Why Rubrik's IPO will transform the cybersecurity industry

Rubrik is attractive to investors based on its high customer base growth rates and the industry's long-term prospects.

Rubrics is attractive to investors based on its high customer base growth rates and industry long-term prospects. The company is developing steadily but suffers significant operating losses. We expect high stock volatility during the company's earnings release period.

Rubrik, Inc. (RBRK) — offers a unique and specially designed zero-trust approach to data security that helps organizations achieve business resilience against cyberattacks, malicious insiders, and disruptions.

Company's products:

- Data Protection;

- Data Threat Analytics;

- Data security provision;

- Cyber recovery.

Products are delivered and consumed through its zero-trust platform, Rubrik Security Cloud (RSC). The platform provides full cyber-resilience of data in enterprise, cloud, and SaaS applications, including:

Corporate: VMware, Microsoft Hyper-V, Microsoft SQL Server, Oracle, Microsoft Windows, Nutanix, Kubernetes, Cassandra, MongoDB, Linux, UNIX, AIX, NAS, Epic and SAP HANA;

Cloud/SaaS: GCP, Azure, AWS, M365 (Microsoft Teams, SharePoint, Exchange Online and OneDrive) and Atlassian Jira Cloud.

Rubrik Zero Labs is an internal data security research laboratory that analyzes the global threat picture and reports on emerging data security issues.

Customers and sales strategy:

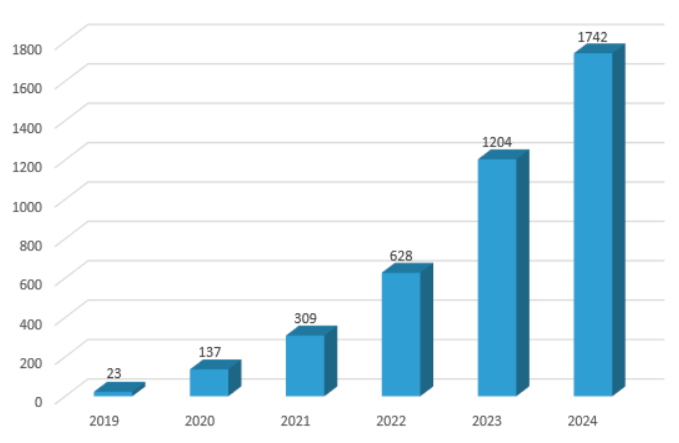

The platform's broad applicability allows the company to serve organizations of any size in a wide variety of industries and regions. As of January 31, 2024, Rubrik had over 6,100 customers, compared to over 5,000 customers as of January 31, 2023. RSS subscriptions are sold through a global sales team and an affiliate network. As of January 31, 2024, the sales and marketing departments employed more than 1,300 employees. The company also offers SaaS products through the trading platforms of its technology alliance partners, including GCP, Azure, and AWS.

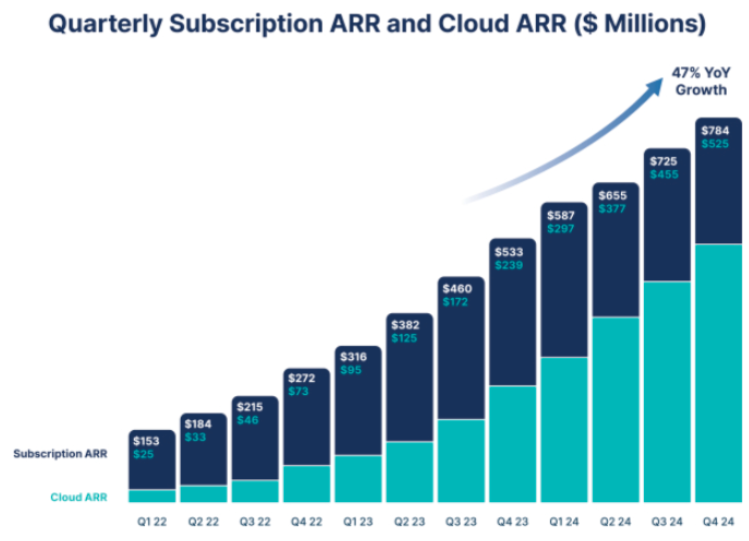

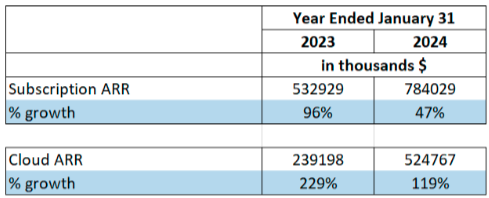

Key business indicators

The company has demonstrated success in attracting new subscription customers, as well as maintaining and expanding relationships with existing customers:

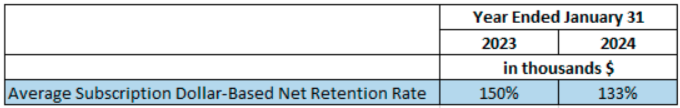

Rubrik stands out as one of the highest performers in the technology sector regarding net subscription retention rate in dollars, equal to 133% as of January 2024.

The high growth rate of the number of customers with an ARR subscription of $100,000 or more is a good indicator of the company's rapid market penetration and demand for its products:

IPO

Investor demand for the IPO was high — the listing was oversubscribed 20 times. The revenues from the initial placement amounted to more than $750 million, which allowed the company to strengthen its financial health well. After the IPO, the company has $880 million in cash on its balance sheet and more than $1 billion, taking into account short-term investments. Thus, the Runway's operating expenses amounted to more than 3 years.

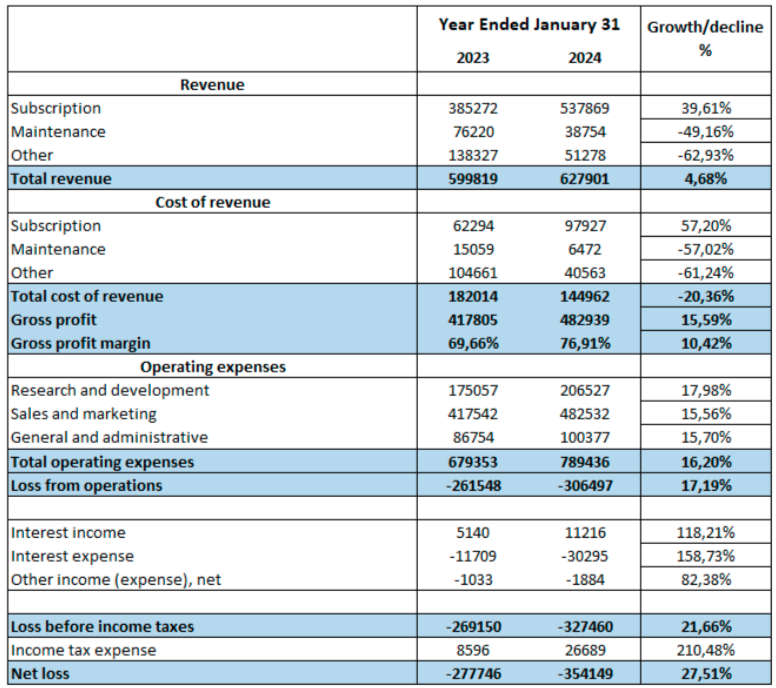

Financial indicators

- The company is not profitable yet, but given the accelerating industry trends, the company has every chance to make a solid profit in the future;

- The gross profit margin remains at a good level of 77%;

- Operating expenses have increased by 17% over the past year. Most of the cost increase was related to employee compensation, due to the rise in the number of employees as the company continued to release new products. This factor reflects the company's development efforts. However, cost control will be necessary for management in future activities, as shareholders must see a path to profitability.

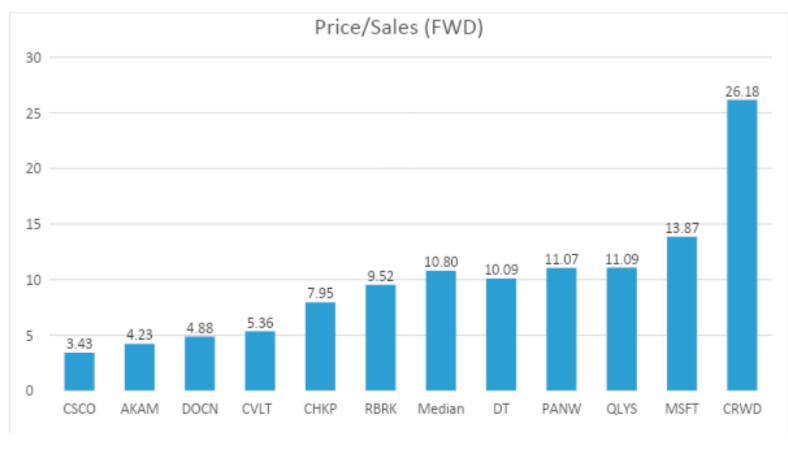

Evaluation

According to the P/S sales multiplier, the company (9.52) is estimated to be slightly below the median of the software sector (10.80). Similar companies (data protection) — CVLT and CRWD have P/S indicators – 5.36 and 26.18, respectively.

Industry trends and opportunities

-

The company's management believes that the total potential market opportunities for the RSC platform will amount to approximately $36.3 billion by the end of calendar year 2024 and roughly $52.9 billion by the end of calendar year 2027, based on market estimates from Gartner® research, which is an average 13% annual average growth rate;

-

Data security. According to a study conducted by Netskope, the surveyed enterprises have, on average, more than 1,000 cloud services. This indicates that more data is being created, transmitted, and used than ever in an ever-expanding enterprise, cloud, and SaaS application network. As a result, organizations need more visibility and control over where their data is located, how it is used, and who uses it.

-

IDC forecasts that more than 291 zettabytes of data will be generated in 2027, representing an average annual growth rate of 22.5% from 2023 to 2027. According to forecasts, in 2024, revenue in the data security market will reach US$6.86 billion. The annual revenue growth rate (CAGR in 2024-2028) is expected to be 13.01%, resulting in a market volume of $11.19 billion by 2028. Source: statista.com .

-

Compliance requirements for confidential data and user access are constantly evolving and multiplying. Rules such as the EU GDPR and CCPA have increased the regulatory burden on organizations and made data compliance management increasingly expensive.;

-

According to Cybersecurity Ventures, the frequency of ransomware attacks will continue to increase over the next eight years and will reach every two seconds by 2031.

Intellectual property.

As of January 31, 2024, the company had 255 patents granted in the United States and patents in various jurisdictions outside the United States, 207 patent applications pending in the United States;

Risks

- The main risk of the company is the rapidly growing competition.

Recent events

-

Rubrik receives the Global InfoSec Award at the RSA Conference for the fourth year in a row;

-

Kyndryl and Rubrik announce the creation of a global strategic alliance offering recovery after cyber incidents;

-

Healthcare organizations lose 20% of their confidential data with each ransomware attack, Rubrik Zero Labs reports;

-

Rubrik Threat Hunting is now available in Rubrik Security Cloud.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities.”

Қазақша

Қазақша