August 12 — August 16: Weekly economic update

Key market insights

In our weekly column, we share with you the main macroeconomic indicators for the market.

MACROECONOMIC STATISTICS

INFLATION

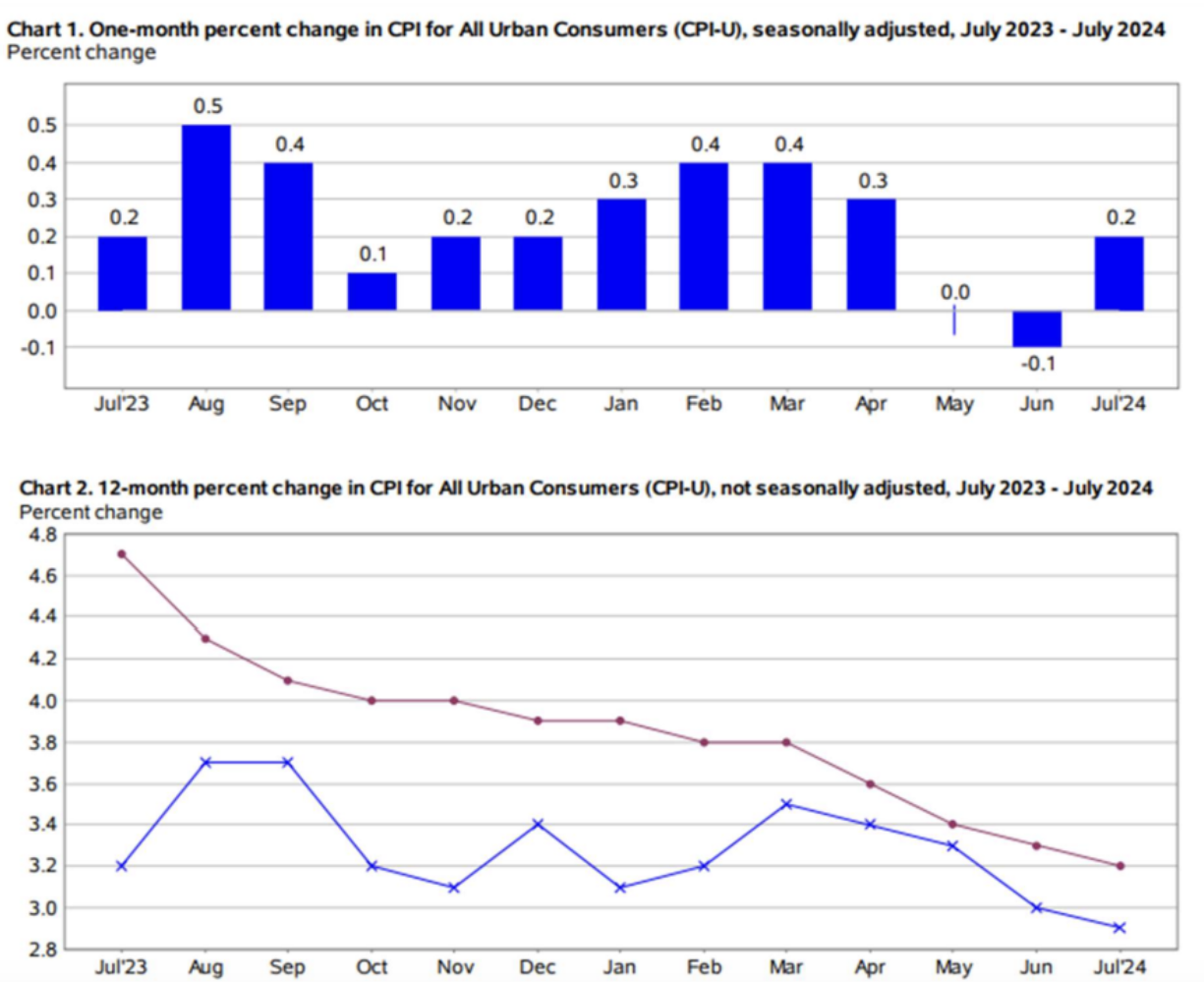

- Core Consumer Price Index (CPI) (YoY) (June): 3.2% (previous: 3.3%)

- Consumer Price Index (CPI) (YoY) (June): 2.9% (previous: 3.0%)

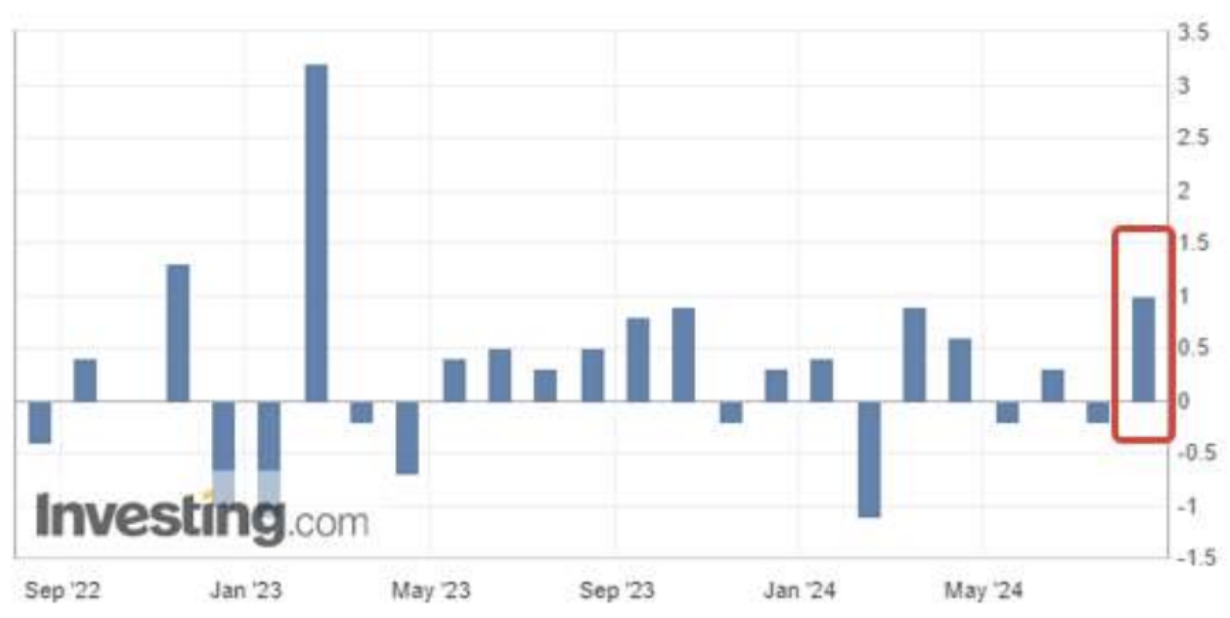

Retail Sales in the US (MoM) (July): 1.0% (previous: -0.2%).

THE FED'S INFLATION TARGET

- Basic price index of personal consumption expenditure PCE (YoY) (June): 2.63% (previous: 2.62%)

- Price index of personal consumption expenditures (YoY) (May): 2.51% (previous: 2.6%)

INFLATION EXPECTATIONS

- 12-month expected inflation (June): 2.9%, (pre: 2.9%);

- 3-year expected inflation (June): 2.33%, (pre: 2.9%);

- 5-year expected inflation (June): 3.0% (pre: 3.0%).

GDP (q/q) (2Q preliminary estimate)

- Growth: 2.8% (previous: 1.4%)

- GDP deflator (q/q) (1Q): 2.3% (previous: 3.1%)

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 56.0 (previous: 55.3)

- Manufacturing sector (June): 51.4 (pre: 49.5, review)

- S&P Global Composite (June): 55.0 (pre: 54.8).

LABOR MARKET

- Unemployment rate (April): 4.3%, (pre: 4.1%);

- Change in private non-agricultural employment (June): 97K, (pre: 136K);

- Average hourly earnings (June, YoY): 3.6%, (pre: 3.8%);

- Initial applications for unemployment benefits: 227K, (pre: 233K)

MONETARY POLICY

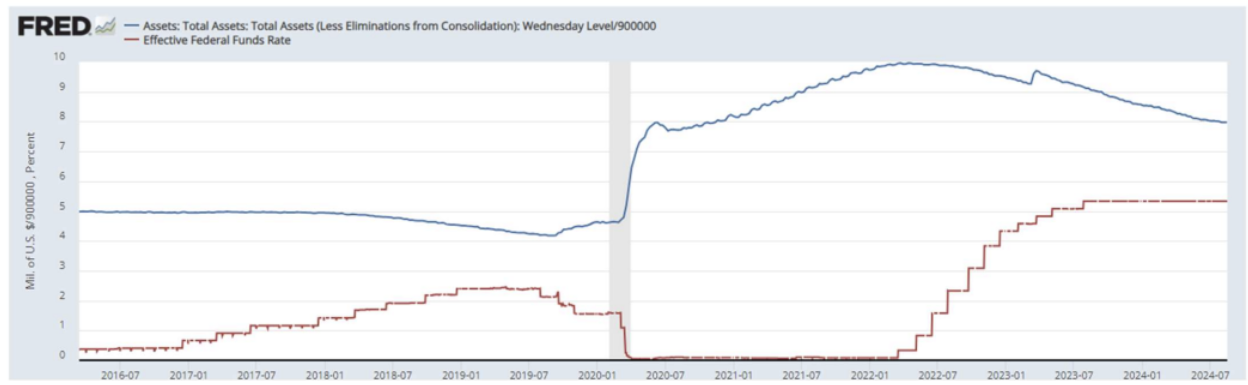

- Federal Funds Rate (EFFR) — 5.50% (in red line)

- Federal Reserve balance sheet continues to decline at a slower pace: $7.177 trillion, (pre: $7.175 trillion)

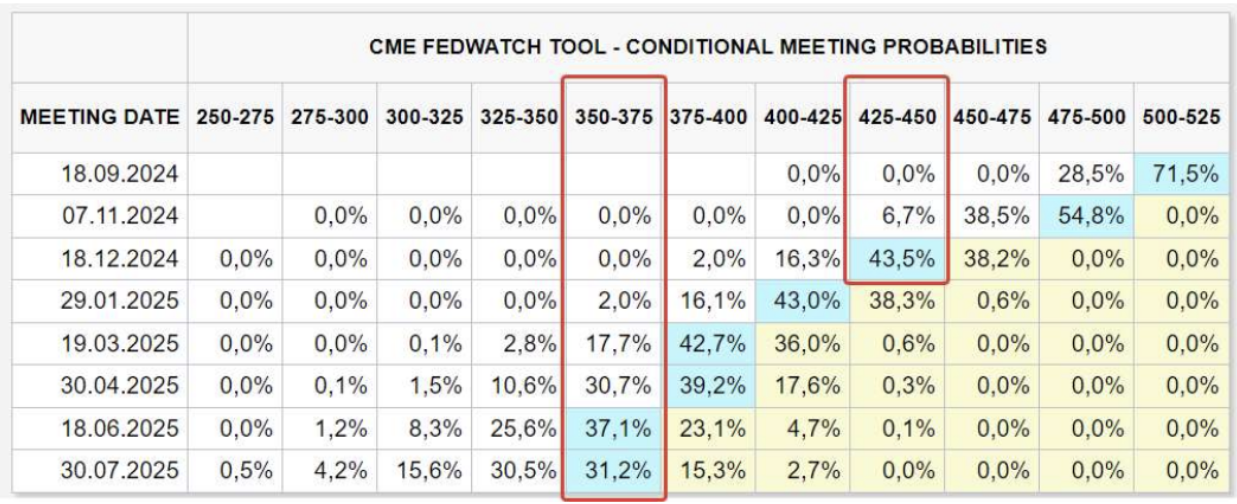

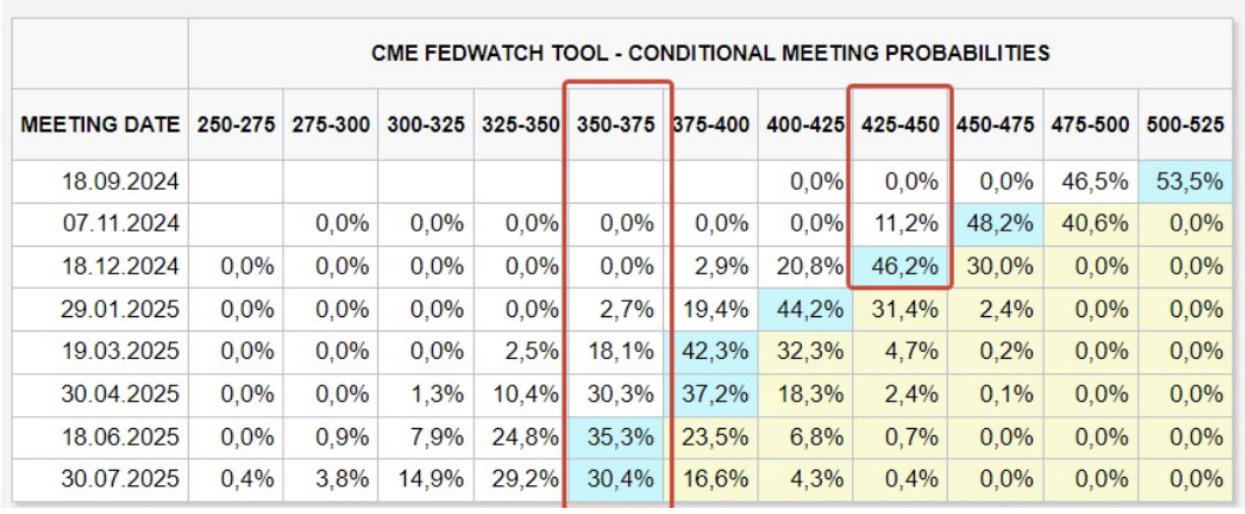

MARKET FORECAST RATE

Today:

A week ago:

COMMENTARY

- From month to month (MoM), the Consumer Price Index (CPI) grew by +0.2% from the previous deflationary figure of -0.1%.

- Consumer inflation data (YoY) came out as expected, decreasing by 0.1% to 3.2% for core CPI and to 2.9% from 3.0% for overall CPI (including food and energy components).

- Despite the monthly increase, the Consumer Price Index continues to trend downward. Moreover, three-year inflation expectations have significantly dropped to 2.33% from 2.9%.

- Retail sales in the US were the key data of the week, which, excluding inflation, grew by 1% in July after the previous decline of -0.2%.

- The growth in retail sales indicates robust consumer spending.

- Vital retail sales data in the US and positive results from Walmart's report (with optimistic forecasts) positively influenced market sentiment, suggesting that the US economy is avoiding a recession and achieving a “soft landing”. This was the central narrative of last week.

- However, consumer spending should be expected to slow as the labor market continues to cool down.

- This sets the stage for the Fed to move towards cutting interest rates next month.

- Atlanta Fed President Raphael Bostic, a voting member of the central bank's rate-setting committee, stated last week that he is “open” to a rate cut in September, emphasizing that the Fed cannot afford to be “late” in easing monetary policy amid signs of a cooling labor market.

- FedWatch guidance remained unchanged: a 1% rate cut by the end of the year to the range of 4.25–4.50%, with a 12-month outlook of a cut to 3.50–3.75%.

MARKET

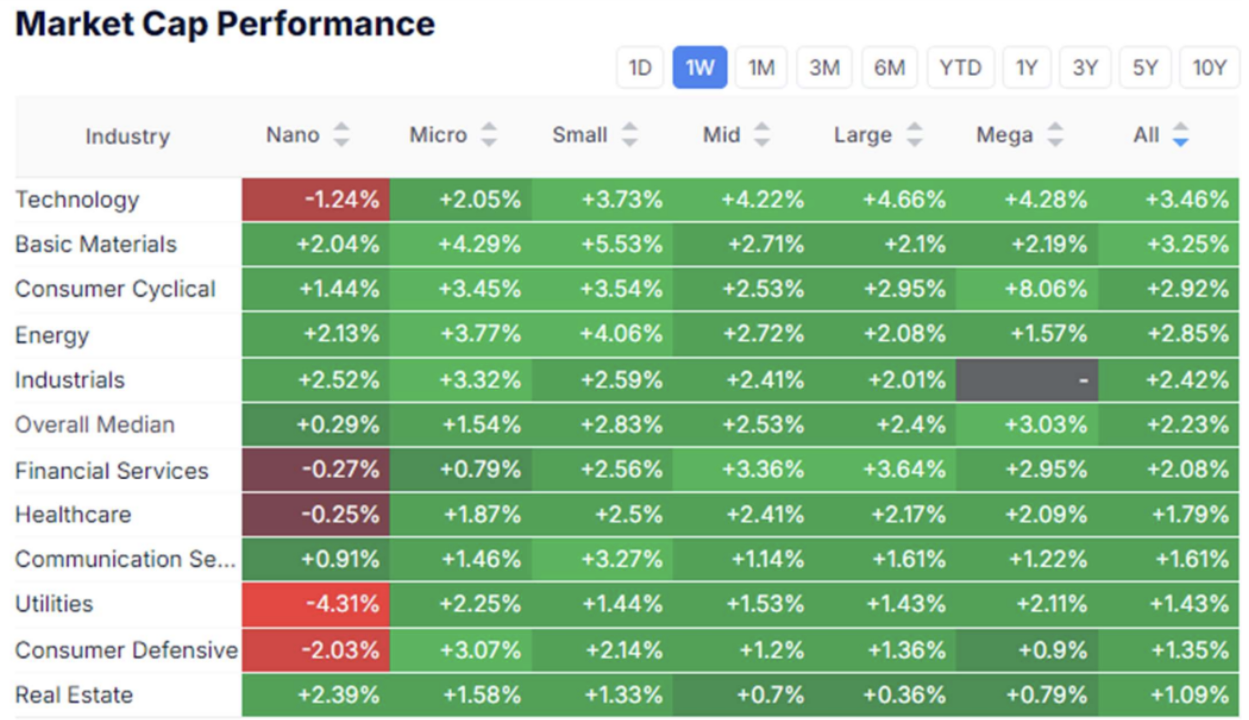

MARKET CAP PERFORMANCE

The stock market:

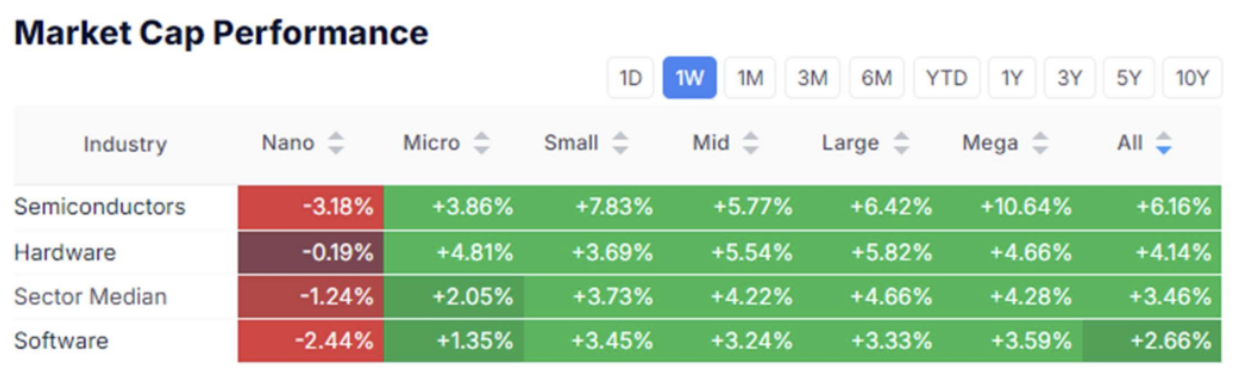

Technology sector:

The US stock market median rose by 2.23%. The leaders were the technology sector, basic materials sector, and importantly, the cyclical consumer sector, indicating a rise in risk appetite. Notably, almost all companies were bought up, including those with micro and small capitalizations, indicating that the index's growth is broad-based and not just driven by the “magnificent 7” tech giants. Defensive sectors showed lower returns amid rising risk appetite. The technology sector saw high demand for semiconductor manufacturers – with a growth of over 10% for the week, the median growth of the entire technology sector was 3.5%.

SP500

Vix

The SP500 index quickly returned to the boundaries of the upward channel. The growth from last week's low was 7.8%, with last week's growth being a substantial 3.7%! This indicates heightened market emotionality due to the latest economic data showing the economy's strength and its subsequent “soft landing.” The index needs to rise only 1.92% to reach a historic peak. The fear index Vix fell to a calm level below 16, indicating the return of risk sentiment to the market.

TREASURY MARKET

The price of long-term bond futures is making its third retest of an important resistance level, which is positive from a technical analysis perspective. Fundamentally, the trend remains upward – the rate is likely to be cut, but the further indicator of sentiment will, of course, be the forecasts and rhetoric of the Fed at the September meeting – the market will particularly try to understand the dynamics of the rate cut.

GOLD

Gold continues its upward movement – today the price reached a historic high of $2550 per troy ounce, thanks to the weakening dollar and the expected monetary policy direction. There is also a price test of the upper boundary of the upward channel. Some correction in gold is possible, but long-term growth triggers remain.

SUMMARY

A Fed rate cut in September is the priority scenario. Recession fears, which triggered a sell-off earlier this month, have been nullified. The markets are now Risk ON. Investors are focused on Fed Chairman Jerome Powell's speech on economic prospects at Jackson Hole on August 23.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша