September 30 - October 4: Weekly economic update

Key market insights

In our weekly column, we share the main macroeconomic indicators for the market with you.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (June): 3.2%, (pre: 3.2%);

- Consumer Price Index (CPI) (YoY) (June): 2.5%, (pre: 2.9%).

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (August): 2.7% (pre: 2.6%);

- The price index of personal consumption expenditures (YoY) (July): 2.2%, (pre: 2.5%).

INFLATION EXPECTATIONS

- 12-month expected inflation (September): 2.7%, (pre: 2.7%);

- 5-year expected inflation (September): 3.1% (pre: 3.1%).

GDP (q/q) (2Q) (third estimate): 3.0%, (pre: 1.6%, revised), GDP Deflator (q/q) (3Q): 2.5% (pre: 3.0%, revised).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 55.4 (pre: 55.7);

- Manufacturing sector (September): 47.0 (pre: 47.9 revised);

- S&P Global Composite (September): 54.4 (pre: 54.6 revised).

LABOR MARKET

- Unemployment rate (August): 4.1% (pre: 4.2%);

- Non-farm Payrolls (August): 254K (pre: 159K revised);

- Change in non-farm private sector employment (August): 223K (pre: 114K revised);

- Average hourly earnings (August, YoY): 4.0% (prev: 3.9%).

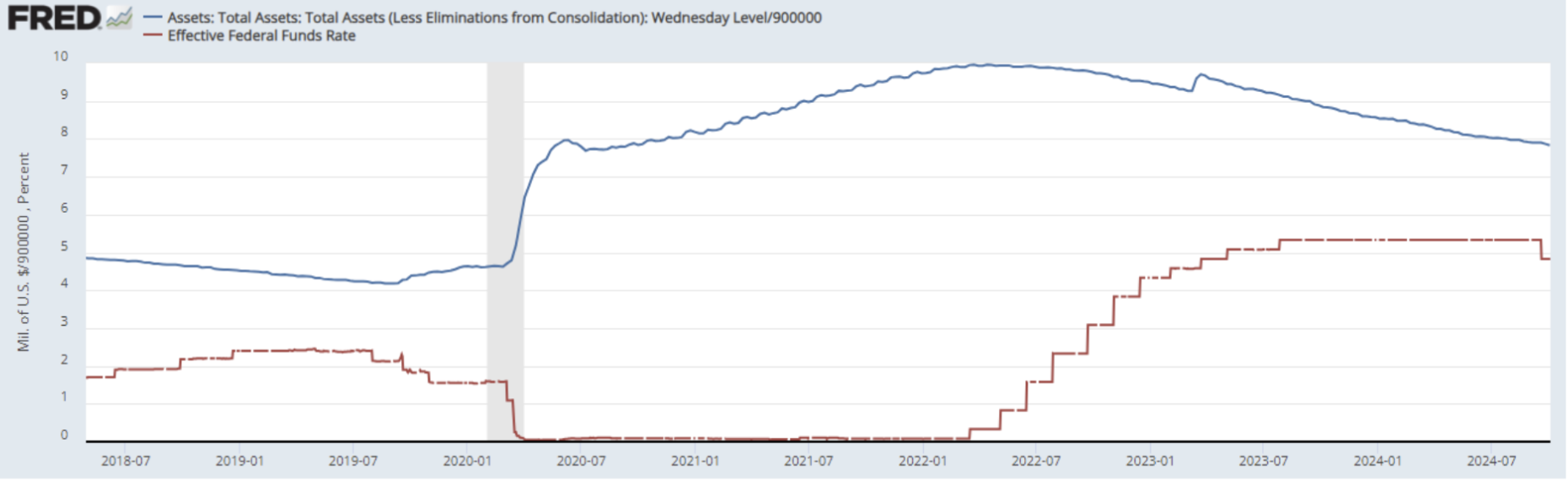

MONETARY POLICY

- Federal Funds Rate (EFFR): 4.75% - 5.00% (highlighted in red);

- Fed Balance Sheet (in blue): $7.046 trillion (vs last week: $7.080 trillion).

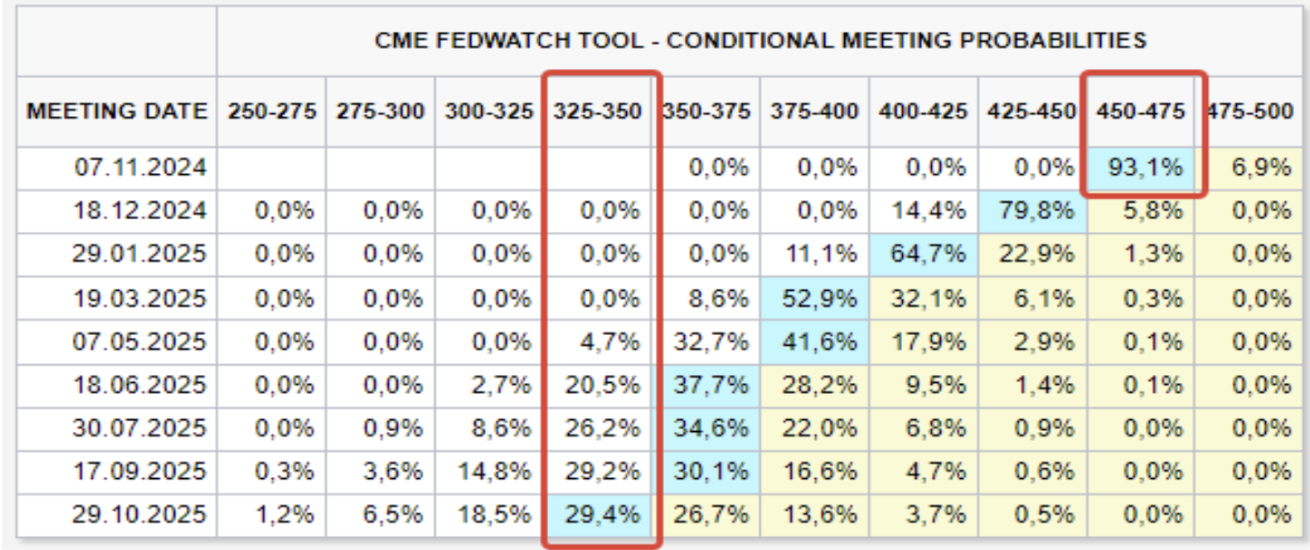

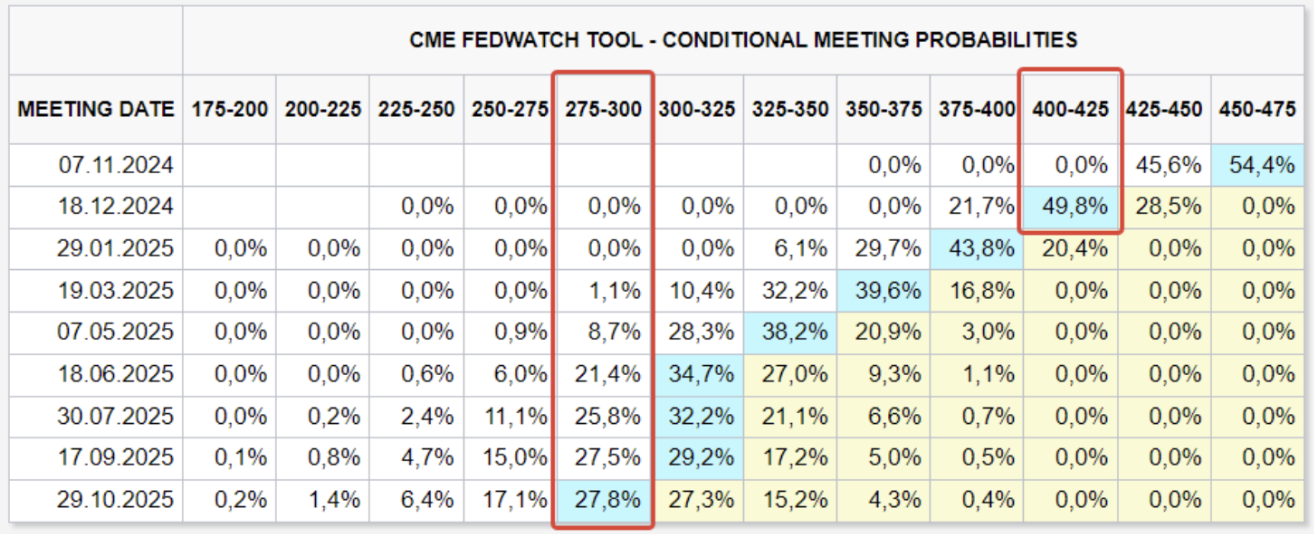

MARKET FORECAST FOR RATE

Today:

A week earlier:

COMMENTARY

Labor market data for September exceeded forecasts and indicated active employment growth: total nonfarm employment increased by 254,000 in September, and the unemployment rate slightly declined to 4.1%. Employment growth continued in food services, healthcare, government, social services, and construction sectors.

In the context of rising employment, market participants' expectations regarding the pace of future rate cuts worsened.

Today, the FedWatch tool shows only one rate cut by the end of the year, to the range of 4.50%-4.75%. Long-term expectations remained unchanged (12 months ahead): a 2.00% decrease to the range of 2.75%-3.00%.

Fed Chair Jerome Powell's rhetoric last week suggested the regulator would return to a 0.25% rate cut in November, if economic data remains stable. The Fed is increasingly confident in a "soft landing" scenario.

MARKET

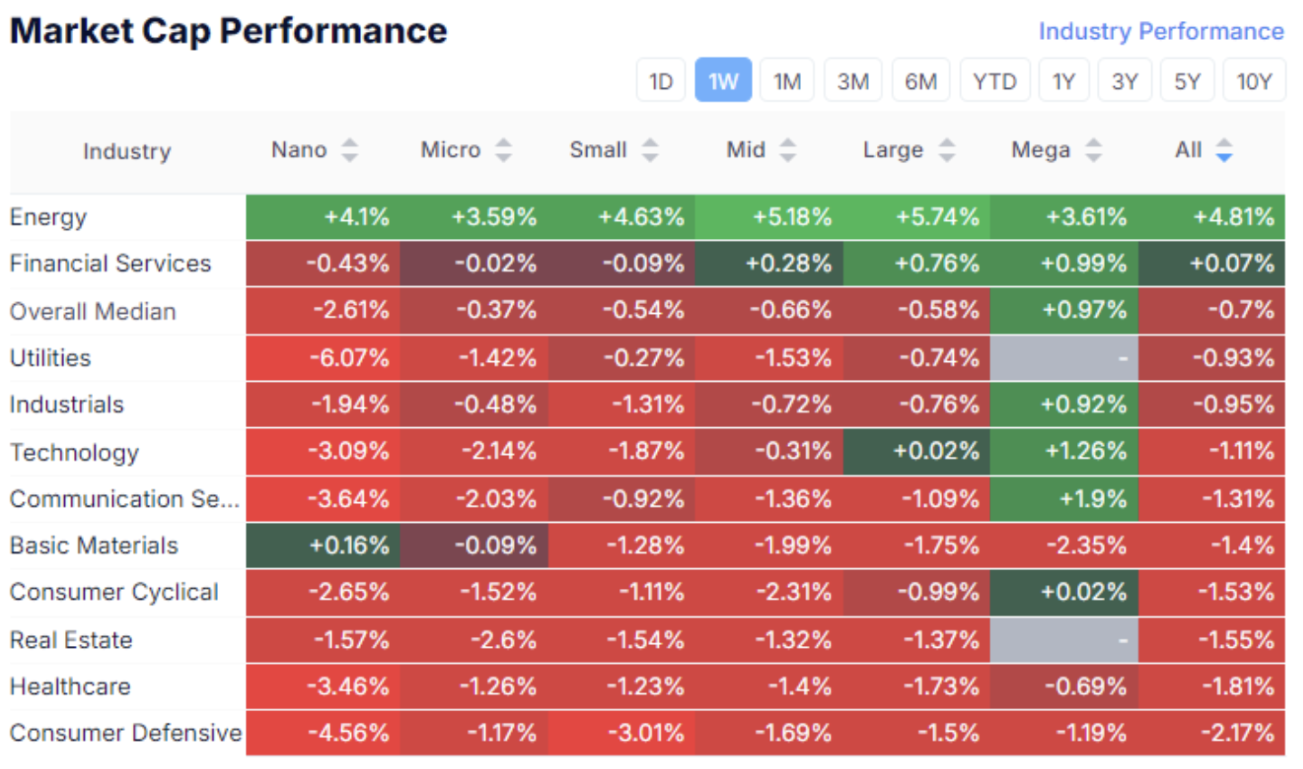

MARKET CAP PERFORMANCE

The stock market:

The median stock market decline was 0.7%. The energy and financial sectors were the leaders. Other sectors experienced asset outflows, with consumer sectors, healthcare, and real estate being the biggest laggards.

SP500

VIX

The SP500 index bounced off a new support level (5670), closing the week at 5751. It is worth noting the VIX, which has been gradually rising since September 26, surpassing the 20 mark, historically considered a significant psychological level. Further VIX growth may signal worsening market sentiment regarding the slowdown of monetary easing. However, this is likely a short-term reaction, and we do not expect a sharp stock market collapse in the near term.

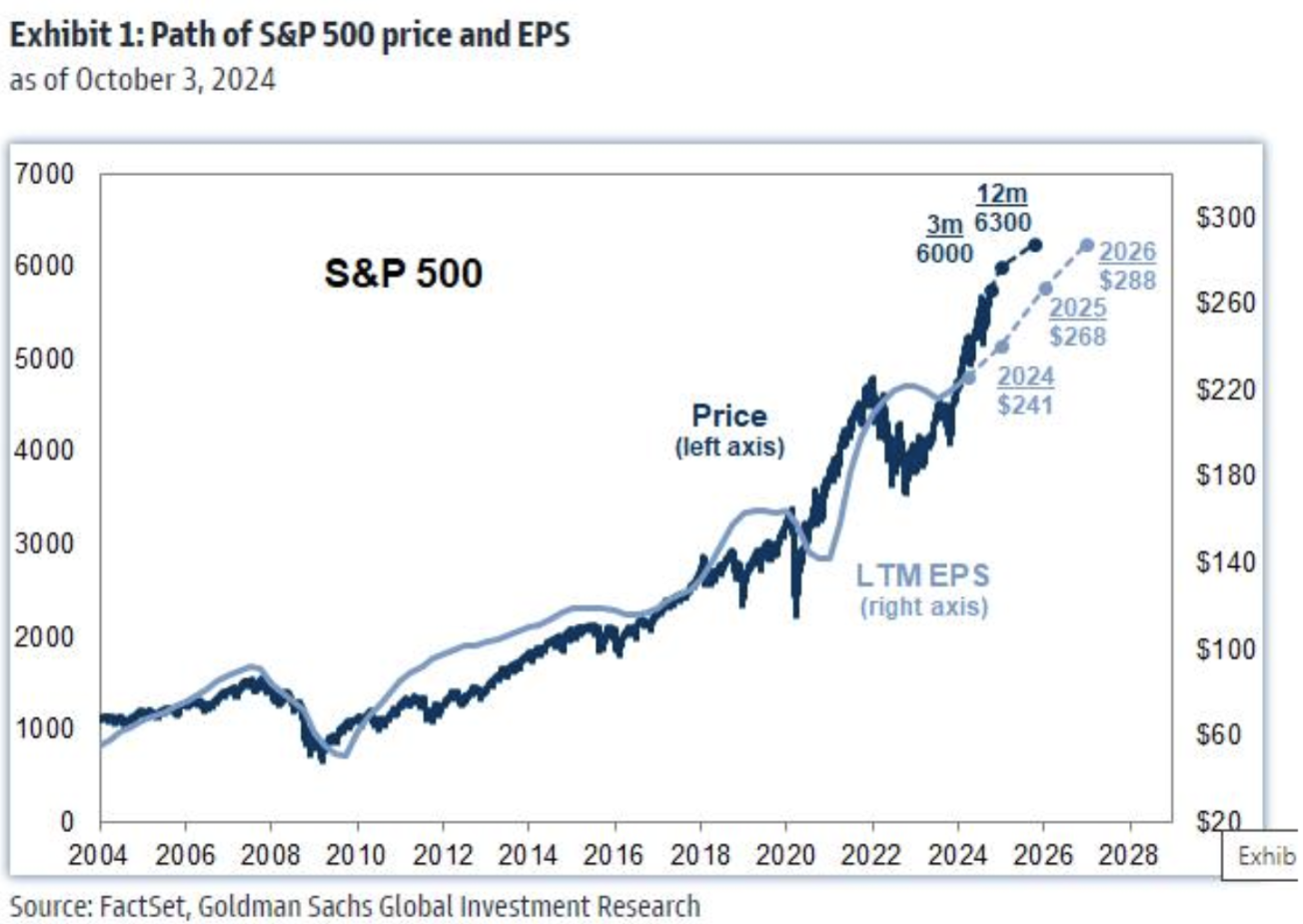

Forecasts: Goldman Sachs' updated forecast expects the SP500 index to reach 6000 by the end of this year and 6300 within the next 12 months.

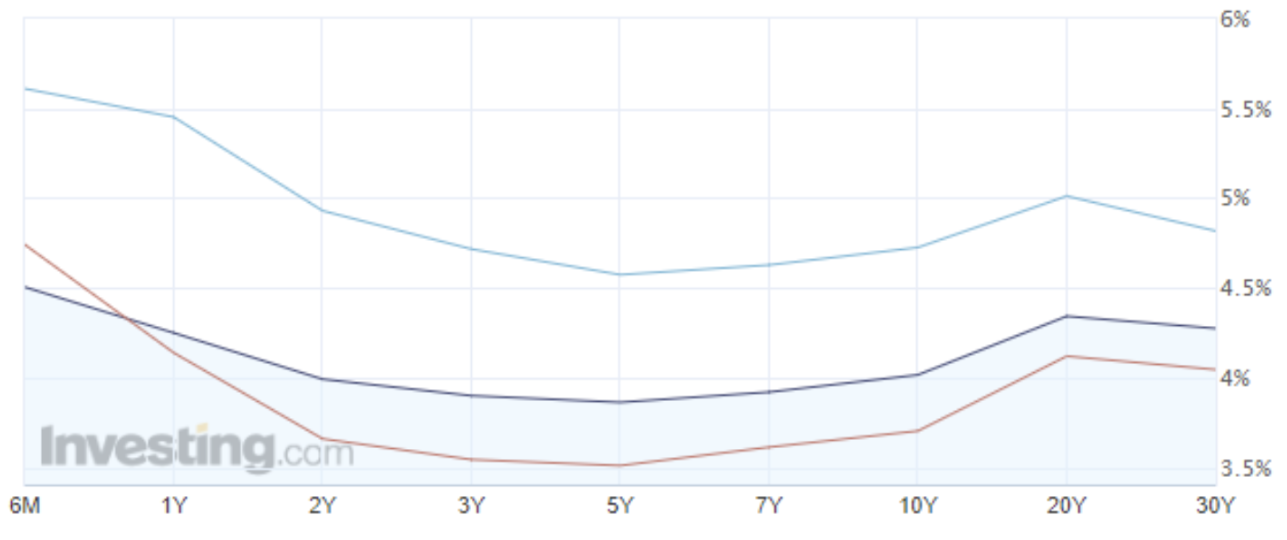

TREASURY MARKET

Treasury Bonds UST10:

Treasury bonds reacted more sensitively to labor market data. If the labor market remains strong, the Fed may reconsider the monetary policy outlook, leading to a longer period of holding rates, which, in turn, would reduce the risk of a second wave of inflation.

Yields:

Today, yields on Treasury bonds maturing in 2 years and over 10 years once again exceeded 4%.

The yield on the corporate index with a BBB rating (blue line) stands at 5.00%.

GOLD

Gold is consolidating below the level of $2708 per troy ounce. Escalation of the conflict in the Middle East may push prices above this level.

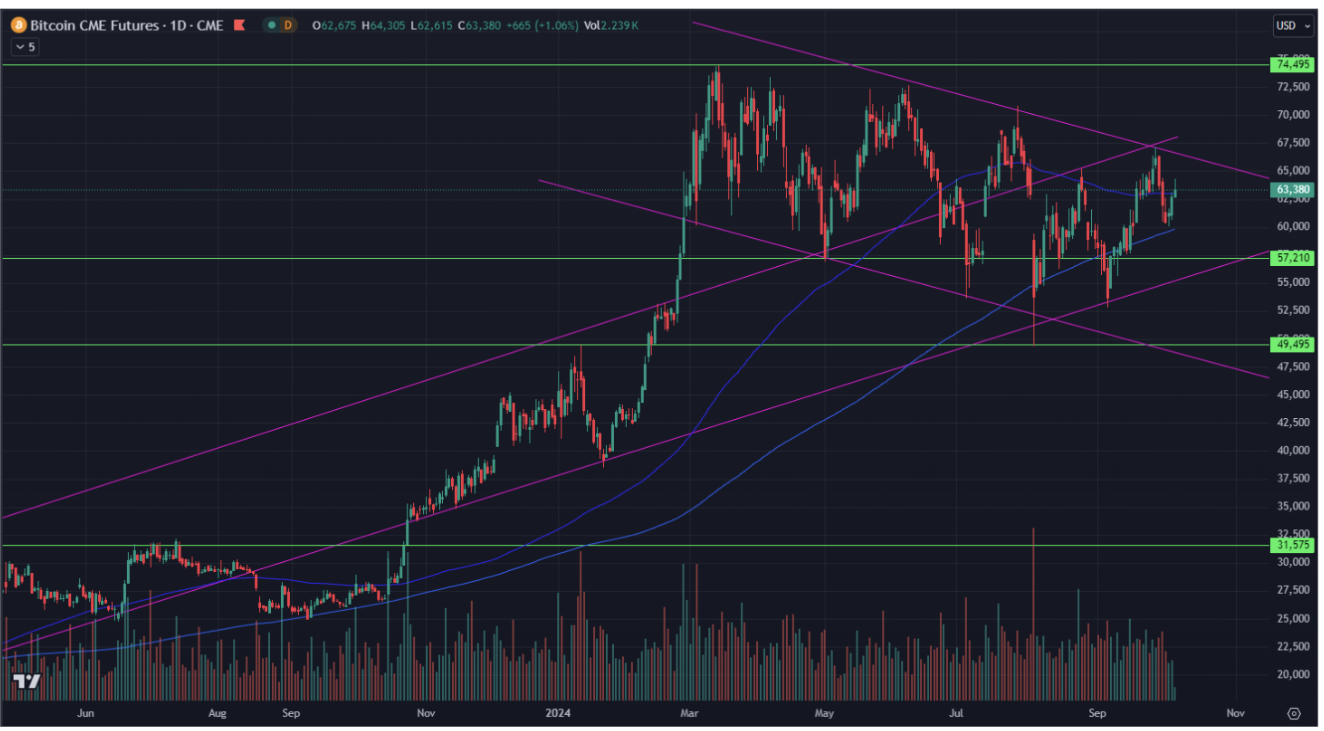

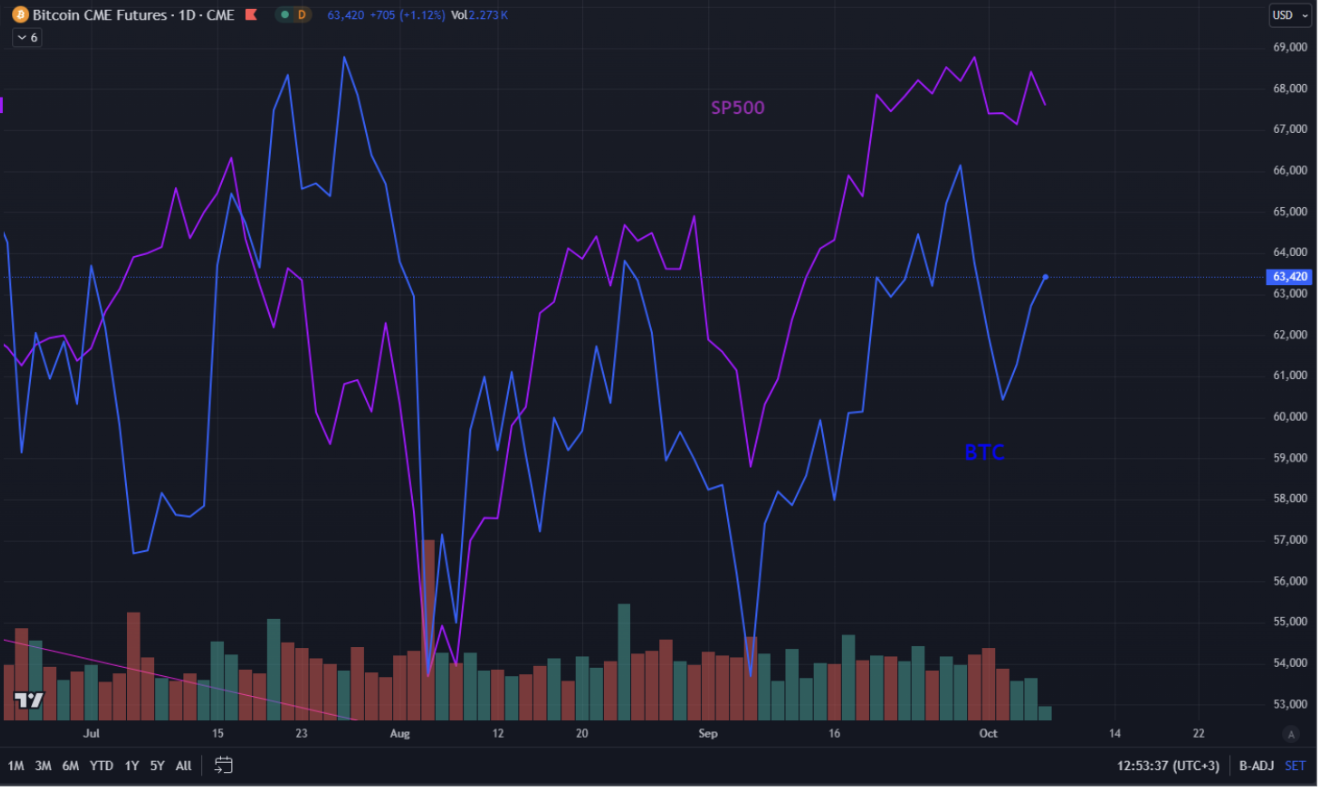

BTC

Bitcoin showed a 4% decline over the past week. The short-term correlation between the leading cryptocurrency and the SP500 index remains positive.

Қазақша

Қазақша