September 23-27: Weekly economic update

Key market insights

In our weekly column, we share with you the main macroeconomic indicators for the market.

MACROECONOMIC STATISTICS

INFLATION

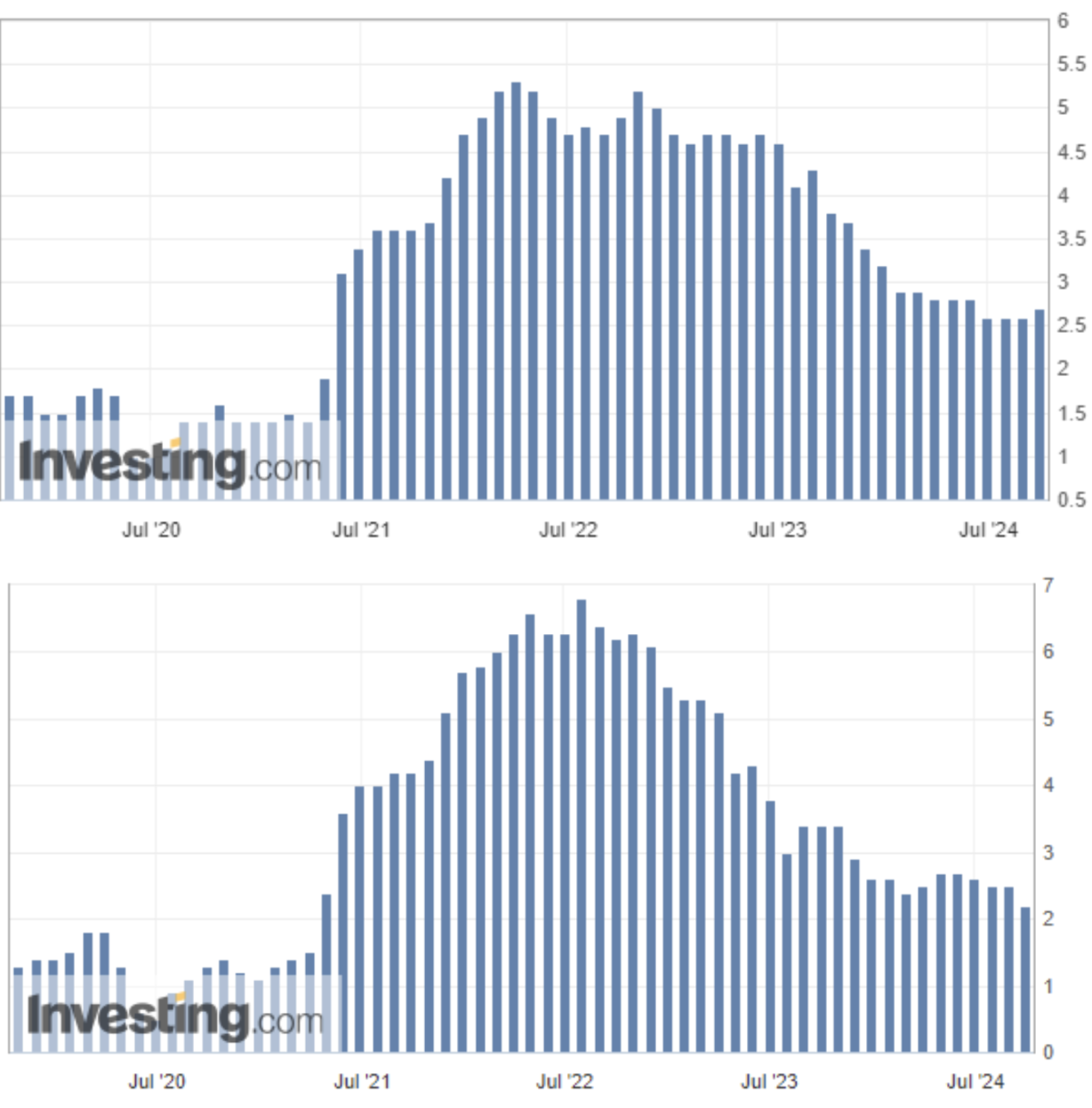

- Core Consumer Price Index (CPI) (YoY) (June): 3.2%, (pre: 3.2%);

- Consumer Price Index (CPI) (YoY) (June): 2.5%, (pre: 2.9%).

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (August): 2.7% (pre: 2.6%);;

- The price index of personal consumption expenditures (YoY) (July): 2.2%, (pre: 2.5%).

INFLATION EXPECTATIONS

- 12-month expected inflation (September): 2.7%, (pre: 2.7%);

- 5-year expected inflation (September): 3.1% (pre: 3.1%).

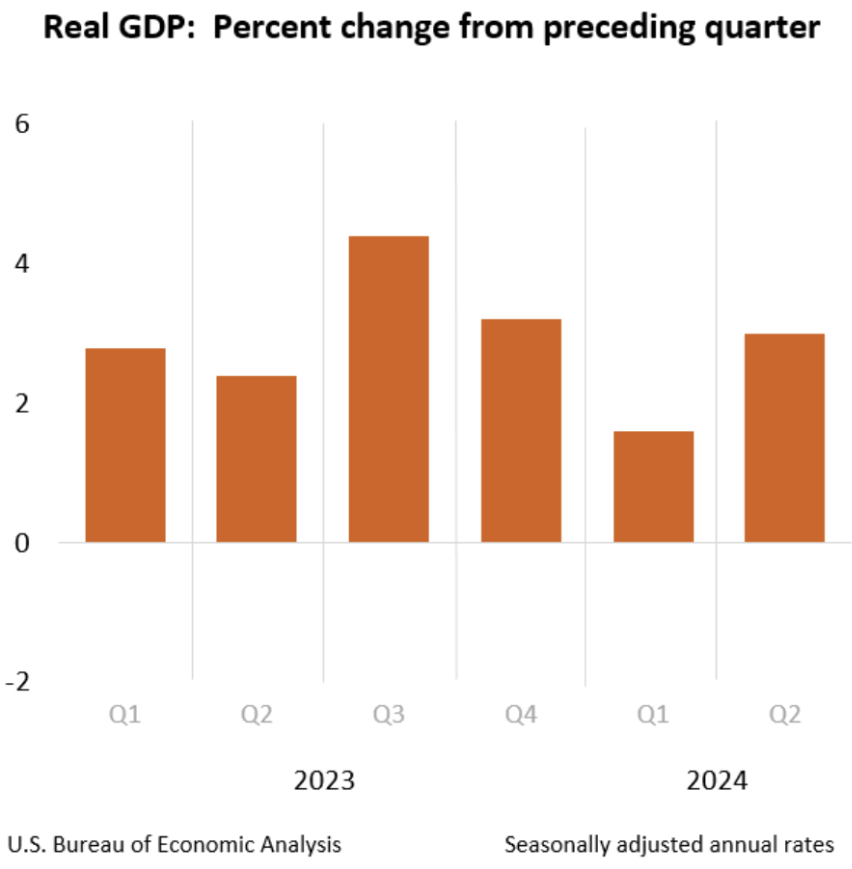

GDP (q/q) (2Q, third estimate): 3.0% (pre: 1.6% revised), GDP Deflator (q/q) (3Q): 2.5% (pre: 3.0% revised).

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): (June): 55.4 (pre: 55.7);

- Manufacturing sector (September): 47.0 (pre: 47.9 revised).

- S&P Global Composite (September): 54.4 (pre: 54.6 revised)

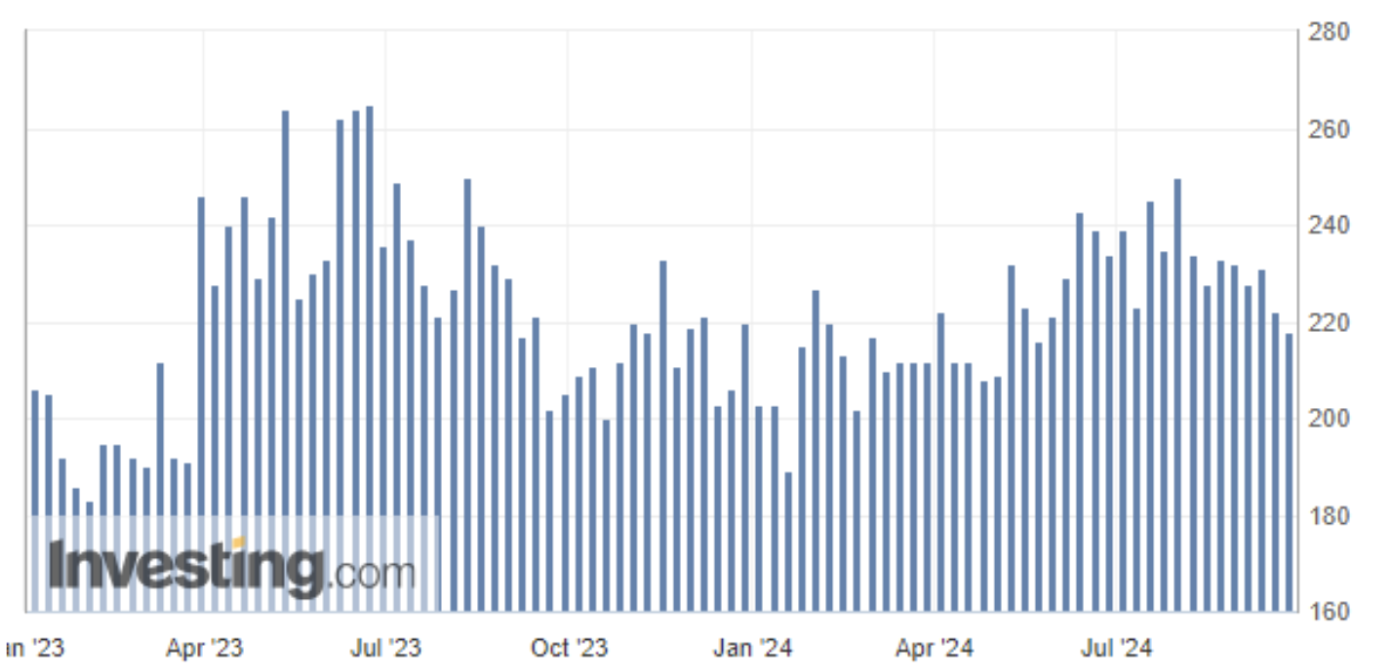

LABOR MARKET

- Unemployment rate (August): 4.2% (pre: 4.3%);

- Non-farm Payrolls (August): 142K (pre: 89K revised);

- Change in non-farm private sector employment (August): 118K (pre: 74K revised);

- Average hourly earnings (August, YoY): 3.8% (pre: 3.3%);

- Number of initial applications for unemployment benefits: 218K (pre: 222K, revised).

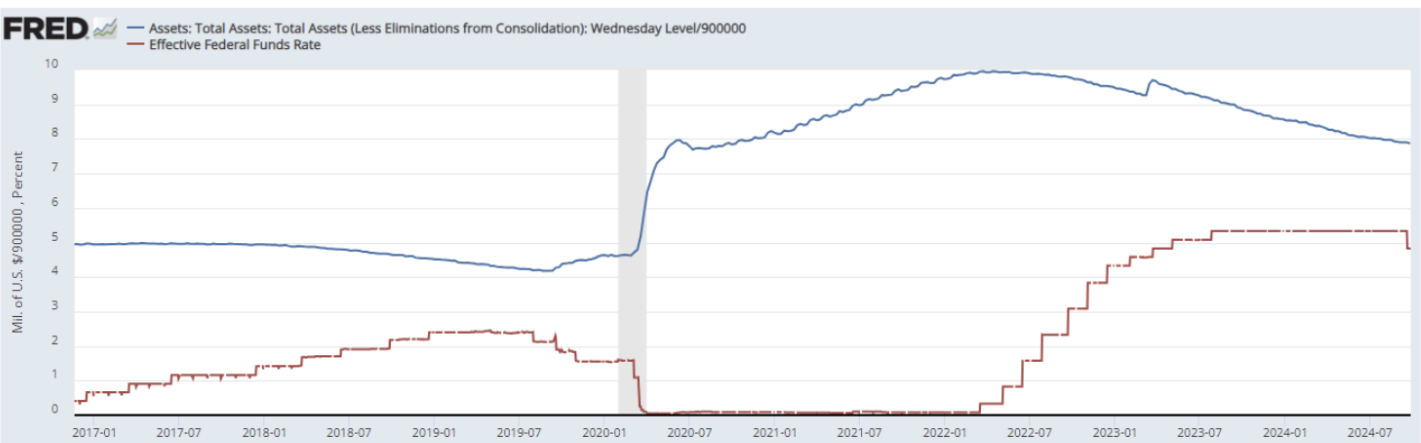

MONETARY POLICY

- Federal Funds Rate (EFFR) — 4.75% — 5.00% (in red);

- Fed Balance Sheet (in blue): $7.080 trillion (vs. last week: $7.109 trillion).

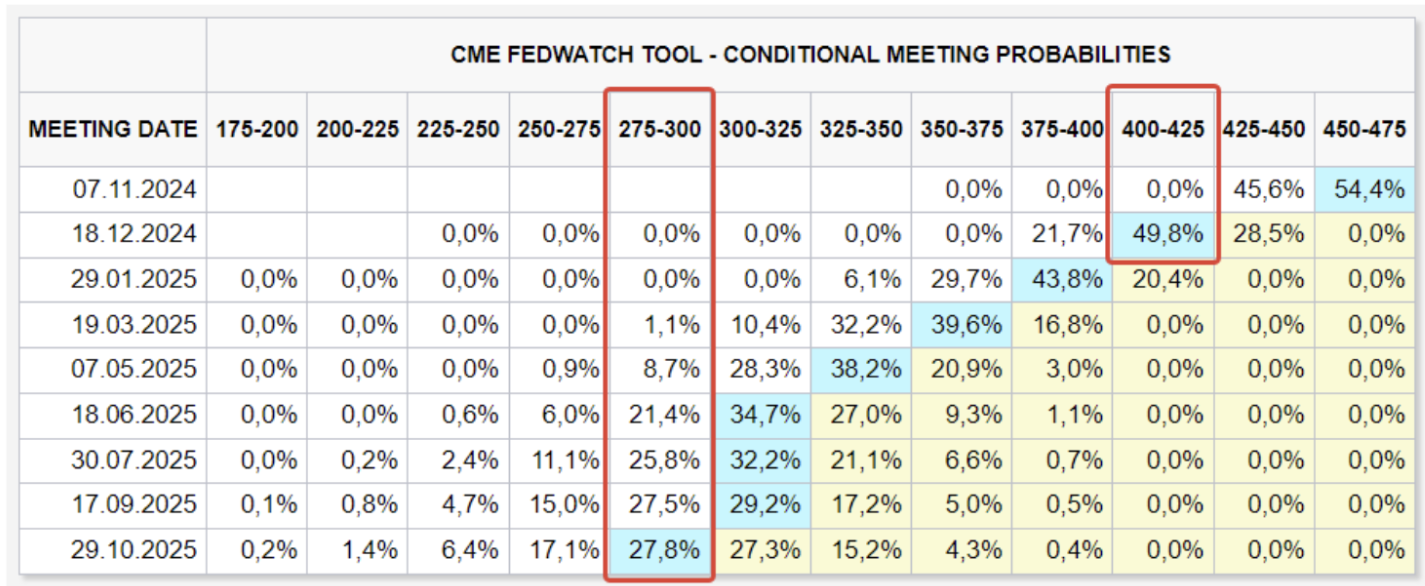

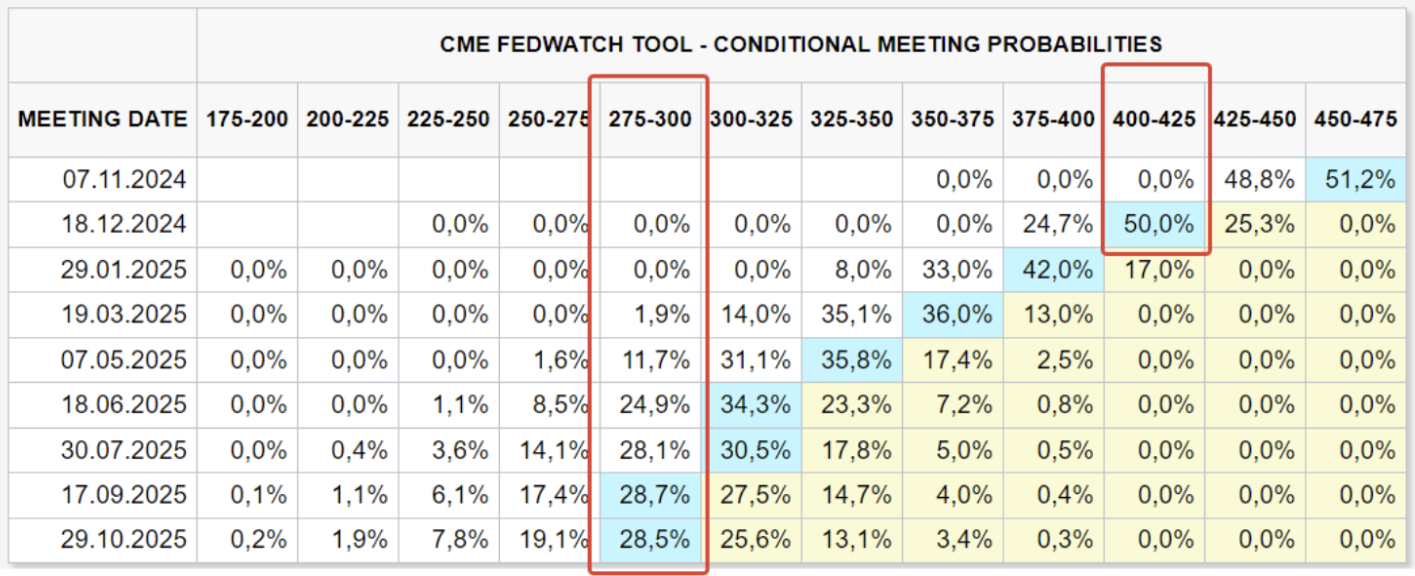

MARKET FORECAST FOR RATE

Today:

A week earlier:

COMMENTARY

Inflation expectations (calculated by the University of Michigan) remained unchanged in September: 2.7% (1 year ahead) and 3.1% (5 years ahead). The Fed's inflation target (PCE indexes) fell month-over-month to 0.1% for both indexes. Year-over-year, the volatile PCE dropped to 2.2%, while core PCE increased by one-tenth to 2.7%.

The gross domestic product (GDP), based on the third estimate, grew by 3.0%, compared to 1.6% in the first quarter. The GDP deflator (GDP price index) fell as expected to 2.5% from 3.0%. GDP growth in the second quarter mainly reflected an increase in consumer spending (with strong demand for durable goods), as well as inventory and business investments. Imports, which are subtracted in the GDP calculation, increased.

PMI business activity indexes for September indicated a continued slowdown in the manufacturing sector. However, the services sector remains strong based on the PMI index.

Summing up the statistical data, it can be said that the U.S. economy continued to expand in the second quarter, primarily driven by the services sector. Consumer spending remains high, with no increase in inflation expectations and moderate figures for the Fed's inflation targets.

The Fed Board members' rhetoric last week had a dovish tone: in summary, there is progress in the fight against inflation, risks are shifting towards the labor market, and a recession is unlikely.

This situation allows the regulator to continue the rate-cutting cycle— the question is, at what speed? In our opinion, there's no need to rush.

According to the FedWatch tool, the outlook remains unchanged: a 0.75% chance of a rate cut by the end of the year (0.25% in November and 0.50% in December), bringing the rate to a range of 3.75%-4.00%. In 12 months, a reduction of 2.00% is expected, to a range of 2.75%-3.00%.

MARKET

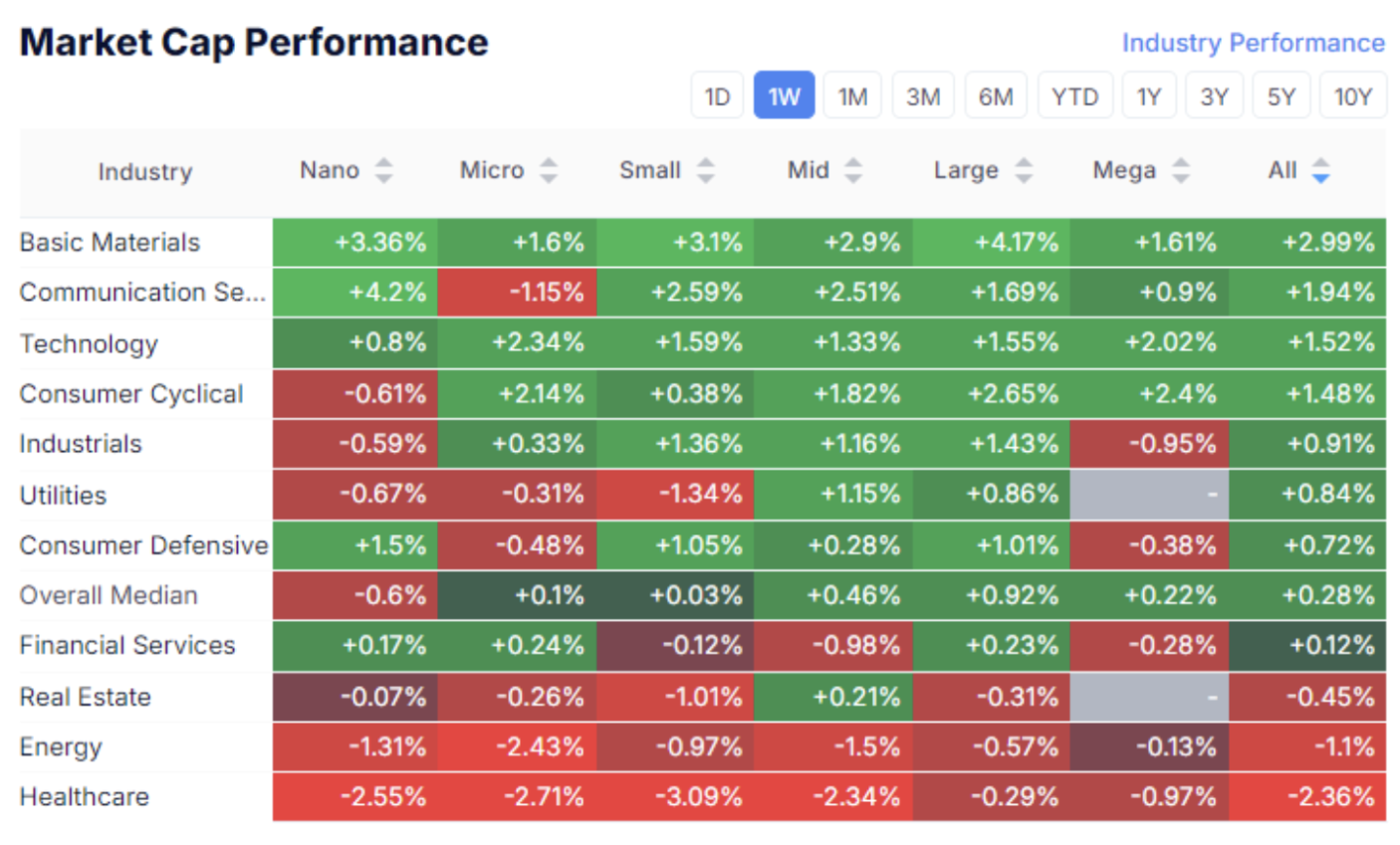

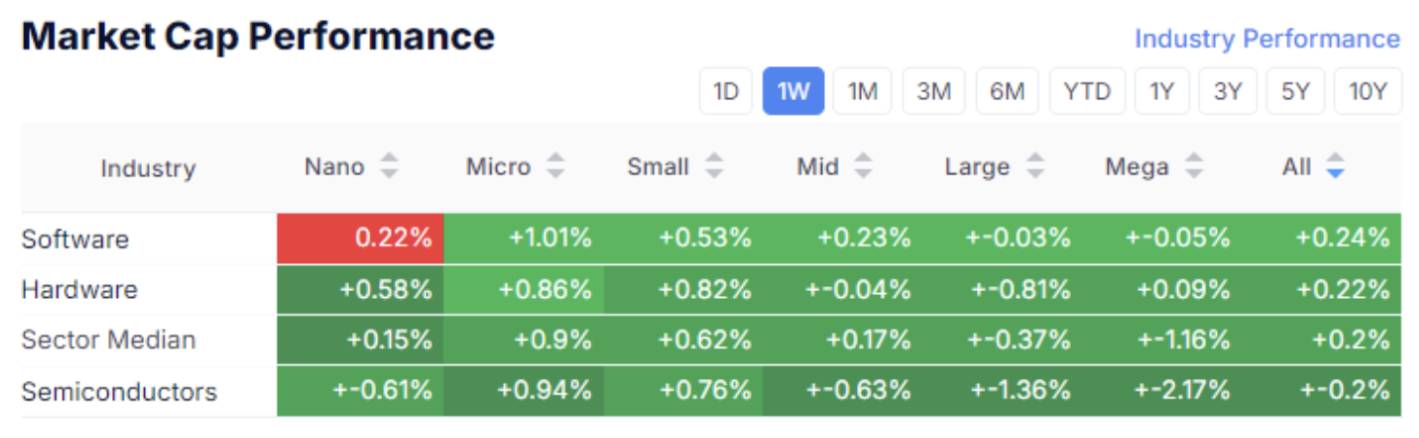

MARKET CAP PERFORMANCE

The stock market:

Technology sector:

Markets were mixed last week, but risk appetite remained. Median stock market growth was 0.22%. The strongest demand was in basic materials, technology, communication services, and the consumer cyclical sector.

SP500

VIX

The S&P 500 index rose by 0.47% over the week, once again setting an all-time intraday high of 5767. Meanwhile, the "Volatility Index" VIX showed an increase to 17.22 in the last three days of the trading week, indicating some market uncertainty.

The price range of 5650-70 for the S&P 500 will continue to act as a support level.

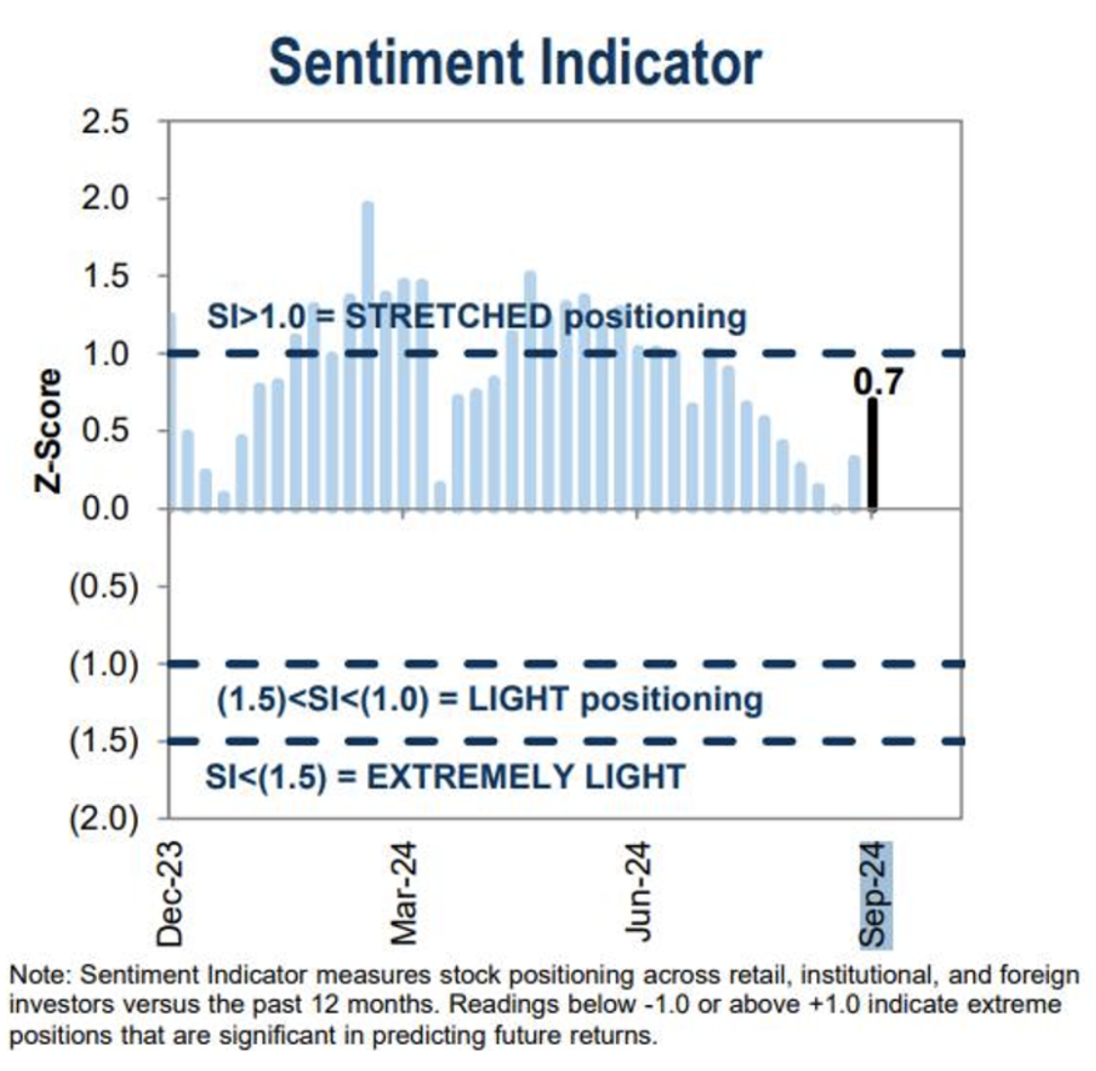

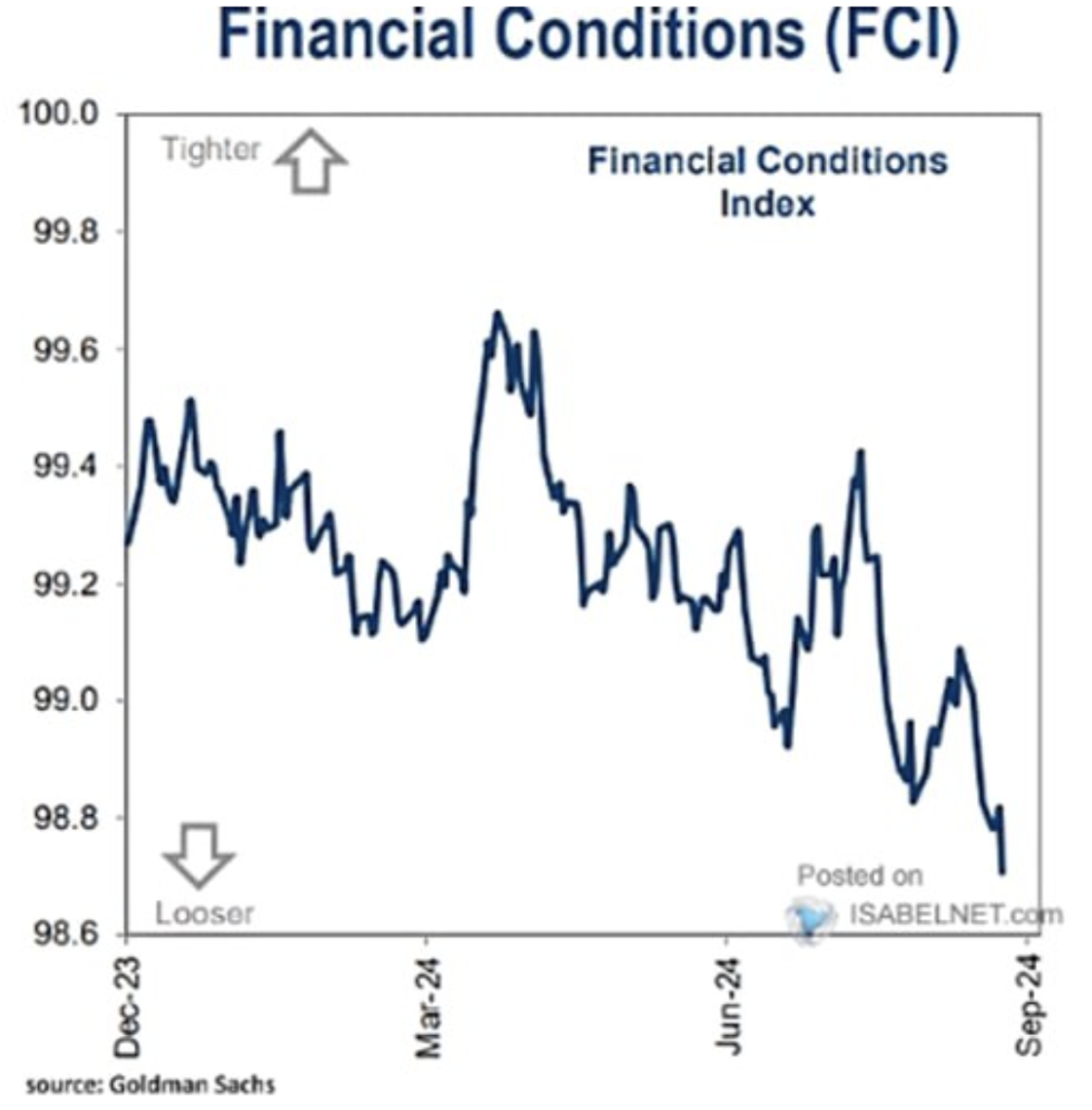

The sentiment indicator for the U.S. stock market from Goldman Sachs significantly rose in September, reflecting improved sentiment after the rate cuts began. The Financial Conditions Index (FCI), also calculated by Goldman Sachs, shows continued improvement in business conditions since March of this year.

The Fed’s rhetoric and current macroeconomic statistics favor demand for risky assets.

TREASURY MARKET

Treasury Bonds UST10:

10-year treasuries showed no growth since the last Fed meeting, which is paradoxical amid a rate-cutting cycle. Today, the probability of bond growth is high, considering FedWatch expectations and the Fed's rhetoric. However, if yields do not decline, it means the bond market is sensing risks, most likely related to a second wave of inflation.

Yields:

The market yield of U.S. Treasury securities with a constant 10-year maturity (red line) is 3.79%. The yield of the corporate index with a BBB rating (blue line) is 4.95%. Compared to last week, the spread between them has not changed and is 1.17%.

DXY

The dollar index against major currencies (DXY) broke through the resistance level of 100. The short-term forecast remains bearish, but the 99 level will serve as strong support if the Fed slows down the rate-cutting pace.

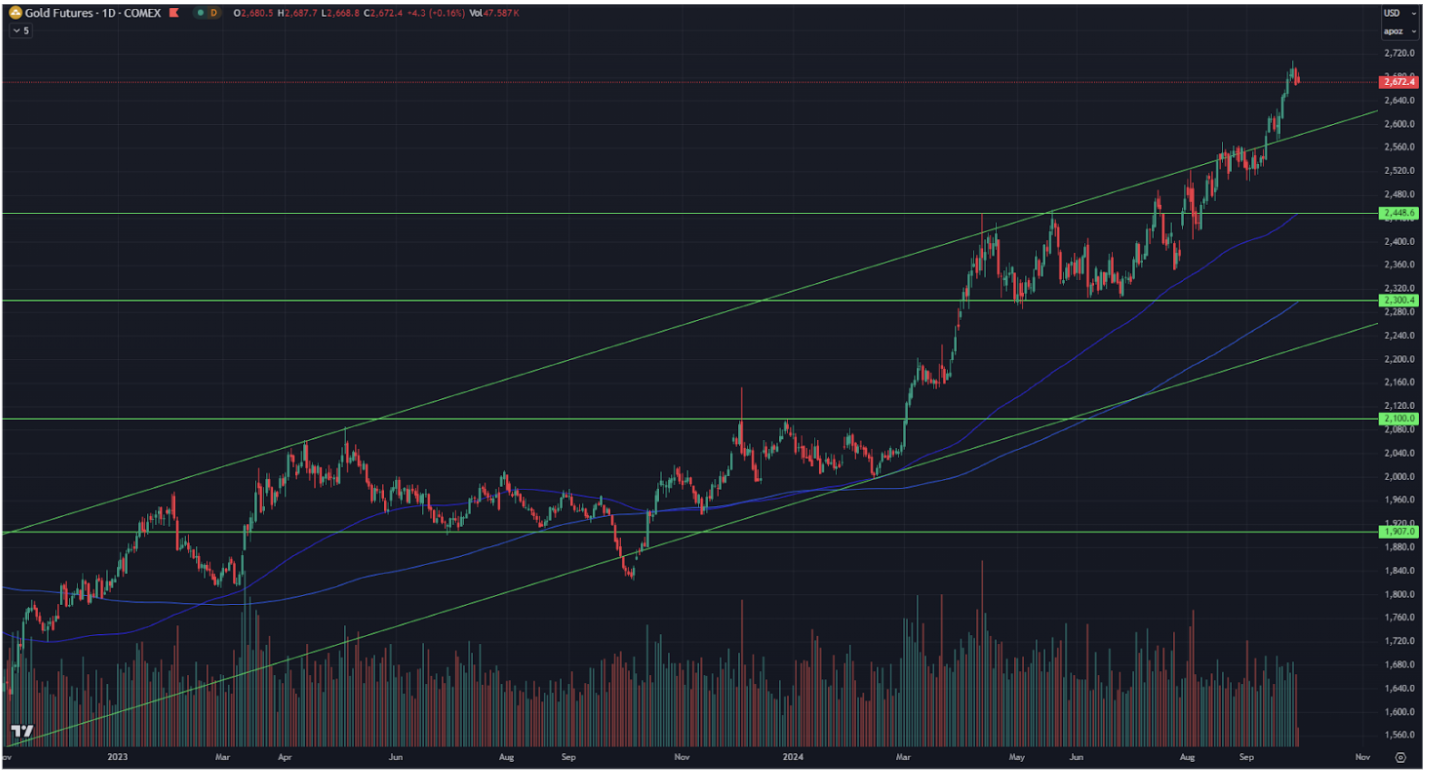

GOLD

Gold continues to show strong demand as a safe-haven asset (due to geopolitics, the slowdown in the global economy, and, of course, inflation risks). The yellow metal set a new high of $2,708 per troy ounce.

BTC

The price of the first cryptocurrency has pulled back from the upper boundary of the channel, which often happens from a technical analysis perspective. However, demand remains strong, with growth for September reaching 17%.

Summary:

On one hand, financial conditions continue to ease, and favorable GDP and PCE index data support the demand for risky assets. On the other hand, rising bond yields and increasing gold prices indicate market uncertainty.

Қазақша

Қазақша