August 19 — August 23: Weekly economic update

Key market insights

In our weekly column, we share with you the main macroeconomic indicators for the market.

MACROECONOMIC STATISTICS

INFLATION

- Core Consumer Price Index (CPI) (YoY) (June): 3.2%, (pre: 3.3%)

- Consumer Price Index (CPI) (YoY) (June): 2.9%, (pre: 3.0%);

THE FED'S INFLATION TARGET

- Core price index of personal consumption expenditure PCE (YoY) (June): 2.63% (pre: 2.62%);

- The price index of personal consumption expenditures (YoY) (May): 2,51%, (pre: 2,6%)

INFLATION EXPECTATIONS

- 12-month expected inflation (June): 2.9%, (pre: 2.9%);

- 3-year expected inflation (June): 2.33%, (pre: 2.9%);

- 5-year expected inflation (June): 3.0% (pre: 3.0%).

GDP (q/q) (2Q.) (preliminary estimate): 2.8% (pre: 1.4%), GDP deflator (q/q) (1 Q.): 2.3% (pre: 3.1%).

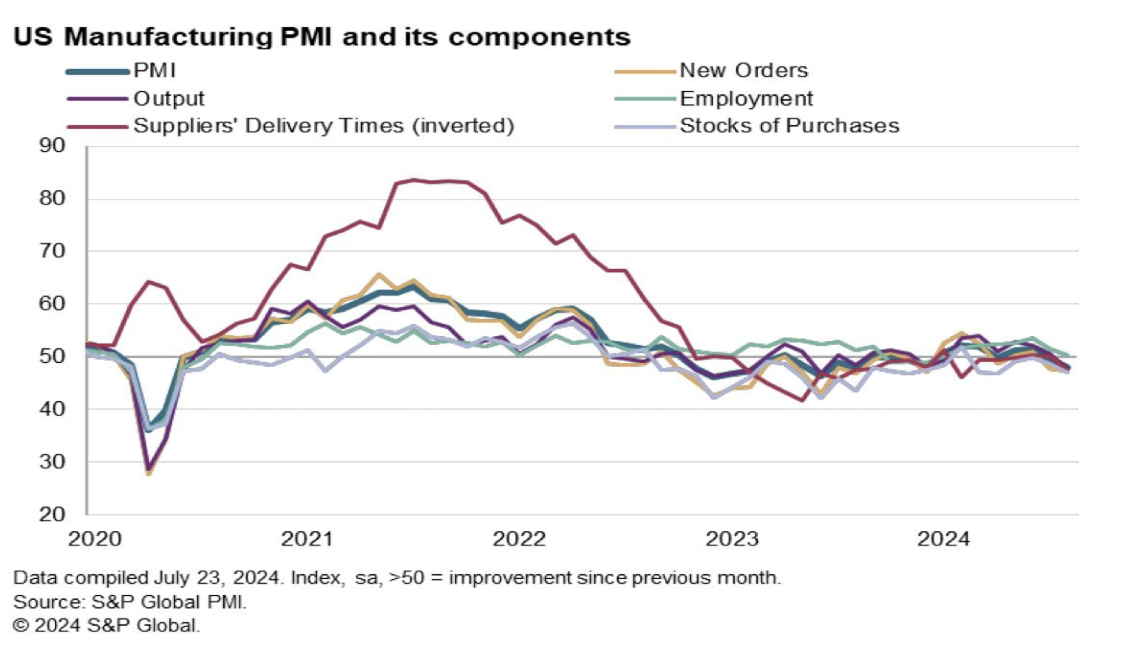

BUSINESS ACTIVITY INDEX (PMI)

- Services sector (June): 55.2 (pre: 55.0);

- Manufacturing sector (June): 48.0 (pre: 49.6, review).

- S&P Global Composite (June): 54.1 (pre: 54.3, review).

LABOR MARKET

- Unemployment rate (April): 4.3% (pre: 4.1%);

- Change in private non-agricultural employment (June): 97K, (pre: 136K);

- Average hourly earnings (June, YoY): 3.6%, (pre: 3.8%);

- Initial applications for unemployment benefits: 232K, (pre: 227K)

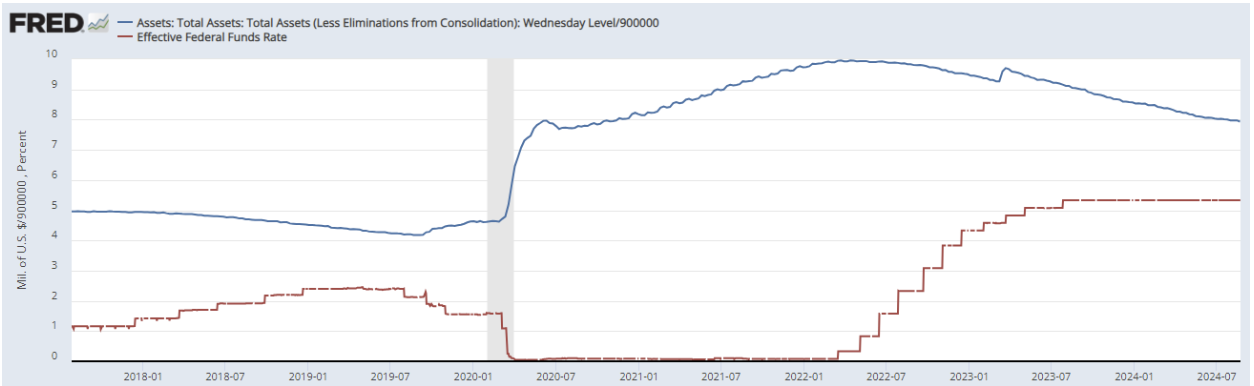

MONETARY POLICY

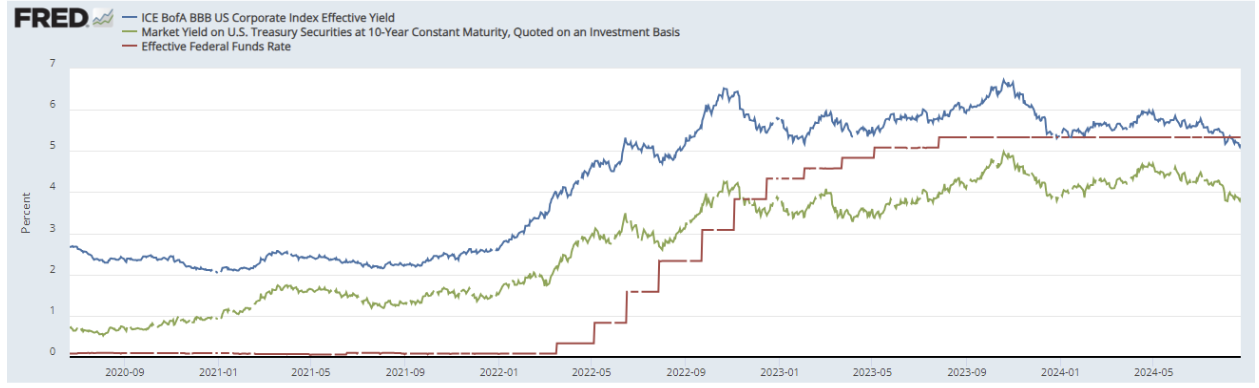

- Federal Funds Rate (EFFR) — 5.50% (in red line)

- Federal Reserve balance sheet continues to decline at a slower pace: $7.139 trillion, (pre: $7.177 trillion)

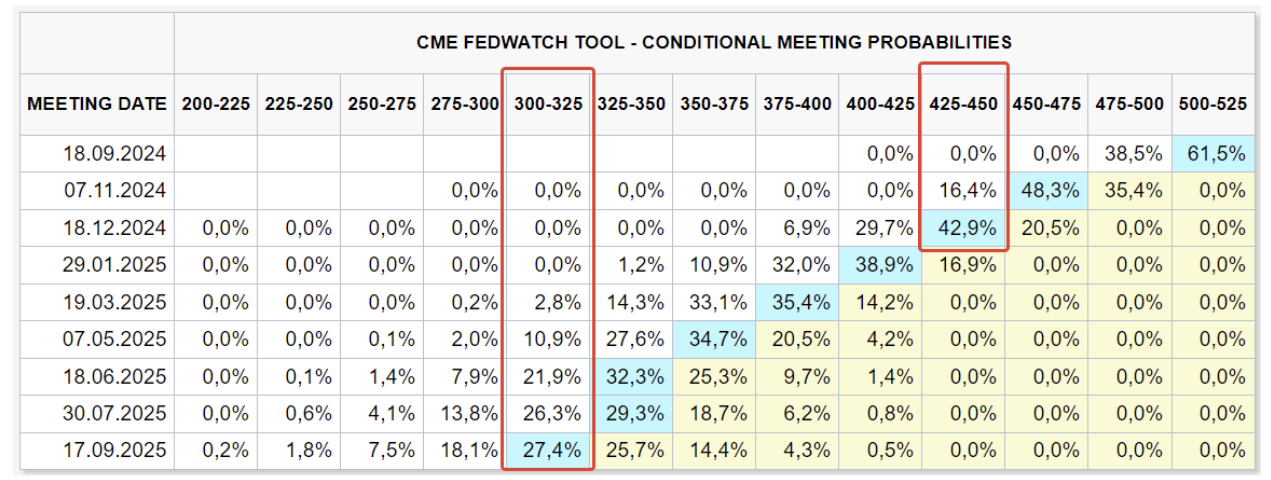

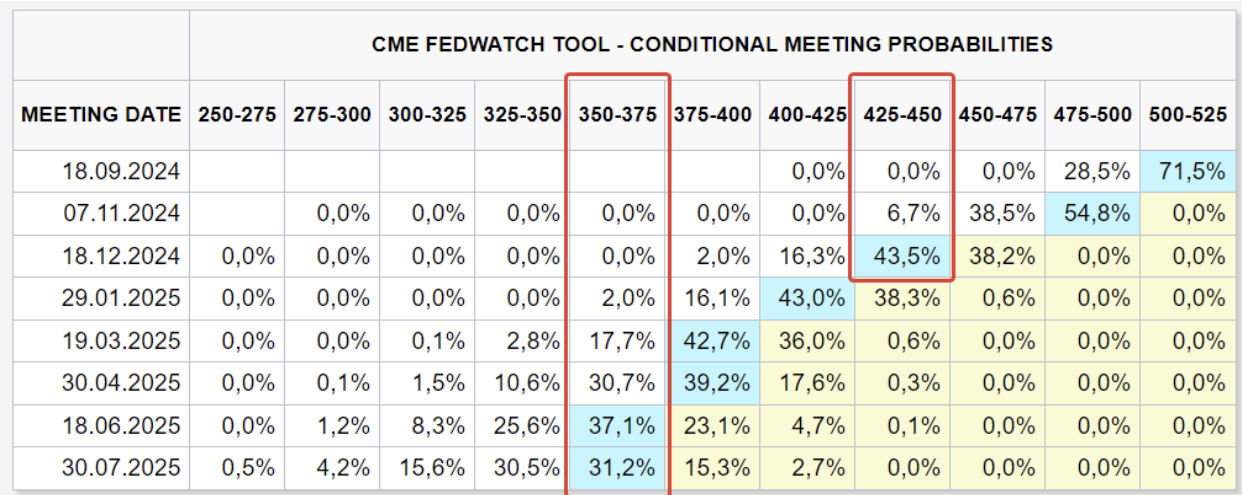

MARKET FORECAST RATE (FEDWATCH)

Today:

A week ago:

COMMENTARY

Powell's Speech at the Jackson Hole Symposium (Key Points):

- The labor market is cooling, indicating that the economy is not overheating;

- Inflation is moving towards the 2% target;

- Inflationary risks have decreased, but employment risks have increased;

- The Fed does not aim to further slow down the labor market;

- The main takeaway from the speech - it is time to adjust monetary policy. The pace of rate cuts will depend on incoming data.

Commentary:

- The business activity index in the US manufacturing sector (PMI) decreased from 49.6 in July to 48.0 in August, indicating worsening business conditions in the manufacturing sector. However, the services sector is still expanding.

- The US Bureau of Labor Statistics (BLS) revised labor market data. The revision of March 2024 statistics showed a decrease in employment by 818 thousand people.

- Interesting fact: Powell points to rising risks in the labor market, and the revised BLS data comes just in time, indicating that the labor market is not as strong as previous statistics suggested.

- The first rate cut is almost 100% likely to occur at the next meeting on September 18.

- FedWatch indicators: a 1% cut by the end of 2024 (range 4.25-4.50%) and a 2.25% cut (range 3.00-3.25%) over the next 12 months.

MARKET

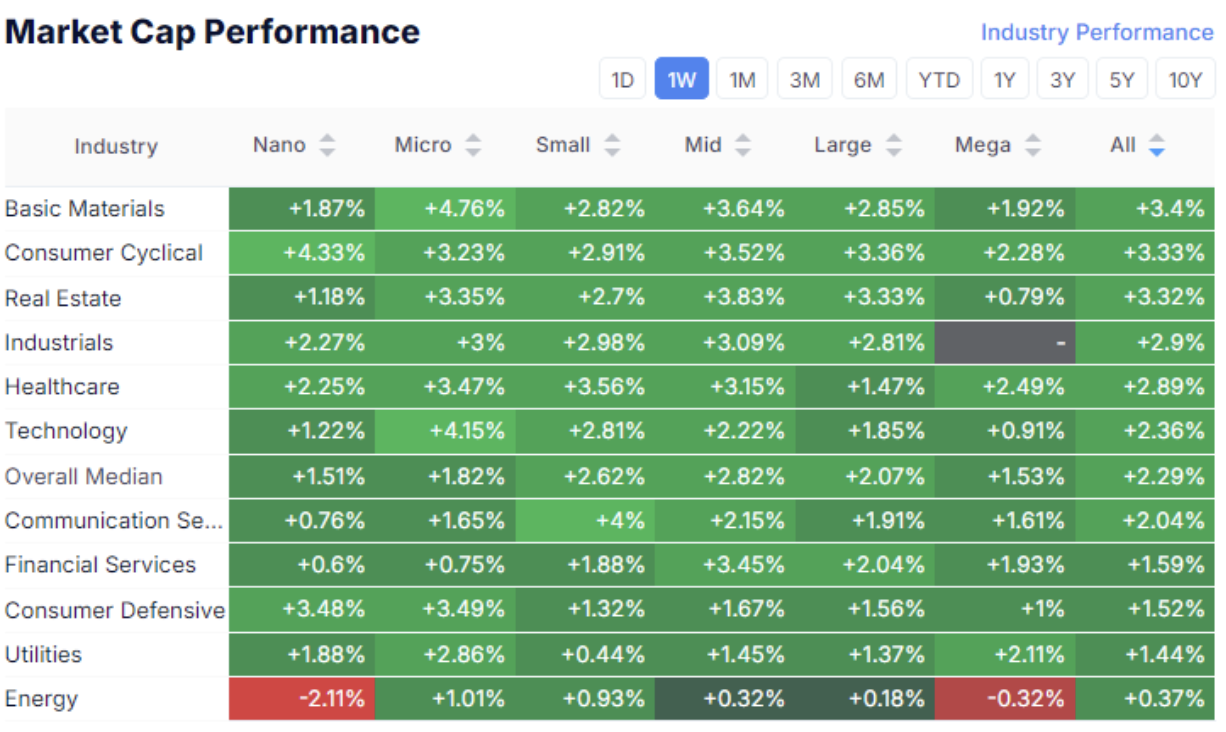

MARKET CAP PERFORMANCE

The stock market:

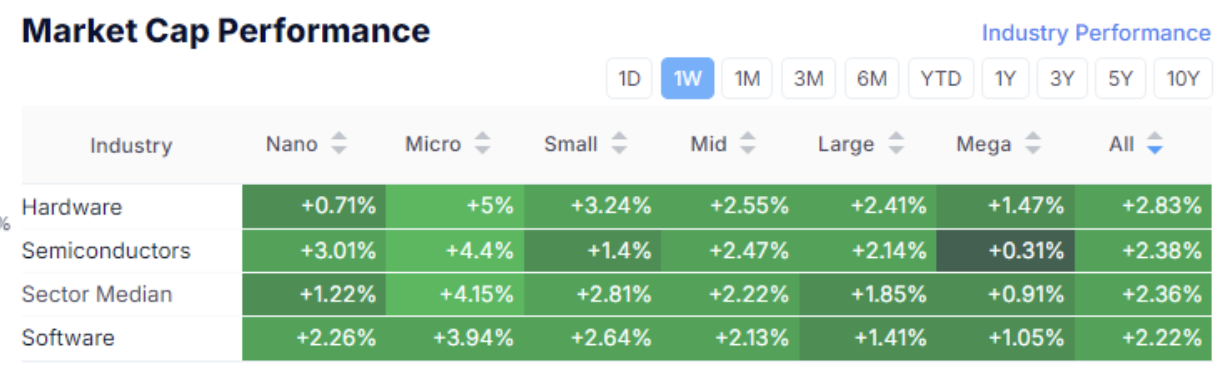

Technology sector:

The US stock market median increased by 1.53%. Leaders: basic materials sector, healthcare, cyclical consumer sector. Almost all companies were bought back, including micro and small capitalization – this indicates that the index's growth is being formed by the entire stock market.

SP500

Vix

The SP500 index quickly returned to historical highs, showing a V-shaped recovery. The entire 10% correction has been bought back, and only half a percent remains to reach the high. The VIX volatility index normalized after a strong spike and is consolidating at a calm level of 16. A signal to entering a bear market is the prolonged stay of the VIX at elevated levels, so a quick return to low levels indicates a lack of panic sentiment.

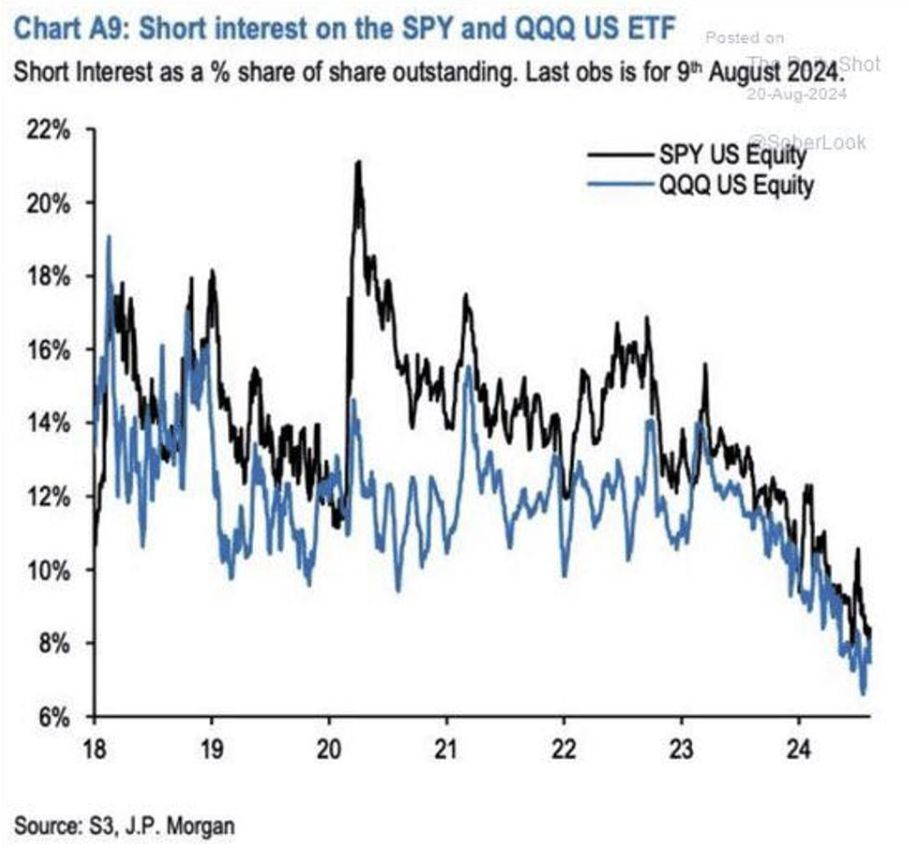

JP Morgan's short interest chart on SPY funds (ETF on SP500) and QQQ (a fund that invests exclusively in non-financial stocks listed on NASDAQ):

The chart shows a record low number of shorts since 2018, which reflects very bullish sentiment in the stock market. However, I should note that extreme values can indicate a potential trend reversal.

TREASURY MARKET

Treasury Bonds UST10:

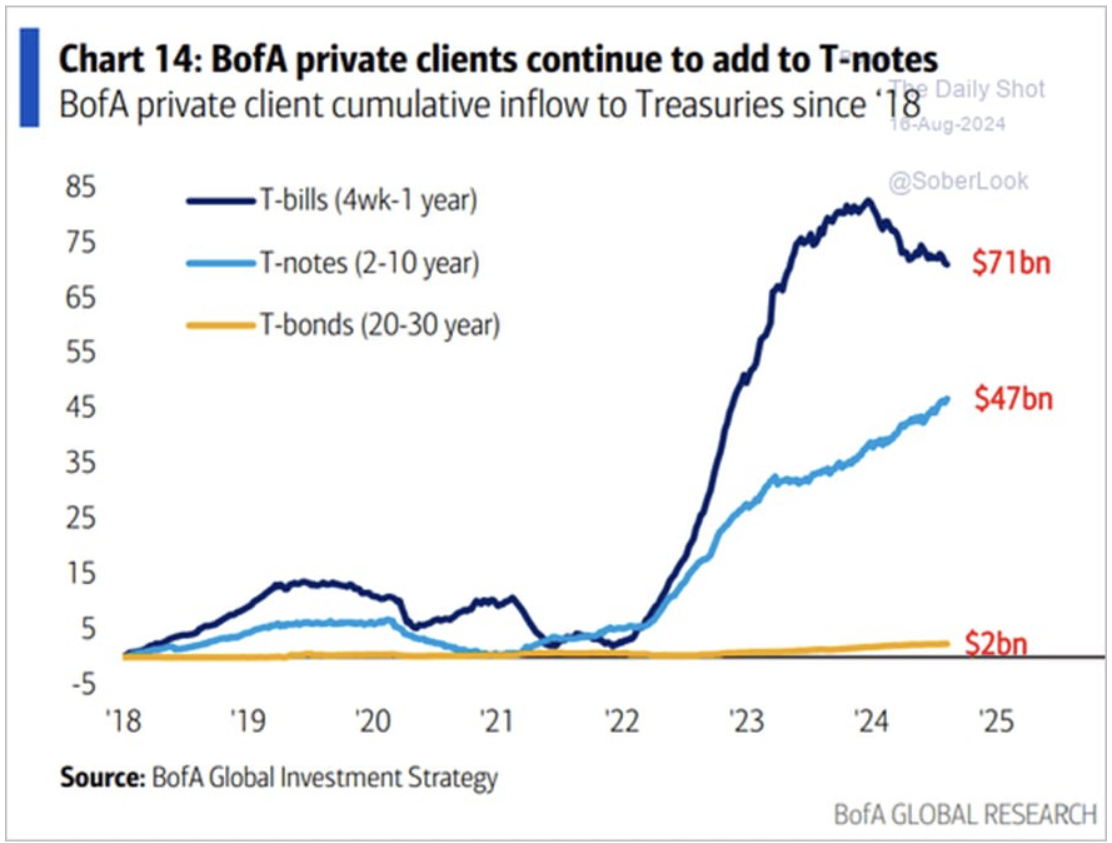

The price of the 10-year bond futures is consolidating above the 2-year resistance level. Growth potential remains as investment interest shifts to longer duration. BofA Chart - Demand Dynamics for Duration (below): Private bank clients are reducing positions in short treasuries (blue line) and increasing positions in bonds with up to 10-year duration (light blue line). This is a global trend.

The shift to longer duration is a sign of expectations for an imminent rate cut:

YIELDS

The market yield of US Treasury securities with a constant 10-year maturity (green line) has decreased to 3.86%. The yield of the corporate index with a BBB rating (blue line) has decreased to 5.16%. The spread between them is 1.30%. Since October 2023, this spread has decreased by 0.45% (from 1.75% to 1.30%). The narrowing of this spread indicates reduced risks in the corporate debt sector.

The yield on both of these instruments is below the federal funds rate. The EFFR rate today is in the range of 5.25-5.50%, while the benchmark borrowing cost (10-year treasuries) is 3.86%. This indicates that the market has already priced in a reduction in the EFFR rate in the medium term by at least 1.00%, which correlates with FedWatch data.

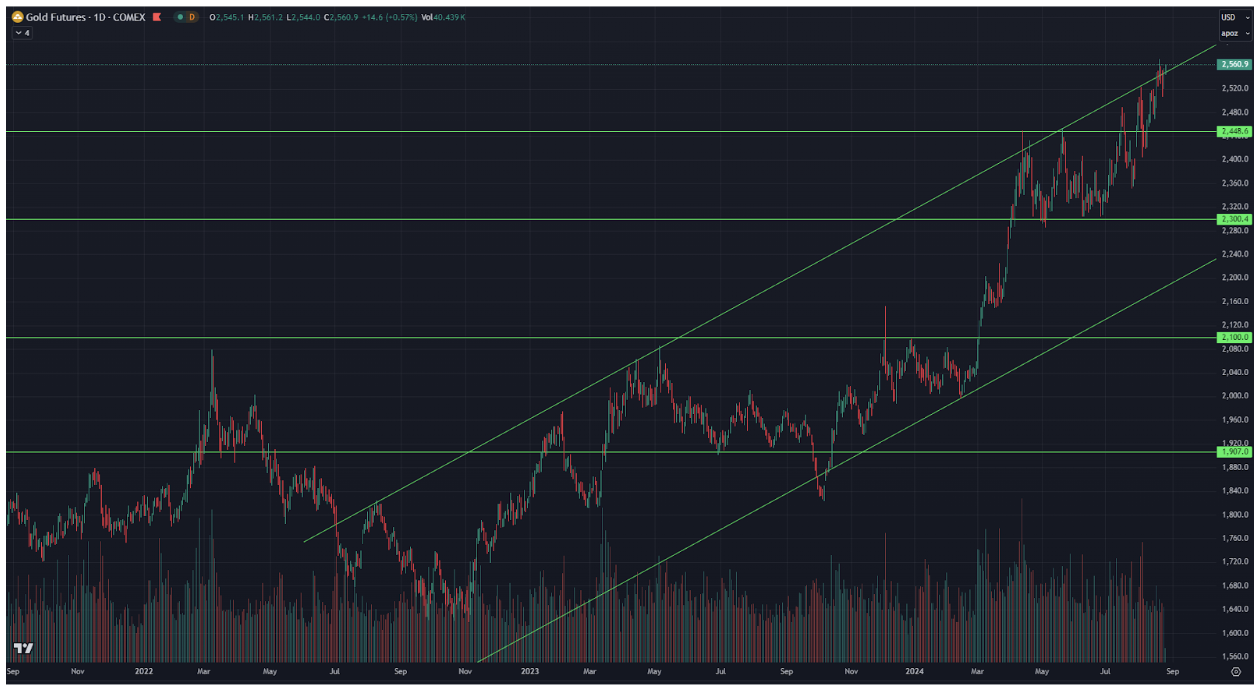

GOLD

DXY

Gold futures (top chart) continue to move upward, setting a historical high at $2570 per troy ounce. The price broke through the upper boundary of the ascending channel. Growth triggers - a decline in the dollar and a shift in monetary policy. Some correction in gold is possible, but the long-term growth potential remains.

Interested in buying private tech companies' shares with us? Check out our Wealth and Growth account plans, which provide you access to exclusive venture capital deals!

Disclaimer: “The use of the trademark is for informational purposes only and does not imply endorsement or affiliation. Additionally, the information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities".

Қазақша

Қазақша