed Balance Sheet (in blue): $7.046 trillion (vs last week: $7.046 trillion):

From the September Fed meeting records (abstract):

- Most Fed Chairmen noted a slowdown in the U.S. economy and a cooling in the labor market;

- Risks to higher inflation have diminished, but too early or excessive rate cuts could reverse progress against inflation;

- Fed balance sheet contraction will continue despite rate cuts.

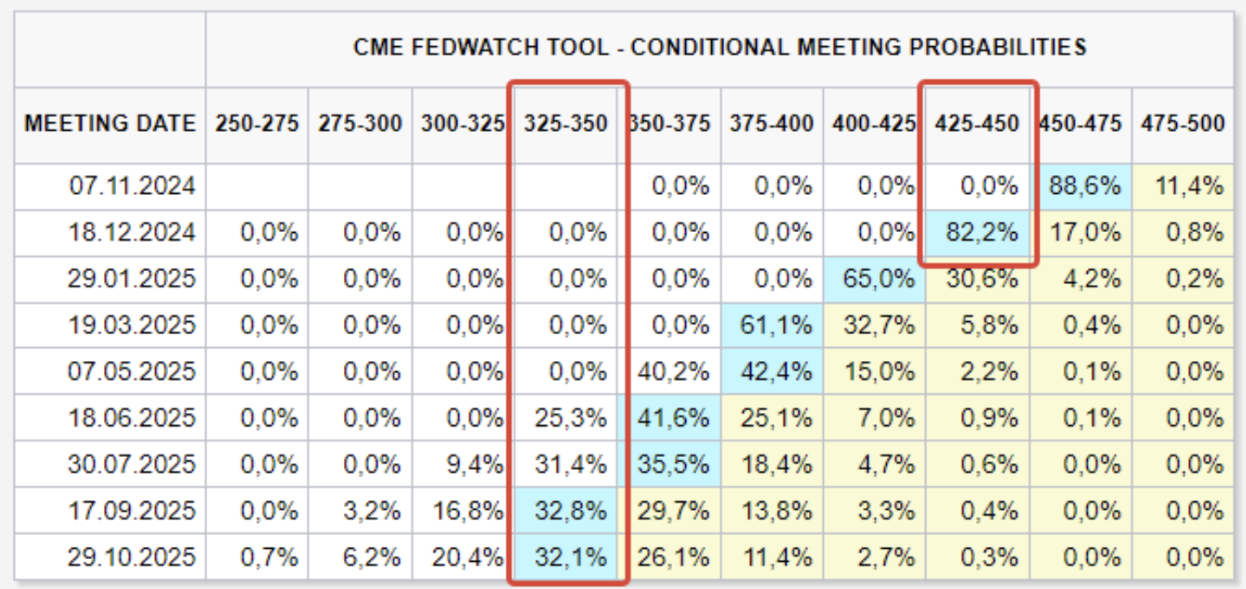

MARKET FORECAST FOR RATE

Today:

COMMENTARY

In September, month-to-month U.S. CPI rose above forecasts by 0.1% and 0.2% for CPI and Core CPI, respectively. On a year-over-year basis, CPI fell to 2.44%, while Core CPI (excluding food and energy) beat expectations to 3.26%. In addition, 12-month inflation expectations also rose 0.2%.

Such data from the September release points to a possible scenario of inflation stalling or even rising, which confirms the Fed's concerns about the risks of a rapid rate cut.

If the next data on inflation indices do not show a decline, we can expect more restrictive rhetoric from the regulator.

But so far Fedwatch expectations have not changed much: two rate cuts for the end of the year to the range of 4.25%-4.50%. Long-term expectations have not changed (for 12 months): 2.00% decrease to the range of 3.25% - 3.50%.

MARKET

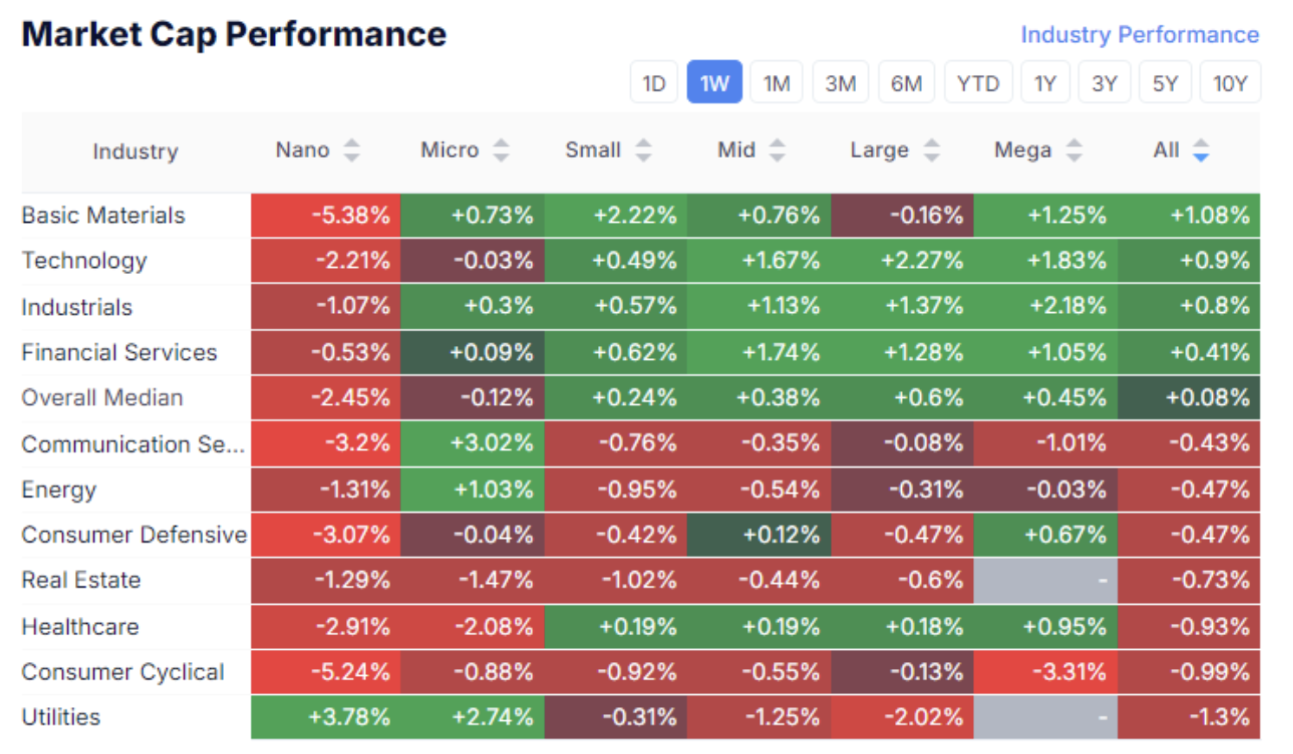

MARKET CAP PERFORMANCE

The stock market:

The median growth of the stock market amounted to 0.08%. There was an outflow of capital more from the defensive sectors, in favor of the technology sector, basic materials, industrial and financial sectors. Thus, Risk ON in the US stock market remains in place.

SP500

VIX

Risk appetite, on the one hand, is confirmed by the performance of the SP500 index, which continued to rise to a new all-time high of 5815. The VIX, on the other hand, does not show a rapid decline, consolidating above 20. The increased value of options on the SP500, may indicate that uncertainty remains. The main risk is a rise in inflation and therefore a slowdown in the pace of easing of the MPC.

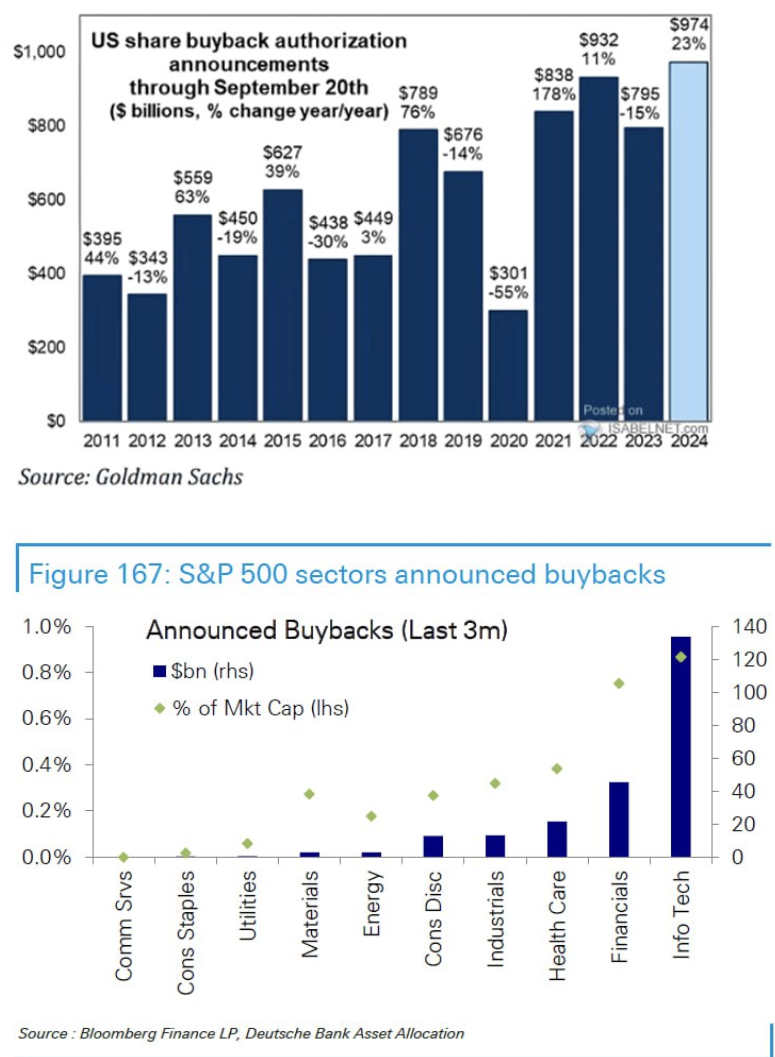

Buyback

According to Goldman Sachs calculations, the volume of announced buybacks in the US this year amounted to $974 billion, an increase of 23% on last year. By the end of the year, the value could exceed $1.0 trillion. High buybacks indicate that CEOs believe their companies' stocks are undervalued. The technology sector leads in buybacks by a wide margin, followed by the financial sector and healthcare.

TREASURY MARKET

Treasury Bonds UST10:

Yields:

The 10-year Treasury bond futures are down 0.67%. The reason is the CPI release and the Fed's rhetoric. The market yield on 10-year constant maturity U.S. Treasury securities (red line), is 4.107%. The yield on the BBB-rated corporate index (blue line) is 5.17%. There is no widening in the spread.

DOLLAR INDEX (DXY)

GOLD

The Dollar Index continues its two-week rise to a value of 102. I note that both bond yields and the dollar index are rising after the Fed meeting. Gold is likely to test the $2700/troy ounce level. Fundamental factors in favor of long-term growth are still in place.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша